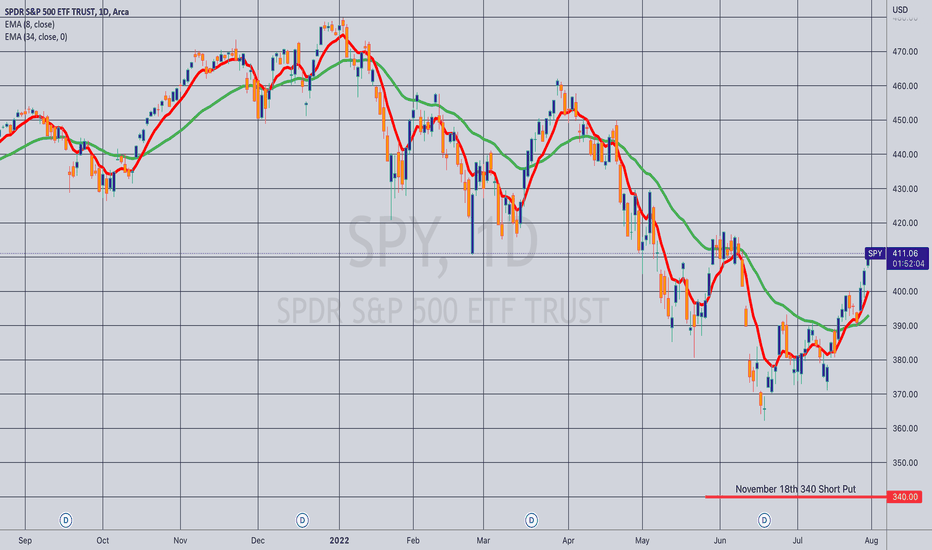

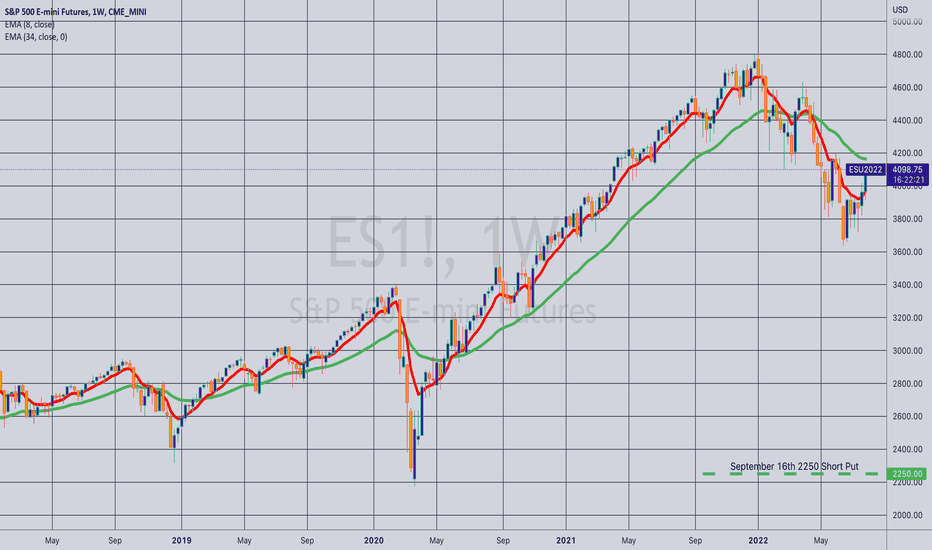

Opening (IRA): SPY November 18th 340 Short Put... for a 3.50 credit.

Comments: Part of a longer duration premium selling strategy in SPY when shorter duration isn't paying. Here, targeting the <16 delta strike paying around 1% of the strike price in credit to emulate dollar cost averaging into the broad market. I'll naturally return to shorter duration stuff if we get weakness and higher IV.

Premiumselling

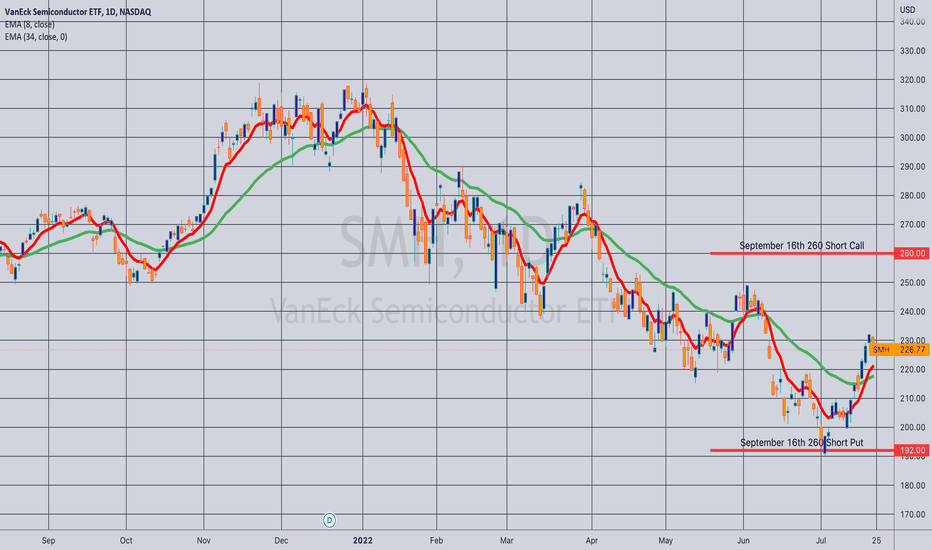

Opened (Margin): SMH Sept 16th 192/260 Short Strangle... for a 4.97 credit.

Comments: Starting to add in some fresh September monthly setups in >50% IVR/>35% 30-day IV exchange-traded funds. Here, SMH is at 50.1/38.7.

4.97 credit on buying power effect of 22.74; 21.7% ROC at max as a function of buying power effect; 10.8% at 50% max. -.11/13.16 delta theta.

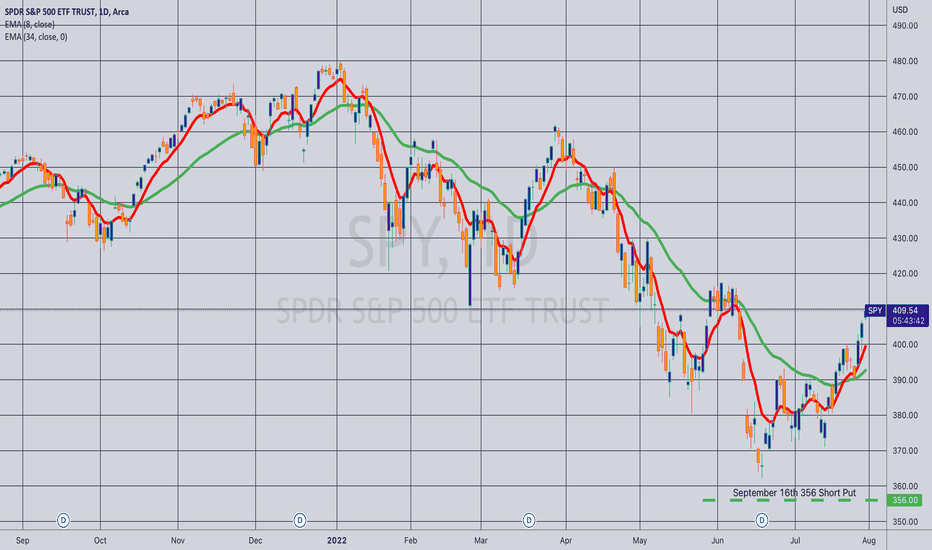

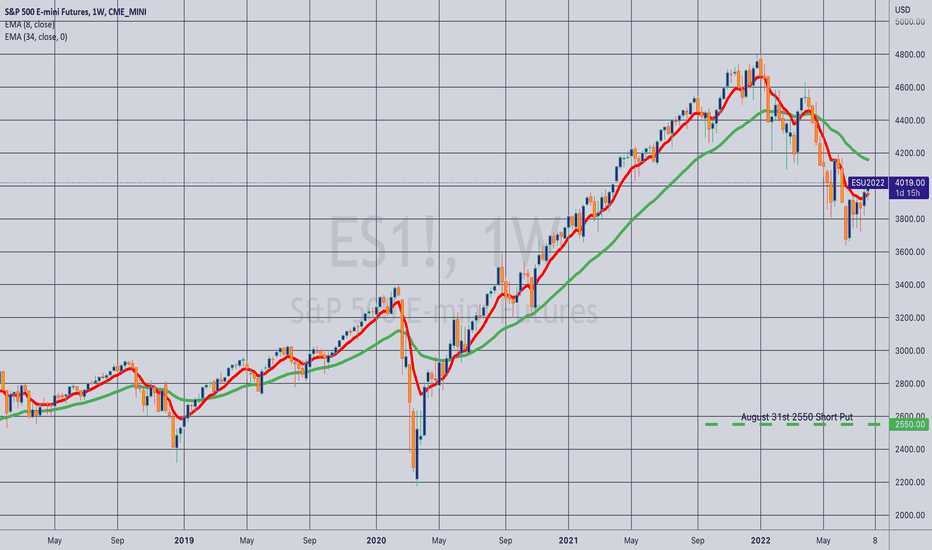

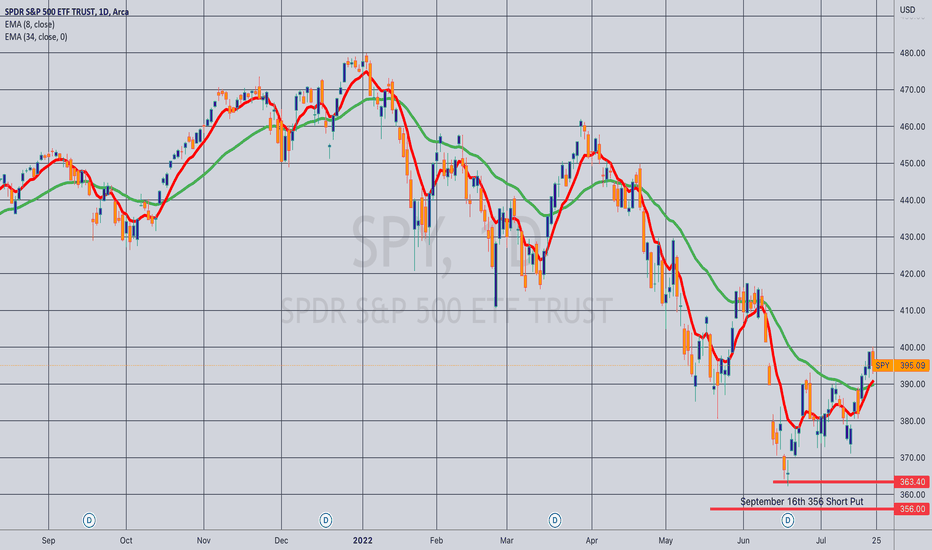

Opened (IRA): SPY September 16th 356 Short Put... for a 3.65 credit.

Comments: Targeting the <16 strike in the shortest duration that is paying around 1% of the strike price in credit in this weakness and comparatively higher IV.

And just this morning I was thinking, "Ugh, I'm going to have to go out to October with SPY to get paid."

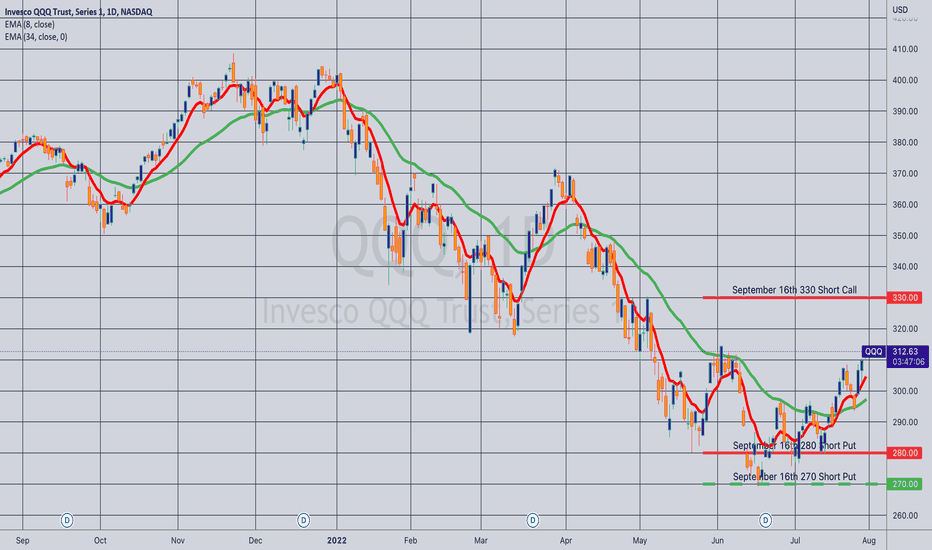

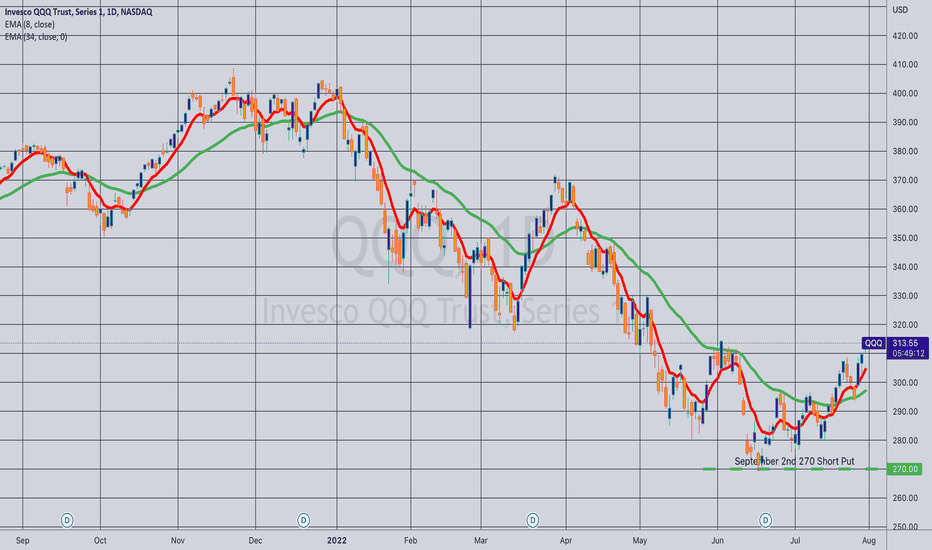

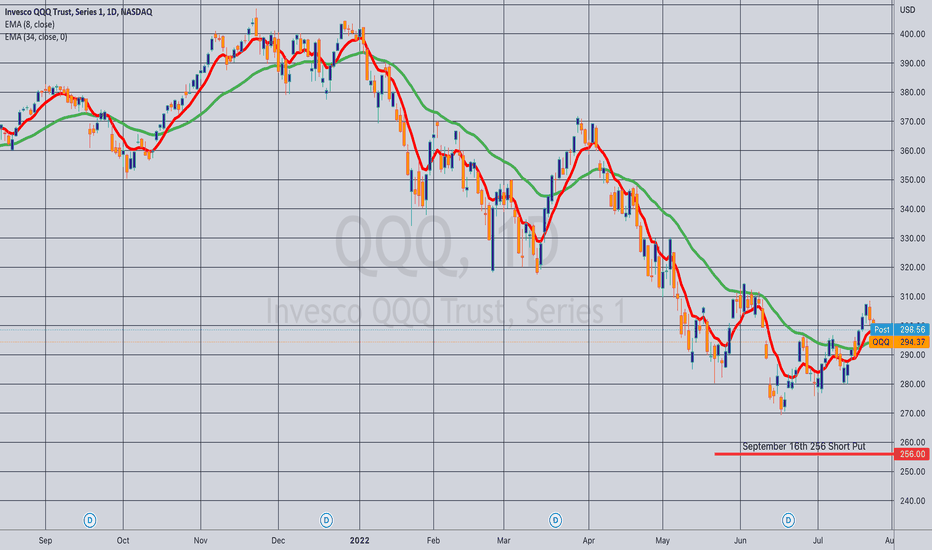

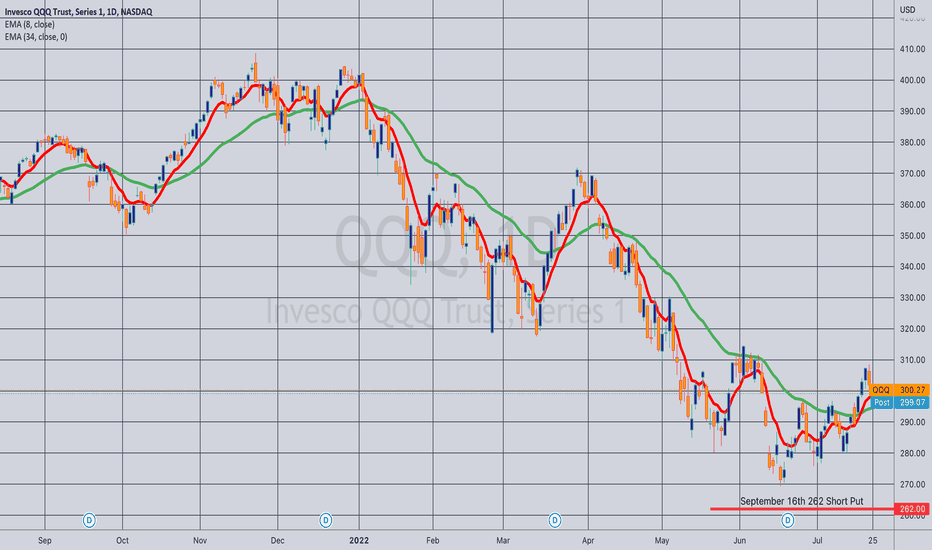

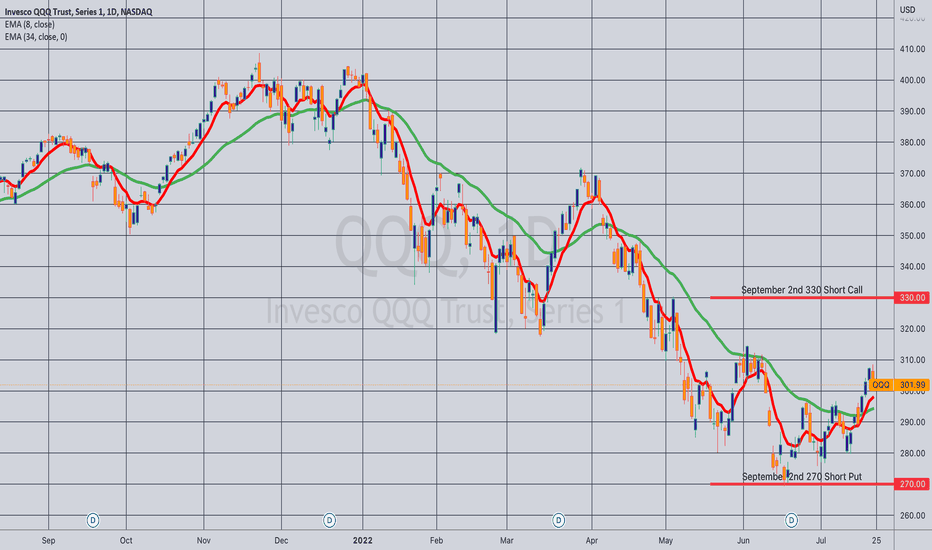

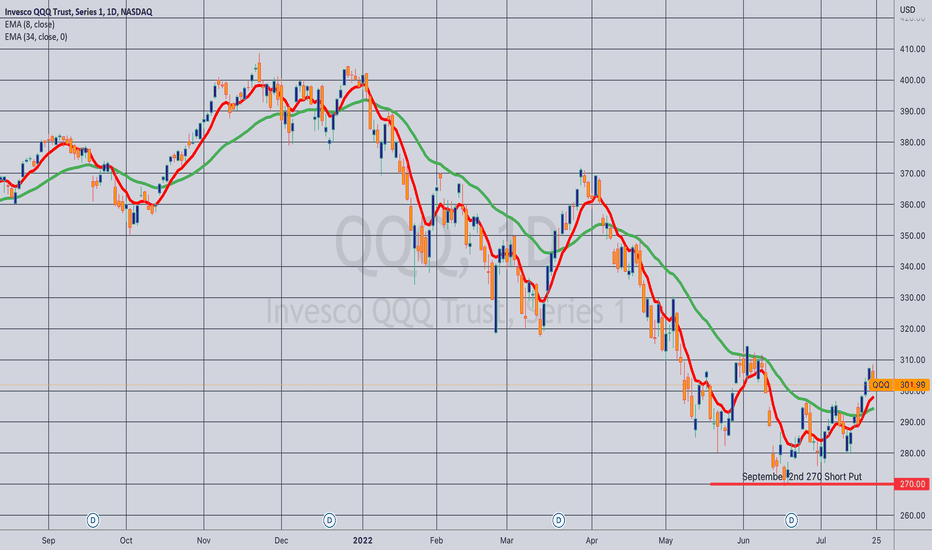

Opened (IRA): QQQ September 2nd 270 Short Put... for a 2.82 credit.

Comments: Targeting the <16 strike in the shortest duration that is paying around 1% of the strike price in credit in this weakness and comparatively higher IV.

As with the IWM short put I put on, this is more of a trade to add back in shorter duration long delta that I stripped off than a "this is a perfect spot to sell a put" sort of trade. I'll look to add at intervals, weakness, and in higher IV, and am fine with taking assignment of shares/selling call against if the market forces me to do that.