BTC Re-Accumulation Breakout | Daily Close Confirmed | Phase DBitcoin just confirmed its first daily close above the pennant breakout, reclaiming the previous ATH (~110K) with conviction.

We now have both structural breakout confirmation on the 1D chart and clear Wyckoff Phase D progression on the 4H.

⸻

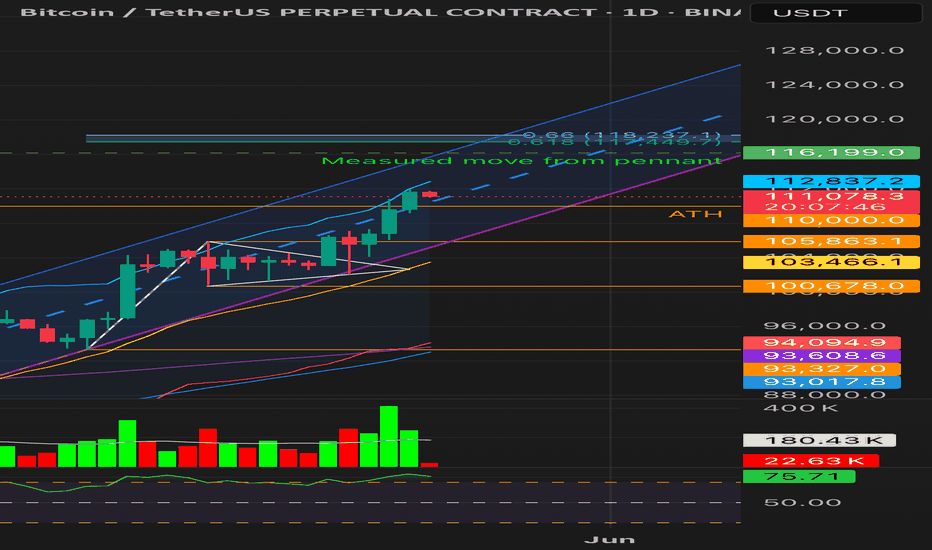

1D Chart Highlights:

• Daily Close: 110,993

• Breakout from bullish pennant

• Volume expanding into the breakout

• RSI: 75.38 → strong momentum, not overbought exhaustion

• TP Ladder:

• TP1: 112.8K (Upper BB)

• TP2: 116.2K (Fib 0.618)

• TP3: 118.2K (Fib 0.66 + trailing)

⸻

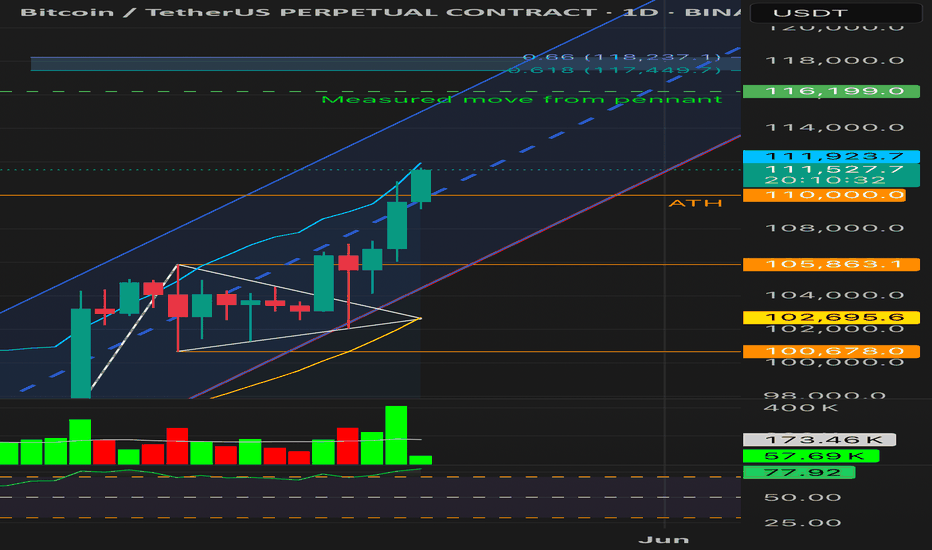

4H Chart Highlights (Wyckoff Re-Accumulation):

• SPRING → TEST → LPS → SOS

• Structure has shifted into Phase D

• Currently forming a BU→ATH zone retest (textbook Back-Up)

• Volume declining, showing lack of supply

• RSI: 67.60 (bullish territory)

⸻

No Short Hedge Triggered

⸻

Summary:

This is a low-risk consolidation above previous ATH, backed by strong momentum and classic Wyckoff mechanics.

As long as BTC holds above ~110K and volume remains controlled, bullish continuation toward 116–118K remains the base case.

⸻

#Bitcoin #BTCUSDT #Wyckoff #Crypto #Reaccumulation #Breakout #TradingView #TechnicalAnalysis #PhaseD

Phased

BTC | Testing ATH — Breakout or Trap?Daily close just under ATH at 109,609

We had only 1H confirmation above ATH, with the first 4H close above ATH likely in 30 minutes. The breakout volume is well above average (Volume MA: 172.89k), but daily candle still below resistance.

This could be:

• A Sign of Strength (SOS) transitioning into Phase E markup,

• Or a premature breakout without higher timeframe validation.

⸻

Breakout Validation Checklist:

1. 1H Close Above ATH (~110k) ✅

▸ Initial signal confirmed, but not sufficient alone.

2. 4H Close Above ATH (Pending ~30 mins)

▸ Must close above 110k, with no strong upper wick.

▸ Confirms intermediate-term strength.

3. Daily Close ≥ 110k

▸ Still missing. Required for macro breakout confirmation.

▸ Watch for candle body, not just wick.

4. Throwback & Support Hold at 109.6–110k

▸ Ideally after 4H confirmation, a retest and bounce = textbook

SOS → BU → Markup pattern.

5. Invalidation Risks:

▸ Daily close <109k with high volume

▸ RSI divergence on 4H

▸ Rejection from 114k–116k Fib cluster

▸ Large bearish engulfing below ATH

⸻

Wyckoff Context:

We’re likely in Re-Accumulation Phase D, testing the breakout.

No signs of UTAD or distribution — but low conviction breakouts at ATH are known trap zones.

⸻

What’s Next?

If 4H + Daily confirm, momentum may push toward:

• TP1: 114,449 (Fib 0.618)

• TP2: 116,199 (Measured move)

• TP3: 118,237 (Upper Fib extension)

⸻

Follow for real-time BTC setups based on structure, RSI, and volume — no hopium.

Like & share if this helps clarify the levels you’re watching.

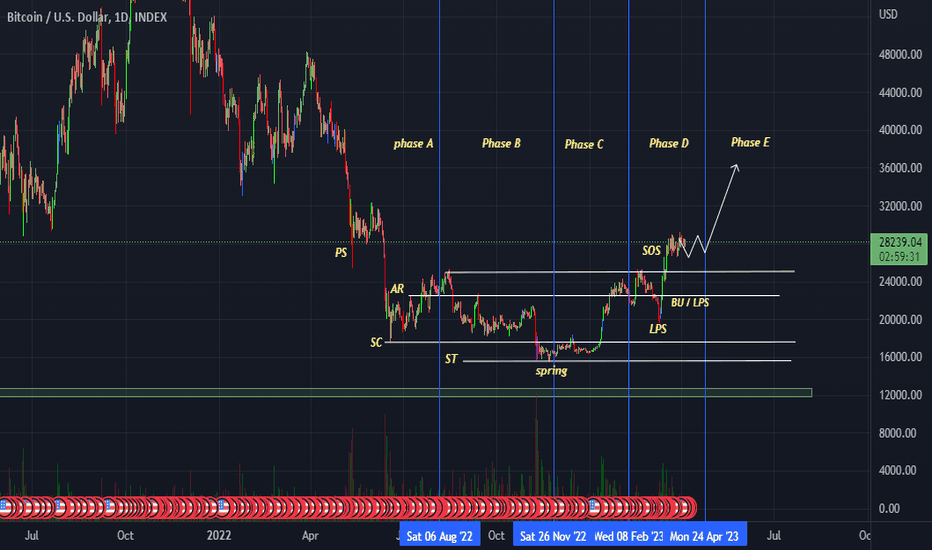

Bitcoin Wycoff Accumulation Phase D into EFor fun i was just re reading up on Wycoffs Methods and decide to put it on the chart to see how it holds up (to the well known photo)

which it really doesnt have to look anything like the photo just so long as those steps or should i say Causes and Effects or Efforts and Results happen, it can better help you know whats happening. and not all of them have to be met, but dont let me bore you. i just wanted this archived to see how it plays out in the future. also, it lines up pretty dang perfect if you ask me. now do i think it rips through phase E to 36k-38,200 give or take? sure. and beyond? welp, it still could reject there an enter back into the "accumulation zone". esp if my thoughts on recession (light one) comes about. anyway no price targets really just archiving this to see it in the future. cheers