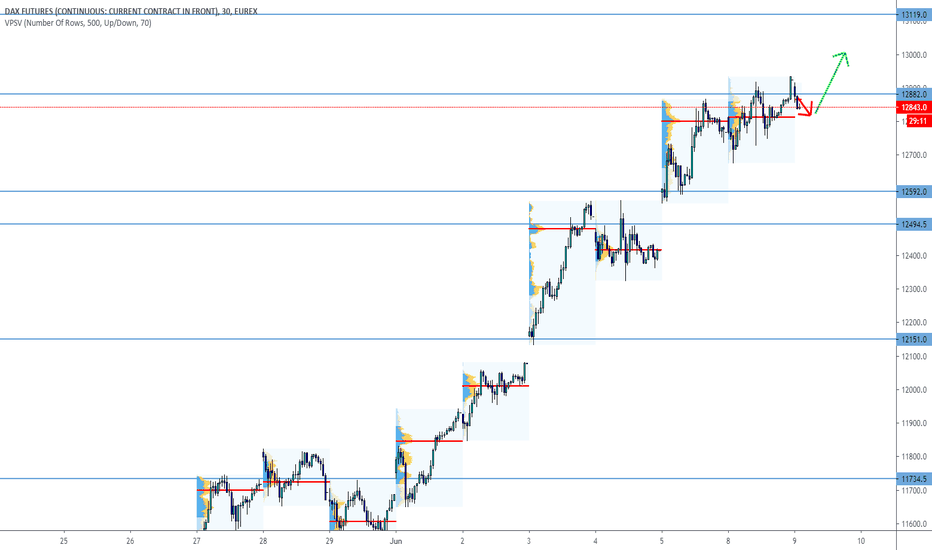

Dax daily: 09 Jun 2020Yesterday's price action has, again, brought great profiting opportunities and Dax added another day to its bullish uptrend, even though the daily range was relatively standard. Right with the open of the European session, the price retested VPOC from Friday and continued consistently towards our resistance of 12 882 where it exemplarily bounced back lower and we were presented with another long entry opportunity on the pullback, below Friday's fair value. Dax eventually broke the resistance and closed at it's high at 12 934.

Important zones

Resistance: 13 119

Support: 12 592, 12 882

Statistics for today

Detailed statistics in the Statistical Application

The statistical probability of yesterday's High breakout is 90%

Macroeconomic releases

NIL

Today's session hypothesis

Dax has opened the day in the near vicinity of the 12 882 S/R zone. We see good chances right at the beginning of the session, especially for closing the gap towards yesterday's close and also retesting this value with the probable scenario of bullish continuation. The Statistical application also favours this thesis as the indication is for a 90% probability of yesterday's High breakout. We don't have any fundamental releases scheduled for the day hence we stick with our hypothesis uptrend continuation, best on pullbacks until we see some clear signs of a correction.

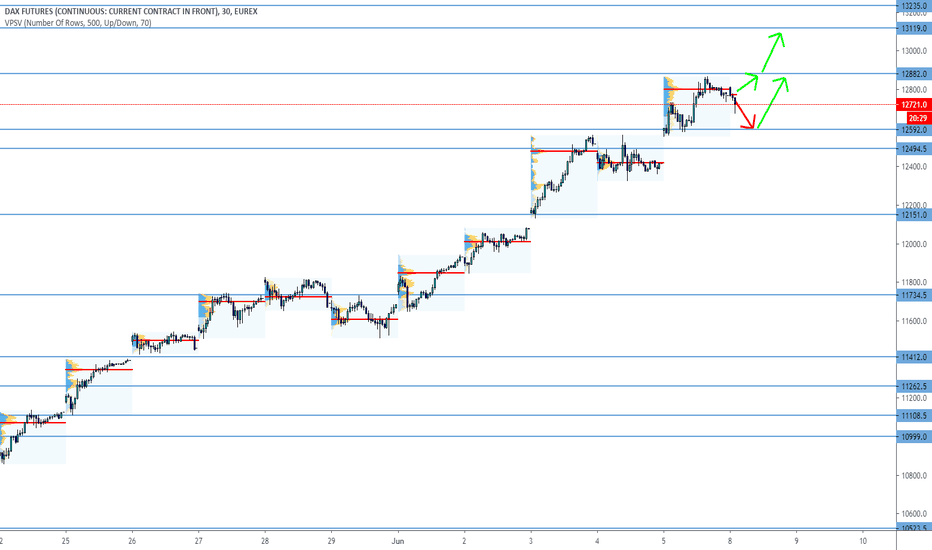

Proprietarytrading

Dax daily: 08 Jun 2020Welcome to the new trading week. Our analysis on Friday turned out very successful, again. According to our statistical application, we saw the closure outside of the previous day range as this hypothesis had a high statistical probability. Dax continued in its bullish traction all the way towards the resistance level at 12 882 and the NFP print helped considerably in this. We haven't yet seen the correction.

Important zones

Resistance: 12 882, 13 119

Support: 12 592

Statistics for today

Detailed statistics in the Statistical Application

Macroeconomic releases

NIL

Today's session hypothesis

A strong uptrend is underway and nothing suggests it should change. For some time already, we anticipate the correction, but Friday's NFP release hasn't really supported this vision, quite the contrary. There is a wave of optimism in the US markets but this is considered unsubstantiated if not false by many analysts. We'll only see the real economic impact of the coronavirus crisis with a delay. The US Indexes reacted to the labour data with obvious positivism and Nasdaq has printed another new record high, wiping out the entire crisis sell-off as if nothing happened. Dax is enjoying this correlated wave of markets optimism. The volume of orders has shifted higher to 12 800 and this week opened at this level, without a significant gap. Until we get some signs of a correction, we prefer to follow the trend with entries at pullbacks.

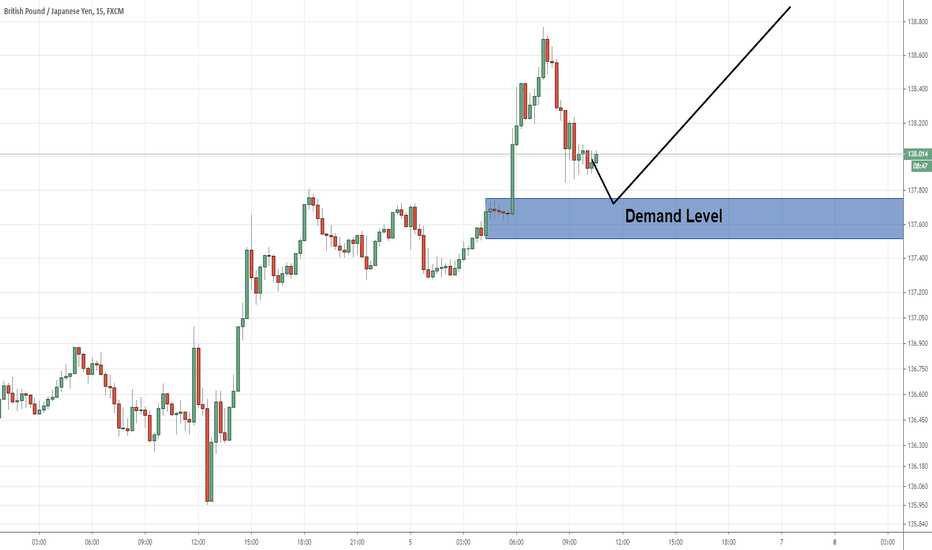

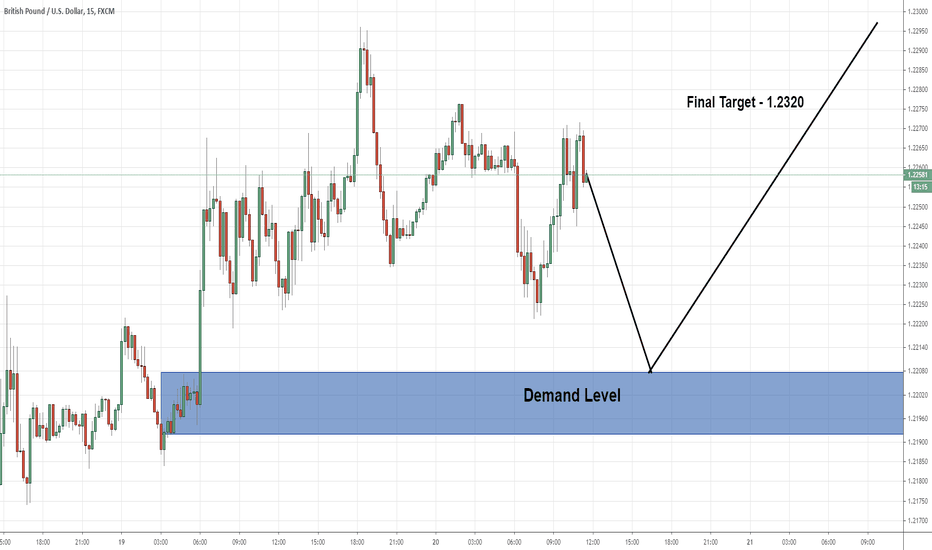

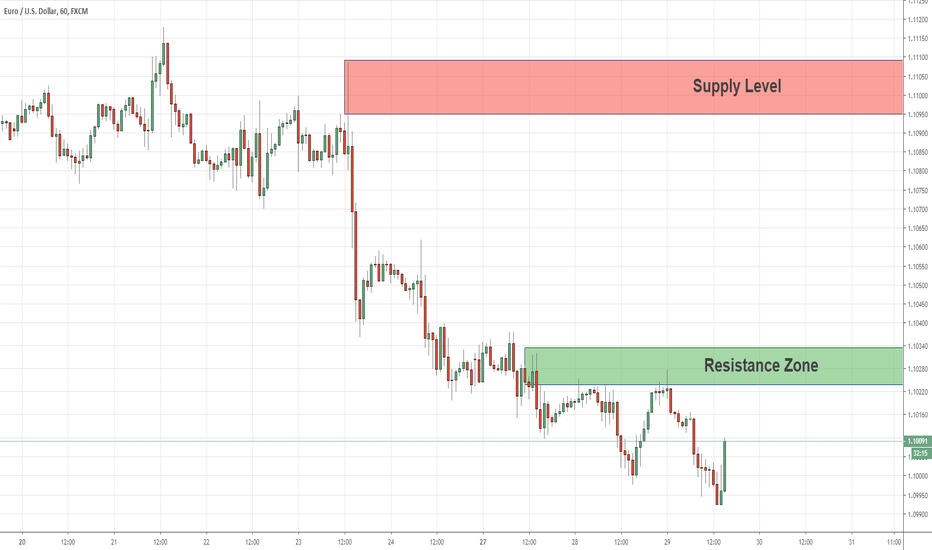

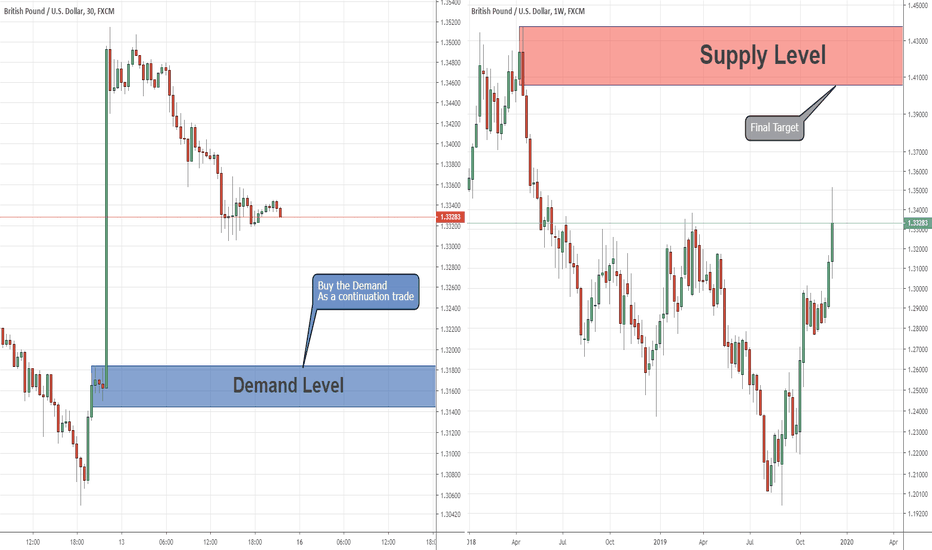

Intraday Key Levels for GBP/USDThese are the next critical key levels to look for intraday positions on GBP/USD.

As we can see the price is bullish at the moment and it seems the price on its way to reaching the supply above.

The demand below seems like a great continuation level for a buy position and if the price retrace that demand I'll buy there.

The supply above is a great level for sell position as a reversal position.

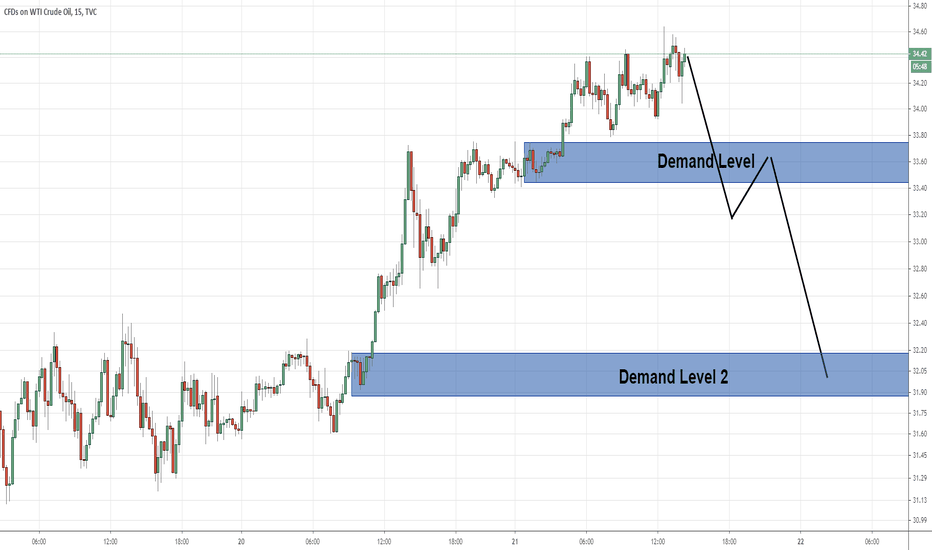

Waiting for reversal opportunityAfter this significant uptrend, I preferred to wait for a reversal signal.

I'll wait for the price to break out the demand below and if that happened I'll look for a price action setup to sell the USOIL.

The target for this position will be demand 2 at the bottom.

This position is relevant for intraday traders

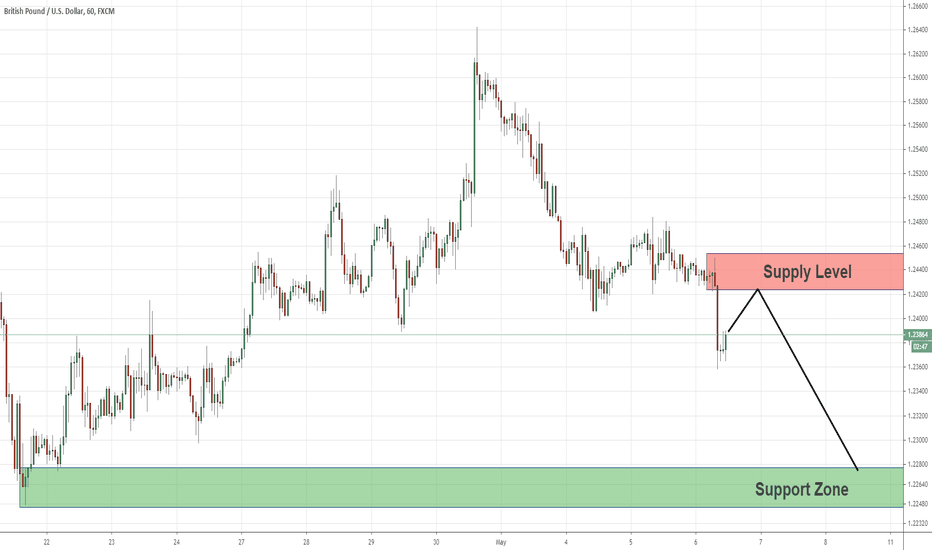

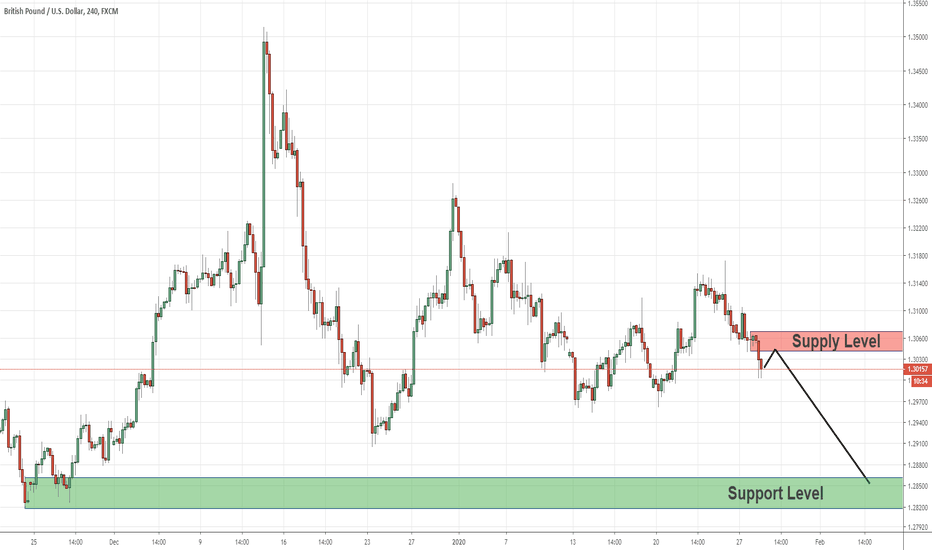

GBP/USD: Opportunity for Swing Sell PositionAs we can see in this H4 chart, the GBP/USD price created a new supply above earlier today.

It seems like a great level for sell position as a for swing traders.

If the price retraces that supply I'll sell there and the final target for this position will be the support below.

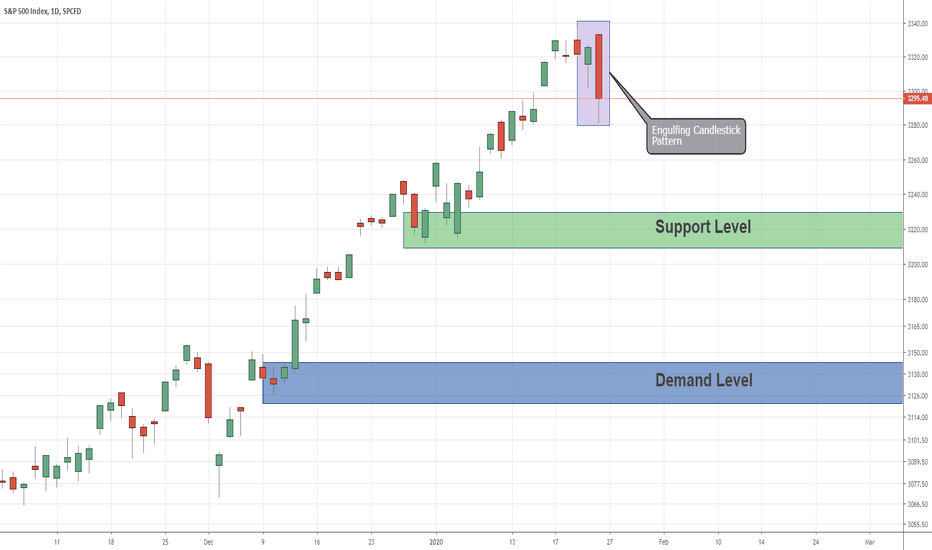

SPX500: Engulfing Candlestick Pattern on Daily ChartAs we can see, the SPX500 price created engulfing candlestick pattern.

We can see how the last trading day engulfed the previous one.

It indicates for reversal opportunity.

I'll look for sell position at 3318.00 zones.

The first target will be the support level below and the final target is the demand at the bottom.

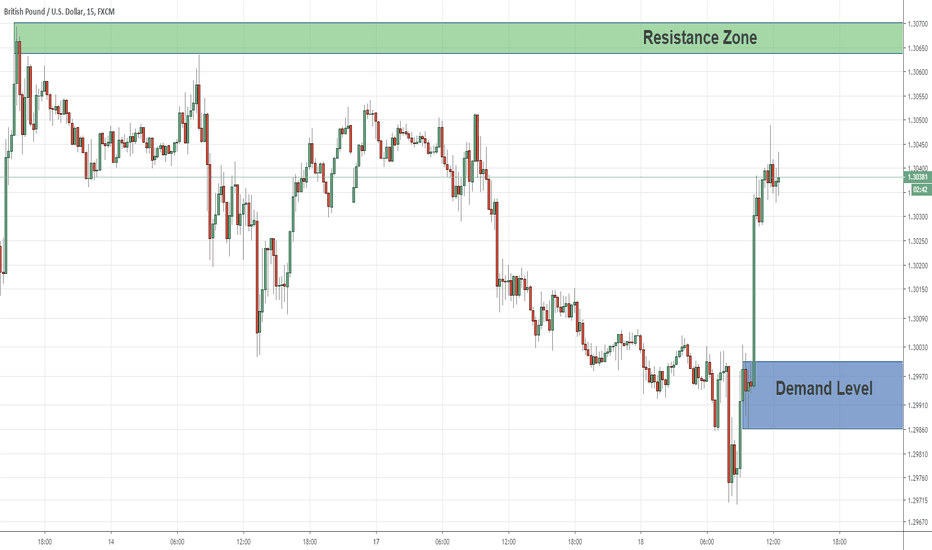

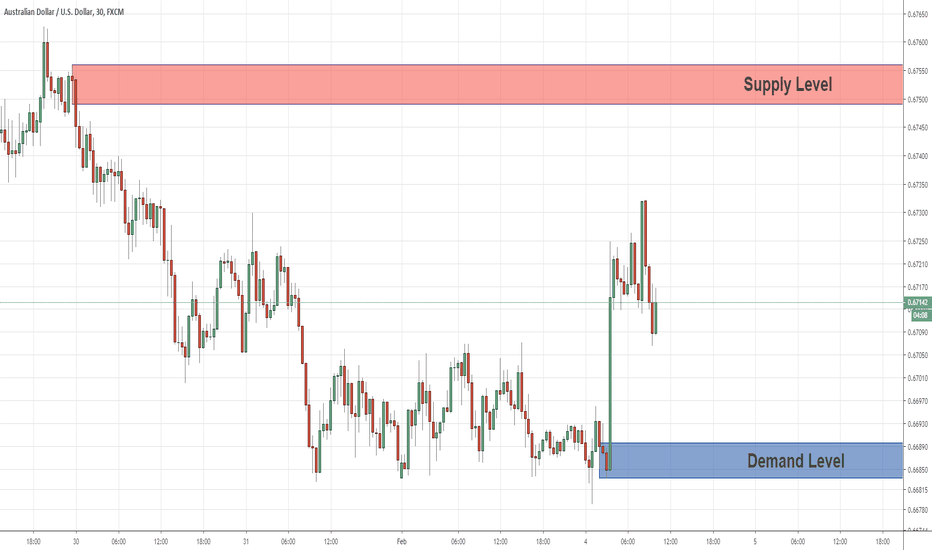

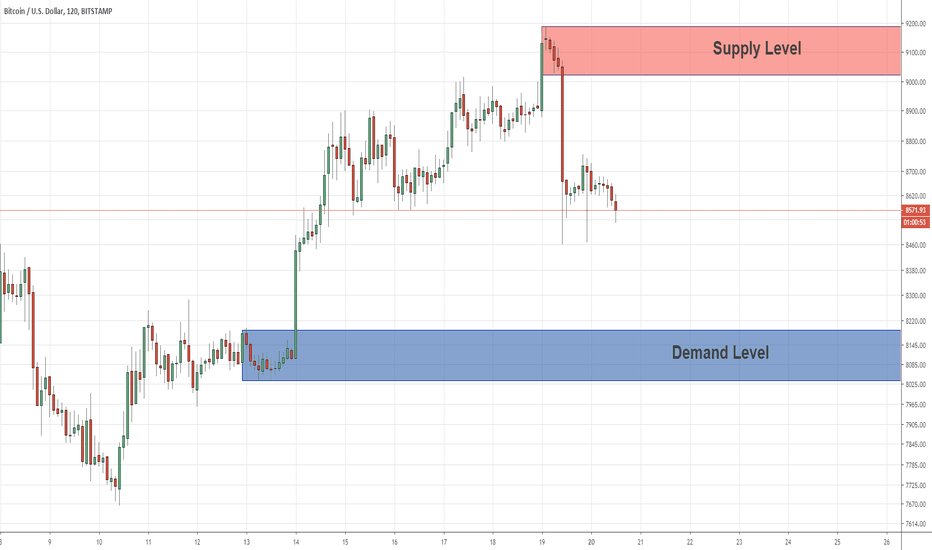

GBP/USD: Key Levels for Swing TradersAs we can see, the price creates a new demand below that broke out the previous supply from left.

It indicates strong demand,

For now, it seems the price on his way to reach the supply above, and therefore, if the price retrace the demand below I'll buy there.

The final target will be the supply above.

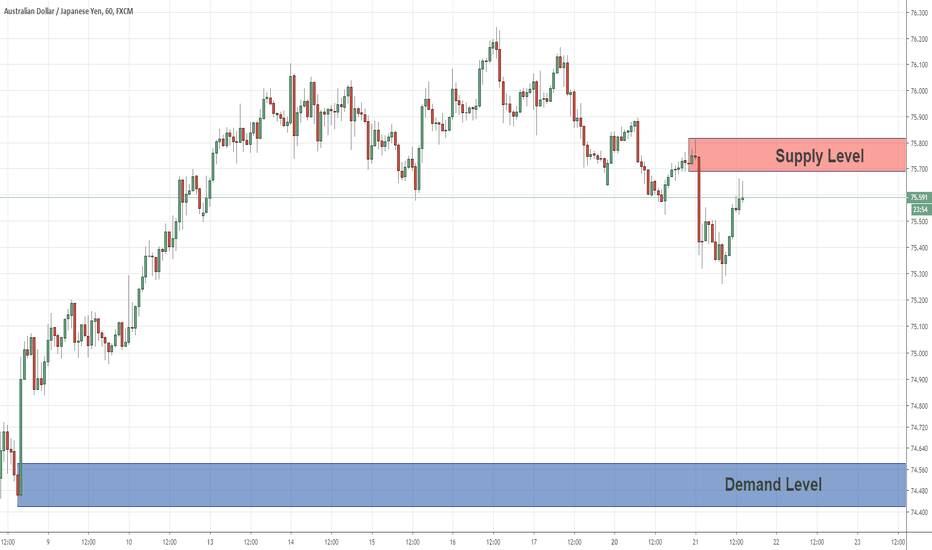

AUD/JPY: Great Continuation LevelAs we can see in the H1 chart, the price changed the momentum to bearish.

It seems the price now tends to reach the demand below.

At the moment, the price gets really close to touching the supply above which is a great level for sell position.

I'll sell at this supply at the first touch of the price and the demand below will be the final target.

USOIL: Two Levels for Sell PositionUSOIL price created two fresh supply levels above,

Each one of them seems like a great level for sell position.

I'll sell USOIL price at supply - 1 and set the stop loss just above this level,

If the price will hit the stop loss I'll sell again at supply - 2.

Both have great risk-reward potential.

CHF/JPY: A Great Level to Join The DowntrendAfter the recent uptrend which we can see on the left side of the chart, the price has changed to a downtrend.

Above us, there is a great fresh supply that seems like a great level to sell CHF/JPY.

I'll sell at this level and the final target will be the support below.

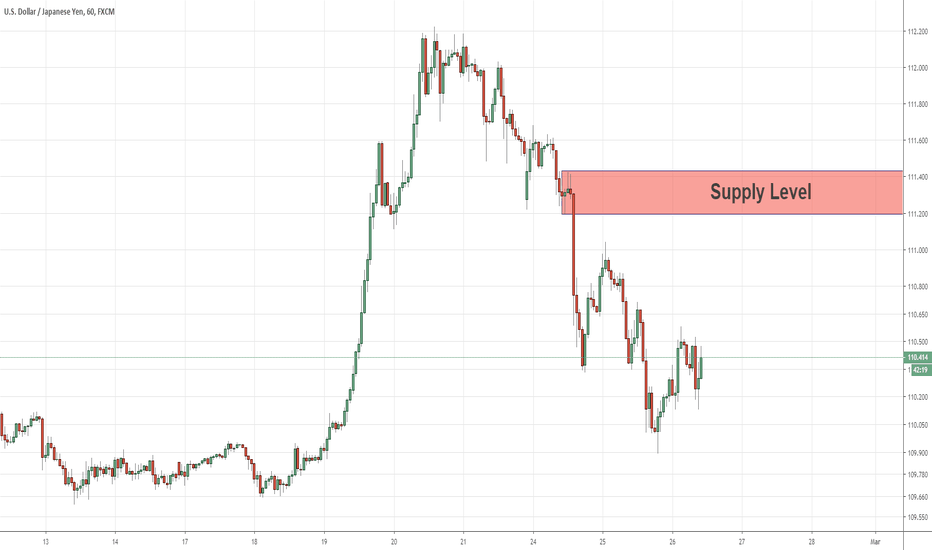

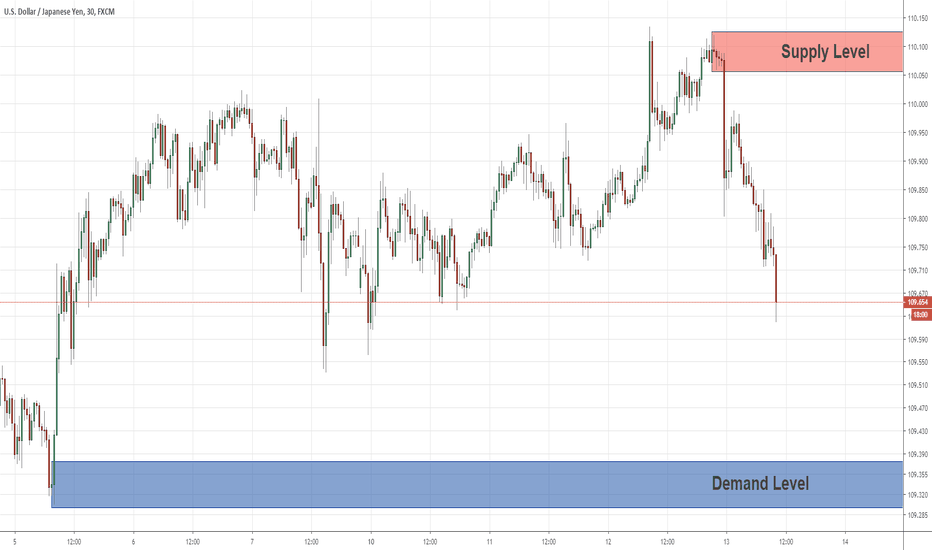

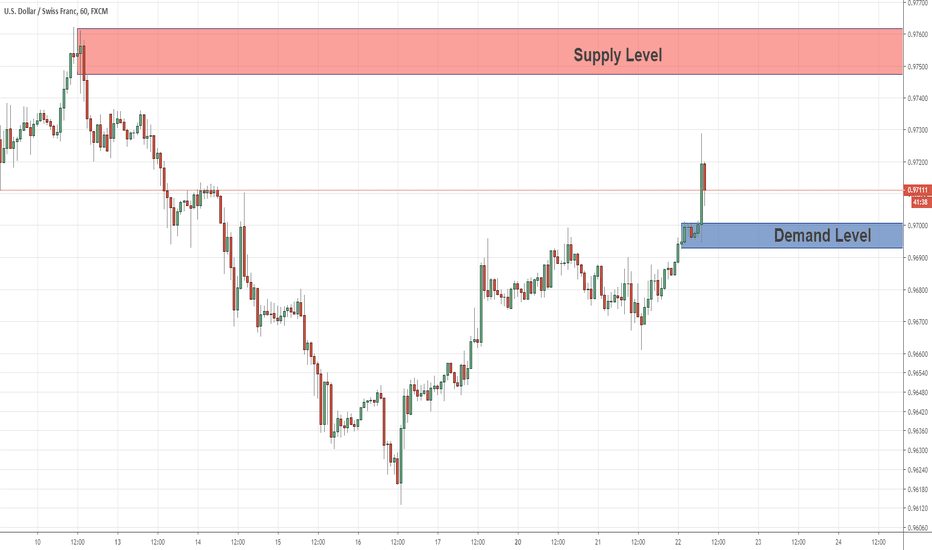

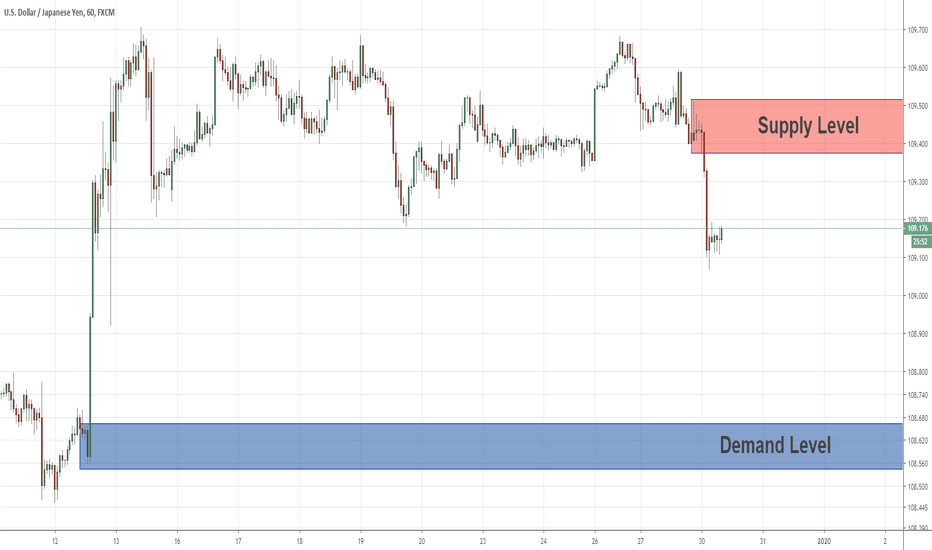

USD/JPY: Key Levels for Intraday PositionsAs we can see on the H1 chart, the price just creates a fresh supply above.

It seems that the price now on its way to reaching the demand below.

If the price will retrace the supply above I'll sell there,

The target will be the demand below which is also a great level for buy position.