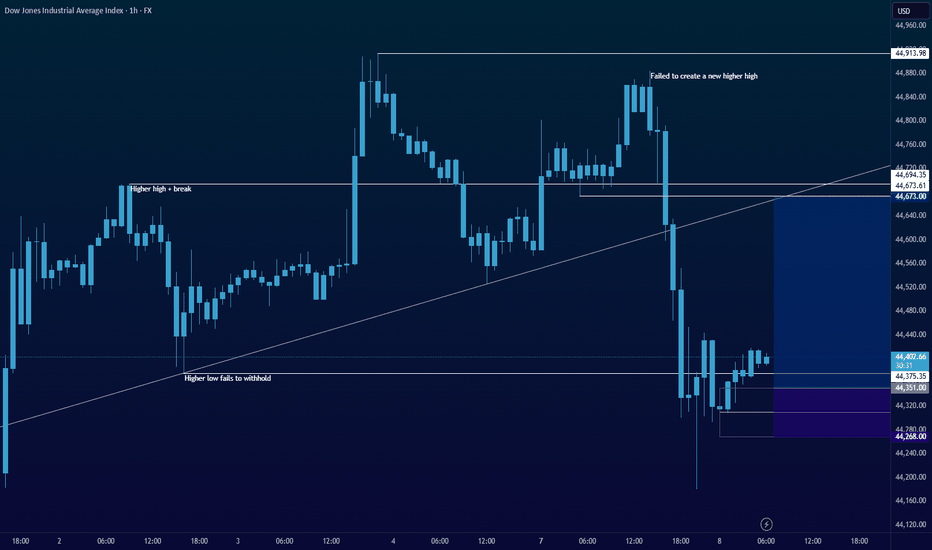

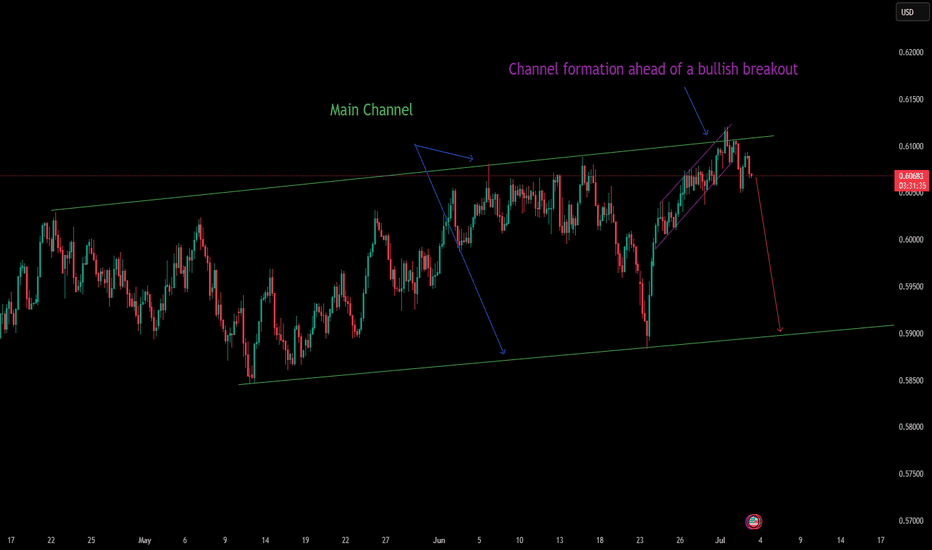

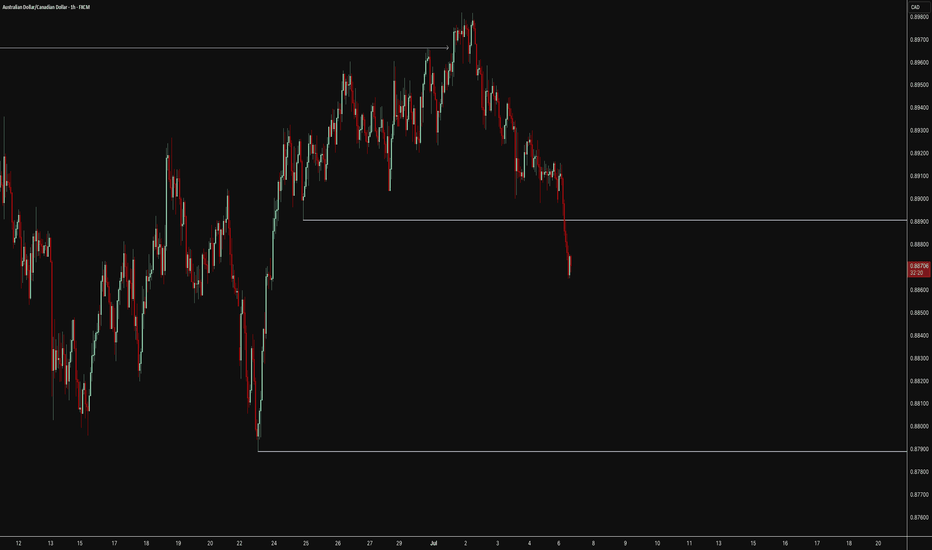

First obvious major clue may be stronger than the second.I think this shows a clear direction in price action. Strong moves addition to bullish trend line and internal structure. Now at the moment, I am looking at the trend line as a major attraction point in the current moment. Some opinions may say that it's more correct to sell down lower from the trend line, and that might be correct. Although, at this moment, price has yet to have a proper pullback after a clean breakout below. It might honestly just be too obvious that it'd go down lower after retesting trend line, so in my opinion, I think the most clear entry right now is to buy now at a low point, might as well be called a liquidity pool. So right now in this strong trend change, the next obvious major potential for move is going to be back at trend line. The next obvious move will be even more obvious, so then it might also be lacking stability, but until then, my focus here is to buy within a potential deep pullback.

Priceaction

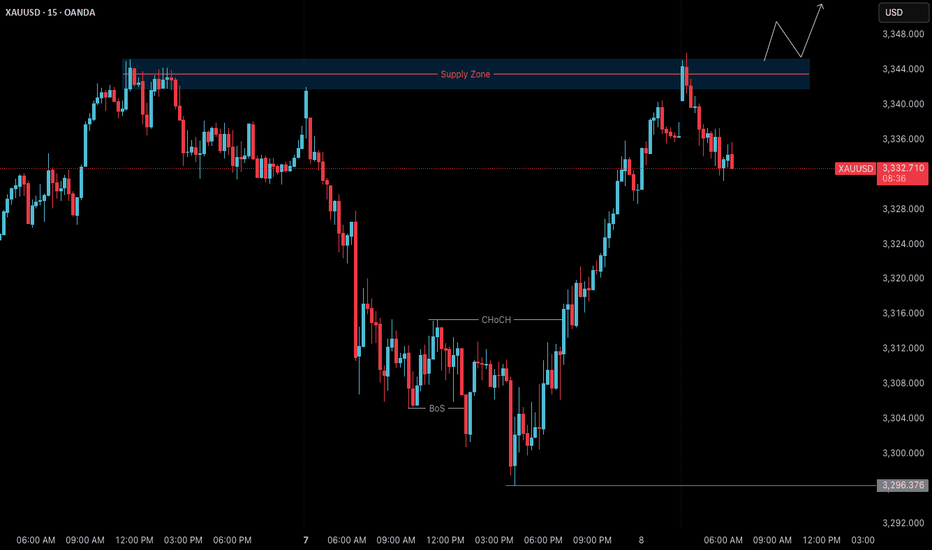

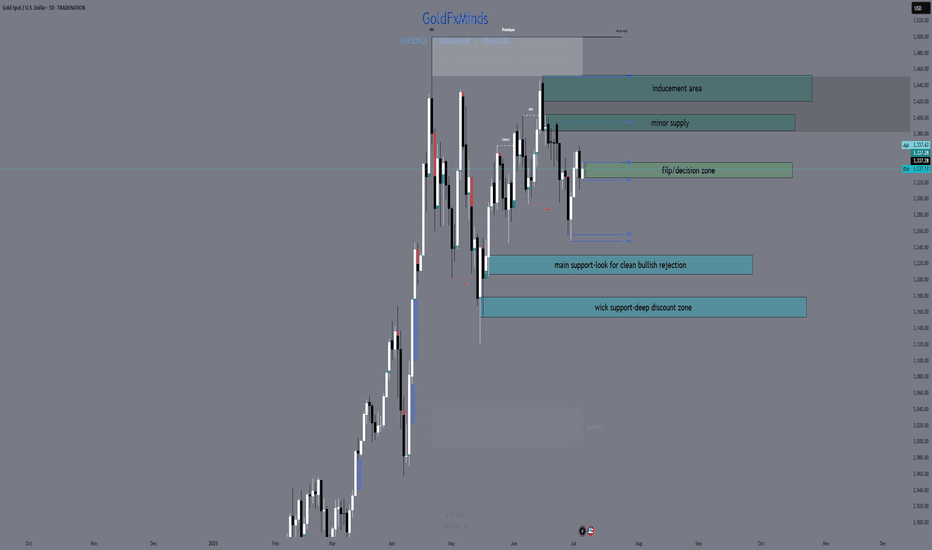

Gold (XAUUSD) – July 8 Analysis | Decision Day at H4 Supply Zone

Gold is currently trading inside a key H4 supply zone (3342–3345) , and today’s session could act as a pivotal turning point for the ongoing structure.

We are now in a region where the H4 may either complete its pullback and resume the uptrend — or allow price to drop deeper toward 3280 before any bullish continuation.

Market Structure Overview

• H4 Trend: Still in a pullback

• M15 Trend: Gave a Change of Character (ChoCh) in the previous session

• Break of Structure (BoS): Not yet confirmed on M15

This puts us in a state of unconfirmed reversal . Without a clean BoS, this could still be a liquidity grab .

Key Levels & Current Setup

📍 H4 Supply Zone: 3342–3345

→ This is where price is currently reacting

→ Sellers may step in here if the broader pullback continues

📍 M15 Structure Status:

→ ChoCh already occurred

→ Price is in a retracement phase

→ BoS is needed to confirm a shift and signal the end of H4 pullback

What Today’s Session Will Decide

🔸 If M15 breaks structure upward (BoS):

→ H4 pullback may be complete

→ Bias turns bullish

→ We’ll plan long setups from M15 POIs with M1 confirmation

🔸 If M15 fails to break and reverses:

→ This could be a liquidity grab

→ Sellers may push price lower

→ Next downside target: 3280 H4 order block , still valid

⚠️ Reminder: Be Prepared for Both Scenarios

• No M15 BoS = No bias

• Wait for structure, not emotion

• Do not force long trades without confirmation

• 3280 remains a high-probability target if rejection confirms

Final Thoughts

This is a structure-led market — we don’t predict, we prepare.

Today’s price action may bring directional clarity.

Structure over speculation.

Let price show intent.

Then act with process, not impulse.

📘 Shared by @ChartIsMirror

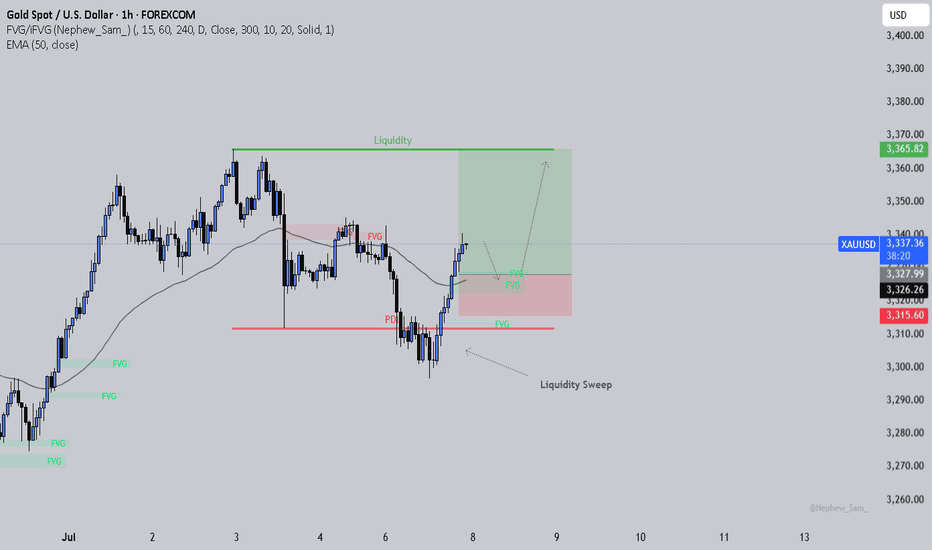

Following Price Flow to the Next TargetPrice swept liquidity below the previous day’s low and then powered back up, breaking structure to the upside. Now it’s sitting above the 50 EMA, moving through fair value gaps left by the rally. I’m watching for a possible pullback into the FVG zone near the EMA. If that level holds, price could look to reach for the liquidity above around 3,365.

But here’s what matters most. Even if this ends up being a losing trade, I’d rather take that loss knowing I stuck to my plan than catch a random win by breaking my rules. Because long-term, winning trades that come from impulse actually set you up for future damage. They teach bad habits.

Losses that happen inside your system? Those are simply the cost of doing business. They protect your discipline and keep your edge intact. Over time, that’s exactly what allows you to stay in the game and grow your account.

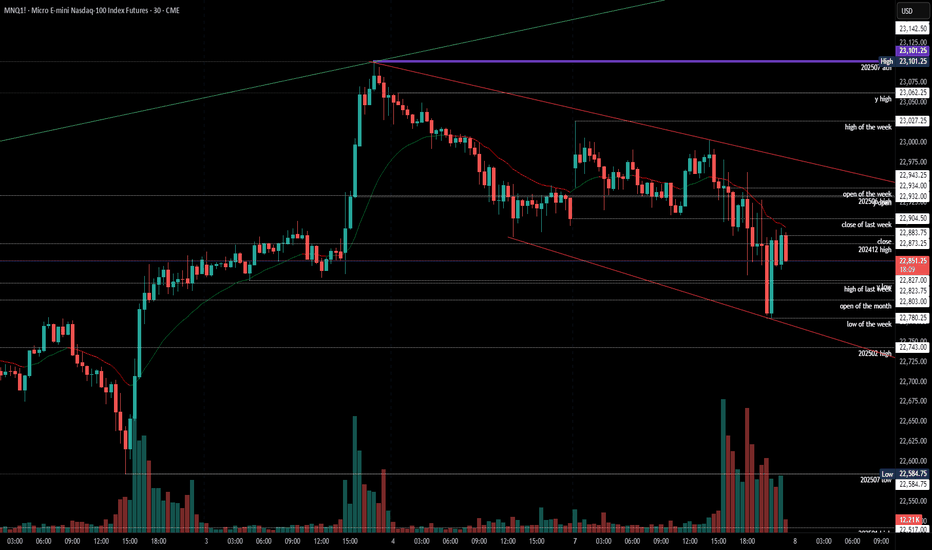

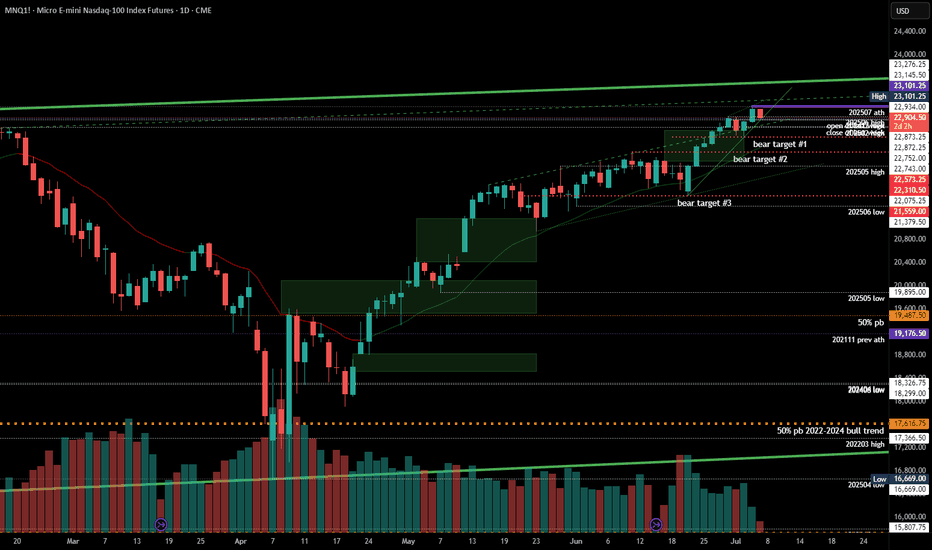

2025-07-07 - priceactiontds - daily update - nasdaqGood Evening and I hope you are well.

comment: Market is ignoring every risk under the sun because the US government is too incompetent to follow-through with their excrement show. Beyond me that we are staying up high. Got no better comment for you today.

current market cycle: bull trend

key levels: 22500 - 23100

bull case: As long as bulls stay comfortably above 22500, they are fine and sideways is a very bullish correction for them. Bears are certainly not doing much, so bulls buy every dip and the chances of a new ath are there since we are very close to it.

Invalidation is below 22500.

bear case: Bears are just not doing enough. Markets have every reason to sell hard but they don’t. Unless we see big 1h bear bars closing on their low with follow-through selling, we can not expect lower prices. We need gaps but all bears get are huge reversal bars. Below 22500 things would look better for them but for now it’s very unlikely. It’s certainly a start that we closed a 4h bar below the 4h 20ema and below last week’s close but unless we make lower lows, it does not mean much.

Invalidation is above 23100.

short term: Neutral.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

trade of the day: Scalping both sides since we had many alternating bars and prominent tails.

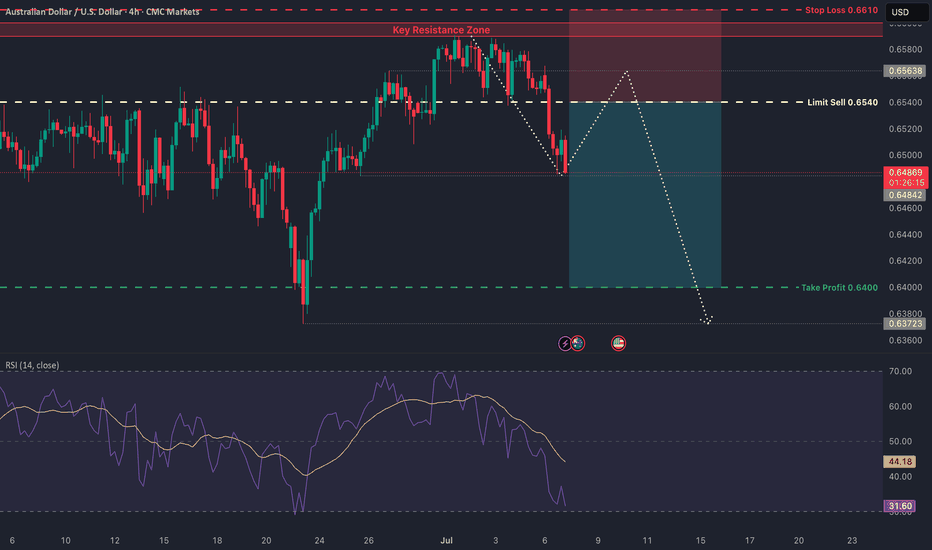

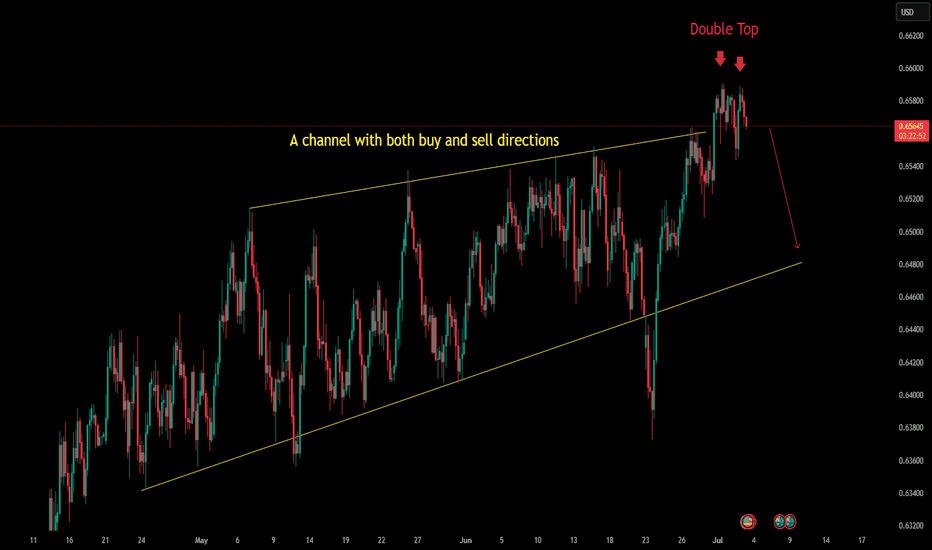

AUD/USD Short: Riding the Perfect Storm to 0.6400Hello, traders! 🚀

A rare and powerful setup is forming on AUD/USD, and all signs are pointing decisively lower. 👇 This isn't just a simple technical pattern; it's a perfect storm of fundamental, technical, and event-driven factors aligning to create a high-conviction short opportunity.

If you're looking for a clean setup with a clear catalyst, this is it. Let's break it down! 🧐

The Core Thesis: Why We're Bearish 🌪️

This trade is built on three powerful pillars that are converging at the same time:

Massive Policy Divergence: 🇺🇸 vs 🇦🇺 This is the engine of the trade.

The Fed (USD): Remains HAWKISH 🦅. They are laser-focused on fighting stubborn inflation and have signaled they are in no rush to cut rates.

The RBA (AUD): Is actively DOVISH 🐨. They've already cut rates and are widely expected to cut again this week to support a weakening economy.

Result: This widening gap in interest rate policy creates a fundamental tailwind that heavily favors a stronger USD and a weaker AUD. 💸

The Dual-Catalyst Event (July 9th): 🗓️ This is the trigger.

FOMC Minutes Release: The minutes from the Fed's last meeting are expected to confirm their hawkish stance, reinforcing USD strength.

Tariff Deadline: A 90-day suspension of Trump-era tariffs expires on the same day . The base case is that tariffs will be reimposed, sparking a risk-off move in the markets.

Result: Risk-off sentiment is toxic for the risk-sensitive Aussie dollar (AUD) and a magnet for the safe-haven US dollar (USD). This is a potential double-whammy for AUD/USD. 💥

The Technical Picture is Screaming "Down" 📉

The chart tells a crystal-clear story of rejection and weakness. As you can see on the 4H chart, the price action is incredibly bearish after failing to break out higher.

The Great Wall of Resistance: Bulls threw everything they had at the 0.6590 - 0.6600 resistance zone and were decisively rejected. 🧱 This wasn't just any level; it was an 8-month high and a major long-term resistance area. A failure this strong is a huge red flag for buyers. 🛑

Momentum has Flipped: We saw classic bearish divergence on the higher timeframes, and as you can see on this 4H chart, we have now decisively broken below the recent rising channel. The path of least resistance has flipped from up to down. 👇

The Trade Plan 🎯

Here are the precise levels for executing this trade idea.

Asset: AUD/USD

Direction: Short (Sell) 📉

Entry Zone: ➡️ Look for a patient entry on a pullback to the 0.6535 - 0.6550 area. This was previous support and is now expected to act as strong resistance. We want to sell into strength.

Stop Loss: 🛑 A daily close above 0.6610 . This level is safely above the recent highs. A break here would invalidate our bearish thesis.

Target 1 (TP1): ✅ 0.6475 . This is the first logical support level. A good area to take partial profits and move your stop loss to break-even.

Target 2 (TP2): 🏆 0.6400 . This is our primary target, representing the bottom of the multi-week trading range and offering an excellent risk-to-reward ratio.

Conclusion: 💡

It's rare for fundamentals, technicals, and a major event catalyst to align so perfectly. The rejection at major resistance, combined with the powerful fundamental driver of policy divergence and the upcoming dual-catalyst on July 9th, makes this a high-conviction setup.

This is my analysis and not financial advice. Always do your own research and manage your risk carefully.

What do you think? Are you bearish on the Aussie too? Let me know your thoughts in the comments below! 👇

And if you found this analysis helpful, please give it a BOOST 🚀 and FOLLOW for more trade ideas! 👍

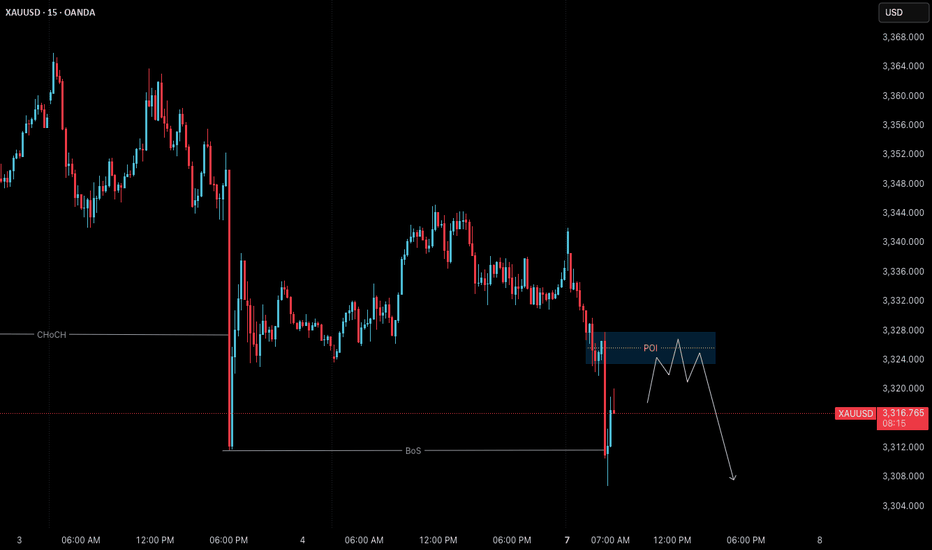

Gold (XAUUSD) – July 7 | Watching 3326 POI for Short Setup🟡 Gold (XAUUSD) – July 7 Bias | Short Setup Developing at 3326 POI

The Gold market remains in a pullback phase on the H4 timeframe , and price may still revisit the 3280 H4 order block before resuming its broader uptrend.

On the M15 timeframe, structure has now shifted clearly.

After an initial Change of Character (ChoCh) , we’ve seen a confirmed Break of Structure (BoS) , placing M15 officially in a downtrend .

✅ Why This Matters:

With both ChoCh and BoS complete, we no longer treat this move as a potential liquidity grab — it now reflects a valid structural reversal in the short term.

But instead of reacting impulsively, we study this shift as a live example of structure-based price action — and how entry zones form after confirmation.

🔍 M15 Order Block in Focus:

• 3323.500 – 3327.800 → Valid M15 POI for short setups

→ This is where we expect price might retrace before resuming its move

→ We’ll observe this zone for M1 confirmation (ChoCh + micro BoS) before taking any action

🎯 Target Zone:

• 3280 – H4 Demand

→ A clean structure-based target aligned with higher timeframe pullback

→ Our model requires minimum 1:3 RR , anchored to price structure

🔁 Key Takeaways:

• H4: Pullback phase remains intact

• M15: Downtrend confirmed (ChoCh + BoS complete)

• Execution plan: Observe 3326 POI; respond only if structure confirms again on M1

• No anticipation. No prediction. Just process.

📖 This is structure-based learning in real time.

We don’t chase setups — we observe shifts.

Let structure teach you. Let price confirm it.

The chart is the mirror.

📘 Shared by @ChartIsMirror

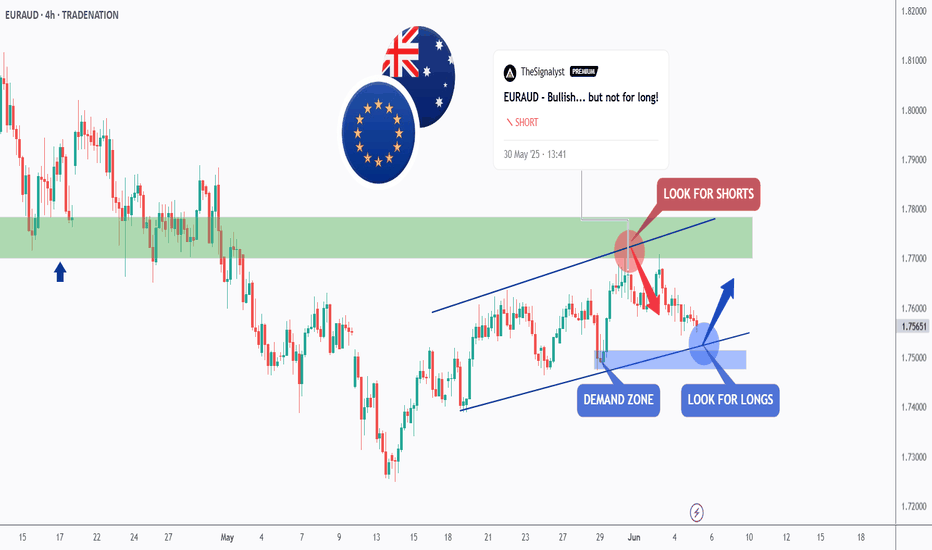

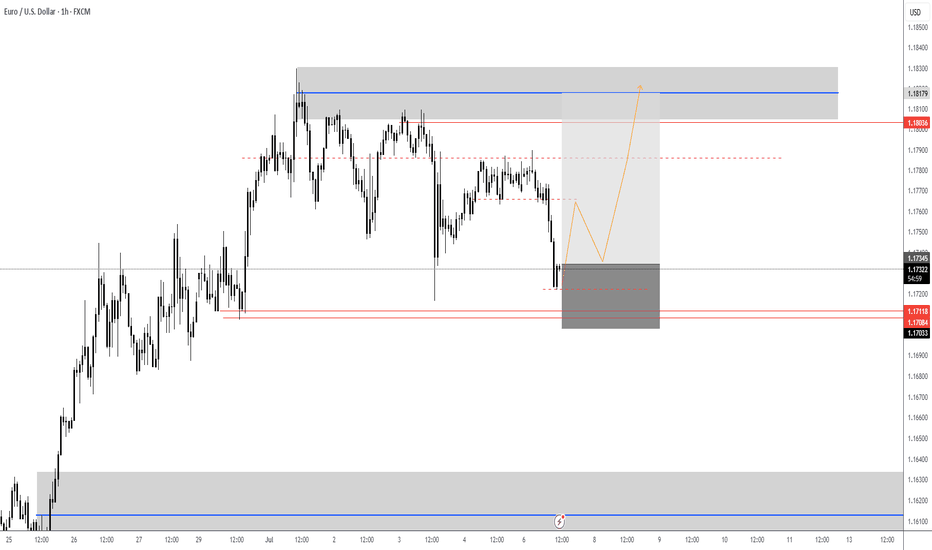

EURAUD - Bearish... but not for long!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

As per our last EURAUD analysis, attached on the chart, it rejected the upper bound of the blue channel and traded lower.

What's next?

📈EURAUD is now retesting the lower bound of the channel.

Moreover, the blue zone is a strong demand.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower blue trendline and demand.

📚 As per my trading style:

As #EURAUD is around the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

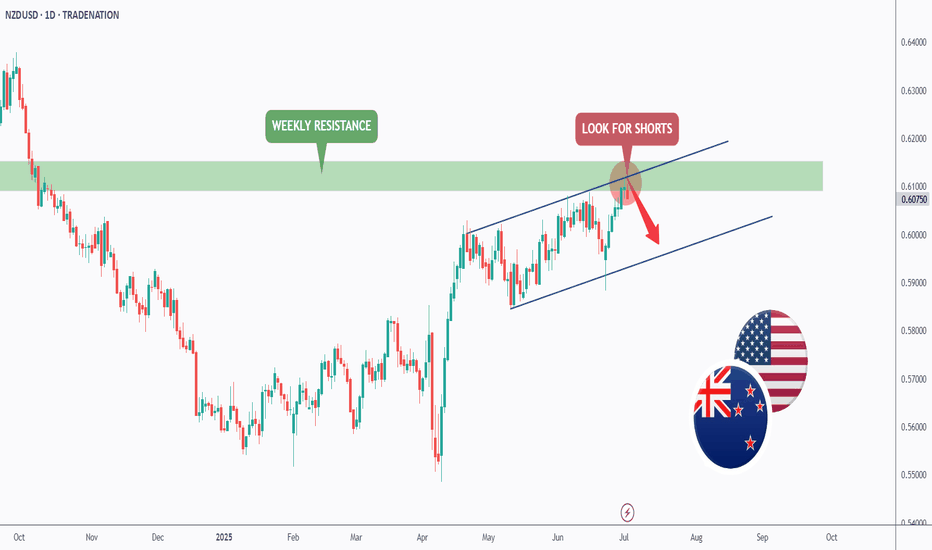

NZDUSD - The Bulls Are Exhausted! Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈NZDUSD has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong weekly resistance.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and green resistance.

📚 As per my trading style:

As #NZDUSD is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

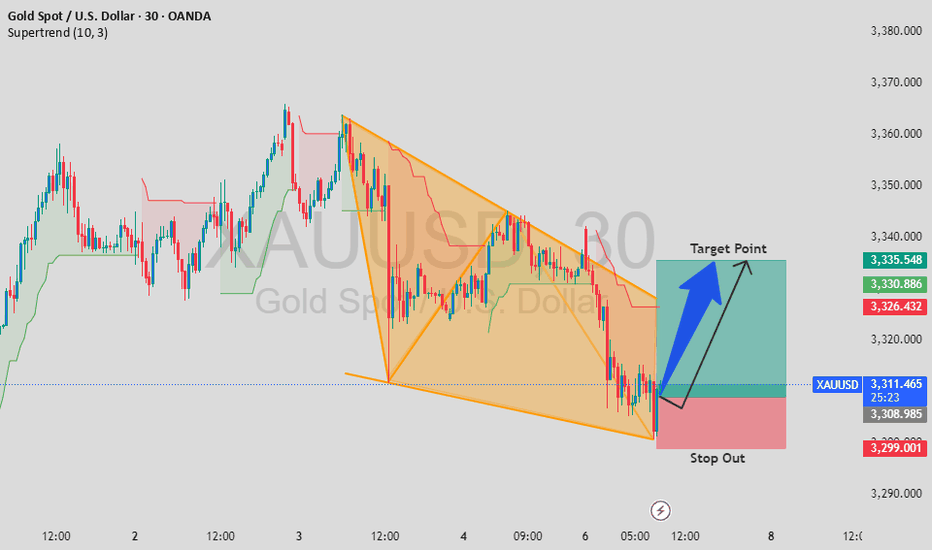

Bullish Breakout Anticipation on Gold (XAU/USD)Bullish Breakout Anticipation on Gold (XAU/USD)

On the 30-minute chart, Gold is forming a classic falling wedge pattern, typically seen as a bullish reversal setup. We've just touched the lower support trendline, and early breakout signs are emerging.

📍 Entry: 3,309.500

🎯 Target: 3,335.500

🛑 Stop Loss: 3,299.000

The risk-to-reward ratio looks favorable, and a breakout above the wedge resistance could push price towards the 3,335+ region. Let’s watch for confirmation and volume on breakout.

👇 Drop your thoughts below and let’s discuss!

✅ If you find this analysis helpful, please support by giving a like and following — your support means a lot! 🙌 🟡

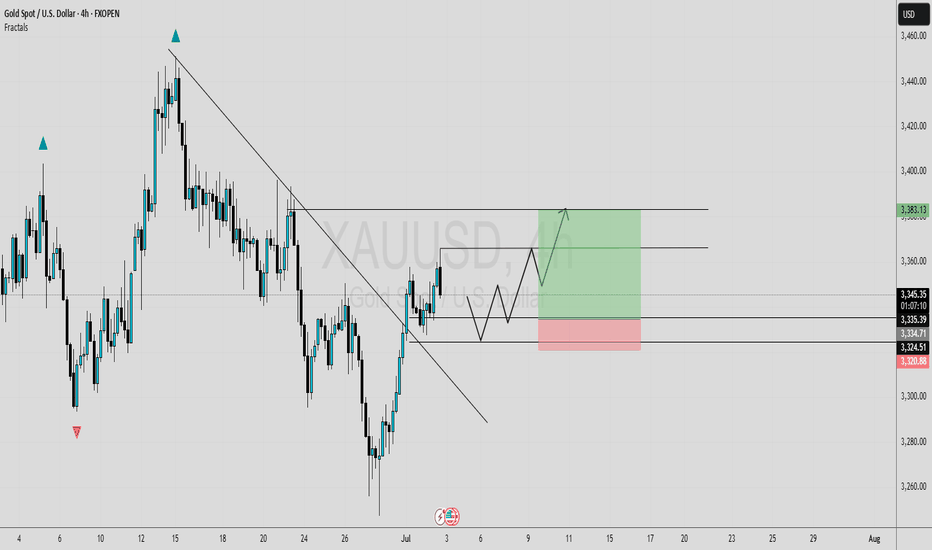

TRENDLINE BREAKOUT [LONG]In this analysis we're focusing on 4H timeframe. As we know that price move impulse toward upside and break trendline, now I'm waiting for retracement. Once price reach my zone and give any type of bullish confirmation than we'll execute our trade. This is a higher time frame analysis and key levels. Let's analyze more deeply into smaller time frame and potential outcomes.

Always use stoploss for your trade.

Always use proper money management and proper risk to reward ratio.

#XAUUSD 4H Technical Analysis Expected Move.

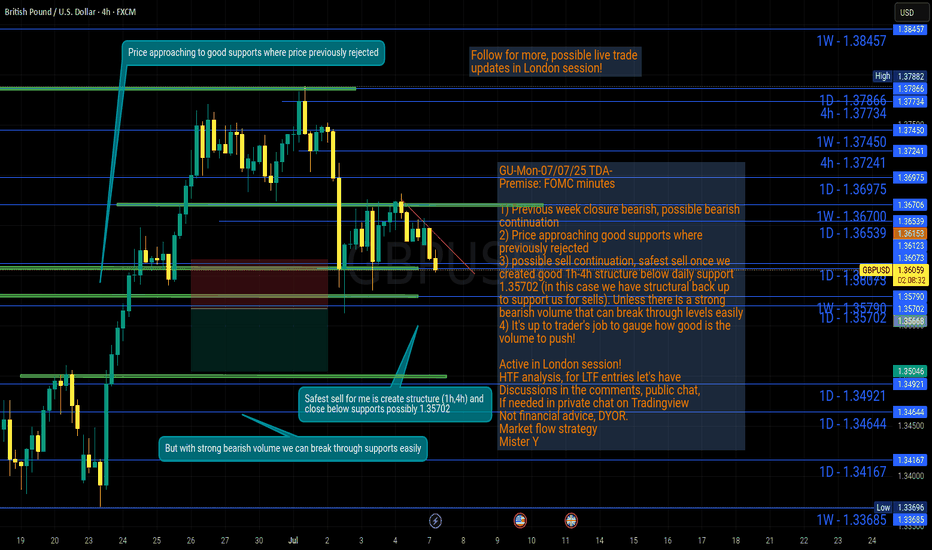

GU-Mon-07/07/25 TDA-Good support zone,but possible sell continueAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

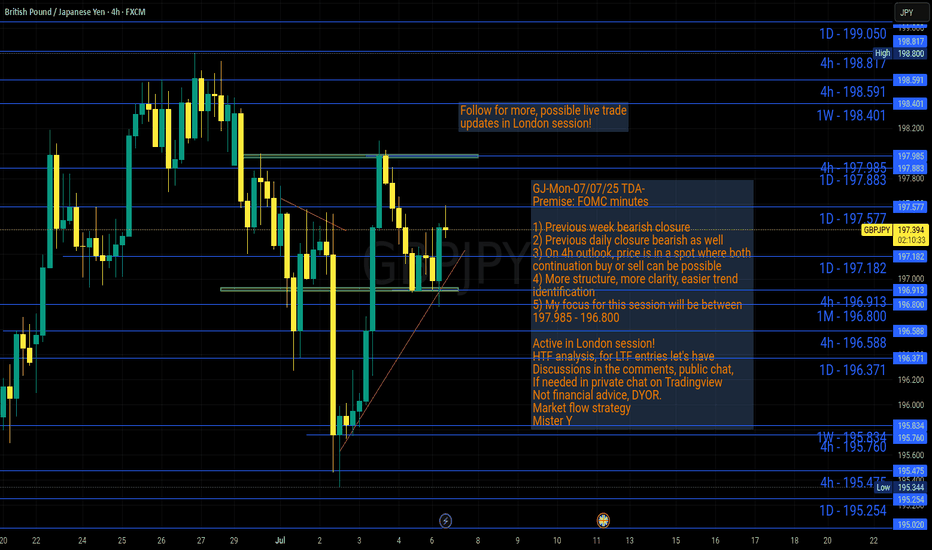

GJ-Mon-07/07/25 TDA-Both sides possible, more structure->clarityAnalysis done directly on the chart

Follow for more, possible live trades update!

I often share my live trades in Tradingview public chat in London session, stay tuned!

I often repeat in my analysis, more structure, more clarity,

easier trend identification. I won't and I will never catch

every single move but with more structure and more clarity

you'll likely to increase the probability that a move will

happen in either direction.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, lot size and replicate the move

over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

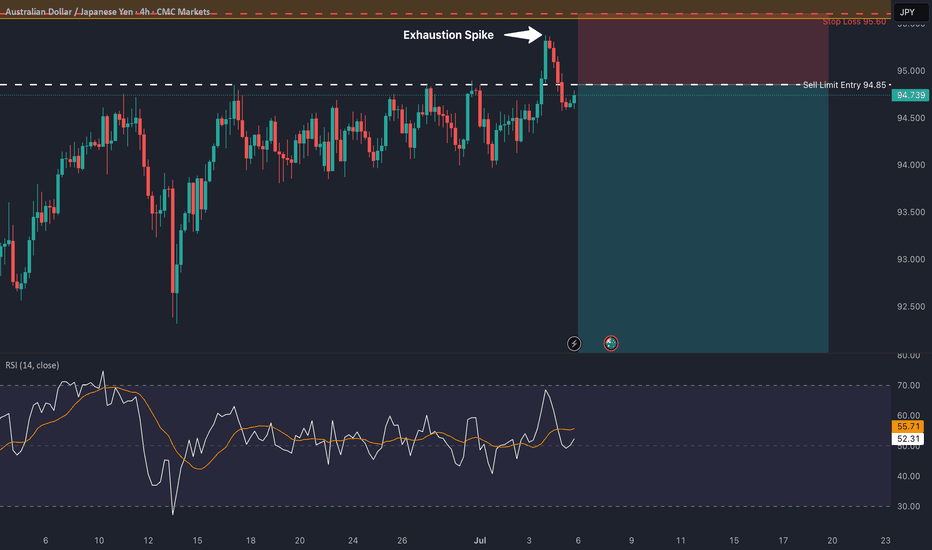

AUD/JPY: Rejection at Key ResistanceThis is a high-conviction short setup on AUD/JPY based on a powerful rejection pattern that has formed on the 4-hour chart. As you can see, the price spiked into the critical resistance zone between 95.00 and 95.55 but was immediately and forcefully rejected, leaving behind a long "Exhaustion Spike."

This is a classic sign of buyer exhaustion and seller dominance. It tells us that despite the recent rally, there is significant supply waiting at these higher levels. This price action provides a clear opportunity to short the pair in anticipation of a significant move down.

🏦 Fundamental Analysis

The fundamental backdrop provides a strong tailwind for this trade, with two key drivers:

1️⃣ Central Bank Divergence: The Reserve Bank of Australia (RBA) is in an easing cycle, having recently cut rates to 3.85% with more cuts expected. In stark contrast, the Bank of Japan (BoJ) is on a path of normalization, having already raised its rate to 0.50%. This divergence in monetary policy is structurally bearish for AUD/JPY.

2️⃣ Imminent Catalysts: This week is packed with event risk that is skewed to the downside for this pair. We have the RBA interest rate decision on Tuesday, July 8th , and the U.S. tariff deadline on Wednesday, July 9th . A dovish RBA or a "risk-off" move from the tariff news would likely accelerate the decline in AUD (a risk currency) and strengthen the JPY (a safe-haven currency).

📊 Technical Analysis

The price action on the chart confirms the bearish bias:

1️⃣ 4-Hour Rejection: The "Exhaustion Spike" at the 95.00 - 95.55 supply zone is the primary signal. It shows a clear failure by buyers and a strong takeover by sellers at a key level.

2️⃣ Long-Term Trend: On the daily chart, the price is trading below the critical 200-day moving average , confirming the long-term trend remains bearish.

3️⃣ Waning Momentum: There is a clear bearish divergence on the daily RSI. The price made a higher high, but the momentum indicator made a lower high, signaling that the rally is internally weak and losing steam.

📋 Trading Setup

This is a swing trade designed to capture a significant correction with a simple "set and forget" plan.

📉 Direction: SHORT / SELL

👉 Entry: Sell Limit @ 94.85

⛔️ Stop Loss: 95.60

🎯 Take Profit: 91.10

💡 Rationale: The entry is placed strategically to capitalize on a potential retest of the rejection area. The stop loss is placed safely above the rejection wick and the major resistance zone. The take profit targets the major structural support from the May 2025 lows, offering an excellent risk-to-reward ratio.

#202527 - priceactiontds - weekly update - nasdaq

Good Day and I hope you are well.

comment: Neutral. Chart is still max bullish but I have no more targets above and I’m fine with this going without me. Below 22600 I will start looking for lower targets. Until then best bears can get is sideways around 23000 but we will get a big move Monday/Tuesday once we have an answer on the US-EU tariff shit show. A good start for the bears is any price below 22584.

current market cycle: resumption of the bull trend but likely the final flag and we most likely will top out here around/under 23000

key levels for next week: 22000 - 23000

bull case: Bulls obviously still in full control. 2 bear bars out of the past 9 is a strong bull trend. Until we see much bigger selling pressure, technically we can only expect higher prices. Bulls broke above the bull channel from 21000 late may and confirmed the breakout now. The issues against the bulls are also the same arguments as for them. It’s overbought, climactic and very very late in the trend. This strong selling this late is something that usually happens before we turn,

Invalidation is below 22600

bear case: Just to make this clear again, bears have nothing right now. This chart is as bullish as it gets, that is why you can not look to short this yet. With that disclaimer, I also think it’s a bad buy. We are beyond overbought on many many economic indicators worsening and this trend is trying to accelerate. This is the time where weak/late bulls come around with the “this time it’s different” and "valuations don’t matter. We will again sell off big time this year but it’s stupid to trying to pick the top here.

Invalidation is above 23200 (any number I write here is stupid because it’s top picking. It could easily go to 23500 given the strength of this move)

short term: Neutral. No interest in buying but too early for shorts. Let’s see what the US-EU trade “talks” bring next week.

medium-long term - Update from 2024-06-29: No change in plans. I expect 20000 to get hit over the next 3 months and maybe 19000 again.

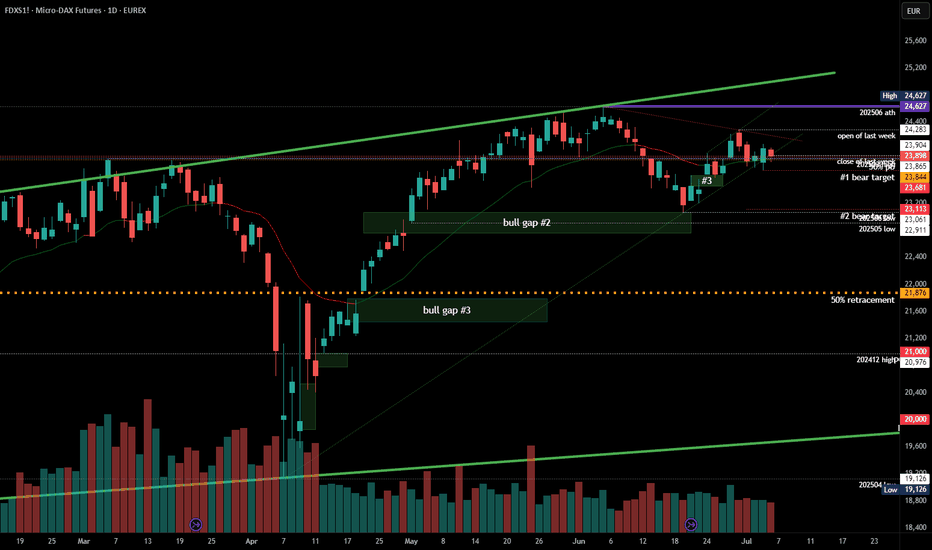

#202527 - priceactiontds - weekly update - daxGood Day and I hope you are well.

comment: Neutral. Clear triangle on the daily chart and mid point is 23850. Week closed at 23900. Market is in balance and I think it’s completely 50/50 for both sides where the breakout will happen. Given the tariff shit show, I would wait for it to happen and be flat until then. If they apply 10%+ tariffs on EU imports, we go down, if they postpone, we rally further. I trade only technicals but this is one of the few moments per year where news will completely determine where the markets will breakout out next.

Big if. If orange face does another TACO move, momentum is strong enough for markets to keep going and squeeze further. We need a very strong daily bear bar to kill it.

current market cycle: trading range - triangle

key levels for next week: 23500 - 24300 (above 24300, 500 comes into play and also likely 600+)

bull case: Bulls made a higher low but barely. This is a bad looking bull trend from the 23061 low and market is currently in breakout mode to decide where we go next. The 24283 high is a reasonable high to turn lower but as longs as bulls stay above 23600, there is a chance of this doing another try at 23300 and above the ugly bull channel is confirmed and higher prices are likely.

Invalidation is below 23500

bear case: Bears keeping it below 24000 is good but they are not doing enough or we would have made lower lows below 23600. Everything depends on the US-EU tariffs over the next days. Technically all bullish targets are met and the 24283 was high enough to qualify as a re-test. Market is free to go down again, it just needs a catalyst.

Invalidation is above 24300

short term: Neutral. I won’t gamble on the trade talk outcome but I am much more eager to sell this on bad news than to buy it on not-too-bad news.

medium-long term from 2025-06-29: Bull surprise last week but my targets for the second half of 2025 remain the same. I still expect at least 21000 to get hit again this year. As of now, bulls are favored until we drop below 23000.

XAUUSD Daily Outlook – July 7, 2025👋 Hey traders, welcome to the fresh week! After the Friday selloff, gold is approaching a key inflection point. Let’s break down what’s happening on the Daily chart and how to approach it with clarity — no guessing, just precision.

Stay focused. The real opportunity is always in how you prepare.

🌍 Macro + Sentiment

Market remains sensitive to yield shifts and broader risk sentiment (BRICS summit also continues)

Price remains elevated in premium territory after months of vertical flow — but structure is finally showing re-accumulation or re-distribution?

📈 Daily Bias

Neutral to bearish until the 3330–3344 zone fully flips cleanly as support

Structure shows lower highs, strong wick rejections in premium zones, and a need for confirmation

🧠 What the chart tells us:

Price is compressing between a D1 FVG (below) and unfilled premium OB (above)

Friday’s low wicked into a small imbalance — but was not a clean tap into the main OB

RSI is midrange, EMAs are flat, and momentum is indecisive

We're either gearing up for a bullish FVG reclaim or prepping for a deeper drop into discount

⚠️ Key Zones to Watch

🔵 Support Zones (Buy Zones)

3230–3208

→ D1 Fair Value Gap + unmitigated bullish OB + discount pricing

→ Valid only with clean bullish rejection. High interest for sniper entries if price returns.

3170–3154

→ Untapped daily OB + historical support wick + aligns with deeper discount zone

→ Stronger bounce zone if 3230 fails. Confluence with fib retracement & RSI likely oversold here.

🔴 Supply Zones (Sell Zones)

3420–3450

→ Premium FVG + D1 OB combo + previous bearish rejection wick

→ High probability inducement area. Valid only if price fails to hold 3344 flip.

3388–3402

→ Minor supply + internal structure break level

→ Short-term reaction area. Lower conviction but watch for rejection if price overextends.

🟡 Decision / Flip Zone

3327–3344

→ Former support now turned resistance

→ If this zone flips bullish and holds, bias shifts to continuation. If rejection occurs, confirms retracement deeper into discount.

✅ Conclusion

The market is entering a decision week — no rush. Let the chart guide you.

Clarity comes not from prediction, but preparation. This chart isn’t hindsight — it’s a live framework.

✨ Final Thought

If this chart feels clear, that’s because it was built with intention — not after the move, but before it happens.

The difference between noise and precision is structure.

And we don’t guess — we prepare.

🚀 If you appreciate detailed, real-time structure like this, hit follow and join the traders who value clean execution over hype.

💬 Drop your bias below — bullish or bearish this week?

📢 Disclosure: I use Trade Nation's broker feed on TradingView and I'm part of their influencer program.

📉 This is educational content and not financial advice.

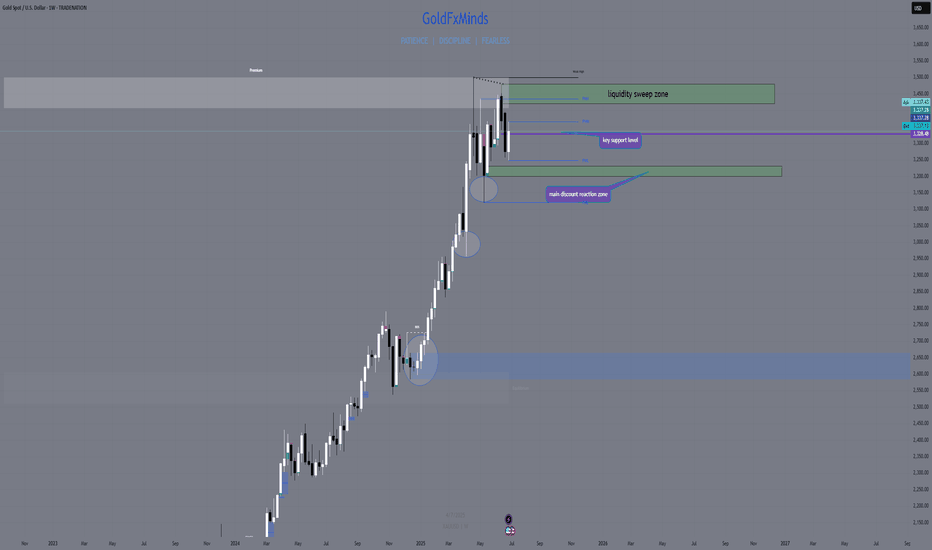

XAUUSD Weekly Outlook | July 7–11, 2025“The market always whispers before it roars. The wise trader listens to structure.”

Hello beautiful minds 💬

We enter the second week of July with strong macro undercurrents and new structure shifts beginning to show. While the U.S. celebrated Independence Day, the market quietly set up key zones for next week’s liquidity sweep.

🔸 Macro & Geopolitical Overview

🟠 Geopolitics: Tensions continue post-BRICS Summit, with a focus on further de-dollarization talks.

💰 U.S. Economy: Consumer credit and NFIB small business confidence to kick off the week.

🔔 Big catalysts:

Wednesday: Fed speeches (Mouslem, Waller, Daly)

Thursday: Unemployment Claims + Bond Auction

Friday: Federal Budget Balance (a key fiscal stress indicator)

📉 Expect spikes in volatility mid-week and dollar reactions post-FOMC speeches.

🔸 WEEKLY BIAS:

Still bullish to neutral, but momentum is cooling inside a premium rejection range.

Price broke structure to the upside in May-June, forming a new weekly higher high (HH) above 3380 — but failed to hold convincingly above the volume imbalance (void zone) around 3430–3480.

We are now rejecting premium and hovering just under the 3327 level — previous institutional support and the midpoint of the weekly FVG.

🔹 Weekly Key Zones

🟢 Support zone to watch (buy interest)

3204–3230 = Weekly FVG + equilibrium retrace + EMA50 rising

This is the main discount reaction zone. If price taps in with bullish PA, we look for bullish continuation toward 3327 then 3380.

🟡 Mid-level (decision point)

3327 = prior key support now acting as resistance

Watch how price reacts here — if it flips cleanly with a daily close, short-term bullish pressure may return.

🔴 Supply zone / resistance (sell interest)

3420–3480 = Weekly FVG + premium OB + liquidity sweep zone

This is the main premium rejection area. If tapped again without strong volume or fundamentals, this may fuel a swing short setup.

🔸 What This Means for You

This week is about patience and precision. The cleanest setups may come after volatility spikes during Fed speeches. Structure will tell — but emotional control will confirm.

If you feel like you’ve been chasing trades lately… this is the week to reset.

Focus only on sniper setups. Wait for them to form. Let others rush.

🔚 Final Words from the Team

Clarity beats chaos. Always. This weekly map is your compass — now it’s your job to wait, watch, and act with precision.

🔔 Follow GoldFxMinds for structured gold planning that respects both price and time.

🗨️ Drop a comment with your bias — bullish or bearish this week?

—

📌 Disclosure: This analysis is for educational purposes only and reflects market structure at the time of writing. No financial advice.

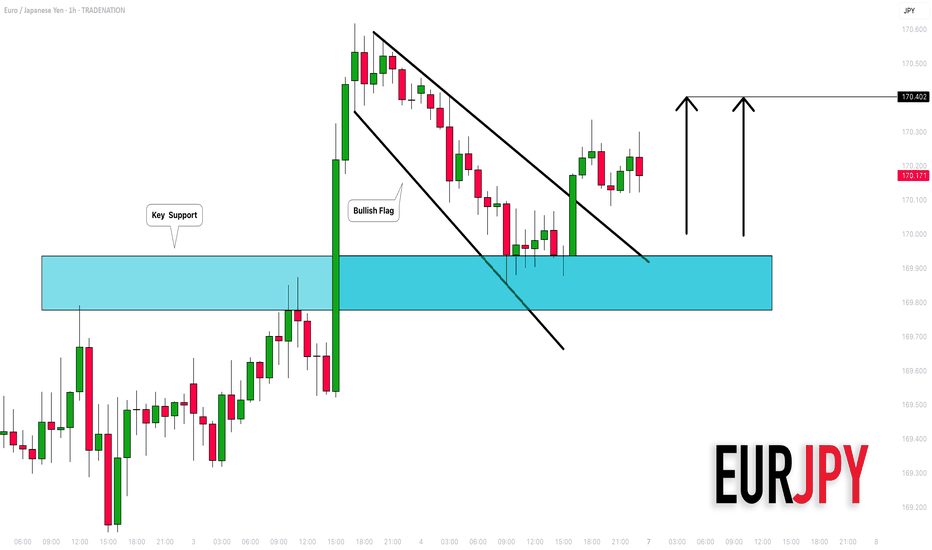

EURJPY: Bullish Outlook Explained 🇪🇺🇯🇵

There is a high chance that EURJPY will continue rising

from an underlined horizontal support.

I see 2 strong price action confirmations:

the price violated a resistance line of a bullish flag

and a neckline of a double bottom pattern.

Goal - 170.4

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.