Pricaction

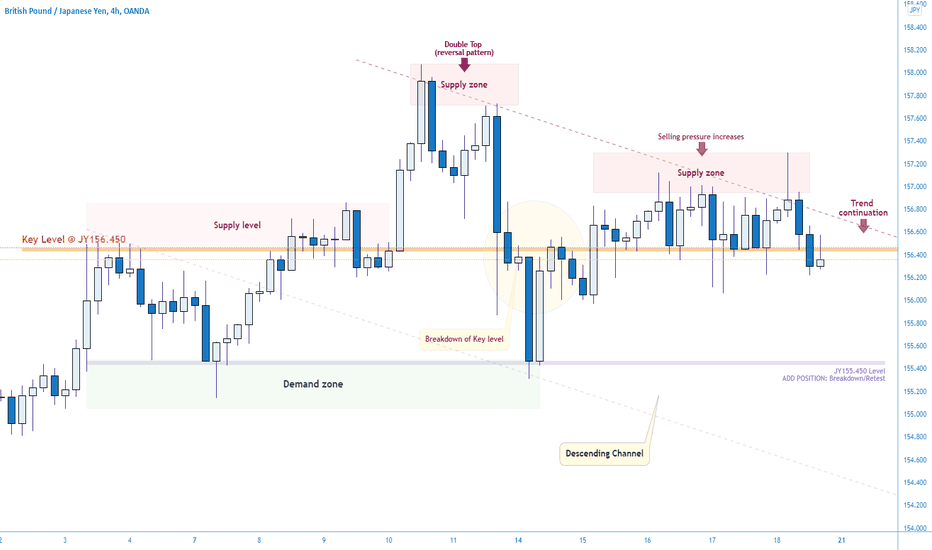

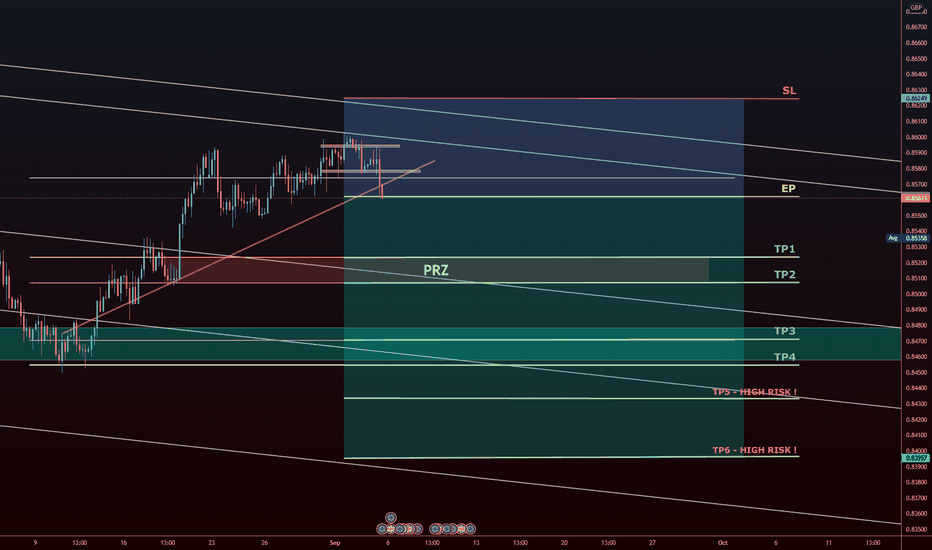

GBPJPY | Perspective for the new week | follow-up detailsThe price moved exactly 400pips in our direction since my last publication (see link below for reference purposes) to set the tone for bearish momentum. In the last week, and with the appearance of a double top pattern; the Pound appears to have found the crucial resistance at JY158 to incite a second downward spiral. The JY158 area already stopped buyers in October 2021 and January 2022. The JY157 area also stopped buyers during the course of last week trading session to signal a bearish momentum.

Tendency: Downtrend (Bearish)

Structure: Breakdown | Supply & Demand | Trendline | Reversal pattern (Double Bottom) | Descending Channel

Observation: i. Despite an overall bullish momentum on this pair (see weekly time frame); the JY157 area has been resisting price action since October 2021 to reveal a bearish tendency at this juncture in the market.

ii. Since testing the JY158 area on the 10th of February 2022, price action has continued to find lower highs which culminated in a breakdown of Key level (JY156.450) at the beginning of last week trading session.

iii. This development gave rise to multiple rejections of the JY157 area to make this area our new supply zone for future selling opportunities.

iv. It is important that we put into consideration that the multiple rejections of the JY157 area share a confluence with the bearish trendline that has been guiding price action since the 10th of February 2022.

v. In this regard, I shall be looking to take a sell position below the key level identified at JY156.450 with an opportunity to add to my existing position at a breakdown/retest of the JY155.450 area in the coming week(s).

vi. Mind you, the early hours/days of the new week might see a price climb to test our new supply zone around the JY157 area to incite further decline... Trade consciously!😊

Trading plan: SELL confirmation with a minimum potential profit of 200 pips.

Risk/Reward : 1:4

Potential Duration: 3 to 7days

NB: This speculation might be considered to make individual decisions on the lower timeframe.

Watch this space for updates as price action is been monitored.

Risk Disclaimer:

Margin trading in the foreign exchange market (including commodity trading, CFDs, stocks etc.) has a high risk and is not suitable for all investors. The content of this speculation (including all data) is organized and published by me for the sole purpose of education and assistance in making independent investment decisions. All information herein is for your reference only and I take no responsibility.

You are hereby advised to carefully consider your investment experience, financial situation, investment objective, risk tolerance level, and consult your independent financial adviser as to the suitability of your situation prior to making any investment.

I do not guarantee its accuracy and is not liable for any loss or damage which may result directly or indirectly from such content or the receipt of any instruction or notification therewith.

Past performance is not necessarily indicative of future results.

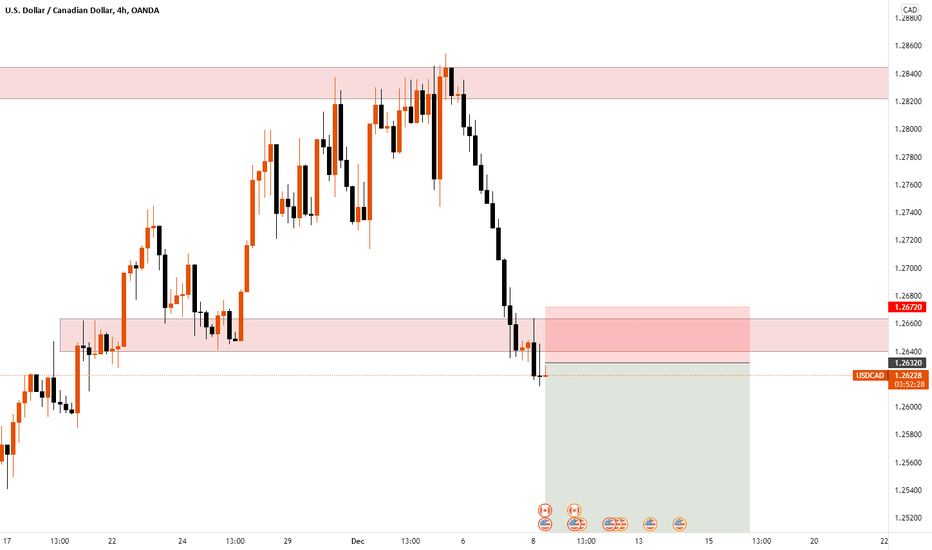

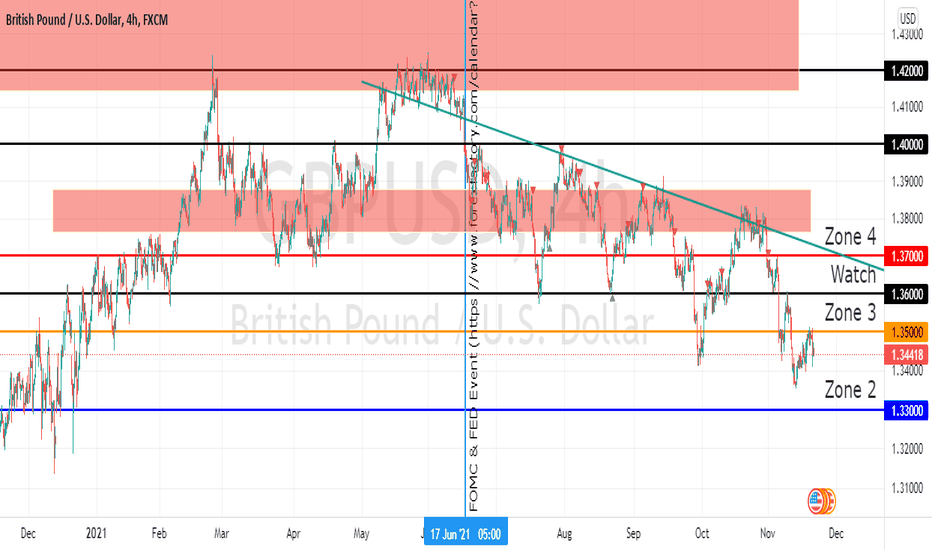

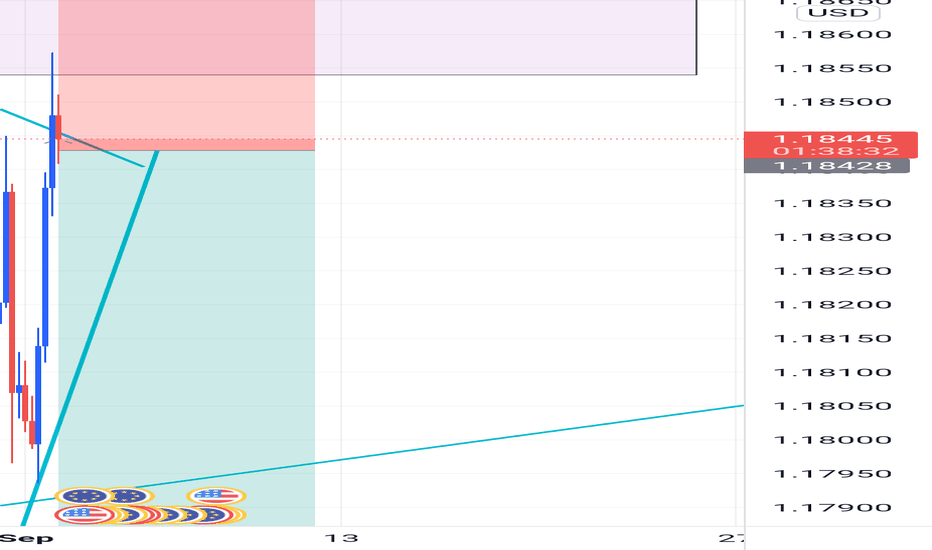

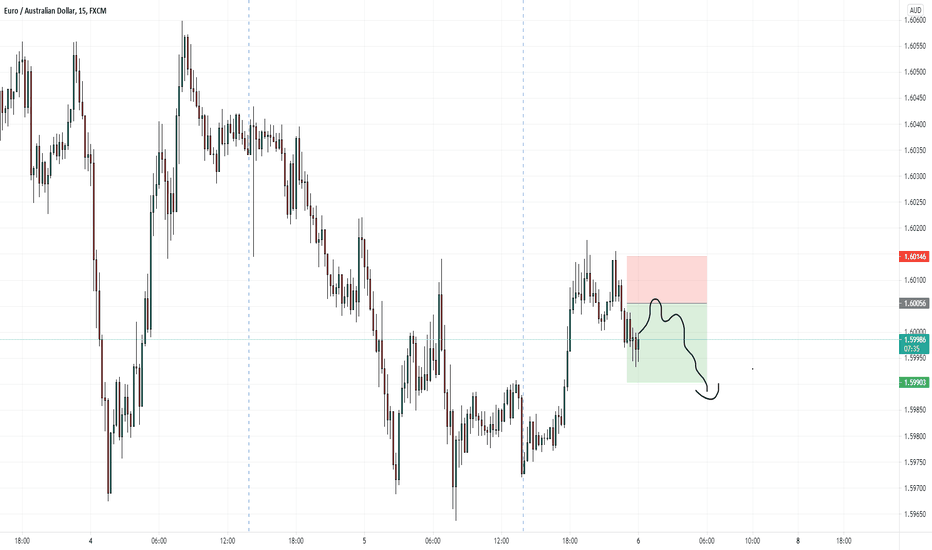

USDCAD, Potential Short, 3.6R SetupSignal Alert - Sell Limit-USDCAD @ 1.2632 , TP @ 136 Pips

- Price broke structure with strong bearish momentum from riding the bearish impulse

- Price shows continuation signals and a further trading range towards the downside

Price: 1.2632

SL: 1.2672 (40 Pips)

TP: 1.2496 (136 Pips)

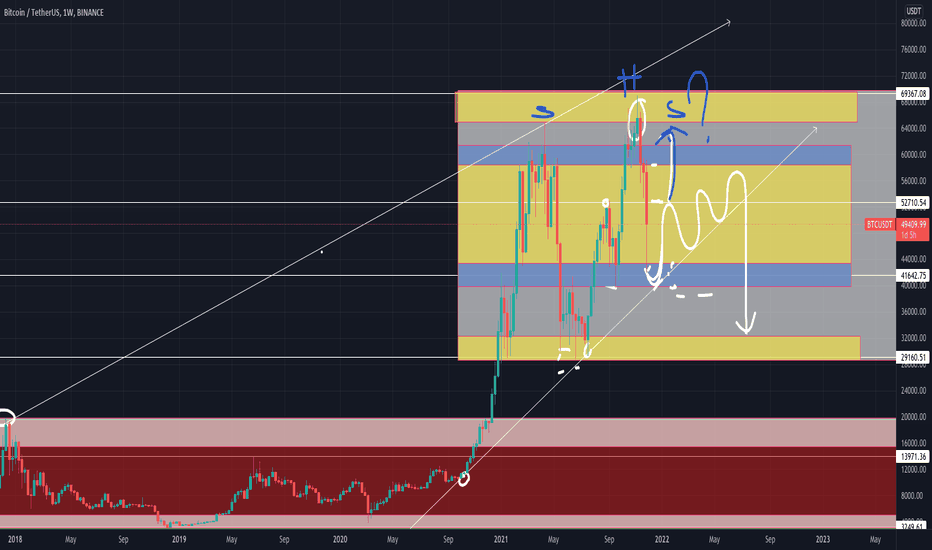

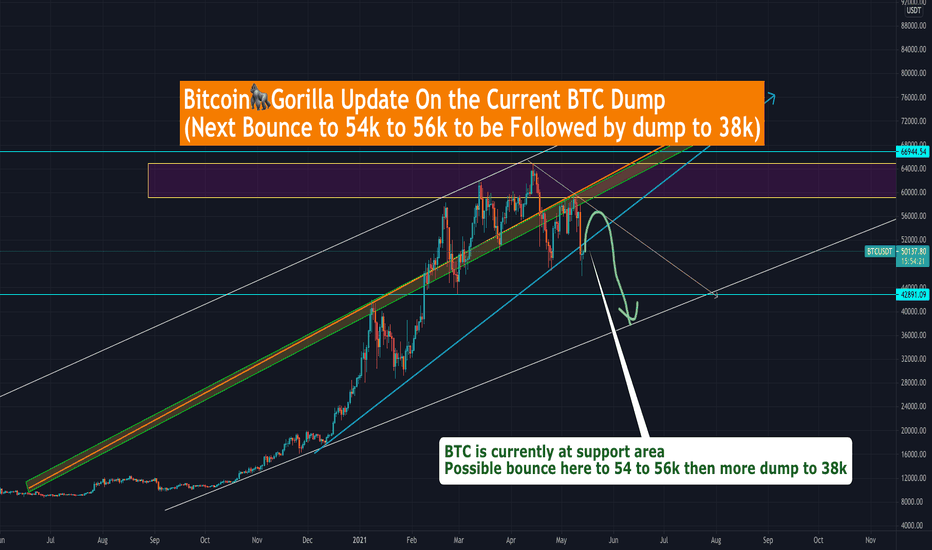

BTC BULLS ARE NOT DEAD YET BUT THEY WLL GET A BIGGER REJECTION The entire Crypto market crashed today and Bitcoin Dump to 10k to hit my Nov prediction support of 42k to 38k support. This is a video update of that BTC dump prediction and here is why a bounce is likely before more dump. A full technical analysis review on today's BTC price dump with Bitcoin Gorilla.

In my last video analysis on 15 Nov 2021, I talked about two important support 42k to 38k and 32k to 28k range. the first support got hit this morning and is currently bouncing but there will be a retest of this support range before buyers can confidently bounce good but I don't expect a new ATH at this point instead a stronger rejection is likely.

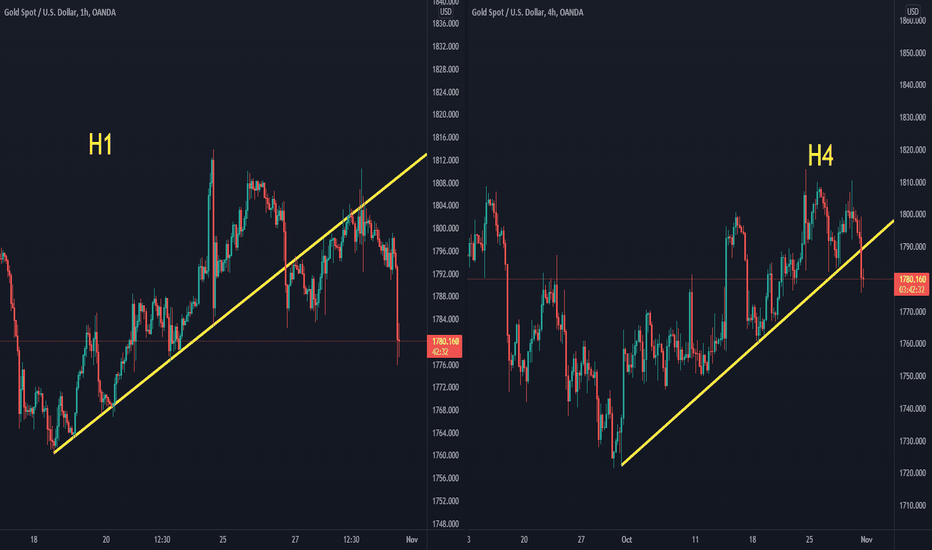

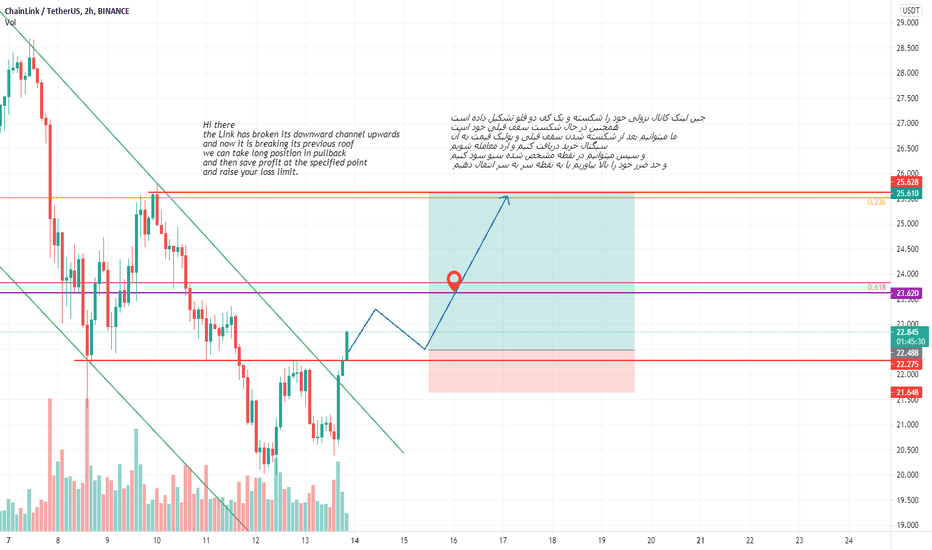

how to trade trend linewhen price goes up they rising along trend line.

in bullish trend we buy on retest and take profit at previous high. repeat this process until trend line breaks

when trend line breaks when enter again on reset of trend line will sell entry with take profit new lower low

we have perfect example of trend line concept on h1 and H4 time frame with retest , breakout , retest.

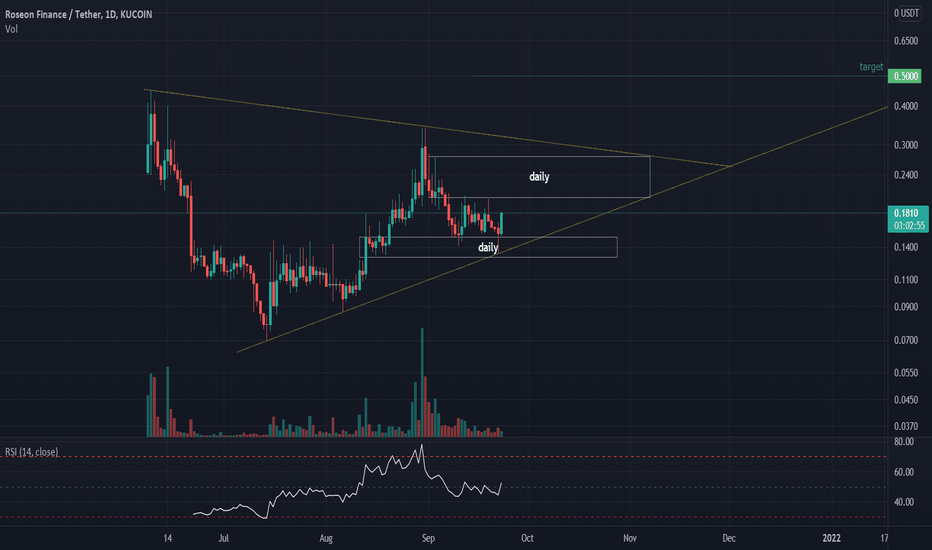

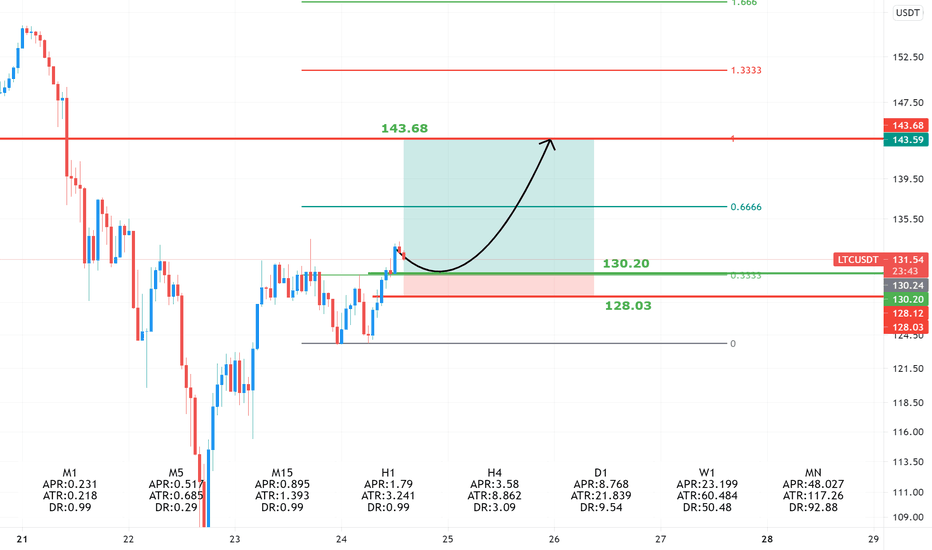

Roseon Finance good for SPOT (;Are you not in love with her ?

an interesting and orderly move, Failure to fight the resistance and Target!!!

it's nice

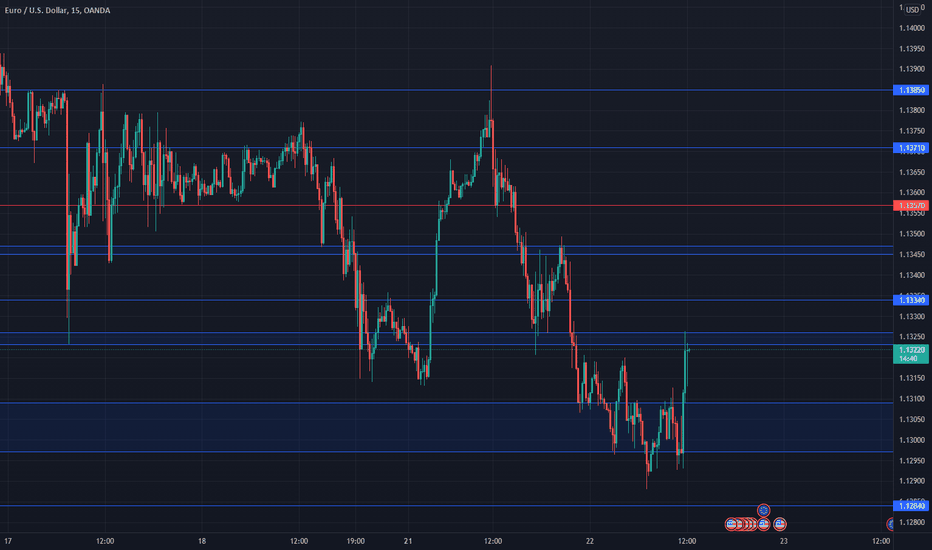

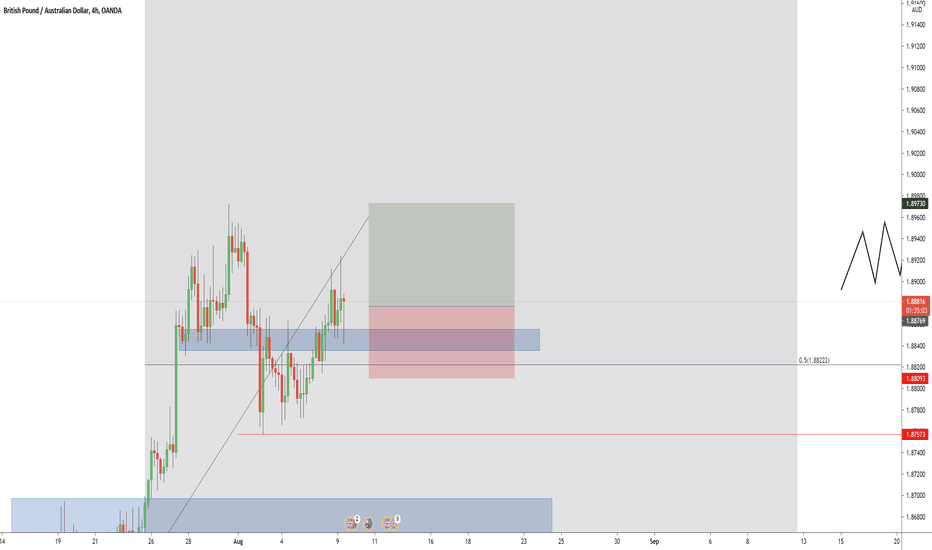

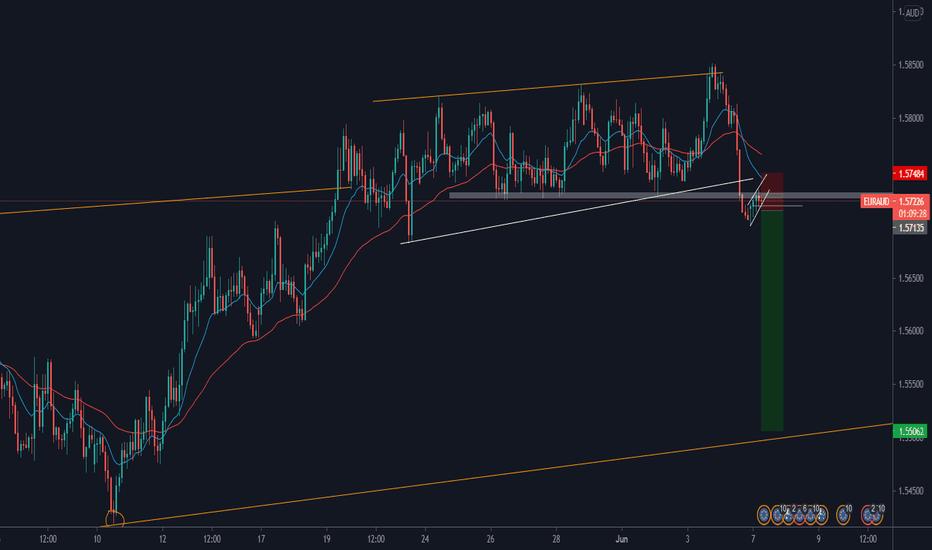

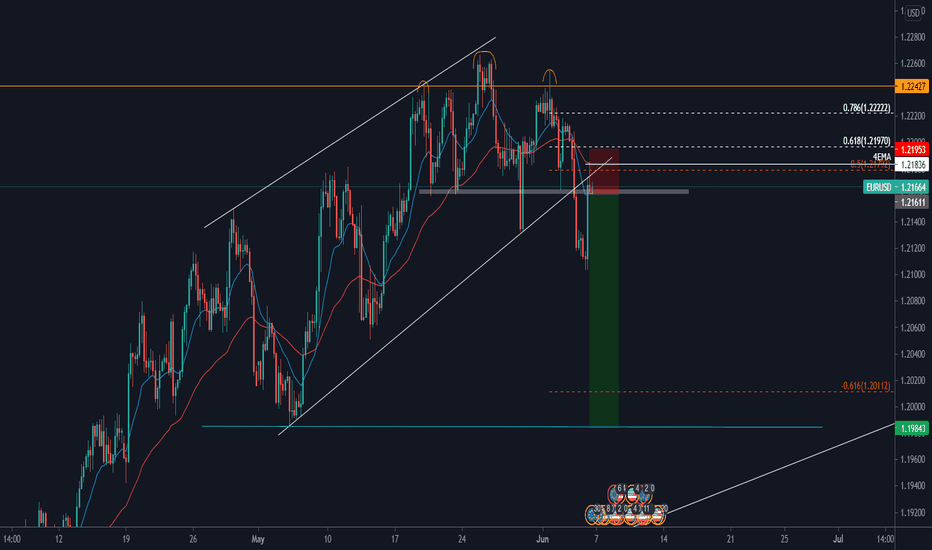

Short on EurUsd 4hI think according to the downward trend that this currency pair has in four hours and daily time, it is determined from the point and moves according to what you see ... Please be patient and just watch ... Remember that a trade is a set of losses and what matters to a trader is the outcome of his trade ... I just watch ... if I make a profit I will be happy and if I lose, I will look for my mistake ..

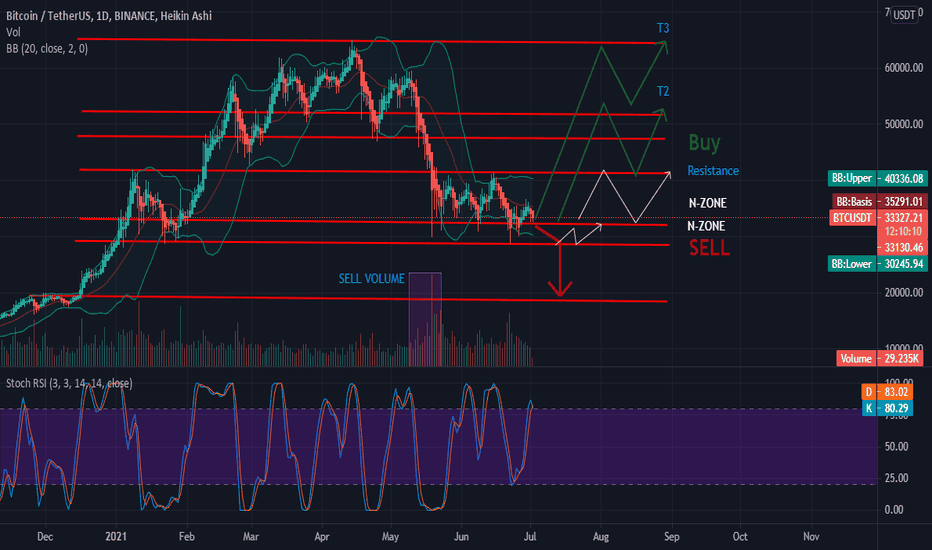

BTCUSDT-midterm-DailyHello Dears

Give us energy with your comments, your comments are important to us and will give us encouragement

The price trend of bitcoin seems to be again in the range of 31 thousand to 29 or even in the worst case below the range of 28 thousand (which we called the selling point),

Neutral zones are great for hourly trading.

Trading points, resistance areas and hourly trading range are identified in the analysis

Note: Considering the volume of SELL made in recent weeks, it seems that 28,000 have very strong support

Our analysis is purely a personal opinion

Please make any transaction with your personal opinion and knowledge.

-----------------------------------------------------------------------------------------

sellpoint <28600

neutral-ZONE >28900 ----40000 ~

(good for Hourly trade)

RESISTANCE =40000 ------41000 ~

Buy(T1) =41500 ~

T2 =51000-------54000 ~

T3 =ABOVE 64000

--------------------------------------------------------------------------------------------

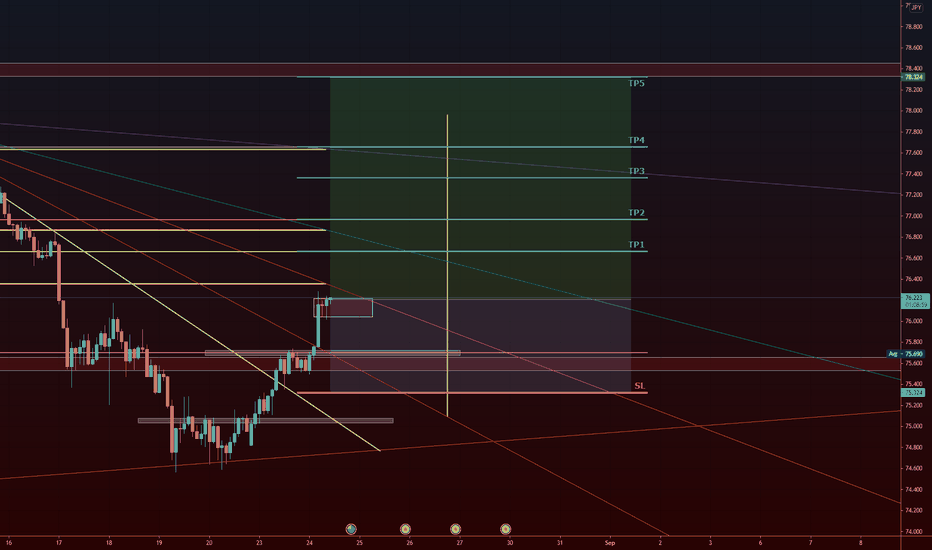

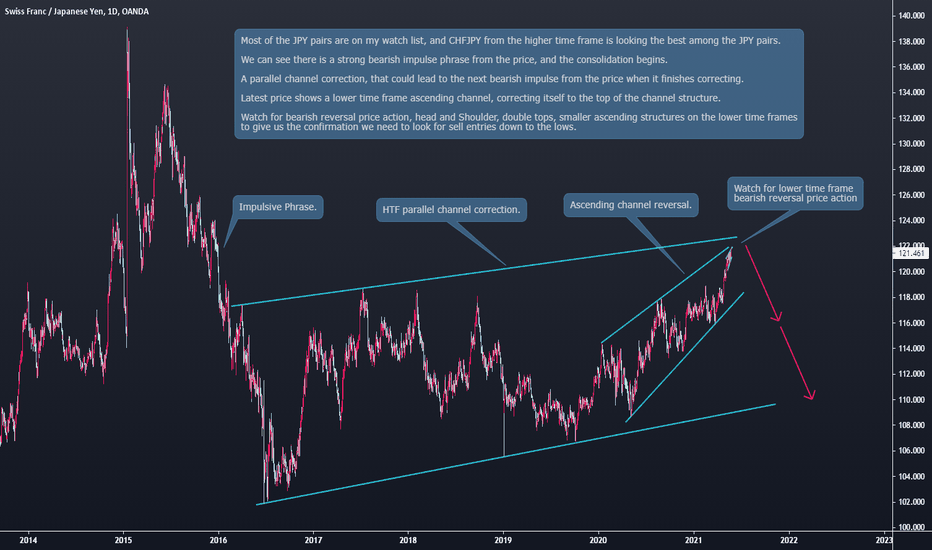

CHFJPY Top of structure, watch for reversal price action to sell

Hi everyone:

Most of the JPY pairs are on my watch list, and CHFJPY from the higher time frame is looking the best among the JPY pairs.

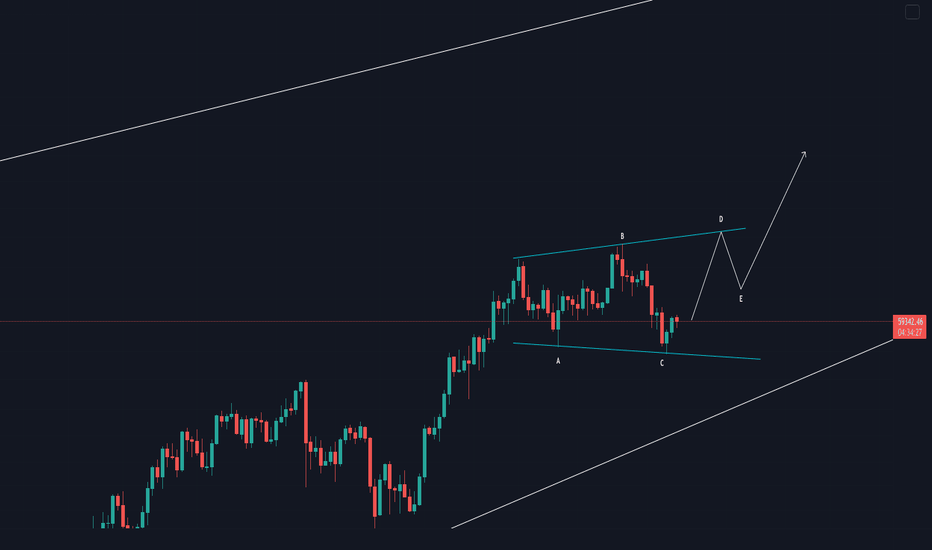

We can see there is a strong bearish impulse phrase from the price, and the consolidation begins.

A parallel channel correction, that could lead to the next bearish impulse from the price when it finishes correcting.

Latest price shows a lower time frame ascending channel, correcting itself to the top of the channel structure.

Watch for bearish reversal price action, head and Shoulder, double tops, smaller ascending structures on the lower time frames

to give us the confirmation we need to look for sell entries down to the lows.

Feel free to ask me questions, or comment/feedback.

Thank you

BTC: Bitcoin🦍Gorilla & The Bulls Plan to Bounce (TA 54k to 56k)Hi, Welcome to this BTC update with Bitcoin🦍 Gorilla. These Bears are not smiling but I see these bulls are also not here to joke so this won't go down just yet.. bulls are not going down easily as I see some good possible bounce for bulls as they struggle to recover the 48k broken support. Now please do keep at the back of your Mind that this dump is far from over just yet but the current support area is strong enough to give some buy power with the capability of supporting the buyers with some buy strength to attempt the sellers line again(THIS IS STRICTLY BASE ON PRICE ACTION).

A closer look at 4hr chart says we likely to see a 3rd leg bounce to the same resistance sellers line where I mark with a red line below

tradingview.sweetlogin.com

But mind you chances of getting rejected is here at around that area. Now mind you that 42k is also a support so we have lots of support lingering below now that will make this bounce possible as this supports are daily chart

My TA is simple, The current bounce is likely to hit 54k to 56k area at worst 58k. I do Intend shorting this resistance as we are likely to see a bigger dip 40k to 38k TA range for short.

Remember this is just my opinion on this market, Do your diligent research and I wish you good out here