Why Recursion Pharmaceuticals RXRX Could Be the NVDA of BiotechRecursion Pharmaceuticals RXRX is rapidly emerging as a transformative force in drug discovery, leveraging cutting-edge artificial intelligence and automation to industrialize and accelerate the development of new medicines. Here’s why RXRX could be the next NVIDIA (NVDA) of biotechnology and why its stock could soar by year-end:

1. AI-Powered Drug Discovery Platform with Unmatched Scale

Recursion integrates AI, machine learning, automation, and advanced data science to decode biology and chemistry, dramatically reducing the time and cost of drug discovery.

The company’s proprietary BioHive-2 supercomputer, built with NVIDIA’s DGX H100 systems, is the most powerful AI computing system wholly owned by any biopharma company, enabling Recursion to process biological data at unprecedented speeds.

By reducing the number of compounds needed for clinical candidates from thousands to just 136–200 and shrinking development timelines to under a year, RXRX is fundamentally changing the economics of pharmaceutical R&D.

2. Strategic Partnerships and Industry Validation

RXRX has forged high-profile partnerships with pharmaceutical giants such as Bayer, Roche/Genentech, Takeda, and Sanofi, validating its platform and unlocking milestone payments that could exceed $20 billion over time.

The company’s collaboration with AI biotech Exscientia in a $700 million deal further cements its leadership in the AI-driven drug discovery space, creating a pipeline of 10 clinical and preclinical programs with hundreds of millions in potential milestones.

NVIDIA itself holds over 7.7 million shares of RXRX, making it one of NVIDIA’s largest biotech investments and a strong endorsement of Recursion’s technology and long-term vision.

3. Explosive Revenue Growth and Strong Cash Position

Analysts forecast Recursion’s revenue to grow at a 65% CAGR from $58.8 million in 2024 to $263 million by 2027, far outpacing the broader biotech sector.

The company ended 2024 with over $600 million in cash, providing a solid runway for continued investment in R&D, platform expansion, and clinical trials.

Wall Street analysts expect more than 50% upside in RXRX stock over the next 12–24 months, with multiple clinical milestones and partnership announcements as near-term catalysts.

4. Disruptive Vision: The “Virtual Cell” and Beyond

RXRX is building toward a “virtual cell,” where AI models can simulate biological processes with such accuracy that wet lab experiments shift from data generation to validating computational predictions.

This approach could dramatically improve drug development success rates, addressing the industry’s notorious 95% failure rate and positioning Recursion as the go-to platform for next-generation drug discovery.

5. Market Sentiment and Institutional Support

RXRX has caught the attention of growth investors and major funds, including Cathie Wood’s ARK Invest, further boosting its profile and liquidity.

Recent stock surges and high trading volumes reflect growing investor confidence in Recursion’s disruptive potential and the broader AI-in-biotech trend.

Recursion

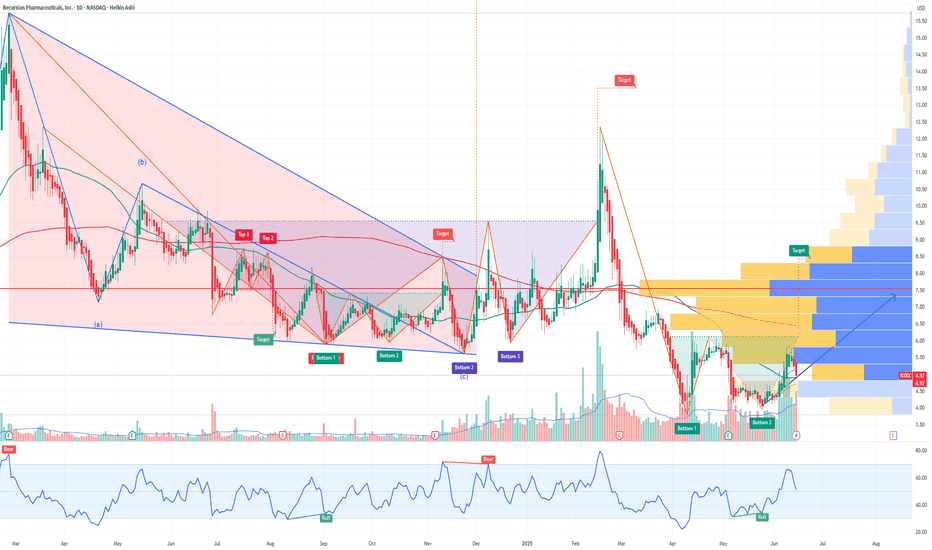

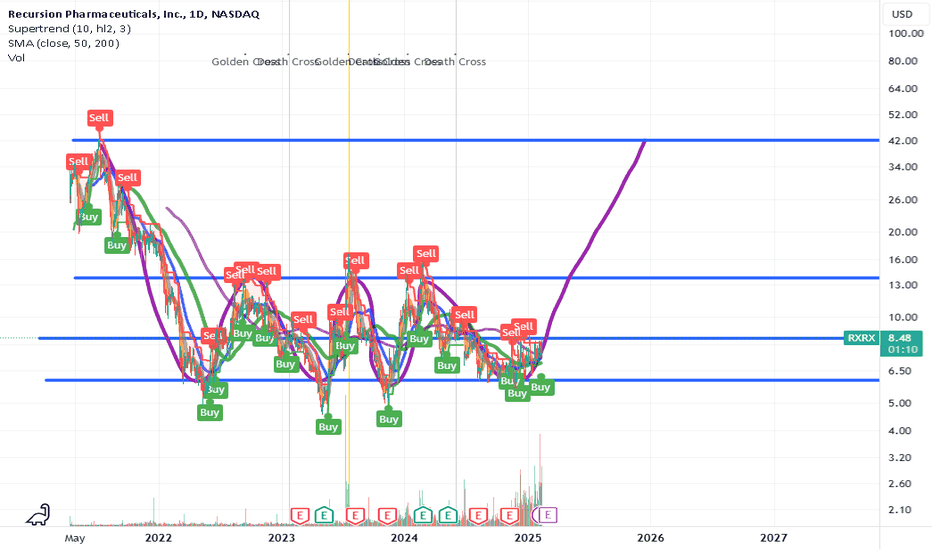

$42 TARGET $RXRX BUY NOW!The triple bottom chart pattern usually emerges after an extended downtrend with bears dominating the market. While the first bottom might reflect regular price fluctuations, the second bottom signals that the bulls are gathering strength and gearing up for a potential reversal. The third bottom demonstrates robust support, suggesting that bears may surrender when the price surpasses resistance levels.

ALSO: Investing in Recursion Pharmaceuticals (RXRX) offers intriguing possibilities for several reasons:

Innovative Technology: NASDAQ:RXRX utilizes artificial intelligence (AI) and machine learning to expedite drug discovery. Their BioHive-2 supercomputer, powered by Nvidia AI chips, is among the most powerful accelerated computing systems globally.

Partnerships: NASDAQ:RXRX has formed alliances with major tech and healthcare leaders, including Nvidia ( NASDAQ:NVDA ), which invested $50 million into its operations. These collaborations aim to streamline drug discovery, making it faster and more cost-effective.

Promising Pipeline: NASDAQ:RXRX boasts a strong lineup of drug candidates, and their technology has already shown promising results. Their merger with Exscientia, another biotech company focused on AI-driven drug discovery, has created a more robust, vertically integrated platform.

Potential for High Returns: While investing in NASDAQ:RXRX involves risks, it also holds the potential for significant returns. The company's innovative approach could transform the healthcare industry, making it a potential "10-bagger" (a stock that increases tenfold in value).

Long-term Vision: RXRX seeks to shorten the drug discovery process from years to months and significantly reduce costs. This long-term vision could lead to substantial growth if successful.

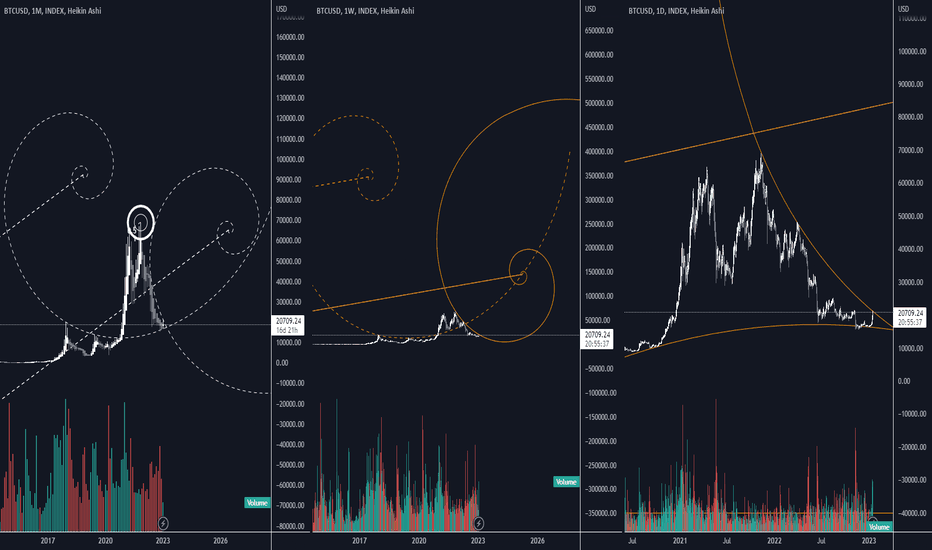

simple?this is why i'm macro bull *reminder to pinch/squeeze scales to snap shapes back into place, shoutout to my fav tradingview glitch*

i'd posted an idea like this before when i was just a baby, monthly spiral made from 21 tops then visually fit, but i jumped the gun and didn't consider diff orientations, or fit to wicks...so i tried to be more careful here. could also just be confirming my bias lol which is of course the criticism everyone makes with geo / trendlines whatever.

but i also wanted to show how the spirals (all made from the 2021 top wicks on their respective timeframes. backwards - november to may. dashed = counterclockwise; solid = clockwise. then visually fit to prior tops/bottoms) look different depending on timeframe, so you shouldn't take them as gospel. also, scale changes them drastically (even when you lock the scale like a good lil degen). but an idea i was toying with is that maybe they call different supports/resistances...like...the weekly spiral calls the early 2022 support. idk, there are so many ways to draw them, and they're just a tool like everything else, which is why confluence with things like fibs and price action is important.

i love seeing the symmetry and the harmony, legit fascinated by this stuff en route to cracking the code

<3

stay safe

reminder looking at 18.5 for retest, then macro bull

eng.teancum.es