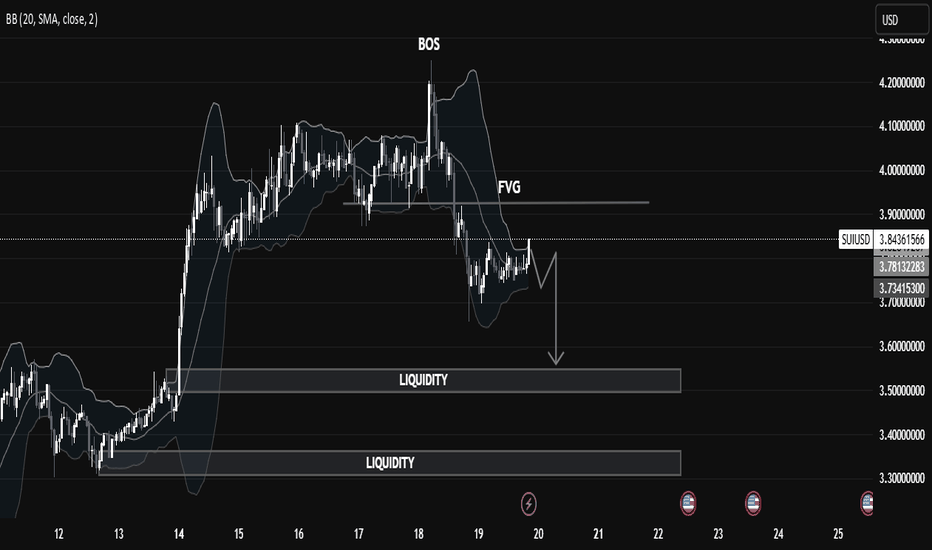

SUIUSD Liquidity Trap in Motion: Price Targeting Deeper Pools🧠 Market Structure Insight (SMC Framework)

🔍 1. Break of Structure (BOS):

The most recent BOS around the $3.95 level marked a bull trap, indicating a transition from bullish momentum to a distribution phase. This suggests institutional players offloaded liquidity at premium prices before initiating a markdown.

🕳️ 2. FVG (Fair Value Gap):

A visible Fair Value Gap (Imbalance) remains unmitigated above the current price action. This zone acted as a supply area, where price sharply moved down, leaving inefficiency in its trail—now serving as a potential point of rejection if revisited.

📌 Liquidity Zones:

Upper Liquidity Cleared: Price has swept highs before reversal (a sign of engineered liquidity grab).

Double Liquidity Pools Below:

First pool: Around $3.55 - $3.60

Second pool: Deep liquidity around $3.30 - $3.35

These levels are highly attractive for Smart Money to target next, suggesting continuation to the downside.

📉 Current Price Behavior:

Market is consolidating in a tight range just below FVG, signaling potential re-accumulation of sell orders.

The chart pattern suggests a potential lower high forming, likely to precede a bearish leg towards liquidity zones.

Bollinger Bands show compression, hinting at volatility expansion soon.

🎯 Trade Outlook (Not Financial Advice):

🔻 Bearish Bias:

Unless price breaks above the FVG zone with strong bullish momentum, the probability favors a bearish continuation targeting:

1st Target: ~$3.55

2nd Target (Deeper liquidity grab): ~$3.30

A rejection from FVG followed by a BOS to the downside would serve as confirmation for this bias.

📚 Educational Takeaway:

This chart is a clean illustration of Smart Money Concepts in play:

BOS > FVG > Liquidity Sweep

Price respects institutional footprints: grab liquidity, fill imbalances, then drive toward untouched liquidity zones.

Recognize market intent through structure shifts and imbalance reaction.

Priceactionmastery

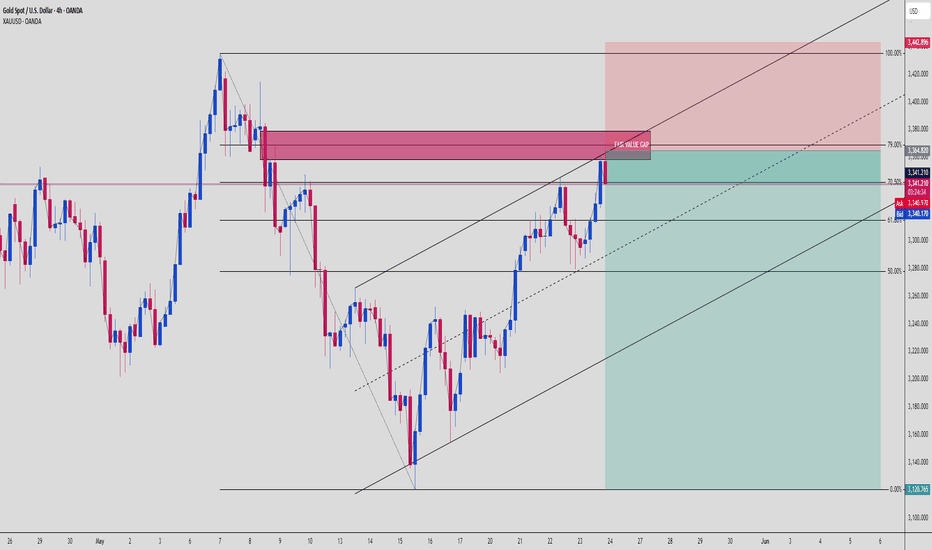

GOLD is About to COLLAPSE from a Fake Pump!📊 GOLD SMC Analysis (XAU/USD 4H)

Gold just tapped into a major Fair Value Gap + Premium OB Zone, aligning with the 79% retracement level. Market structure shows exhaustion, and a perfect short setup is forming.

🔍 Smart Money Narrative:

Strong prior bearish move = institutional sell-off ✅

Clean retrace into FVG (Fair Value Gap) and OB (Order Block) = sell zone 💯

Price tapped into 3,351 – 3,364 range (marked red)

That level aligns with the 79% Fib + channel resistance 🚨

The confluence = Smart Money liquidity grab ➡️ expect dump

📍 Key Confluences:

✅ FVG: clear imbalance filled (great trap zone)

✅ Order Block: bearish origin of last impulse

✅ 79% Fib Level: classic retracement kill zone

✅ Bearish Trendline + Channel Top: dynamic resistance

✅ 3:1+ RRR short idea in play

📉 Trade Plan (Sell Setup):

Entry Zone: 3,351 – 3,364

Stop Loss: 3,442 (above swing high)

Take Profit:

TP1: 3,280 (61.8% level)

TP2: 3,120.76 (full move, 0% Fib)

RRR: 1:3 to 1:4 🤑🔥

🧠 Institutional Logic:

Retail is chasing breakout highs 😬

Smart Money is selling into OB + FVG → trap those late longs

Next? Smash weak lows and rebalance price with a deep pullback

💬 “Gold’s headed for a cliff dive?” Drop a 💰 or ‘XAU’ if you’re riding this wave down!