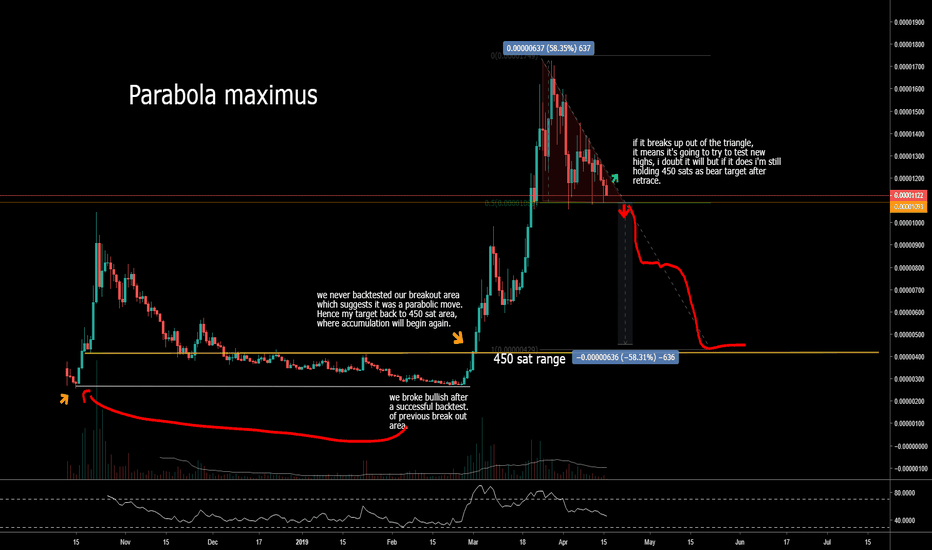

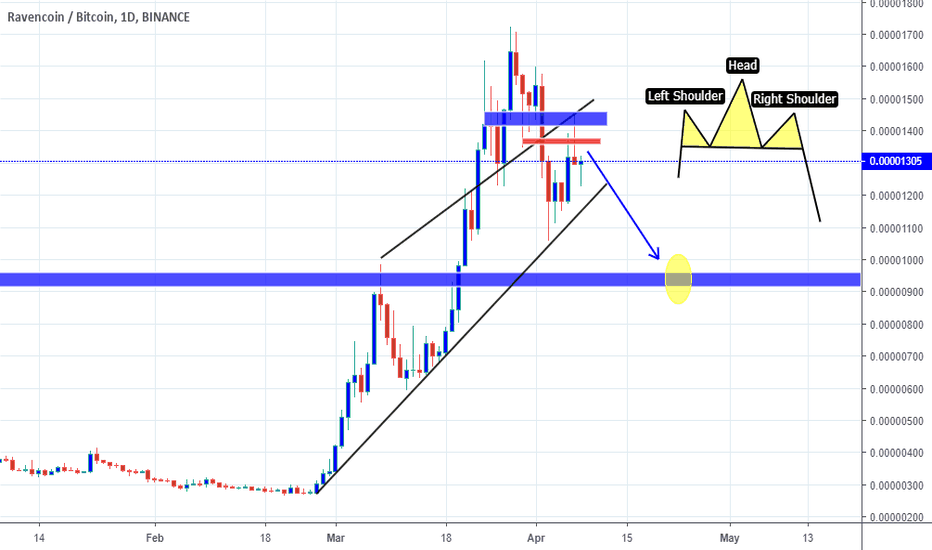

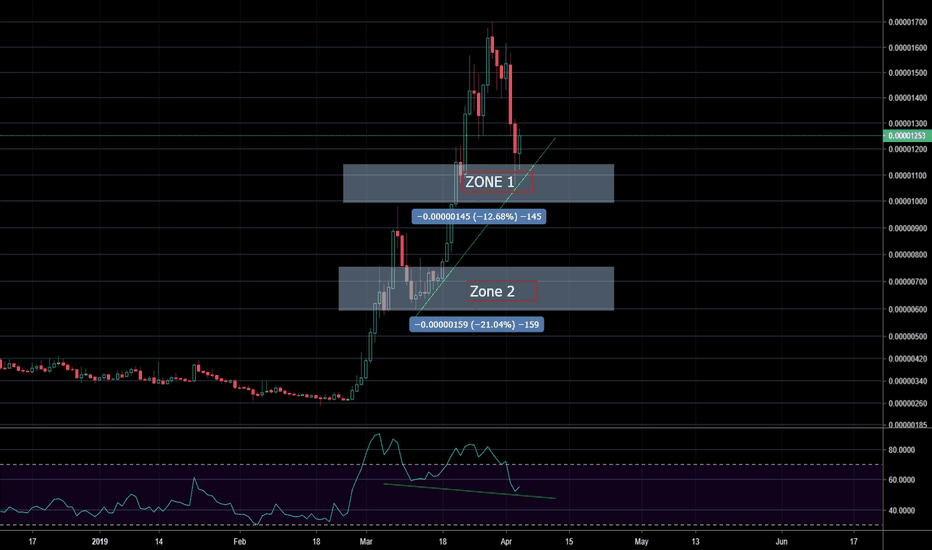

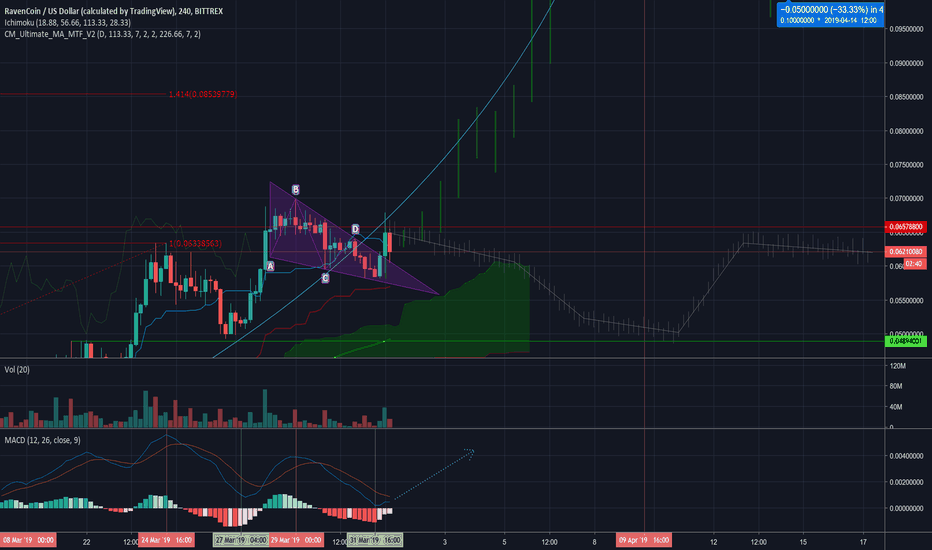

Ravencoin Parabolic retraceAs a die hard raven coin fan myself and being a happy investor back in the day to sell on this move. I am suspecting this bearish scenario to play out in the short/medium term, unless it's not done with its move yet but even if it did make new highs i'm convinced we will meet back at around 450 sats. Hence why i sold most of my ravens after we failed to make a new higher high and higher low on the daily at the peak.

A clear Descending triangle pattern with a breakdown level towards 450 sats. Fib retracement from 450 to last peak shows we are currently holding on .05 fib, which is usually the strongest support point in these moves.

Hence there is still a chance we can break bullish out of the triangle, but i'm giving it a low probability, since we keep testing it and fail to make new higher lows. My mind will be changed if the daily trend changes, if not i suspect a very nasty %50+ retracement from these levels.

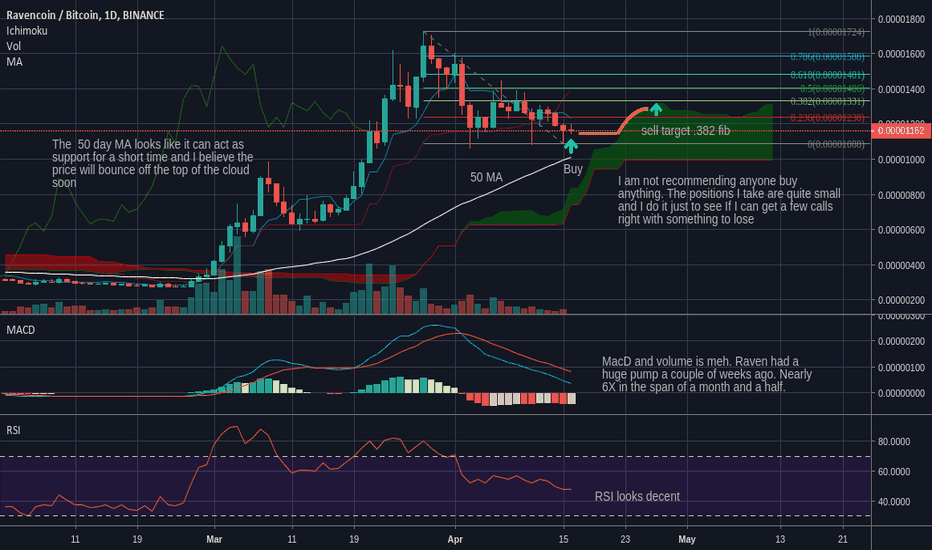

Ravencoin

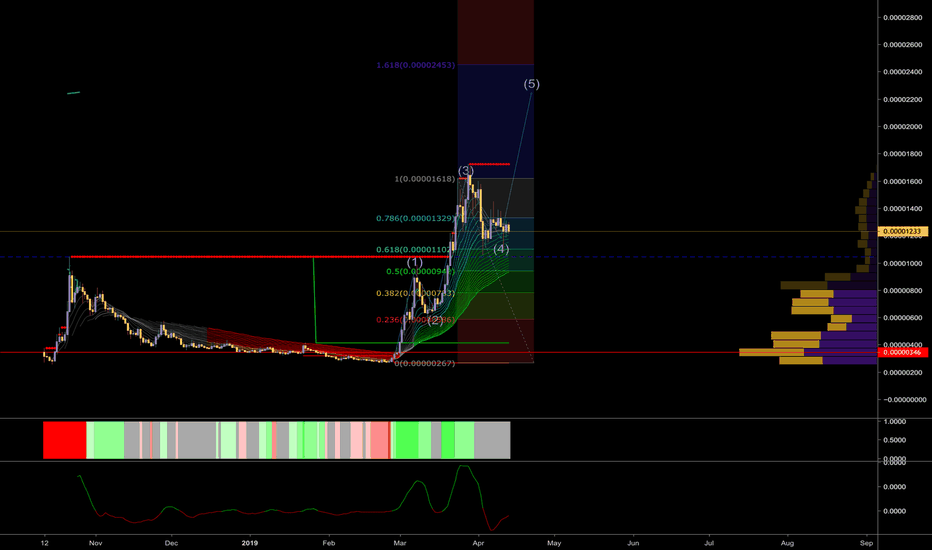

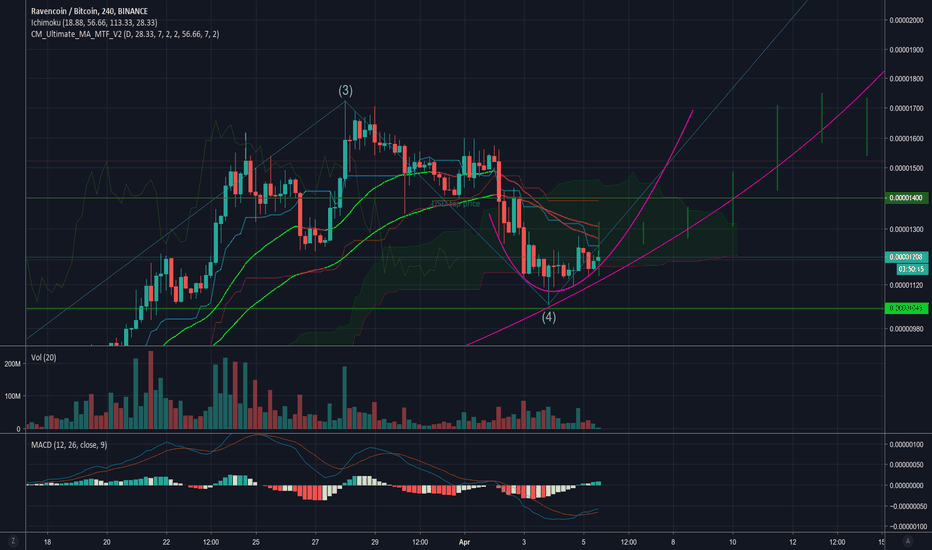

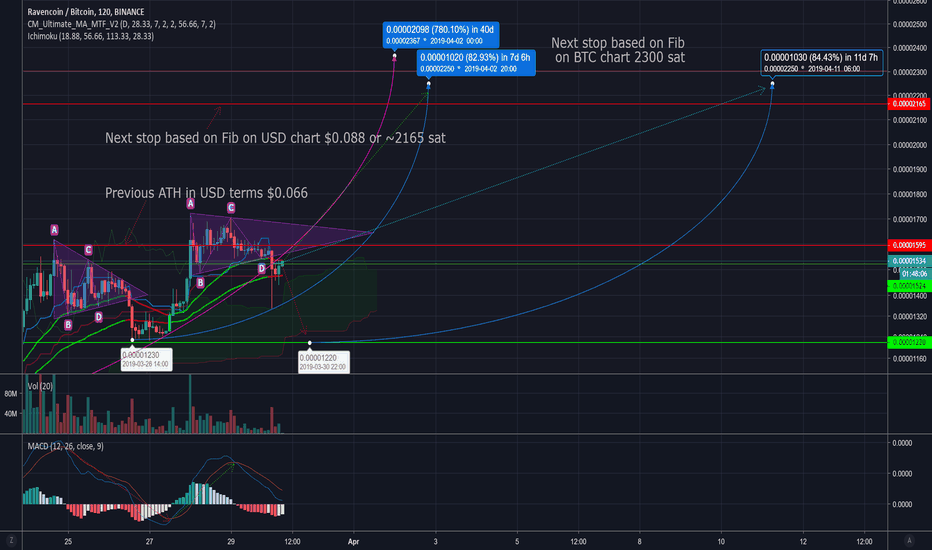

Ravencoin - Potential Wave 5We have been watching Raven for quite sometime, its brought us many 100% gains since Novemeber, Here, we are in a precarious space, but we are looking at a potential wave 5 break out, Its not always exact to use elliot wave theory, so when we are up this high we have super tight stop losses on profits. We are following the meandering 4th wave definition, so we are looking for a breakout, or potential break down here. Even still the 10% ups and downs are like a money making machine for intraday traders.

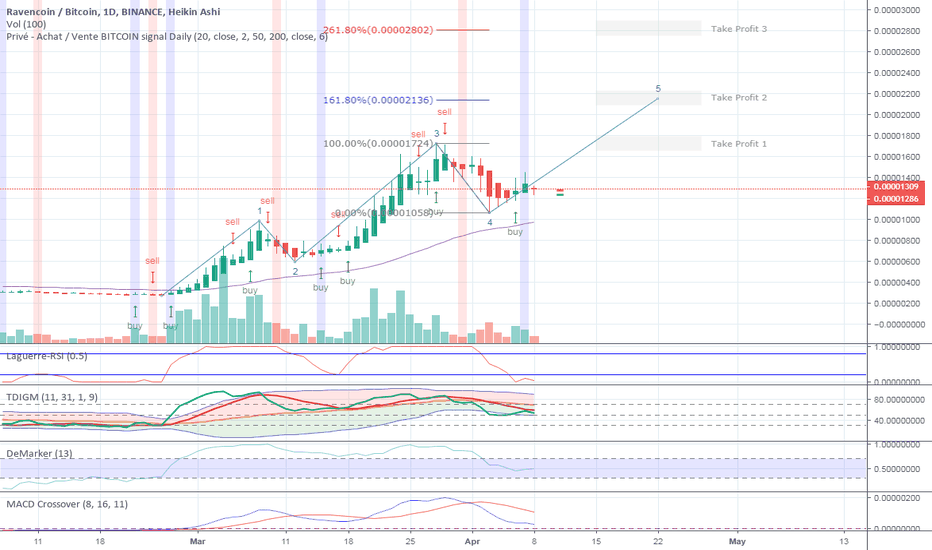

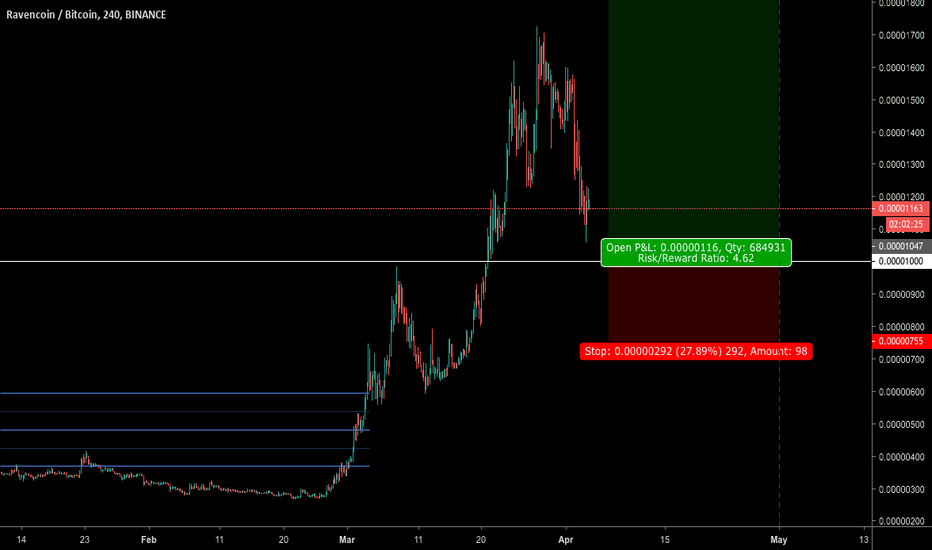

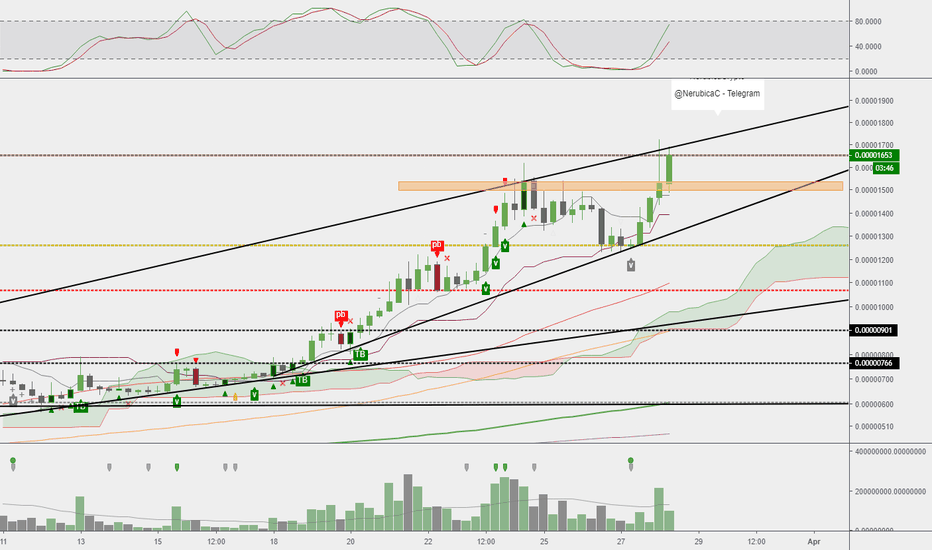

Raven: Last Wave before Big Correction?Hi.

We are probably doing the fifht wave before to get a good correction in ABC .

I expect we could hit TP3.

TP1 : 0.00001724 btc

TP2 : 0.00002136 btc

TP3 : 0.00002802 btc

Check it out my script to know if there is a stock market correction: Short Free Indicator for BITCOIN/USD

(See Link to Related Ideas below)

Hope this time there will be no 100M$ injected like 2019, 2nd April!

Trade safe.

Cheers!

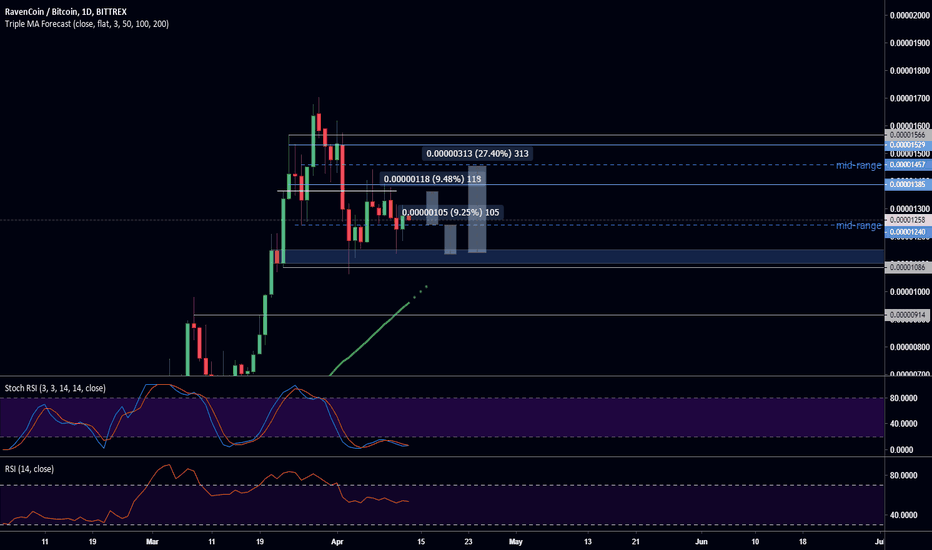

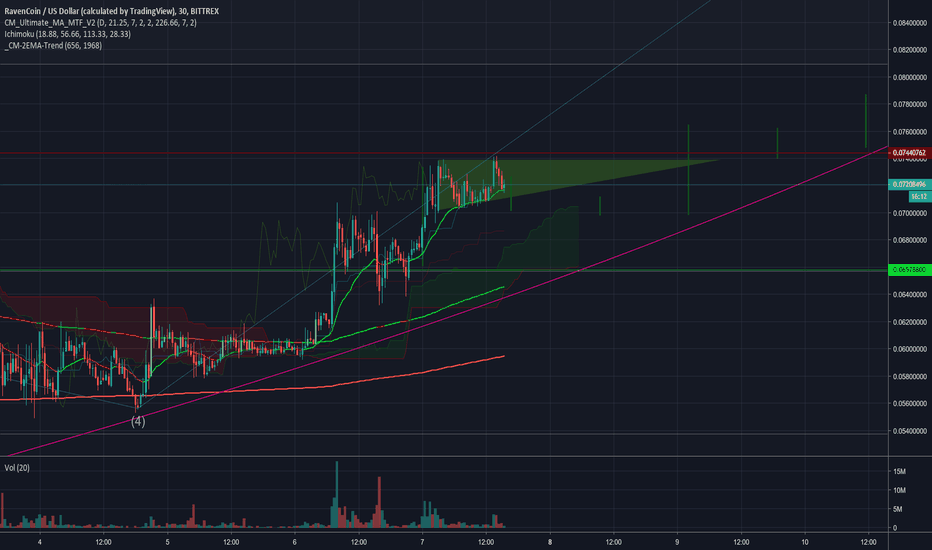

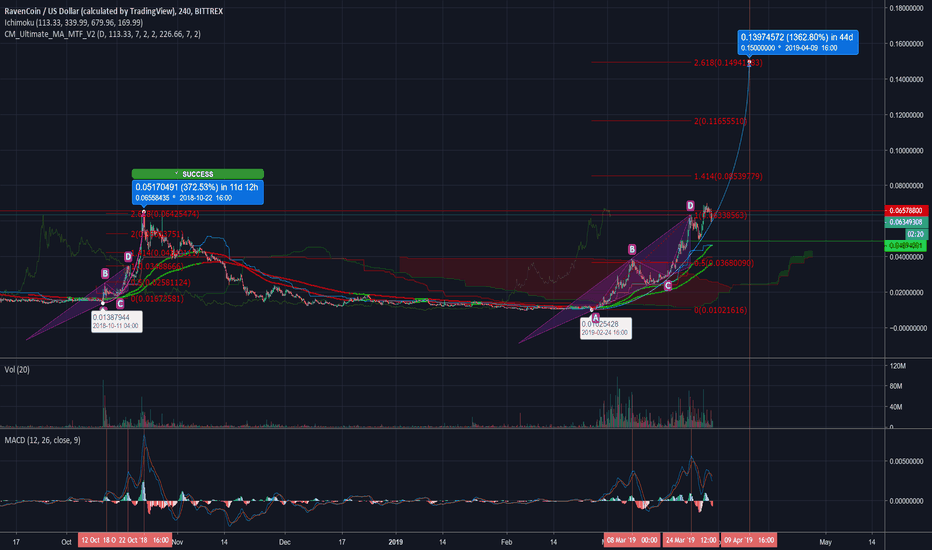

#Ravencoin $RVN consolidation just below $RVNUSD all time highDuring the process of price discovery when making new highs it is important to reference the RVNUSD chart and not just the RVNBTC chart. This is true especially in times when there is a lot of movement in the BTCUSD price as there has been since the breakout from the lows.

This chart indicates a price target of $0.15 to $0.16 which is a little lower than the target on the other chart. This is likely due to the increase in the value of BTCUSD, which sent RVNBTC and other crypto assets (which surged ahead of BTC) lower in BTC terms.

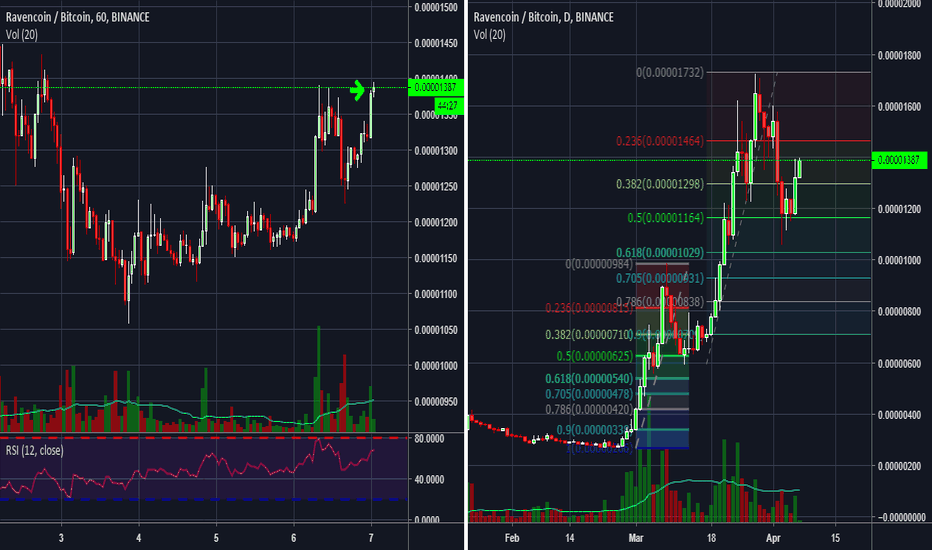

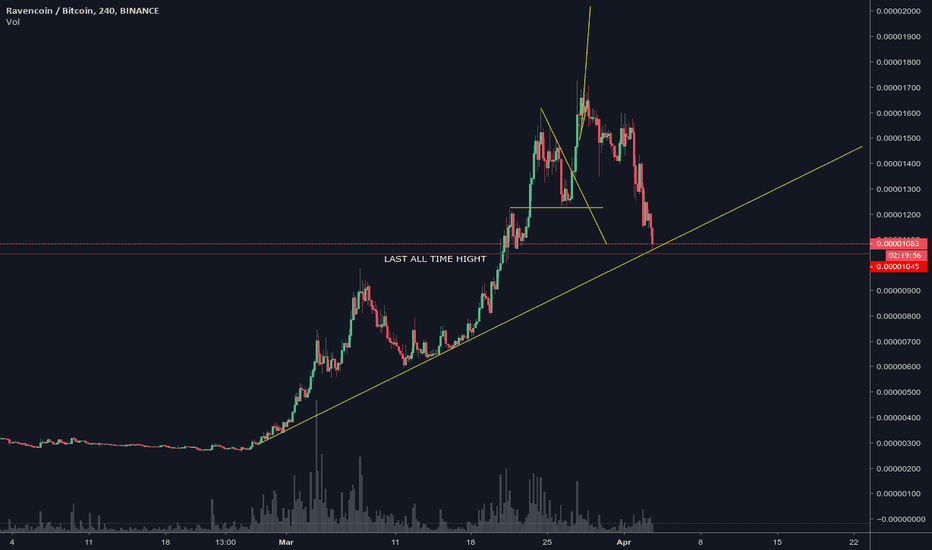

RVN Coinbreakout on rvn btc the level has been tested two prior times and third time could be a charm.

gotta watch btc and the overall market looking a little heavy.

also check out etc for a good trade as well with the current breakout i would look to enter a pullback.

Binance the best place to trade alts imo my referreal code if your not trading there yet www.binance.com

End of profit taking in #Ravencoin $RVN bounced off 2018 highThe Parabola seen here is a common and fairly reliable bottoming pattern. Bouncing off the high of the previous price surge is also a common and reliable bottoming pattern as resistance becomes support. It is bullish when you see that buyers and sellers are coming into balance above support.

#Ravencoin $RVN wave 4 bottom is in, wave 5 to 3100 - 3600 SatThese estimates are based proportionally in percentage terms on the previous wave pattern seen in $RVN in 2018, this wave pattern appears to be similar but on a larger scale. BTC and ETH made similar moves in their early days. The timeframe is the big question, the volatility in BTC certainly could delay things. The pattern displayed above is invalidated if the price dips much below 980 sat.

Satoshis are more valuable now, this is good for #Ravencoin $RVN...so is increased volume and price action in the cryptosphere. Anyone upset about the RVNBTC chart should take a look at the RVNUSD chart where a new all-time high was set $0.074. As BTC consolidates and likely pulls back a little over the coming days, do not be surprised as altcoins begin to make new highs.

#Ravencoin $RVN back-test of the falling wedge.The Bittrex chart is a little cleaner than the Binance one. I think it is worth paying attention to the RVNUSD chart at this point as Ravencoin enters into price discovery territory. If the price does not break into new highs it looks like it will set into a range between $0.05 and $0.065 .

Same #Ravencoin pattern as 2018 would take price to $0.15 $RVNAs incredible as it may seem it is possible at least that RVN will not stall out at the same USD price as 2018. An analysis of the 2 charts show that the price may have a long way to go if in fact it breaks above resistance over the next week and replicates the same sort of move as it did in 2018.

$RVN tested by $BTC drop to 4 Sidereal EMA Support, now on 1.68 BTC dropped and once RVN was below the 1.68 fib retrace support line many stops were hit and it tested the 2 hour Ichimoku cloud.

It looks like the $0.066 is providing some resistance. I do expect that to be broken over the next few weeks and become support.

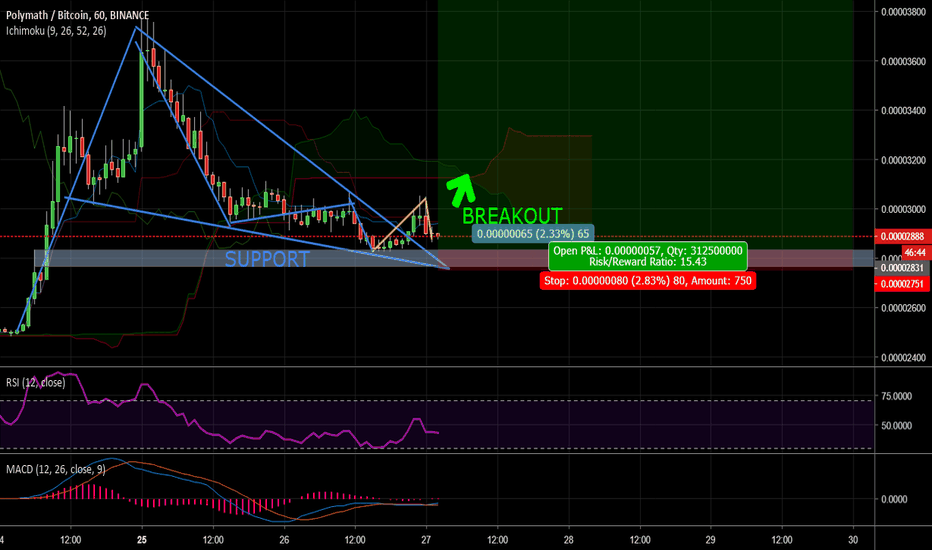

$POLY basic idea, as $RVMJust a basic idea, following very similar patterns as RVN, not a buying advice, just a basic and pretty primitive idea, bcuz i'm still learning, so, let's see :)

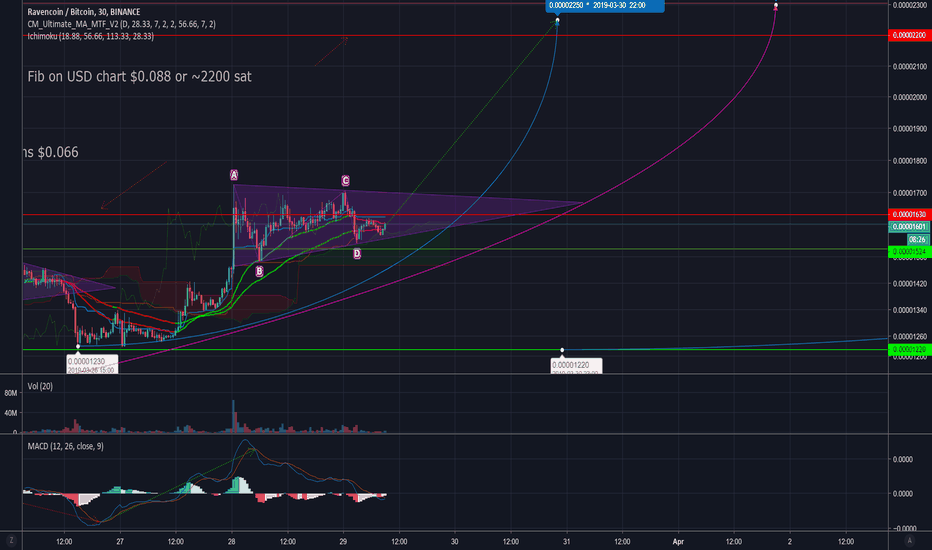

$BTC move lowers $rvn $0.066 resistance to 1595 sat #RavencoinBoth the resistance and the target have moved down by about 35 sat based on the Fibonacci retracement levels on the RVNUSD chart due to bitcoin's appreciation against the dollar. That resistance is now right on top of the 30 min cloud and will soon provide support.

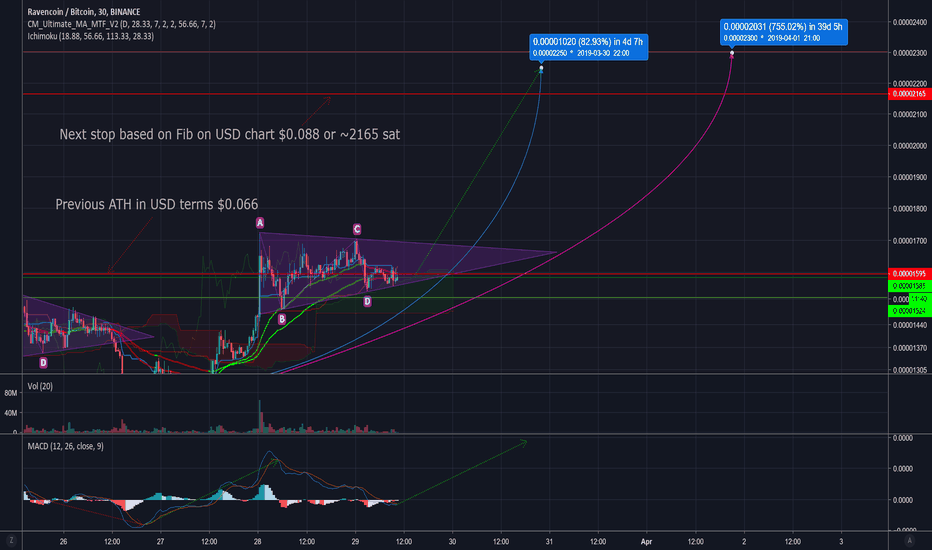

#Ravecoin $RVN breaking back above previous USD ATH, coil wedgeIf it breaks out of the top of this consolidation wedge I expect to see it plugging higher through the weekend to the 2200 to 2250 range or $0.088.

The cycles are accelerating as the pattern becomes more obvious to ever-larger numbers of crypto traders. This will continue until it breaks down due to a FOMO driven event which drives the valuation sky high followed by a crash. This has not happened yet. The movements in price are still relatively orderly despite a very high appreciation rate.

From a fundamental perspective, things look great. New assets are being registered daily in the namespace and as the valuation grows so does the security of the network. This is due to the profitability of mining driving ever higher hash rates, now surpassing Etherium Classic (ETC).

Ravencoin is quickly graduating beyond the level where 51% attacks are feasible partly due to the X16R algorithm keeping ASICs at bay and making it possible for any GPU on any gaming PC to mine profitably. The biggest issue currently observable is that 31% of the hashing power resides with one pool, this will likely not be a problem especially if the valuation continues to grow. At the moment I expect the market cap to reach somewhere in the neighborhood of $500MM in the next few months.

In the long term (a decade or so), I expect that the market cap could go as high as $36B if it is adopted for use in listing shares of publicly traded companies and REITs, another real estate shares. One $RVN would be worth $2 in today's US dollars at that point.

In the near future (within this year) I expect the valuation of 1 RVN to reach above and then stabilize around $0.13 to $0.15.