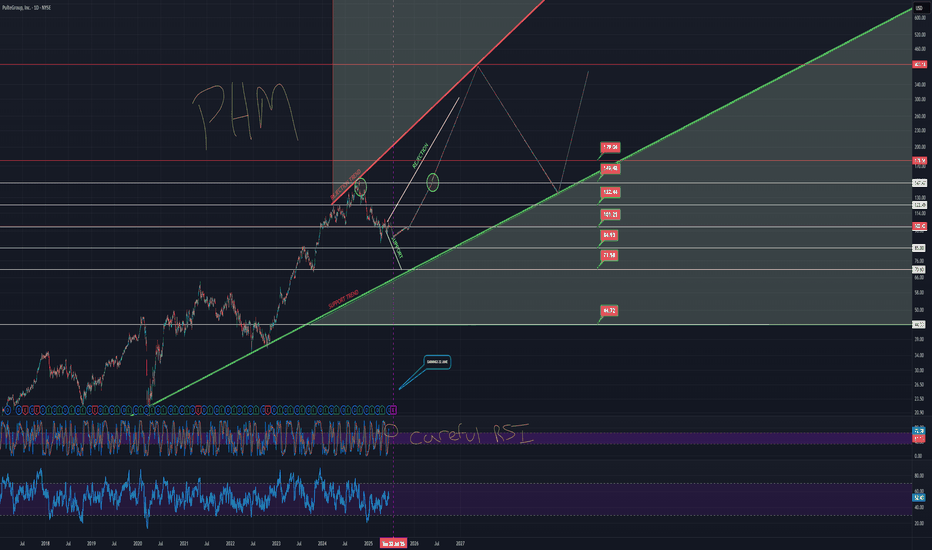

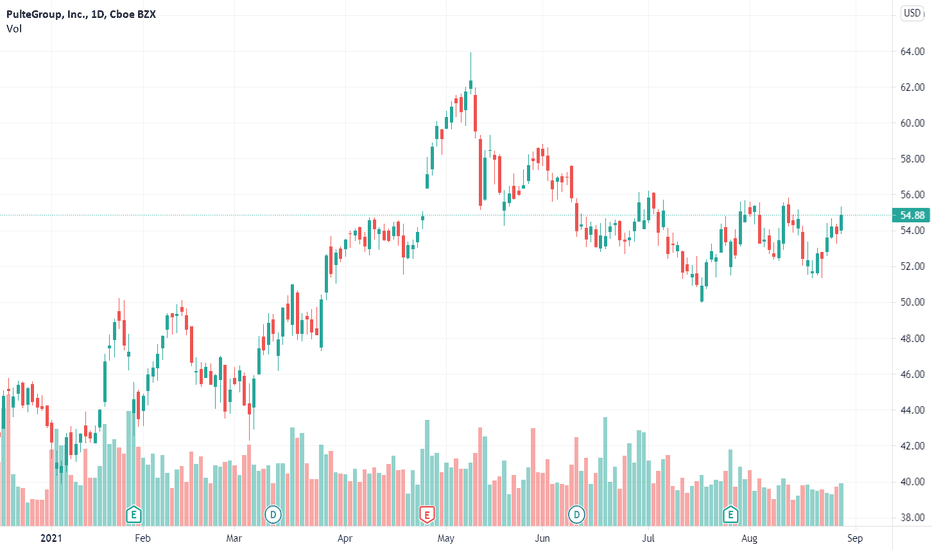

PHM CHART UPDATE PHM top rejection trend in red.

Bottom support in Green.

Mid term support and rejection show in light green and red.

All price targets labeled.

Trends extended.

Ghost feed is a guideline.

Careful above 180.

Careful into earnings it looks like a drop to stable levels around 94 to mid 80's which these levels can take us back upwards to the 120 mark, which can then climb upwards to around 145 and then 180.

PHM

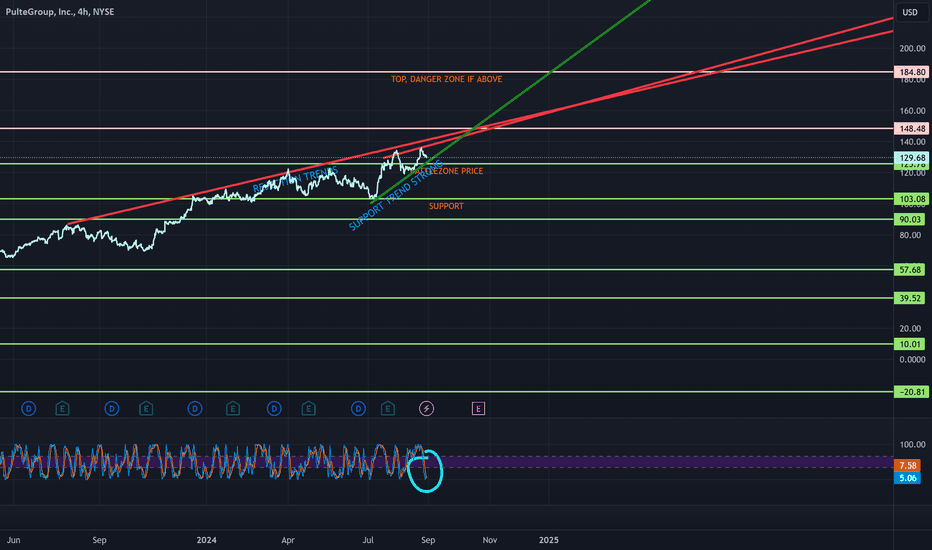

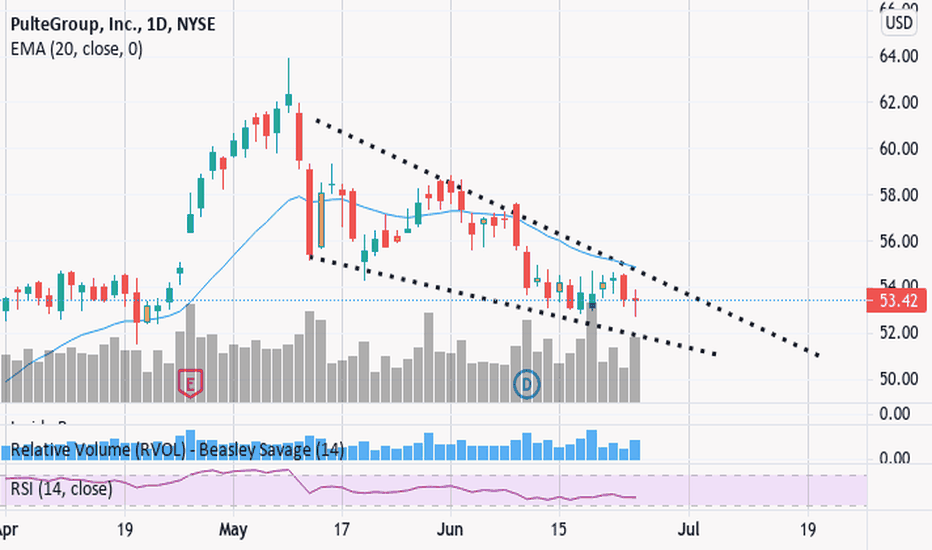

PHM UPDATED CHART - What's NEXT?What's next?

I'm not certain, but it looks like price can hold this key zone and use the rejection trends to bounce upwards to the 184 target (which is adjusted upward from 170).

RSI on the weekly is somewhat gapped, but bullish.

RSI on the daily is bullish.

RSI on the 4, 2 and 1 are near bottoms, so it's not a bad guess to say, maybe with all these indicators resetting and as we are nearing a strong support trend and strong horizontal support line, we might see a bounce.

good luck phm dudes.

also, bbbyq, gme and a whole bunch of other fun coming up.

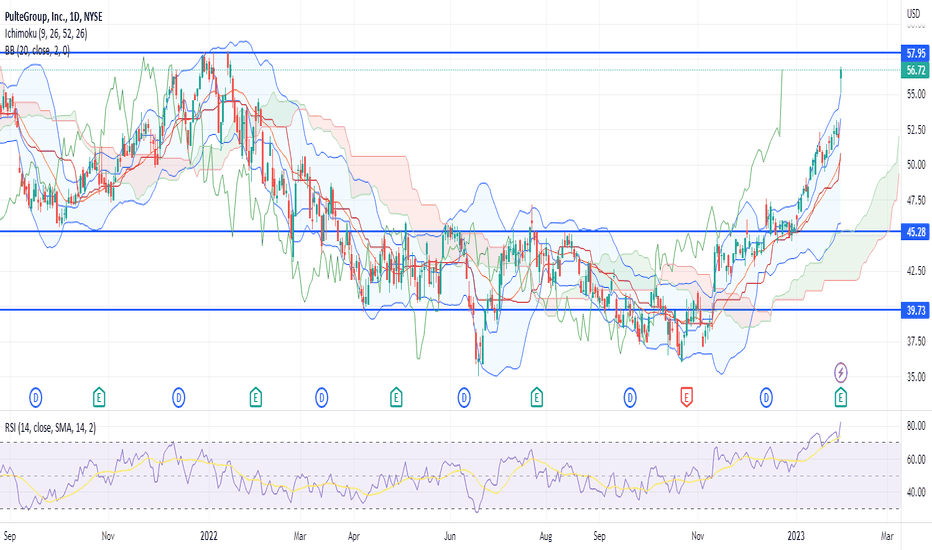

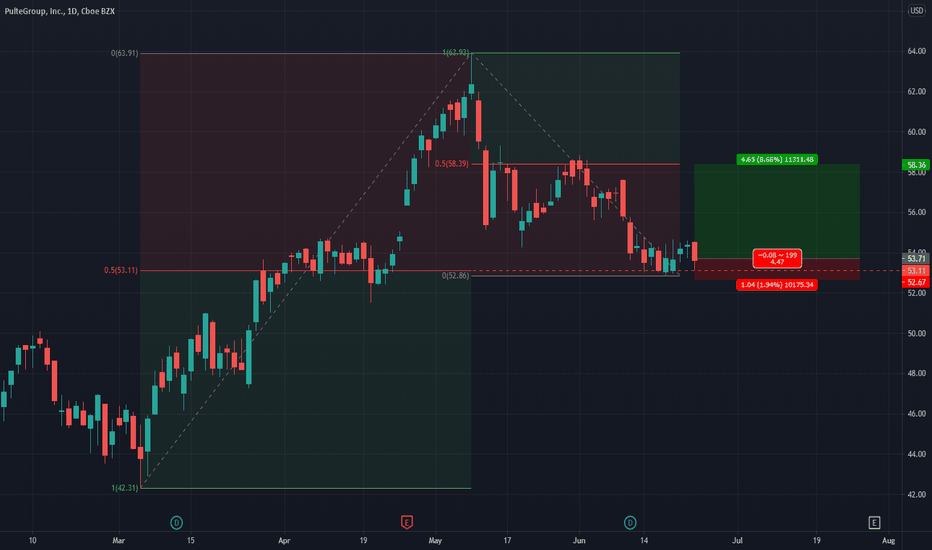

PHM is going to see some massive support jump in2 massive trend lines on the bottom side of price, one of which is likely to spring the price to at least 95, and possibly even 130. Even if we drop past 63, there is still price support and a likely chance you'll see price jump from these levels. This stock is massively bullish.

These trend lines are BIG. There is potential to see the price move quickly, and there is even more potential to see it reject that top trendline.

It's close for sure, I think these next few moves likely occur over the next few days to weeks. So you could see some up and down getting ready for a bigger move to the upside.

There is so much support layered on this chart, it's hard to be a bear in the long term.

Buy zone is somewhere between like 65-54.

I draw snakes on charts.

thank you for looking.

PHM PARABOLIC MOVEI mean, if you can't see that something major is happening with this stock, you're high...

HOWEVER, Holy Gaps batman.

Topside pump takes us to around 125, with a max of like 136. There is support but watch out for a retracement from whatever "good" sounding news is coming. This stock is being setup to drop over 50%.

Personally, I like the dog coin next, you can see my chart below.

WHY real-estate when you can buy data? PHM needs to figure out how to monetize whatever data they can collect.

I HATE the new notifications @ Tradingview My feedback, as this is a terrible design. I'm missing a ton of notifications.

Please at least give us the option to move it back.

Sincerely,

a somewhat loyal customer.

Also, I wrote my feedback on my very bullish stock pick, Pulte Group.

Thank you for your time.

PMH SELL +++Homebuilder stocks are soaring on short term profit from last year, lol. Interest rates for a 30 year mortgage are approaching 7%, we haven't had the fallout from a recession yet with millions of job losses, foreclosures, defaults, repossessions then and ONLY then would I say we have hit a bottom and it's time to buy. This stock is likely up on short covering, which they should just be adding not covering the horizon looks bleak for the American economy built on debt and money printing

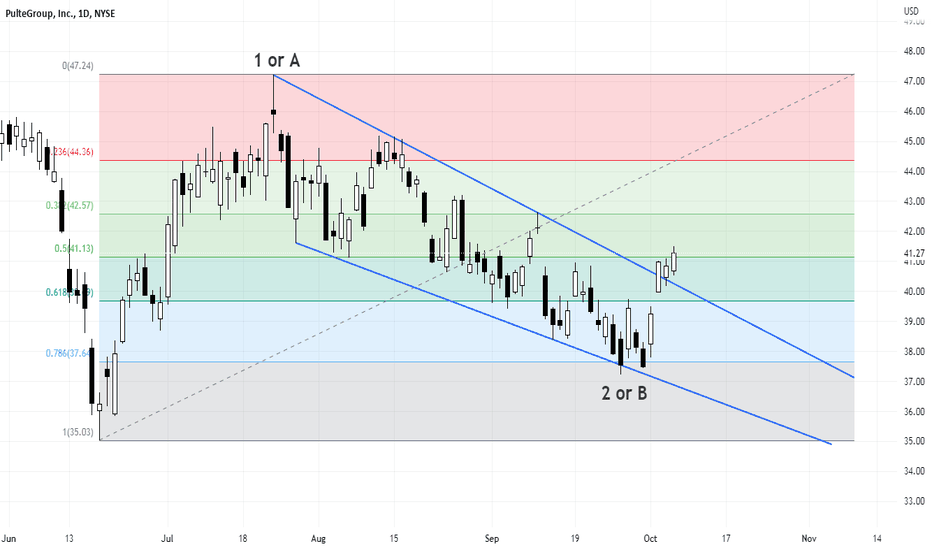

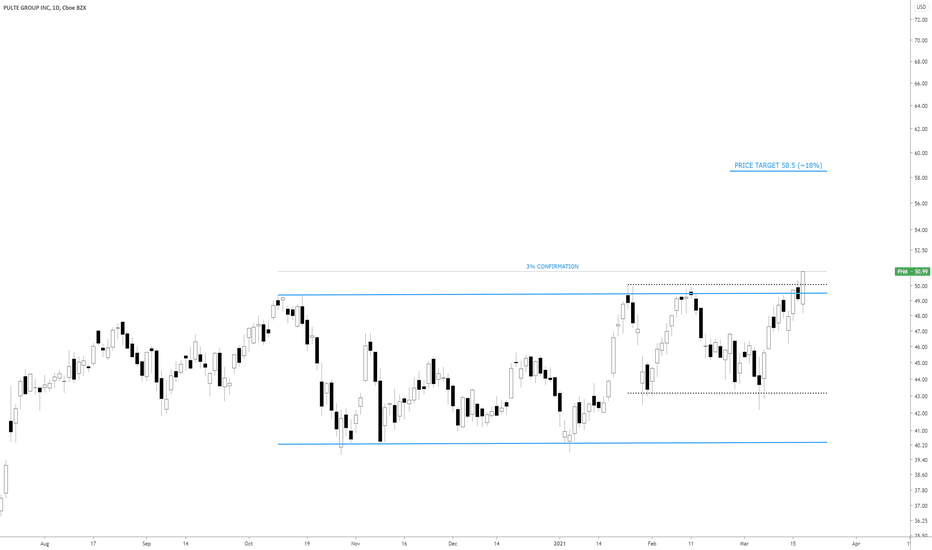

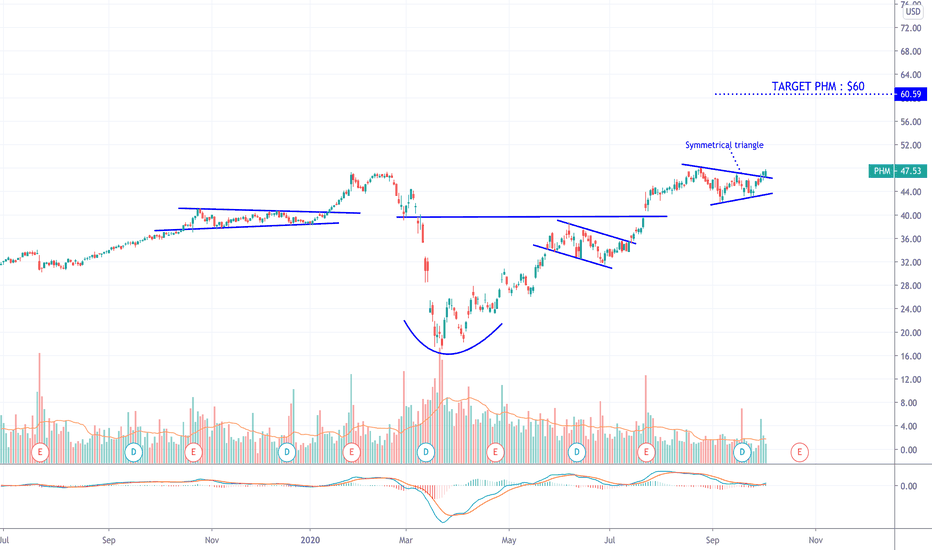

PHM - Long after wedge breakoutAfter a 5 wave rally, the stock has corrected in a three-wave pattern. The correction has retraced 78.6% of the 35.03-47.19 rally and prices are rising again, breaking outside the wedge that has been forming since end of July. My take profit comes in at which the rally from the lows will be equal to the previous rally around 50.5 My stop is below the recent lows at 36.50

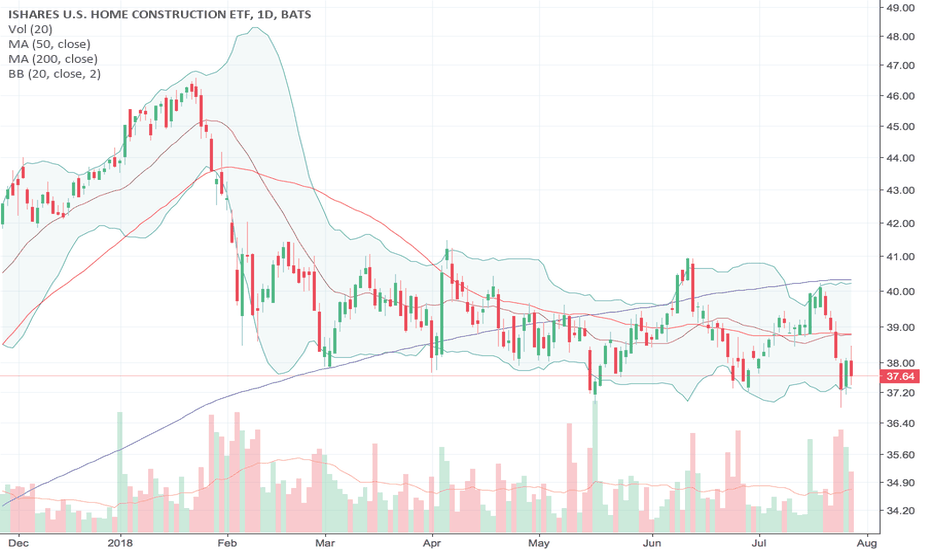

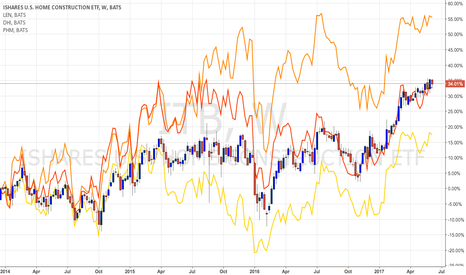

Housing Market Review – A Wobbly Edifice As Builders Break Down Alongside bearish trading action in builder stocks, July’s housing market data may have delivered confirmation of persistent investor fears.

"Housing Market Review – A Wobbly Edifice As Builders Break Down And Data Weaken" drduru.com $ITB $DHI $MTH $KBH $PHM $TOL $TPH #housingmarket #housingwatch #homebuilders #stockmarket #economy #gdp

Housing Market Review (May, 2018) - A Fresh Flicker of LifeHousing Market Review (May, 2018) - A Fresh Flicker of Life As Sentiment Turns Without A Change in Data. The housing data continue to plod along but the market for home builder stocks is suddenly warming up all over again.

drduru.com $ITB $CCS $DHI $PHM $LEN $FPH $LGIH $MTH $XHB

Dissonance: Decelerating Housing Data, Diverging Builder StocksHome builder stocks are starting to diverge as housing data decelerates. Investors are showing interesting preferences even as all builders continue to tell similar stories. For more....

Housing Market Review (April, 2018) - Dissonance: Decelerating Housing Data and Diverging Home Builder Stocks drduru.com $ITB $PHM $LEN $KBH #housingwatch #stockmarket

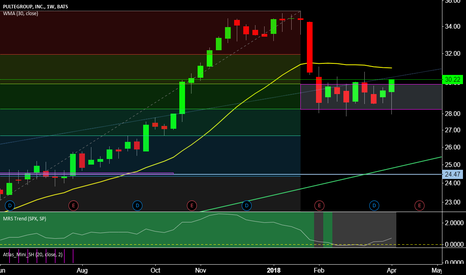

Swing Trade Idea in PHM!We really like to keep our charts simple and momentum in price action is the most important thing to us. One of my favorite setups is a squeeze because it allows me to get into a stock or option before the large move has been made. This is obviously really nice when you trade with options because of the greeks and implied volatility starts working for you. Here is some brief bullet points on why we like this setup:

- This stock has consolidated back to the 21 day moving average after a very bullish move.

- The price is in a squeeze and is starting to fire out of that squeeze to the upside

- There was good volume on the move higher today

My strategy is based on swing trading stocks and options. My hold time averages around 8 days, but can go as long as 3 months depending on momentum and price action. Please make sure to have an exit strategy in place at all times no matter how good a setup looks...anything can happen!

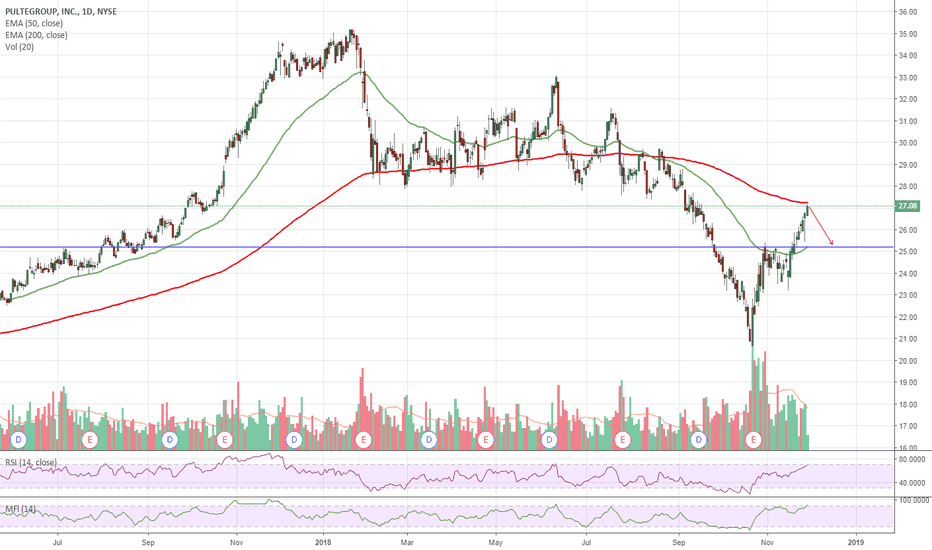

Home Builders to sell with rising interest rates and lower salesTurning very bearish on the home builders. Increasing interest rates will increase costs. Delinquencies are rising and creditors are contracting. Most activity in mortgage applications is either refi - due from recent fall in 30-year, or existing home sales. Builders are falling behind and sales goals will not be met.

PHM Bullish Swing I have two setups on this one. Stock is gaping up on earnings today. Because of that, I'm not sure if it will pull all the way back to the lower entry @ $20.00

One could consider having both orders open and cancelling the lower entry if we don't get a pullback that far. If we do, there is a good chance the the higher entry idea gets stopped out.

Entry 1: 20.40 with a stop @ 19.95 and a target of 21.30

Entry 2 (preferred): 20.00 with a stop @ 19.50 and a target of 21.00