Silver = to the moon??? September 03, 2025Who’s Loading Up:

A top dog at Pan American Silver Corp., a heavyweight in North American silver digs, just scooped up a hefty chunk of shares.

Deal Size: This exec grabbed 50,000 shares at $22.50 a pop on August 28, 2025, dropping $1.125 million—talk about putting skin in the game!

Company Lowdown

Pan American Silver Corp. runs 10 mines across the Americas, packing 468 million ounces of silver and 6.7 million ounces of gold. Based out of Vancouver, they’ve got cash flowing like a river, fueling big bets like La Colorada Skarn and Escobal.

Sector Vibes:

• The Silver Institute’s calling for a fifth straight supply crunch in 2025, with photovoltaics and AI tech demand hitting all-time highs.

• Tariff threats, green energy boom, and a possible Fed rate cut in September 2025 could send silver soaring.

Big Funds Jumping In

Last quarter (June–August 2025), heavy hitters like Sprott Asset Management (+8% in Pan American), BlackRock Inc. (+5% in iShares Silver Trust), and Invesco Ltd. (+6% in VanEck Silver Miners ETF) piled into silver.

Buzz on X says Saudi Central Bank’s dipping its toes into silver via iShares Silver Trust (SLV), ditching its gold-only playbook.

London Vaults Drying Up

The LBMA’s silver stash is under siege from a supply deficit. With 150 million ounces short in 2024, the Silver Institute hints reserves might shrink 5–10% yearly if demand keeps raging, setting the stage for a price explosion.

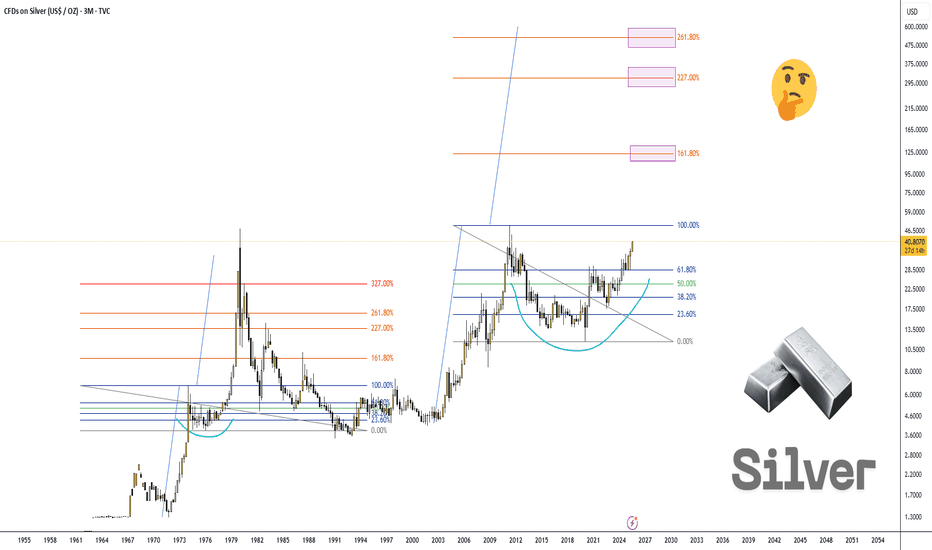

1979 Boom & 2025–2026 Wild Cards

1979 Flashback: The Hunt Brothers’ silver grab, plus inflation and oil chaos, rocketed silver from $6 to $50/oz (+700%). Gold jumped from $300 to $850/oz on similar vibes.

2025–2026 Triggers:

Inflation’s sticky above 3%, the USD’s wobbling from tariffs, and a Fed cut looms in September 2025. Watch for U.S.-China trade wars, Middle East flare-ups, or a BRICS metals exchange—any could ignite a 1979-style silver rocket if deficits worsen.

Price Targets:

Short-Term (3 months): $60.00 (+46.9%)

Mid-Term (6–12 months): $120.00 (+193.7%)

Long-Term (18–24 months): $240.00 (+487.5%)

🤔🤔🤔🤔🤔🤔🤔🤔

Panamerican

Pan American Silver: Low 🎤 🎧She hit the floor (she hit the floor)

Next thing you know

Shawty got low, low, low, low, low, low, low, low…

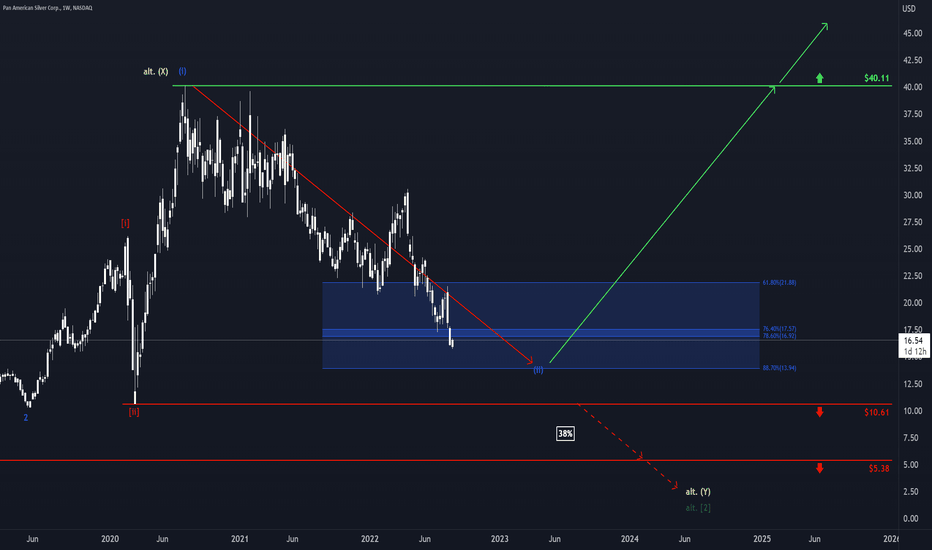

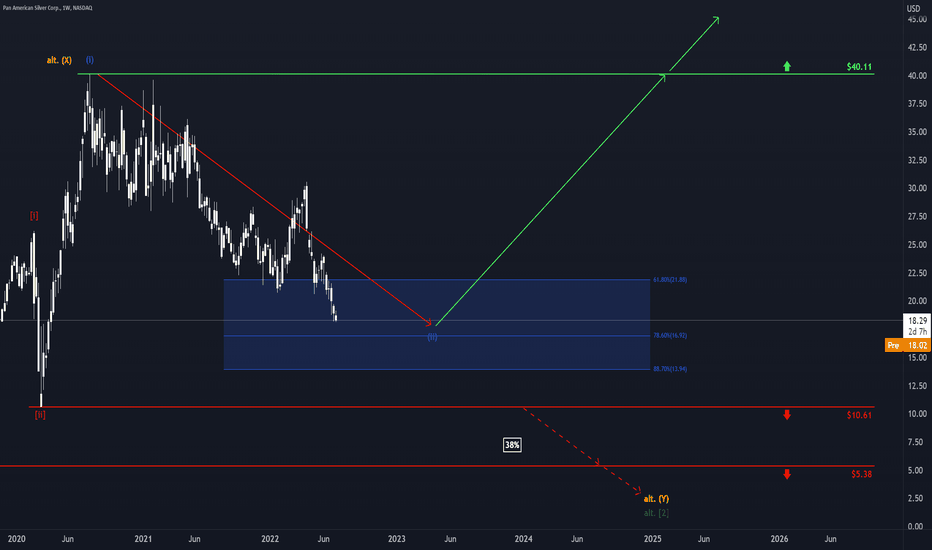

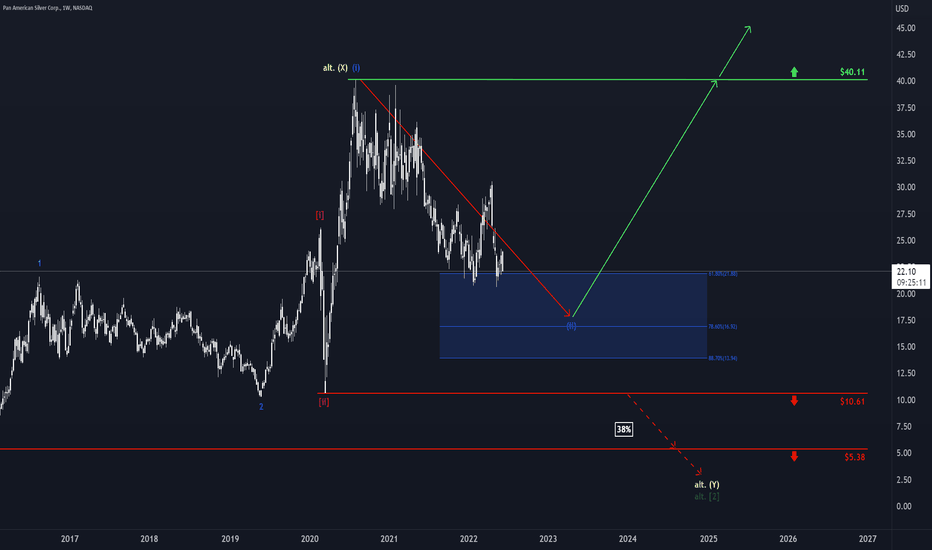

“Shawty”, in this case, is Pan American Silver, which is shaking its “big booty” in its “apple bottom jeans” to the beat of Flo Rida’s song Low and is progressing deeper into the blue zone between $21.88 and $13.94. It has not (yet) “hit the floor” but could of course use the blue zone until the bottom to finish wave (ii) in blue. Afterwards, though, Pan American Silver should take off, heading for the resistance at $40.11. However, there is a 38% chance that Pan American Silver could get too low and thus drop below the support at $10.61, which would then trigger further downwards movement below the next mark at $5.38.

Pan American Silver: Exciting!The tension is building! Pan American Silver is getting closer to the middle of the blue zone between $21.88 and $13.94, where it should ideally complete wave (ii) in blue. As soon as this is done, Pan American Silver should turn around and move upwards, heading for the resistance at $40.11. A 38% chance remains, though, that the price could drop through the blue zone and below the support at $10.61, thus initiating further descent below the next support at $5.38.

Pan American Silver: Aquanaut 🤿So far, Pan American Silver has only been snorkeling along the surface of the blue pool between $21.88 and $13.94. However, we expect it to put on its diver’s gear and to plunge deeper into the water to finish wave (ii) in blue. Afterwards, Pan American Silver should emerge from the depths and rise above the resistance at $40.11. There remains a 38% chance, though, that Pan American Silver could lose its compass in the blue zone and dive deeper and deeper, even below the support at $10.61. Once there, it should tumble further below the next support at $5.38 as well.

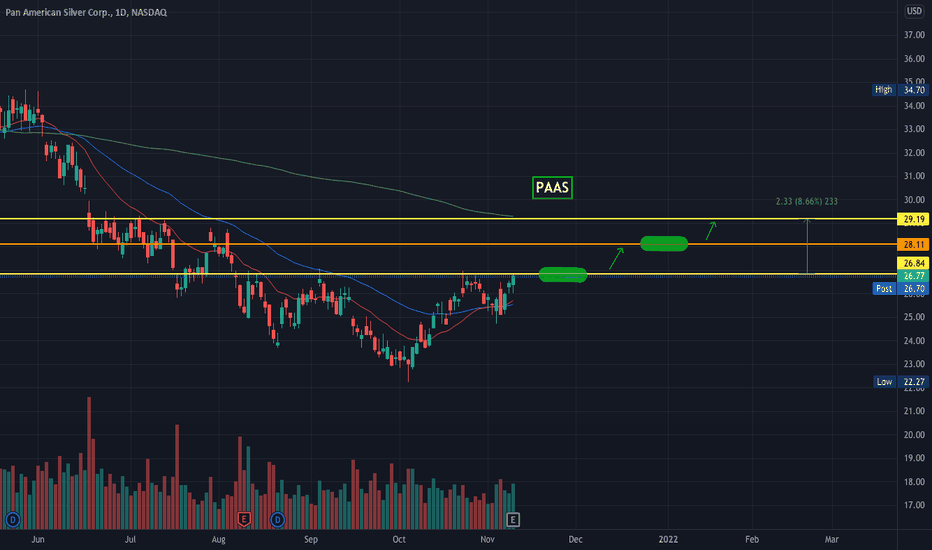

PAAS looks bullishIf PAAS can break and close the $26.84 resistance on the 4hr and daily candles, we can expect a rise to $28.11 (first target) and then $29.19 (second target). - HH