Review and plan for 14th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

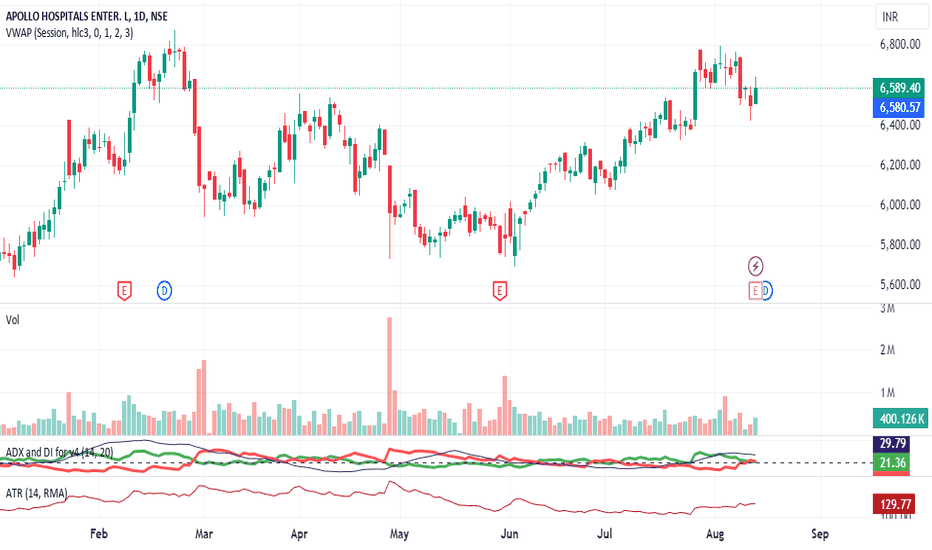

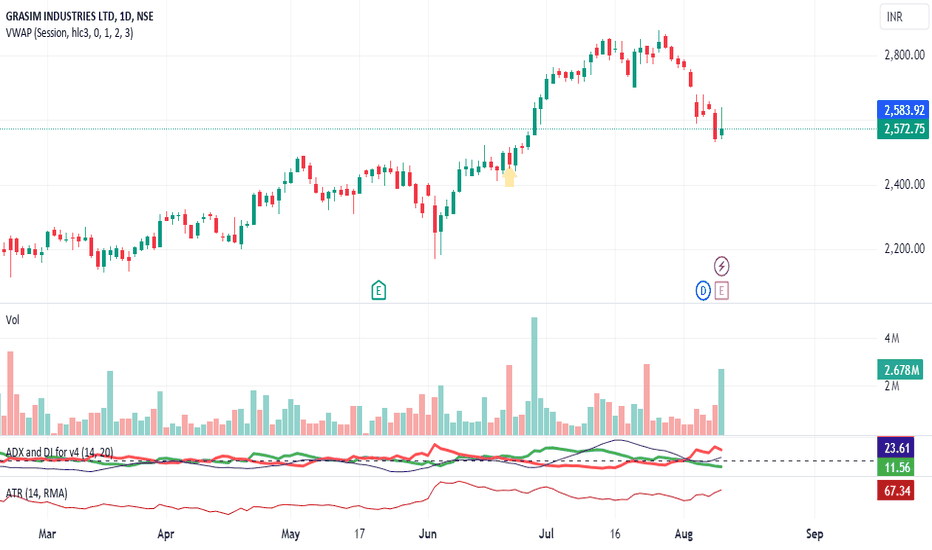

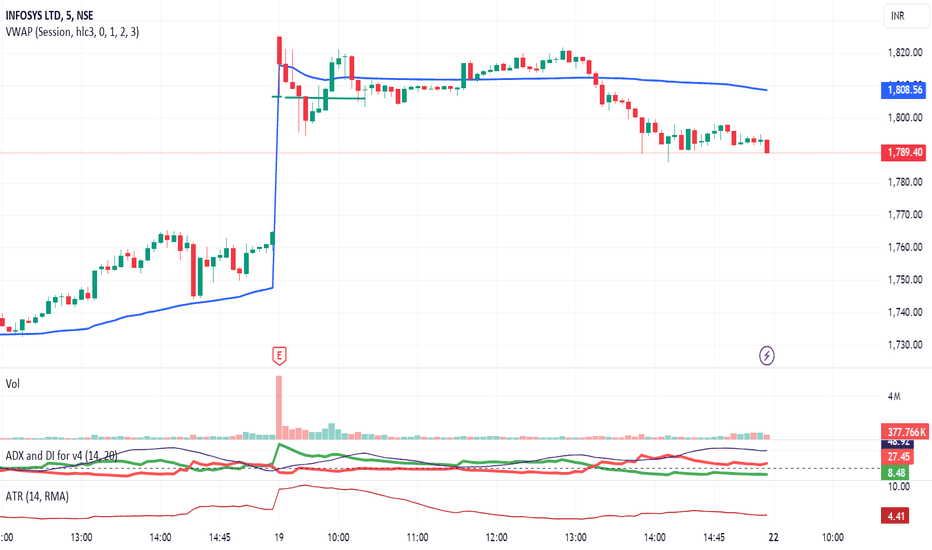

Stocks to watch.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Results

Review and plan for 14th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

Stocks to watch.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 12th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

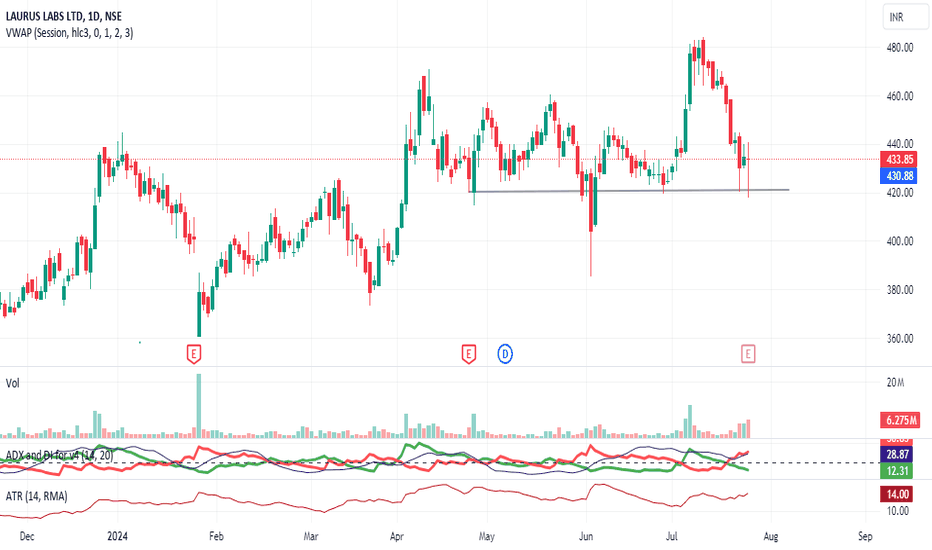

stocks to watch- included.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 9th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

stocks to watch...

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 9th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

stocks to watch...

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 8th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

stocks to watch included.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 7th August 2024 Nifty future and banknifty future analysis and intraday plan in kannada.

stocks to watch.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Plan for 5th August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

STOCKS TO WATCH.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

review and plan for 1st August 2024Nifty future and banknifty future analysis and intraday plan in kannada.

stocks too.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 26th July 2024Nifty future and banknifty future analysis and intraday plan in kannada.

STOCKS TO WATCH- included.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 22nd July 2024 Nifty future and banknifty future analysis and intraday plan in kannada.

Stocks to watch included.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan(stocks to watch) for 30th May 2024 Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

NRB Bearings: Bullish Setup & Earnings BoostChart Pattern:

NRB Bearings has recently exhibited an inverted head and shoulders pattern, which is typically a bullish reversal indicator. This pattern suggests a potential upward trend following a period of consolidation.

Support Levels:

The stock has established a strong base at key support levels, indicating sustained buying interest and forming a solid foundation for future price movements.

Critical Resistance:

A decisive close above the 340 level could significantly boost the stock's price, as it would confirm the breakout from the inverted head and shoulders pattern, signaling a stronger bullish momentum.

Upcoming Catalyst:

The upcoming quarterly results are anticipated to reflect good financial growth, which could serve as a catalyst for upward price movement. Positive earnings reports often attract increased investor interest, driving the stock price higher.

Trade Setup:

Entry Point: Consider creating a long position if the stock closes above the 340 level, confirming the bullish breakout.

Stop Loss (SL): Set a stop loss below the right shoulder of the inverted head and shoulders pattern to manage downside risk effectively.

Target Levels: Identify initial targets at previous resistance levels. Further targets can be adjusted based on the stock's performance and overall market conditions.

Disclaimer:

Before taking any position, consult your financial advisor to ensure the trade aligns with your investment strategy and risk tolerance. This analysis is for educational purposes only and does not constitute financial advice.

Happy Trading!

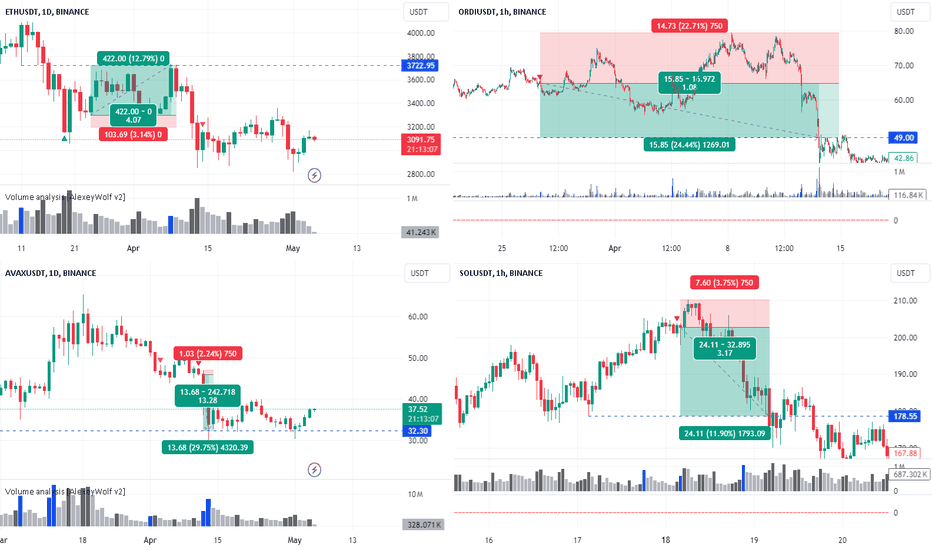

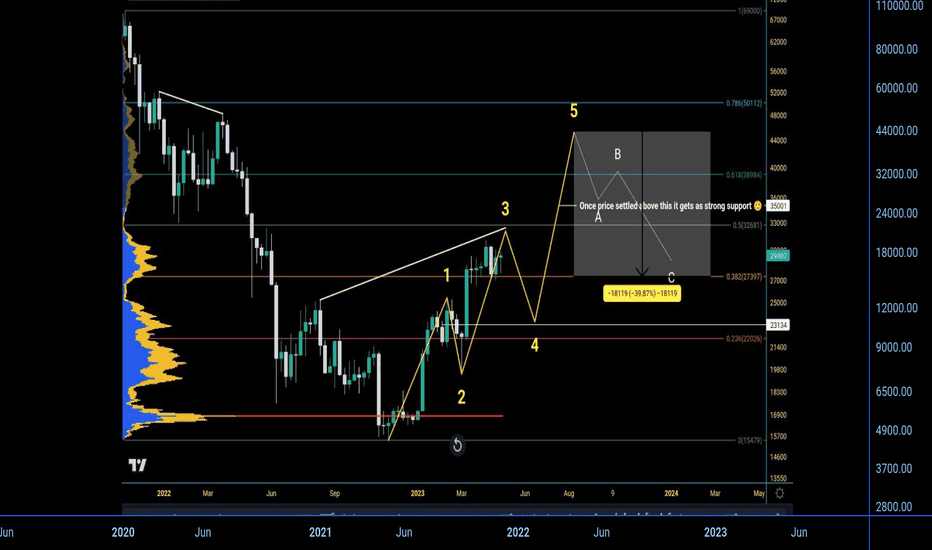

Trading Ideas Results for March-AprilThis year I started sharing my analytical reviews and trading ideas since mid-March. I like using TradingView because here you can't edit or delete a published idea. Everything that has been published can be found and verified, which is not always possible on other platforms, for example, in Telegram channels where the administrator can adjust the statistics.

It's time to summarize the interim results of trading ideas from mid-March to April 30. In this review, I will only consider short-term ideas on the daily and hourly timeframes. Medium-term ideas on the weekly and daily timeframes will be analyzed in a separate review.

There were 4 short-term ideas. All of them are on the chart attached to this post. One for buying and three for selling. The results are also visible on the chart, and they are 100%, all targets were achieved. You can find more details about the ideas by following the links below (see related ideas). But was everything so good? Unfortunately, no, if we look more closely at how the price moved in each idea.

For AVAX, the selling time was chosen perfectly. Without any drawdown (2%), the price reached the target: +29%.

For ETH, I waited for the price to return to the range of 3200-3400 for buying, the drawdown after buying reached up to 3%, and the achieved target was +12%.

For SOL, the idea was to sell, and the drawdown on the trade reached up to half of the target (4%), but then the target was achieved with a gain of +11%.

For ORDI, a less favorable moment was chosen for selling compared to other ideas, resulting in a drawdown of 23%, which is comparable to the achieved final target of +24%.

It is worth noting that ORDI's market capitalization is 15 times smaller than AVAX's. Could this be the difference? What is an acceptable drawdown percentage for you before the idea works out? Share your thoughts in the comments.

By the way, as part of the educational article on March 31, I made a short-term forecast for OPUSDT. Interestingly, it also worked out. Without any drawdown, the target was achieved: +29%.

I will publish the interim results of medium-term ideas in a separate review.

Review and plan for 29th April 2024Nifty future, banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 26th April 2024 Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and plan for 25th April 2024 Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Review and Plan for 24th April 2024Nifty /banknifty and stocks analysis, and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

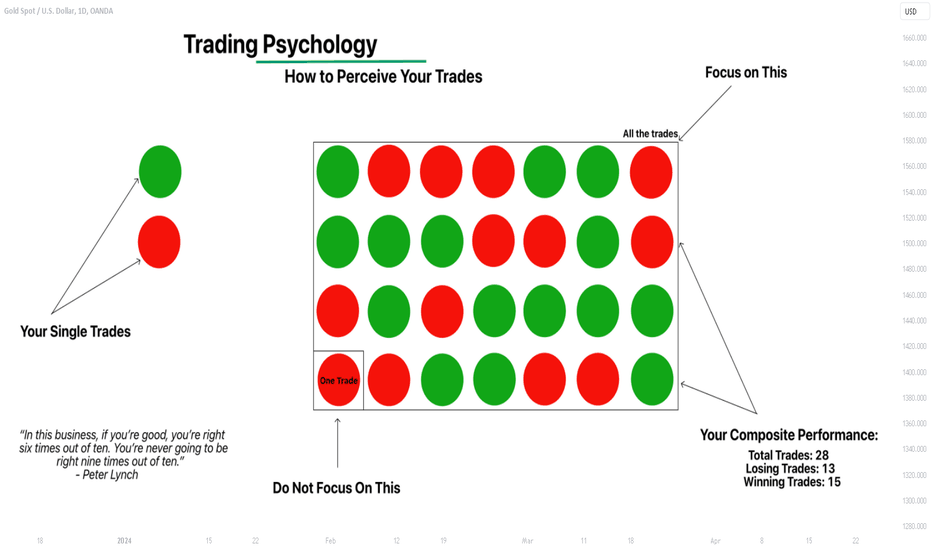

Trading Psychology and Your Losses

Hey traders,

In this post, we will discuss a common fallacy among struggling traders: overestimation of a one single trade .

💡The fact is that quite often, watching the performance of an active trading position, traders quite painfully react to the price being closer and closer to a stop loss or, alternatively, coiling close to a take profit but not being managed to reach that.

Fear of loss make traders make emotional decisions :

extending stop loss or preliminary position closing.

The situation becomes even worse, when after the set of the above-mentioned manipulation, the price nevertheless reaches the stop loss .

Just one single losing trade is usually perceived too personally and make the traders even doubt the efficiency of their trading system.

They start changing rules in their strategy, then stop following the trading plan, leading to even more losses.

❗️However, what matters in trading is your long-term composite performance . A single position is just one brick in a wall. As Peter Lynch nicely mentioned: “In this business, if you’re good, you’re right six times out of ten. You’re never going to be right nine times out of ten.”

There are so many factors that are driving the markets that it is impossible to take into consideration them all. And because of that fact, we lose.

The attached chart perfectly illustrates the insignificance of a one trading in a long-term composite performance.

Please, realize that losing trades are inevitable, and overestimation of their impact on your trading performance is detrimental.

Instead, calibrate your strategy so that it would produce long-term, consistent positive results. That is your goal as a trader.

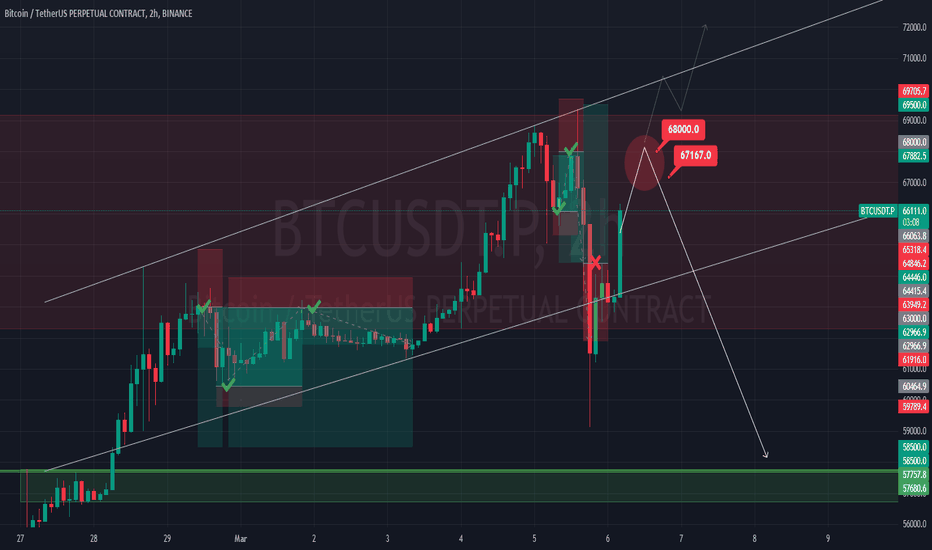

#BTC #Bitcoin #Update & #Result #Eddy #BTC #Bitcoin #Update & #Result #Eddy

Update : (( The possibility of correction of Bitcoin from the specified price tags can be deep or within the specified limit, what do you think? ))

Result : (( Out of 6 signals sent, we experienced a stop "Risk-Free" & a stop "loss" & 4 signals received their profit <3 )) What's About You? ;-)

Related Relevant Analysis of Bitcoin : (( BTC/USD )) : Check Link :

My #Analysis of #USDT "Tether Market Cap Dominance" from the link below :

Previous BTCUSDT.P Setups 1+2 :

Previous BTCUSDT.P Setups 3+4 :

Previous BTCUSDT.P Setups 5+6 :

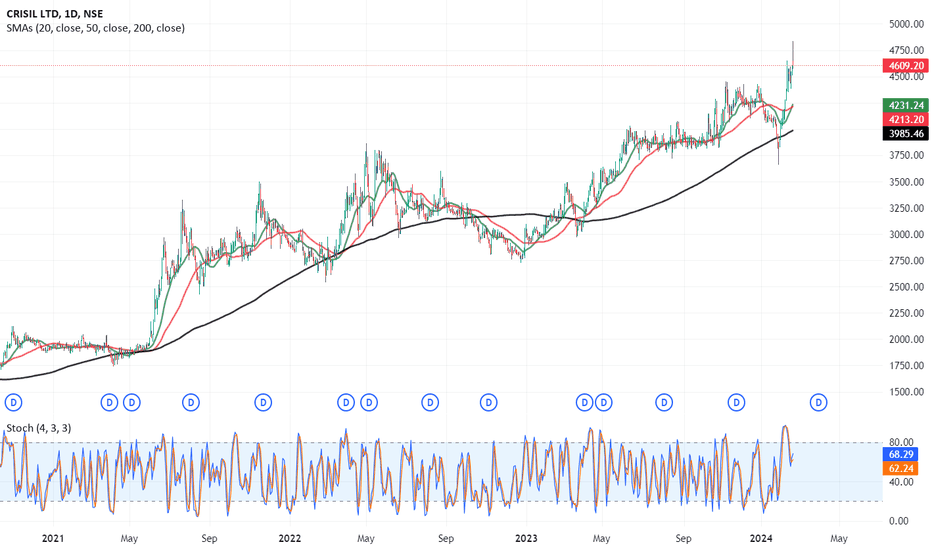

Quarterly result trade in JHUNJHUNWALA stockCrisil Ltd. the famous multibagger stock of Late Sri Rakesh Jhunjhunwala portfolio has posted its best ever quarterly result, revenue of 918 cr and net profit of 210 cr. For the first time ever it has crossed 200 cr quarterly net profit. The yearly sales has also crossed 3000 cr and net profit of 650 cr for the first time ever. It is an excellent result by the company. The stock is expected to rise up in the next week and can be considered a good buy for the next week time period and also it can be considered an excellent pick for long term investing because of continuous growth every year and future growth potential.

Please invest after your own analysis.

May this analysis post positive profit in your portfolio.

Thank you

GBPUSD Jan 17th Long Results Long Signal Trade

Jan 17th 2024

Results

A.1 Set-up On the 4h chart

Entry Price: 1.26350

Stop Loss: 1.25850

Take Profit: 1.27200

Note: Alerts are for 2 long trades off previous zone.

My Trades:

I placed two long trades (see 1 and 2 on chart)

Trade 1: I took 0.75% profit

Improvements: I could have let the trade breath and I would currently still be in the trade with a new locked in profit of 1.08%

Trade 2: Scale in trade

Was a breakeven trade

Improvements:

Same concept as trade 1. If I did I would be locked in with 2% profit and looking for a 3rd scale in trade.

Here result 😌 on $BTC pump and dump Hi 👋 I am RAJ 😊 professional trader ✨

Here result 😌 on BITSTAMP:BTCUSD i predicted on May 2023

Said we are going to reach correction and pump 📌

7 month's completed 🚀 as plan going forward ⏩

Check ✔️ chart 📉📈 as said reach $31.8k then correction $25.2k 😂

Then return pump towards $37.8k

Wicks 40's

Meanwhile 😂 may PPL struggle to predict up or down 😆

Here my successfully result 😌

I don't say only sucess

This year 🙌 i done 18 charts prepared 12 succeed 6 lost