GOLD reversal candle near support zoneAfter it broke upper level support at $1262, the price accelerated to the downside. But in mid term perspective, we are in range after a big movement to the upsode from the beginning of the year.

MAybe we will have some tactical reversal. Break above high $1229 can lead us to 8 EMA first ($1235), then we have 21 EMA, our next target $1249. Stop below low at $1211.50

Reddogreversal

US Dollar index bullish reversal from support zoneIn general, week from 30th of June to 4th of July was positive for global markets. Indexes gained 1-2% mainly on better then expected job numbers from US. Dow Jones above 17000 with technology index Nasdaq at 14 years highs , after the government reported the economy created 288,000 jobs in June and the unemployment rate fell to 1,6%. A stock or index hitting new high has no overhead supply to contend with. When a stock or index reaches a new high supported by big volume clues, it has been propelled upward by institutions taking positions because they believe that fundamentals are solid and the prospects for the future are even better.

The European union kept monetary policy unchanged as expected following last month's measures to stimulate the economy. CAC 40 bounced off 4407 where 21 EMA is situated. It could be our new point of reference. Week before sellers managed to broke down accelerated trend, if they still want to keep control on price they should defend break down point 4500. After big run in 2013-14 years it may take a pause and pull back a bit deeper to 50 EMA and macro trend line close to 4300.

The US dollar gained against major currencies. The job report is bullish for the U.S. dollar, and a headwind for gold. Dollar Index bounced off support zone that is in tact since April 2014. Now we have green, reversal candle that can lead to something bigger if next week buyers will lift prices above previous high of that candle. US Dollar still under pressure below key moving averages. I will use my levels of support/resistance and pivot points to measure price action.

LNKD showed relative strengthYeasterday US markets closed in red with QQQ -0.8%, SPY -0.9% and DIA -0.94%.

But this social network reversed from lows and closed near highs.

I think we are close to resolution of this wide range with upside bias because of that strength. Now we have higher low @ $143.45 and important intermidiate support @ $145 that was retested intraday.

Another action point is previous high of the day @ $149.50. If it will go above and hold we can see $153.34

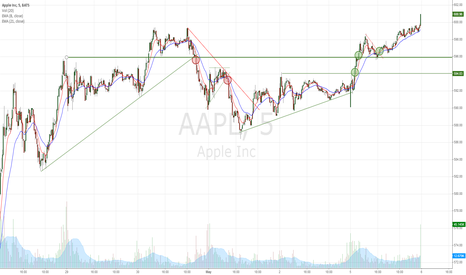

AAPL don't chase price, stay tactical It is difficult to buy here after $40 move from earning's gap but on intraday basis there we can still trade tactically keeping long in our mind.

Actually, it is one of the best stocks in this choppy, range-bound market because after earnings was released it had nice, powerfull 2 days continuation move then some rest, inside days which is healthy after such a big move with Red Dog Reversal (so we can put some tactical trades on the short side) and yeasterday we saw breakout and some trend plays.

Today we will see if it can continue through previous high of the day for another potential move higher. Support levels at $598.40 then $596.

Overall market closed well on highs but stays choppy with $SPY in front of resistance and $QQQs showed recent relative weakness.