Unveiling the Complex Landscape of Sally Beauty's Q1 PerformanceSally Beauty Holdings Inc. (NYSE: NYSE:SBH ) stands as a distinctive player, catering to both everyday consumers and salon professionals with a diverse array of salon-quality beauty products. The recently unveiled Q1 FY2024 earnings report, however, paints a nuanced picture of the company's performance. While some aspects hint at resilience, others raise concerns, leaving investors and industry observers eager to decipher the path forward.

Understanding the Financial Landscape:

The Q1 results saw Sally Beauty ( NYSE:SBH ) reporting revenue in line with expectations but registering a 2.7% year-on-year decline, settling at $931.3 million. Delving into the financial metrics, the company's GAAP profit per share dropped from $0.52 to $0.35 over the same quarter last year, signaling a notable dip in profitability.

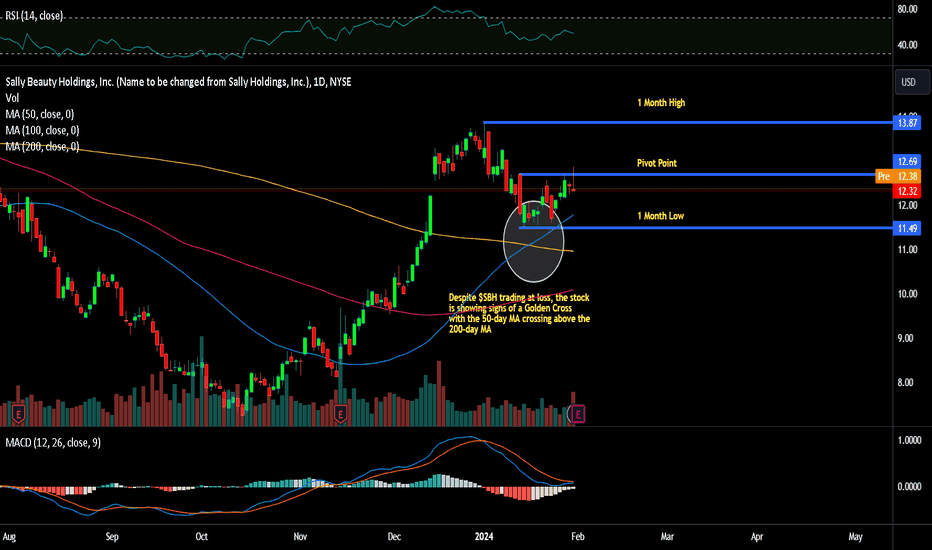

Analysts anticipated an EPS of $0.37, marking a 4.5% miss. Despite the slight revenue beat, the market responded with caution, as reflected in the stock's flat performance, currently trading at $12.4 per share with a market capitalization of $1.32 billion.

Key Performance Indicators:

Several key performance indicators merit attention when dissecting Sally Beauty's Q1 results:

1. Free Cash Flow Challenges:

- The company reported a free cash flow of $20.47 million, reflecting a 31.6% decrease from the same quarter last year. This reduction in free cash flow raises questions about the company's ability to invest in growth opportunities and weather economic uncertainties.

2. Gross Margin Contraction:

- The gross margin (GAAP) contracted from 50.8% to 50.2% year-on-year, suggesting potential pressure on profitability. Understanding the factors contributing to this margin contraction is crucial in evaluating the sustainability of the business model.

3. Same-Store Sales and Store Count Dynamics:

- While the same-store sales remained flat year on year, the company's store count decreased by 23 over the last 12 months. This prompts an exploration into the strategic decisions behind store closures and their impact on Sally Beauty's overall market presence.

4. Competitive Landscape and Growth Prospects:

- Positioned as a mid-sized retailer, Sally Beauty faces the challenge of competing against larger counterparts with better economies of scale. The report highlights a four-year decline in revenue, emphasizing the need for the company to navigate market headwinds and explore avenues for sustainable growth.

Analyzing the Retail Environment:

The beauty and cosmetics retail sector is undergoing a transformation, influenced by evolving consumer preferences and the surge in e-commerce. Sally Beauty ( NYSE:SBH ), straddling the line between catering to consumers and salon professionals, must adapt to these shifts in buying behavior.

Conclusion:

In conclusion, Sally Beauty's ( NYSE:SBH ) Q1 FY2024 results present a mixed bag of challenges and potential opportunities. While the company has demonstrated resilience in certain segments, concerns about declining revenue, compressed margins, and store closures linger. Investors and industry observers keen on the future trajectory of Sally Beauty ( NYSE:SBH ) will closely monitor the company's strategic initiatives, seeking clarity on its ability to navigate the complex retail landscape and unlock sustained growth.

As the stock hovers at $12.4 per share, the coming months will likely be crucial in determining whether Sally Beauty ( NYSE:SBH ) can overcome the obstacles presented in its Q1 report and chart a course towards renewed success in the beauty retail sector.

Quarterresult

Globant SA (NYSE: GLOB) Impressive Q3 Financial PerformanceGlobant SA (NYSE: GLOB) announced its impressive financial performance for the third quarter. The company surpassed analyst expectations, demonstrating its continued growth and success.

During this quarter, Globant reported earnings of $1.48 per share, which exceeded the analyst consensus estimate of $1.47 by 0.68 percent. This represents a significant increase of 16.54 percent compared to the earnings of $1.27 per share in the same period last year.

Furthermore, the company achieved remarkable quarterly sales of $545.28 million, surpassing the analyst consensus estimate of $545.23 million by 0.01 percent. This notable achievement signifies an impressive growth rate of 18.83 percent compared to the sales from the same period last year.

Globant’s ability to outperform analyst predictions in both earnings and sales showcases its strong business strategy and execution. This performance highlights the company’s commitment to delivering exceptional results and reinforces its position as a leader in the industry.

The stock performance of GLOB (Globant S.A.) was closely watched by investors. With a previous close of $183.09, the stock opened at $193.96 and had a day’s range of $193.96 to $206.99. The volume traded on that day was 1,243,797 shares, significantly higher than the average volume of 382,698 shares over the past three months. With a market cap of $7.6 billion, GLOB is a significant player in the technology services sector.

GLOB has been experiencing impressive earnings growth. In the last year, its earnings grew by 51.33%, and this year, it has grown by 13.20%. Looking ahead, the company is projected to have an earnings growth of 23.35% over the next five years. This positive trend in earnings growth indicates that GLOB is performing well and has a promising future.

In terms of revenue growth, GLOB has also shown remarkable progress. Last year, its revenue grew by 37.25%, which is a significant achievement. This growth indicates that the company is attracting more clients and generating higher sales. This positive revenue growth is likely to contribute to the company’s overall profitability and success.

Technical Analysist

Price Momentum

GLOB is trading near the top of its 52-week range and above its 200-day simple moving average.

What does this mean?

Investors have been pushing the share price higher, and the stock still appears to have upward momentum. This is a positive sign for the stock's future value.