Premiumselling

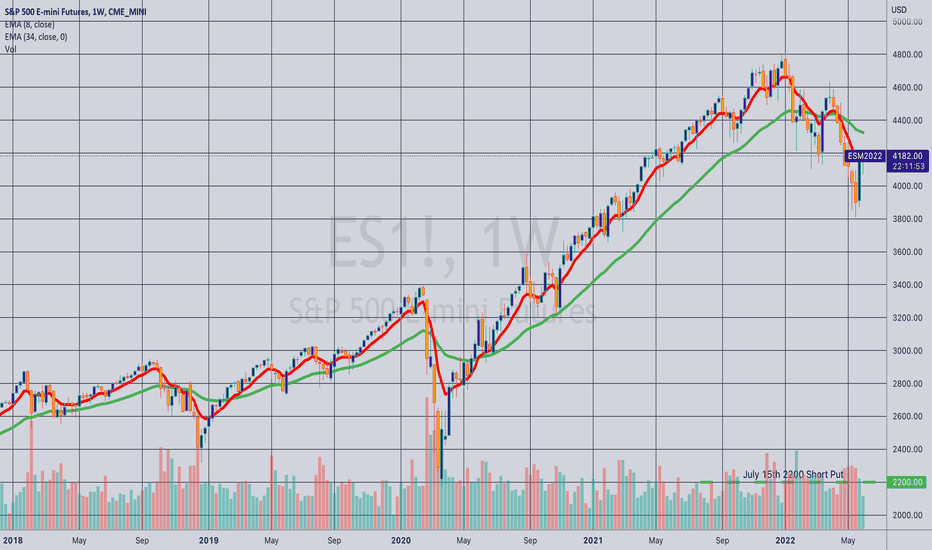

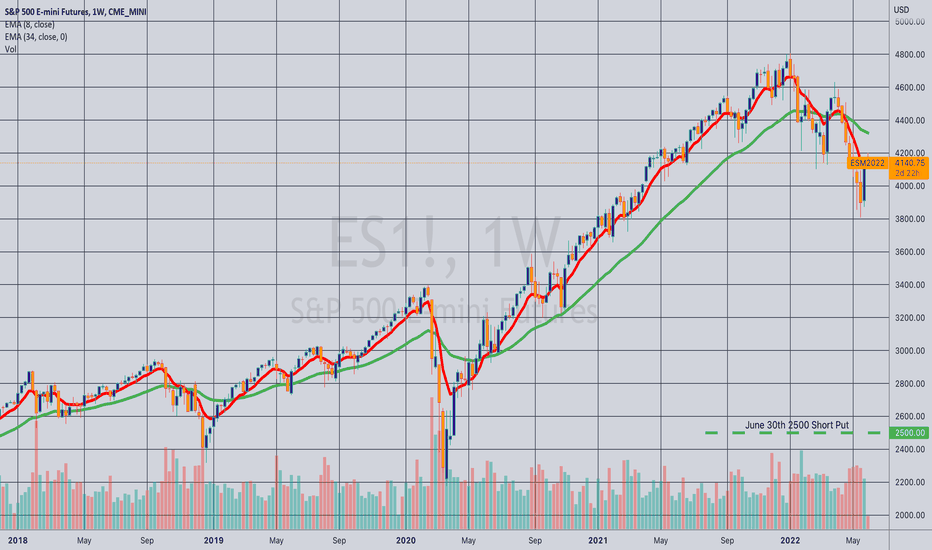

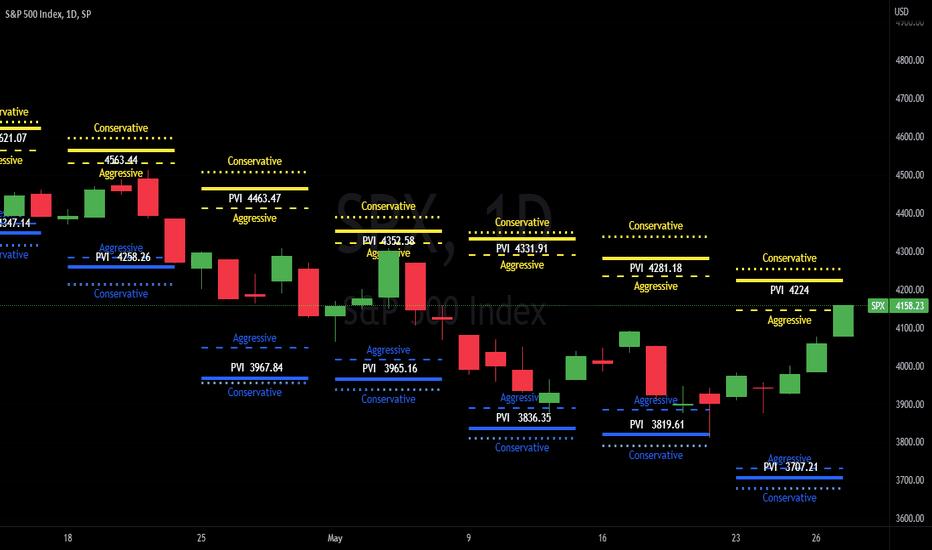

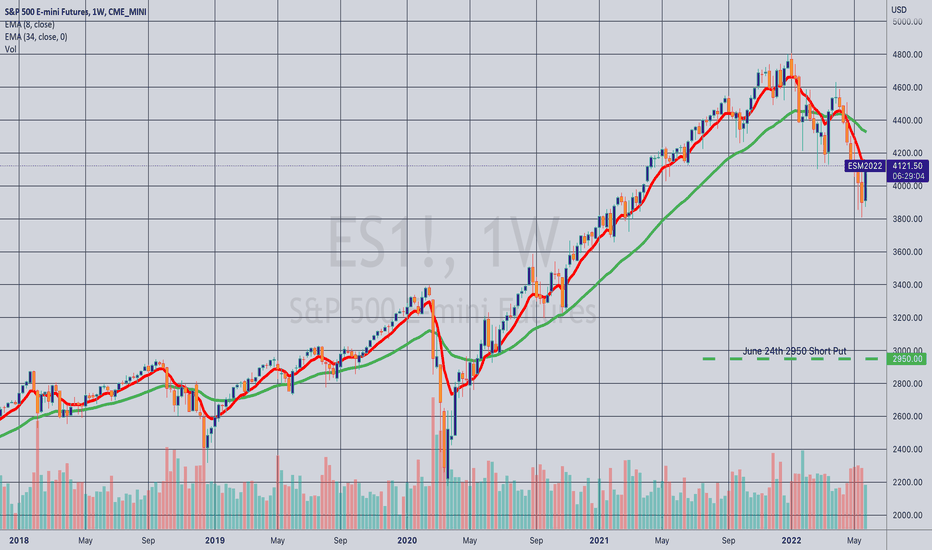

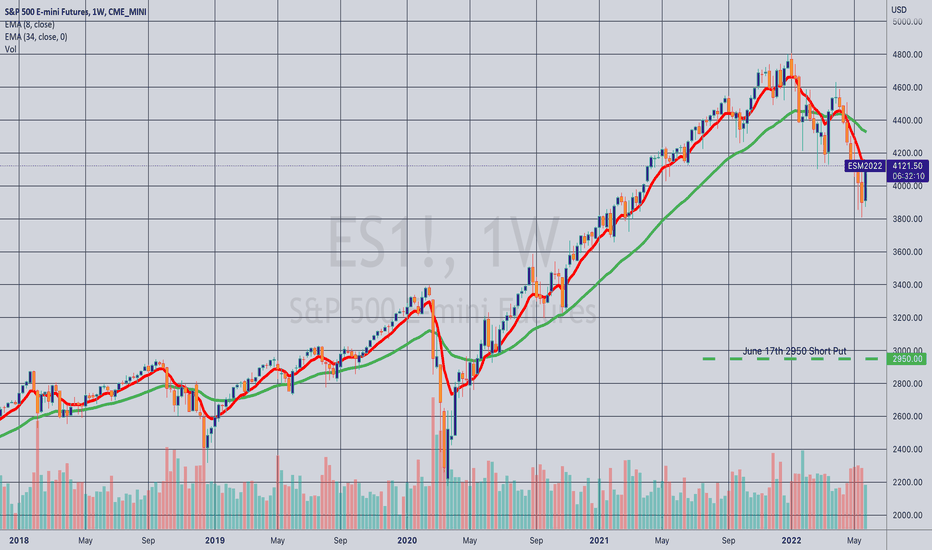

Opening: /ES July 15th 2960 Short Put... for a 3.00 credit.

Comments: Targeting the strike that is 75% or less than the current price of /ES that routes for around 3.00 in the contract of shortest duration. 3.00 (1.50 max) on 16.71 buying power effect; 9.0% ROC at max; 4.5% at 50% max as a function of buying power effect.

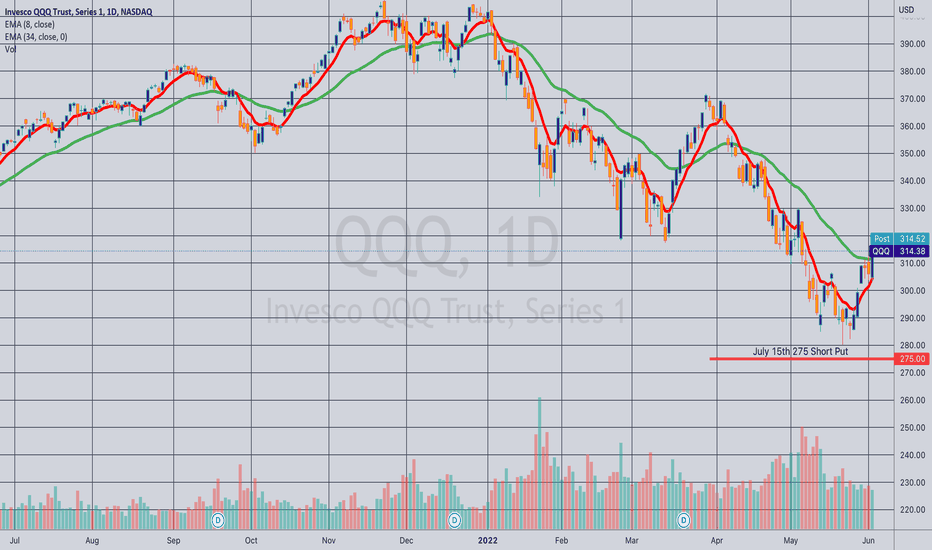

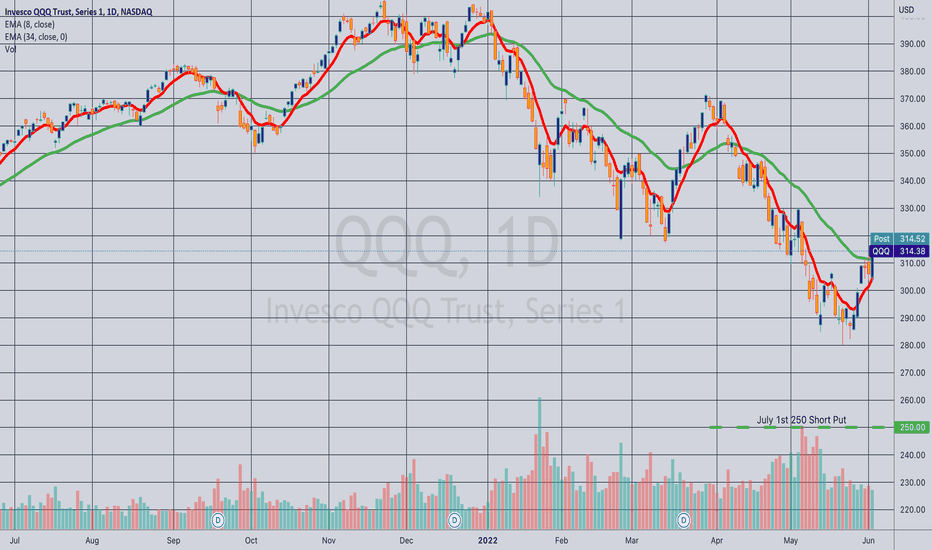

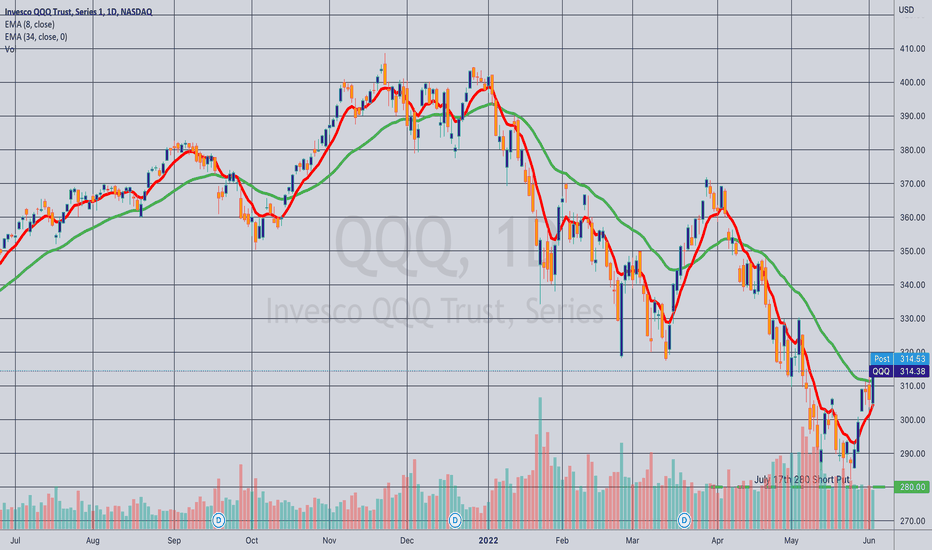

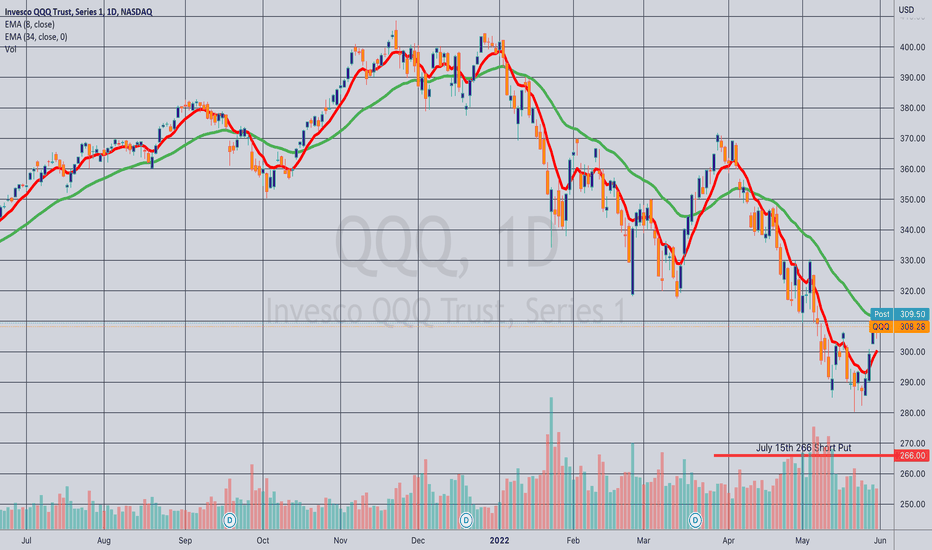

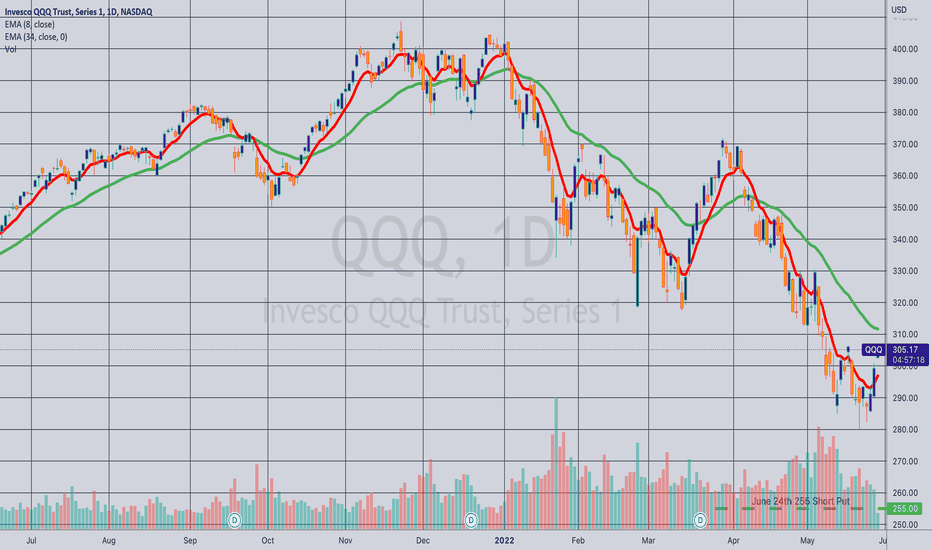

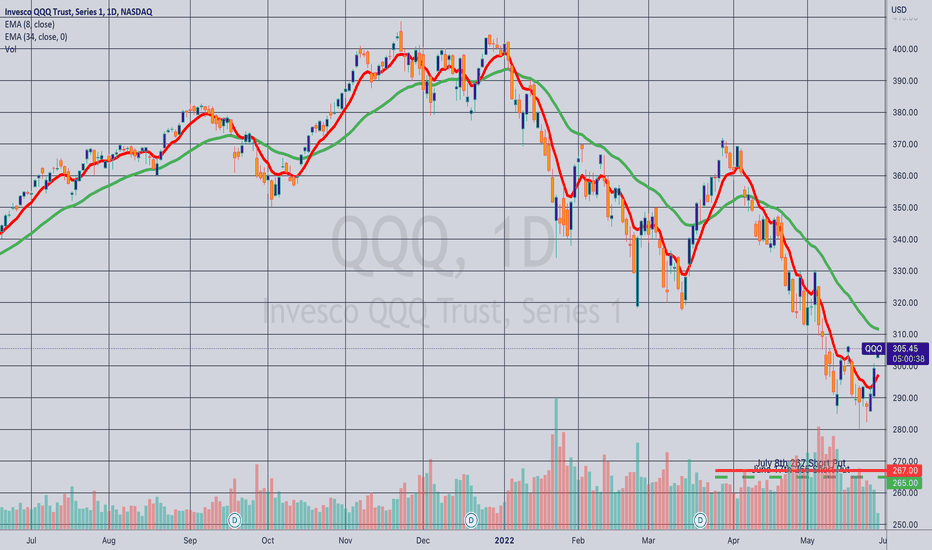

Opened (IRA): QQQ July 15th 275 Short Put... for a 2.81 credit.

Comments: Targeting the <16 delta strike paying around 1% of the strike price in credit in the expiry nearest 45 DTE in the broad market exchange-traded fund with the highest 30-day IV to emulate dollar cost averaging into the broad market.

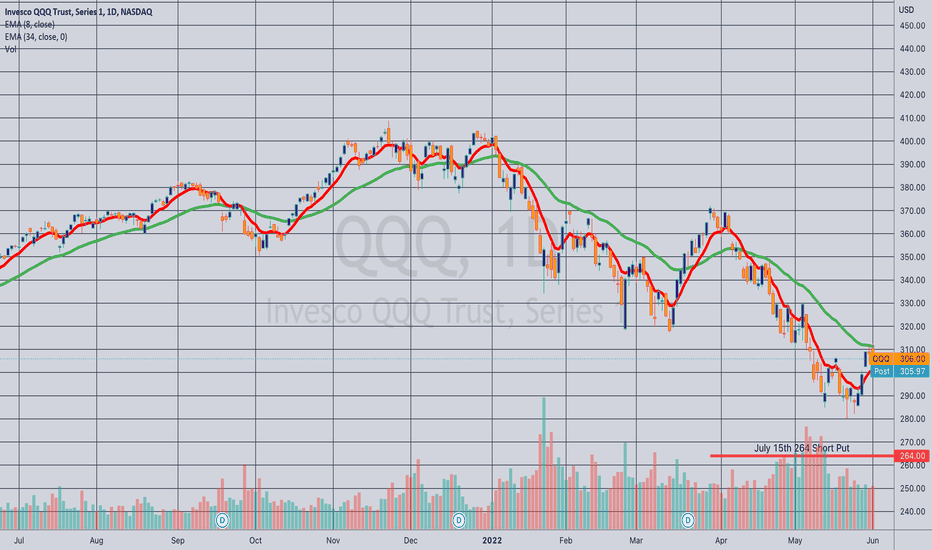

Opened (IRA): QQQ July 15th 264 Short Put... for a 2.64 credit.

Comments: Targeting the <16 delta strike paying 1% of the strike price in credit in the expiry nearest 45 DTE in the broad market exchange-traded fund with the highest 30-day IV to emulate dollar cost averaging into the broad market. Looking to get more maximally deployed over time, so increasing "occurrence frequency."

Opened (IRA): QQQ July 15th 266 Short Put... for a 2.72 credit.

Comments: I can either increase size or increase frequency ... . (There's probably a joke in there somewhere). Going with an increase in frequency, targeting the <16 delta strike in the expiry nearest 45 DTE paying around 1% of the strike price in credit to emulate dollar cost averaging into the broad market.

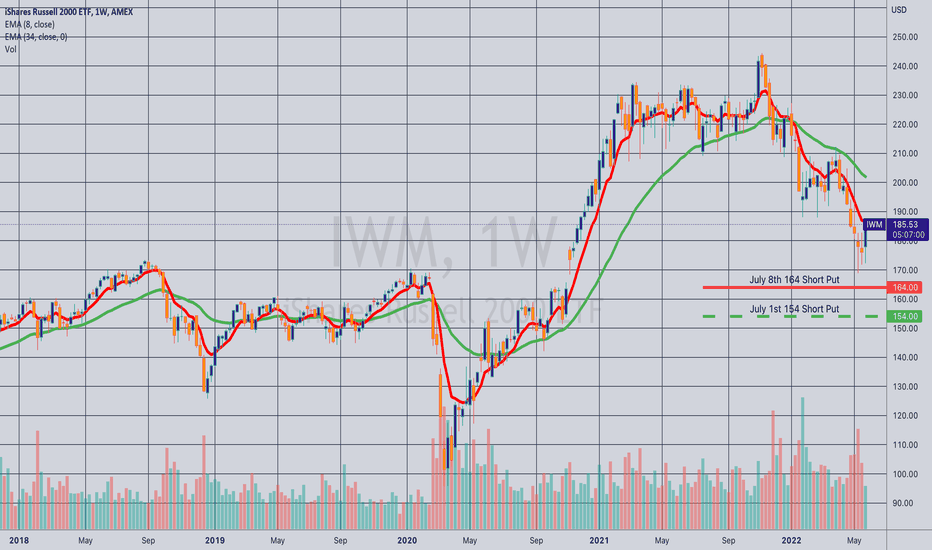

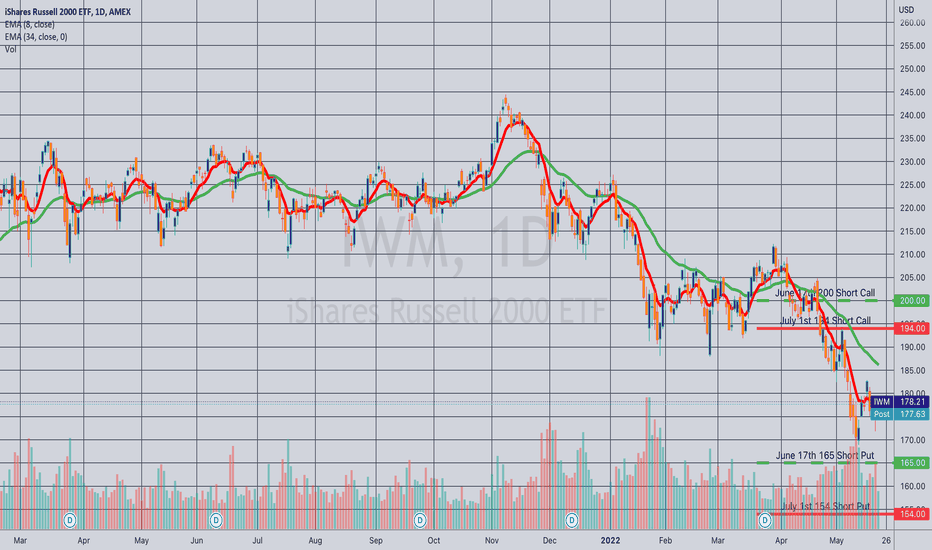

Rolling: IWM July 1st 158 Short Put to July 1st 173... for a 1.64 credit.

Comments: Rolling up the short put aspect of my July 1st IWM short strangle, the short call of which is at the 194 to cut the delta/theta ratio to around 1:1. Total credits collected of 6.33.

It's now delta/theta -12.03/14.85.

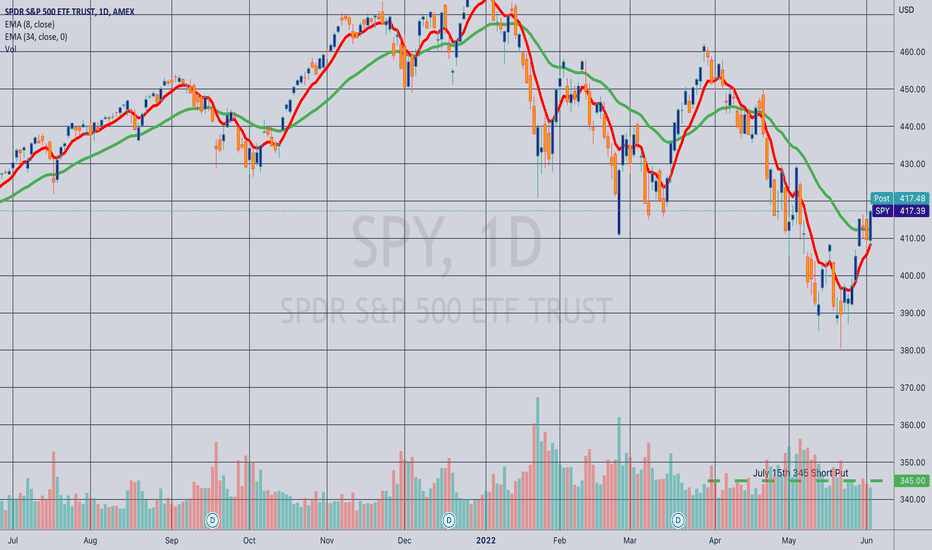

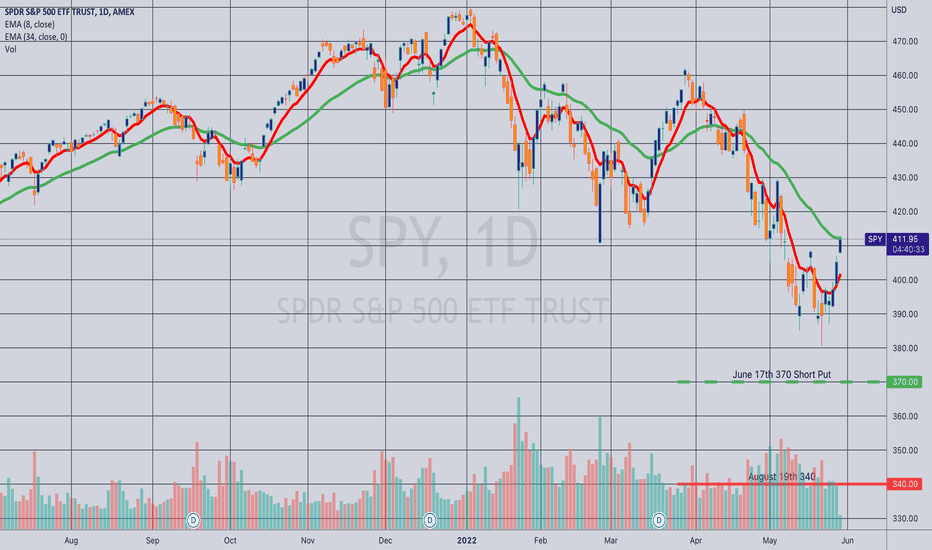

Rolling (IRA): SPY June 17th 370 Short Put to August 19th 340... for a 2.31 credit.

Comments: Part of a longer-dated strategy to emulate dollar cost averaging into the broad market. With the June 17th 370 at greater than 50% max, rolling it out to the <16 delta strike in shortest duration monthly paying at least 1% of the strike price in credit. Credits collected of 3.65 (See Post Below), plus the 2.31 here equals 5.96 relative to a short put value for the August 340 of 3.48, so I've realized gains of around 2.48 ($248) so far.

I considered rolling out to July, but still have rungs on in that expiry that I don't want to step on, so rolling out for longer duration here is more of a practical thing than a mechanical thing.

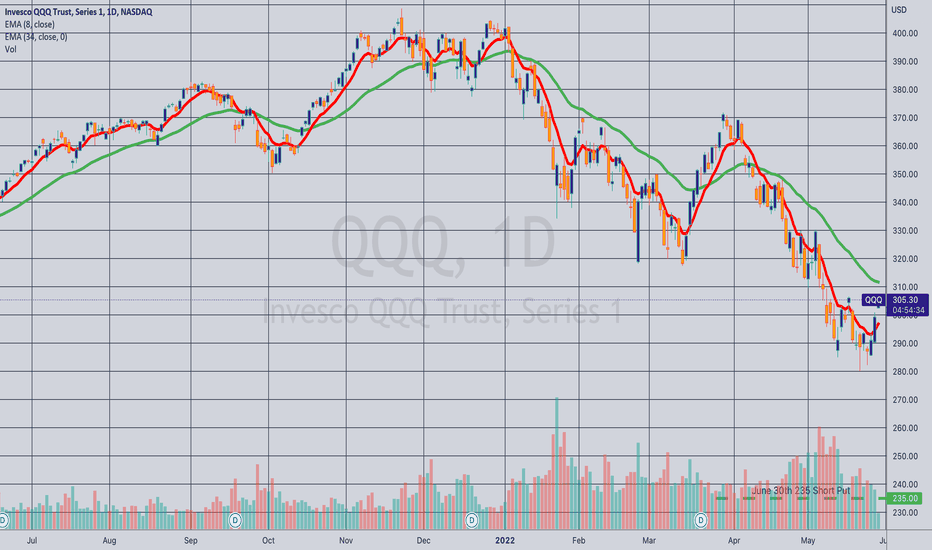

Rolling (IRA): QQQ June 17th 265 Short Put to July 8th 267... for a 1.80 credit.

Comments: With the June 17th 265 at >50% max (finally), rolling it out to <16 delta strike in the expiry nearest 45 days until expiry paying around 1% of the strike price in credit. Collected 3.00 (See Post Below) plus the 1.80 here, for a total of 4.80 in credit.

Rolling (IRA): IWM July 1st 154 Short Put to July 8th 164... for a 1.04 credit.

Comments: With the July 1st 154 at greater than 50% max, rolling it out to the <16 delta strike in the expiry nearest 45 days paying at least 1% of the strike price in credit. Total credits collected of 1.64 (See Post Below) plus the 1.04 here, for a total of 2.68.

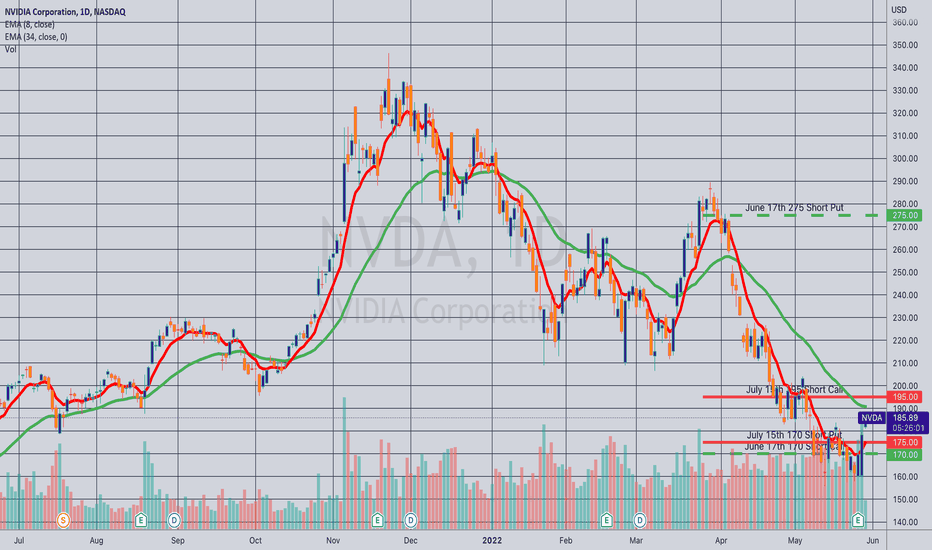

Rolling: NVDA June 17th 170C/275P to July 17th 170P/195C... for a 92.02 debit.

Comments: Now that the underlying has done its "earnings move," I'm uninverting and rolling for a debit that is less than the total credits I've collected so far (95.25). I generally don't like to make a habit of doing this, but with both legs in the money and with the 275 somewhat illiquid (and therefor a pain to roll), I'm doing it here. Still 3.23 net credit to date.

Rolled: IWM June 17th 165/200 Short Strangle to July 1st 158/194... for a .90 credit.

Comments: Locking in some realized gain here on this little bounce, recentering side risk, and receiving a credit all at the same time. I rolled both sides to the 16 delta strikes, so that the position is back to delta neutral.

Total credits received of 4.69, relative to a current short strangle price for the July 1st 158/194 of 3.28, so I'm up 1.41 ($141) on the position.