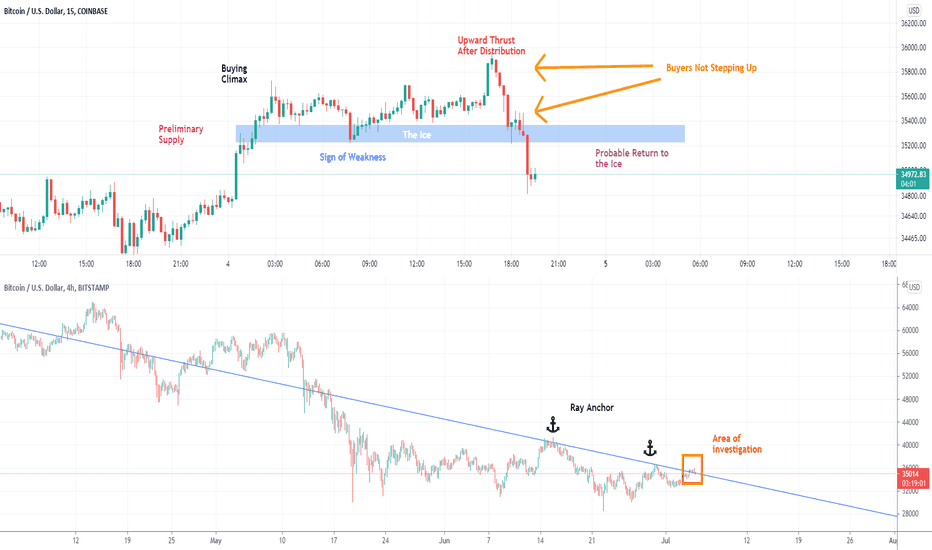

Quickpost: Low Time Frame Wycoff DistributionTop chart is the 15 minute chart and shows the key components to distribution. As of right now there has not been a key return to the ice. This is also some what provisional as usually they are way more Signs of Weakness in the move so this would be less reliable than the topping formation BTC saw at 60K

The 4 hour chart shows that this trend line has been flipping support and resistance for a while now so the move would be big either side. My bias remains to the downside.

Happy 4th of July

Quickpost

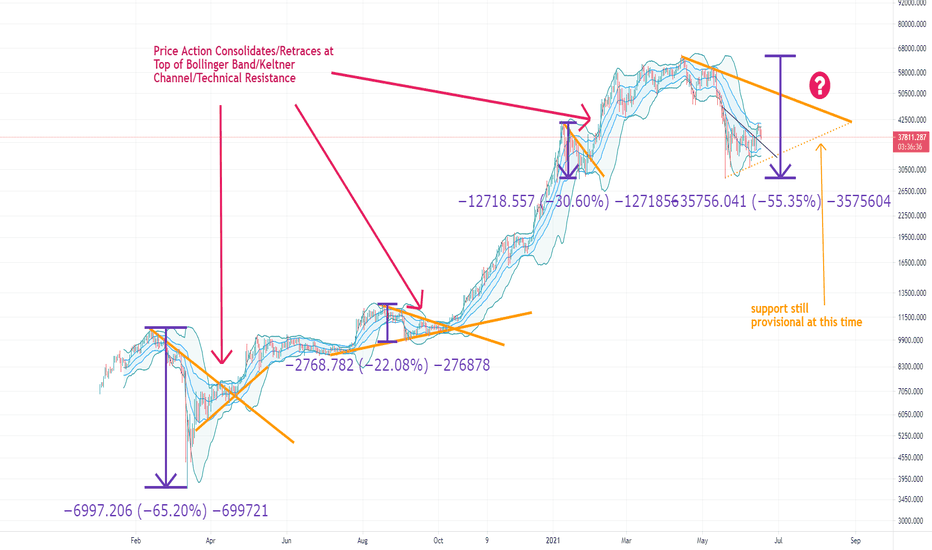

Despite Dollar Drama Bitcoin Behaves Normally (Quickpost)DXY and other dollar indices have pumped rather well over the last week or so and there is a lot of talk about how that will affect the other fiats and the fiat alternatives like silver, gold and crypto.

So far BTC hasn't really done anything untoward. Weeks ago it had a major dump and crawled its way back into the daily Bollinger Band and Keltner Channel. It then went to the top of the BB and KC and after a big move like that we could expect a lot of technical resistance. The key thing to watch will be the the supports of the BB and KC to kick in. This means we could see some more downside as the low of the BB is at 33.4k and the low of the KC is at 35k. And it would be very normal to see some wicking here. If you are looking for a bounce you don't want to see candle bodies out of the Keltner and you don't want to see too much price action below the provisional support of the triangle..

The three day chart shows that price action has regained the KC and is testing the support. If it holds in a couple of period price could be at 43k and a few more periods after that at $50k=ish

I have some serious reservations as to the long term bullishness of bitcoin but after this slam down the area of least resistance is to the upside. I know lots of people are watching for a head and shoulders but I just don't see it happening at this time. If I had to put a percent chance on a head and shoulders it would be around the 20% chance.