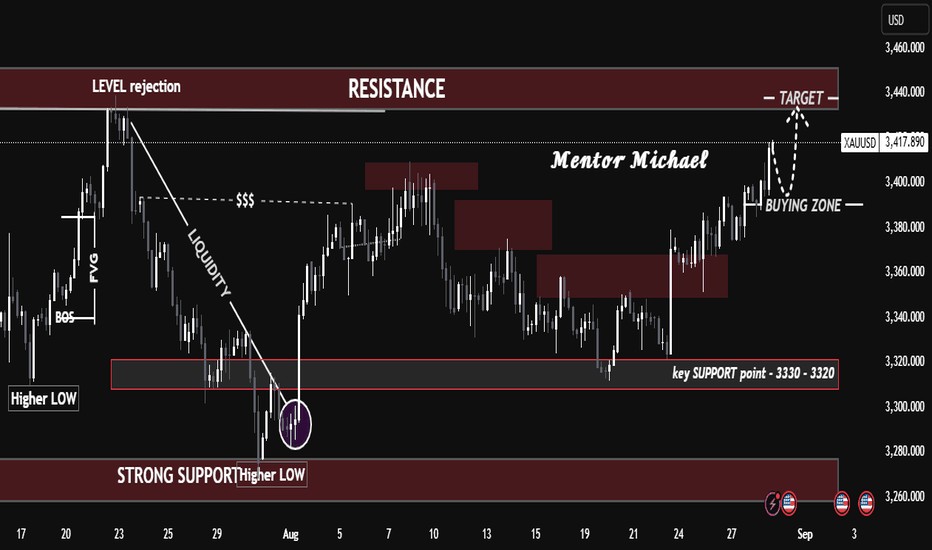

XAUUSD Professional OutlookXAUUSD Professional Outlook

Gold has been carving out a strong bullish structure, showing resilience after multiple liquidity sweeps and rejections from deeper zones. The chart indicates that buyers continue to dominate, with price currently pressing toward a critical resistance region.

🔹 Key Observations

Structure Alignment

The market has successfully defended every higher low, proving the strength of buyers.

Recent momentum confirms that demand zones are being respected while supply zones are gradually weakening.

Support & Demand Control

3320 – 3330 stands as a major structural support, where liquidity was swept and buyers re-entered aggressively.

Current buying zone around 3380 – 3400 is the short-term level where fresh orders may accumulate before continuation.

Resistance in Focus

The resistance block around 3415 – 3440 is the immediate test.

A rejection here could trigger a controlled pullback, but the probability favors a bullish breakout given the ongoing higher-low pattern.

Liquidity Dynamics

Smart money has already cleared liquidity below the July swing.

Market is now targeting liquidity pockets above, aligning with a push toward the 3440+ region.

🎯 Trading Scenarios

Bullish Case (Higher Probability)

Buy retracement toward 3380 – 3400, with upside targets at 3440 and extended 3480 – 3500 if breakout occurs.

Bearish Risk Case

Failure to hold above 3380 could push price back into 3320 demand, where the larger bullish thesis would be tested.

📝 Final Note

Gold is operating in a controlled bullish cycle with momentum favoring buyers. As long as 3320 holds firm, dips remain buying opportunities, and the path of least resistance is upward. The upcoming test at 3440 will be decisive for either a strong continuation or a temporary pullback

Professtionalchart

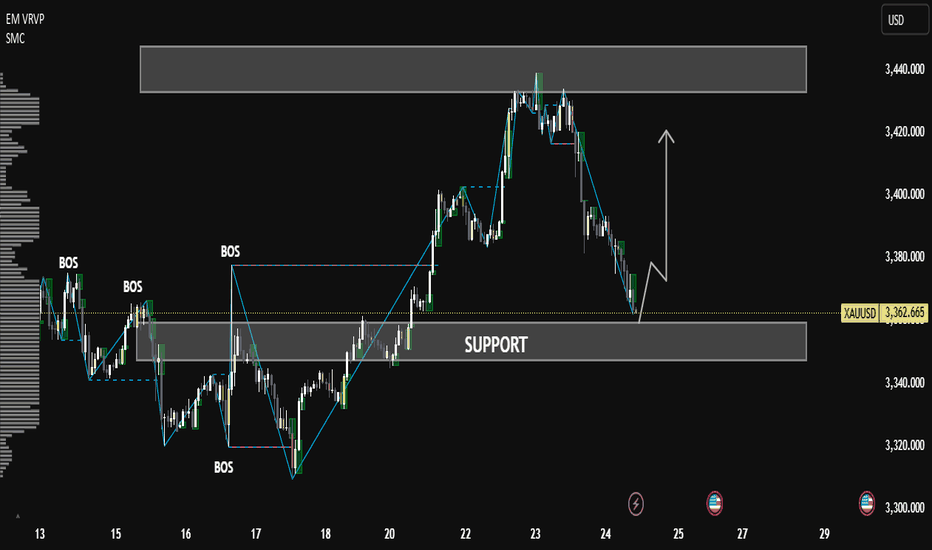

XAUUSD Price Analysis — Support Zone Reaction & Potential XAUUSD Price Analysis — Support Zone Reaction & Potential Bullish Reversal

🔍 Market Structure Overview

The chart shows a clear bullish market structure characterized by multiple Breaks of Structure (BOS) and a strong upward trend that recently corrected into a key support zone around 3360–3340.

This correction phase may be coming to an end as price reaches a high-probability demand area, with bullish reaction forming at the support level.

🧠 Smart Money Concept (SMC) Breakdown

📌 Break of Structure (BOS) confirms institutional activity and directional bias.

🔄 After a strong uptrend and BOS on July 22–23, a healthy retracement has taken place toward a major demand zone.

The support level is aligning with past consolidation and previous BOS zones, providing confluence for a bullish bounce.

📊 Technical Confluence

✅ Volume Profile (VRVP) shows strong buyer activity at current levels.

✅ The price is reacting within the support box with a small bullish candle, indicating potential accumulation.

✅ A clean liquidity sweep may have occurred just below minor lows, shaking out weak hands before a move upward.

🎯 Forecast

If price holds above the 3360 level, and bullish confirmation continues (e.g., break above minor lower highs), we can expect:

Short-term target: 3400

Major target: 3440 (marked resistance zone)

⚠️ Invalidation: A clean break and close below 3340 may lead to deeper correction or change in structure.

📘 Educational Title Suggestion

"Smart Money Reaction at Demand: XAUUSD Poised for Reversal from Key Support"