BTC - Block Out The NoiseThere is a lot of talk going on surrounding all the markets and eveb BTC, of course.

I saw a tweet come across my feed that had a user claiming an incoming crash of BTC and I couldn't help myself in laughing a bit for seeing through and identifying that he really had no idea wtf is going on.

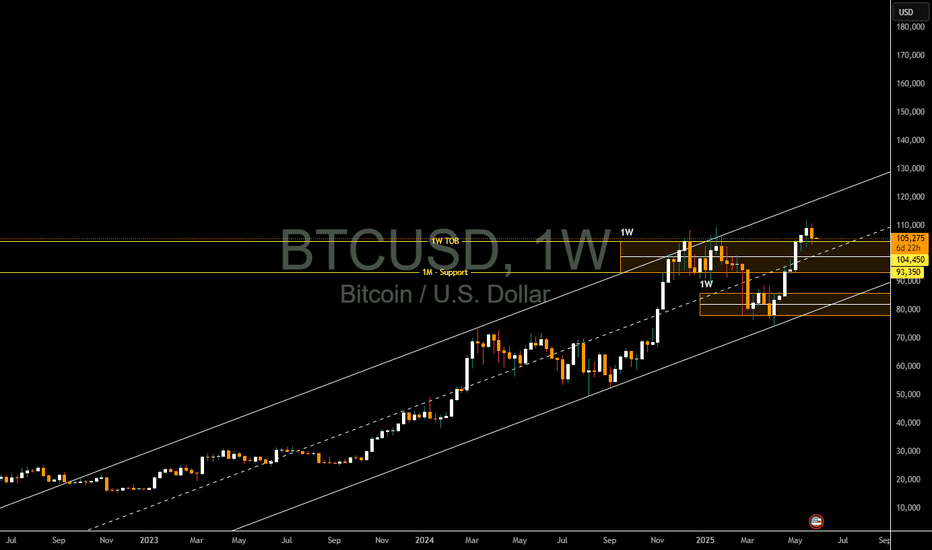

We are currently set to close the week above the consolidation box that BTC has produced and punched over. We are holding above the top of the box at about $104,450 for the third consecutive week. If we really were to crash or retest levels below, we'd first have to have a weekly candle close under $104,450 and then we could see cost basis, or the median, of the consolidation box retested at about $$99,000.

Long story short, because we are holding above the top of the box, I think we'll be more likely to continue consolidating on a lower time frame and trying to continue breaking new highs.

Most people have no idea what's going on and are just guessing. I am no different in that respect. I do use the potterbox strategy to help me sift through the noise and ultimately make sense of what price is doing relative to the structures it has created before. Per the PBS, we're okay and on a lower 24HR timeframe, we've actually done a great job in bouncing. For now, I don't see a meltdown coming. We simply retested a level and created empty space above us on a 24HR timeframe to, hopefully go back up. I'm hoping we see $120K this year and, maybe, with enough momentum we could really see a rally big enough to break this channel we are in.

Potterbox

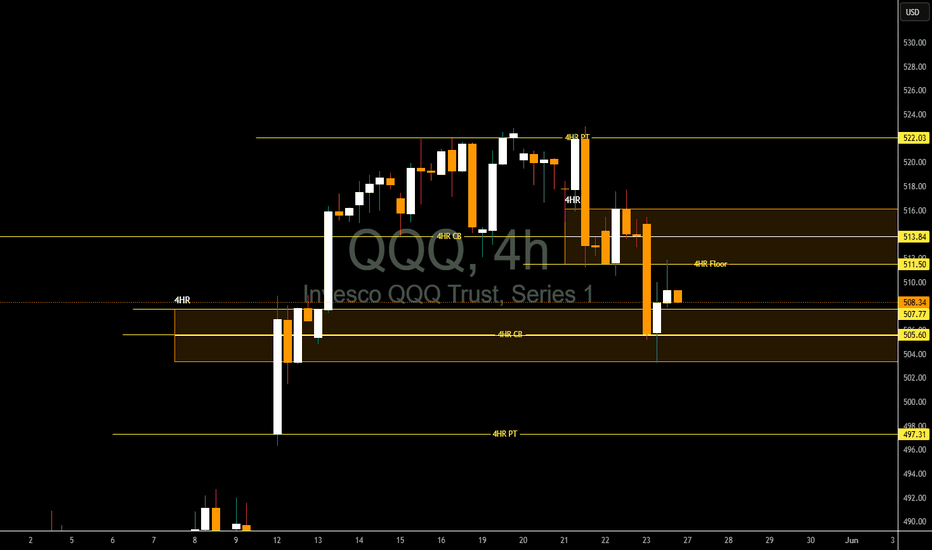

QQQ To Be DeterminedUsing the Potterbox strategy, we can see that we successfully bounced off the 4HR cost basis, or median at about $505.60 and closed above the top of the box at about $507.77.

I believe that to continue to the upside, we'll have to first secure the floor above at $511.50 with a 4 hour candle close. At that point, we'll have a chance to punchback with a candle close above cost basis at about $513.84. With that, we can look to head to the upside and use $522 as a price target.

On the other hand, if we drop below the top of the box that we closed above, we could retest cost basis at about $505.60 and if we get a candle close at that end, then we can look to continue downwards towards a $497 price target.

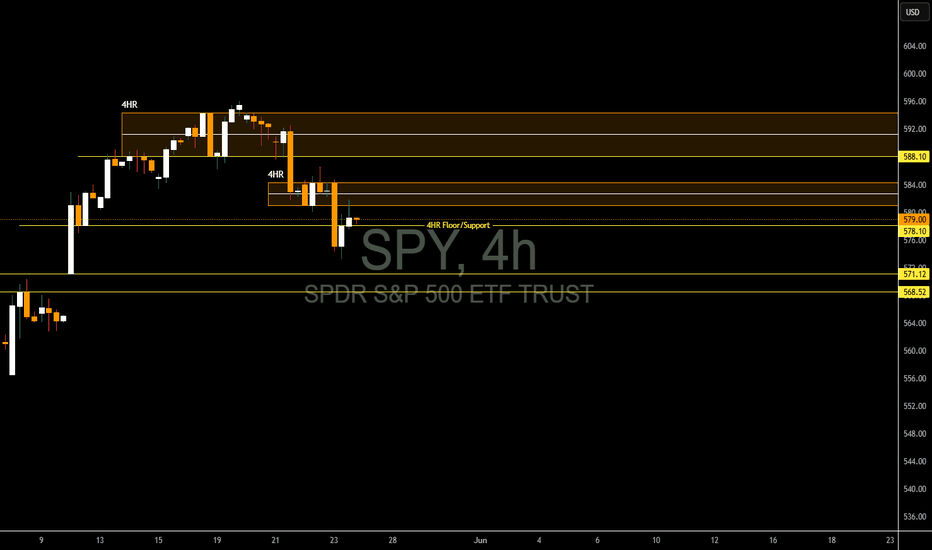

SPY at a CrossroadsUsing the Potterbox strategy on the 4 hour time frame I can see that we are at a huge level of support that is holding at $578, which I think will be crucial in deciding whether we break down or make an attempt to try and head to the upside.

$571 and then $568.50 are downside targets, if we end up breaking down below the $578 support.

Above us, there is a box where price consolidated that we retested the bottom of back on Friday. If we are able to hold support at $578, we are likely to retest and try and secure the floor at $581. With a $582.75 break, which is cost basis, or the median of the box, we are likely to head to the bottom of the next box above us at $588.

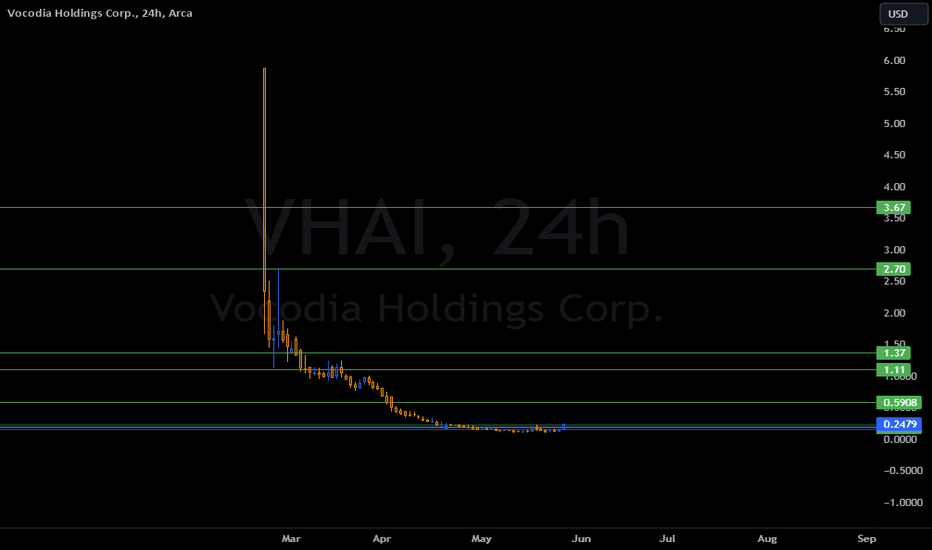

VHAI TO THE MOONhere we go again, this is def ffie flavored, dont get married to it. get in get paid. im loaded with 10k shares @.19 closed at .24 already.

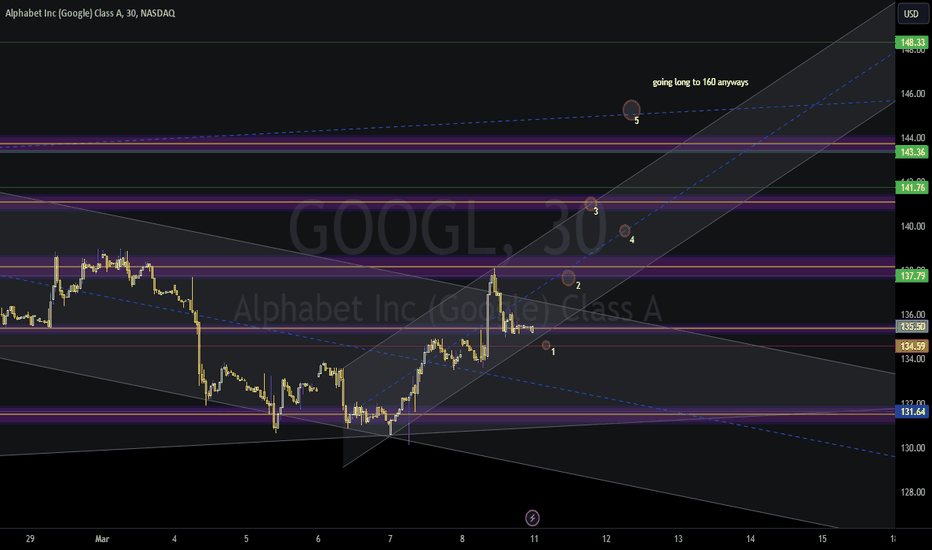

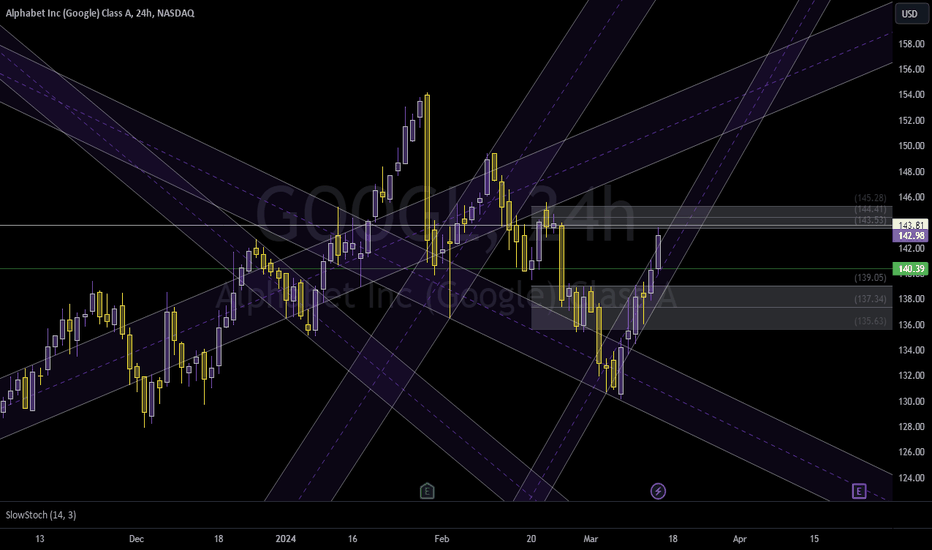

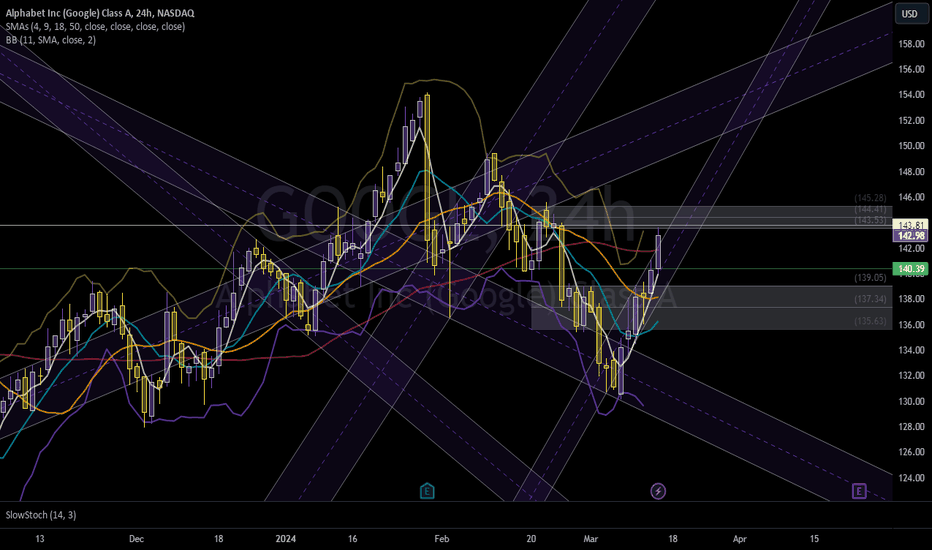

Trying to kick a 50yd field goal GOOGLafter watching 4 TTI vids im now an expert on longs and am calling it now. 159 or so i dunno when but its just what it loooks like to me. jk jk. really just trying to learn swing trading at a deeper level following market structure. looking to see how it plays out and what happens when it fails so i can replicate said results and play them to my advantage

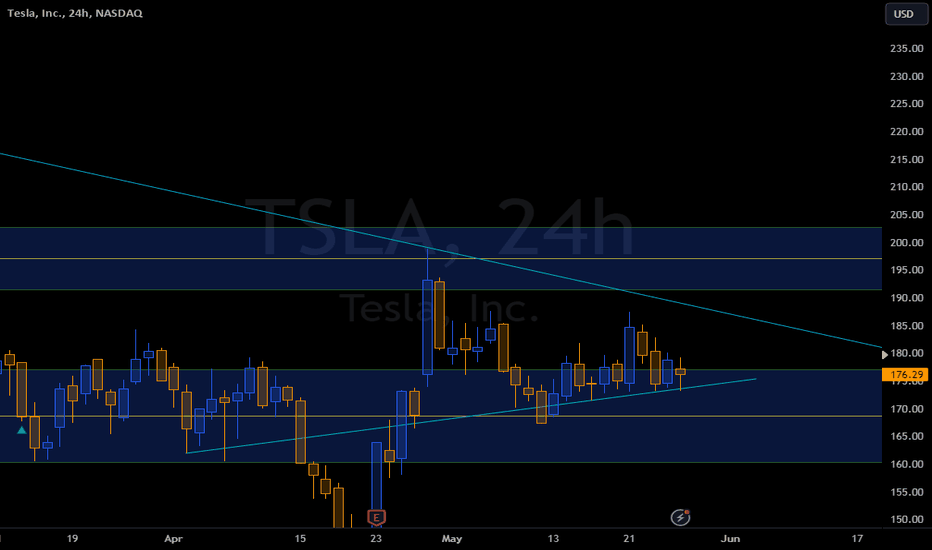

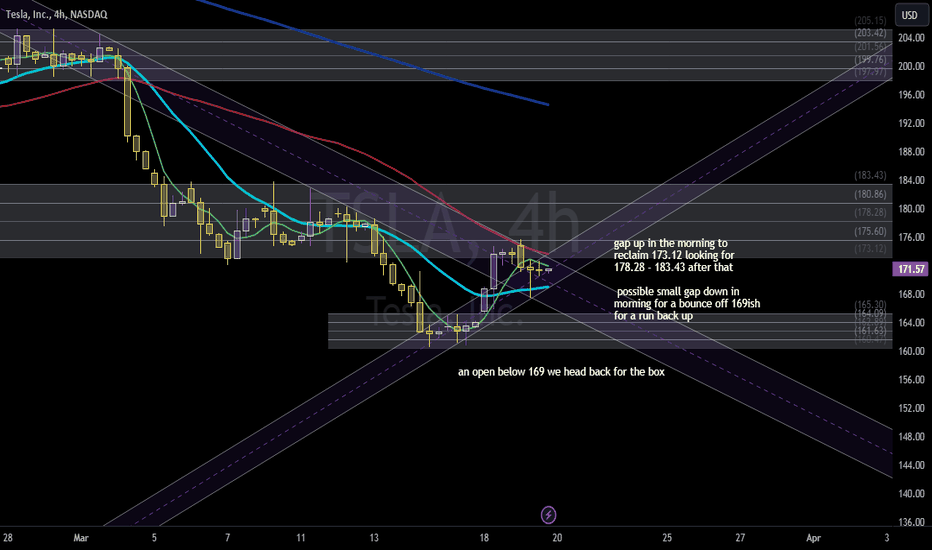

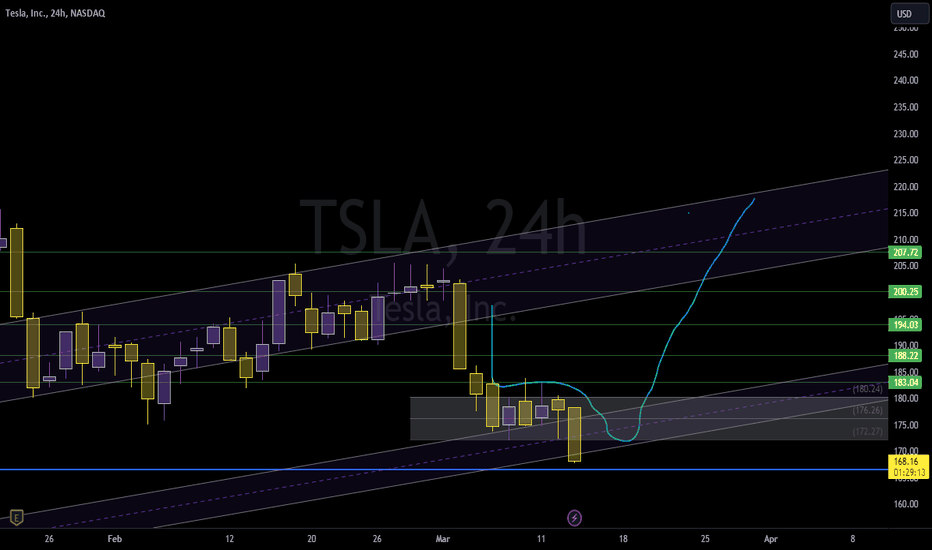

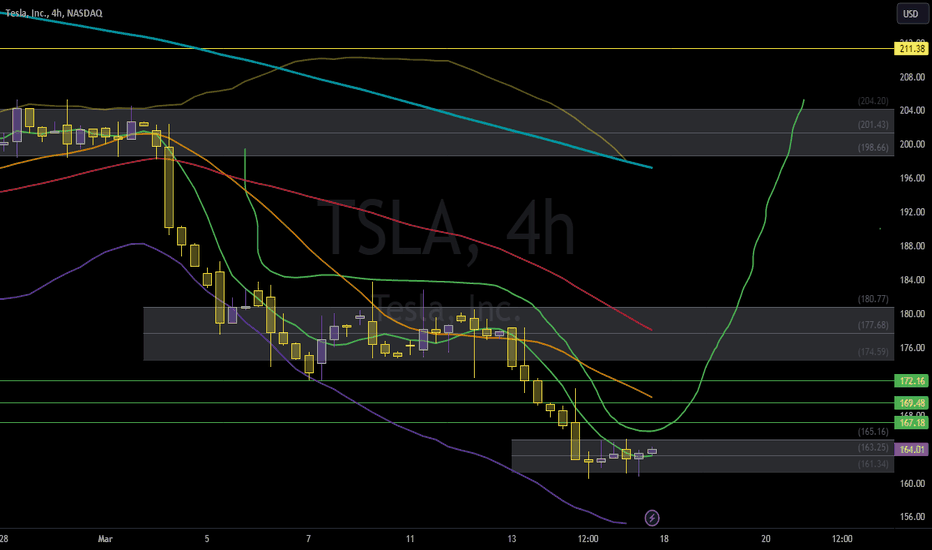

TSLA loves my moneytrying tsla long AGAIN. looking at broader time frame. if this does work out im only shorting tsla from now on lol. i can nail the downside for some reason. looks like a drop at open. if we open of the box we should fly. if not more bloodbath. daddy powell will be the pivot day i think