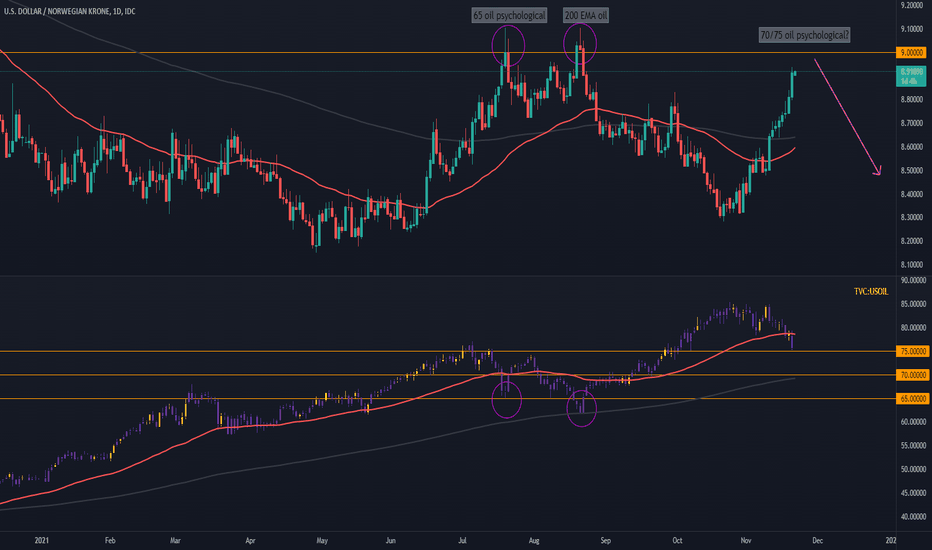

USDNOK will hit psychological as Oil approaches supportUSDNOK is strongly anti-correlated to the prices of oil. Although the US imports most of its oil from Canada, some of the oil producers there are owned by a Norwegian company. Then, the prices are moving globally with oil being one of the most traded commodities.

Last time they USDNOK and USOIL both hit a psychological resistance, both reversed at the same time. USDNOK has fallen sharply from 9.0 level as oil has risen from a 65 level. Later on, the oil went for 200 EMA and USDNOK returned to 9.0 and bounced again.

I don't see any fundamental basis for cheaper oil. Even if there are lockdowns, they will be fairly limited and then, the demand is bound to stay high. Even more so with Europe concerned about winter and Japan starting to use its reserves soon.

So I find it very likely that Oil might stop and reverse at 75 or 70 level where the price meets 200 EMA, also. Of course, at that time, USDNOK will be around the level of 9.0 and that's when Norwegian Krona started to gain strength against US Dollar.

When the price action on both pairs supports the idea, I will be shorting.

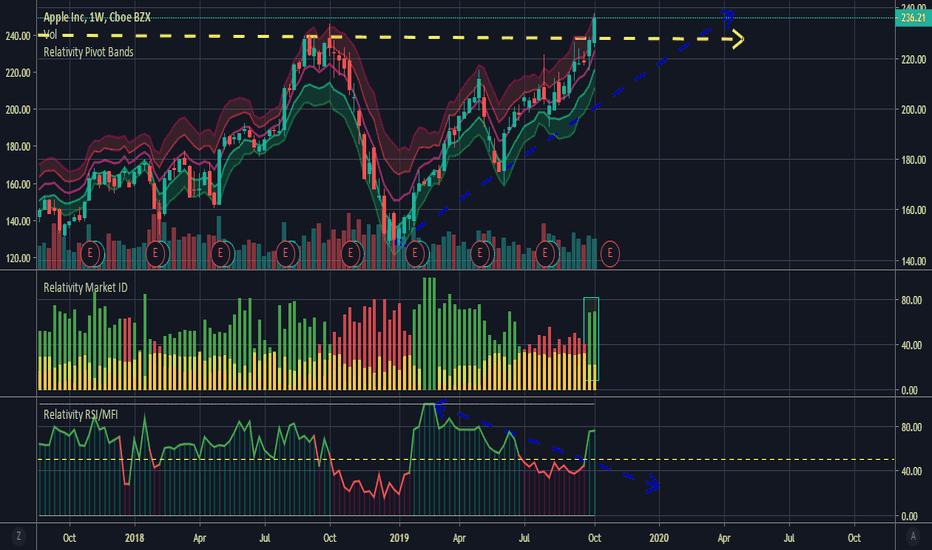

Relativity

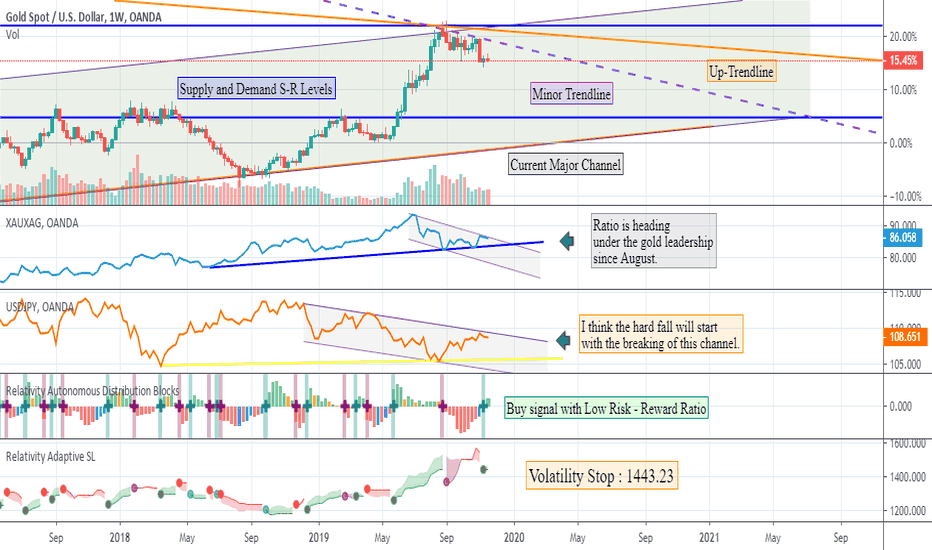

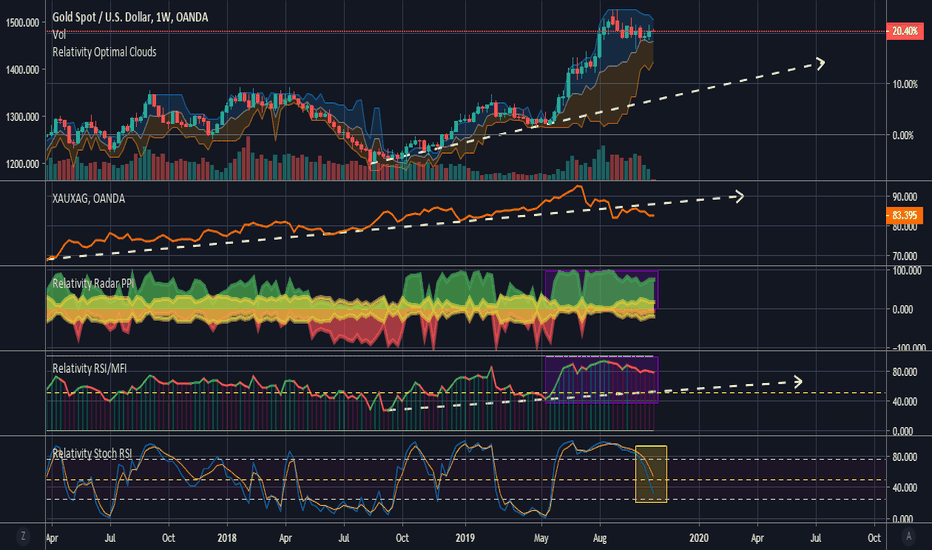

Gold Strategic Overview before new weekMy weekly views on gold are indicated on the presentation.

Even though the buy signal is coming, I think this is the only response buys for now.

The bull market continues on the main channel.

And in 2020, even though I expect higher peaks than 2019, I think that gold prices should fall slightly.

I expect gold prices to fall in the medium term.It is very important to have the position size to withstand this.

The USDJPY parity can give you the clue about when the due date will come.

This is because the correlation between the Japanese yen and gold price movements is very high in the weekly timeframe.

When we look at the gold / silver ratio, we see that the pair continues under the leadership of gold.

Here is a possibility Minor - trend line can be challenged.

Although I personally go over the net short position on a weekly basis, I am of the opinion that short positions will be opened on a daily basis.

Although it is a bit risky now, it is a good idea to follow it carefully and achieve the appropriate risk / reward ratio.

I wish success to all traders in the new week , regards.

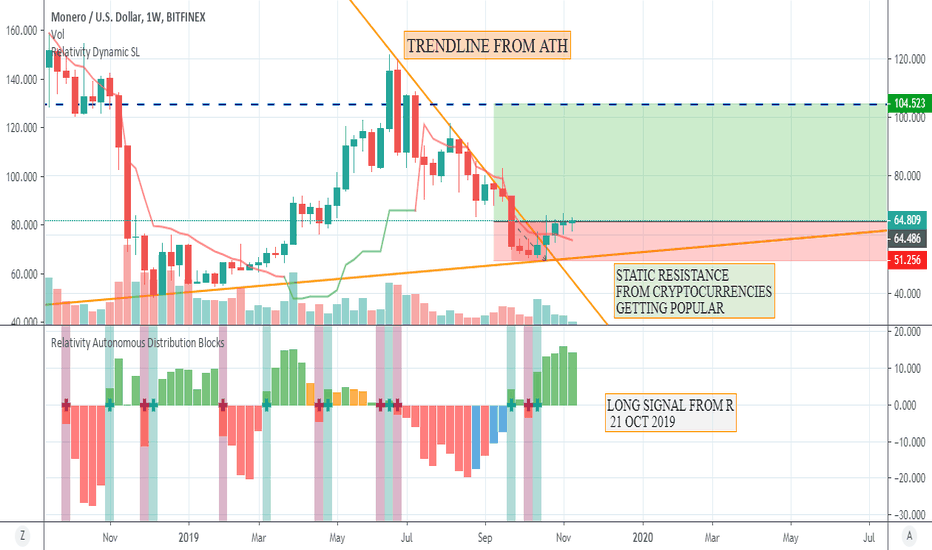

XMRUSD : LONG"Google is planning to offer checking accounts within its Google Pay app", The Wall Street Journal reports.

This is my strongest foothold in this analysis. There may be good news for the "Hodl"ers.

Including non-trace technology, this expectation may increase the demand for Monero.

I guess they were the first to integrate this technology successfully inside of this cryptocurrency.

I think that cryptocurrencies with this feature and high daily transaction volume should be carefully monitored for buy oppurtunies.

Stoploss : 51.2

Goal : 104.5

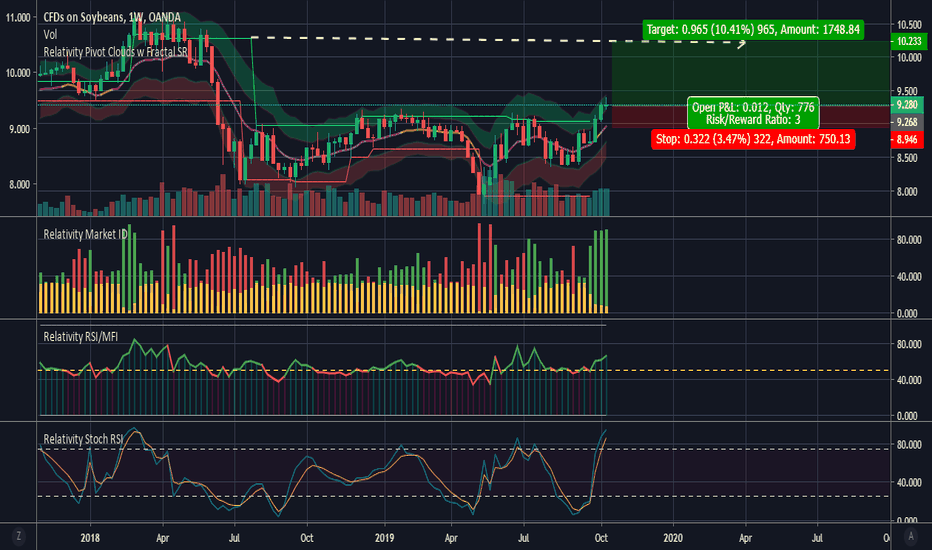

GOLD : Technical OverviewGold prices continue to remain in the rising trend, although the upward region has slackened occasionally, the bear market has not been switched.

When we look at the gold / silver ratio, we see that silver is preferred more.

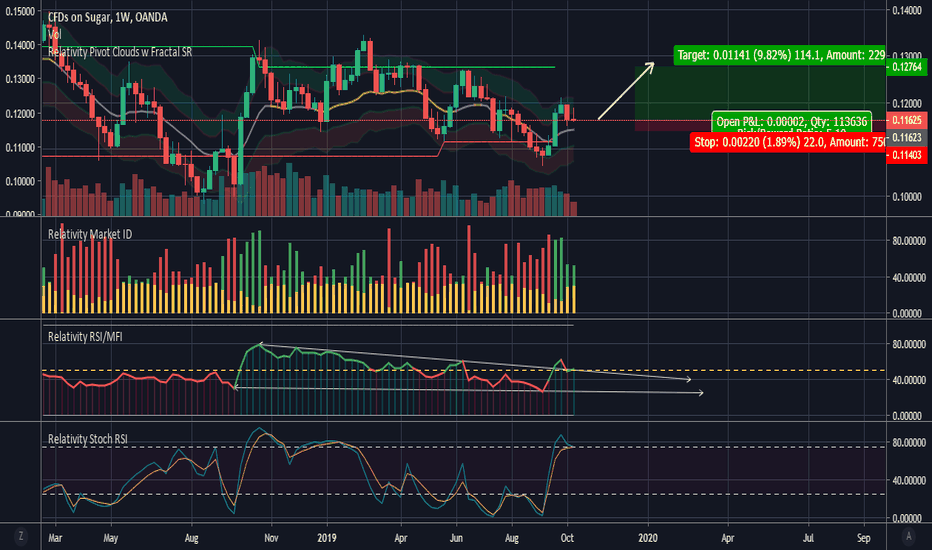

Relativity technical indicators can be observed here.

A new idea for gold will be shared in a different analysis when the time comes.

I will look silver (XAGUSD) , perhaps more preferred silver, may put silver into more serious trends.

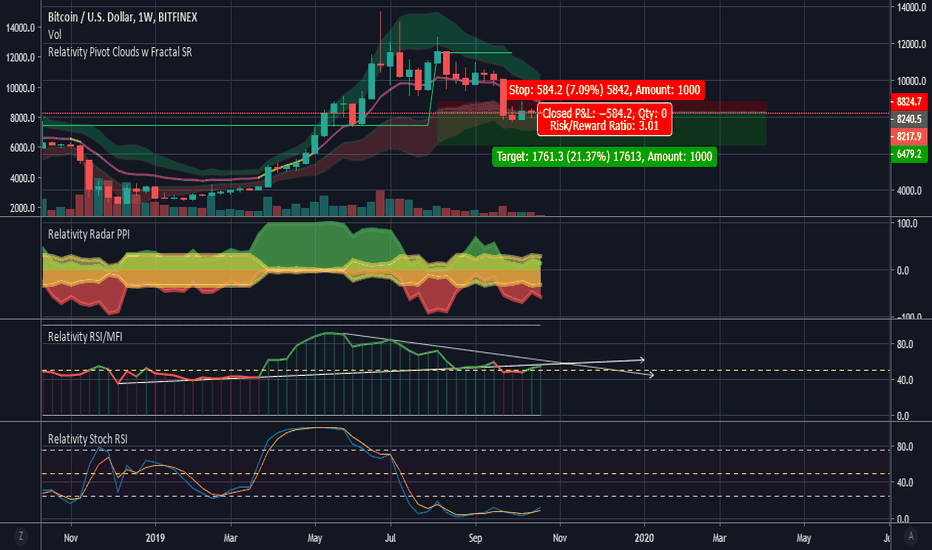

BITCOIN : SHORT Although I think crypto coins are risky, I think there must be a more powerful development for an upward movement than a downward movement.

Nice analysis as a risk / reward ratio.

Adjust your stoploss level according to your leverage.

This analysis involves a big risk, if your positions are large for your capital.

But the reward is high , so it is good to make position size small.

Be careful.

I do not recommend aggressive positions.

Because altcoins are strong now.

My suggestion :

Stoploss: 8825

Goal: 6479

Note: The risk / reward ratio of the analysis is 1/3.

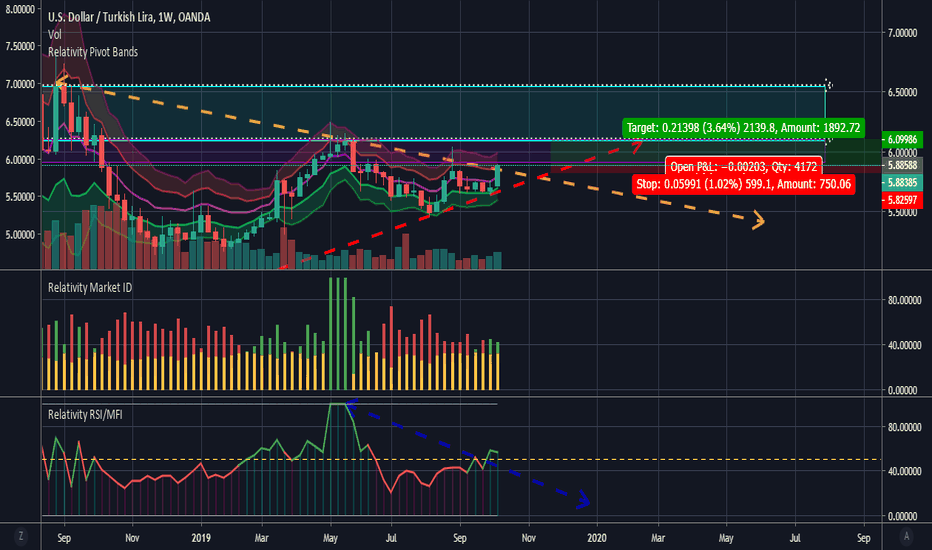

USDTRY - LONG (Gradual)Our risk / reward ratio is 0.28 in the first field and 0.09 in the second field.

There was a close above 5.84.

Long positions can be tried in small lots.

However, losses can be a bit high since the bar cannot be sure without closing, so stoploss should be placed directly at 5.81 or 5.84.

Our sales level for the first area is 6.095.

If the first area breaks down, our sales level is 6.56.

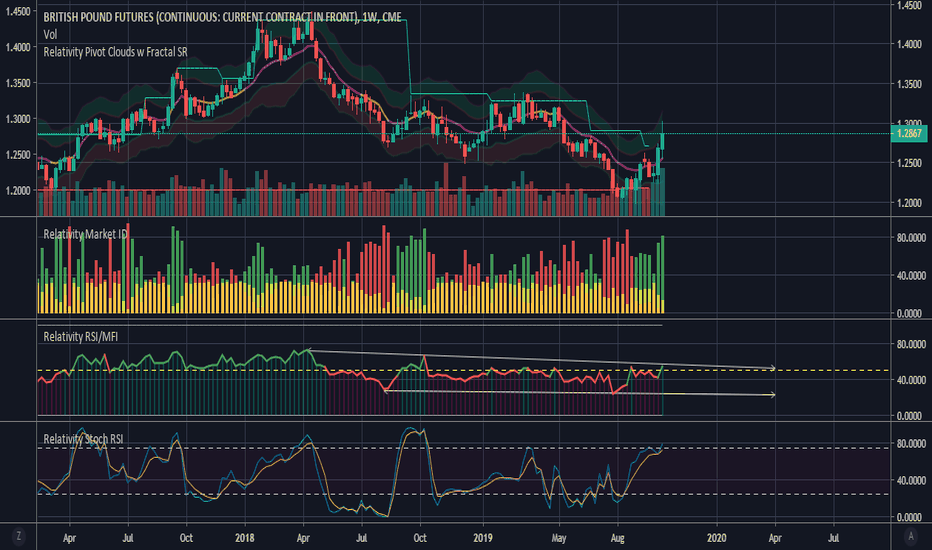

BRITISH POUND : "Can't take my eyes off you."There are so many improvements to this instrument that I paused even when I saw the long signal.

Everyone's waiting for what British Pound gonna do.

I drafted the analysis three times and erased it.

I'm looking at the channel I drew on the RSI.

And on the one hand, I follow developments.

My opinion is neutral , despite positive signals in line with mixed developments.

Regards.