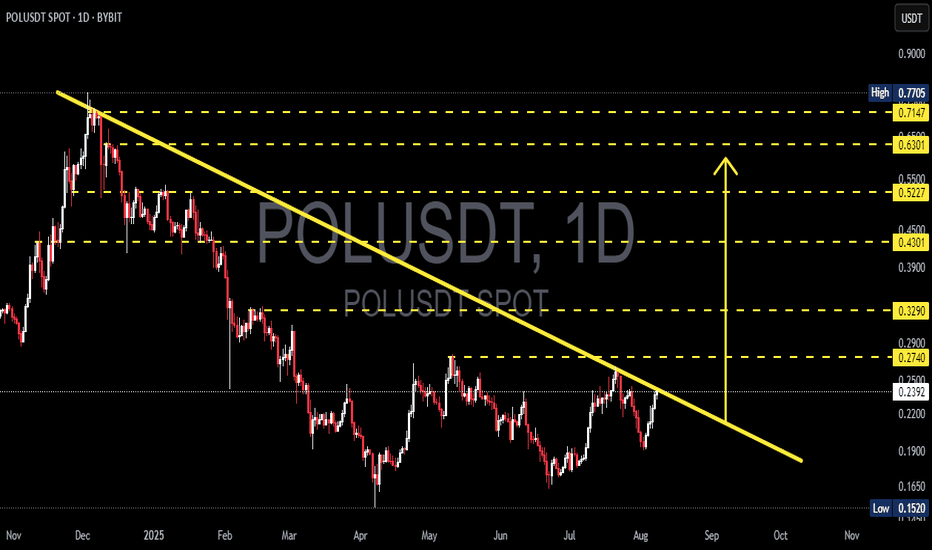

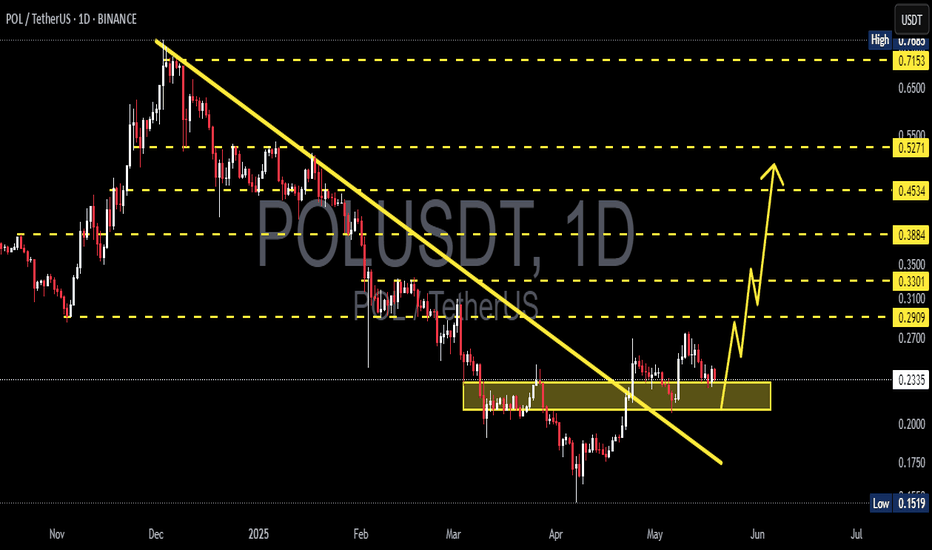

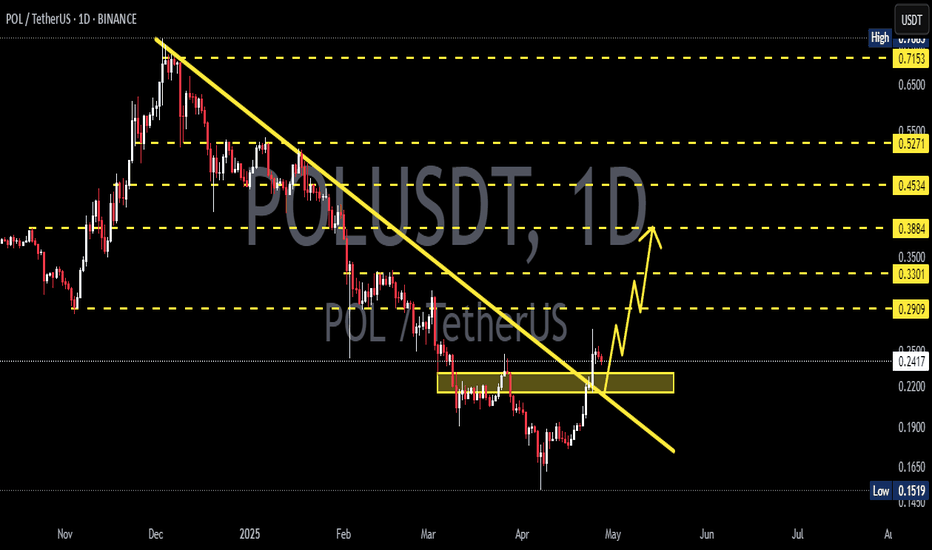

POL/USDT Preparing for a Major Breakout?📊 Chart Overview:

POL/USDT is currently showing signs of a potential trend reversal after months of sustained bearish momentum. The price is now testing a long-term descending trendline that has acted as a strong resistance since the November 2024 peak — and this moment could be a critical turning point for the market.

---

📌 Pattern Structure & Technical Setup:

🔸 Primary Pattern: Descending Trendline, capping every rally since late 2024.

🔸 Potential Reversal Structure: Falling Wedge Pattern – often a bullish reversal signal, supported by weakening bearish pressure and a series of higher lows forming since June 2025.

🔸 Current Position: Price is testing the trendline resistance around the $0.24–$0.27 zone.

---

📍 Key Price Levels:

✅ Resistance:

$0.2740 → Key breakout level; confirmation of trendline break.

$0.3290 → Important horizontal level, previously acted as major support.

$0.4301 – $0.7147 → Extended bullish targets based on Fibonacci retracement and historical price memory zones.

🛑 Support:

$0.2200 → Minor support if price rejects the trendline.

$0.1520 → Major long-term support (current all-time low).

---

📈 Bullish Scenario (Breakout Case):

If price successfully breaks and closes above $0.2740, we could expect:

Confirmation of a long-term downtrend breakout.

A shift in market sentiment from bearish to bullish.

Short-term target: $0.3290 → then $0.4301.

Higher upside potential if volume supports the breakout and altcoin momentum strengthens.

> 🚀 Volume will be the key validator – a breakout without volume = weak signal.

---

📉 Bearish Scenario (Rejection Case):

If the price fails to break the trendline:

Likely rejection and pullback toward the $0.2200 support zone.

If selling pressure increases, a retest of the $0.1520 demand zone is possible.

This would extend the consolidation phase or confirm continued bearish control over the medium term.

---

🔍 Conclusion & Trading Strategy:

POL/USDT is at a technical decision point. A confirmed breakout could mark the end of the accumulation/distribution phase and trigger a new bullish leg.

📌 Strategy Overview:

Breakout Traders: Enter after confirmed daily close above $0.2740, target levels above.

Reversal Traders: Enter conservatively after a retest of the breakout zone with a tight SL.

Bearish Traders: Consider shorts on strong rejection at the trendline, targeting $0.22 → $0.15.

---

🧠 Extra Notes:

Watch Bitcoin dominance and overall market sentiment.

Volume confirmation is crucial for validating breakout strength.

Be cautious of fakeouts, especially around dynamic resistance like trendlines.

#POLUSDT #CryptoBreakout #FallingWedge #AltcoinAnalysis #TechnicalAnalysis #CryptoSetup #PriceActionTrading #BullishBreakout #BearishScenario #CryptoReversal #TrendlineBreakout