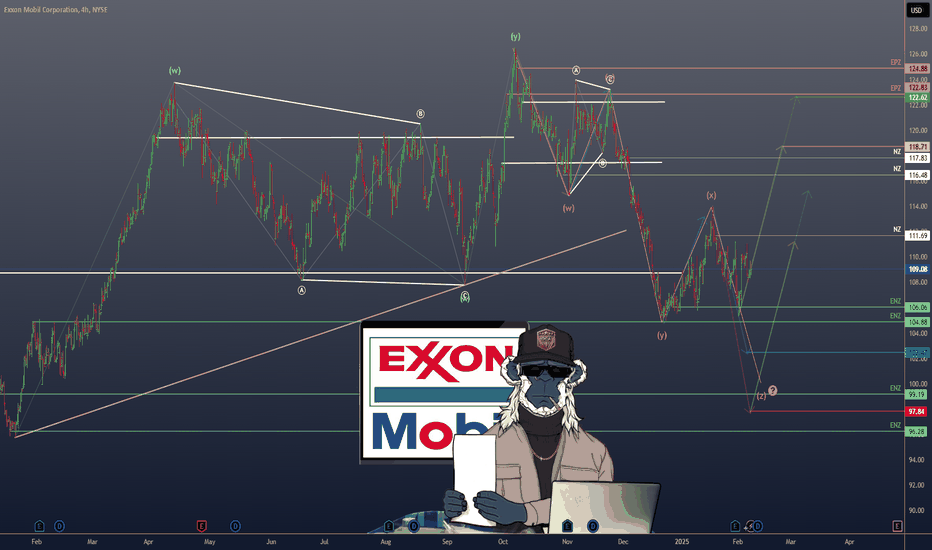

EXXONMOBIL ($XOM) EARNINGS & OUTLOOKEXXONMOBIL ( NYSE:XOM ) EARNINGS & OUTLOOK

1/7

ExxonMobil is back in the spotlight after Q4 2024 earnings. ⚡️💰

From a $59.5B Pioneer merger to record Permian production, there’s plenty to unpack. Let’s dig in!

2/7 – Q4 & FULL-YEAR EARNINGS

• 2024 earnings: $33.7B, down from $36.0B in 2023

• Q4 2024: $7.6B net income (~$1.72/share), with $12.2B in operating cash flow

• Distributed $36B to shareholders in 2024—talk about rewarding loyalty! 💸💥

3/7 – EXPANSION & STRATEGY

• Targeting higher output in Permian Basin & Guyana, despite oil oversupply

• FWB:20B annual share-repurchase program planned for 2025

• Recent Pioneer merger boosts upstream portfolio—long-term production potential just got a big upgrade 🚀

4/7 – VALUATION VS PEERS

• P/E ratio ~13–14, below the industry range (15–18) ✅

• Dividend yield ~3.5%, beating the 3.0% sector average

• Stacks up against Chevron ( NYSE:CVX ) & Shell ( NYSE:SHEL )—but ExxonMobil’s Guyana assets could be the real differentiator 🌍⛽️

5/7 – RISK FACTORS

1️⃣ Oil oversupply + OPEC+ cuts → Price uncertainty 📉

2️⃣ Global economic slowdown → Softens demand

3️⃣ Regulatory scrutiny → Heightened costs

4️⃣ Shifting to renewables → Could reduce big-oil momentum

6/7 Is ExxonMobil truly undervalued given its strong cash flow & dividend?

1️⃣ Yes – Undervalued gem

2️⃣ No – Oil oversupply risk is too high

3️⃣ Maybe – Need more clarity on renewables

Vote below! 🗳️👇

7/7 – SWOT SUMMARY

• Strengths: Advantaged assets (Permian/Guyana), robust cash flow 🏭

• Weaknesses: Reliance on oil price, smaller renewables exposure

• Opportunities: Pioneer merger, carbon capture, high-value chemical products

• Threats: Regulatory, oversupply, economic slowdown