WAIT FOR A TRIPLE CONFIRMATION AND CAPITALIZE ON THE TARIFFS

Analysis and Prediction by DunnInvesting

Market Overview

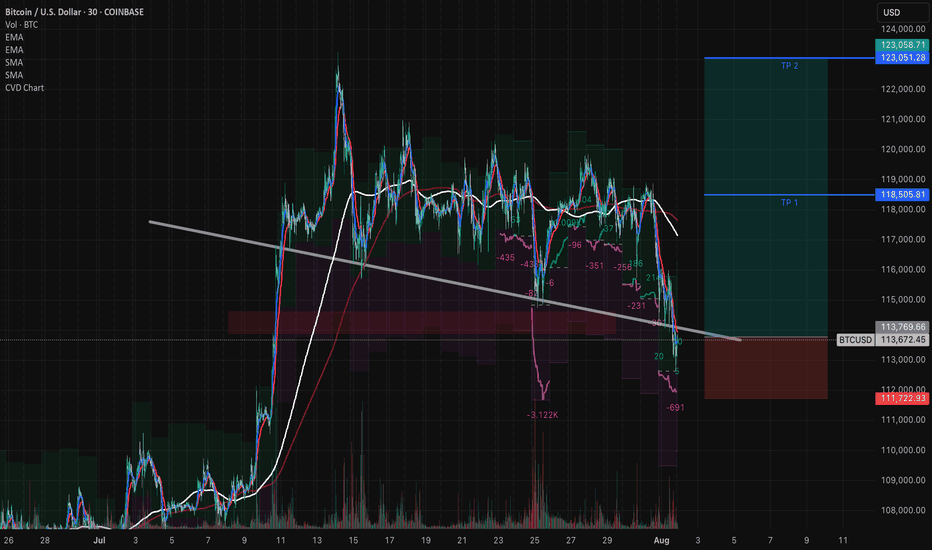

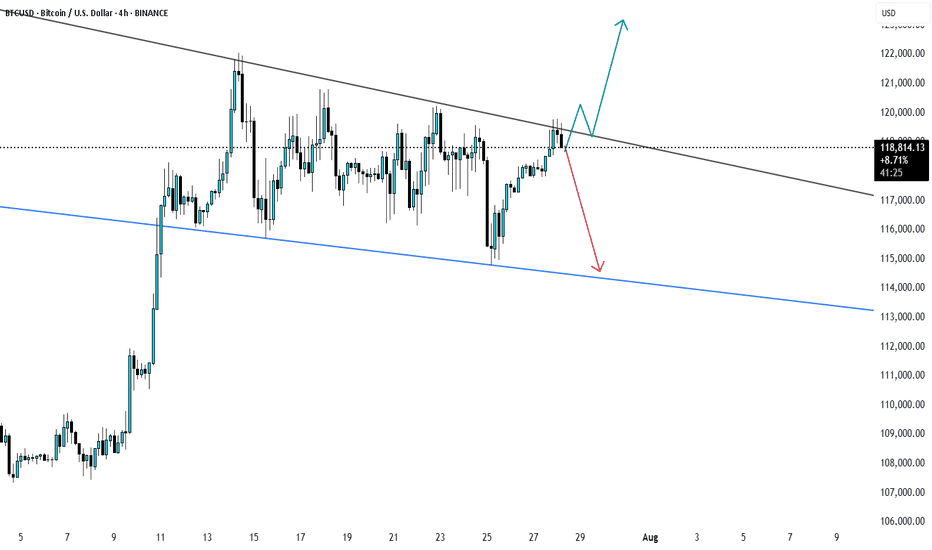

The BTCUSD chart on a 1-hour timeframe shows a recent consolidation phase following a sharp decline. Key technical indicators suggest a potential reversal or continuation pattern. The price is approaching a critical support zone around $113,792.86, with a descending trendline acting as resistance.

Thought Process

Support Zone Identification: The $113,792.86 level aligns with a historical support zone and the 50-period EMA, indicating a strong area for potential buying interest.

Trendline Resistance: The descending trendline has capped recent upward movements. A break above this level could signal a bullish reversal.

Triple Confirmation: Wait for three confirmations:

A bullish candlestick pattern (e.g., engulfing candle) at the support zone.

A break above the trendline with increased volume.

A retest of the trendline as new support.

This setup offers a clear entry point with defined risk below the support zone, making it understandable and actionable.

Trade Plan

Entry: $114,500 after triple confirmation.

Take Profit 1 (TP1): $118,505 (4.5% gain).

Take Profit 2 (TP2): $123,051 (7.5% gain).

Stop Loss: $112,000 (below support, ~2.2% risk).

Risk-Reward Ratio: 1:2.04 (TP1) and 1:3.41 (TP2).

Profit Targets and Stop Loss

TP1 at $118,505 targets a conservative 4.5% move.

TP2 at $123,051 aims for a more ambitious 7.5% upside.

Stop loss at $112,000 protects against a breakdown below support.

Clarifying Notes

This idea leverages the current market uncertainty around tariffs, which could drive volatility and create trading opportunities. Monitor volume and news closely for validation.

Disclaimer

This is not financial advice. Trading involves risk, and you should only trade with capital you can afford to lose. Consult a financial advisor before making any trading decisions.

Community ideas

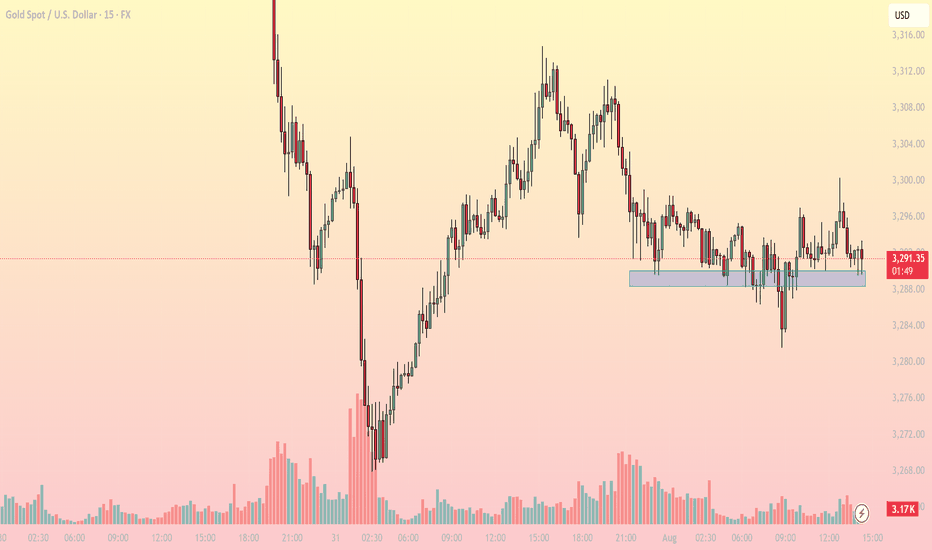

Gold consolidates near key support – What's next for?1. Market Overview

On the 15-minute chart, XAUUSD is trading around 3,290–3,292 USD, hovering just above a critical intraday support zone at 3,287–3,289 USD (highlighted in blue). This area has repeatedly provided a bounce in recent sessions, indicating persistent buying interest.

The current price action reflects sideways movement within a narrow range (3,287–3,296 USD), and notably, declining volatility, as shown by reduced candle range and trading volume.

2. Technical Breakdown

EMA: Price is moving around the EMA20 and EMA50, reflecting indecision and lack of directional momentum.

RSI (inferred): Likely hovering near the neutral 50–55 zone, confirming a balanced market.

Trendline: A descending series of lower highs from the 3,312 peak suggests bearish pressure, though buyers still defend key support.

Fibonacci: The 3,287 USD zone aligns with the 61.8% Fibonacci retracement level, reinforcing its strength as a bounce area.

3. Key Levels to Watch

3,287–3,289: Support - Repeated reactions here – key demand zone

3,296: Immediate resistance - Needs breakout to confirm bullish move

3,302: Next resistance - Breakout target – short-term top

3,275: Deeper support - Retest level if support breaks

4. Trading Strategy Scenarios

🔹 Scenario 1 – Long setup at support

Entry: 3,287–3,289 (wait for bullish reaction like pin bar or engulfing)

Stop Loss: Below 3,284

TP1: 3,296 | TP2: 3,302

🔹 Scenario 2 – Short setup on breakdown

Entry: Below 3,284 (after clear bearish candle close)

Stop Loss: 3,288

TP1: 3,275 | TP2: 3,268

5. Conclusion

Gold is in a tug-of-war at a sensitive support zone. Whether bulls defend or bears break below will set the tone for the rest of the session. Focus on price reaction around 3,287 to determine direction – avoid blind predictions.

Make sure to follow for more live strategies as the New York session unfolds – and save this post if you find it helpful!

What’s your view on this support zone? Let’s discuss below!

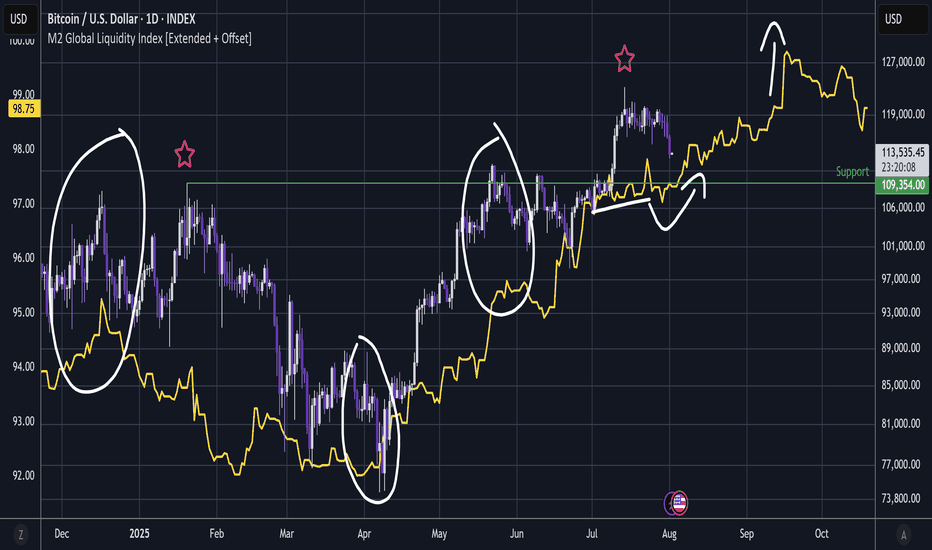

BITCOIN - M2 Global Liquidity Is Silver Lining ?BTC / M2 Global Liquidity (Offset 78 days)

History did repeat and the standout Shooting Star has again led to significant dump action as it .

And the fact that this is happening while stock indexes are wobbling while Trump unleashes more tariffs - should be a cause for concern.

But to lighten moods, I have added M2 Global Liquidity.

To remind, there has been incredible correlation and I have circled a few instances.

Also notice there is quite a flat area in M2 - it looks somewhat similar to the flat area that Bitcoin just slumped from.

Then notice that M2 had a small slump then carries on up until what looks like some sort of blow off phase in September - then corrective action; perhaps a 3 wave correction (before continuing on up).

So obviously this area is very dangerous but there might just be a silver lining 🤔

That said, now that indexes have wobbled, this area is certainly dangerous and we could yet see another wave down in tandem with stock indexes as we did in January.

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

Solana coin Long setupIn this video I go through the current price action and talk about how the 126$ target level was recently reached for a clean long entry and on the daily timeframe we printed a higher low .

I expand on my thoughts for a continuation to the upside and to retest some higher levels of resistance 180$s and time will tell if we print a higher high at the 180$s before retesting the $200 zone .

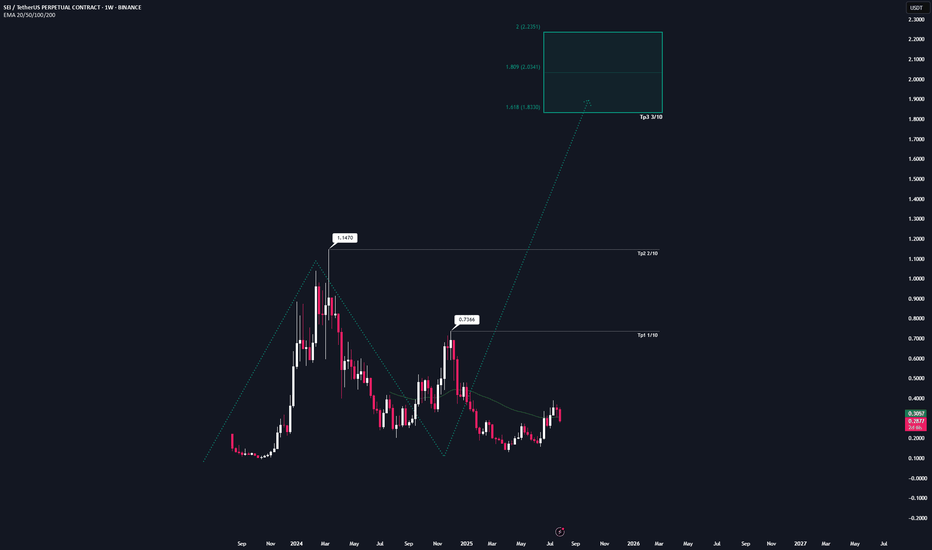

SEI | Full AnalysisHere is the top-down analysis for Sei as requested 🫡

Weekly Timeframe:

We have a potential large structure forming on the weekly chart that will be activated once we break the ATH. Its target zone lies between $1.8 and $2.2.

My sell targets for SEI this cycle are:

TP1: $0.73

TP2: $1.14

TP3: $1.83

These are my sell targets based on my technical analysis. However, I won’t rely on them alone — I also follow several on-chain indicators. Once retail euphoria kicks in and my indicators trigger, I’ll start selling accordingly.

Daily chart:

On the daily, we have a sequence that has already been activated and almost reached its target zone. That’s why the B–C correction level remains a valid buy zone, which I’ll also use for additional long entries.

This would be the second attempt from a B–C correction level, as we’ve already tapped it once (where I went long) and I’ll be entering again here.

Target zone for this sequence: $0.39–$0.44

Local Price action:

On the lower timeframe, we’ve just completed a bearish structure that perfectly overlaps with the B–C correction level. This increases the probability of this setup significantly, as both sides (bulls and bears) want the same thing here: bulls are buying the market, while bears are covering shorts and taking profits.

-----

Thats the my full Analysis for SEI, hope it was helpful if you want me to do another analysis for any other pair just comment down below.

Also, if anyone is interested in how my trading system works, let me know and I’ll post some educational content about it.

Thanks for reading❤️

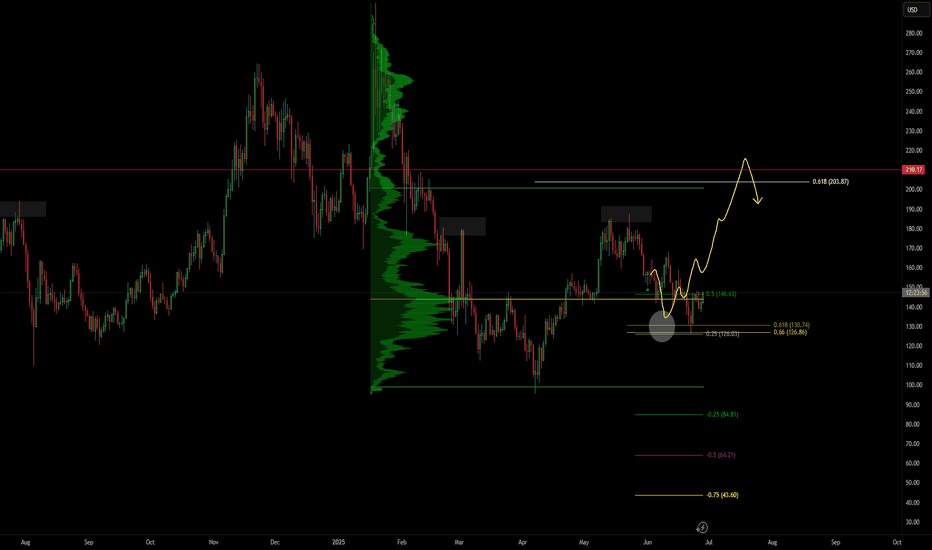

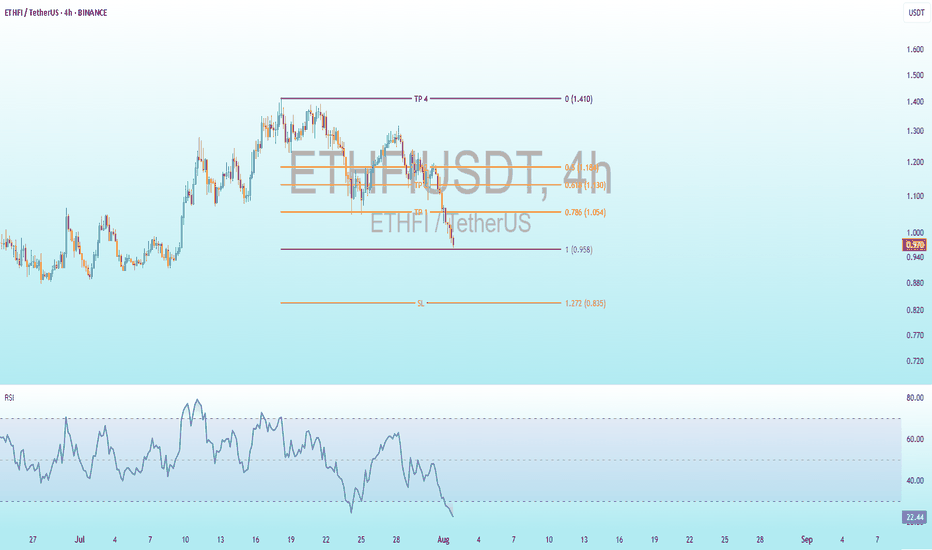

ETHFI Bullish DivergenceBINANCE:ETHFIUSDT

Trade Setup:

Target 1: 1.054 (0.786 Fibonnaci Golden Zone).

Target 2: 1.130 (0.618 Fibonnaci Golden Zone).

Target 3: 1.184 (0.786 Fibonnaci Golden Zone).

Target 4: 1.410 (0 Fibonnaci).

Stop Loss: 0.835 (1.272 Fibonnaci).

RSI Analysis: The RSI is showing a bullish divergence, suggesting potential bullish momentum. The current RSI is around 22.36, approaching oversold territory, so caution is advised.

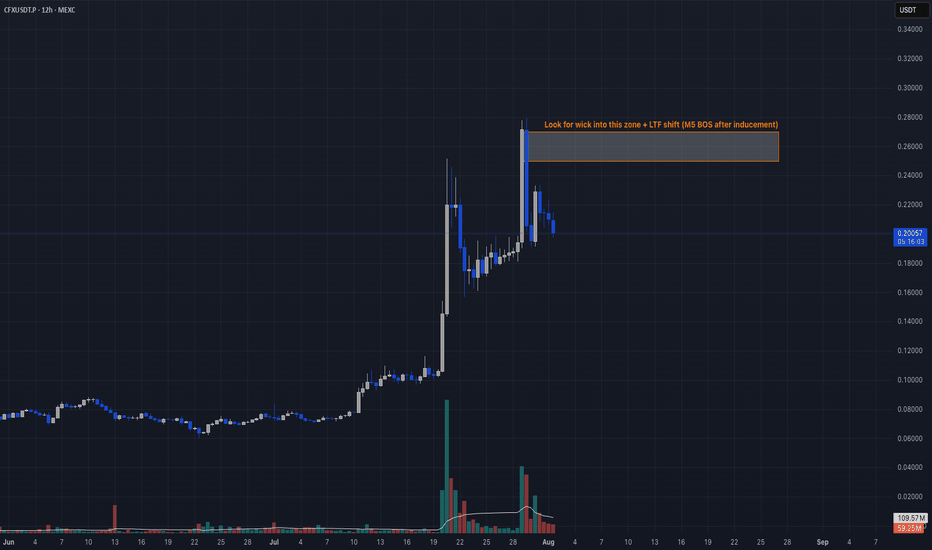

Sell-the-News Reversal📣 What’s up traders!

CFX just got injected with hopium from a pharma deal, a China stablecoin rumor, and the Conflux 3.0 upgrade… but here’s the thing: when price flies 119% and RSI hits 94, smart money starts reaching for the eject button. 🚨

🔥 TRADE SETUP

Bias: Short

Strategy: Sell-the-News Reversal

Entry: $0.25 – $0.27

SL: $0.29

TPs: $0.186, $0.145, $0.120

Why?

– HTF rally straight into resistance

– RSI 94 + $11M in short liquidations = exit liquidity confirmed

– OI and funding surged, now showing early cracks

– LTF BOS + failed continuation at highs.

Candle Craft | Signal. Structure. Execution.

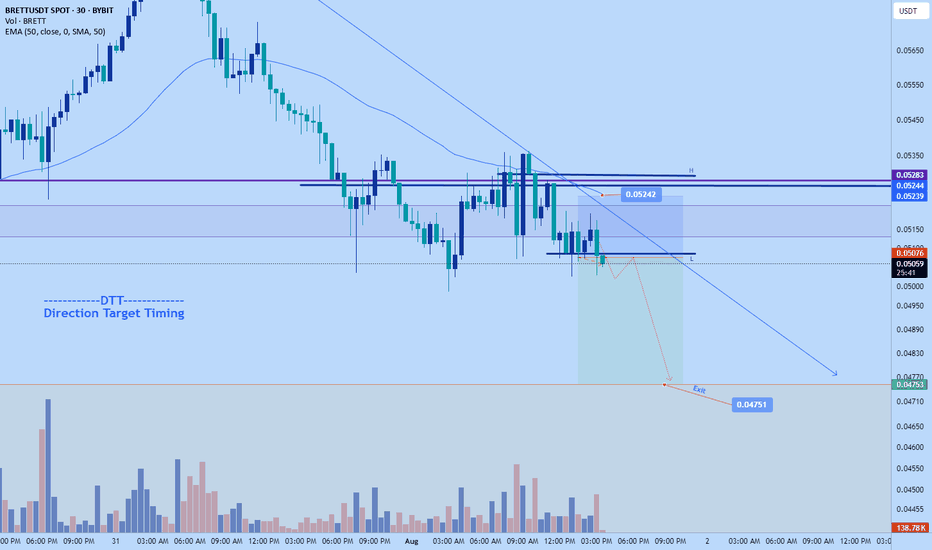

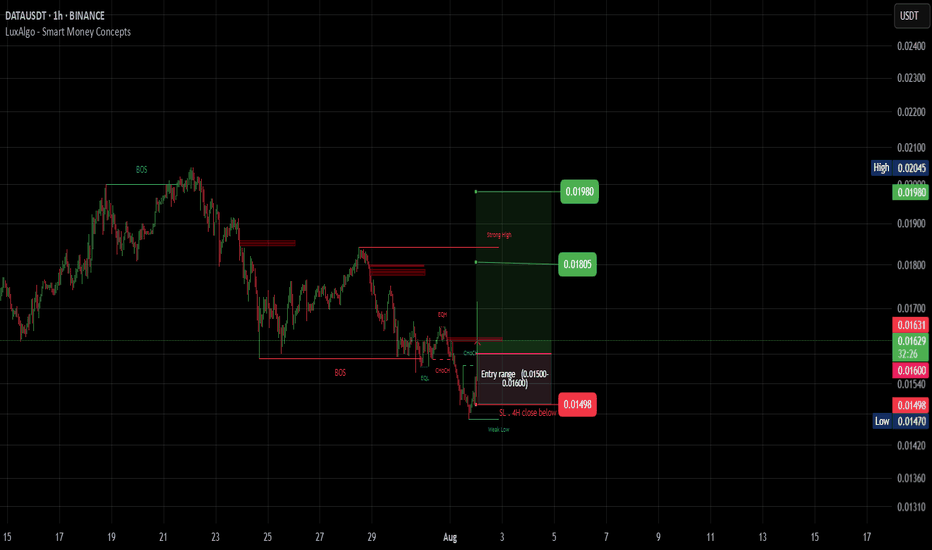

#DATA (SPOT) BINANCE:DATAUSDT

#DATA/ USDT

Entry range (0.01500- 0.01600)

SL 4H close below 0.00.01498

T1 0.0180

T1 0.0198

_______________________________________________________

Golden Advices.

********************

* collect the coin slowly in the entry range.

* Please calculate your losses before the entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

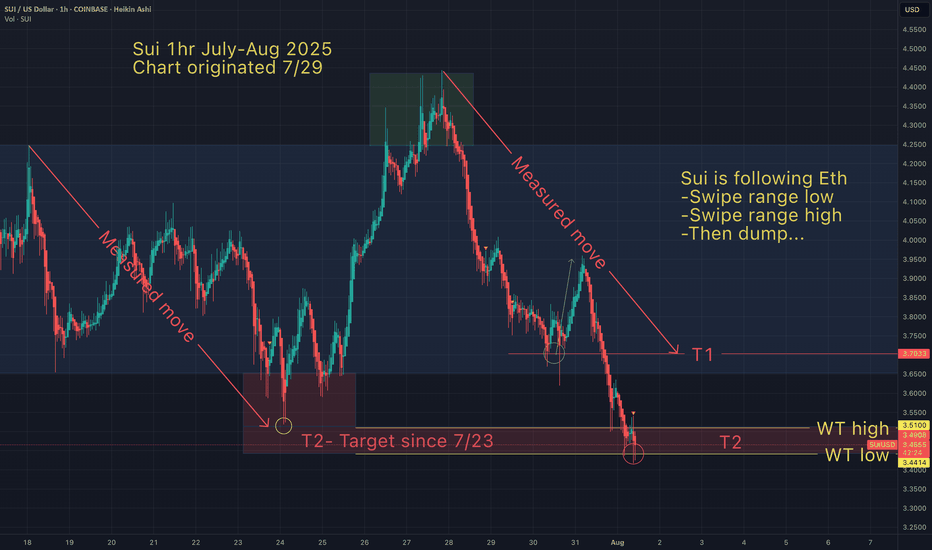

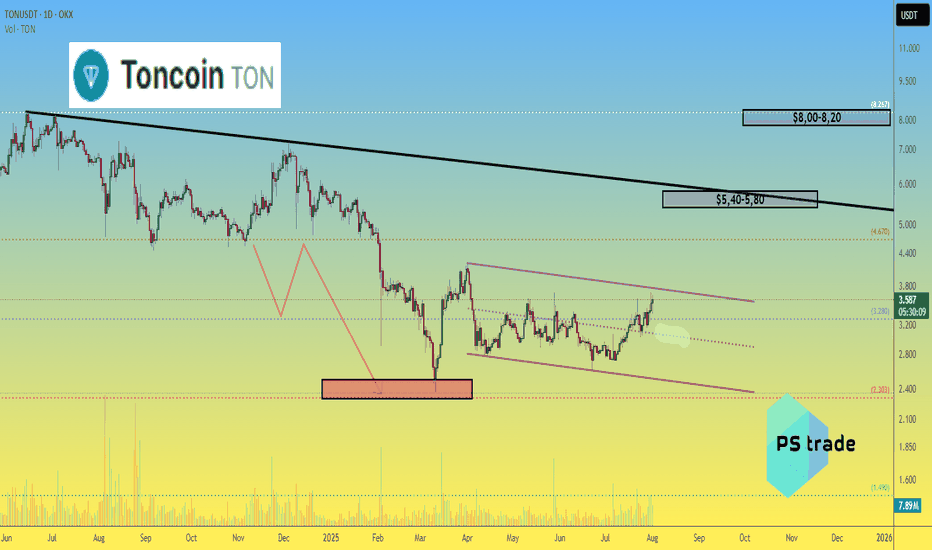

Toncoin TON price analysis💎 CRYPTOCAP:TON didn’t become a legend over the past 9 months — but at least our correction target of $2.30–2.50 played out with precision.

While most of the crypto market is currently going through a correction, #Toncoin keeps pushing upward. Still, we remain realistic:

🎯 First target: $5.40–5.80

🎯 Second target: $8.00–8.20

🚀 It’s not a “to the moon” scenario, but a potential 2x–3x from current levels is attractive.

The key support level OKX:TONUSDT remains at $3.00 — as long as it holds, the bullish trend remains valid.

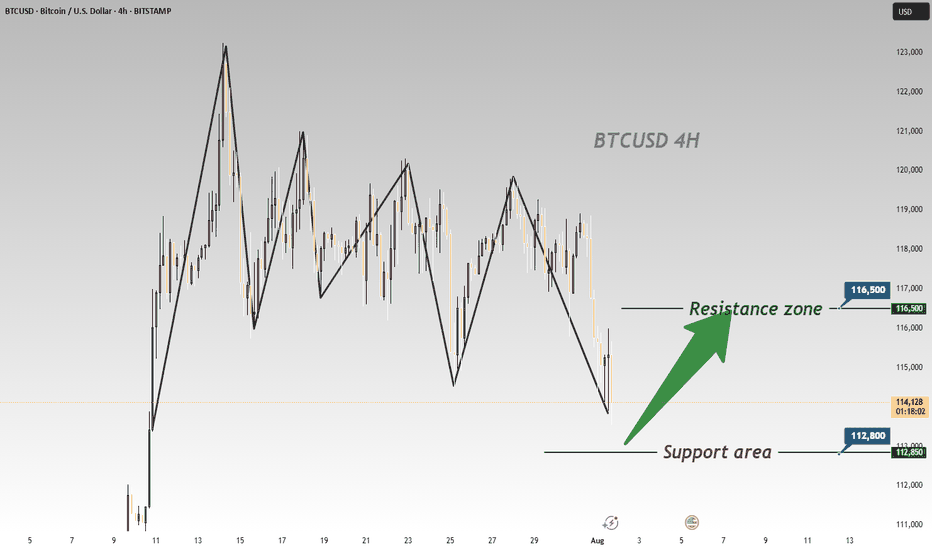

BTC Plummets Post-NFP; Go Long for Rebound to 116500BTC has plummeted significantly under the influence of the non-farm payroll data 📉, and now is an excellent opportunity to go long. Its Support level is around 112800, and according to the current trend, we can wait for a rebound to around 116500.

⚡️⚡️⚡️ BTCUSD ⚡️⚡️⚡️

🚀 Buy@ 113000 - 113800

🚀 TP 114500 - 115500 - 116500

Daily updates bring you precise trading signals 📊 When you hit a snag in trading, these signals stand as your trustworthy compass 🧭 Don’t hesitate to take a look—sincerely hoping they’ll be a huge help to you 🌟 👇

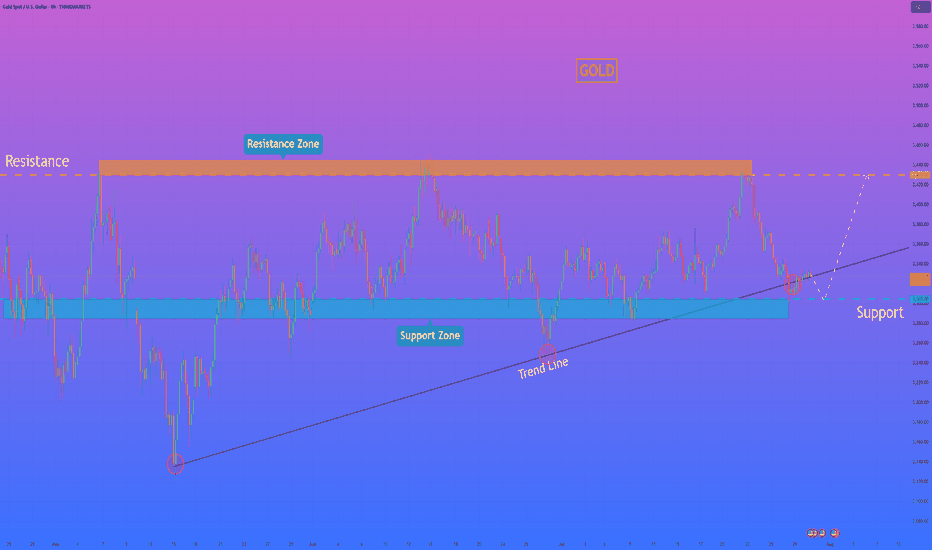

HelenP. I After correction to support level, Gold start to growHi folks today I'm prepared for you Gold analytics. An examination of the chart highlights a well-established long-term uptrend, with the bullish structure being clearly defined by a major ascending trend line that has consistently provided dynamic support. Currently, the price is undergoing a healthy correction after being rejected from the major resistance zone around 3430. This pullback is now guiding the price towards a critical confluence of support, where the aforementioned ascending trend line intersects with a strong horizontal support zone at 3305 - 3285. My analysis for a long position is based on the high probability of a bullish reaction from this key area. I believe that as the price enters this support confluence, it will be met with strong buying pressure, as it represents a logical point for buyers to defend the trend. A confirmed bounce from this zone, demonstrated by a rejection of lower prices, would be the main condition to validate the continuation of the uptrend. Therefore, the primary goal for the subsequent rally is set at the 3430 resistance level, as a retest of the recent high is the most logical objective following a successful defense of the trend. If you like my analytics you may support me with your like/comment ❤️

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

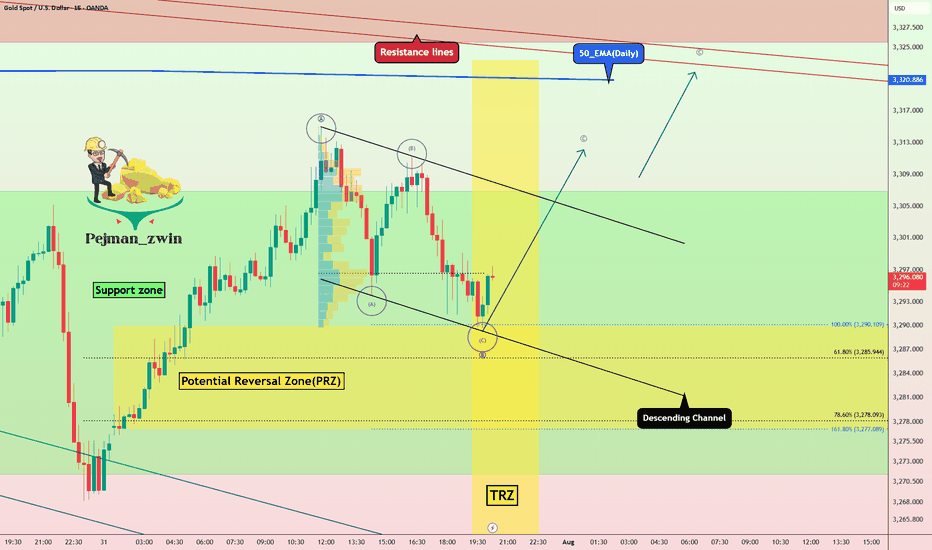

Gold in PRZ + TRZ: Is a Bullish Reversal Brewing(Short-term)?Gold , as I expected in yesterday's idea , fell to the Potential Reversal Zone(PRZ) and started to rise again .

Today's Gold analysis is on the 15-minute time frame and is considered short-term , so please pay attention .

Gold is currently trading in the Support zone($3,307-$3,275) and near the Potential Reversal Zone(PRZ) and Time Reversal Zone(TRZ) .

In terms of Elliott Wave theory , it seems that Gold can complete the microwave C of wave B at the lower line of the descending channel.

I expect Gold to trend higher in the coming hours and rise to at least $3,311 .

Note: Stop Loss (SL) = $3,267

Gold Analyze (XAUUSD), 15-minute time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy; this is just my idea, and I will gladly see your ideas in this post.

Please do not forget the ✅ ' like ' ✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

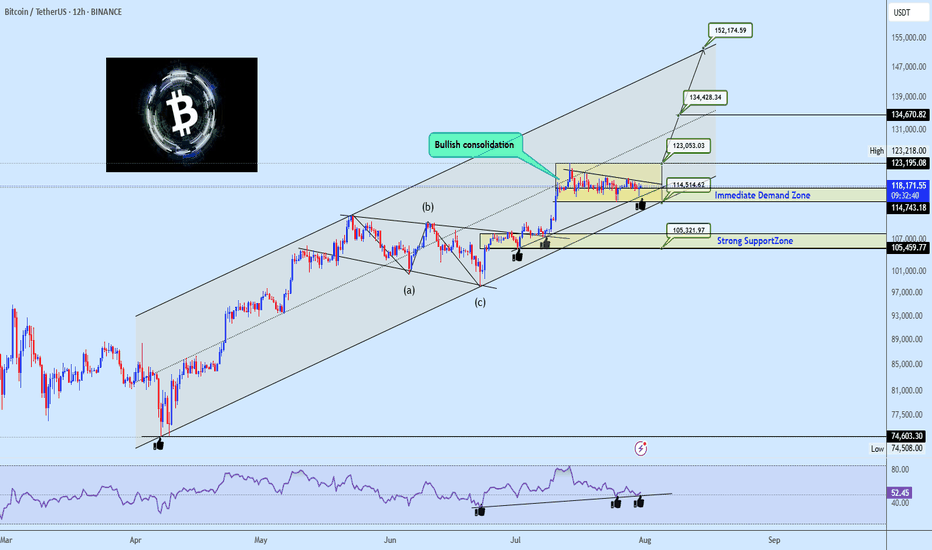

Bullish Channel Intact: BTC Poised for Next Leg Toward 152KBitcoin continues to coil within a bullish consolidation zone above the critical $114.5k–$117.5k Immediate Demand Zone, firmly riding the ascending channel structure that has guided price since the March swing low. The prior wave structure confirms a clean ABC correction, followed by a powerful breakout and a structured range indicative of accumulation, not exhaustion.

The RSI shows persistent bullish divergence, confirming hidden strength, with multiple support bounces confirming demand. The current tight consolidation above former resistance now flipped demand presents a launchpad scenario for a breakout towards major projected upside targets.

Targets to Watch:

🟢 $123,053 – Range breakout threshold, aligns with channel midline and prior local high.

🟢 $134,428 – Measured move from current range and top channel boundary intersection.

🟢 $152,174 – Final leg projection based on macro channel trajectory and bullish wave extension potential.

On the downside, failure to hold $114.5k opens the door to a test of the $105k Strong Support Zone, which aligns with prior structural demand and broader trendline confluence.

💬 Drop your favorite altcoins in the comments for quick analysis , let's catch the next movers before they fly!

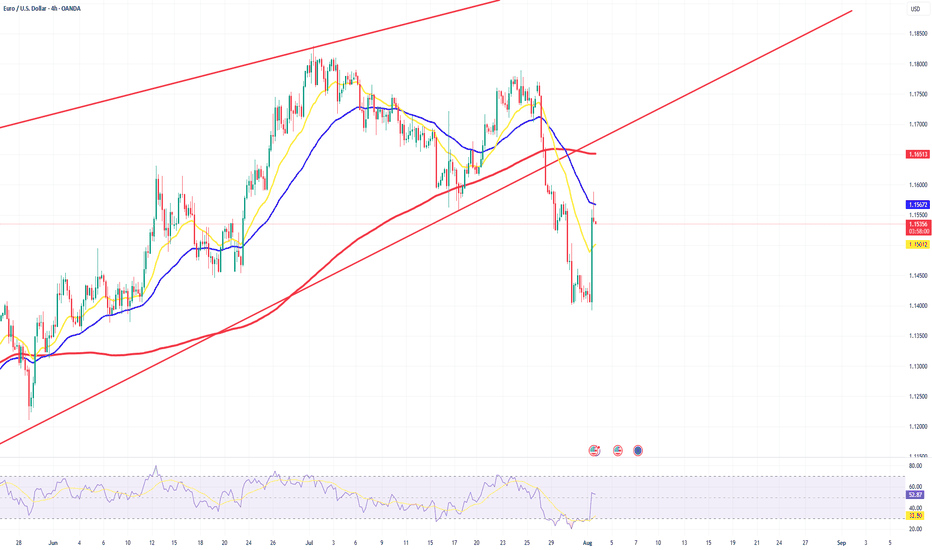

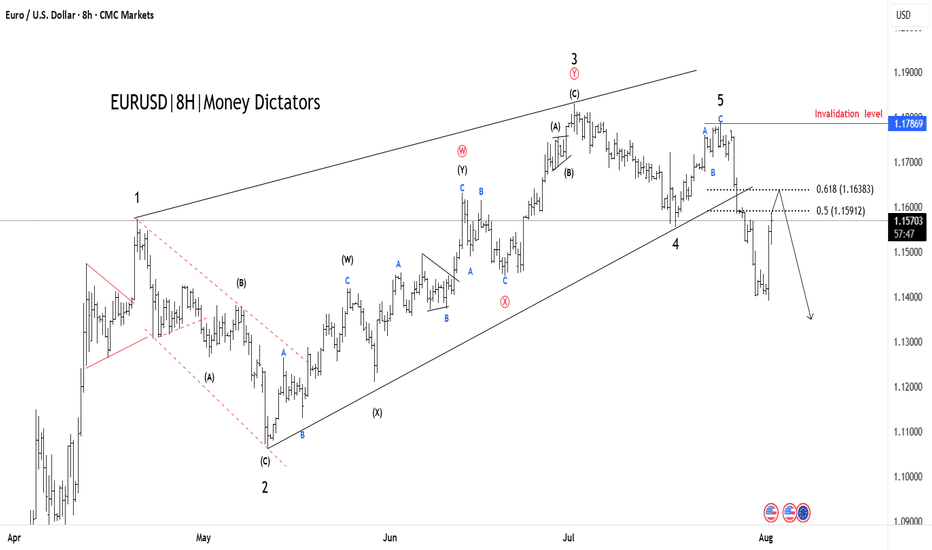

EUR/USD Elliott Wave Count Signals Downside TargetsThe EUR/USD chart is displaying a completed 5-wave Elliott impulse structure, suggesting the potential start of a larger corrective move to the downside. Wave 5 appears to have finished after a classic ending diagonal pattern, with price now breaking below the wave 4 support trendline — a strong confirmation of trend exhaustion.

Currently, price is retracing upward towards the 0.5–0.618 Fibonacci retracement zone of the last impulsive leg, around 1.15912–1.16383, which may serve as the final rejection zone for bears to re-enter. This area aligns perfectly with prior support-turned-resistance and is considered the potential reversal pocket.

If price holds below the 1.17869 invalidation level, the structure supports the beginning of an ABC correction or a larger bearish impulse.

Target 1 (T1): 1.14800

Target 2 (T2): 1.13915

Stop Loss (SL): 1.17869

This scenario remains valid as long as the price does not break above 1.17869. A clean break and close above this level would invalidate the bearish setup and suggest a possible wave extension.

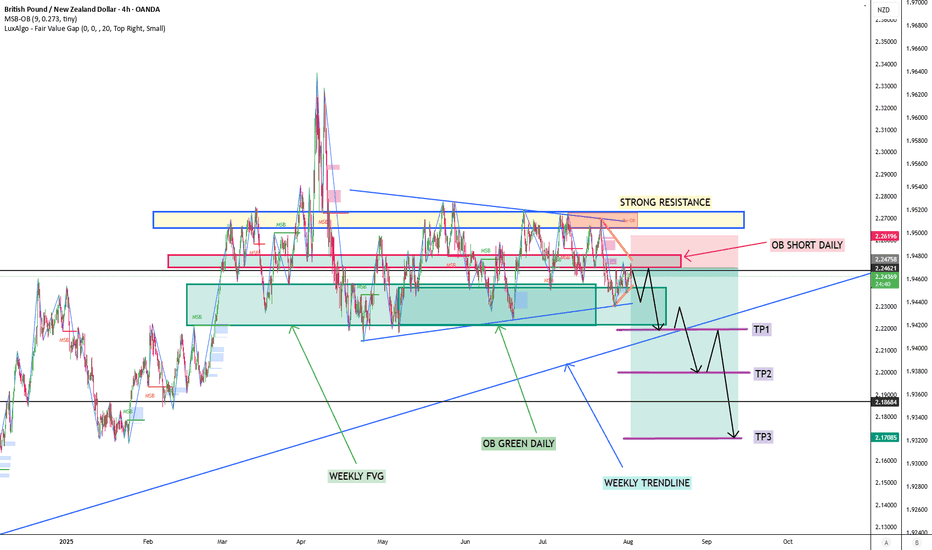

GBP/NZD POTENTIONAL SHORT OPPORTUNITYThis is an idea for GBPNZD's potential short opportunity based on what the technicals indicate.

The trend has been emphasising its bullish approach for almost three years.

Price respected almost 11 times due to the strong resistance within 150 days between 2.265 & 2.275 and bounced off bullish OB on the daily chart and FVG on the weekly chart.

An institutional sharp decline on the weekly chart, followed by a clear wedge, can support a further drop once swept by bearish daily OB. A breakout to the micro wedge (orange) within a macro wedge can also help further down move.

Given that a bearish pin bar followed by a bearish doji is a strong warning signal of potential reversal or bearish continuation that appears inside the micro wedge.

TP1 is considered the first support at the bottom, where the daily OB and the weekly FVG meet at around 2.22000 or the area close to the trendline. If the price breaks through the trendline, TP2 and TP3 will be expected to be achieved.

TP2 may be located at the micro accumulation around 2.20000, and TP3 at the following major support around 2.15000-2.17000 that previously acted as both support and resistance.

Good luck and have a great weekend.

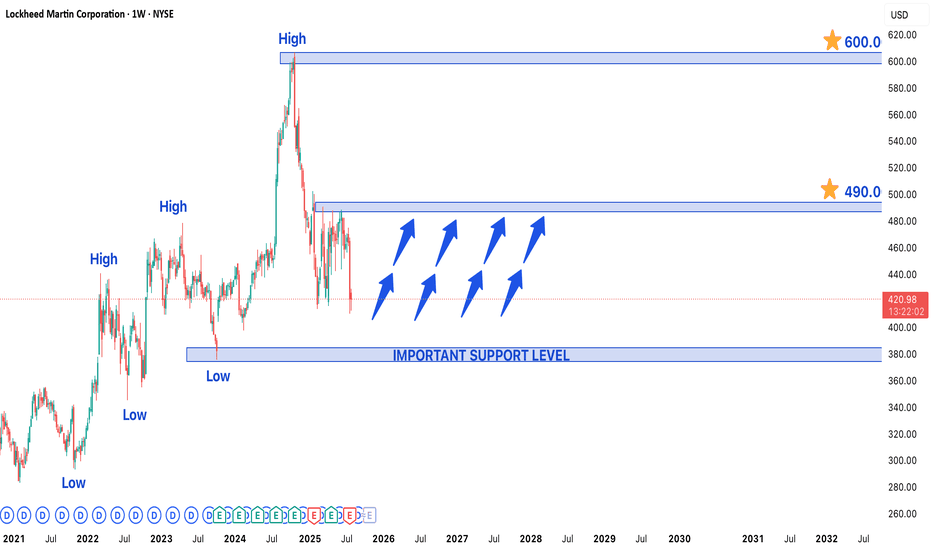

Lockheed Martin Stock in Bullish Trend - Key Levels to watchLockheed Martin (LMT) Stock in Strong Bullish Trend - Key Levels to Watch

Lockheed Martin's (LMT) stock is currently exhibiting a well-defined bullish trend, trading near a recent higher low that may serve as a crucial support level for the next upward move. The defense giant continues to benefit from robust global military spending and a strong contract pipeline, positioning the stock for potential further gains.

Technical Structure & Key Levels

- Higher Low Support: The current price zone represents a critical support area where buyers have previously stepped in, maintaining the upward trajectory

- Upside Targets:

- Near-term: $490 (previous resistance zone)

- Long-term: $600 (potential breakout extension)

- Major Support: $375 would act as strong demand zone if any deeper pullback occurs

Bullish Catalysts Supporting the Trend

1. Defense Sector Strength:

- Record US defense budget allocations for 2024-2025

- Increased NATO military spending amid global tensions

2. Contract Backlog:

- F-35 program continues to drive revenue

- Hypersonic weapons and space systems development

3. Technical Momentum:

- Price trading above key moving averages (50/200 DMA)

- Higher highs and higher lows confirm uptrend structure

Trading Strategy Considerations

- Optimal Entry:

- On bounces from current support level

- On breakout above $460 confirmation

- Risk Management:

- Stop-loss below $375 for longer-term positions

- Partial profit-taking near $490 resistance

- Confirmation Signals:

- Volume increase on upside moves

- Sustained closes above $460

Potential Risks to Monitor

- Geopolitical shifts affecting defense budgets

- Program delays (particularly in F-35 production)

- Broader market corrections impacting defense sector

Long-Term Outlook:

The combination of fundamental strength and technical positioning suggests LMT could progress toward $490 near-term, with $600 as a viable long-term target if the bullish structure holds. Traders should watch price action around current levels for continuation signals while remaining mindful of the $375 support as a critical level for the bullish thesis.