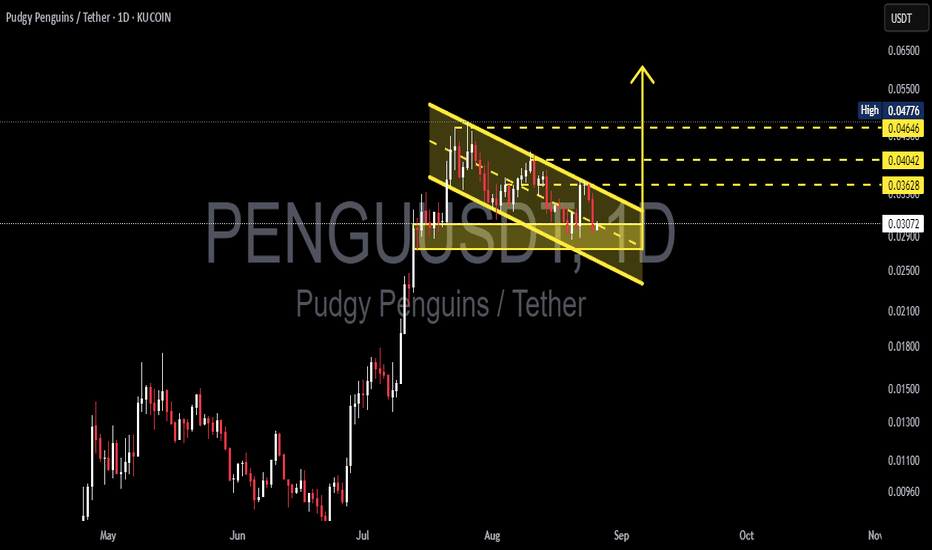

PENGU/USDT — Descending Channel!, Bull-Flag or Breakdown?🔎 Technical Analysis

Currently, PENGU/USDT is trading inside a descending channel following a sharp rally in July–August. This structure often appears as a healthy consolidation after a strong impulse move and can be classified as a bull-flag pattern — a potential bullish continuation setup waiting for confirmation.

Key Support: 0.0306 remains the critical demand zone. Multiple retests have held this level, making it an important line in the sand.

Key Resistance: The upper boundary of the channel, along with 0.03628, 0.04042, and 0.04646–0.04776, are the major upside targets if a breakout occurs.

Pattern Structure: Lower highs and lower lows forming a clean descending channel, but still within the context of a broader bullish trend.

Confirmation: A breakout above the channel with strong volume would confirm the bull-flag setup. A breakdown below 0.0306, however, would invalidate it and shift bias bearish.

---

🚀 Bullish Scenario

1. Channel Breakout: If price breaks above the descending channel and closes daily above 0.03628, upside targets include:

🎯 Target 1: 0.03628

🎯 Target 2: 0.04042

🎯 Target 3: 0.04646 – 0.04776

2. Retest Confirmation: A successful retest of the breakout level could provide a safer long entry.

---

🔻 Bearish Scenario

If price fails to hold 0.0306 and breaks down with strong selling volume, downside levels to watch:

📉 0.02500 – 0.02200

📉 possibly extending toward 0.01800 if bearish momentum accelerates.

Such a move would invalidate the bull-flag and suggest deeper correction.

---

📝 Trading Notes

Aggressive Approach: Enter near 0.0306 support with tight stop-loss below 0.028 → higher risk/reward but less safe.

Conservative Approach: Wait for a confirmed daily breakout above 0.03628 before entering → safer confirmation.

Risk Management: Always apply stop-loss and size positions properly — false breakouts remain a risk.

---

📌 Conclusion

PENGU is at a critical crossroads:

Bullish bias if it breaks out of the channel and reclaims 0.03628 → potential continuation toward 0.046+.

Bearish bias if it loses 0.0306 → downside correction likely toward 0.025–0.022 or lower.

While the overall trend remains bullish from the prior rally, confirmation is key before the next major move.

#PENGU #PudgyPenguins #Crypto #Altcoins #TechnicalAnalysis #PriceAction #BullFlag #DescendingChannel #BreakoutSetup

PENGUUSDC

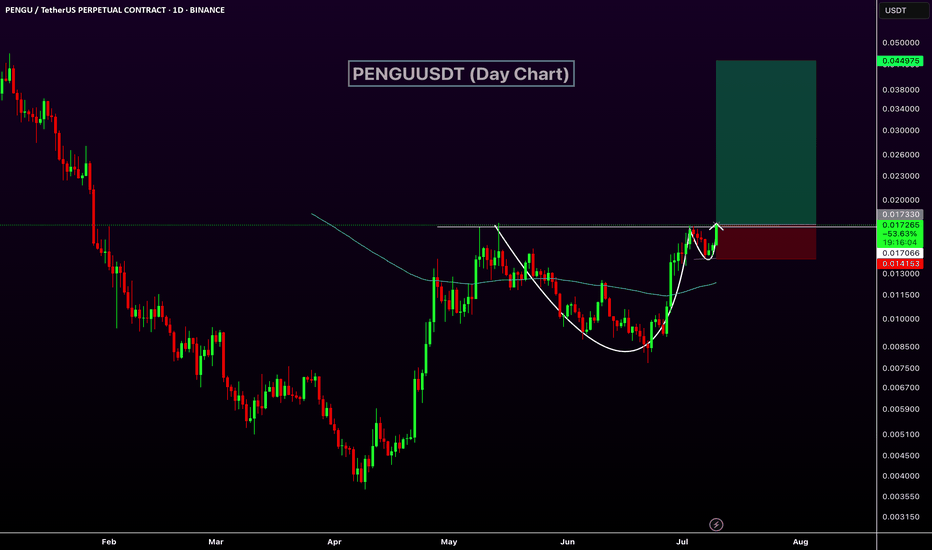

PENGUUSDT 50%-150% potentialBINANCE:PENGUUSDT is showing a classic cup and handle breakout on the daily chart, supported by a strong upward move and a bullish structure. Price has successfully broken out of key resistance around 0.0173, and volume is picking up. If momentum continues, the projected target points toward the $0.045 level, suggesting a potential upside of 50%-150%. The setup remains valid as long as price stays above the handle low around 0.0141.

Regards

HExa