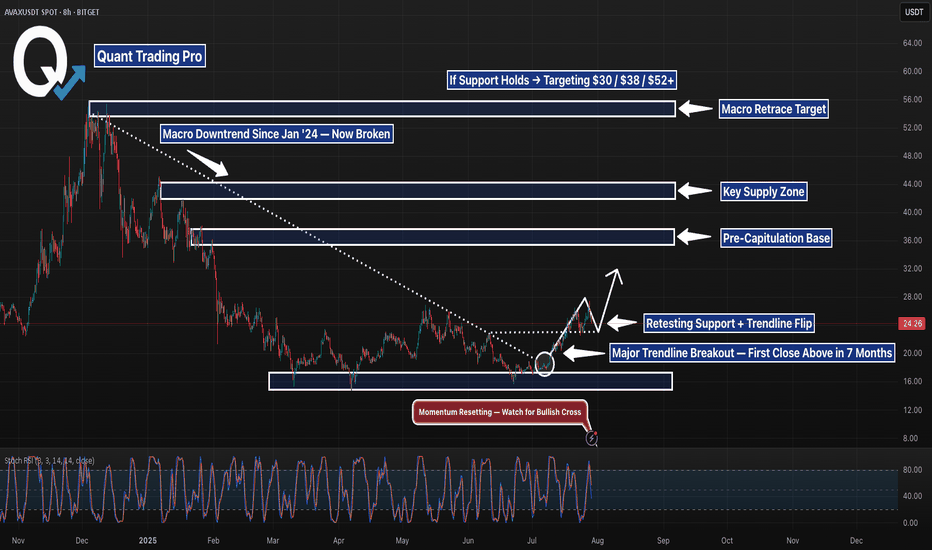

AVAXUSDT 8H — Trendline Break Confirmed, Retest in ProgressAVAX just closed above a 7-month macro downtrend and is now pulling back into a high-confluence retest zone. With the prior trendline now acting as potential support — and price holding above a multi-tap demand level — this is a high-stakes inflection point.

📊 Technical Breakdown:

Breakout:

The descending trendline that defined AVAX’s entire bear structure since January has finally broken. A clean candle close above that line marked a shift in control from sellers to buyers.

Retest Zone:

Price is now sitting directly on top of the broken trendline and the horizontal demand zone that’s held since Q1. This dual-level confluence offers a high-probability bounce area — or a decisive invalidation if lost.

Momentum Check:

Stochastic RSI is resetting — not overbought — giving bulls room to push higher if this retest holds.

Targets to the Upside:

$30 – Local breakdown zone from late Jan

$38 – Pre-capitulation base (March)

$44 – Major structural resistance

$52–53 – Full retracement target from the December high

🧠 Trade Context & Bias:

Bullish case:

A bounce here with strong volume confirms the trendline flip and opens the door for midterm continuation toward the $38–$44 zones.

Bearish case:

If AVAX breaks below $22 with momentum, this would invalidate the breakout structure and shift bias back toward range-bound or bearish continuation.

This is where structure meets opportunity. A successful retest could place AVAX at the front of the next altcoin rotation — but only if buyers defend this level with conviction.