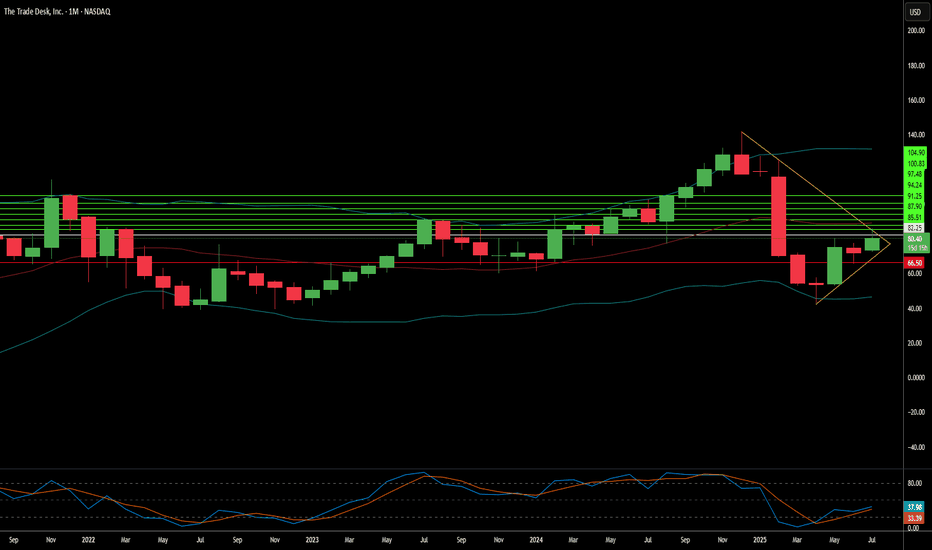

The Trade Desk: Why the Sudden Surge?The Trade Desk (TTD) recently experienced a significant stock surge. This rise stems from both immediate market catalysts and robust underlying business fundamentals. A primary driver was its inclusion in the prestigious S&P 500 index, replacing Ansys Inc. This move, effective July 18, immediately triggered mandated buying from index funds and ETFs. Such inclusion validates TTD's market importance and enhances its visibility and liquidity. This artificial demand floor, coupled with TTD's $37 billion market capitalization, underscores its growing influence within the financial landscape.

Beyond index inclusion, TTD benefits from a significant structural shift in advertising. Programmatic advertising is rapidly replacing traditional media buying, expected to account for nearly 90% of digital display ad spending by 2025. This growth is driven by advertisers' need for transparent ROI, publishers avoiding "walled gardens" through platforms like TTD's OpenPath, and AI-driven innovation. TTD's AI platform, Kokai, greatly lowers acquisition costs and enhances reach, resulting in over 95% client retention. Strategic partnerships in high-growth areas like Connected TV (CTV) further reinforce TTD's leadership.

Financially, The Trade Desk demonstrates remarkable resilience and growth. Its Q2 2025 revenue growth of 17% outpaces the broader programmatic market. Adjusted EBITDA margins hit 38%, reflecting strong operational efficiency. While TTD trades at a premium valuation - over 13x 2025 sales targets-its high profitability, substantial cash flow, and historical investor returns support this. Despite intense competition and regulatory scrutiny, TTD's consistent market share gains and strategic positioning in an expanding digital ad market make it a compelling long-term investment.

Programmatic

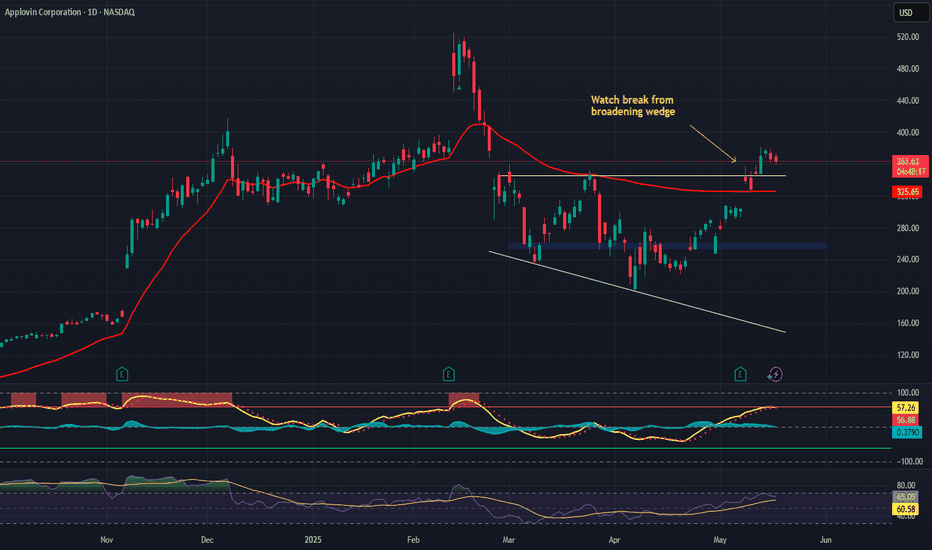

AppLovin Corporation (APP) – Rewiring Ad Tech with AI at ScaleCompany Snapshot:

AppLovin NASDAQ:APP is shedding its legacy gaming identity and emerging as a pure-play AI advertising infrastructure leader. Post its $900M gaming unit divestiture, the company is laser-focused on AXON 2.0, its next-gen AI ad engine, positioning APP as one of the most transformative players in the digital ad ecosystem.

🚀 Key Growth Drivers:

🧠 AXON 2.0 – AI-Powered Programmatic Ad Platform

Delivers real-time ad bidding with predictive optimization

Retail and eCommerce verticals seeing rapid adoption

Scalable infrastructure = operating leverage + high margin tailwinds

🛠️ Self-Serve & GenAI Expansion

Self-serve ad tools on the roadmap = democratizing access for SMBs

Generative AI ad creatives enable fast, customized campaigns at scale

Broadens TAM beyond top-tier advertisers to long-tail marketers

💰 High-Margin, Asset-Light Model

Post-divestiture, APP’s margins are structurally higher

Lean, software-first model with strong unit economics and cash generation

Flexibility for buybacks, R&D, or strategic M&A

📊 Market Positioning & Flywheel

Network effects: More advertisers = better data = smarter bidding

Competes with The Trade Desk, Google DV360, and Meta in ad optimization

First-mover advantage in mobile AI bidding infrastructure

📈 Financial & Strategic Highlights:

Q/Q margin expansion amid rising advertiser retention

Structural cost improvements post-gaming spinout

Potential for SEED_TVCODER77_ETHBTCDATA:2B + in annualized EBITDA as AI scaling accelerates

🧭 Investment Outlook:

✅ Bullish Above: $255.00–$260.00

🚀 Upside Target: $520.00–$525.00

🎯 Thesis: AppLovin is evolving into the NVIDIA of mobile ad tech—using proprietary AI infrastructure to reshape programmatic advertising. With high-margin growth, expanding use cases, and a clear product vision, APP is a top-tier AI advertising compounder.

#AppLovin #APP #AdTech #AXON #AIAdvertising #Programmatic #DigitalMarketing #GrowthStock