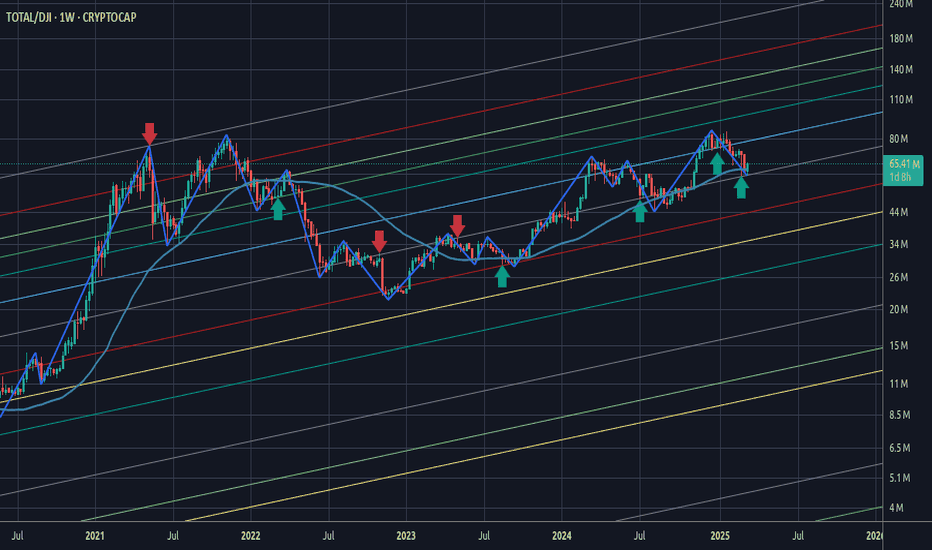

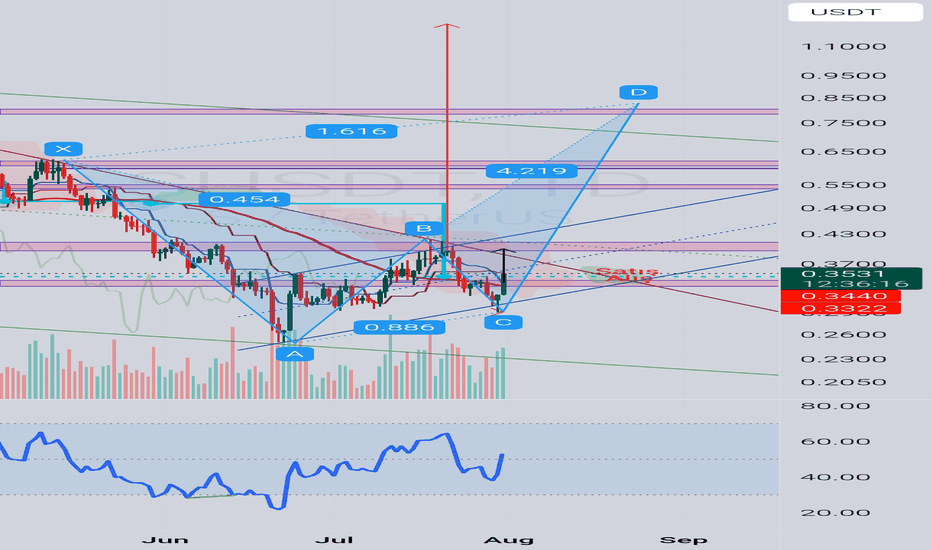

Money Flow - 2### Money Flow Spread from DJI to Cryptocurrency: A Fibonacci Perspective

The financial markets operate in an interconnected ecosystem where capital flows between asset classes based on macroeconomic trends, investor sentiment, and risk appetite. One such dynamic involves the movement of funds from traditional markets like the **Dow Jones Industrial Average (DJI)**—a barometer of blue-chip stocks—to emerging asset classes such as **cryptocurrencies**. This phenomenon can often be analyzed using **Fibonacci retracements and extensions**, which serve as powerful tools for identifying key support, resistance, and potential price targets during shifts in market momentum.

#### 1. **Market Sentiment and Capital Rotation**

- The DJI represents large-cap equities that are heavily influenced by institutional investors, central bank policies, and global economic conditions. When these factors trigger volatility or uncertainty in traditional markets, investors may seek alternative investments with higher growth potential or hedging properties.

- Cryptocurrencies, known for their decentralized nature and high volatility, attract speculative capital during periods when confidence in traditional assets wanes. For instance:

- During bearish trends in the DJI, characterized by falling prices and increased selling pressure, some investors might reallocate portions of their portfolios into cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH).

- Conversely, bullish trends in the DJI could signal improved risk appetite, prompting a portion of crypto gains to rotate back into equities.

#### 2. **Fibonacci Retracements: Identifying Key Levels**

- Fibonacci retracement levels are derived from the Fibonacci sequence and are widely used in technical analysis to predict areas of support and resistance. These levels (e.g., 23.6%, 38.2%, 50%, 61.8%) help identify potential turning points in price action.

- In the context of money flow from the DJI to cryptocurrencies:

- A significant decline in the DJI could lead to a pullback to Fibonacci retracement levels (e.g., 38.2% or 61.8%). At these junctures, traders may reassess their positions and consider diversifying into cryptocurrencies.

- Similarly, after a sharp rally in cryptocurrencies, prices might retrace to Fibonacci levels before continuing upward. Investors exiting equities due to underperformance might view these retracements as entry points for digital assets.

#### 3. **Fibonacci Extensions: Projecting Price Targets**

- While retracements focus on corrective moves within a trend, Fibonacci extensions project potential price targets beyond the initial move. Common extension levels include 127.2%, 161.8%, and 261.8%.

- In scenarios where money flows out of the DJI and into cryptocurrencies:

- If the DJI experiences a prolonged downtrend, its losses could coincide with outsized gains in cryptocurrencies. Fibonacci extensions can help forecast how far crypto prices might rise amid this influx of capital.

- For example, if Bitcoin breaks above a key resistance level following a surge in inflows from equities, traders might use Fibonacci extensions to estimate future price milestones (e.g., $100,000 or $200,000).

#### 4. **Psychological Drivers Behind the Transition**

- Fibonacci levels resonate with traders because they align with natural human tendencies toward symmetry and proportion. This psychological aspect amplifies their relevance when analyzing cross-market dynamics.

- As money exits the DJI and enters cryptocurrencies, Fibonacci-based trading strategies provide a framework for understanding how participants perceive value across different asset classes. For instance:

- Institutional investors exiting equities might anchor their decisions around Fibonacci-derived thresholds, ensuring disciplined entry and exit points in volatile crypto markets.

- Retail traders, who dominate much of the cryptocurrency space, also rely on Fibonacci tools to time their trades, creating self-reinforcing patterns that influence overall market behavior.

#### 5. **Case Study Example**

- Imagine a scenario where the DJI drops sharply due to rising interest rates or geopolitical tensions. The index falls from 35,000 to 30,000—a decline of approximately 14%. Traders observe Fibonacci retracement levels at 38.2% ($31,900) and 61.8% ($33,100), expecting temporary bounces at these levels.

- Simultaneously, Bitcoin rallies from $20,000 to $30,000 as investors seek refuge in digital gold. Using Fibonacci extensions, analysts project further upside to $38,200 (127.2%) or even $48,500 (161.8%), attracting additional capital from equity markets.

#### 6. **Conclusion**

- The interplay between the DJI and cryptocurrencies highlights the fluidity of modern financial markets. By leveraging Fibonacci retracements and extensions, traders can better anticipate shifts in money flow and position themselves strategically.

- Whether driven by macroeconomic headwinds, technological innovation, or evolving investor preferences, the migration of capital from traditional indices like the DJI to digital assets underscores the growing convergence of old and new finance. Fibonacci analysis serves as a bridge, offering insights into both the timing and magnitude of these transitions.

Community ideas

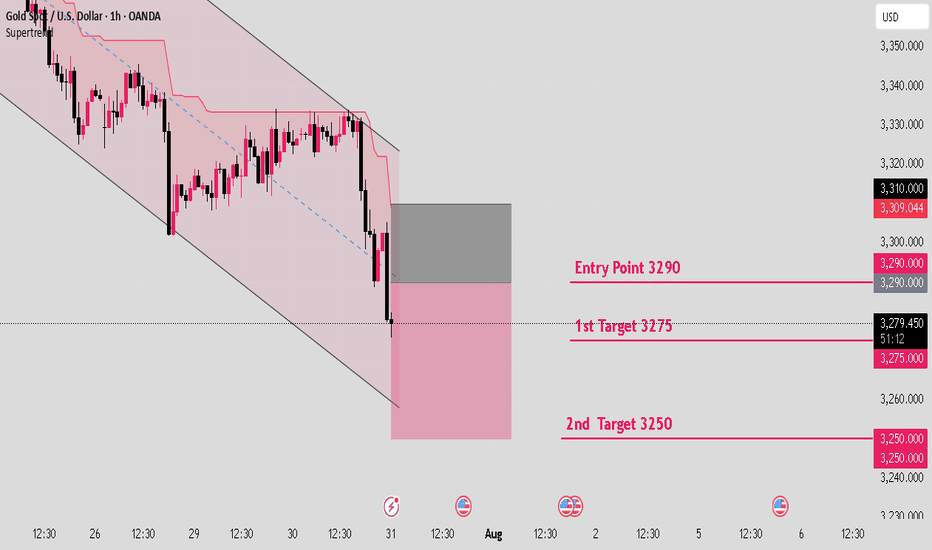

Gold will drop like rain till 3250.Hello IGT FOLLOWER'S

Here is my gold overview, According to me Gold is currently facing resistance around the 3290–3310 zone. This setup anticipates a rejection from this area, with bearish momentum expected to push price downward. A break above 3310 would invalidate the setup, so risk management is key.

Key points:

Entry point: 3290

1st target : 3275

2nd target: 3250

Follow me for more latest updates and signals

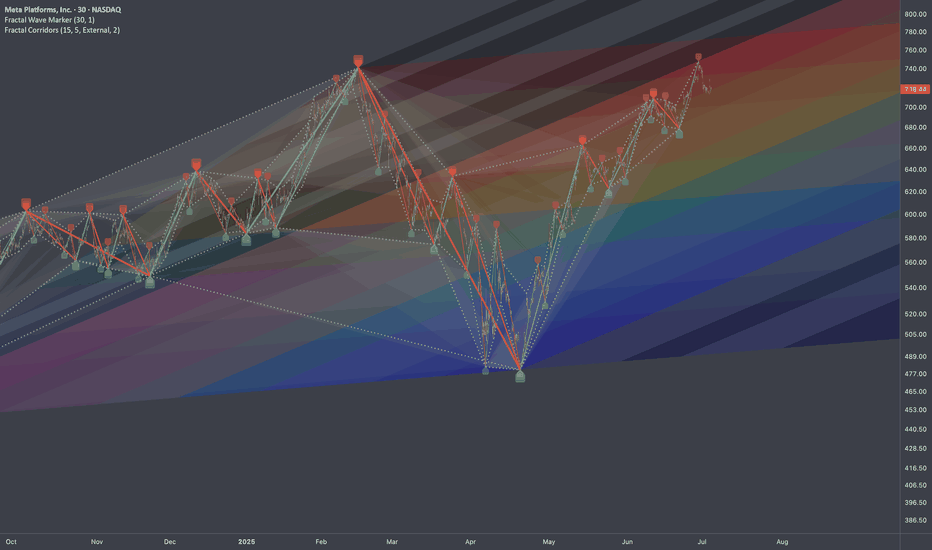

META: Testing Alternative Interconnection TypeResearch Notes

Given expression like this:

Fractal Corridors can be used for horizontal perspective of the same pattern manifestation. Alternative frames of reference exposes how historic swings of various magnitude in some way wire the following price dynamics. tradingview.sweetlogin.com helps to seek a matching commonality in angles of trends which gives a hint how structure evolves in multi-scale perspective.

I use both when it comes to working with complex waves and making interconnections through fibonacci ratios.

To define emerging wave's limits (probable amplitude), I'll test classic rule of Support/Resistance shift in fibs. (When resistance becomes support or vice versa)

By theory it means a trendline can also shift like that.

In our case this can be applied as:

Fibocnacci Structure:

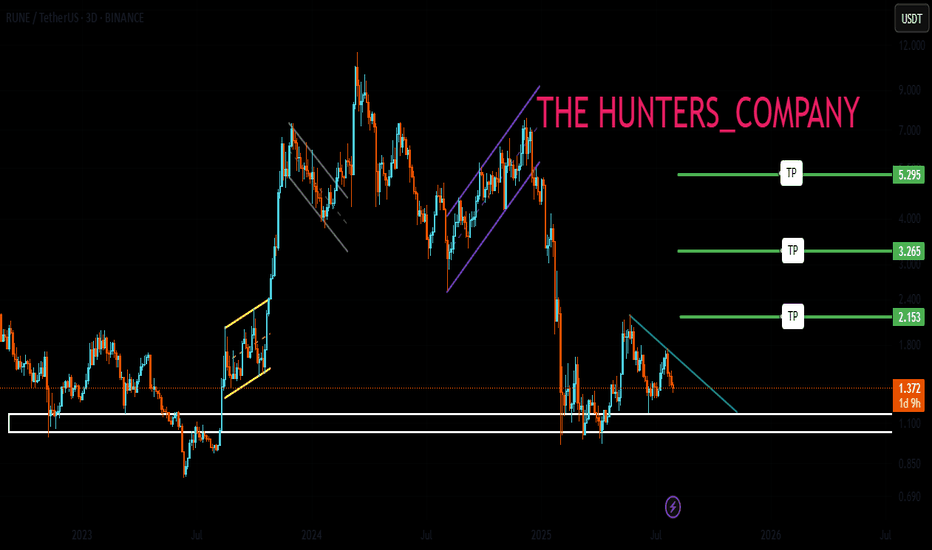

RUNE : Ready to pump?Hello friends🙌

👀According to the price drop, you can see that the price has reached an important area, which, according to the pattern formed, if the specified resistance is broken, we can enter with risk and capital management and move to the specified targets.

🔥Follow us for more signals🔥

*Trade safely with us*

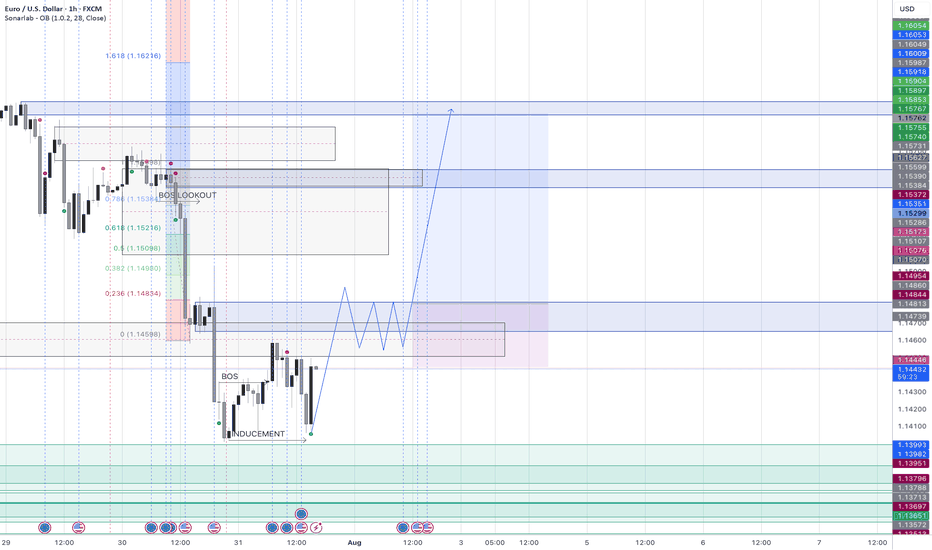

On the look out for a break above 1.14829 to confirm BullishHi Friends - Here is my own bias. Not a financial advise.

1. Buying intent spotted after the break of structure on the 1h time frame at 1.14381 BOS

2. Price retraced back to the liquidity that drove price back up on July 10th at 1.14005

3. We are looking out for price to close above 1.14805 and seek liquidity to move to the up side.

4. Possible consolidation between 1.14024 and 1.14858

Violation of the setup above will lead to a movement to the downside.

See you on the profitable end.

The Surge!

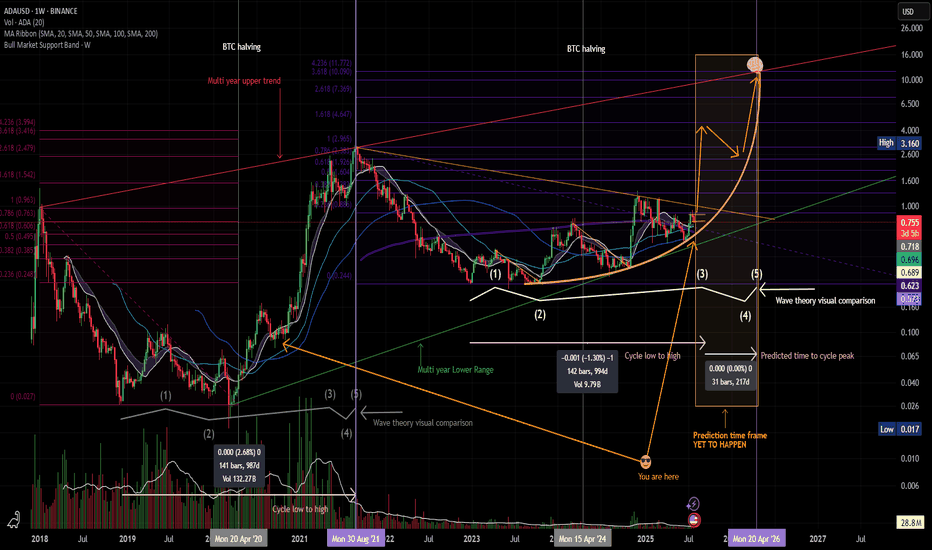

$ADA Macro ThesisGD To all

I have cleaned up and thrown a few other correlated patterns on the Chart for my Macro thesis.

You will have to watch the metrics and on chain data as well as sentiment to verify as we move fwd.

This is Pattern recognition on a Log Chart:

BINANCE:ADAUSD

I have been using this thesis since 2019 and have been able to successfully ident general buy/sell points ( weighing against real world events and on chain data )

I hope it helps you and feel free to ask questions.

Told ya I like crayons

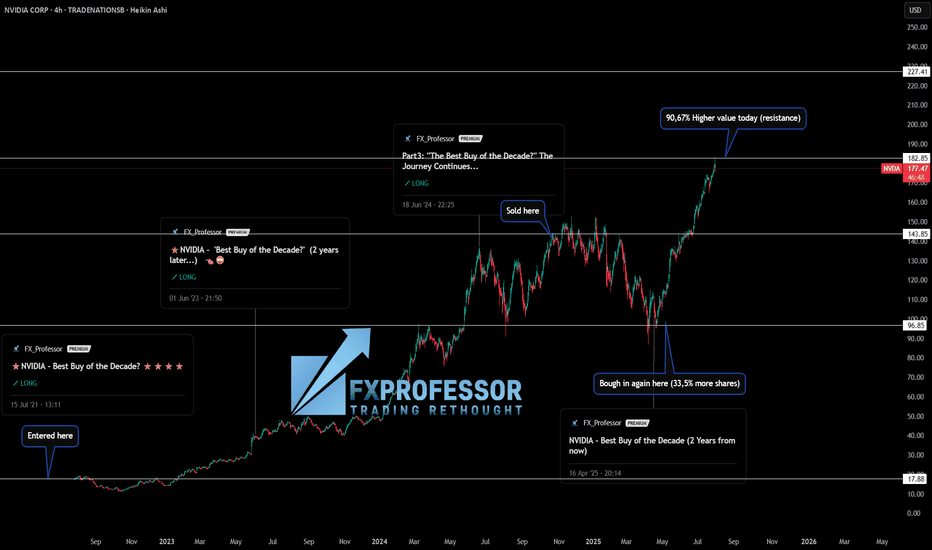

NVIDIA – From Thesis to Profits: How Fundamentals & Technicals 📚💡 NVIDIA – From Thesis to Profits: How Fundamentals & Technicals Aligned 🚀🧠

This isn’t just a trade —it’s a lesson in how conviction, timing, and structure come together when you truly understand what you're investing in.

I’ve been publicly calling NASDAQ:NVDA the “Best Buy of the Decade” since July 2021 when the price was around $18. Why? Because I’m a gamer, I understand chips, and I knew exactly what NVIDIA was building long before AI became a buzzword. From graphics cards to data centers and AI compute, the fundamentals were solid.

But let me be clear: I’m not a holder forever. I use technical analysis to manage entries and exits. And that’s where the real edge comes in. 🎯

Here’s how the trade evolved:

✅ Initial entry: $17.88 (2021)

✅ First target hit: $143.85 → Took profits

✅ Re-entry: $96.85 → Got 33.5% more shares for the same money

✅ Today’s value (July 31st): Up +90.67% in just 100 days

📅 That’s from April 23rd to today.

(and it was ALL publicly posted here, for You!)

This is what happens when macro conviction meets micro execution.

🧠 The key takeaways:

Fundamentals gave me the why.

Technicals gave me the when.

And risk management gave me more shares for free.

That’s not luck —it’s structure, patience, and doing the work. If you’re just “HODLing” and hoping, consider learning how to work the chart instead of letting the chart work you.

Let me know in the comments—did you catch this move? Are you in, or waiting for the next entry?

One Love,

The FX PROFESSOR 💙

ps. in this case i did not sell many shares today i hedged with a short on SP500. Nvidia might correct a bit

Disclosure: I am happy to be part of the Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis. Awesome broker, where the trader really comes first! 🌟🤝📈

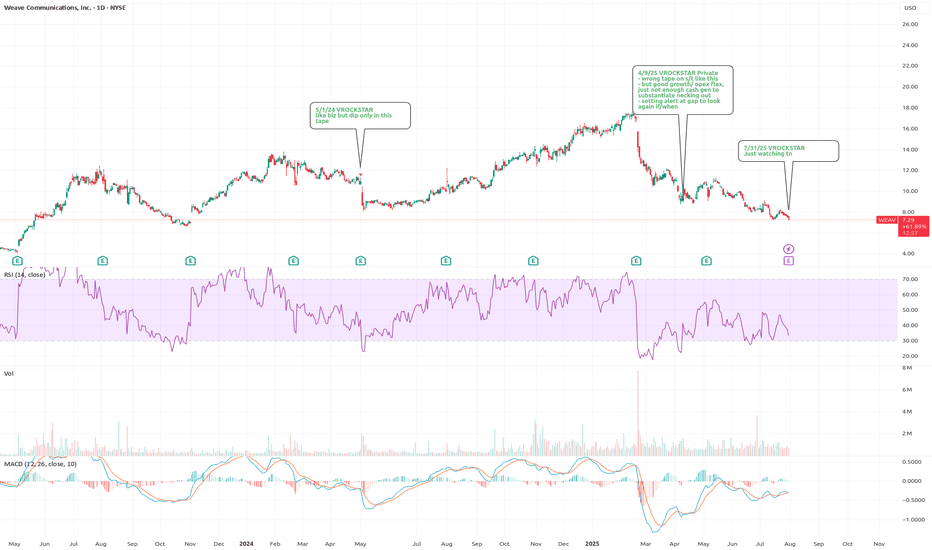

7/31/25 - $weav - Just watching tn7/31/25 :: VROCKSTAR :: NYSE:WEAV

Just watching tn

- this tape has enough issues where $10 or $15 or $25 bn companies can't catch a needed bid for fcf yields and growth far in excess of what fiat IOU's yield

- so i already have my "favorite" $500 mm c'mon let'sgoco called NASDAQ:GAMB and liquidity and size seem to matter right now

- which (see private notes on chart) is why i am not going to complicate my life w/ this one tonight. but probably a dip buy esp if there's some sort of growth hiccup and i'd have time to investigate

- all in, this seems like a cool niche software co that hasn't really turned the corner on opex inflection to get toward DD ebitda mgns, but where if there remains progress as we've seen over the last year, it will be a matter of time

- tough to value this in a typical context

- so i'd say so far i like rev growth and sales flex on opex line, "therefore" R&D seems to be producing

- you all know rule of thumb, but in this tape let's put a heftier discount rate on 40 mm annualized budget of 20% (a defensibly conservative bar) and that's 40/.2 = 200 mm.. stock at 500 mm cap and you know i like to 2x that r&D budget, which says anything below 20% is a pretty easy dip buy for me (ex structural issues which i'd need to investigate). anything 15%... let's see. shallow 10%.. pass and look later. and if it's up... it just remains on the eternal watchlist.

be well

V

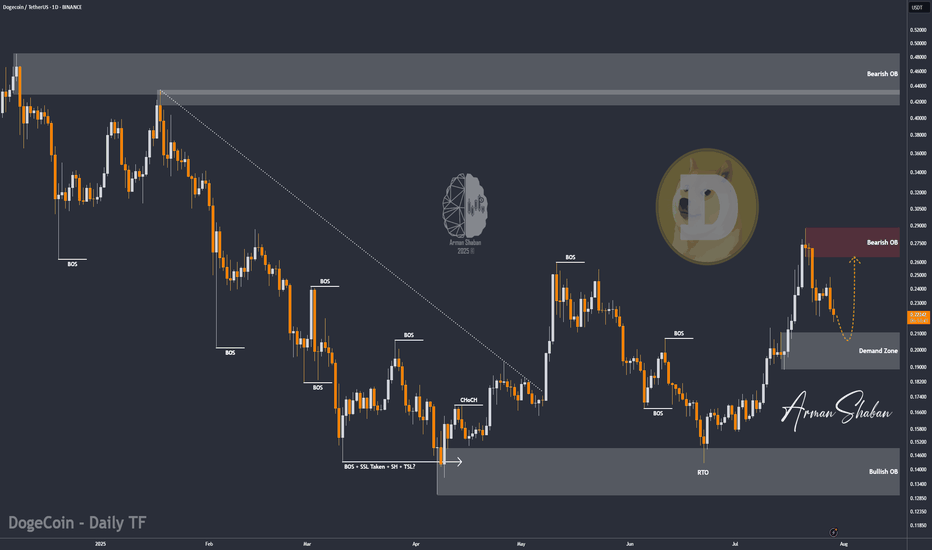

DOGE/USDT | Eyes Bounce from Key Support – Next Targets Ahead!By analyzing the Dogecoin chart on the daily timeframe, we can see that after reaching the $0.29 area, the price entered a correction and is now trading around $0.22. If DOGE dips into the key support zone between $0.19–$0.21, we could expect a strong bullish reaction. The next potential targets are $0.287, $0.32, $0.41, and $0.70.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

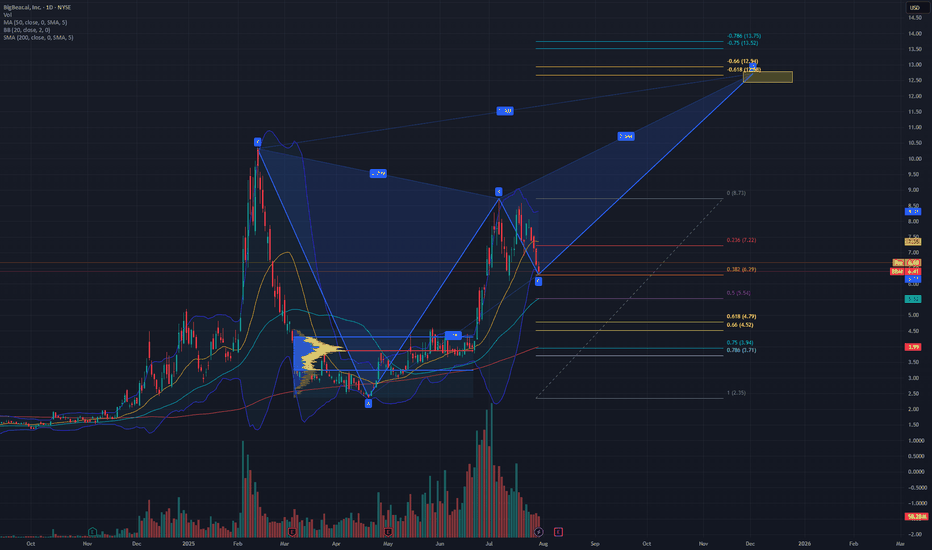

XABCD pattern playing out $12 targetBBAI is looking like it will play out the XABCD butterfly pattern if it continues to rally from the .382 of the pull back from previous $2.35 lows and 8.73 highs.

Breaking down and close below the $6.06 daily candle will potentially expose the previous consolidation POC at $3.87, which is a .75 pull back.

Using Fib time, I am expecting a $12 range around this year in December.

Will look to open a 7/12 bull call spread at Jan 2027 exp.

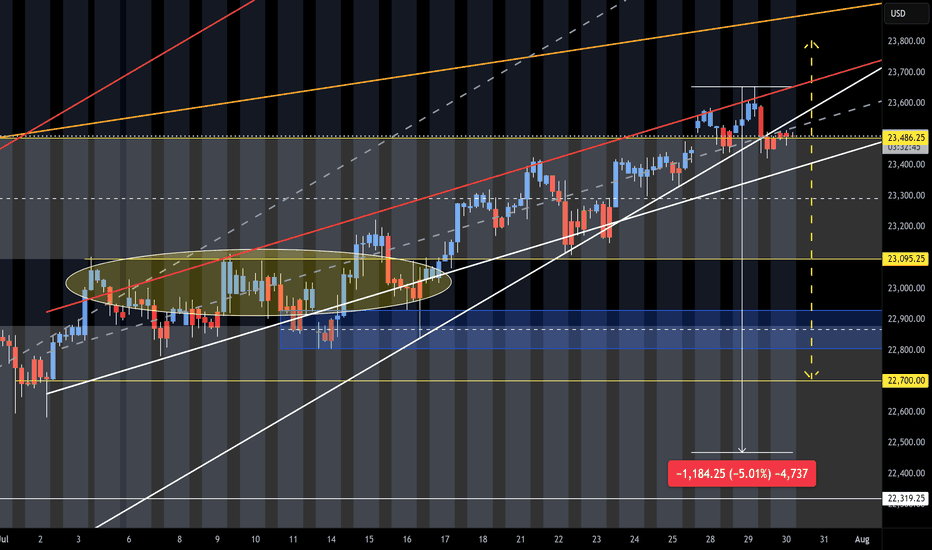

NQ Short (07-30-25)NAZ is at upper target and Turn Zone from May 12th post. Failure here should see a 5% drop test. The idea is that buyers will need some sellers in order to get higher. The sellers will help to test the level strength. Month end into a Friday-Monday Long play and a break in this long standing pattern may create the opposite. Current danger zone is the 23,486 KL. Look Long above and short below. Scalping Shorts should turn to holding shorts and scalping Longs. Expect timely Tweets and same old Tricks near or under the DZ. O/N is still The BOSS until both the O/N and Reg Session sell (on same day).

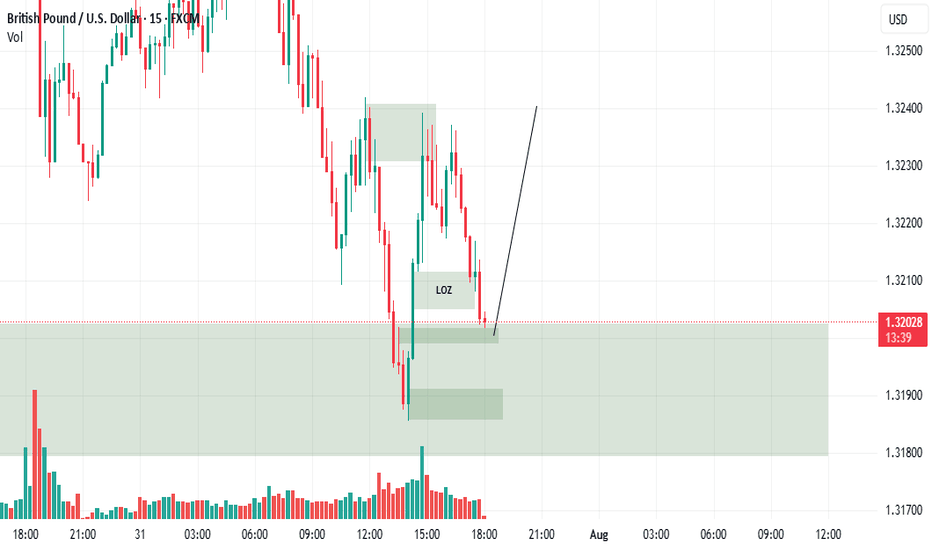

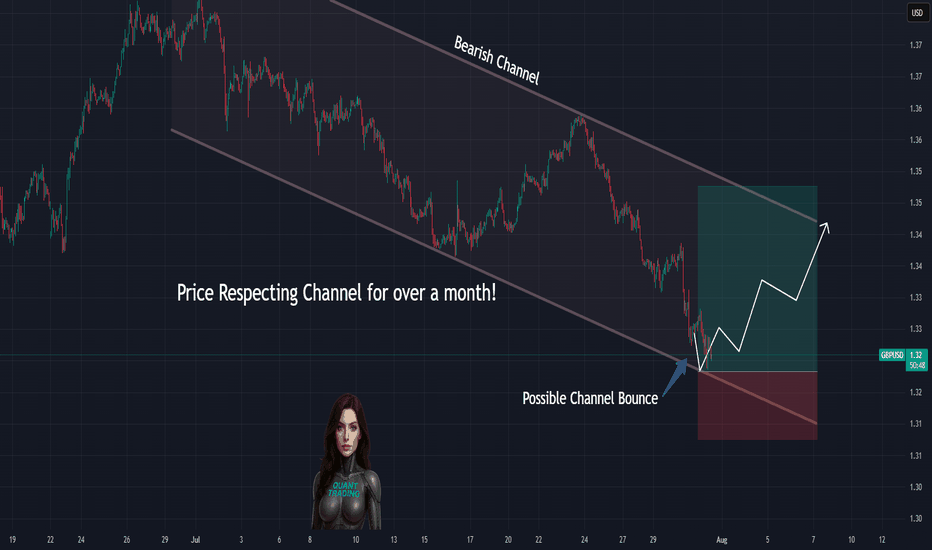

Price Doing Exactly What We Predicted… so farGBPUSD tapped the exact bottom of our marked channel and bounced — just as forecasted.

📌 Price respected structure to the pip

📌 Stoch RSI curling up right as expected

📌 Channel still in play, eyes on midline next

⏱️ Timeframe: 1H

#gbpusd #forex #chartprediction #backtest #channeltrading #technicalanalysis #tradingview

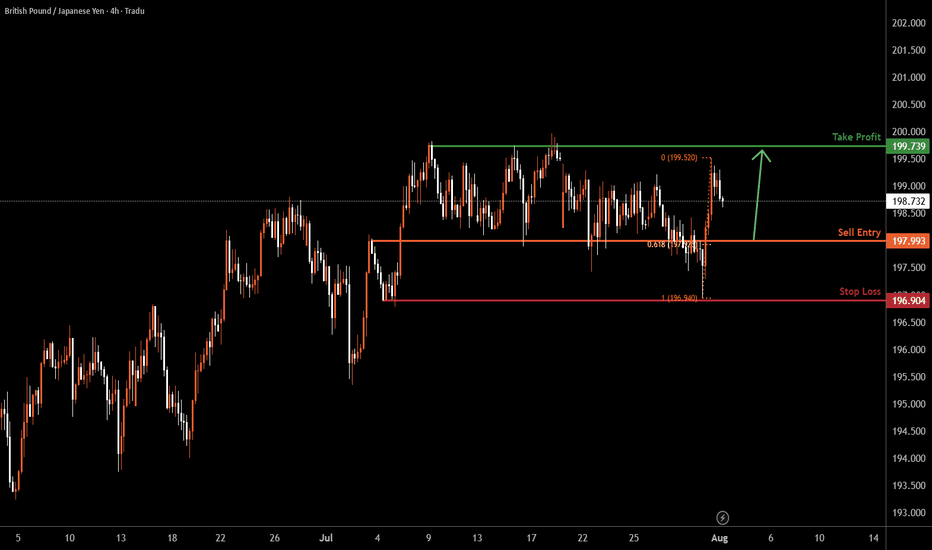

GBP/JPY H4 | Bullish bounce offGBP/JPY is falling towards the buy entry, which is an overlap support that lines up with the 61.8% Fibonacci retracement and could bounce to the take profit.

Buy entry is at 197.99, which is an overlap support that aligns with the 61.8% Fibonacci retracement.

Stop loss is at 196.90, which is a swing low support.

Take profit is at 199.73, which is a multi-swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.