Pivot Points

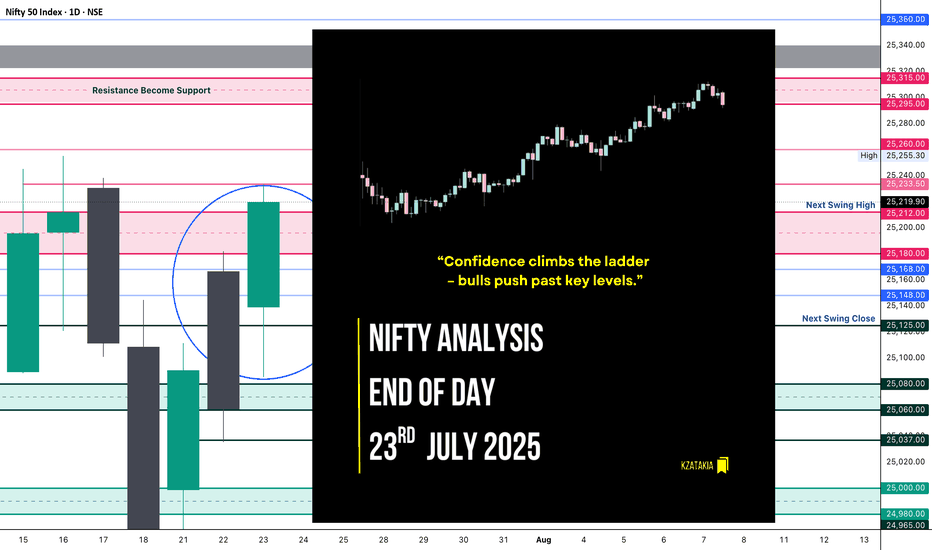

Nifty Analysis EOD – July 23, 2025 – Wednesday 🟢 Nifty Analysis EOD – July 23, 2025 – Wednesday 🔴

“Confidence climbs the ladder – bulls push past key levels.”

Nifty opened with a Gap Up of 78 points and initially retraced 54 points, finding solid footing around the CPR Zone. Once reclaimed VWAP, the index climbed in a methodical, low-volatility uptrend, breaking one resistance after another: CDH, R1, 25150, PDH, and the key zone 25200~25212 — finally touching the anticipated resistance at 25333, and closing just below that at 25219.90, close to the day’s high.

📌 Flashback from Yesterday's Note:

“If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.”

👉 This expectation played out to perfection today — gradual yet confident bullish strength led Nifty to reclaim 25200 and close above it.

🔍 Today’s close of 25220 is higher than the last 7 sessions, suggesting a bullish shift in structure. However, bulls now face the real test — breaching the 25300 ~ 25350 resistance zone.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 25,139.35

High: 25,233.50

Low: 25,085.50

Close: 25,219.90

Change: +159.00 (+0.63%)

Candle structure analysis:

Real body: Green body = 80.55 pts → strong bullish body

Upper wick: 13.60 pts → very small

Lower wick: 53.85 pts → moderate

Candle Interpretation:

The session opened stable, dipped to 25,085, but strong buyers showed up, helping price climb throughout the day and close near high. A firm green candle, signaling buyers in control.

Candle Type:

A Bullish Marubozu–like candle, not perfectly clean but represents strong continuation momentum.

Key Insight:

Close above 25200 confirms a bullish grip

If price holds above 25220–25250, next push could be towards 25280–25330

Immediate support now moves to 25,120–25,140

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 181.35

IB Range: 64.35 → Medium

Market Structure: Balanced

Trades Triggered:

⏱️ 10:45 AM – Long Entry → Trailing SL Hit (1:2.65 RR)

🔁 Support & Resistance Levels

Resistance Zones:

25,180 ~ 25,212

25,233

25,260

25,295 ~ 25,315

25,340 ~ 25,322 (Gap Zone)

Support Zones:

25,168

25,125

25,080 ~ 25,060

25,037

🧠 Final Thoughts

“Momentum is not magic—it’s built one level at a time.”

Bulls showed strength with control and consistency today. With 25200 reclaimed, they now hold the ball — next challenge lies at the gates of 25300–25350. Will they break through or pause for breath? Tomorrow holds the answer.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

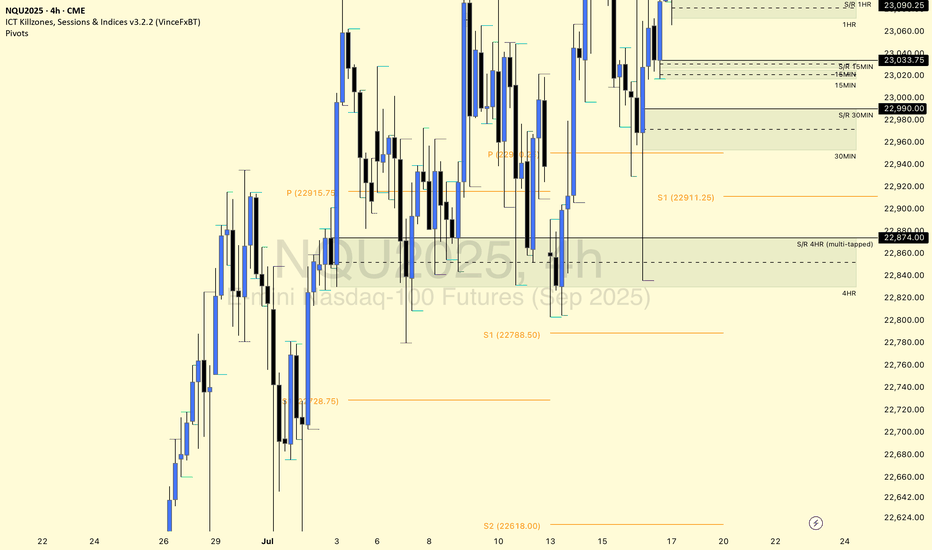

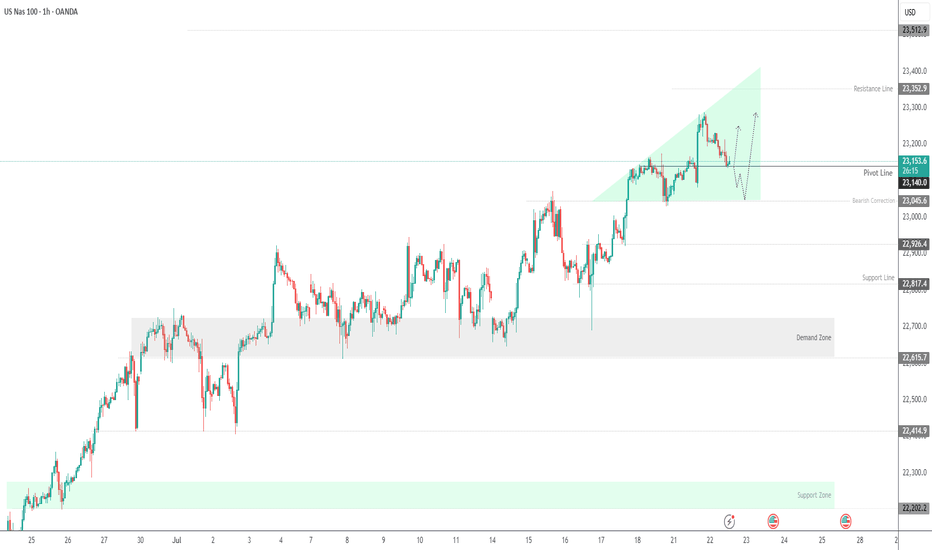

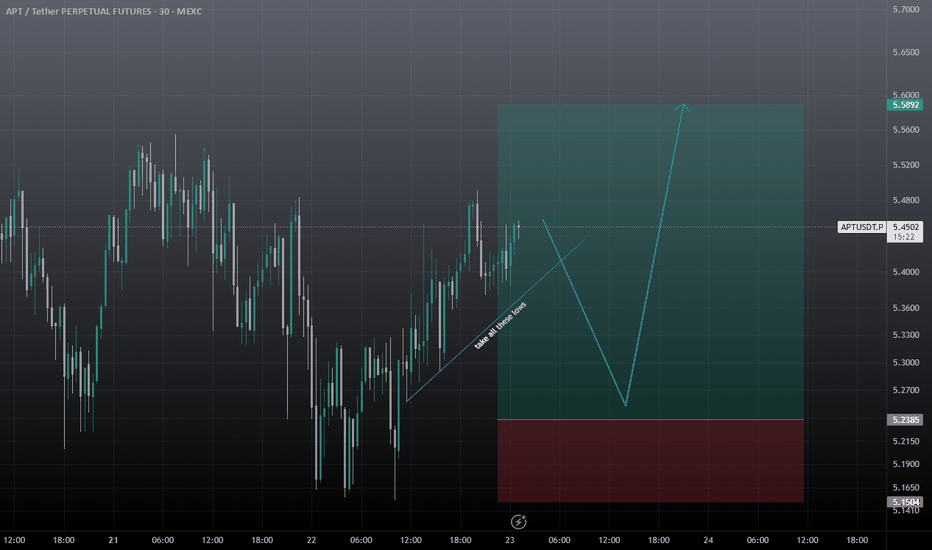

$NQ Supply and Demand Zones 7/23/25tradingview.sweetlogin.com

This SEED_ALEXDRAYM_SHORTINTEREST2:NQ chart is posted for my YouTube community.

The 1HR S/R level is holding price down well for now and we have tapped into the 4HR supply 2x so far. We have built up support that can use as potential bounce levels if* respected, but price needs to reclaim the S/R level and show higher lows. If not, a continuous close at lower lows with rejecting support at demand can show price dropping to 22830-23000 zones. The 4HR demand below has also been tapped into multiple times, so it's only a matter of time before it can no longer hold up (it's pretty much invalidated at this point lol).

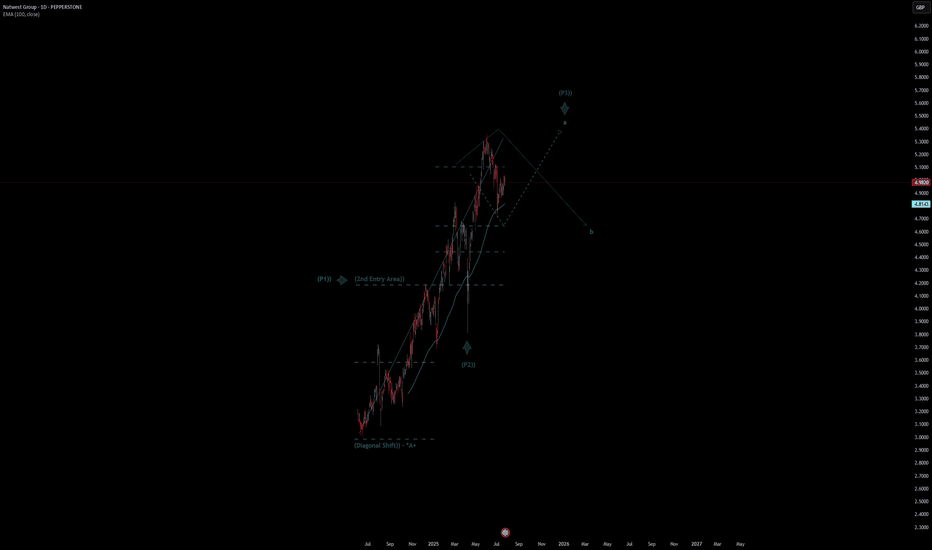

Natwest Group Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Natwest Group Quote

- Double Formation

* (Diagonal Shift)) - *A+ | Completed Survey

* (2nd Entry Area)) | Subdivision 1

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* (TP1) = a / Long Consecutive Range

* (TP2) = b / Short Consecutive Pullback | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 150.00 GBP

* Entry At 156.00 GBP

* Take Profit At 167.00 GBP

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

USNAS100 Eyes 23350 Ahead of Powell & Earnings StormUSNAS100

The price maintains bullish momentum, as outlined in the previous idea, with a clean rejection from the 23280 zone. Today, volatility is expected to increase ahead of Jerome Powell’s speech and a wave of key earnings reports.

As long as price holds above 23140, the outlook remains bullish toward 23230 and 23350.

A short-term correction toward 23045 is possible if we get a 1H close below 23140.

Resistance: 23230 · 23350 · 23510

Support: 23045 · 22920

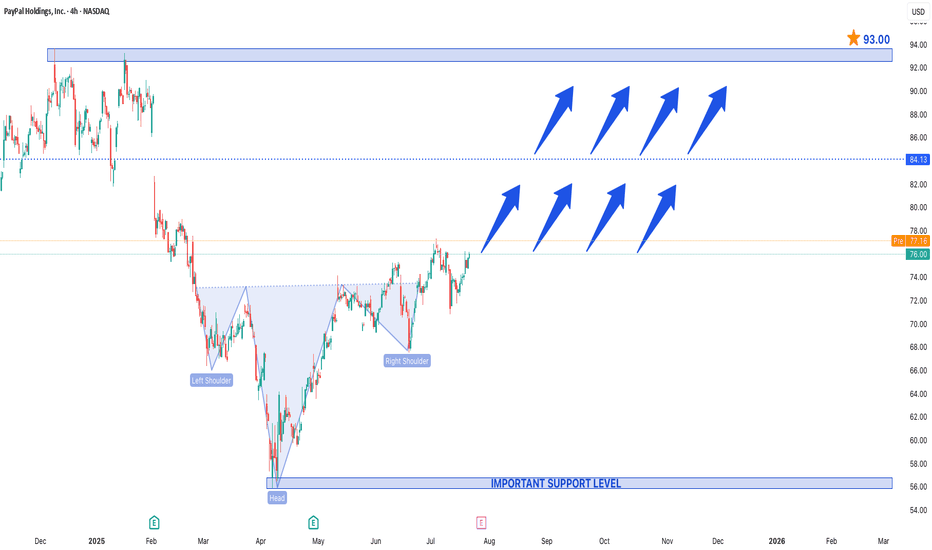

Head & Shoulders Pattern Spotted in PayPal Holdings IncHead & Shoulders Pattern Spotted in PayPal Holdings Inc.

A Head & Shoulders (H&S) pattern has been identified in PayPal Holdings Inc. (PYPL), but unlike the traditional bearish reversal setup, this could be an inverse Head & Shoulders, signaling a potential bullish turnaround.

Key Observations:

1. Left Shoulder – A decline followed by a rebound.

2. Head – A deeper low, then a recovery.

3. Right Shoulder – A higher low, suggesting weakening selling pressure.

4. Neckline Break – A decisive close above the resistance (neckline) confirms the bullish reversal.

Price Projections:

- Support at $55 – This level has held strong, acting as a critical demand zone. A bounce from here could fuel the next rally.

- Upside Target at $93 – A successful breakout above the neckline could propel PYPL toward $93, representing a ~40% upside from current levels.

Why This Matters for Traders:

- Bullish Momentum – The pattern suggests that sellers are exhausted, and buyers are stepping in.

- Volume Confirmation – Increasing volume on the breakout would strengthen the bullish case.

- Market Sentiment Shift – If PayPal sustains above key resistance, it could attract institutional interest.

Trading Strategy:

- Stop Loss – Below $55 for risk management.

- Target – $93, with interim resistance near $75 and $85.

Final Thoughts:

While technical patterns are not foolproof, the inverse H&S in PYPL suggests a potential trend reversal. If the breakout holds, $93 could be the next major target, making PayPal an interesting watch for swing traders and investors.

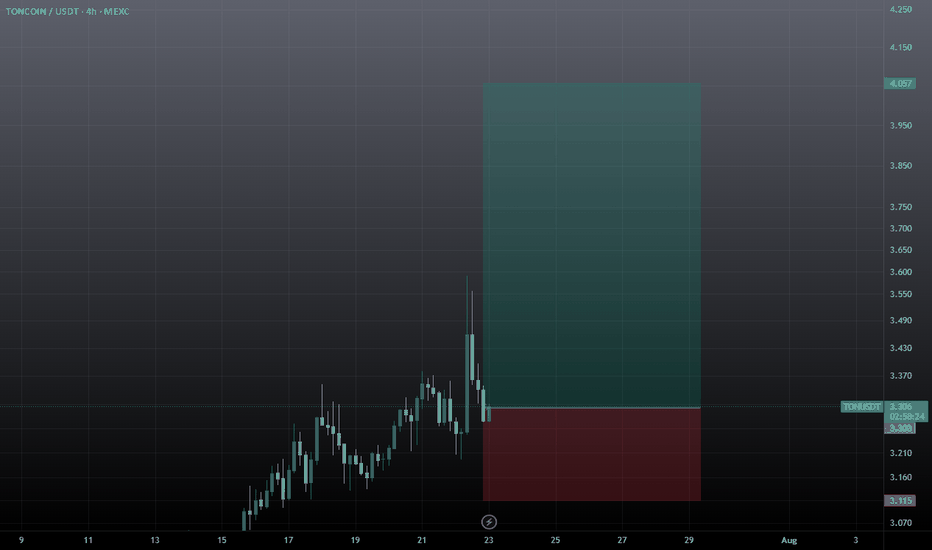

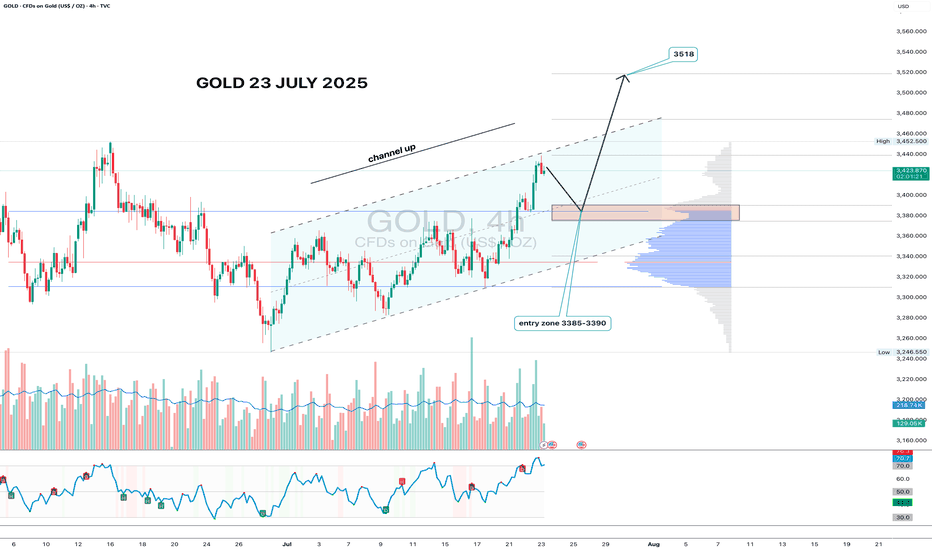

Gold 4H - channel breakout, looking for 3518 nextGold has formed a clean ascending channel on the 4H chart, broke out above resistance, and is now pulling back into the 3385–3390 zone. This area aligns with volume clusters - a perfect entry zone for bulls waiting on the sidelines.

If price holds this zone and prints a reversal candle with volume, the upside target remains at 3518 - the 1.618 Fibonacci extension and historical resistance. Volume increased during the breakout move, confirming interest. RSI still has room to go higher, supporting the bullish continuation.

Fundamentally, gold remains a safe-haven asset amid geopolitical tension, USD weakness, and potential Fed easing. Central bank accumulation further supports the bullish case.

Tactical setup:

— Entry zone: 3385–3390

— Trigger: candle confirmation + volume

— Target: 3518

— Invalidation: break below 3360 without buyer volume

If the plan plays out — gold might shine bright while bears squint in disbelief.

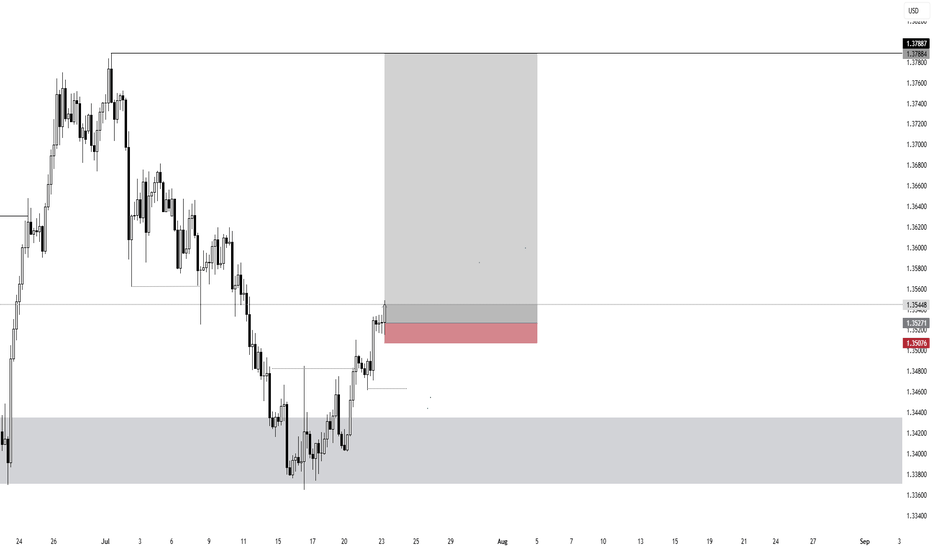

EURUSD| Back Aligned Bullish - Still in Analysis ModePair: EURUSD

Bias: Bullish

Following price closely and adapting to the market’s rhythm.

Recent structure showed that price is still respecting last week’s key zones — so I’ve realigned with the bullish bias accordingly.

No entries yet — still in analysis mode, which honestly is the best part 😉

Watching for clean LTF confirmations before engaging. No guessing. No forcing.

Price always tells the truth — you just gotta stay patient enough to listen.

#EURUSD #SMC #bullishbias #marketstructure #inducementking #smartmoneyflow

Bless Trading!

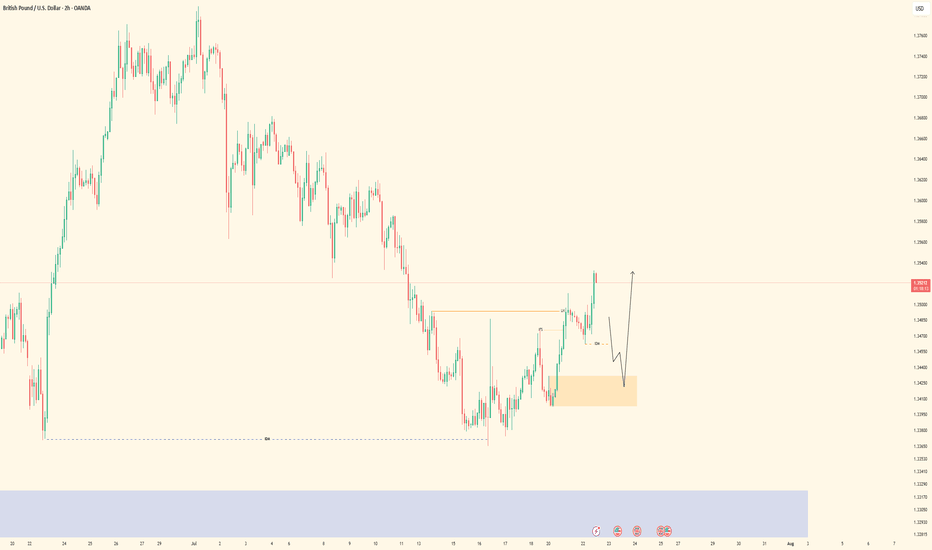

GBPUSD| Bullish Structure Intact - Waiting on BSL SweepPair: GBPUSD

Bias: Bullish

Been following price closely while staying in analysis mode — no rush.

Recent structure remains intact and aligned to the upside. Now waiting for a clean BSL sweep to clear liquidity before looking for LTF confirmations to engage in buys.

Momentum is there, structure is clean — I just need price to do its part.

Staying patient. Still in sync.

#GBPUSD #SMC #bullishstructure #orderflow #inducementking #smartmoneytrader

Bless Trading!

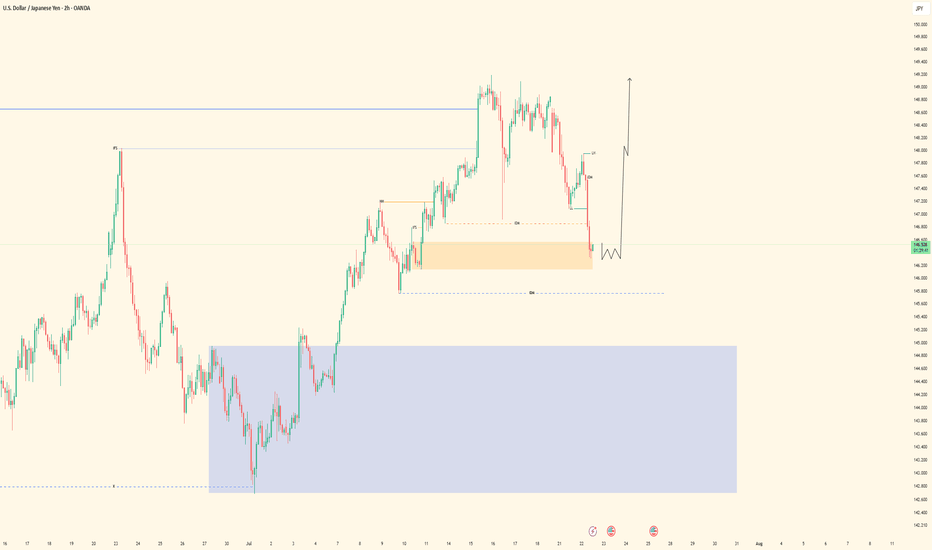

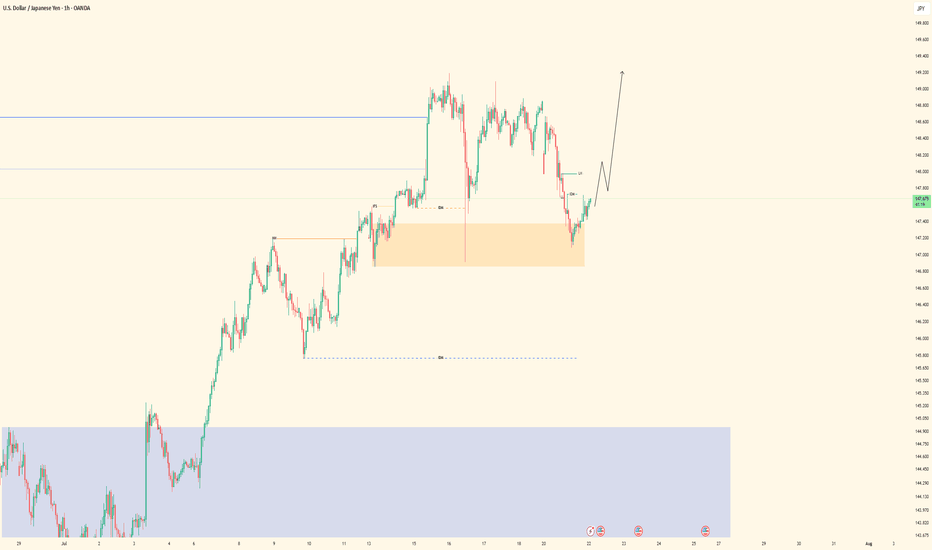

USDJPY| Bullish Bias - Mitigated OB, Waiting for LTF ConfirmsPair: USDJPY

Bias: Bullish

Price swept deeper liquidity and has now mitigated a key 30M bullish order block.

From the 2H bird’s eye view, structure is still aligned to the upside — but I remain in analysis mode until LTF confirms the shift.

No need to force anything — price is doing its job, and I’m waiting for it to speak clearly through confirmation.

Bullish structure still in play, but we wait for the perfect moment.

#USDJPY #SMC #bullishbias #orderblock #structuretrader #inducementking

Bless Trading!

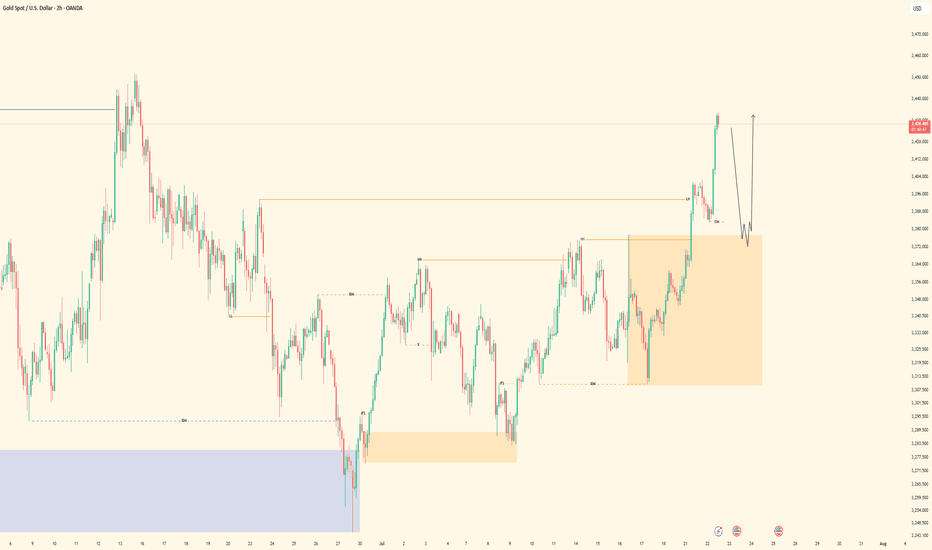

XAUUSD| Still Bullish - Waiting on BSL Sweep for EntryPair: XAUUSD

Bias: Bullish

Price remains bullish and structurally intact. This morning’s updated view confirms the bullish alignment — no change in directional bias.

Currently watching for a clean BSL sweep to clear out early liquidity, followed by LTF confirmations before engaging.

Higher time frame perspective from the 2H chart offers a solid bird’s eye view — staying patient and letting price come to me.

No rush — structure is king.

#XAUUSD #gold #smartmoney #SMC #orderblocks #inducementking #structurefirst

Bless Trading!

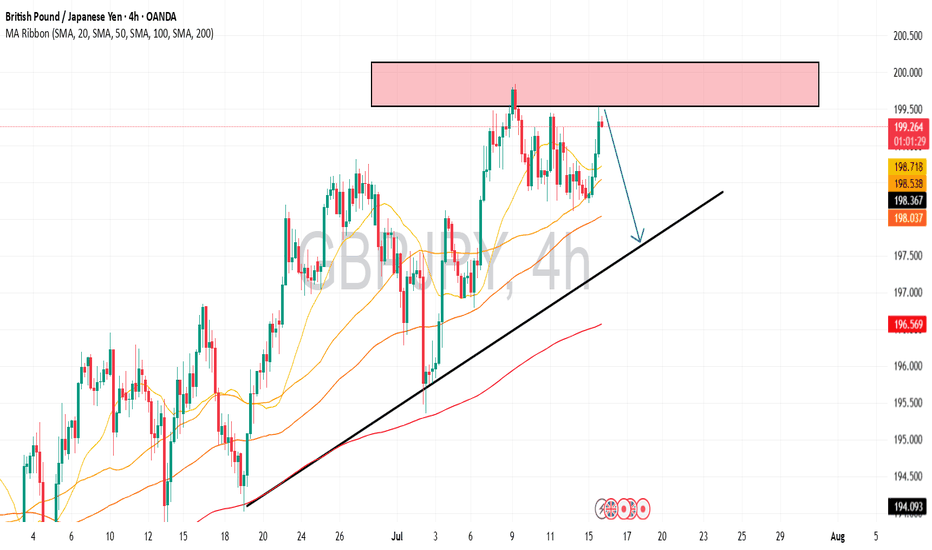

GBPJPY is in the Down Trend From Resistance LevelHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

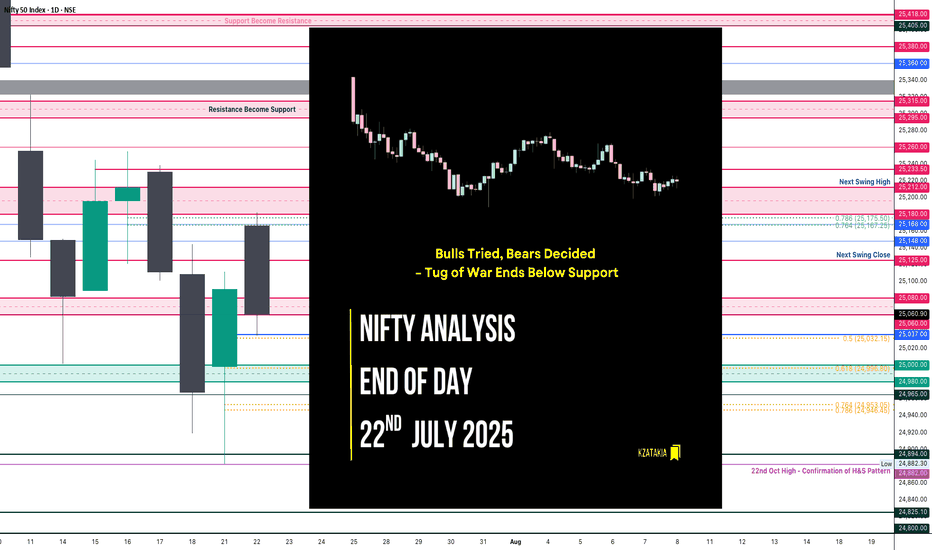

Nifty Analysis EOD – July 22, 2025 – Tuesday🟢 Nifty Analysis EOD – July 22, 2025 – Tuesday 🔴

"Bulls Tried, Bears Decided – Tug of War Ends Below Support"

Nifty opened with an 88-point gap-up, continuing the bullish sentiment, right at the resistance zone of 25,180 ~ 25,212. However, the market opened at the high (OH) and quickly slipped around 100 points to form the Initial Balance (IB). After a brief bounce back to the mean, it faced resistance, leading to a breakdown of IB and further losses of 77 points.

A supportive bounce emerged near 25,060 ~ 25,080, but the price was pushed down again by PDH + VWAP + R1. The day closed below PDC and under the support zone at 25,065, showing bearish dominance despite a volatile tug-of-war between bulls and bears.

Today’s low tested the 0.5 Fibonacci retracement level (from yesterday’s low to today’s high). If this is truly a retracement, 25K must hold in upcoming sessions, and bulls will need to reclaim 25,200 to regain their grip.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

📊 Daily Candle Breakdown

Open: 25,166.65

High: 25,182.00

Low: 25,035.55

Close: 25,060.90

Change: −29.80 (−0.12%)

Candle Structure:

Real Body: Red (−105.75 pts) → Decent bearish body

Upper Wick: 15.35 pts → Small

Lower Wick: 25.35 pts → Moderate

Interpretation:

Price opened strong but faced selling near 25,180, leading to a steady drop throughout the session. The lower wick shows some buying attempt near 25,035, but the close below open signals bears dominated.

Candle Type:

Bearish candle with moderate lower wick – resembles a Bearish Engulfing setup after a green candle, suggesting profit-booking or fresh selling.

Key Insight:

Sellers defending 25,180–25,200 firmly

Holding above 25,030–25,050 is critical; breaking this could retest 24,950–25,000

Bulls must reclaim 25,120–25,150 for momentum revival

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 182.32

IB Range: 92.6 → Medium

Market Structure: Balanced

Trades Triggered:

10:45 AM – Short Trade → Trailing SL Hit (1:0.8)

12:45 PM – Long Trade → SL Hit

📌 Support & Resistance Levels

Resistance:

25,080 ~ 25,060

25,125

25,168

25,180 ~ 25,212

Support:

25,037

25,000 ~ 24,980

24,965

24,894 ~ 24,882

24,825

24,800 ~ 24,768

🧠 Final Thoughts:

"Markets often dance between zones of power — where bulls flex and bears press. It's not chaos, it's the choreography of sentiment."

The 25,000–25,212 zone continues to be the battlefield. Let’s see who seizes the upper hand tomorrow.

✏️ Disclaimer:

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

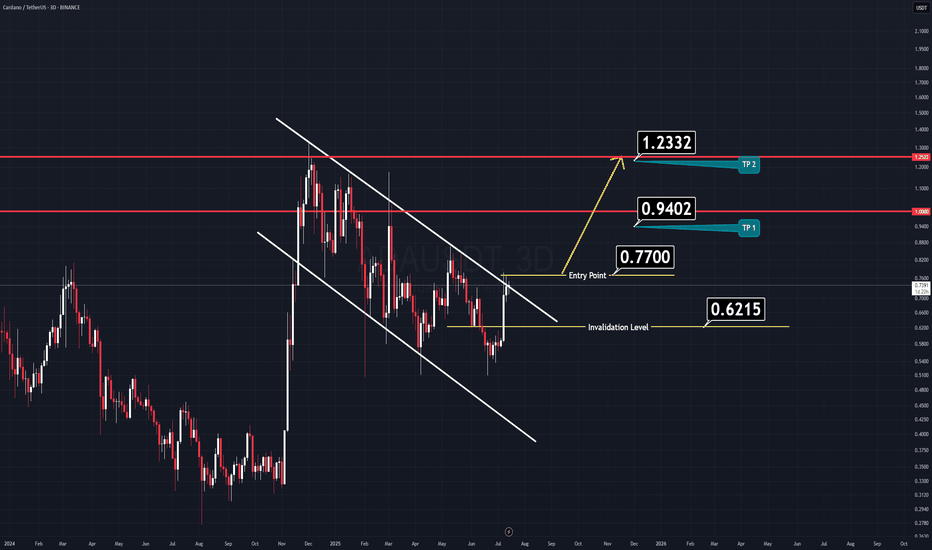

ADA Analysis (3D)Here’s another clean and straightforward chart, this time on Cardano (ADA).

ADA has formed a large flag pattern, which looks poised for a breakout soon.

Just like the previous setup, nothing complicated here.

✅ Entry Idea:

Consider entering when the price breaks above the previous daily candle’s high.

All the key levels are already marked on the chart for easy reference.

Keep it simple,

Good Luck.

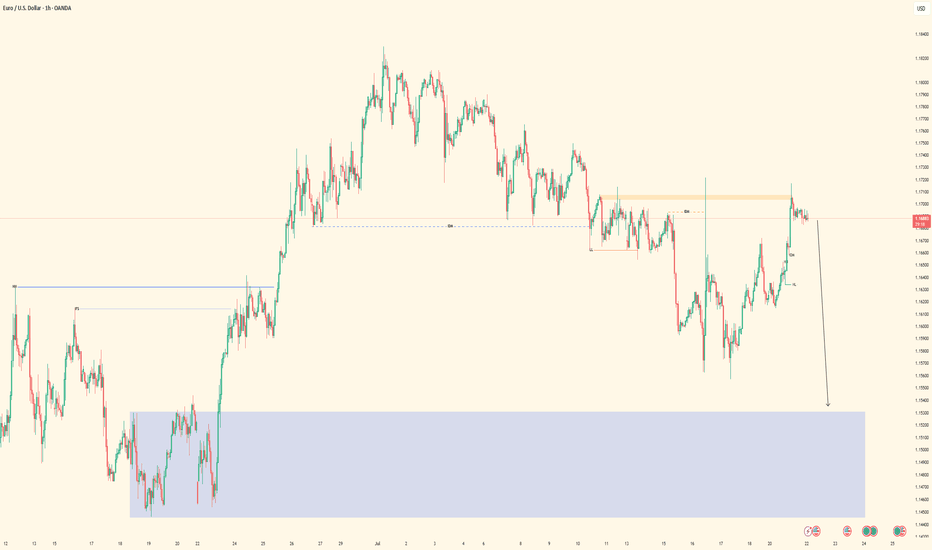

EURUSD - Sell Setup in ProgressPair: EURUSD

Bias: Bearish

HTF Overview: Structure leaning bearish — price respecting recent lower highs with room to fall into deeper 4H demand.

Current Zone: Price just mitigated the 30M sell-side OB, showing early signs of reaction.

LTF Confirmation: Still in observation mode — waiting for 5M or 1M confirmation to trigger short entries with confidence.

Entry Zone: Focused on refined LTF shift beneath the 30M OB — ideal setup includes inducement or liquidity run before executing.

Targets: First target is intraday low — ultimate target is the strong 4H demand zone below.

Mindset Note: Let the market bring the entry to you — don’t jump ahead of confirmation. Smart patience wins.

Bless Trading!

GBPUSD| - Bearish Play Setting UpPair: GBPUSD (GU)

Bias: Bearish

HTF Overview: Bearish structure intact — market has been respecting lower highs and pushing into downside pressure.

Current Zone: Price just mitigated the 30M OB, reacting as expected within the supply zone.

LTF Confirmation: Now waiting for clean confirmations on 5M or 1M — not in trader mode yet, analysis still in control.

Entry Zone: Watching for internal liquidity sweep or inducement followed by structure shift to confirm the sell.

Targets: First target is the next 30M low — extended target based on 1H continuation.

Mindset Note: No chasing — let the LTF tell the story before pulling the trigger. Control the urge, trust the system.

Bless Trading!

USDJPY - Bullish Bias, In OB ZonePair: USDJPY (UJ)

Bias: Bullish

HTF Overview: Bullish structure remains intact — price currently pushing upward, respecting higher timeframe flow.

Current Zone: Price is now sitting within the 30M OB, showing potential strength but no LTF confirmation yet.

LTF Confirmation: Still in analysis mode — sitting on hands, waiting for clean reaction on 5M or 1M before considering entries.

Entry Zone: 30M OB being monitored closely — ideal setup would include inducement and clear shift before entry.

Targets: Next 1H high remains the first target — extended targets to be trailed if momentum builds.

Mindset Note: Analysis first, execution second. Discipline is the edge — no rush until LTF gives the green light.

Bless Trading!