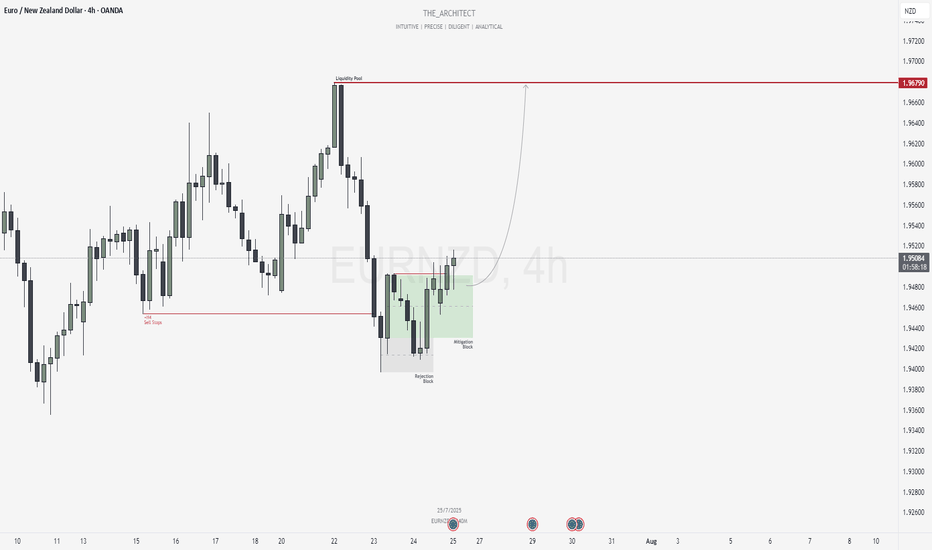

EURNZD: Bullish Shift and Institutional Re-Entry from SupportGreetings Traders,

In today’s analysis of EURNZD, we observe that institutional order flow on the H4 timeframe has recently shifted bullish. This alignment now provides us with a clear bias to seek buying opportunities in line with the predominant higher timeframe trend.

Higher Timeframe Context:

The weekly timeframe is currently delivering bullish order flow. With the recent bullish market structure shift (MSS) on the H4, we now have confluence across both timeframes, which strengthens our confidence in seeking long setups on lower timeframes.

Key Observations on H4:

Sell Stop Raid & Structural Rejection: Price action recently swept sell-side liquidity, a typical behavior indicating institutional order pairing. Following this, price attempted to move lower but failed to break the previous low, instead being supported by a Rejection Block. This led to a bullish market structure shift—our key signal of trend continuation.

Mitigation Block Entry Zone: Price has since retraced into a Mitigation Block—an area where previous institutional selling occurred. The purpose of this pullback is to mitigate earlier positions and initiate fresh buying orders. This now becomes our zone of interest for potential confirmation entries towards the upside.

Trading Plan:

Entry Strategy: Look for lower timeframe confirmation entries within the H4 Mitigation Block.

Target: The objective is to target the H4 liquidity pool residing at premium prices, aligning with the discount-to-premium delivery model.

For a detailed market walkthrough and in-depth execution zones, be sure to watch this week’s Forex Market Breakdown:https://tradingview.sweetlogin.com/chart/EURNZD/BZC9xW1L-July-21-Forex-Outlook-Don-t-Miss-These-High-Reward-Setups/

As always, remain patient and disciplined. Wait for confirmation before executing, and manage your risk accordingly.

Kind Regards,

The Architect 🏛️📈

Rejectionblock

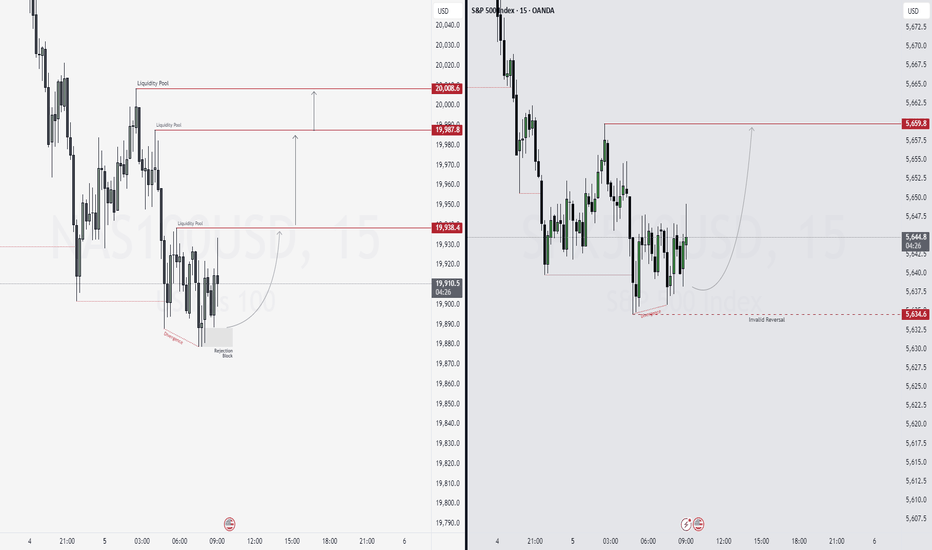

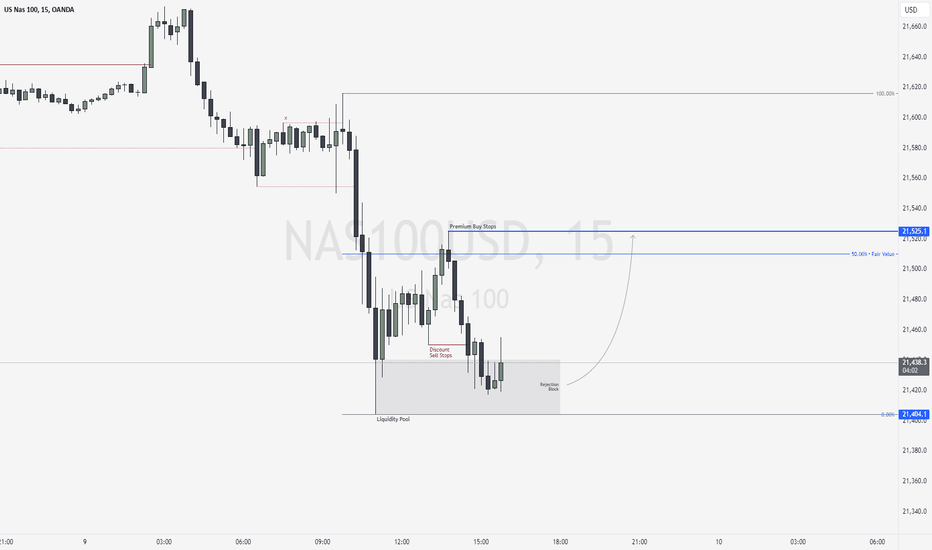

NAS100USD: Rejection Block & Breaker Converge for Sell SetupMarket Context:

In today’s analysis of NAS100USD, we note that although the market has been trading within bullish institutional order flow, current price action is presenting multiple signs that a bearish reversal may be underway. Institutional behavior appears to have shifted, particularly after liquidity was swept and price began to respect resistance zones.

Key Observations:

Premium Buy Stop Sweep:

Price action swept the swing high rather than breaking it cleanly, indicating a stop raid. This is a common smart money tactic used to engage with buy stop liquidity in premium pricing before reversing.

Rejection Block Formation:

A sharp rejection followed the liquidity sweep, leaving behind a Rejection Block—a powerful institutional resistance zone. This suggests the institutions placed sell orders against willing buyers and are defending this level.

Market Structure Shift:

We observe a break in internal structure to the downside, further confirming that the prior bullish order flow may now be transitioning into a bearish phase.

Breaker Block Retest:

Price has retraced into a Breaker Block, where institutions typically revisit prior zones of buying to mitigate exposure and initiate new sell positions. This zone is reinforced by alignment with the previous buy stop sweep, providing a high-value confluence area for short opportunities.

Trading Plan:

Entry Strategy:

Await confirmation within the breaker on the lower timeframes. Once confirmed, these zones offer a strong institutional case for short positioning.

Targets:

Focus on discount liquidity pools as the primary objective. Selling from premium levels with the intention of targeting undervalued zones mirrors institutional execution models.

Stay aligned with smart money behavior—observe, confirm, and act with precision.

Happy Trading!

The Architect

NAS100USD: SMT Divergence Hints at Potential ReversalGreetings Traders,

In today’s analysis of NAS100USD, although the current market structure reflects bearish institutional order flow, there are growing signs that a potential reversal may be forming.

Key Observations:

1. Smart Money Technique (SMT) Divergence:

We are currently observing SMT divergence—a strategy where the underlying asset (NAS100) is compared against its benchmark (US500). These indices typically maintain a 90–100% correlation. However, when this correlation breaks down, it often signals that a reversal may be imminent. In this case, while NAS100 continues to show bearish momentum, the divergence from US500 suggests the possibility of bullish interest building.

2. Institutional Support at the Rejection Block:

Further confluence for a potential reversal lies in the presence of a rejection block acting as a strong institutional support level. This is a zone where smart money previously defended price, and if confirmed, it could provide an optimal entry for long positions.

Trading Plan:

We will monitor the rejection block for confirmation of bullish intent before entering any trades. If confirmed, the idea is to target the buy-side liquidity residing in premium pricing zones.

Invalidation Level : This reversal idea will be invalidated if NAS500 breaks below its most recent swing low.

Stay alert for confirmation, and always ensure the idea fits within your broader trading framework.

Kind regards,

The Architect

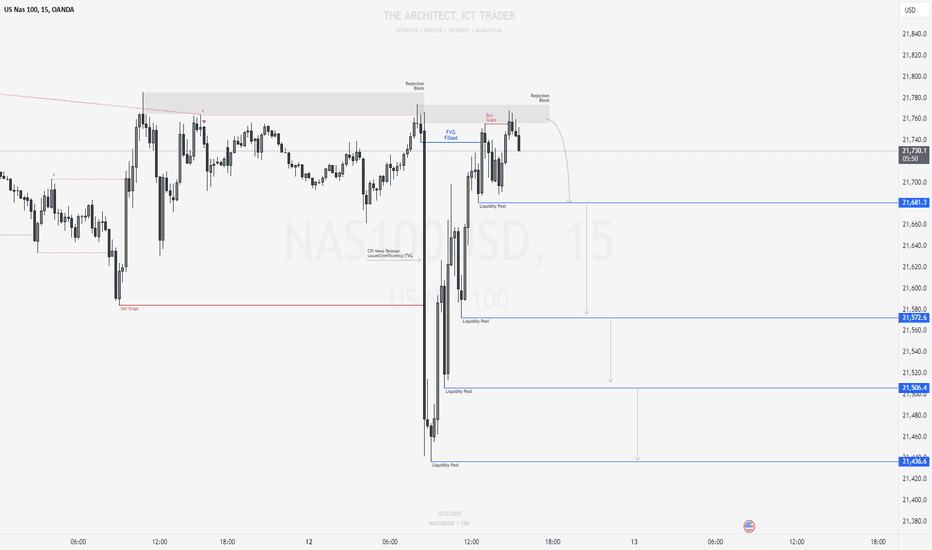

NAS100USD: CPI Volatility & Institutional Continuation Sell-OffGreetings Traders,

In today’s analysis on NAS100USD, we observe that the market remains bearish following a significant CPI news release. This high-impact event resulted in a sharp bearish displacement, reinforcing the ongoing bearish narrative. Yesterday, I shared an analysis predicting this continued bearishness. For those interested, you’ll find that analysis attached at the end of this description for deeper context.

KEY OBSERVATIONS:

CPI-Induced Displacement : The CPI release triggered a large downward move, forming a massive single candle that left behind a noticeable inefficiency—a Fair Value Gap (FVG).

Liquidity Grab & Fair Valuation: After sell stops were taken, price retraced to fill the FVG, restoring fair valuation. This retracement fully closed the gap, confirming a continuation of bearish order flow.

Premium Price Zone: We are currently in a deep premium price range, which aligns with institutional distribution zones. These areas offer excellent opportunities for confirmation-based sell entries.

TRADING PLAN:

Entry Strategy: Look for confirmation at the current premium price level before entering short positions.

Targets: Focus on discount liquidity pools at lower prices, as these are the areas institutions will likely target to take profits.

By following the institutional flow, we align ourselves with smart money practices, improving our precision and probability of success. Stay patient and disciplined—confirmation is key!

For more context, here’s yesterday’s analysis below.

Happy Trading!

The Architect 🏛📊

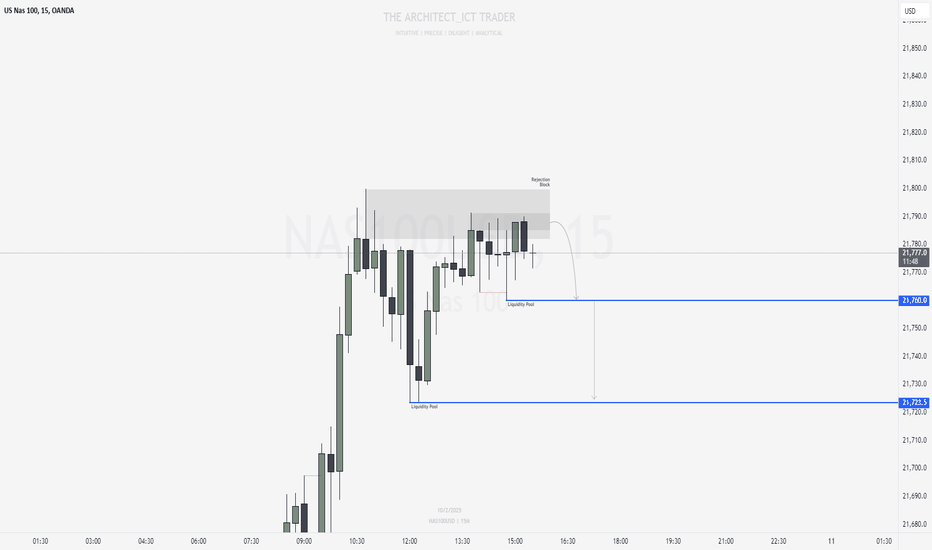

NAS100USD: Rejection Block Signals Potential Liquidity DrawGreetings Traders,

In today’s analysis on NAS100USD, we observe that price is currently reacting to a rejection block, an institutional resistance zone. This offers a potential opportunity to seek short positions, anticipating a minor draw on liquidity to the downside.

The plan is to wait for a bearish confirmation within this zone and target the liquidity pools resting below key lows.

Stay patient and disciplined while awaiting confirmation before executing trades.

Kind Regards,

The Architect

NAS100USD: Is a Reversal Brewing in Bearish Territory?Greetings Traders!

Today’s analysis highlights a fascinating setup on NAS100USD. While the market remains bearish overall, there are compelling signs suggesting a potential reversal. This could either lead to a minor retracement or evolve into a stronger, extended bullish trend. As always, we let the market confirm its intentions.

Current Market Outlook:

Price is sitting at heavy discount levels, having swept discount sell stops. This movement hints at the possibility of smart money entering buy orders against willing sellers. Remember, the narrative here is simple: buy in discount prices, sell in premium prices.

Key Confluences:

Rejection Block Support: Price is strongly rejecting a key rejection block, establishing a robust institutional support zone.

Discount Level Alignment: Current levels are ideal for buying opportunities, provided confirmation aligns with the broader market narrative.

Trading Strategy:

I am closely watching for confirmation entries at these levels, with the first target being the premium buy stops above the 50% Fibonacci level (fair value). This zone offers an excellent area for profit-taking and aligns with institutional order flow.

Let’s Collaborate!

Have insights, questions, or analysis? Share them in the comments below. Together, we can dissect the market and make informed decisions!

Kind Regards,

The_Architect

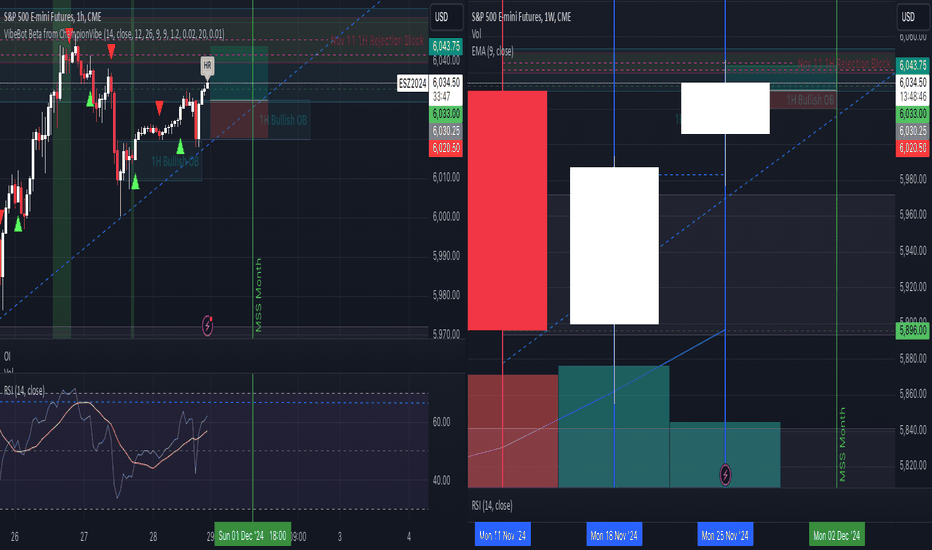

ES1! Futures Mini Hourly Trade (ICT Rejection Block?)Short and simple, just here to track this trade idea officially using ICT concepts.

Although my Intermediate analysis is Bearish for ES1! I do believe there is some reason to be Bullish in the short term . Missed most of the move but this trade is would be more of a scalp /short swing if youre into that. This would be off the most recent 1H Bullish OB and targeting the unmitigated highs from Nov 11 7am ( 6,053 level ) which coincedentally is an unmitigated Rejection Block (**unverified**), seems like the only area with Buy Side liquidity left before ranging back down into discount or establishing a new high before retracing.

It seems like price strength doesn't much area to move because I believe this is the most recent move away from EQ in this current weekly range.

Interested to see how this develops.

Entry: 6,030

Stop: 6,020

PT 1: 6,035 (0.6 RR)

PT 2: 6,044 (1.38 RR)

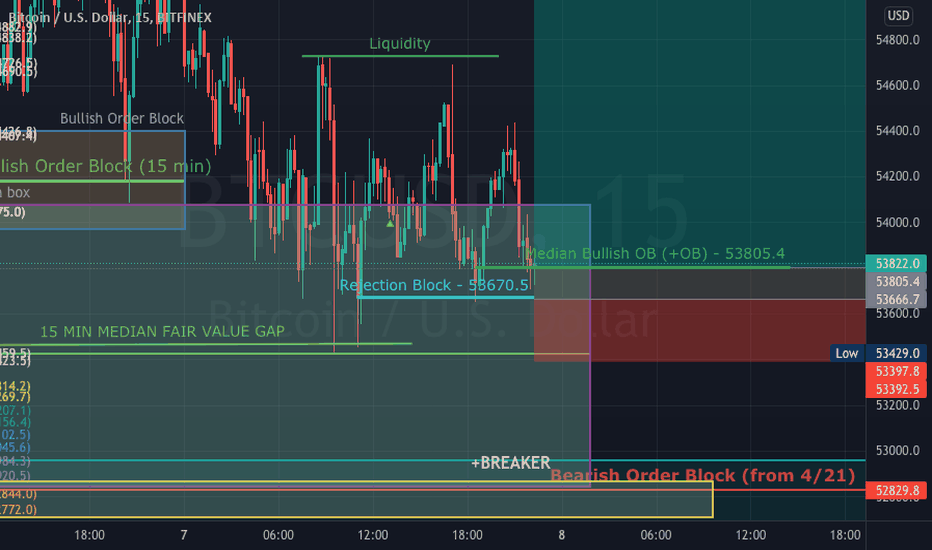

$BTC - Long Between Order Block/Rejection Block (Smart Money)-techniclly if you're following my previous Idea, we're still not out. I'm just making another setup for anyone who didn't catch my earlier I dea, better setup too. Will type more, just want to get the idea out there that this should be going long and check my linked idea for previous info.

I'll complete all of this in 15