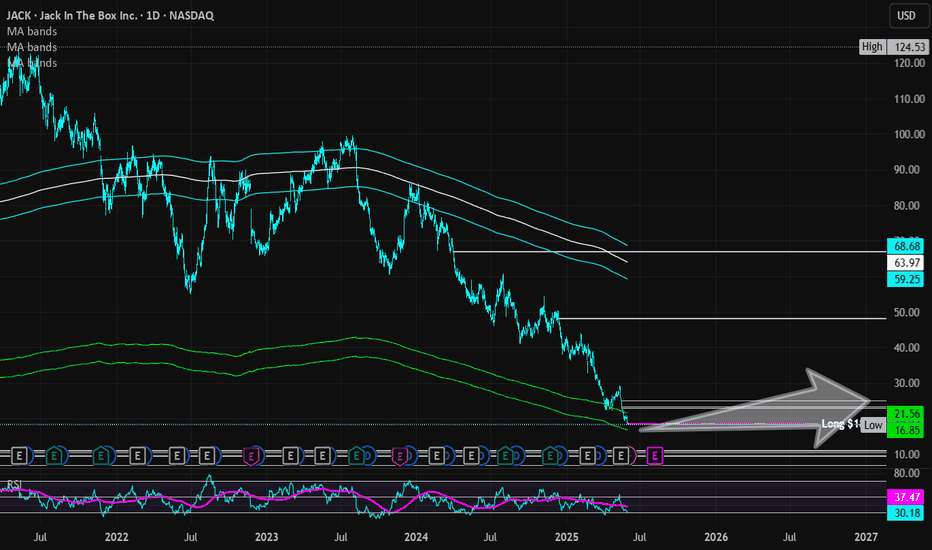

Jack in the Box | JACK | Long at $18.48Jack in the Box NASDAQ:JACK has taken a massive hit to its stock price since its peak in 2024 at just over $124 a share. It's currently trading around $18 and has entered my "crash" simple moving average zone. More often than not, this area signifies a bottom (or future bounce), but I view it more as a consolidation area to accumulate shares. Float = 18M; short interest = 19%...

Looking at NASDAQ:JACK fundamentally, this isn't the healthiest of restaurant companies. It is using a high level of debt to finance its operations and a high dividend yield of 9.28%. The company's revenue and profits have been slowly declining since 2023, as well. However, after 2025, the company anticipates a slow turnaround to begin. It will be closing 80-120 restaurants across the U.S. in 2025, which is a positive to help the company moving forward. NASDAQ:JACK also just got a new CFO and they are (at least from an outsider's view) attempting to change to generate share value. At this share price, I believe the company is in dire straits to get some investor confidence back. It's a strong name with long history.

While the stock price may hit true resistance at just under $17, NASDAQ:JACK is in a personal buy zone at $18.48. Targets are set low due to economic uncertainty.

Targets:

$23.00 (+24.5%)

$25.00 (+35.3%)

Restaurantgrowth

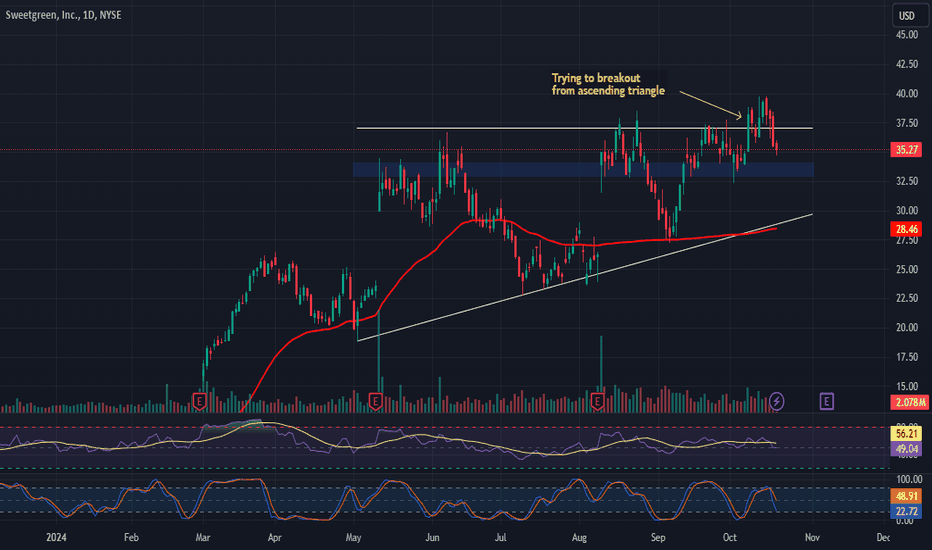

Sweetgreen (SG) AnalysisCompany Overview: Sweetgreen NYSE:SG is strategically expanding its footprint, with four new restaurant openings in Q2 2024, including a significant location in New Hampshire. This move underscores Sweetgreen's focus on untapped markets, aimed at driving revenue growth and geographic diversification.

Key Catalysts:

Expansion into New Markets: Opening in new locations, particularly in New Hampshire, demonstrates Sweetgreen’s plan to broaden its market presence, catering to new customer bases, which could meaningfully contribute to its overall growth trajectory.

Infinite Kitchen Concept: The successful implementation of the Infinite Kitchen at Penn Plaza is a game-changer. This innovative concept, which reduces wait times to under 3 minutes while improving operational efficiency, enhances the customer experience. As this model is scaled across more locations, Sweetgreen stands to gain from higher margins and enhanced customer satisfaction, potentially leading to stronger unit economics.

Operational Efficiency: The Infinite Kitchen rollout improves labor productivity and reduces operational bottlenecks, allowing Sweetgreen to serve more customers in less time. This could be instrumental in improving both top-line growth and profit margins.

Investment Outlook: Bullish Outlook: We remain bullish on SG above $33.00-$34.00, with the company's ability to innovate through its Infinite Kitchen model and its focus on entering new markets. Upside Potential: Our upside target for SG is $62.00-$64.00, driven by operational improvements, increased restaurant count, and scalability of its efficient kitchen model, which should bolster profitability and revenue growth.

🚀 SG—Innovating in Food Service with Efficiency and Expansion. #RestaurantGrowth #OperationalExcellence #Scalability

🍔📈 Shake Shack (SHAK) Analysis 🌍🔍Strong Performance:

Shake Shack NYSE:SHAK , a growing restaurant chain, ended 2023 on a high note with successful sales strategies and margin expansion. CEO Randy Garutti highlighted the opening of 41 new U.S. restaurants and 44 international locations, including in Thailand and the Bahamas. Despite inflationary pressures, same-store sales saw a 2.8% year-over-year increase.

Expansion Potential:

With the Federal Reserve potentially maintaining or lowering interest rates, Shake Shack could see further expansion in 2024. With 518 locations (334 in the U.S.) at the end of 2023, there is significant growth potential. While it may not reach the size of McDonald's, it could approach Five Guys' nearly 1,500 U.S. locations, potentially quadrupling its current count.

Investment Outlook:

Bullish Outlook: We are bullish on SHAK above the $87.00-$88.00 range.

Upside Potential: With an upside target set at $145.00-$150.00, investors should monitor sales growth and expansion efforts as key performance drivers.

📊🍔 Keep a close watch on Shake Shack's growth for promising investment opportunities! #SHAK #RestaurantGrowth 🌍📈