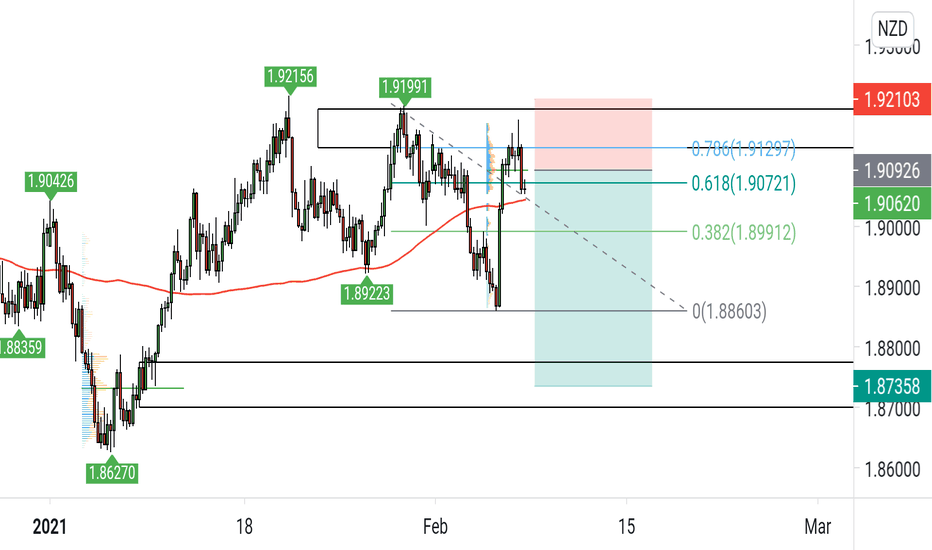

NZDUSD - SHORT ENTRY PRICE - 0.71490The price has reached the supply zone. Considering only the sale.

NZDUSD - SHORT

ENTRY PRICE - 0.71490

SL - 0.71900

TP - 0.70300

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

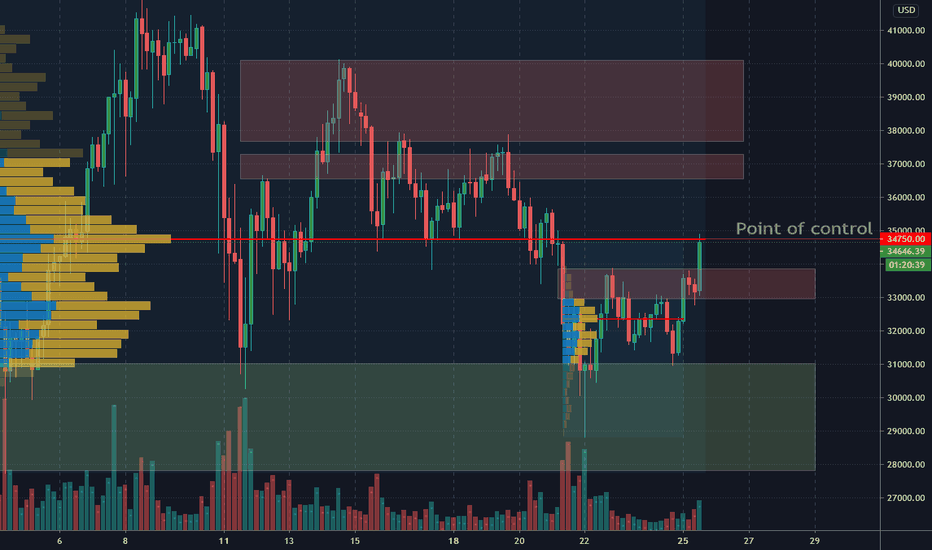

POC

EURUSD - SHORT ENTRY PRICE - 1.18990Consider the option of EURUSD leaving the uptrend channel. The main volume is concentrated so far @ 1.18700. A strong impulse is needed to break through this level.

EURUSD - SHORT

ENTRY PRICE - 1.18990

SL - 1.19280

TP - 1.18230

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

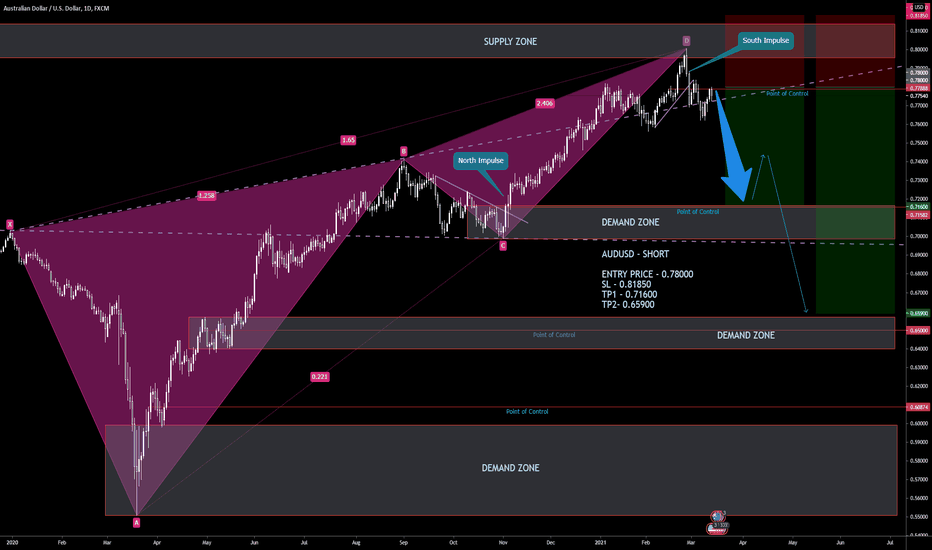

AUDUSD – SHORT (LONG THERM TRADE) ENTRY PRICE - 0.78000The Bearish Wolfe Wave Pattern has been completed. Last impulse to the North has been exhausted. A strong South impulse has been appeared. It’s time to sell this pair as the long term trade!

AUDUSD – SHORT (LONG THERM TRADE)

ENTRY PRICE - 0.78000

SL - 0.81850

TP1 - 0.71600

TP2- 0.65900

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

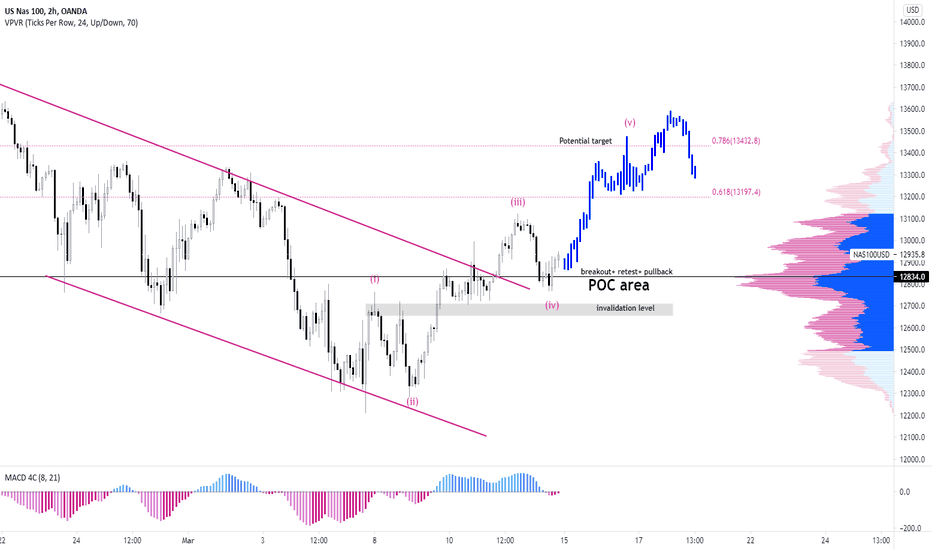

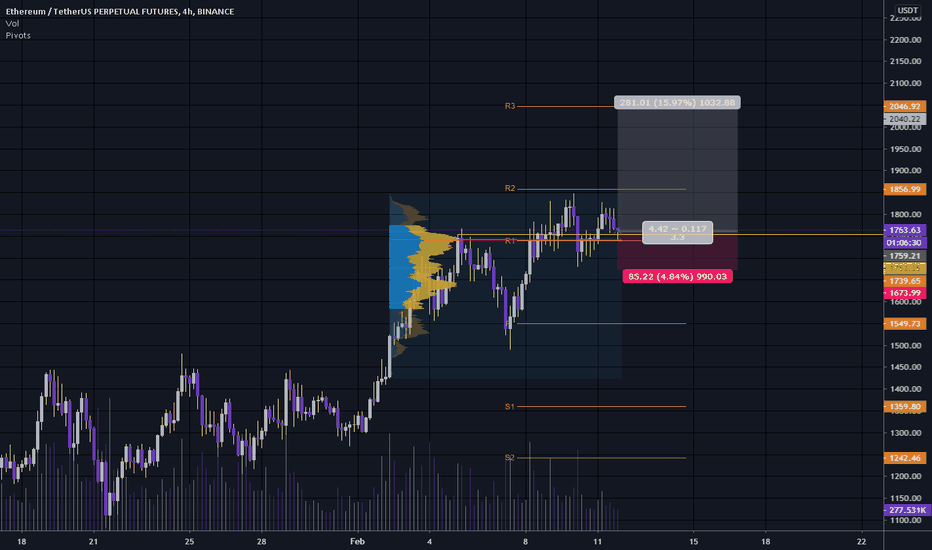

NAS100 (LONG) Potential Bullish ContinuationHello Folks,

NAS100 has broken the bearish channel in a bullish zone near The POC 12790 zone where is expected to provide a new rebound after the retest of the broken structure.

This potential rebound from the POC zone could aim for higher levels which will form an upward continuation movement. (Plus a Potential EW count).

Let's see how it goes..!!

Good luck

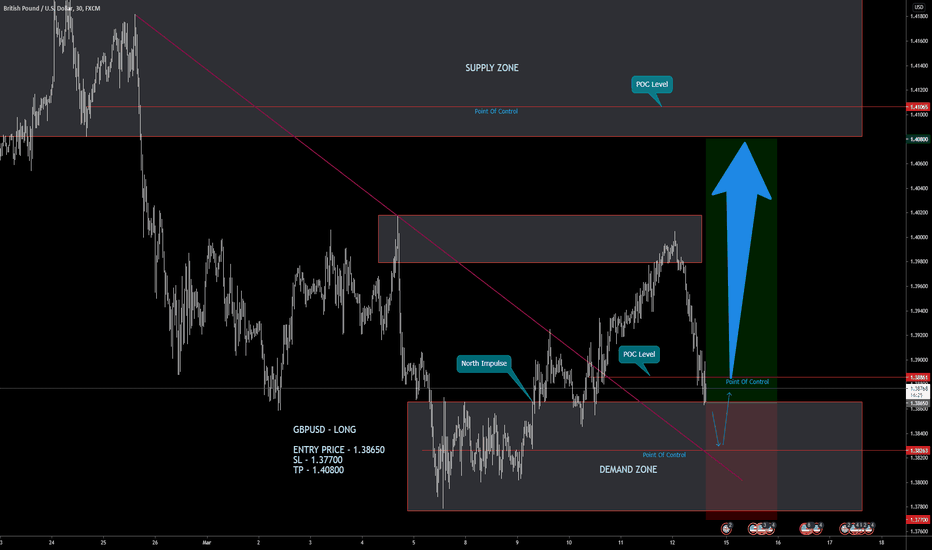

GBPUSD - LONG ENTRY PRICE - 1.38650Re-enter for long trade. Stop level under Demand Zone.

GBPUSD - LONG

ENTRY PRICE - 1.38650

SL - 1.37700

TP - 1.40800

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

GBPUSD - LONG ENTRY PRICE - 1.39350The impulse to the North continues to develop towards the target in the supply zone 1.40800. The price passes the 1x1 support line.

GBPUSD - LONG

ENTRY PRICE - 1.39350

SL - 1.38700

TP - 1.40800

Always follow the 6 Golden Rules of Money Management:

1. Protect your gains and never enter into a position without setting a stop loss.

2. Always trade with a Risk-Reward Ratio of 1 to 1.5 or better.

3. Never over-leverage your account.

4. Accept your losses, move on to the next trade and trust the software.

5. Make realistic goals that can be achieved within reason.

6. Always trade with money you can afford to lose.

Please leave your comment and support me with like if you agree with my idea. If you have a different view, please also share with me your idea in the comments.

Have a nice day!

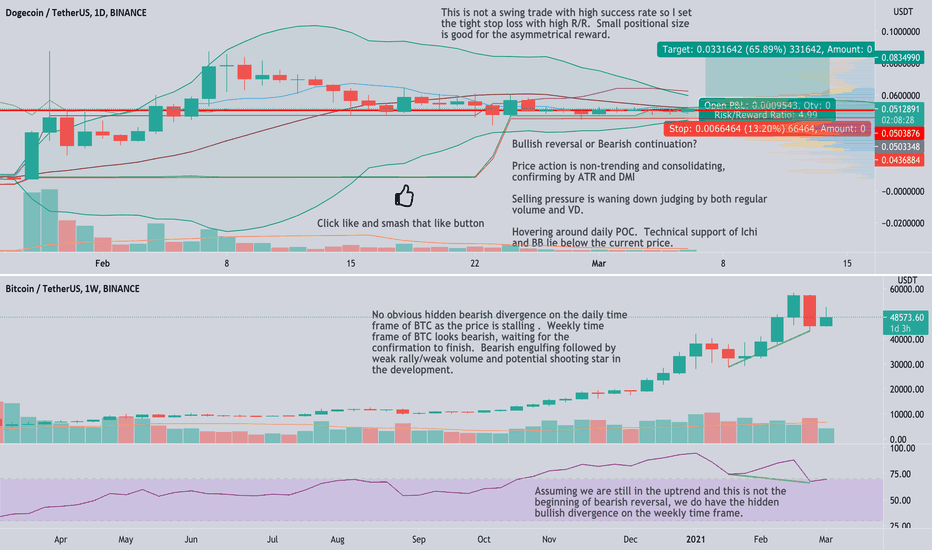

DOGE- Bullish reversal or Bearish continuation?This swing setup might be overly conservative, but given the uncertainty of BTC price and the complete lack of fundamental of DOGE. I tend to be extra careful when my swing trade has no chance of turning into the long-term holding.

Just my two cents. Not the trade advice.

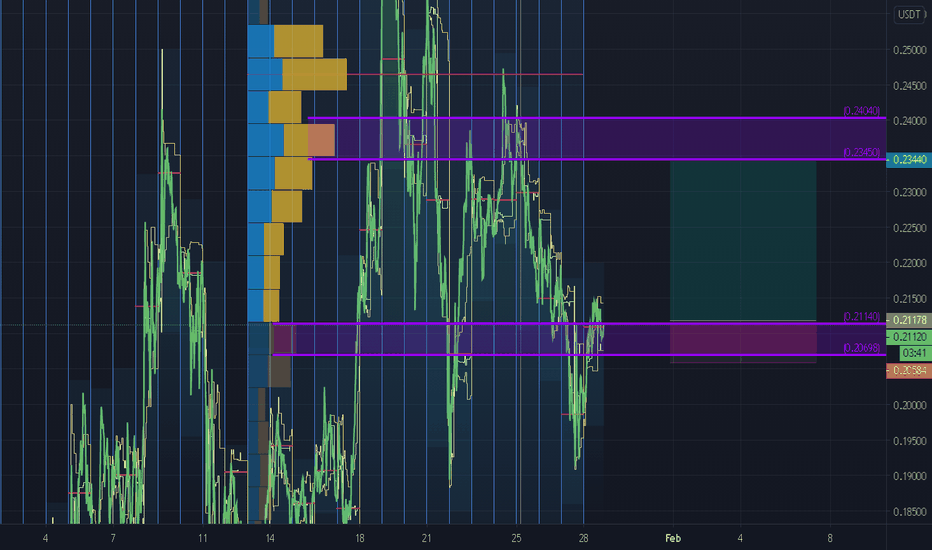

LTO short using volume profileVolume Profile is showing us that if LTOUSDT breaks this HVN at (0.211), it is going to the next HVN at (0.234)

Buy 0.211

TP 0.234

SL 0.205

This is not financial advice. Do your own analysis to trade.

Good luck, traders :)

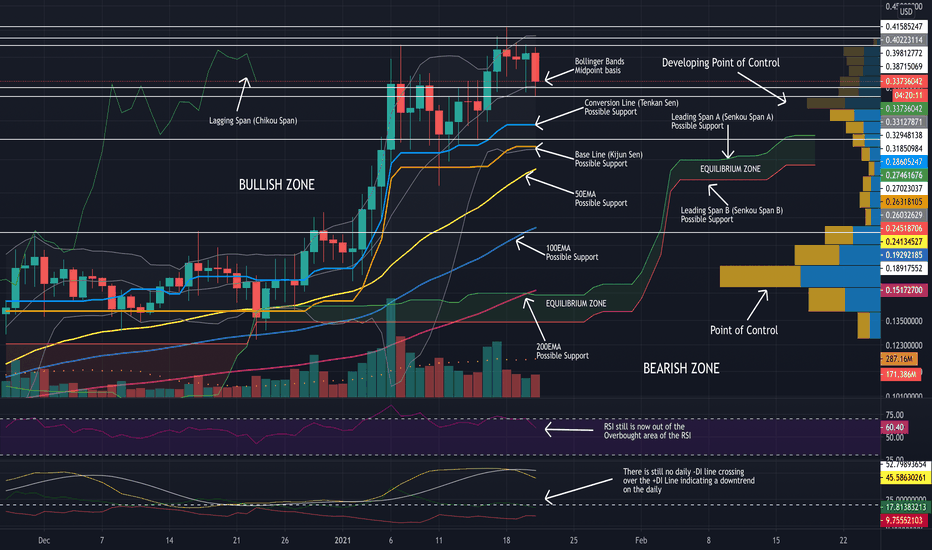

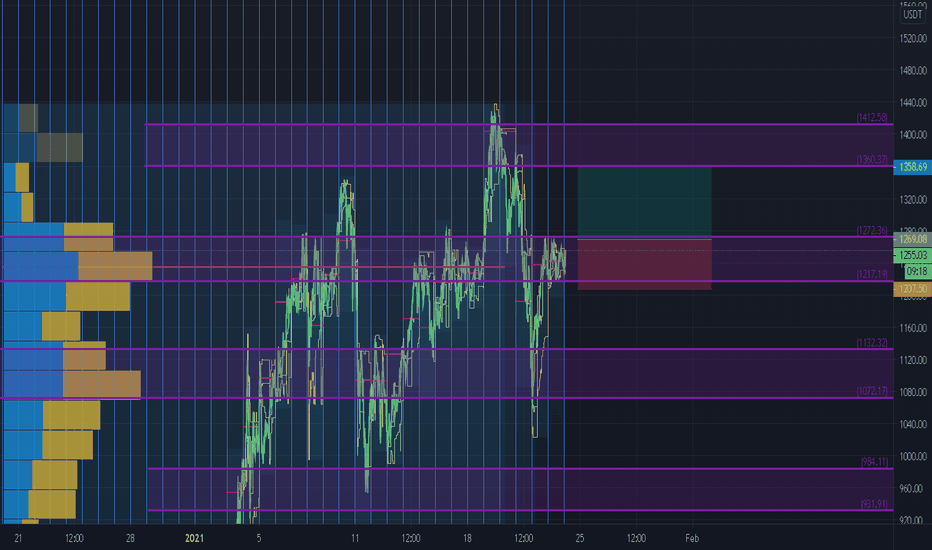

ADA - Show us your POCBefore everyone goes screaming to the hills asking Charles Hoskinson for their money back, remember that with shorter timeframes, one must expect pullbacks and short-term downtrends now and again, it enables the market to remain healthy, enables compound interest from the peeps who took profit at the ATH to re-invest that CI and also encourages people who missed out, to buy back in at a cheaper price. Although for some reason, most people feel comfortable buying BTC $42K the they do at $31K, absolutely crazy 🤯. First and foremost let’s look at the daily chart, ADA is still in a longterm uptrend, and will be unless it breaks through its Leading Span B (Senkou Span B) Cloud (Kumo) Support and into the Bearish Zone along with the Lagging Span (Chikou Span). Obviously this all depends on if you are a scalper, day trader, short-term, mid-term, longterm or just Hodl-ing for the next 5 years because this will all be dependant on what your timeframe of choice & whether or not you believe in the Ichimoku Cloud system. The RSI is indicating we are out of the Overbought area and we still have room to drop, although that’s no indication we will drop. The ADX DI SMA is indicating we are still in a longterm uptrend because the -DI (Red Line) has yet to cross over the +DI (Green Line) which would indicating a downtrend on the daily. The ADX (Yellow Line) is at 45 indicating a strong trend but we have fallen under the 10 period SMA (White Line) which is at 52, so we need that to reverse for renewed strength. A key point to look out for is if this daily candle closes above its Bollinger Bands Midpoint basis, if that happens then i’m getting the Kleenex out. Notice that we have a new developing POC (Point of Control) at around $0.31, so that is something to keep your good eye on especially if the buyers out weigh the sellers. If ADA does dip further, i cannot see it dipping past its Base Line (Kijun Sen) Support and certainly not past its 50EMA on the daily. Well, maybe if BTC shits the bed down to £10K 😅. Obviously its best to check earlier timeframes to get a sense of what’s happening there and what may happen on the daily. Once this daily candle closes, and also where it closes, we’ll have a much better idea of what to expect. I hope this is helpful 👍

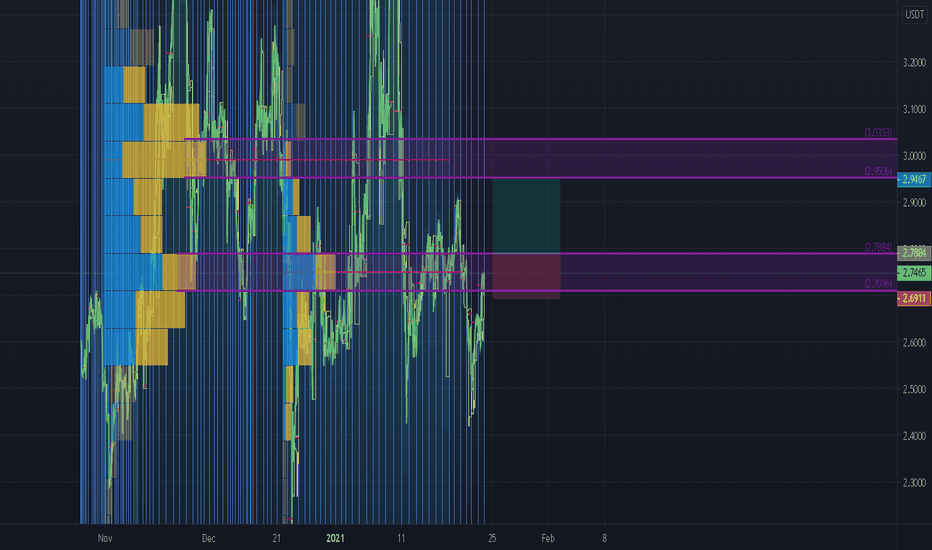

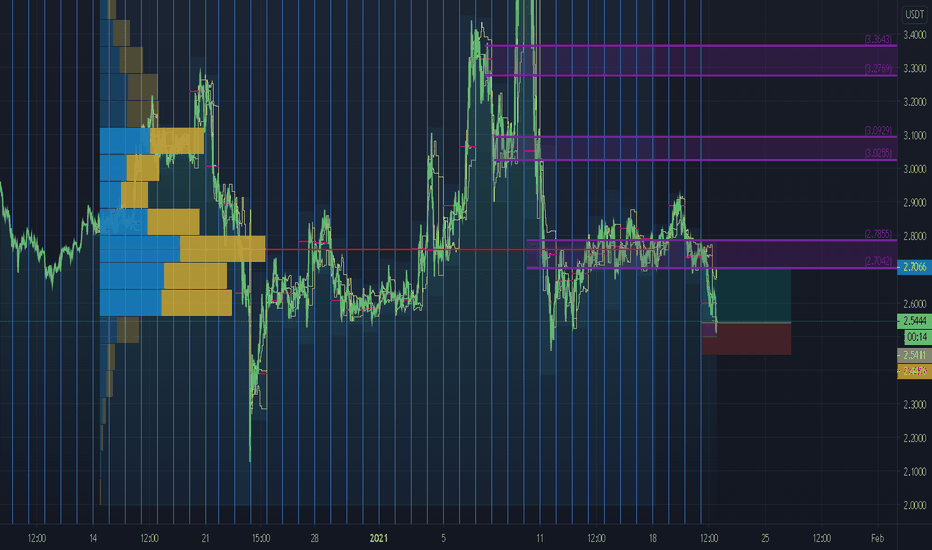

EOS Short 5.7% on Volume profileMy last trade on EOS went fine, and we got a 6% Profit. Now, if it breaks this HVN at (2.79), it will go to its POC at (2.95)

This is my personal opinion, do your own analysis to trade.

Good luck traders!!

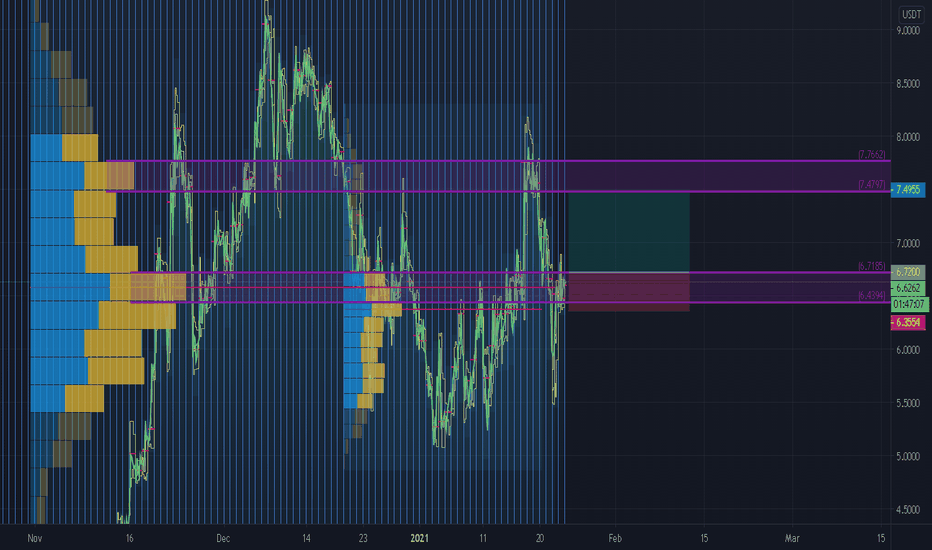

Waves using Volume Profile If Waves breaks its POC at (6.74) It will go up to the next HVN at (7.45).

TP 7.45

SL 6.35

This is my personal opinion. Do your own analysis to trade.

Good luck traders :)

EOS out of its value area!!Volume Profile shows us that EOS is 7% lower than its value area, which means it has a big potential to reach its POC soon. (This is only my personal opinion. Use your own analysis to trade).

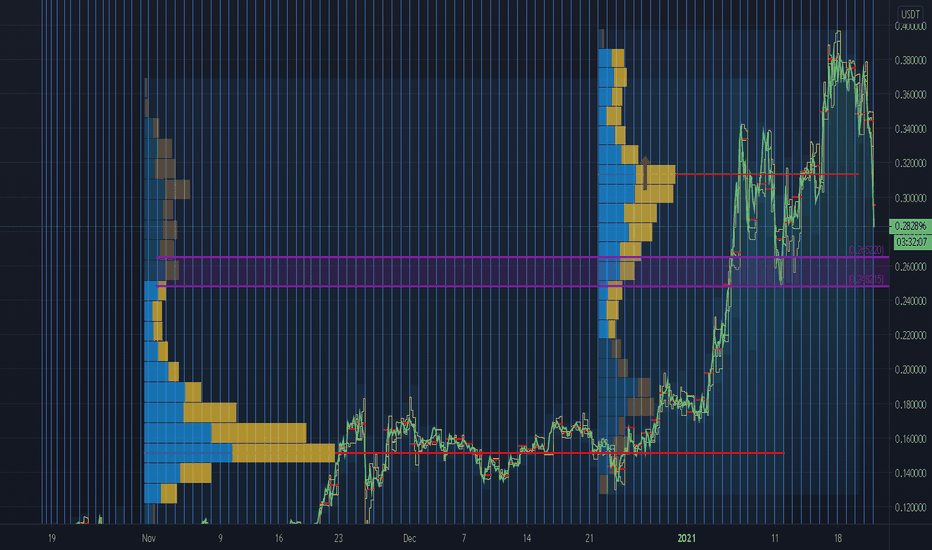

Where is ADA going to?Volume Profile is showing us that ADA is trying to make a new value area. To be sure, if it will make a new ADA must not break 0.24. If ADA breaks that price, it may go down to its old value area. If it bounces back, that means it made a new value area, and it is going to higher prices. 0.24 is where we are going to know the answer to our question! (This is my personal opinion. Do your own to trade.)

Have a good day, traders :)