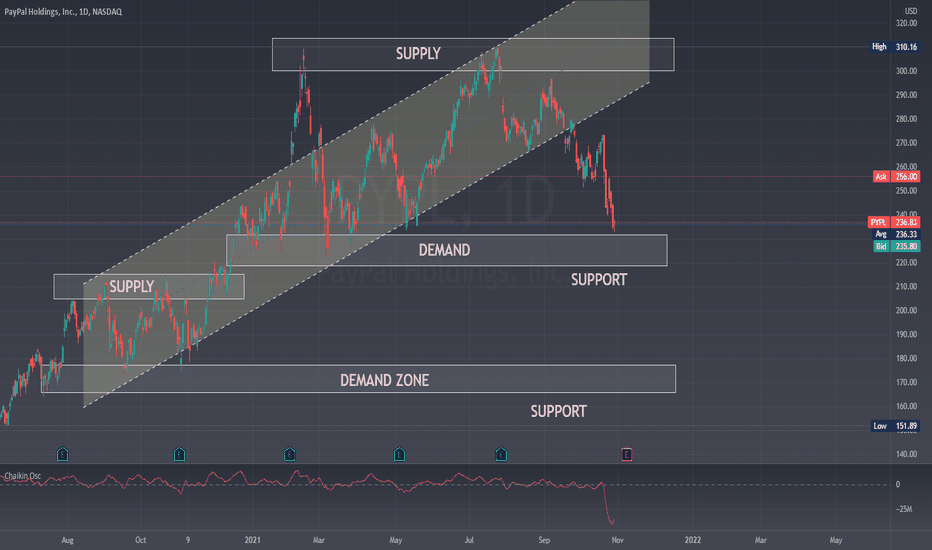

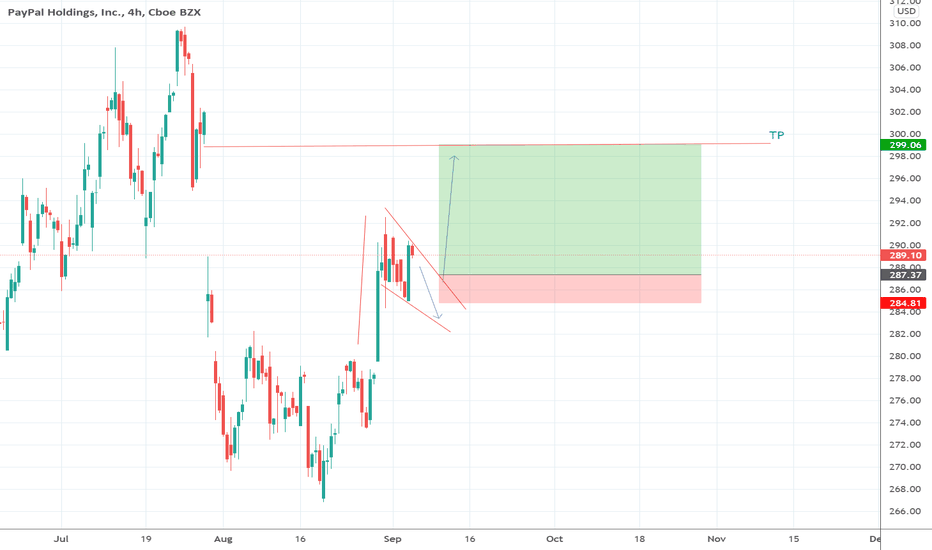

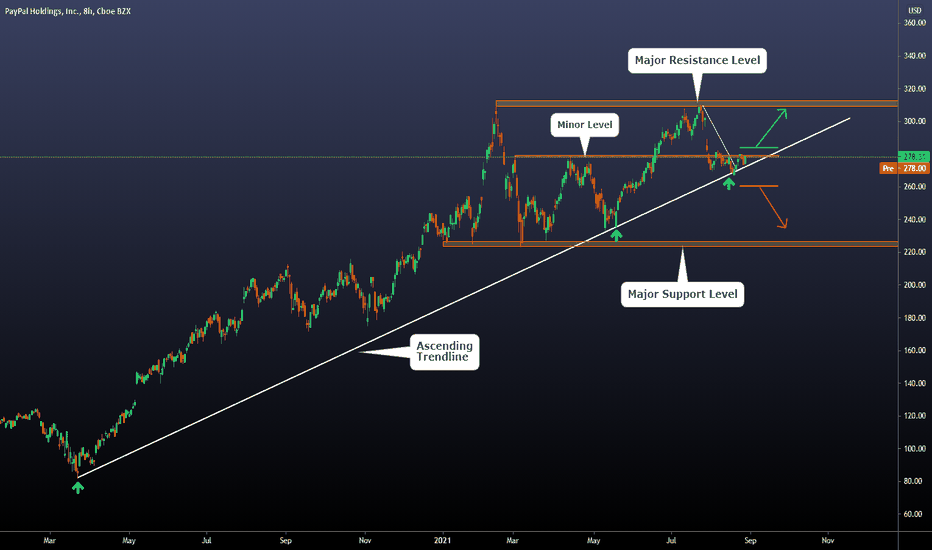

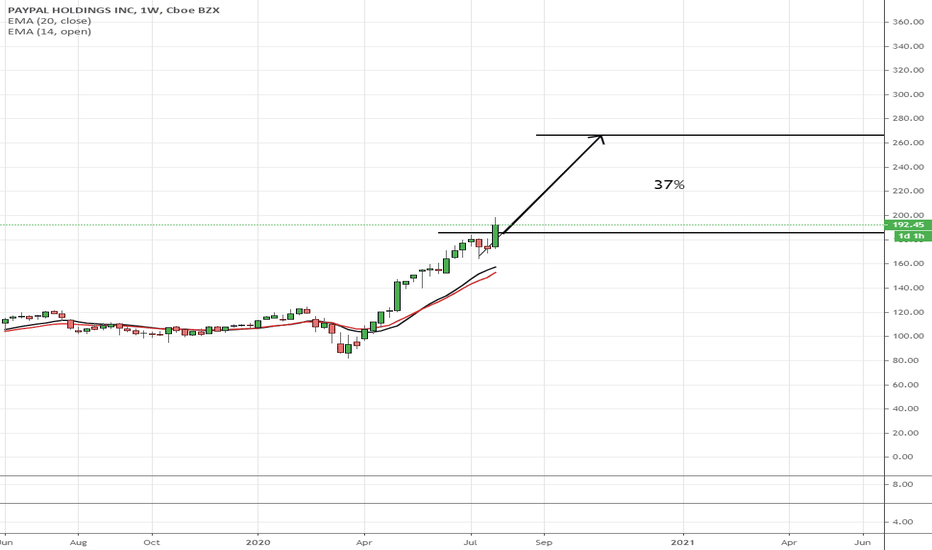

PAYPAL ON STRONG DEMAND ZONE, READY FOR BULLISH REBOUNCEPayPal stock quick analysis & labeling of the supply and demand situation in the market.

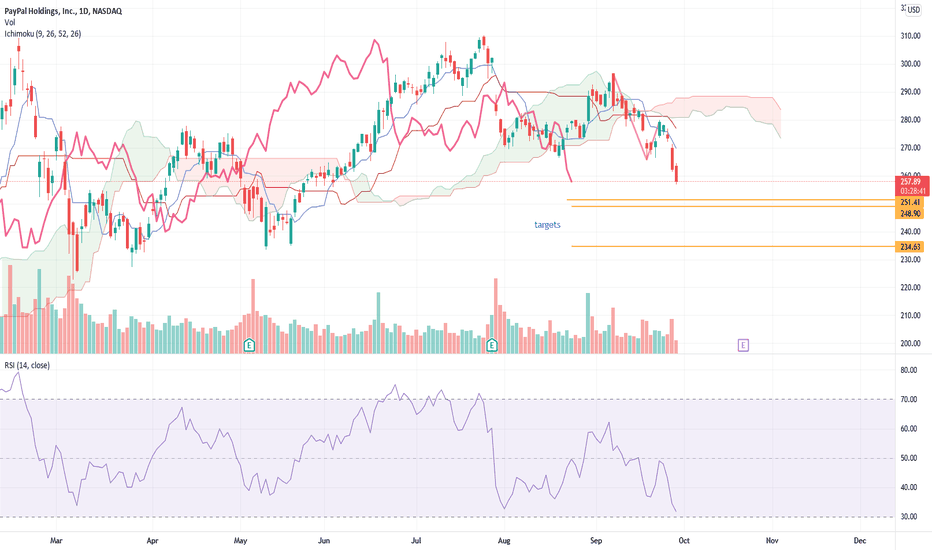

Marked out on the chart you can see zones of supply and demand, and we are approaching a zone of demand coming into this earnings release.

Should PayPal post solid EBITDA and raise its outlook at all, then any bounce might be able to be traded risking off of this demand zone with a target of the previous supply zone around 305. Should it fail to do so, then the stock may breakdown past this zone of demand, and sink further as it's growth multiple is re-rated lower.

While PayPal is relatively expensive right now, its solid (and accelerating) growth of 24%ish over the last year may continue, thus driving the stock higher.

We are also trading at the recent relative limit of discount to average pricing, at nearly -8% to recent prices. This may be a signal of slowing future price acceleration to the downside into earnings.

A potential trade around this release would be a weekly anchor spread, which is a calendar with one leg pre earnings , and one post earnings . Should the stock vol begin to calm into earnings as investors position for the news, it may be a solid way to take advantage of that with a ~$300 win per contract.

Additionally, an interesting bet may be a far otm long strangle, with the long put lower than the zone of demand - bet on a breakdown. If it happens, it may be ugly.

Technically we have great levels working here, globally uptrend and locally downtrend. The level was confirmed with two false breakdowns.

We have to note 13th of November reports also. And we can expect accelerate movement from 220 to 300$.

Risk Disclosure: Trading Foreign Exchange (Forex) and Contracts of Difference (CFD's) carry a high-risk level. By registering and signing up, any client affirms their understanding of their own personal accountability for all transactions performed within their account and recognizes the risks associated with trading on such markets and such sites. Furthermore, one understands that the company carries zero influence over transactions, needs, and trading signals. Therefore, it cannot be held liable nor guarantee any profits or losses.

Paypal

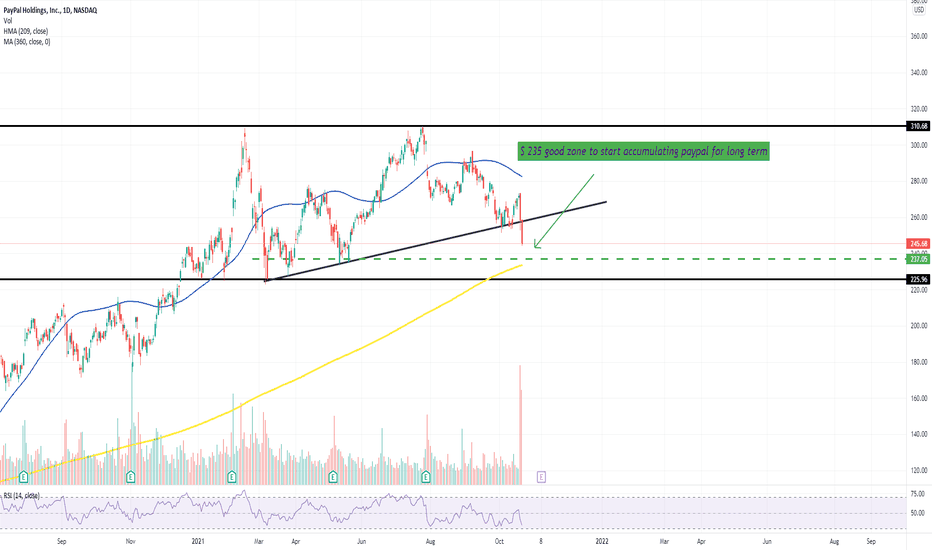

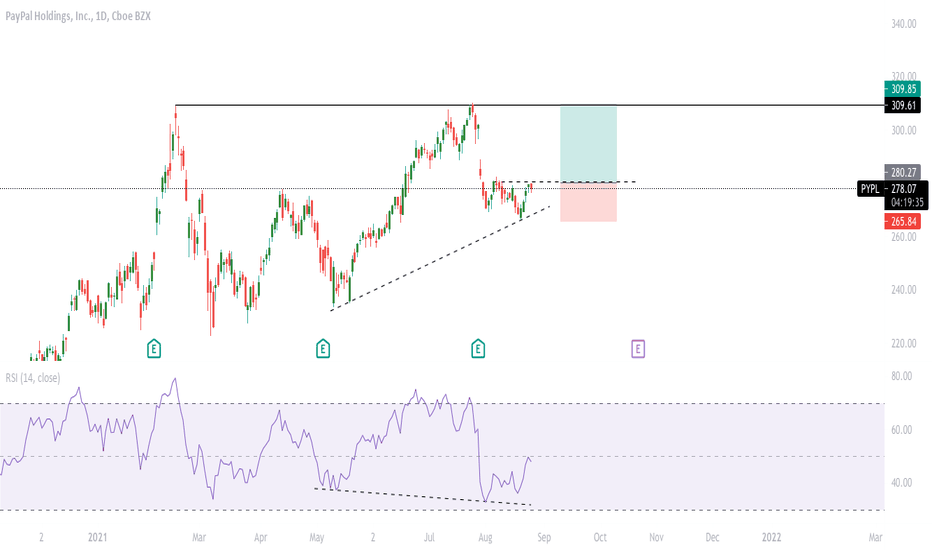

PayPal (PYPL) Analysis

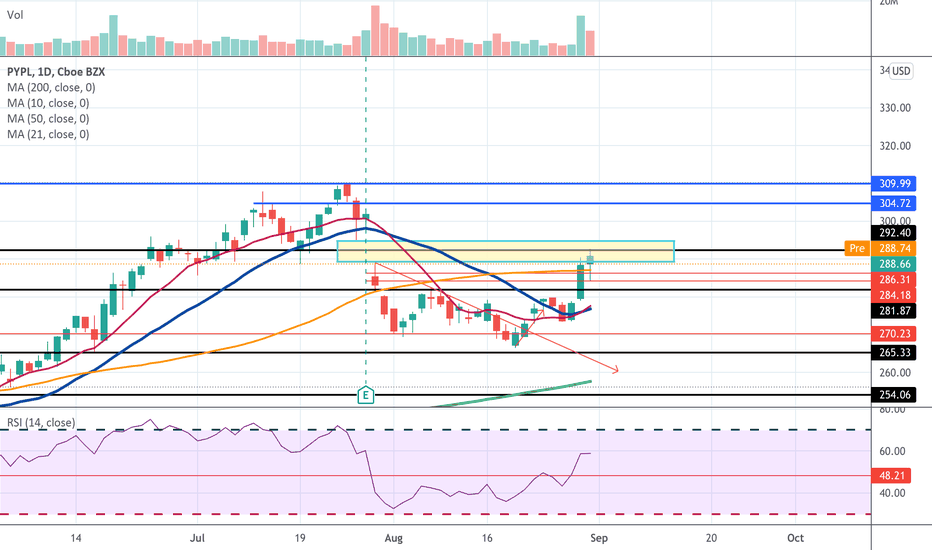

PayPal was one of the companies that post-covid has grown the most, we are talking about a + 271% from the lows of March 2020 to the double maximum reached between February and July 2021.

A dizzying growth with always positive Earnings, which beat expectations.

Except that of July 28th.

This time, albeit positive, the earnings proved to be disappointing, and in fact, on July 29 the stock opened in a gap down of more than 5% and then gave way to a bearish phase that lasts until today, where we are just two days old. of heavy sales due to the rumor that the holding of San Jose is in talks to buy Pinterest.

Physiological pull-back based on news or the start of a major bearish phase?

Paypal has, compared to the past, a lot more competition, and it won't be long for Amazon to enter this brokerage business.

The company is moving, precisely because it knows that there is a need for news for investors. The purchase of Pinterest could be strategic, as the creation of e-commerce on the platform, with the experience and ecosystem of PayPal, could be very interesting and profitable.

Without forgetting that eBay has changed its policy a few months ago, creating its own payment ecosystem and making it mandatory, excluding PayPal from a partnership that lasted for about two decades. (I'm speaking about the European situation).

The future scenario remains uncertain.

The November Earnings will be crucial.

From a graphic point of view, the entry levels are quite evident and stand at:

- $ 240 current level, but I decided to wait

- 213 $ area, first volumetric level of some importance

- $ 173 of course, should it ever arrive here, I would definitely buy one.

Happy trading

Lazy Bull

TSLA - PUTS - OPTIONSAll,

First off I like TSLA, Elon etc. They had an absolute monster run, but what goes up most come down (some). I think we see 760s or 750s retest. Adding PUTS once it fails up here and volume dies off. Also some semi not great news recently. Once again TA and bull run coming to an end I think.

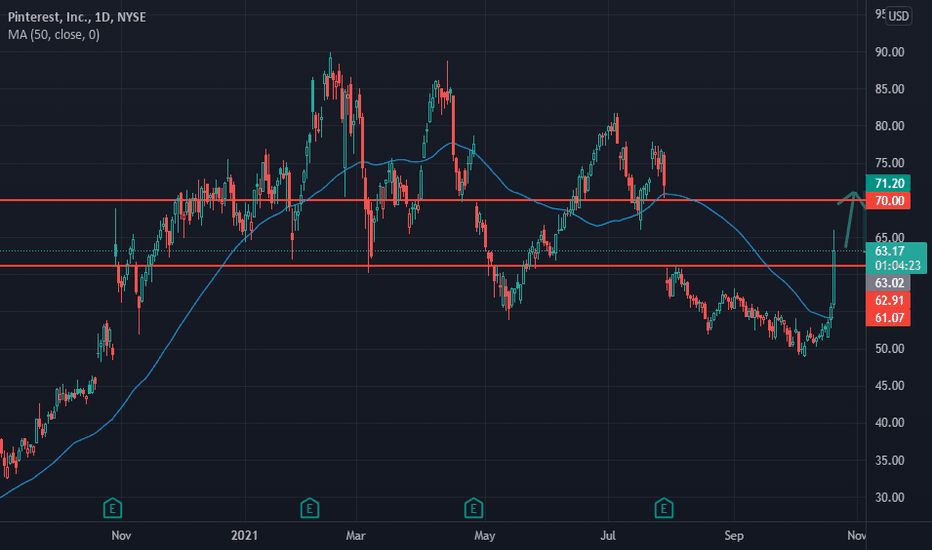

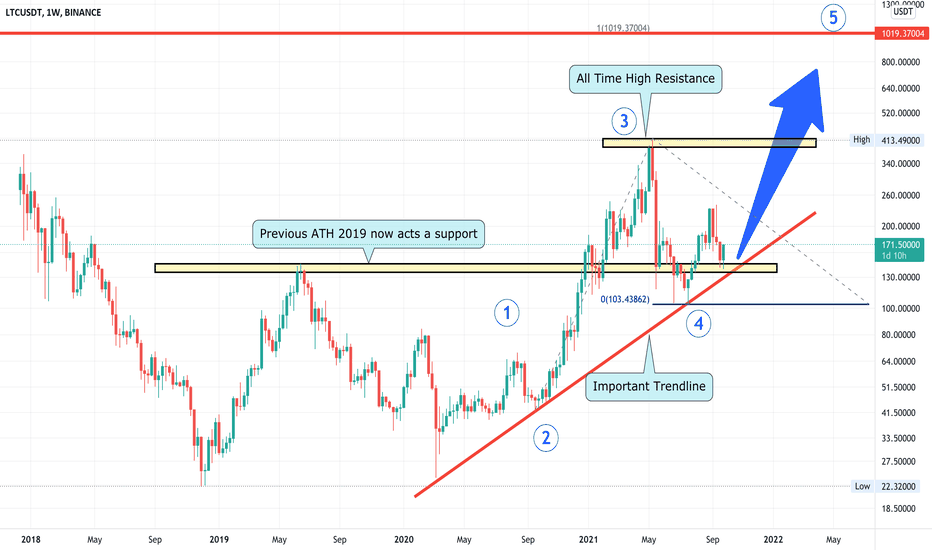

Let's make a deal!Paypal is in talks with Pinterest about a possible takeover. The price per share is being discussed in the neighborhood of $70. It would be around $39 billion. Potential earnings, if you go in at this point, could be 11%.

Watch closely, there could be pullbacks. You can exit the trade with a stop loss if it goes above the 61

❤️ If you find this helpful and want more FREE forecasts in TradingView

. . . . . Please show your support back,

. . . . . . . . Hit the 👍 LIKE button,

. . . . . . . . . . . Drop some feedback below in the comment!

❤️ Your Support is very much 🙏 appreciated!❤️

💎 Want us to help you become a better Stock trader?

Now, It's your turn!

Be sure to leave a comment let us know how do you see this opportunity and forecast.

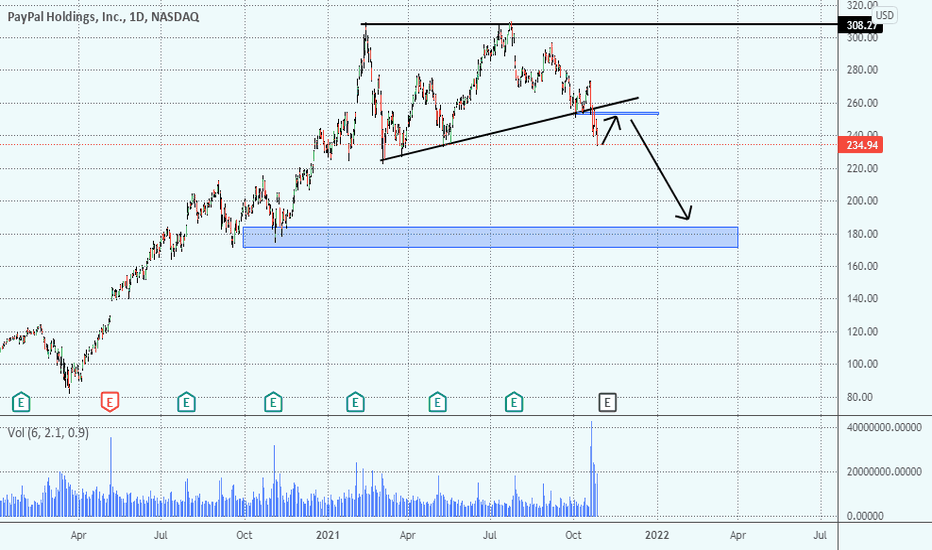

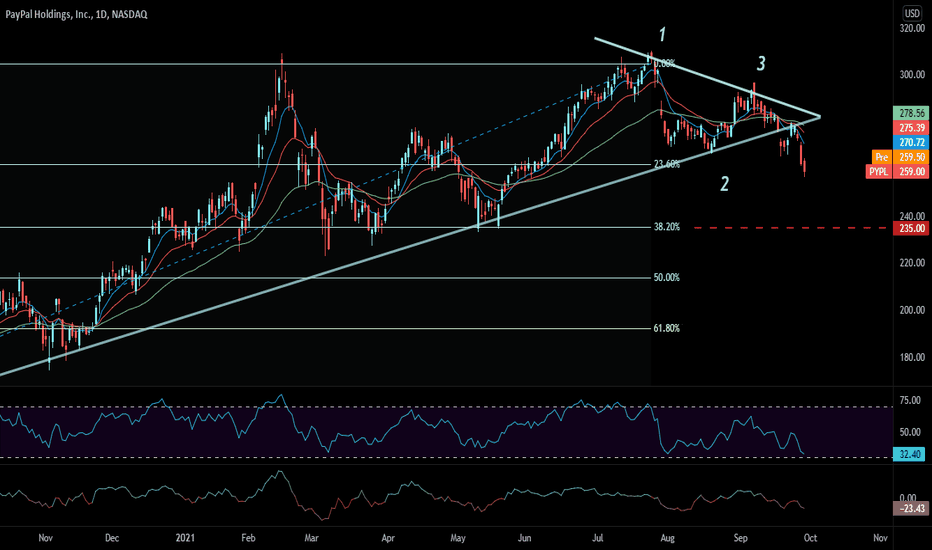

PayPal under pressurePayPal Holdings Inc shares fell 1.22%, or $3.19 per share, to close Wednesday at $259.00. The stock showed a lot of weakness since the company's latest earnings report on July 21 showed a higher sales and earnings in Q2, but, its projections for the full-year 2021 were downbeat.

The stock has violated the ascending trendline aggressively with a downward gap confirming the formation of a bearish reversal pattern on the daily timeframe. PYPL may extend its pullback hitting the pattern's target at $235.00 that corresponds to the 38.2% Fibonacci retracement level.

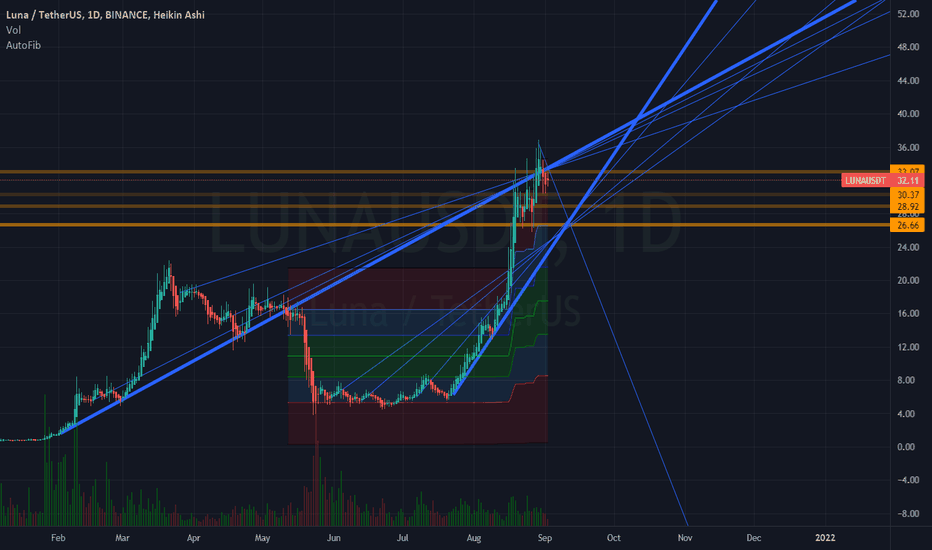

Look at the beautiful pattern the trend lines are makingWell guys, I dont know if you been holding for awhile or not but WHAT A YEAR. $LUNA is MASSIVE. This has been my greatest hand so far and you know what, I think it will continue to be the best. With all the minting and burning does anyone really need DD? I dont do technicals I just like charts. I've been successful with charts alone. With that said, Im not a professional. This is for entertainment only. Do your own research. You should know that already.

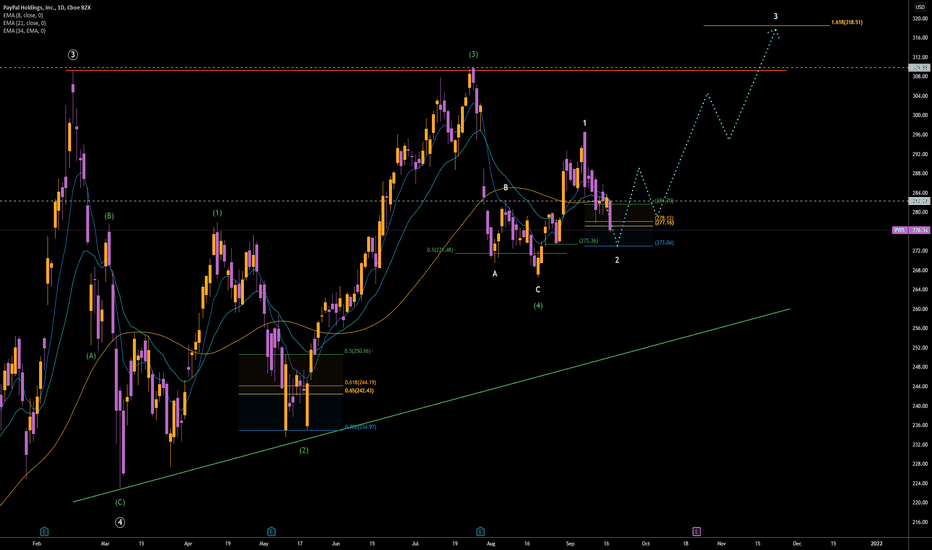

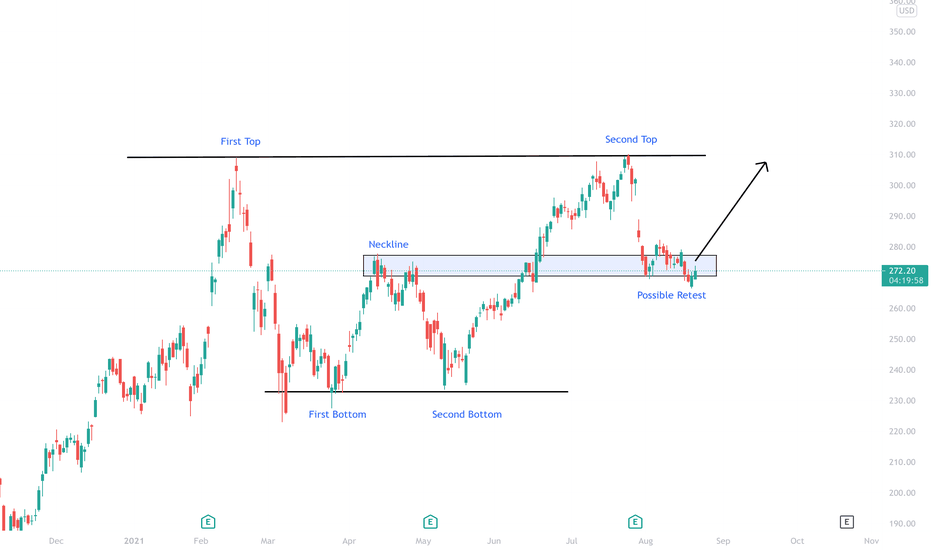

$pypl #paypal update2 pt is above $303 at this phase i was inform you about the potential stock move one week before

at this pt is $304

yesterday the buyers absorbed the sellers from quick gains but the stock closed green with higher high

we saw that there is big power here.

strong long

it is safe bet and this

disclaimer

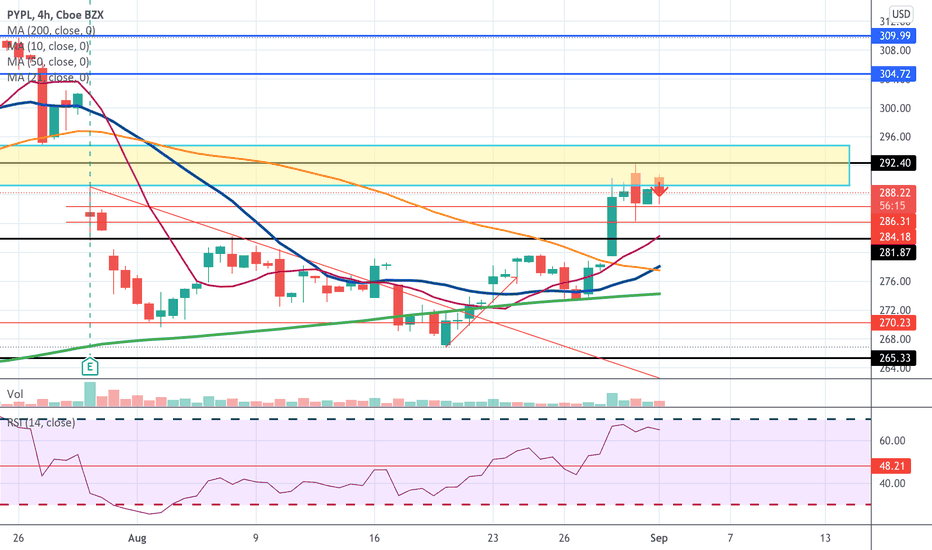

PYPL against the ascending trendline + lower timeframe viewToday we will talk about PYPL!

-The price has bounced on the main ascending trendline since the 2020 March bottom

-What can we expect from here? We have defined two horizontal levels (green and red) for the bullish and bearish views. Please don't consider them as triggers; use them as reference lines. On the next image, we will show you the specific filters we will be using to develop setups (we will not short PYPL. However, we defined what, in our view, would be a clear scenario)

-What about Risk? Always absolutely always risk no more than 1% to 2% of your capital. That will keep your account safe and your mental state healthy.

-We can keep writing to make this post longer. But all the necessary information to have a clear idea on what we are observing here is already on the text and the image.

We wish you a great trading week.

PAYPAL OPPORTUNITYPayPal Holdings, Inc. is an American multinational financial technology company operating an online payments system in the majority of countries that support online money transfers, and serves as an electronic alternative to traditional paper methods such as checks and money orders

Divergence on the daily for PayPal. Excellent opportunity with 1: 2 risk return

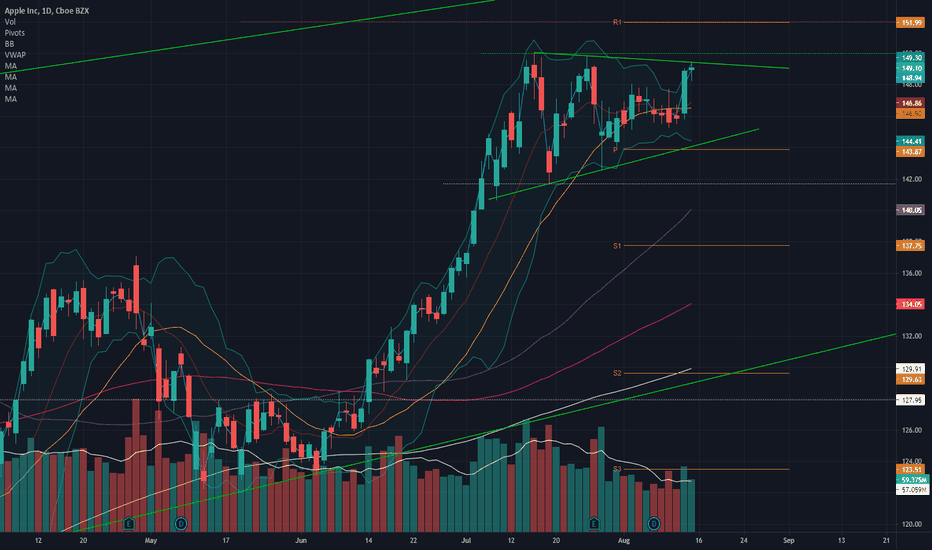

Weekly Watchlist! 8/16 - 8/20Check out what stocks we are watching for this next week as well as a recap of last week's video!

NASDAQ:FB

Nice level forming right under the gap of the $366 level. Will look for a breakout there with targets of $367, $368, $370, $372

NASDAQ:AAPL

AAPL finally looks ready for its next move higher with a breakout over the $150 level. Targets will be $151, $152, and lastly $155 if we decide to swing our position

NASDAQ:PYPL

Nice pennant forming here, will be looking to take the upside breakout of $277 with targets of $278, $279, $280

PAYPAL: Is this a consolidation phase or potential drop?The price has risen significantly from the lows of $224 up to $308 - We have now seen a correction in the price and the stock seems to be consolidating at this point. Will it maintain support and move within the ascending triangle pattern or drop further down if it breaks support? We will probably know that before end of September or first week of October. For, I will maintain a LONG view.