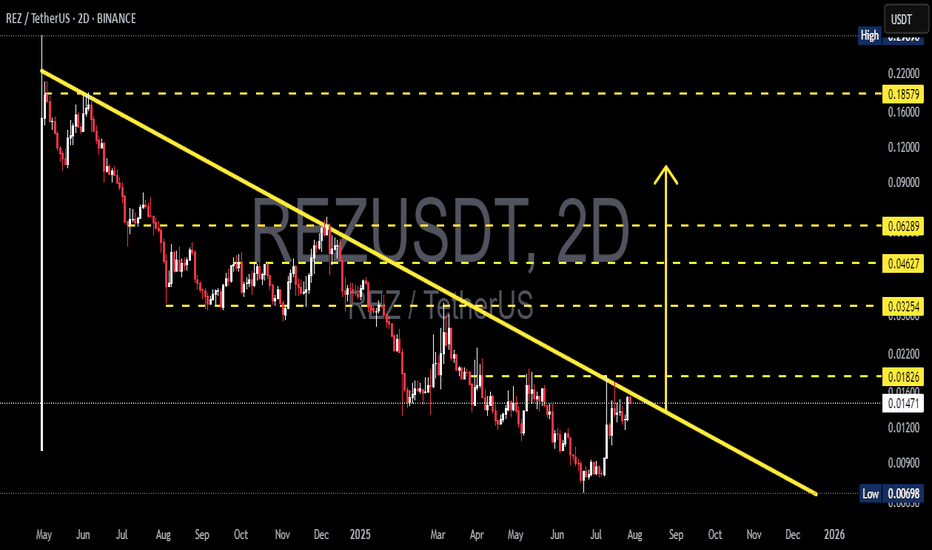

REZUSDT at a Critical Point– Testing a Major Long-Term TrendlineComplete Analysis:

The REZUSDT pair is currently showing a highly compelling setup, as price approaches a long-term descending trendline that has held since May 2024. This is a pivotal moment that could dictate the next significant move—either a bullish breakout or a bearish rejection continuation.

---

📉 Pattern and Structure

The chart is forming a large Descending Triangle pattern, with the descending trendline consistently pushing the price lower for over a year.

Price is now nearing a key horizontal resistance at approximately 0.01826 USDT, which also intersects with the long-term trendline.

The lowest support level sits at 0.00698 USDT, marking the bottom from a major previous decline.

---

📈 Bullish Scenario

If the price successfully breaks and closes above the trendline (~0.01826 USDT), then:

The next potential upside targets could be:

0.03254 USDT

0.04627 USDT

0.06289 USDT

This breakout could signal a trend reversal in the medium term, especially if accompanied by strong volume.

---

📉 Bearish Scenario

However, if the price gets rejected at this resistance area:

It could pull back toward:

The minor support at 0.01200 USDT

The major support at 0.00698 USDT

A rejection at this trendline would confirm the continuation of the bearish descending triangle pattern, which traditionally favors further downside.

---

🧠 Conclusion:

REZUSDT is currently in a make-or-break zone. The market’s reaction to the descending trendline will be crucial in determining the next move. Traders should monitor volume and wait for a solid candle confirmation before entering any position.

#REZUSDT #CryptoAnalysis #TechnicalAnalysis #AltcoinBreakout #DescendingTriangle #CryptoTrading #TrendlineBreak #SupportResistance #REZAnalysis #BreakoutWatch