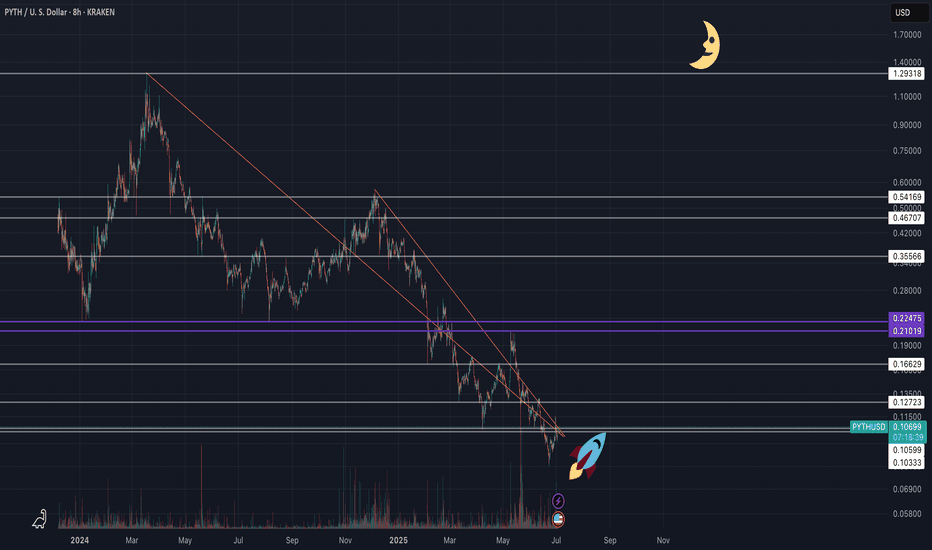

PYTH NETWORK (PYTHUSD) - (10X - 50X Potential)Pyth Network is an oracle protocol originally built for Solana, optimized for ultra-low latency and first-party data directly from exchanges and market makers. Unlike Chainlink’s node-aggregator model, Pyth enables real-time price feeds (as fast as 400ms) sourced directly from over 100 institutional providers, including Binance and Cboe.

🧩 Why Pyth?

DeFi apps need fast, accurate pricing to avoid exploits and ensure fair trading. Pyth delivers high-frequency, high-integrity data, especially valuable for derivatives, perpetuals, and high-speed DeFi protocols.

🌐 Massive Expansion

What started on Solana now powers 100+ blockchains, including Ethereum L2s, Cosmos, Sui, Aptos, TON, and more. As of 2025, over 420 protocols integrate Pyth, with over $48B+ monthly trading volume secured. It has become the #2 oracle in DeFi by usage, dominating ecosystems like Solana, Sui, and Injective.

📊 Tokenomics & Unlocks

Max supply: 10B PYTH

Circulating: ~5.75B (mid-2025)

Next major unlock: May 2026 (~2.1B tokens)

Utility: Governance, staking, publisher rewards, and oracle integrity

Pyth’s decentralized governance is growing, with a DAO now guiding key protocol parameters. It’s also expanding beyond price feeds, launching products like randomness (Entropy) and MEV mitigation tools (Express Relay).

Disclaimer: This is not financial advice. Always do your own research before making investment decisions.

Parcl

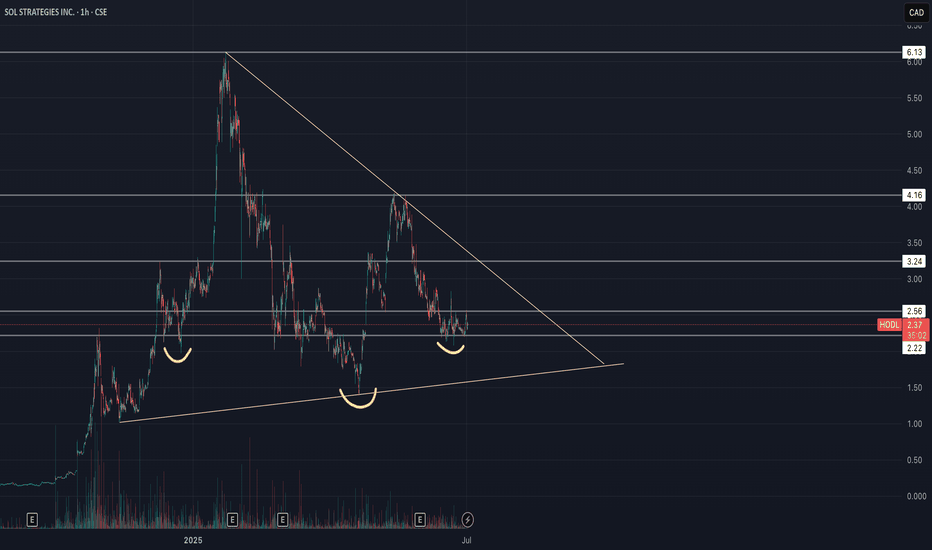

Sol Strategies Inc (HODL) - Inverse H&S🚀 SOL Strategies (HODL) – Public Market Gateway to Solana Yield

SOL Strategies (CSE: HODL) is a publicly traded company laser-focused on the Solana ecosystem. With nearly 395,000 SOL held (most of it staked) and over 3.7 million SOL delegated to their validators, they generate consistent income through staking rewards and validator commissions.

Their business model is simple:

📌 Accumulate SOL → Stake it → Run institutional-grade validators → Earn yield

📌 Expand through partnerships (3iQ, Neptune, BitGo, Pudgy Penguins)

📌 Hold strategic Solana ecosystem tokens like JTO and jitoSOL

📌 Operate with SOC 2-certified infrastructure and pursue a Nasdaq listing

SOL Strategies is not just holding crypto – they are building core infrastructure for Solana, giving equity investors direct exposure to staking economics in one of the fastest-growing blockchain networks.

📊 For traders: HODL stock offers a pure-play vehicle for Solana exposure, with an income-generating twist.

⚠️ Always do your own investment research and make your own decisions before investing.

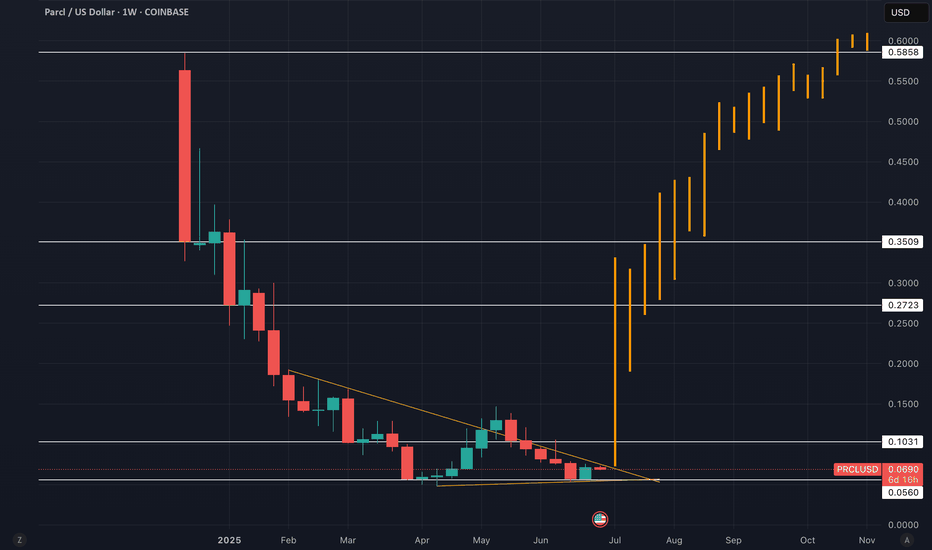

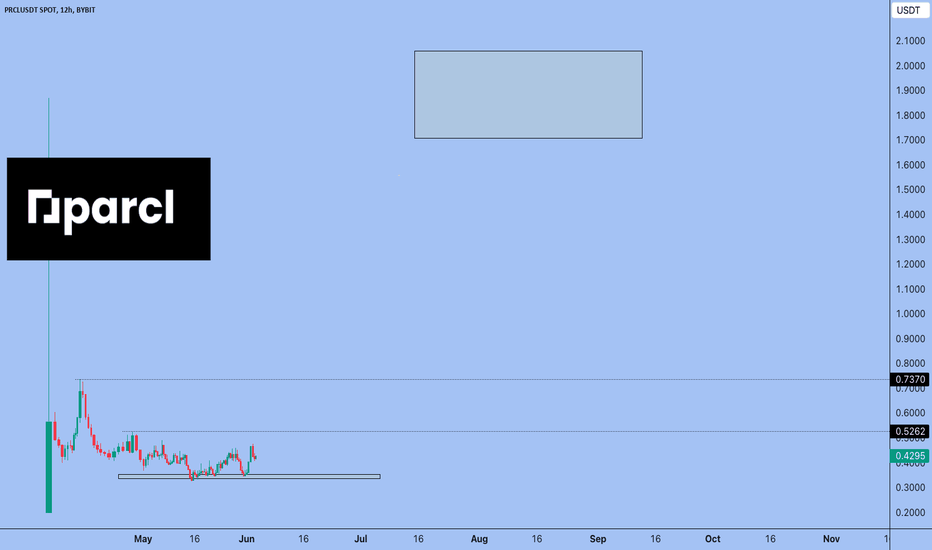

Parcl - PRCL-USD - 30 Million Market Cap (100x Potential)tradingview.sweetlogin.com

CHATGPT Research Summary:

Parcl: Unlocking Real Estate Exposure on the Blockchain

Introduction:Parcl is a groundbreaking decentralized platform that enables traders and investors to speculate on real estate market price movements much like they trade crypto or equities. By combining real-time housing data with blockchain technology, Parcl offers around-the-clock, borderless, and highly liquid exposure to global residential real estate markets. In this comprehensive blog post, we’ll explore what Parcl is, how it works, what it means to own the EGX:PRCL token, the unique opportunities it provides for investors (including AI-driven strategies), its core strengths, and the risks and challenges it faces. The tone is professional, investment-focused, and designed for the TradingView audience.

What is Parcl and How Does It Work?

Parcl allows users to trade real estate price indices for global cities without ever owning or transacting physical property. Each index represents the aggregated median price per square foot/meter for residential properties in a specific city. Users can go long or short on these indices using perpetual contracts with up to 10x leverage, entirely on-chain and settled in USDC.

Built on Solana, Parcl leverages the blockchain's high speed and low fees to offer a seamless and cost-efficient trading experience. Users only need a Solana-compatible wallet (e.g., Phantom) to deposit USDC, select a city index, and place a trade. There are no barriers such as down payments, brokers, or escrow delays — just rapid, decentralized access to global housing markets.

Data integrity is ensured through Parcl Labs, which aggregates millions of housing data points daily to generate real-time city indices. These feeds are streamed on-chain via oracles like Pyth Network, ensuring transparency and reliability.

What Does It Mean to Own EGX:PRCL ?

The EGX:PRCL token is the governance and utility token of the Parcl ecosystem. Holders of PRCL can:

Participate in protocol governance by voting on changes to platform parameters, fee structures, and market expansions.

Access premium real estate data and analytics through Parcl Labs.

Receive airdrops, rewards, or staking incentives as part of community growth and loyalty initiatives.

While PRCL doesn’t currently offer revenue sharing, it grants holders influence over protocol decisions and potential future economic alignment as the ecosystem matures.

A New Asset Class for Investors and AI Agents

Parcl opens up a completely new asset class: blockchain-native, synthetic real estate exposure. This has major implications:

For retail investors, it democratizes access to real estate, which was previously limited by geography, capital requirements, and illiquidity.

For sophisticated traders, it enables granular bets (e.g., short New York, long Miami) and high-frequency strategies previously impossible in traditional real estate.

For AI agents and algorithmic investors, Parcl provides composable, on-chain access to a diversified asset class that can be rebalanced and traded programmatically.

In short, Parcl makes real estate a liquid, programmable, and globally accessible financial primitive.

Core Strengths: Why Parcl Stands Out

Solana-native speed & cost-efficiency: Enables fast execution and micro-investments ($1+), ideal for retail users and automated agents.

Unique data infrastructure: Parcl Labs’ real-time indices provide unparalleled accuracy and granularity.

Sophisticated perpetual AMM model: Handles liquidity and market balancing with dynamic funding rates and cross-margining.

Growing community and product-market fit: With 80,000+ users and over $1.3B in cumulative volume, Parcl is becoming the most liquid real estate trading venue in the world.

Risks and Threats to Consider

Regulatory uncertainty: Synthetic real estate products may eventually face classification as securities or derivatives in some jurisdictions.

Liquidity dependencies: The AMM model depends on sufficient USDC liquidity pools; low liquidity could cause slippage or insolvency risk.

Smart contract vulnerabilities: As with all DeFi platforms, there is non-zero risk of exploits or oracle manipulation.

Platform dependency: Parcl is tightly coupled to Solana — if the chain experiences downtime or congestion, the protocol may be impacted.

Investors should also be aware of token unlocks and potential dilution from early backers and treasury allocations.

Future Outlook and 100x Potential

With a current market cap near $30 million, Parcl represents a high-upside, early-stage bet on tokenized real estate. If the project gains traction and achieves broader adoption, it’s feasible to imagine a future market cap of $2.5 to $3 billion, representing a 100x potential from current levels.

Factors that could drive this include:

Expansion to more global cities

Increased PRCL utility and staking incentives

Growing demand for real-world assets (RWAs) on-chain

Enhanced support for automated and AI-driven strategies

Final Thoughts

Parcl is redefining what it means to invest in real estate. By transforming local, illiquid property markets into a global, composable, and liquid asset class, Parcl enables both human and AI investors to access and trade the housing market like never before.

Whether you’re a trader looking for uncorrelated exposure, a long-term investor seeking innovation, or a technologist building AI agents — Parcl offers a compelling opportunity.

⚠️ Disclaimer: This is not financial advice. Always do your own research and make investment decisions based on your individual risk profile.

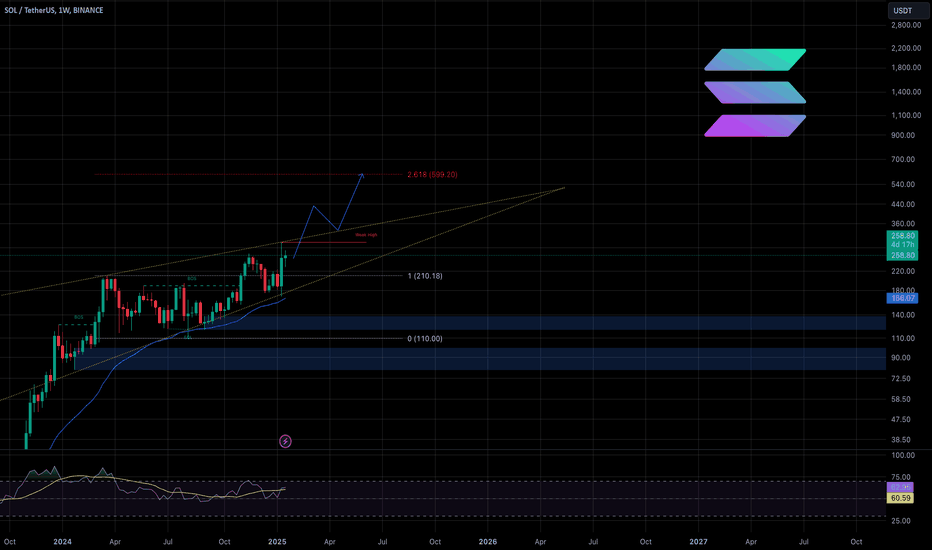

Solana (SOL) 22.03.2025In the near term, Solana (SOL) is showing a desire to return to its price channel, but further asset allocation is likely to be delayed until the summer of 2025. Despite the possible optimistic outlook for growth, it is worth preparing for corrective moves in September. SOL is among the three assets where market makers are already active, which may indicate artificial liquidity maintenance or position accumulation.

Significant growth is likely to be expected in Ethereum (ETH), while recent momentum is more likely to manifest itself in Bitcoin (BTC) and Solana (SOL). The long-awaited altcoin season may start soon, which requires investors to be more selective. It is recommended to reallocate capital from fundamental assets to high-risk instruments with growth potential, keeping a balance between risk and return.

Special attention should be paid to the Solana ecosystem, where promising projects such as PRCL are already present, which emphasizes the technological and investment attractiveness of blockchain.

Alex Kostenich,

Horban Brothers.

Solana's Ecosystem and the Winds of ChangeIn the tapestry of today's financial markets, I see patterns that most do not. The current state of the Solana ecosystem reminds me of the housing market before the 2008 crash; not in its vulnerability, but in the potential for exponential growth, masked by the noise of the day-to-day market fluctuations.

Solana's Rise and the RWA Sector

Solana, with its high transaction throughput and low costs, has positioned itself as a beacon for developers and users alike. It's not just about speed; it's about utility. The Real World Asset (RWA) sector on Solana, particularly with projects like Parcl, offers a unique opportunity. Parcl enables investors to engage with real estate markets through tokenization, providing liquidity to an otherwise illiquid sector. This is akin to giving a farmer access to the stock market, only without the intermediaries that often siphon off value.

The potential here is vast, as it democratizes access to real estate investment, which has traditionally been the preserve of the wealthy. Solana's infrastructure supports this with its scalability, making it an ideal platform for such financial innovations. The growth in this sector could mirror the growth in tech stocks during the early internet boom, but with a foundation that's more robust and less speculative.

The ETF Approval Horizon

Now, about the ETF. The winds of regulatory change are upon us. With a new SEC chair who understands the transformative power of blockchain technologies rather than fear-mongering about them, we're looking at a landscape where a Solana ETF could not only be approved but could potentially redefine institutional investment in cryptocurrencies.

This isn't merely speculation; it's about understanding the shifts in regulatory climates. Much like how I foresaw the mortgage-backed securities debacle, I see a clear path for Solana ETFs, driven by the necessity for financial institutions to adapt or perish in this new digital economy. The approval of such an ETF would inject significant liquidity into Solana, potentially increasing its market cap and solidifying its position against other blockchain networks.

The future of Solana, particularly with its RWA initiatives and the potential ETF approval, could be a defining moment in blockchain's integration into traditional finance. But remember, we navigate these waters not for the calm but for the storm of opportunity they promise.

Horban Brothers,

Alex Kostenich

Parcl $PRCL - RWA gem on SOLParcl (PRCL) is a decentralized real estate project built on the Solana blockchain. It allows users to invest in digital square feet of real estate in various cities around the world.

The Parcl project provides tools for speculation and hedging in the real estate market by offering indices for various cities. Users can trade debt or short positions depending on their forecasts for rising or falling real estate prices in selected cities. A key element of the Parcl ecosystem is the PRCL token, which serves to manage the protocol and provides various benefits to holders, such as voting rights in protocol management decisions and access to improved data and trading incentives within the ecosystem. The Parcl project has attracted attention due to its unique concept of allowing users to invest in real estate digitally and the ability to trade in the real estate market using blockchain technology.

Team

The Parcl team is a diverse group of people with experience in a variety of fields including Wall Street, big tech, and PhD-level research. The team consists of 14 talented individuals and plans to expand. Some of the most notable members of the team include:

Trevor Bacon - Founder and CEO of Parcl. Trevor has a background in finance and technology, has worked at several hedge funds and has been involved in blockchain and cryptocurrencies for over five years.

Kellan Grenier is co-founder, COO and head of strategy at Parcl. Kellan has nearly a decade of experience as an investment analyst in traditional finance (TradFi).

Jason Lewris - Co-founder and Chief Data Officer at Parcl, Jason has a background in data science and machine learning, having worked at Microsoft and Deloitte.

Together, the team developed the Parcl protocol, a decentralized real estate trading platform built on the Solana blockchain. The protocol allows users to trade price movements in real estate markets around the world via city indices. Parcl has also received strategic investments from prominent companies and investors including Fifth Wall, JAWS, IA Capital, Eberg Capital and SkyBridge Capital. These investments have helped the team to expand and further develop the Parcl ecosystem. The Parcl team aims to democratize access to global real estate investing and create a culture of continuous growth and collaboration.

Tokenomics

The Parcl token distribution plan is designed to incentivize and reward the community, early supporters and advisors, and to promote the growth and development of the Parcl protocol. The plan includes initial distribution to the community, ongoing distribution to the community, growth and incentives, and allocations to early adopters and advisors.

1. Initial Community Distribution:

8% of the total volume (80,000,000 PRCLs) distributed to community members. 75,000,000 PRCLs (7.5% of total) distributed to early adopters of the Parcl protocol. 5,000,000,000 PRCL (0.5% of total) distributed to core members of the Parcl community.

2. Ongoing Community, Growth, & Incentives: 28% of the total (~280,000,000,000 PRCL) is reserved in the treasury for the protocol's key goals. These goals include infrastructure, growth, partnerships, and continued incentivization of the network.

3. Early Supporters & Advisors:

- 28% of the total supply (~280,000,000 PRCL) is set aside for early supporters and advisors. These tokens are unlocked over a 3 year period with a 1 year break.

4. Core Contributors:

- 21% of the total (~210,000,000,000 PRCL) is distributed to core contributors. These tokens vest and unlock over 3 years, with a 1 year break.

5. Ecosystem Fund:

- 15% of the total proposal (~150,000,000 PRCL) is set aside in a portion dedicated to ecosystem development. This fund is intended to incentivize the long-term growth and development of Parcl's ecosystem. The tokens in this fund will be used to improve the performance of liquidity providers (LPs) and traders, increase the liquidity of protocols, and incentivize developers to create valuable Parcl-based products.

Utility

Governance

The PRCL token will govern some aspects of the protocol and decentralized trading application. Users will use the token to vote on critical changes to risk parameters and protocol architecture. The governance structure is expected to be implemented by the end of 2Q24.

Data functionality

PRCL token holders will have access to best-in-class institutional-quality real estate data through an API developed by Parcl Labs. Over time, users who maintain the required level of PRCL in their connected wallets will continue to access the API.

Network Incentives

Parcl token holders will have the opportunity to participate in perpetual network incentives (e.g., points) shortly after the first distribution event. These incentives are designed to encourage and reward eligible PRCL holders for their participation and contribution to the Parcl ecosystem.

RWA

Real World Assets (RWA) in the context of Parcl refers to the tokenization of real world real estate prices on the Solana blockchain. Parcl is a decentralized perpetual exchange focused on real-world real estate prices and offers real-world index markets for speculation or hedging. The platform allows users to access the world's largest asset class - real estate - through “city indices,” which are the median price per square foot/meter aggregated at the city or neighborhood level.

Parcl's approach to tokenizing real world assets is groundbreaking and aims to democratize access to global real estate investing. The innovative use of decentralized smart contracts with perpetual futures allows users with as little as $1 to access price movements in real estate markets around the world, making the platform accessible to a wide range of investors.

The integration of real-world assets into the blockchain ecosystem represents a significant step towards tokenizing traditional financial assets, offering new opportunities for investment and risk management in the real estate sector. Parcl's focus on real estate RWAs positions the company as a key player in the emerging landscape of decentralized finance and blockchain technology.

Conclusion

Looking forward, Parcl's focus on RWA real estate positions it as a key player in the emerging landscape of decentralized finance and blockchain technology. The platform is committed to its mission of making real estate accessible to all by providing access to the price points of real estate markets with no minimum requirements, high liquidity, and low transaction fees. With continued development and support from the community, Parcl is well-positioned to continue its growth and innovation in real estate tokenization. Overall, the main drawbacks include the large competition in the real estate market and the lack of a license, which is crucial in the RWA sector. However, the team, capitalization and Solana involvement are all positives that make this project undervalued. In addition, there is potential for listing on Binance.

token is now available for purchase on Bybit

Best regards EXCAVO