DBRG is taking SWCH private? What now?Well, right after data center infrastructure stock SWCH announced solid 1st quarter earnings results, we get an announcement that it's going private. DBRG and IFM Investors are taking it private for $11 billion. Shareholders will get $34.25 per share on the transaction.

The price action gapped up to around that level and it will stay in this range until the transaction is complete and SWCH shares disappear from the exchanges.

This looks like a good thing for SWCH fundamentally, as the company continues to expand its data center capacity. You need investors to keep buying up land for data center infrastructure.

Solid Revenues and Net Income growth make the purchase a sweet deal for NYSE:DBRG and IFM, which is not publicly traded.

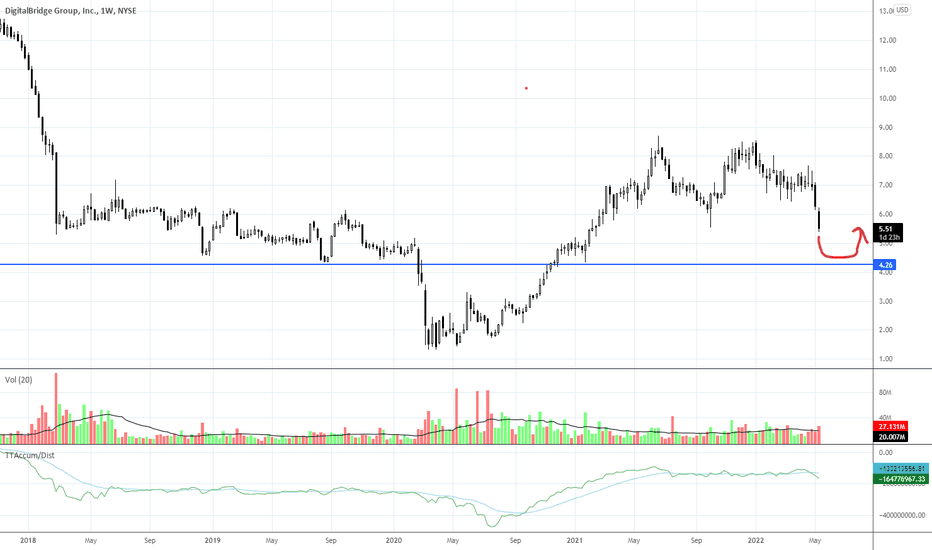

But don't go running to buy the REIT DBRG just yet. It's taking a dive like most other large caps. And an acquisition is a costly thing for any company--this can put a dent in the trend of the share price.

Like I've been writing throughout the index correction: WAIT for the bottom to develop. Most traders and investors are just impatient. If you'd just wait for it...

Thanks for reading, hope you learned a little something. Visit my website to learn more.

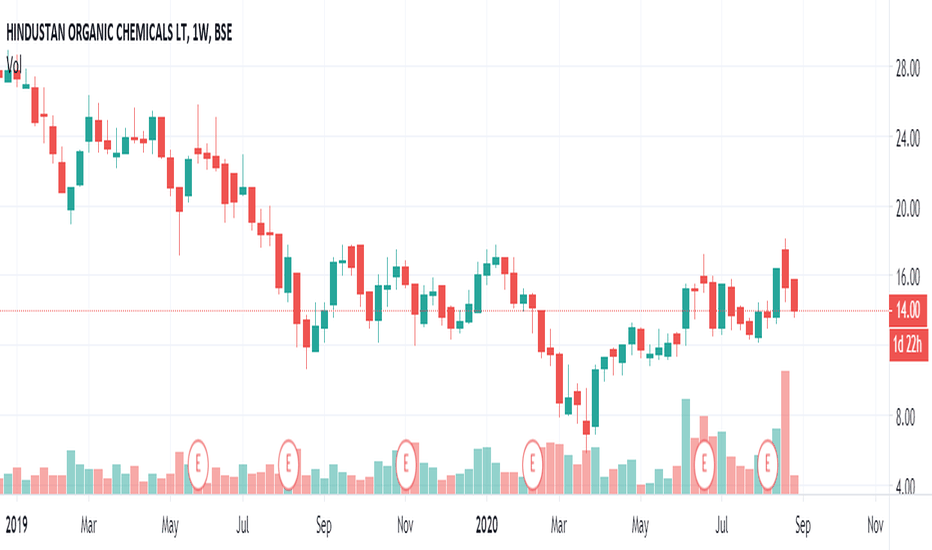

Privatization

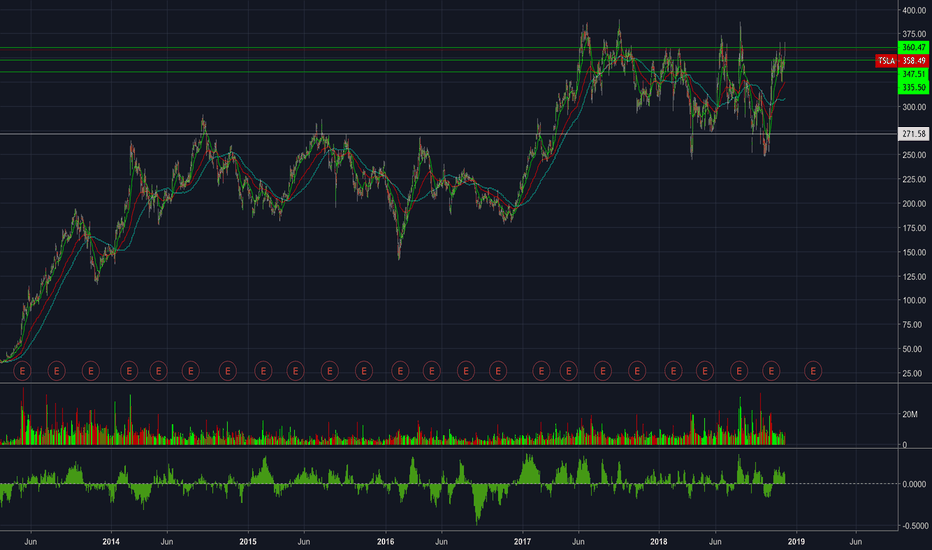

TSLA - leading the charge but one of many to comeTSLA ; despite their occasional run-in with the SEC or hickup from logistics behind timing in production Tesla is a dominate force in an emerging market and can not be ignored as a force to be reckoned with. AMZN found itself in a very similar situation back in 2005 and since then they have proven their value through diversification and exemplary customer service. The only problems Tesla might run into is over diversifying before the time is right. Musk has been diligent as to feed the company cash as it's needed to ensure the success of the business. The fact that NASA was able to effectively privatize space travel is just icing on the cake and I think we see this trend continue... prisons and space leading the charge but there are many other subcategories that have potential for privatization and Amazon and Tesla will be the leading brands into 2030s, at this rate, no doubts.

From the technical side TSLA looks great above 271.85 for the *long* (bullish) ((price to go up))... our next key level and the one acting as resistance presently is 360.47. Beyond this we will push new alltime highs and I believe a catalyst will be required for this to happen and the move will happen quickly.