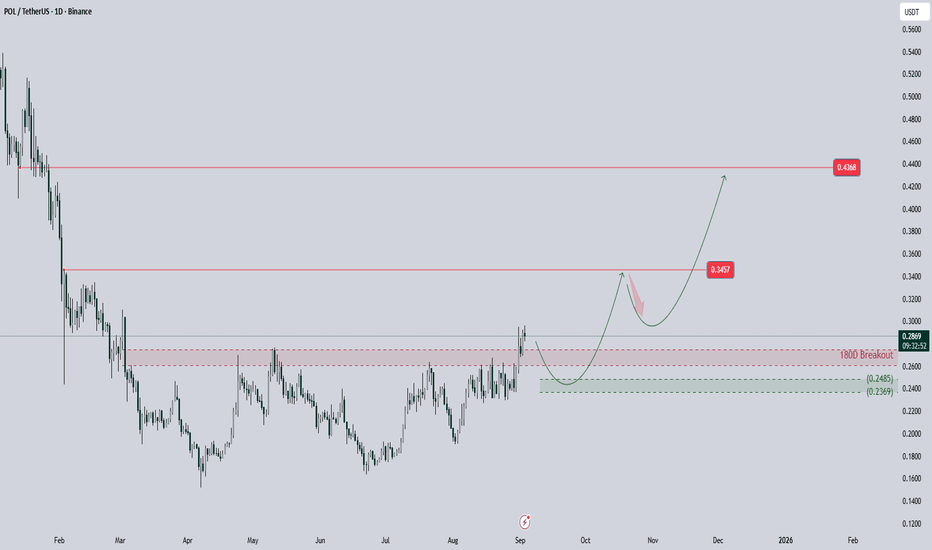

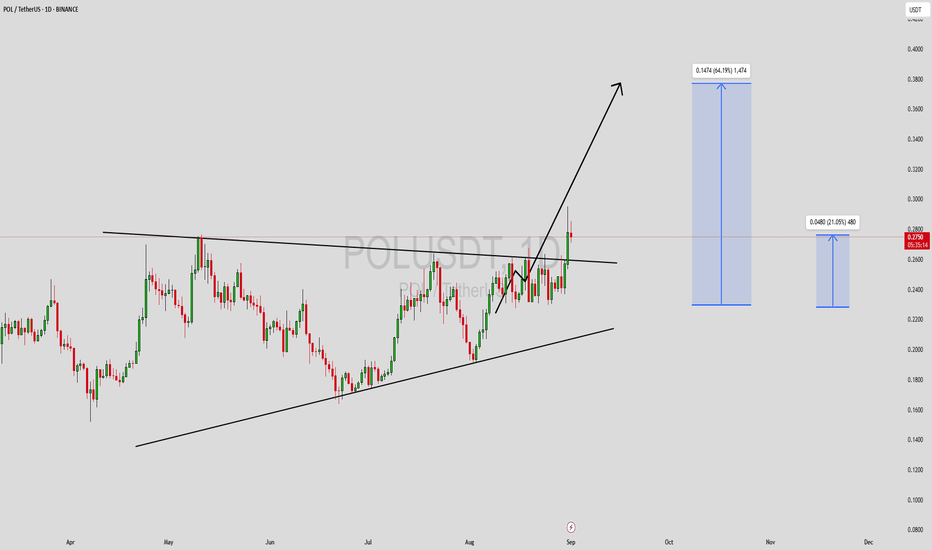

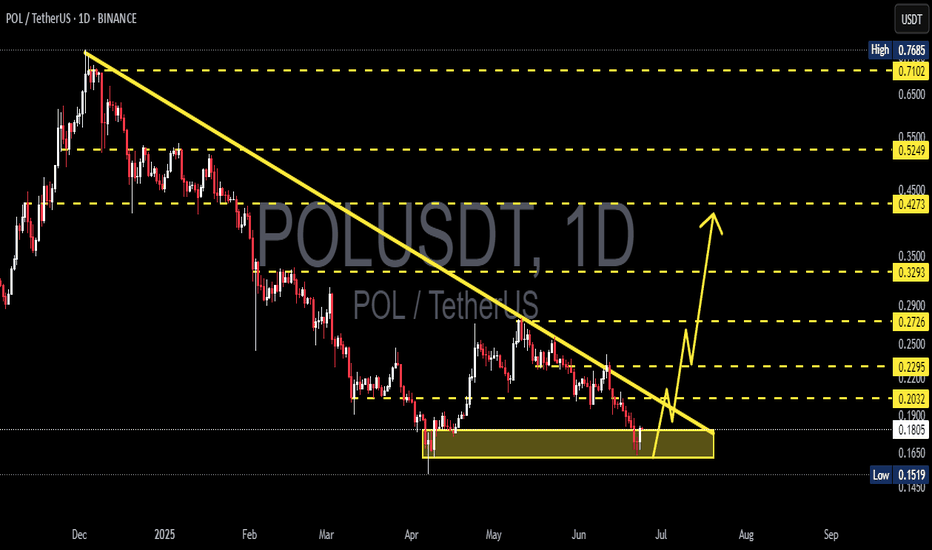

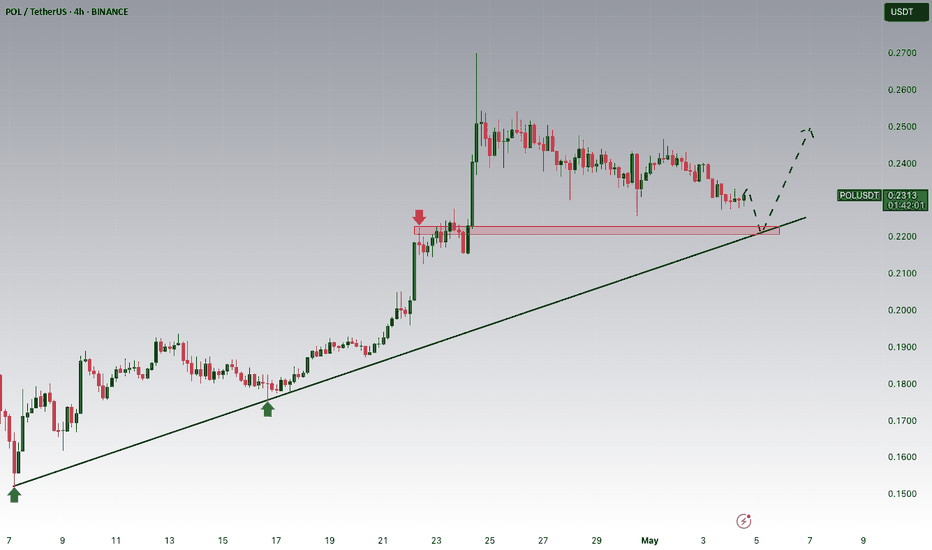

Ready for the POL RallyAfter 180 days of being in a range and below the resistance line, the BINANCE:POLUSDT has finally broken the resistance area and given us the confirmation we need to ascend to higher prices.

However, before the move starts, I would like it to return to the box marked in green on the chart and then begin its upward movement. For the long-term targets, I have marked two red lines, which could be the long-term goals. There is also a possibility that it could reach these targets quickly with sharp moves.

⛔ This is not financial advice; do your own research.

POLUSDT

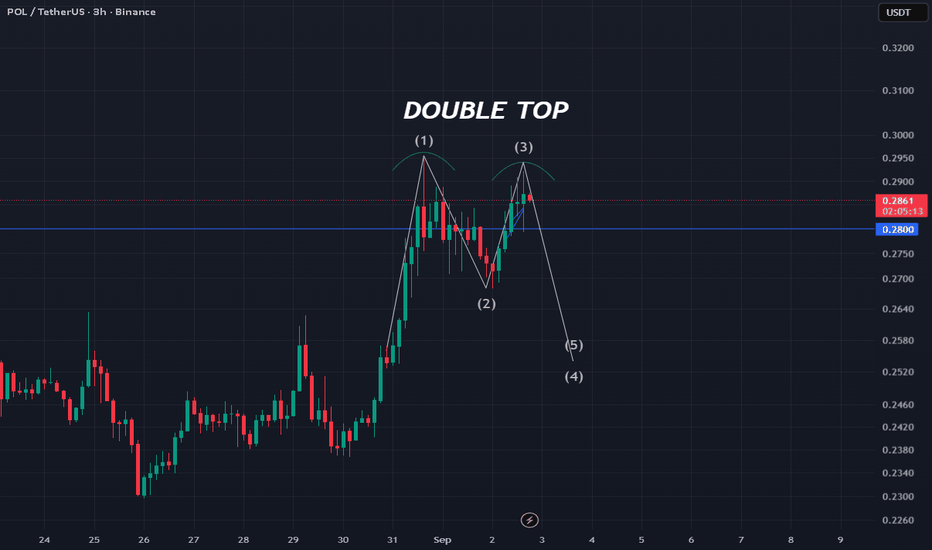

POL/USDT Trade Idea💎 BINANCE:POLUSDT Trade Idea 💎

📊 Pattern spotted: Double Bottom ✅

This setup indicates strong support around 0.2800 and signals a possible bullish reversal.

⚡ Entry (Advanced): 0.2860 – 0.2870

🎯 Target (TP): 0.2960

🛡️ Stop Loss (SL): 0.2800

✨ Risk/Reward: Low Risk – High Profit 🚀

This is an advanced entry with tight SL and strong upside potential.

📈 If the neckline breaks and sustains above, we can expect a bullish move towards the target.

🔑 Summary: Double Bottom gives confidence of reversal 📉➡️📈. Perfect setup for traders who like low loss & high reward opportunities.

POL/USDT Trade Idea💎 BINANCE:POLUSDT Trade Idea 💎

📊 Pattern spotted: Double Bottom ✅

This setup indicates strong support around 0.2800 and signals a possible bullish reversal.

⚡ Entry (Advanced): 0.2860 – 0.2870

🎯 Target (TP): 0.2960

🛡️ Stop Loss (SL): 0.2800

✨ Risk/Reward: Low Risk – High Profit 🚀

This is an advanced entry with tight SL and strong upside potential.

📈 If the neckline breaks and sustains above, we can expect a bullish move towards the target.

🔑 Summary: Double Bottom gives confidence of reversal 📉➡️📈. Perfect setup for traders who like low loss & high reward opportunities.

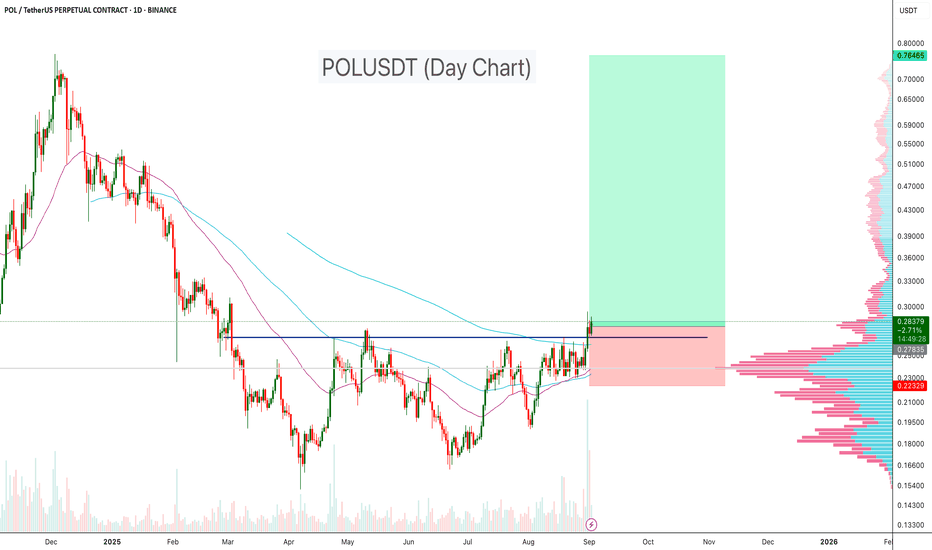

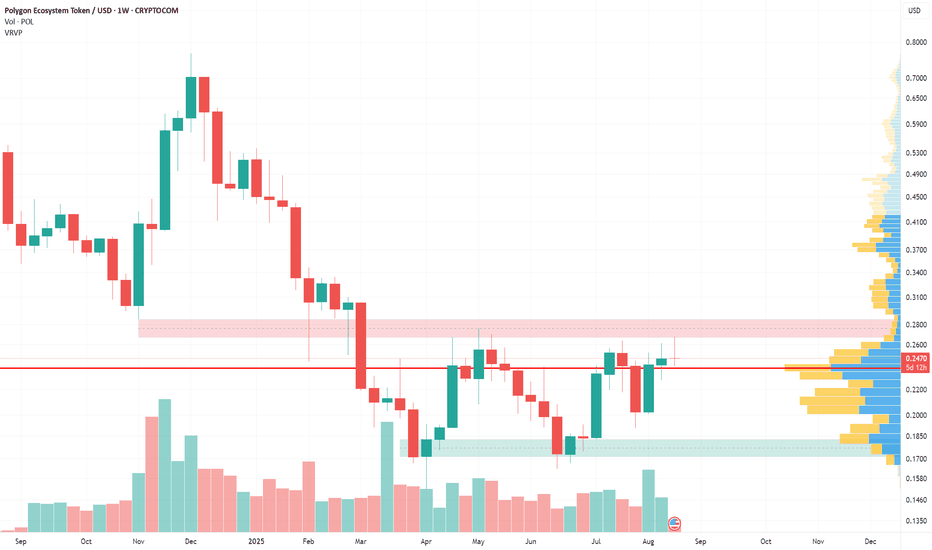

POLUSDT Reversal Confirmed!POLUSDT is showing a strong bullish reversal setup on the daily chart. The price has broken above resistance and both the 100 EMA and 200 EMA, signaling a momentum shift to the upside. A clear double bottom pattern has formed, with a breakout above the neckline resistance, confirmed by high trading volume. These technical signals suggest that the market structure is turning bullish, and as long as the price holds above the breakout zone and EMA support, there is strong potential for continuation toward higher resistance levels.

Key Points:

- Price trading above 100 & 200 EMA

- Double bottom neckline breakout

-Breakout supported by high volume

- Volume profile shows major accumulation below current price, lighter resistance above

Cheers

Hexa

POLUSDT Forming Bullish WavePOLUSDT is showing an interesting technical setup as the price consolidates within a broader ascending structure. After weeks of accumulation, the pair has recently attempted a breakout, supported by growing investor interest and consistent trading volume. This suggests that the market is preparing for a strong move, with potential upside targets aligning well with the 50% to 60%+ gain expectation.

The price action highlights a bullish breakout structure, where higher lows and repeated resistance testing indicate increasing buying pressure. If this breakout sustains, POLUSDT could accelerate toward higher price zones, fueled by momentum traders and fresh inflows of capital. Such patterns often act as the beginning of a larger bullish wave, which makes this setup highly relevant for short to mid-term traders.

Investor sentiment around this project has been improving, with many considering POLUSDT as an undervalued opportunity compared to other crypto pairs. The combination of good volume, favorable technicals, and renewed interest strengthens the probability of further upside continuation. Traders should closely monitor breakout confirmations as the price approaches critical resistance levels.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Is $POL (ex-#Matic) preparing for a breakout?After 4 months, the situation remains stable at OKX:POLUSDT

Key technical focus: breakout & consolidation above $0.28–0.30.

📌 Observations:

Market correction ongoing, yet #POL is holding strong.

Market Cap: ~$3B.

No major fundamental drivers currently seen.

📈 If momentum continues, x2 by the end of the year is realistic — possibly higher, depending on capital inflows.

What’s your view? Do you see hidden fundamentals supporting this strength?

______________

◆ Follow us ❤️ for daily crypto insights & updates!

🚀 Don’t miss out on important market moves

🧠 DYOR | This is not financial advice, just thinking out loud.

Polygon Update ·Everything Continues To Point HigherPolygon looks good. We have the same dynamics on this chart from the previous update.

There is a challenge of resistance currently taking place. This resistance is likely to break based on the fact that POLUSDT continues to trade closer and closer to it, with no more retraces basically. When this happens we know that resistance is weakening and with this weakening comes the next advance.

In early August there was a higher low and the preceding move was very steep and fast. And so was the recovery producing a v shape. After the v shape recovery POL has been sideways at resistance.

Late 2025. That's when the entire cryptocurrency market will have its bull-run. The date has not change; we are getting very close. The closer we get, the stronger the signals become.

Everything continues to point higher.

Thanks a lot for your continued support.

Namaste.

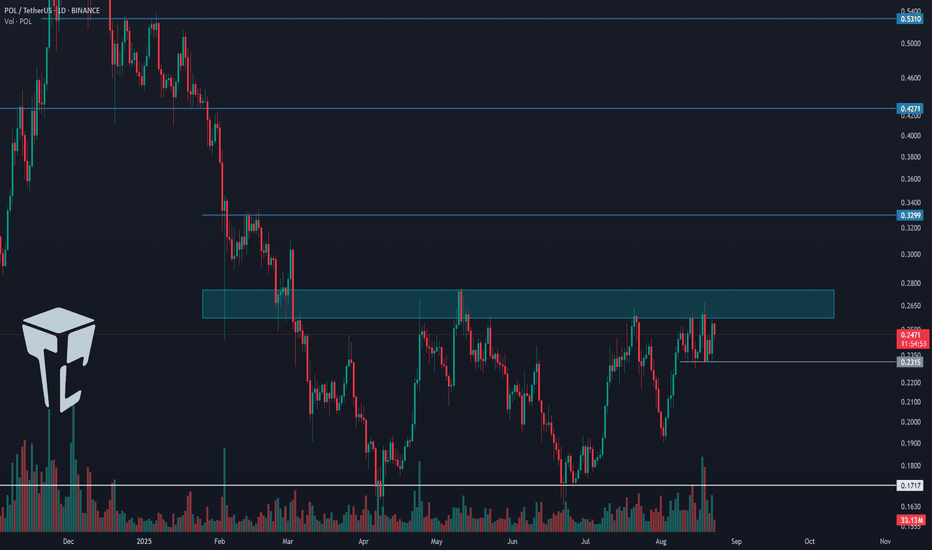

TradeCityPro | POL Testing Range Top Amid Bullish Momentum👋 Welcome to TradeCity Pro!

In this analysis I want to review the POL coin for you. One of the so-called Ethereum Killer projects that in the previous bull run was highly hyped to replace Ethereum and now with a market cap of 2.6 billion dollars is ranked 42 on CoinMarketCap.

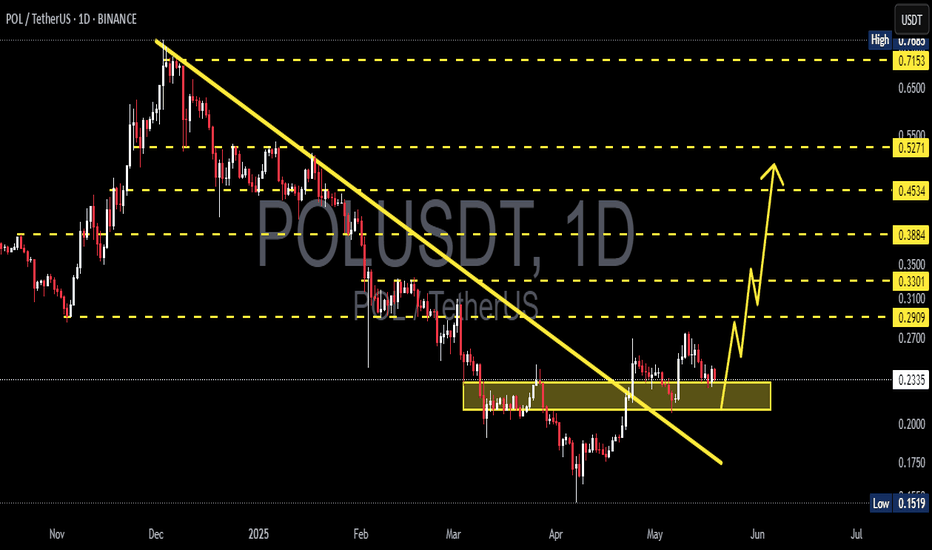

📅 Daily Timeframe

In the daily timeframe, this coin, like most altcoins, is in a very long-term range box. Now, after significant buying volume, it has reached the Maker Seller zone at the top of the box.

✔️ Since the price has registered a higher low than the 0.1717 bottom, the probability of breaking the zone has greatly increased. On the other hand, buying volume has gradually increased as the price has moved from the bottom of the box to the top, which shows the strength of the bullish trend.

⚡️ Now several daily candles in a row are stuck near this zone, consolidating just below it. If the zone is broken, we can have a long-term long position or even buy this coin in spot.

📊 If the bullish move starts, the resistance levels we can use as targets are 0.3299, 0.4271, and 0.5310. If the bullish trend continues and there are no signs of weakness, each of these levels can act as a new trigger for a long position.

🔍 If the price gets rejected from the resistance zone, with the breakdown of the 0.2315 trigger, the probability of a bearish move toward the 0.1717 bottom also exists, and with the breakdown of 0.2315 we can open a risky short position.

💥 With the breakdown of 0.1717, we also get the main confirmation of the trend change, and if this level is broken, this coin could have a very large drop.

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

Another attempt to reverse from the downtrendPOL (MATIC) remain within downtrend on higher timeframes, but on daily shows intentions to grow higher. Red zone is old range bottom formed since token listing in 2021 and tested 4 times before break down. July 8th scam pump wick re-tested that level from below for the first time. So if manage to get there again, that will be the second time.

Monthly 20-sma moves in a downtrend - now around 0.468 and next month might be around 0.43 - that major dynamic SR is a magnet for price. At least when divergence becomes too large. So it can be taken as a target for future PA.

Smaller TF consolidation range is within 0.227 and 0.265 - will move within it till break in one of the directions.

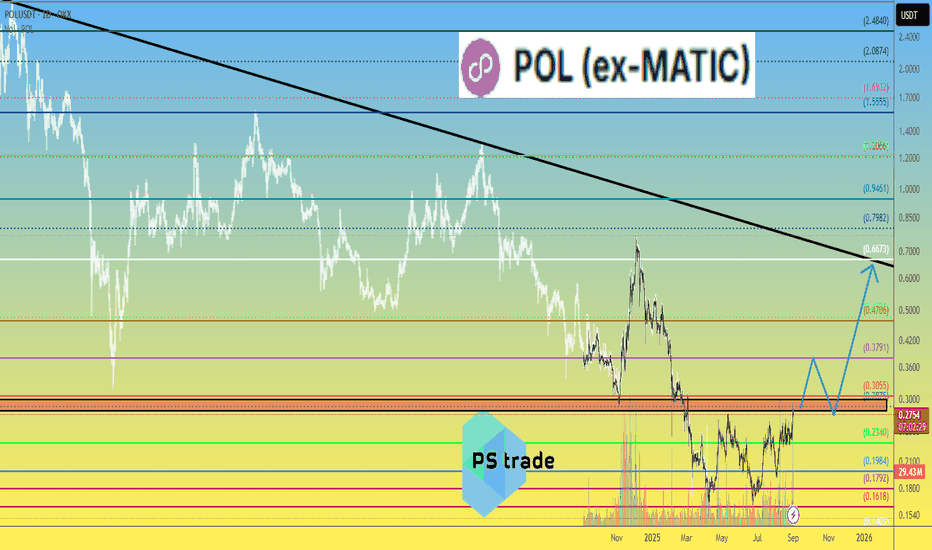

The Top vs The Bottom · Polygon vs Bitcoin, Ether & XRPEthereum will keep on growing of course and Bitcoin as well. Notice the difference between Bitcoin, Ether, XRP and Polygon. What an incredibly huge difference. The three mentioned are trading at very high prices compared to past history while POL is trading very close to its bottom.

I mean, this can definitely be good.

POLUSDT is trading at bottom prices but the downtrend is no longer active. There are no new lows in more than four months. The entire wave between December 2024 and April 2025 lasted four months. So seeing the same amount of time that produced such a strong bearish move produce nothing more than consolidation, is good news.

Polygon has been trading at bottom prices but slowly going up. We have a rising bottom, an ascending triangle. The upper resistance that is keeping the pattern active is still valid and being challenged this week. As soon as this resistance breaks, expect maximum growth. Some pairs will move up right away while others will continue to consolidate for months.

Polygon's consolidation is reaching its end.

Thanks a lot for your continued support.

Namaste.

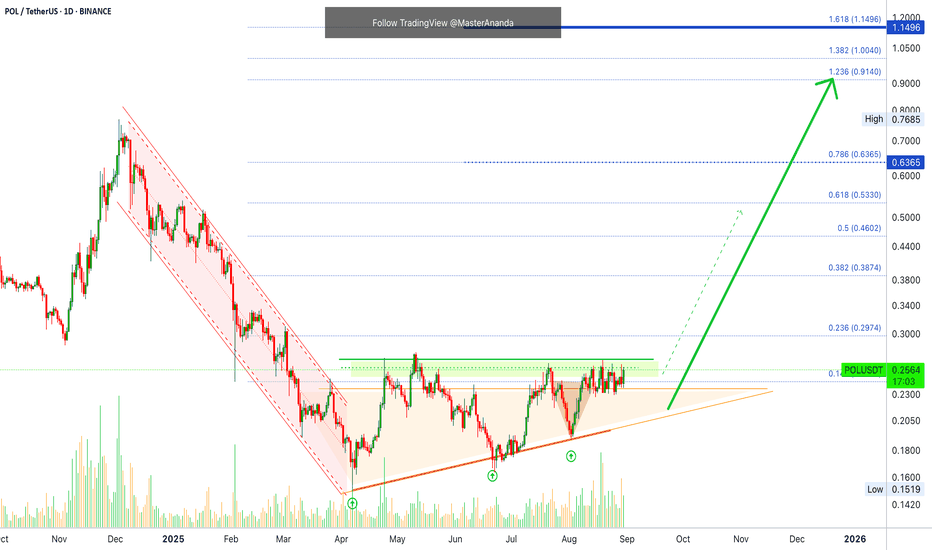

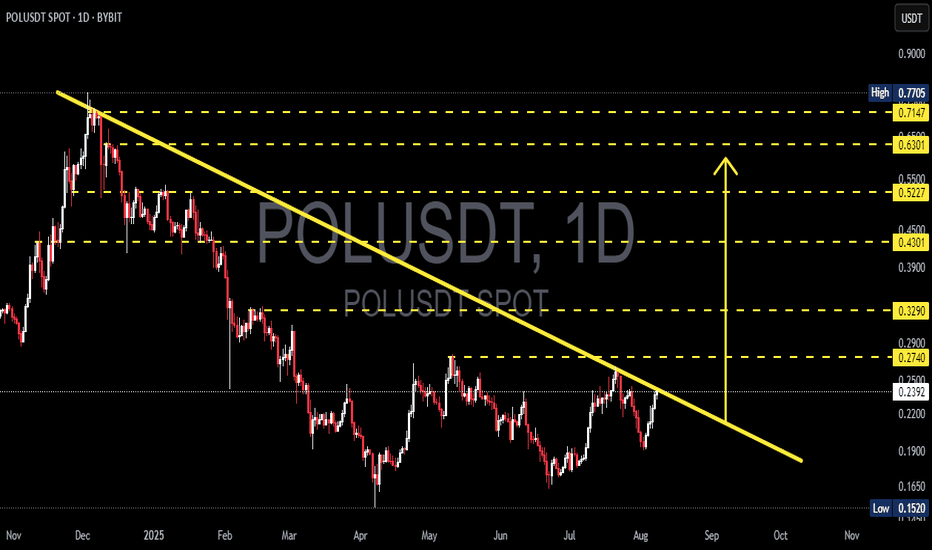

POL/USDT Preparing for a Major Breakout?📊 Chart Overview:

POL/USDT is currently showing signs of a potential trend reversal after months of sustained bearish momentum. The price is now testing a long-term descending trendline that has acted as a strong resistance since the November 2024 peak — and this moment could be a critical turning point for the market.

---

📌 Pattern Structure & Technical Setup:

🔸 Primary Pattern: Descending Trendline, capping every rally since late 2024.

🔸 Potential Reversal Structure: Falling Wedge Pattern – often a bullish reversal signal, supported by weakening bearish pressure and a series of higher lows forming since June 2025.

🔸 Current Position: Price is testing the trendline resistance around the $0.24–$0.27 zone.

---

📍 Key Price Levels:

✅ Resistance:

$0.2740 → Key breakout level; confirmation of trendline break.

$0.3290 → Important horizontal level, previously acted as major support.

$0.4301 – $0.7147 → Extended bullish targets based on Fibonacci retracement and historical price memory zones.

🛑 Support:

$0.2200 → Minor support if price rejects the trendline.

$0.1520 → Major long-term support (current all-time low).

---

📈 Bullish Scenario (Breakout Case):

If price successfully breaks and closes above $0.2740, we could expect:

Confirmation of a long-term downtrend breakout.

A shift in market sentiment from bearish to bullish.

Short-term target: $0.3290 → then $0.4301.

Higher upside potential if volume supports the breakout and altcoin momentum strengthens.

> 🚀 Volume will be the key validator – a breakout without volume = weak signal.

---

📉 Bearish Scenario (Rejection Case):

If the price fails to break the trendline:

Likely rejection and pullback toward the $0.2200 support zone.

If selling pressure increases, a retest of the $0.1520 demand zone is possible.

This would extend the consolidation phase or confirm continued bearish control over the medium term.

---

🔍 Conclusion & Trading Strategy:

POL/USDT is at a technical decision point. A confirmed breakout could mark the end of the accumulation/distribution phase and trigger a new bullish leg.

📌 Strategy Overview:

Breakout Traders: Enter after confirmed daily close above $0.2740, target levels above.

Reversal Traders: Enter conservatively after a retest of the breakout zone with a tight SL.

Bearish Traders: Consider shorts on strong rejection at the trendline, targeting $0.22 → $0.15.

---

🧠 Extra Notes:

Watch Bitcoin dominance and overall market sentiment.

Volume confirmation is crucial for validating breakout strength.

Be cautious of fakeouts, especially around dynamic resistance like trendlines.

#POLUSDT #CryptoBreakout #FallingWedge #AltcoinAnalysis #TechnicalAnalysis #CryptoSetup #PriceActionTrading #BullishBreakout #BearishScenario #CryptoReversal #TrendlineBreakout

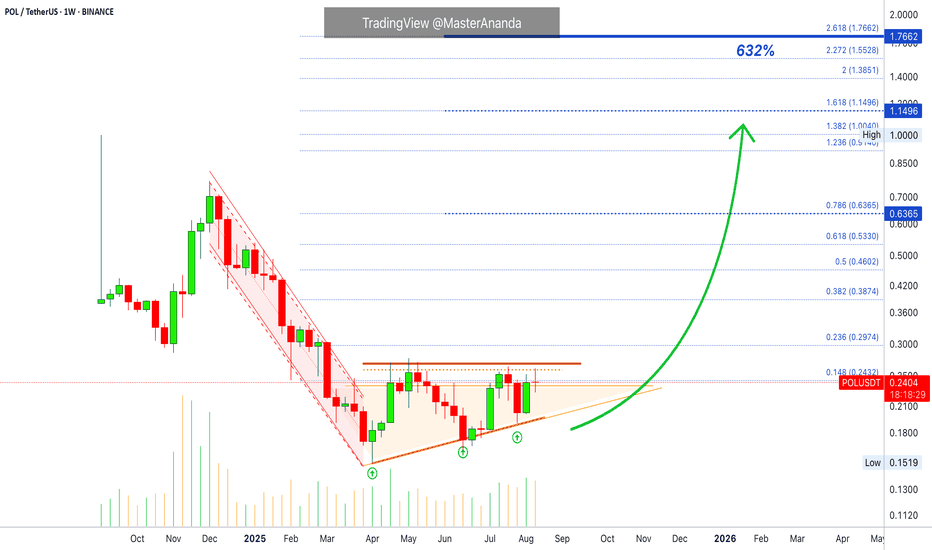

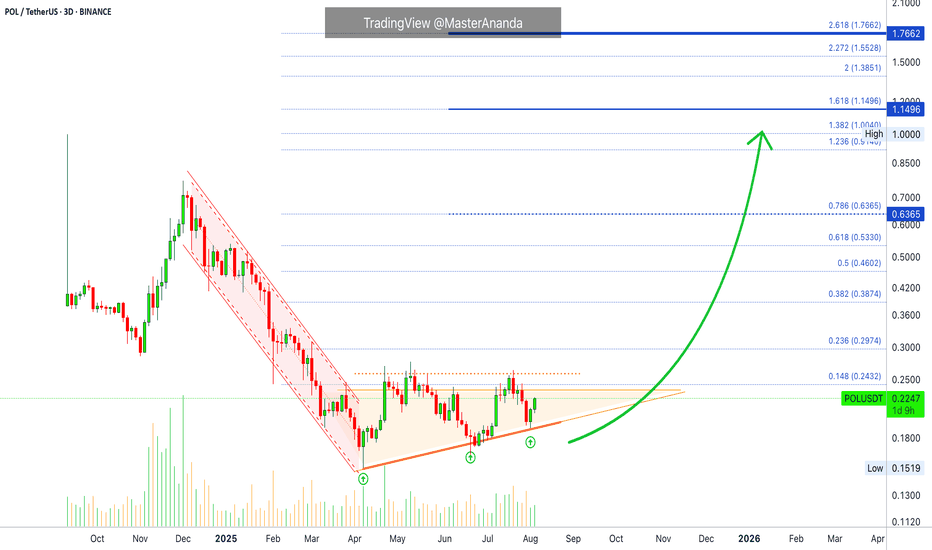

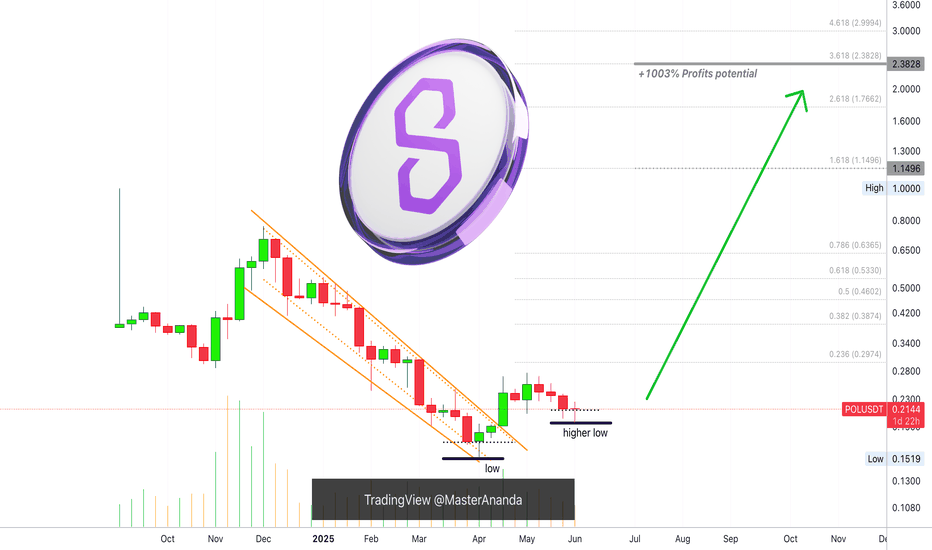

Polygon · Bottom, Recovery & 5,000% Growth PotentialPolygon has been bullish since April, clearly rising from its base for months. Now this Cryptocurrency trading pair is preparing for a new phase and market cycle. It is preparing for its 2025 bull market wave.

Polygon after a major drop produced a clear bottom and higher lows. This process has been active now four 120 days/4 months. This is a long consolidation period and there are no new lows, clearly. A rising triangle as a reversal signal is also present on the chart.

The accumulation period has been lasting, we can see how patience is key for success. Who would be able to hold for four long months? Who is still holding wise for 120 days?

Well, those who wait get paid. Those who waited will get paid but there is no need to wait because you can still buy and profit from the incoming bullish wave. The difference is that prices are higher now so growth potential is limited compared to several months in the past, that's how it works. The market builds up strength slowly and as this strength is being built prices grow.

When there is enough strength, enough interest and enough growth, the masses enter the market and this produces a major bull run. I've been warning you, we are getting very close. The action is already happening now, don't be surprised when you see a 300%+ bullish jump. That is exactly what is coming and it will all happen within a few months.

Expect 500% to start but aim for 1,000%, 2,000% and in some cases even more. Many good, strong and reputable pairs will grow 3,000%, 4,000% or 5,000%. Polygon will be one of the big ones.

Thanks a lot for your continued support.

Namaste.

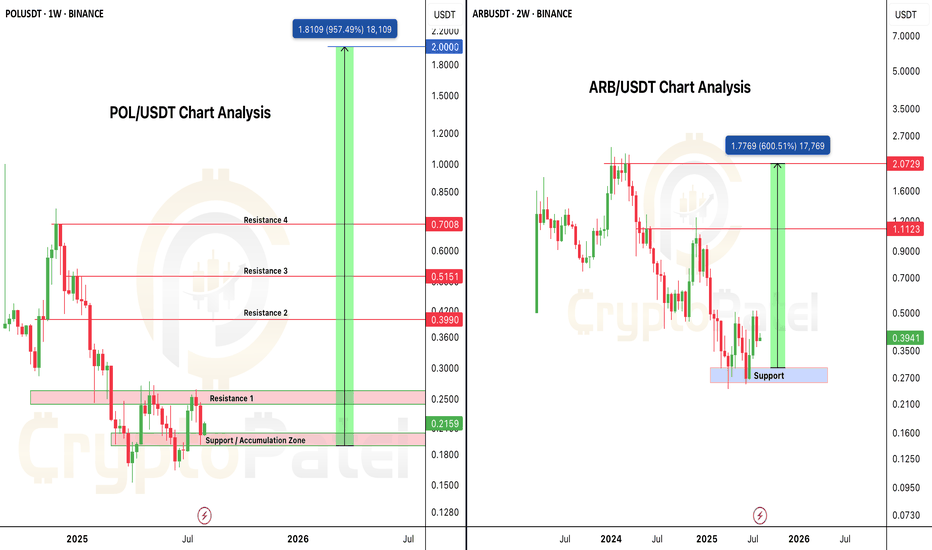

Altseason is Loading... Which One’s Your 10x Pick – $POL or $ARB🚨 BULL MARKET ACCUMULATION ALERT 🚨

Both PSX:POL and AMEX:ARB are currently trading below $0.40, and both charts are showing strong long-term bullish structure.

PSX:POL Analysis:

• Current Price: Under $0.40

• Strong Entry Zone: $0.20 – $0.17

• Bull Run Targets: $2 – $5

• Backed by powerful fundamentals, strong tech, and serious investors.

AMEX:ARB Analysis:

• Current Price: ~$0.40

• Key Accumulation Zone: $0.40 – $0.30

• Bull Run Targets: $2 – $5

• One of the strongest L2 ecosystems with deep liquidity and solid fundamentals.

Both are technically oversold, fundamentally strong, and positioned for major upside in the coming altseason.

Question for the community:

Which one hits $2 first — PSX:POL or AMEX:ARB ?

Drop your pick below 👇

NFA & DYOR

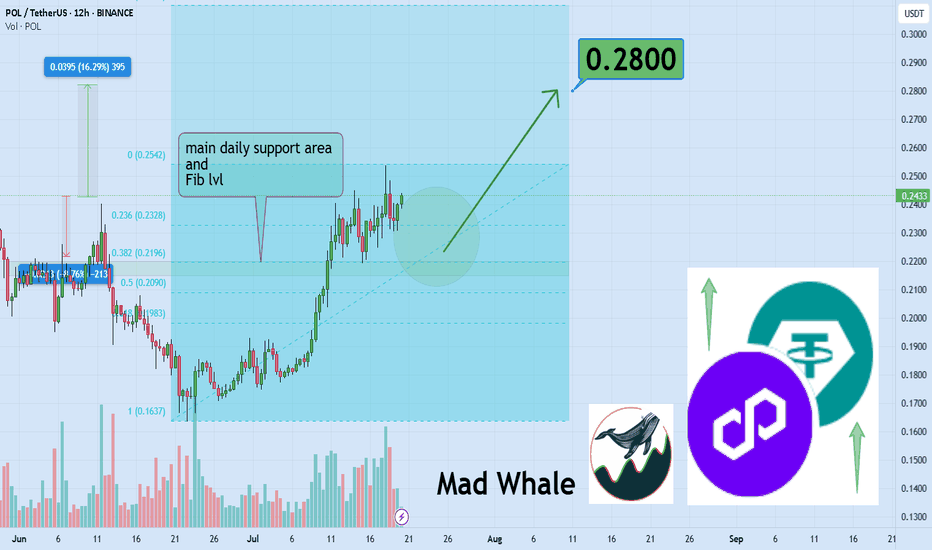

POL At Critical Fib Level, Targeting 0.28 With 16% GainHello✌

Let’s analyze Polygon’s upcoming price potential 📈.

BINANCE:POLUSDT is currently testing a crucial daily support level that aligns with a significant Fibonacci retracement zone 📉. This area could provide a strong foundation for a bounce. If the support holds, a move toward 0.28 is likely, offering approximately 16% upside potential 📈.

✨We put love into every post!

Your support inspires us 💛 Drop a comment we’d love to hear from you! Thanks, Mad Whale

Polygon, Higher Low? Easy 1,000% Profits PotentialFour weeks red! Do you really believe the market will continue moving lower? If the answer is yes; think twice, stop! Think again.

Four weeks red is all that you will get you bearish bastard.

Your time is over. We are taking over, the bulls are entering the game.

You had your fun, you had it for a few days.

You can't have it anymore, I am calling my friends.

Friends, look at Polygon (POLUSDT), the chart looks great.

Whenever there is a retrace within a bull market, this is an opportunity to enter again.

Great timing, great prices; the start of a new bullish wave.

Prices are about to grow... Everything is about to grow... Crypto is going up. Are you in or are you out? Did you miss the initial bullish breakout? That's ok. The next bullish wave will 4-6 times bigger than the previous one for this pair. Sometimes even more. Here we have 1,000% profits potential as an easy target.

Get ready and be sure to be prepared.

Start buying like the world is about to end. Why?

Because there will be so much growth in the coming days, that you want to profit all the way. To profit you need to be in, you have to buy when prices are low.

You cannot wait for the green candle, the best time is now.

Thanks a lot for your continued support.

Namaste.

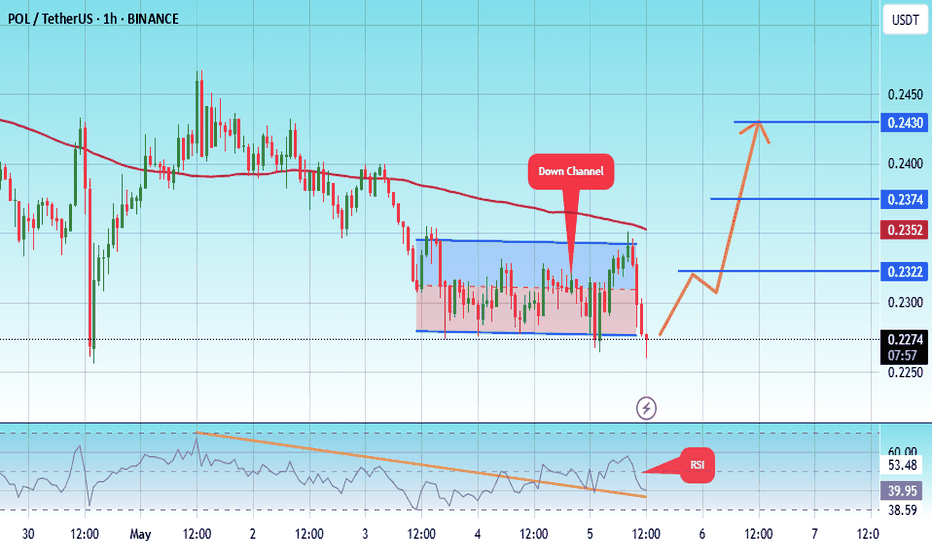

#POL/USDT#POL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 2270.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2270

First target: 0.2322

Second target: 0.2374

Third target: 0.2430

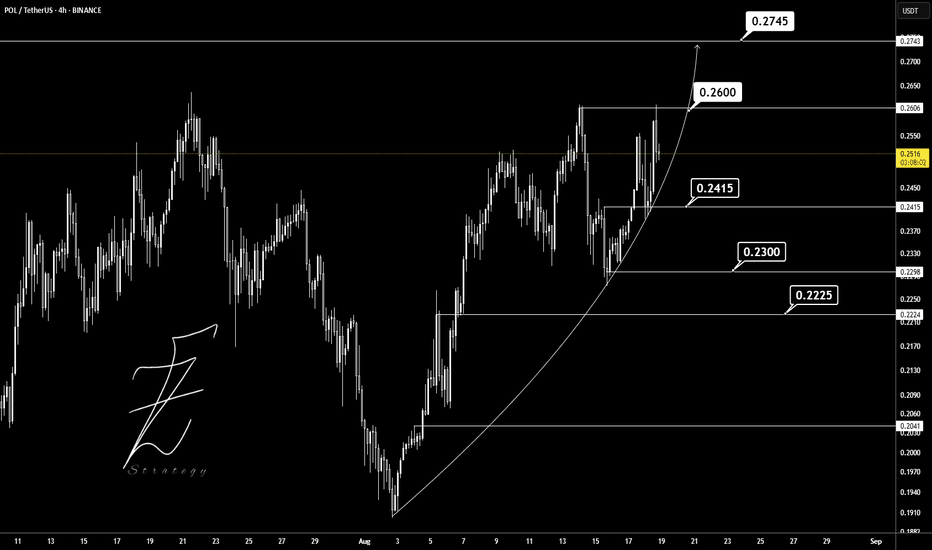

POLUSDT Potential UpsidesHey Traders, in today's trading session we are monitoring POLUSDT for a buying opportunity around 0.2220 zone, POLUSDT is trading in an uptrend and currently is in a correction phase in which it is approaching the trend at 0.2220 support and resistance area.

Trade safe, Joe.

Polygon Ecosystem Token Last Chance, It Is Not Too LateLet's close the day with a classic —RSI bullish divergence.

Polygon Ecosystem Token (POL) has been moving lower and hit bottom on the 7th of April. It's RSI on the other hand isn't doing the same, it bottomed in early July 2024. While POLUSDT went on to produce lower lows, its 3D RSI has been doing higher lows. This is a very strong bullish divergence and also a classic reversal signal.

This signal coupled with volume and marketwide action confirms that the bottom is in.

This pair is going through a pause now, a small one, before additional-huge growth.

The market is giving us one last chance to buy all we want before massive growth.

When the next move starts, there will never be a chance to buy at prices like we have now today. This is good. Cryptocurrency will evolve and the entire world will benefit.

This is a friendly reminder.

Time to work. Wake up!

It is not too late.

Namaste.

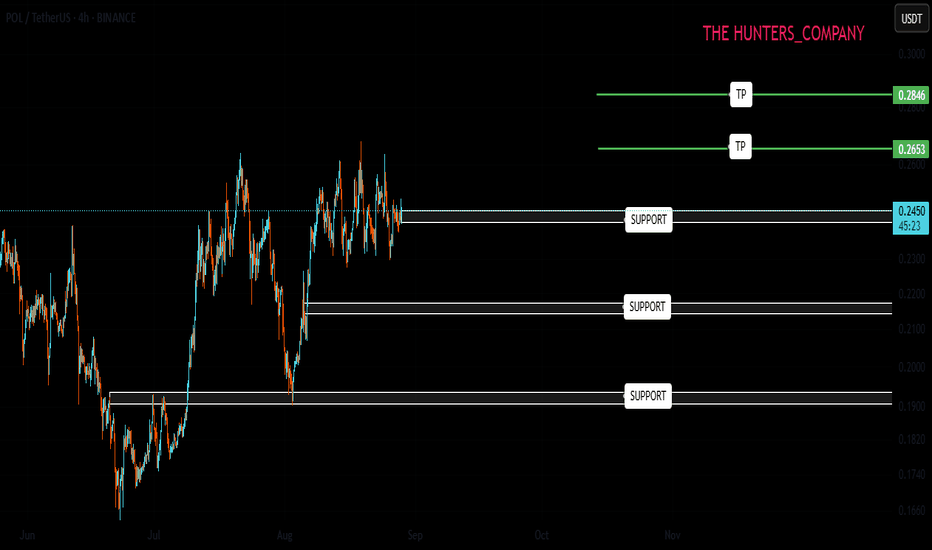

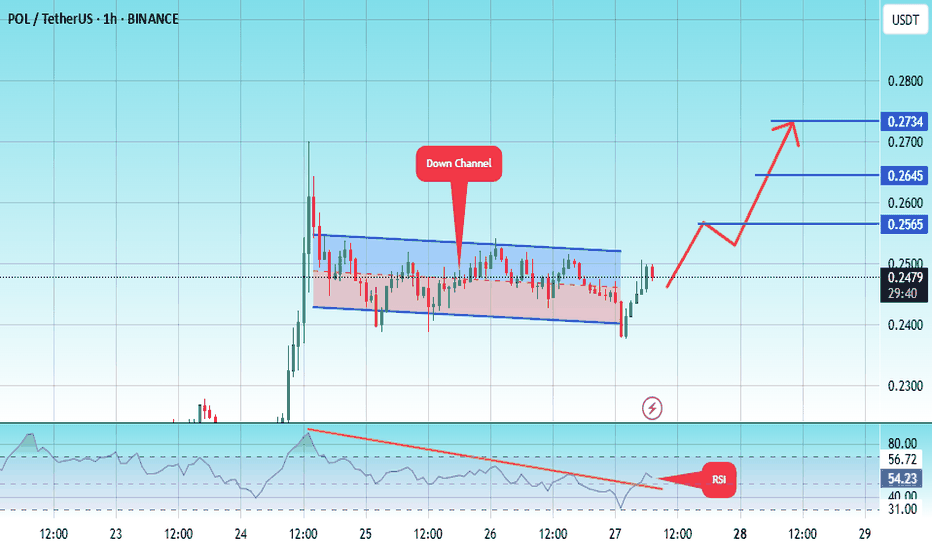

#POL/USDT#POL

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 0.2400.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2480

First target: 2565

Second target: 0.2645

Third target: 0.2734