FTSE100 - Fresh highs incomingThe FTSE is currently sat at strong support. Sellers tried to push price lower, but the index was bought back up to form a pinbar (red arrow). Lower BB also sits at this point (see %B in bottom window).

Considering the lacklustre fall from the rising wedge and the subsequent pin bar, we can expect 6800 to break (see how long price spent lingering around the level).

The next resistance is ~6838, so a break and restest of the 6800 is likely and will be the perfect high probability entry.

An aggressive entry would be at open on Monday (I personally will probably take this based on the pinbar with a stop below the low).

Target is the psychological level of 7000, which acted as a strong support throughout 2019.

High prob:

Entry = 6805 when retesting the level

Stop = 6735

TP = 6800

R:R = 3

Aggressive:

Entry = 6720

Stop = 6642

TP = 6800

R:R = 4

Happy trading:) follow for more of this kind of stuff!

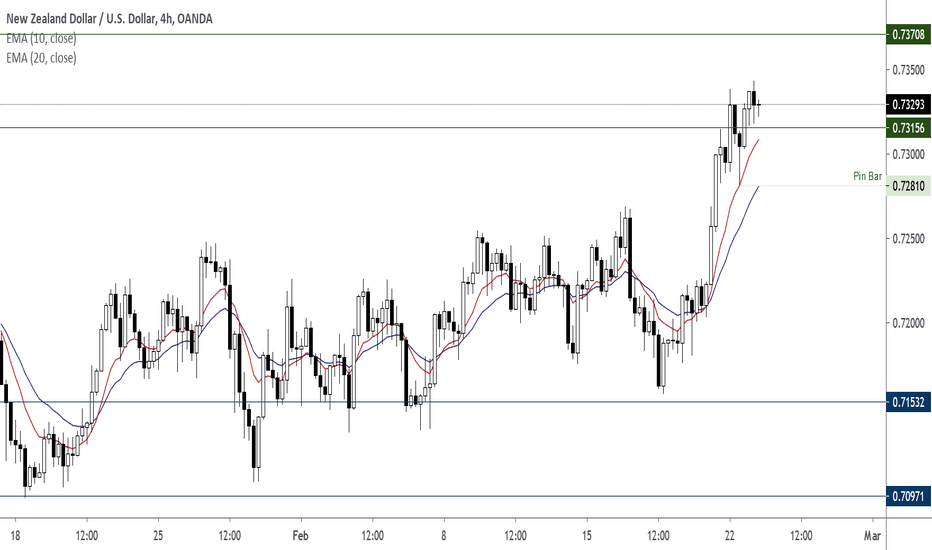

Pin Bar

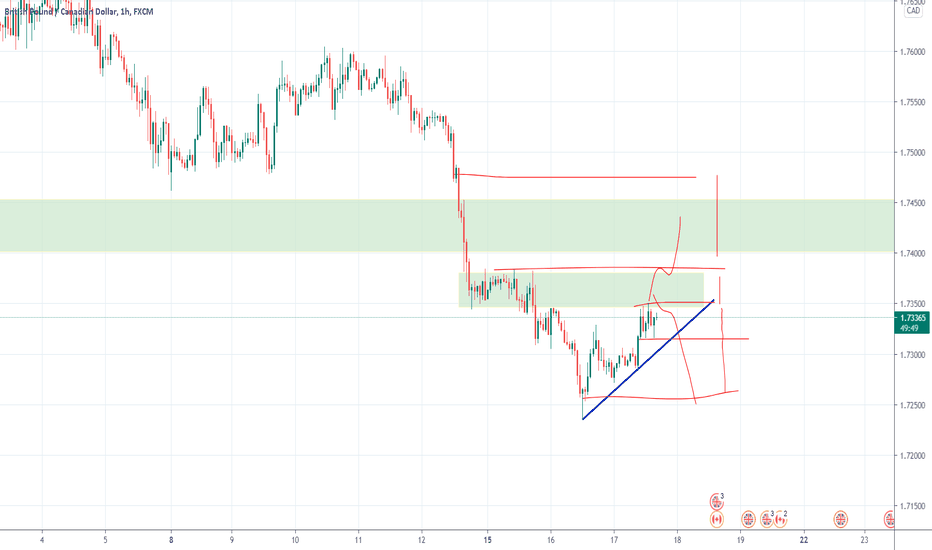

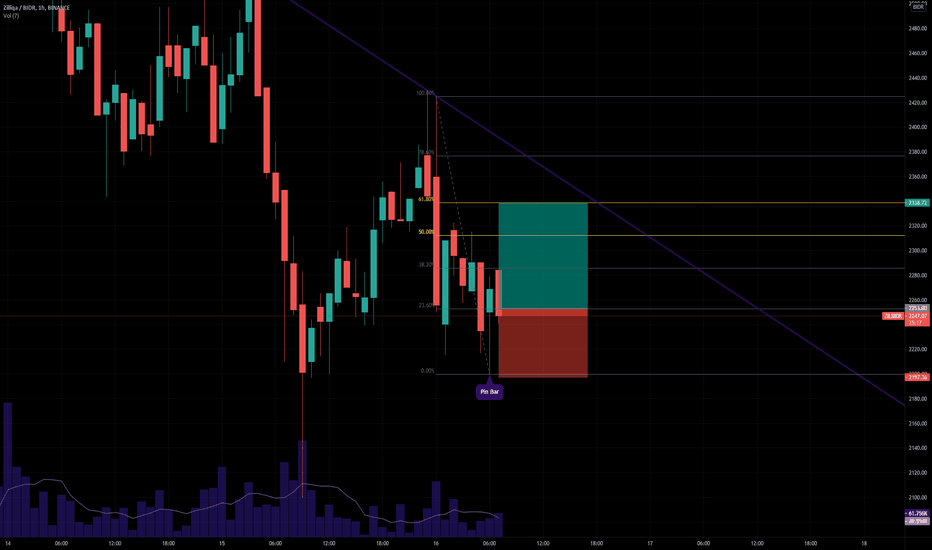

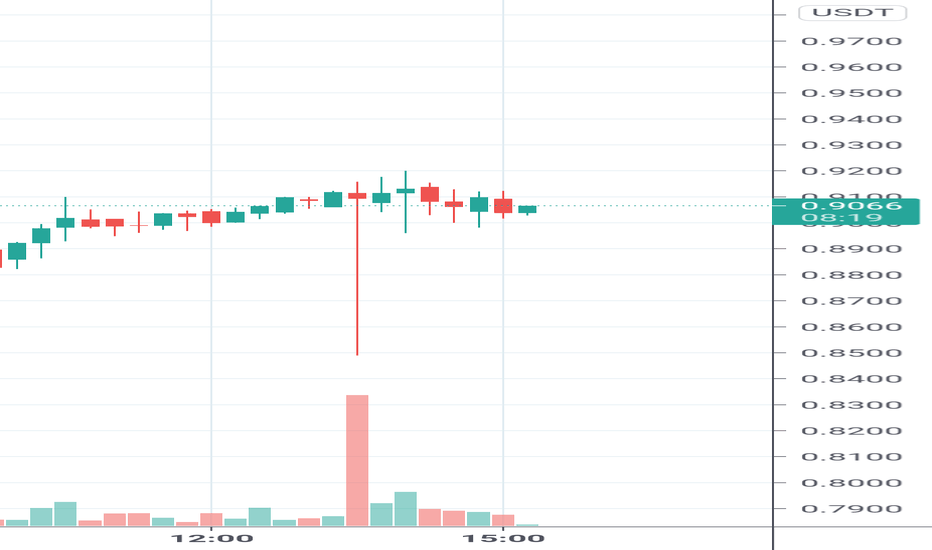

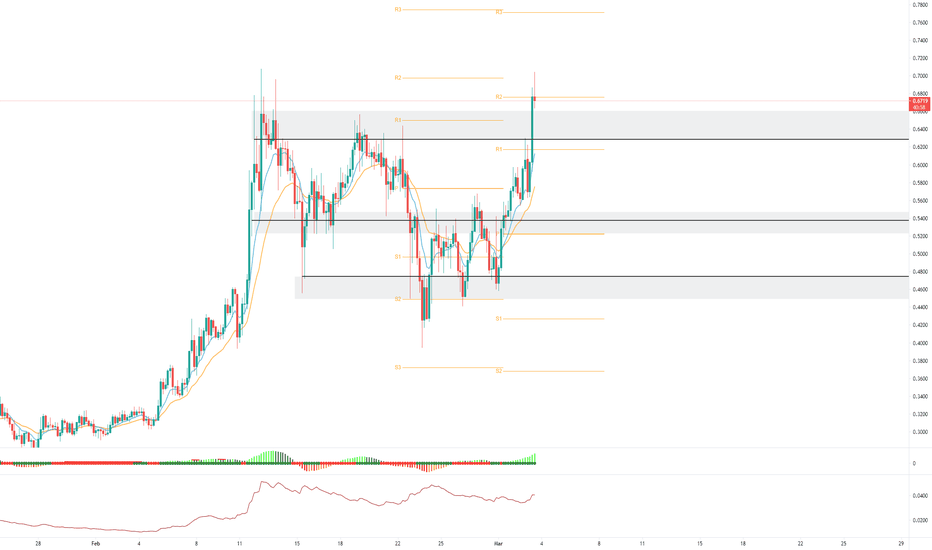

ZILBIDR - Long Position (16/03/2021)I take long position in ZIL

Why ?

- There is a confirmed pin bar candlestick

- I set the entry to 23.6% fibonacci retracement

- I set my take profit 61.8% fibonacci retracement, confirmed by the trend line that it still make sense

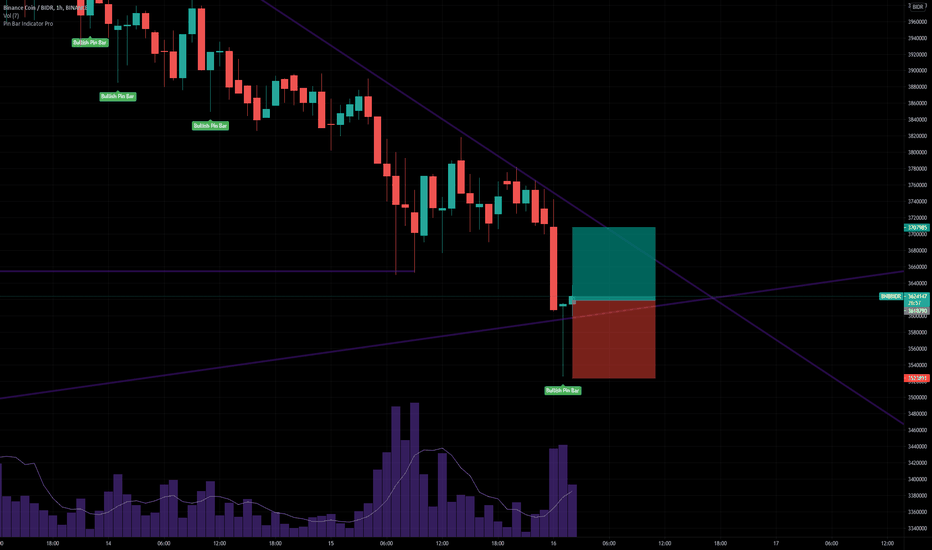

BNBBIDR - Long Position (16/03/2021)This is based on what I have learned on my failed setup (linked below).

I have lower my target profit.

It's not a good risk reward ratio, but we will see.

Btw, I have wrote my own pinescript to detect pin bar candlestick hehe.

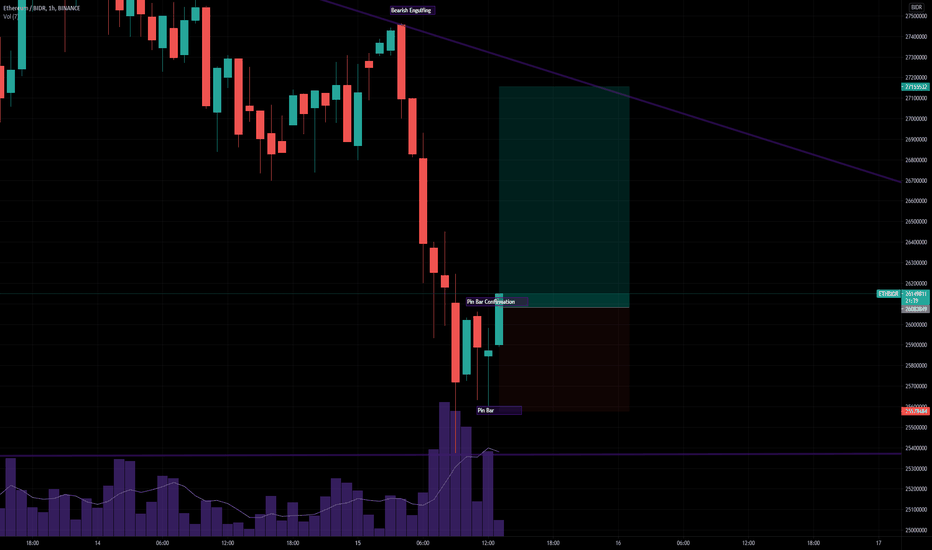

ETHBIDR - Going Long (15/03/2021)Hi guys, currrently I have lost 10% of my investment in just two days.

I have blindly set buy order limit in support area, it hit my support area and also my stop loss 👀😅

Lessons learned.

I have learn and do the following:

1. Identifying the trend in daily chart

2. Identifying Area of Value via support, resistance or key level.

I have missed the last step: Identifying the trigger to buy.

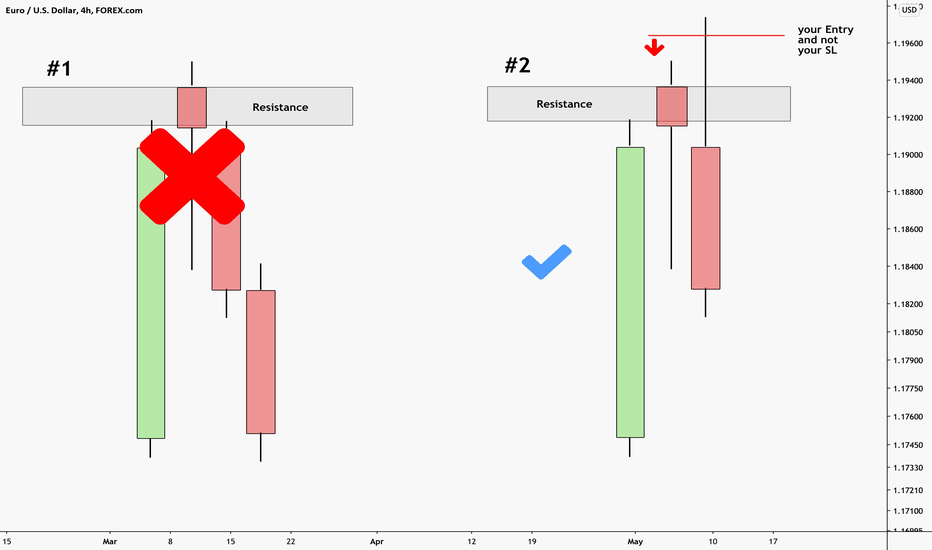

Recently I came across the following article: Price Action Entry Rules: How to ‘Enter' at the Break

Well you shold google it, I can't attach the link 😅

It have a great advice on how to timing your trade.

I recommend you to read the article.

Now this idea is an example of me practicing the rules.

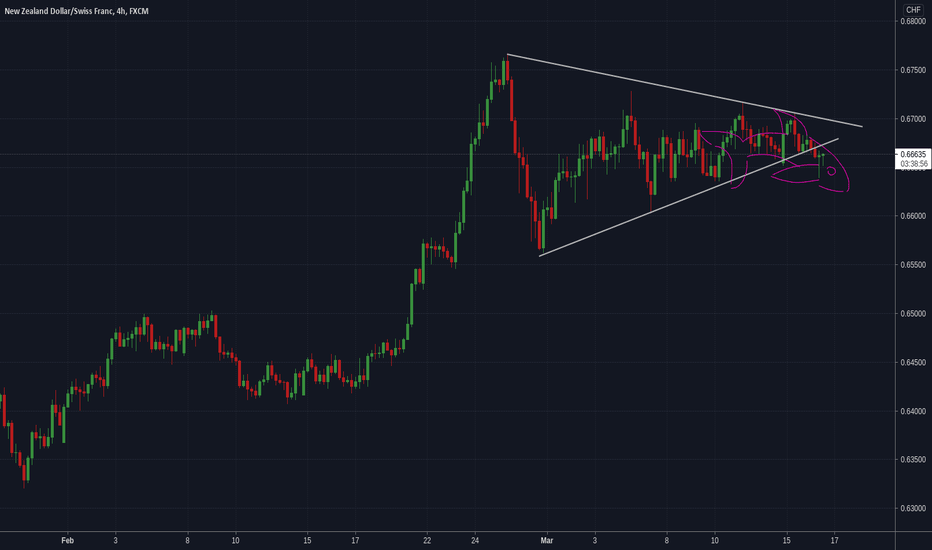

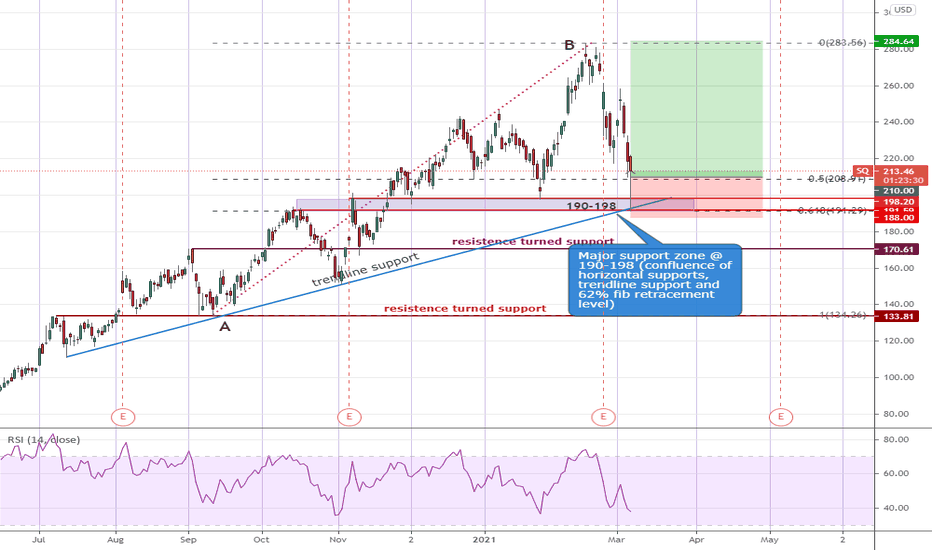

SQ - opportunity to accumulate!It is likely that this just just a steep correction (not a protracted bear market) hence we need to look beyond the fear for opportunities that do not come so often!

SQ crashed 30% in just a little over 2 weeks. There is a strong support zone at 190-198, little would we expect that it will crash more than 10% today to test this zone before staging a strong rebound.

This support zone is a confluence of horiztonal supports, a trendline support as well as the 62% fib retracement of the AB swing up.

While it is already forming a bullish pin bar today, there is a chance the stock could retest the low near 190 over the next few days. As long as we do not breach 190, I would sit tight..

That said, pls trade carefully! Cut loss if trade did not work out so that we survive with enough cash for the next opportunity

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Thank you. Feel free to give me your thoughts ! :)

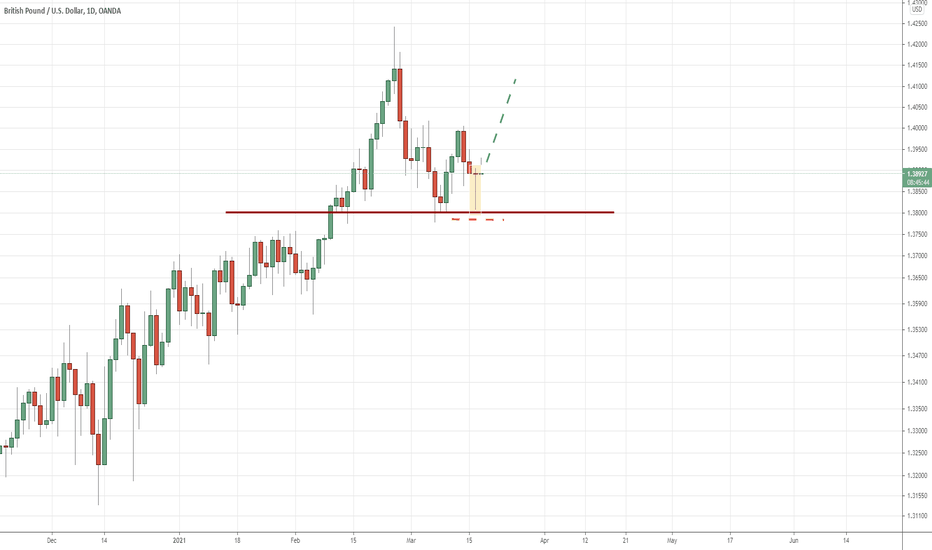

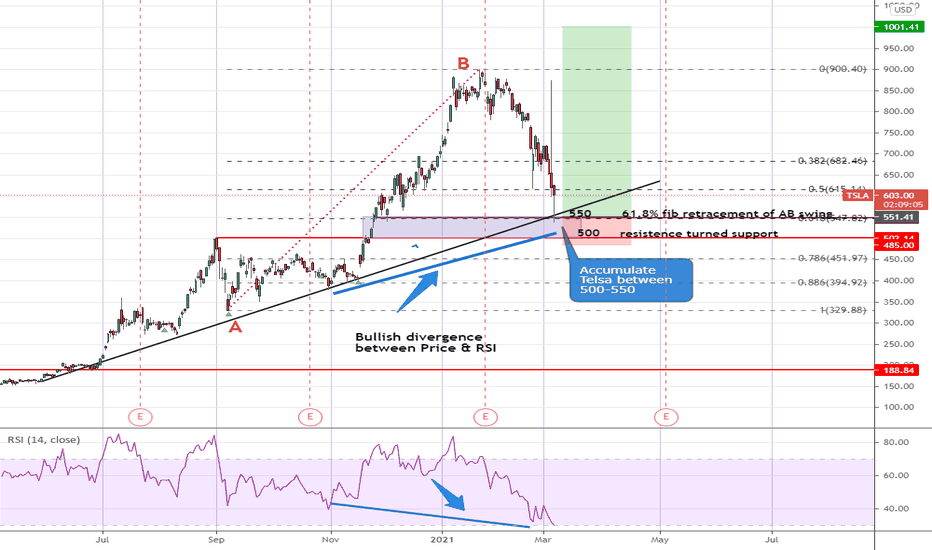

TSLA - time to accumulateThe market "crash" has been hurting a lot of people pretty bad, less so for those who had adhere to strict stop losses. However, one must look beyond the "fear" and keep an eye for good buying opportunities in good quality stocks during such times.

Telsa "crashed" into a support zone 500 - 550 today, hitting a low of 539 before recovering to possibly form a bullish pin bar today. This is a zone with a confluence of "supports", namely a trendline support, 61.8% fib retracement and also a "resistence turned support". Adding to these, there is a bullish divergence in the making.

For those who thought they had missed the oportunity to stake Tesla, I would venture to stake some now (ideally not too far above 500-550).

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Thank you. Feel free to give me your thoughts ! :)

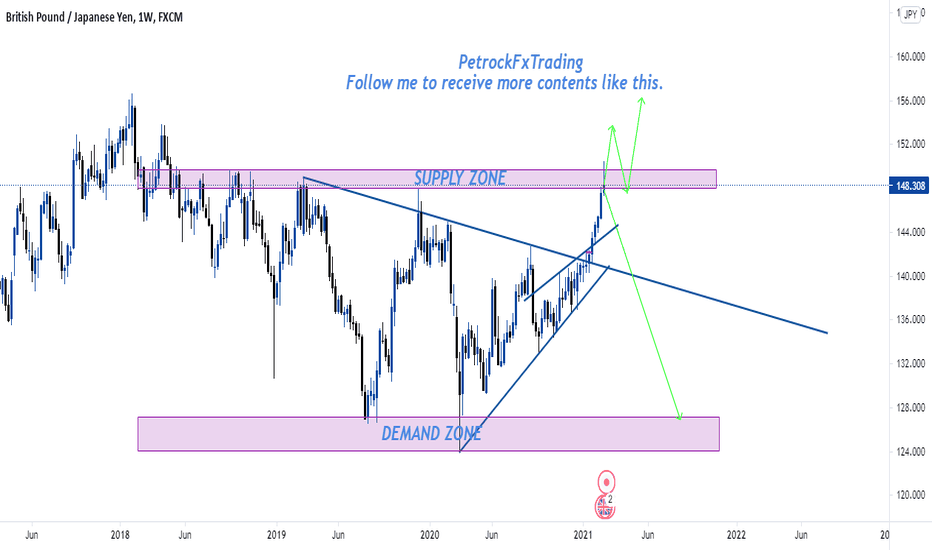

GBPJPY UPDATE - LONG OR SHORT?Here is an update on GBPJPY analysis I made a week ago. On 20th February 2021, I made it known that we need a confirmation to either go long or short.

The present candle is forming a bearish pin bar which signals a sell order. Notwithstanding, we need a another candle to show a good confirmation of what to do.

What do you think?

Share your opinion in the comment section✍️

Please support this idea with a LIKE👍 if you find it useful🥳

Also, kindly cheer me with coins if you like my work.

Follow me to receive more updates on this pair🤙

Happy Trading💰🥳🤗

Trading Involves High Risk⚠️

Not Financial Advice💸

Use Proper Risk Management💹

Thank you for your support!💓

NB: If you have any question for me or you would like to learn forex trading, improve on your technical analysis skills or have access to VIP, DM me.

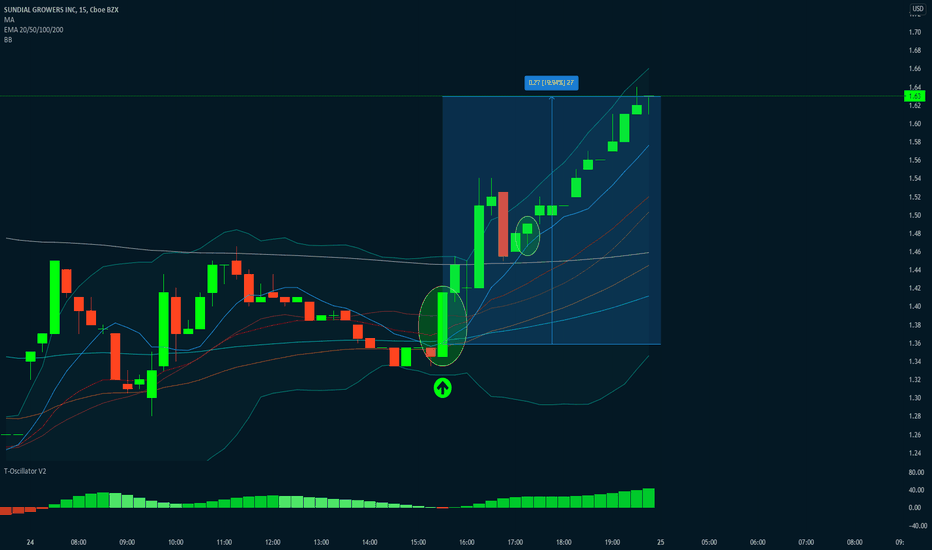

SNDL easy money and it grew on a tree..kindaPin bar strategy off the MA starting with a nice bar off the Bollanger band on the 15min chart. When you see these don't hesitate to enter for intraday trade! High probable trade here! Zoom out a bit and the daily doesnt look as good. As always use proper risk management and trade smart!

Please hit that like/follow button!

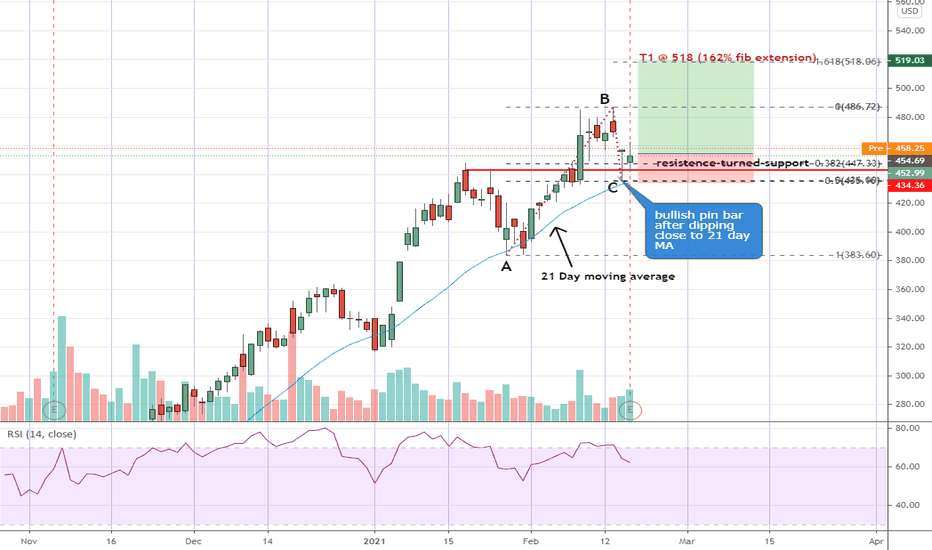

ROKU - still strong and finding supportROKU dipped below a resistence-turned-support @ 443 briefly to test close to the 21 day moving average before closing as a pretty bullish pin bar on Wednesday. The stock has only retraced less than 50% of its recent AB swing up and has held well yesterday despite the overall market sell off.

Expecting this stock to continue it's uptrend with possible near term target @ 518 (162% fib extension of the BC swing upwards)

Disclaimer: This is just my own analysis and opinion for discussion and is not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance. Thank you. Feel free to give me your thoughts ! :)