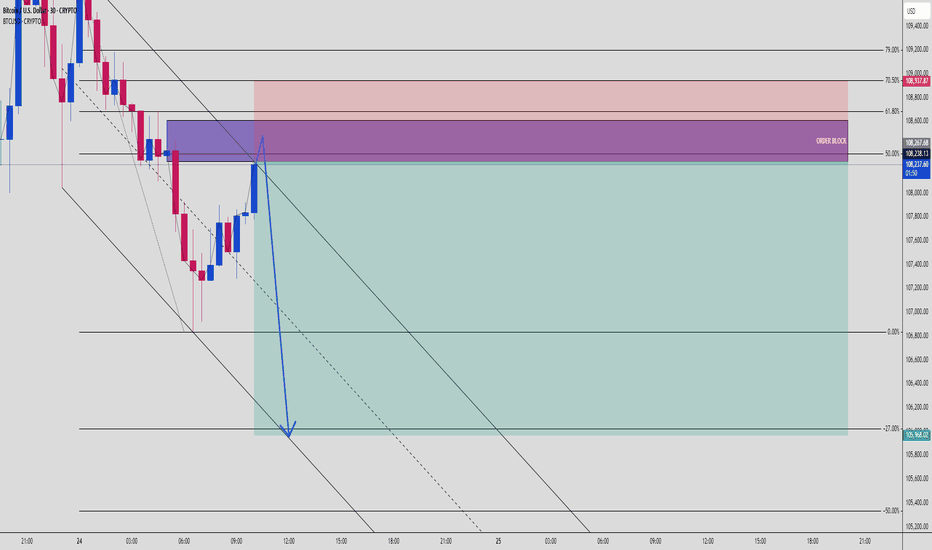

Bitcoin’s Fake Pump Ends HERE! OB + FVG = Bearish Trap?📊 BTCUSD SMC Breakdown (3D Chart)

Price tapped into a High Probability Reversal Zone (OB + 61.8–79% Fib) with strong downward projection. This is a classic case of Smart Money selling into late bull euphoria. 👀

🧠 Smart Money Story:

Sell-side Liquidity Grab: Prior highs got swept—liquidity hunted 💧

Order Block (OB) + 61.8–79% Fib: This area is confluence-rich

Channel Top + Trendline Rejection = Extra confluence 🧱

Strong bearish reaction wick confirms Smart Money presence 🔥

Projection drawn toward 105,968 = -27% extension

📌 Key Technical Zones:

Zone Type Level / Range

Order Block : 108,267.68 (Purple Zone)

Premium Zone (OB + FVG) : 108,267 – 108,938

Entry Trigger : 108,251.52 (Current Price)

SL Zone (Invalidation) : Above 109,000

TP1 – TP2: 106,800 – 105,968 (TP2 = -27%)

🛠️ Trade Setup Idea (Short):

Sell Entry: 108,251 – 108,937

Stop Loss: 109,200

Take Profit 1: 106,800

Take Profit 2: 105,968

RRR: ~1:4 📉💰

Priceactionbtc

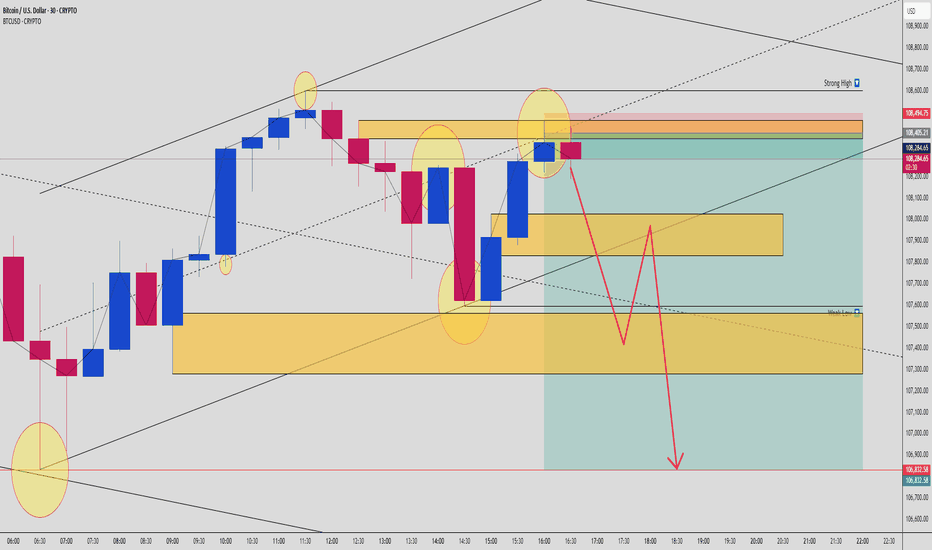

BTCUSD Smart Money Reversal: OB + FVG Trap Targets Weak Lows🚨 BTCUSD Smart Money Concept Alert (30-Min Timeframe)

A classic bearish setup is unfolding on Bitcoin, and it’s screaming trap + reversal for anyone watching closely. Here’s why this could be your high-probability short of the week… 👇

🔍 1. Liquidity Sweep at Key High

We just saw a clean sweep of prior swing highs near 108,400 – a clear signal that Smart Money has hunted liquidity above weak retail stops. That big push into the premium zone? Not real demand. It’s engineered manipulation. 🔧

📉 2. Premium OB + FVG Confluence

Price has just tapped into a juicy confluence zone:

🔲 Order Block @ ~108,400–108,494

🟦 Fair Value Gap (FVG) imbalance sits right below

🎯 All aligning with 61.8–79% Fib retracement from the prior bearish leg

This is where Smart Money institutions enter the party. Look left: it’s the same game played again and again. Trap the highs, fill the imbalance, then dump.

🔄 3. Reversal Evidence Already In Play

A bearish reaction candle confirms rejection from this OB zone. The wick shows aggression – a clear sign of selling pressure stepping in at the premium.

Expectations now shift from retracement to trend continuation toward unmitigated demand zones below.

🧠 4. Weak Low & Liquidity Engineering

Below current price lies a weak low around 107,300 – that’s your magnet. Price needs to sweep that inefficiency, and the structure suggests liquidity vacuum mode is active.

Key zone targets:

🟨 First TP: 107,800 (FVG base)

🟨 Second TP: 107,300 (weak low sweep)

🔻 Final TP: 106,832 (full mitigation zone = 1400+ pip potential)

🎯 5. Execution Plan

💼 Smart Entry:

Entry zone is anywhere from 108,250 to 108,490 (OB + FVG overlap)

SL above 108,600 (structure invalidation)

📊 Targets:

TP1 – 107,800

TP2 – 107,300

TP3 – 106,832

⚖️ RR: ~1:3 or better if executed precisely

🧩 Market Psychology:

This isn’t just technicals. It’s narrative vs. reality.

Retail sees breakout → Long

Smart Money sees sweep → Sell

Retail buys late → Fuel for Smart Money exits

🛡️ Risk Reminder:

Trade the setup, not emotions. Let price come to your zones. Stay mechanical, not emotional. Partial out and trail stops once TP1 hits. Never chase.

✅ Summary:

BTCUSD is showing a perfect bearish Smart Money setup. OB + FVG confluence, strong premium reaction, engineered weak low, and liquidity zones below. Textbook SMC pattern. Play it right, and this setup could deliver clean, high-RR profits.

⚡ Drop a “BTC READY” in the comments if you're watching this one with sniper focus.

🧠 Tag a trading buddy who still thinks we’re in a breakout!