RIG

THE WEEK AHEAD: TSLA, RIG, X, EWZWith the vast majority of options-liquid earnings plays in the rear view mirror, premium selling becomes a search for just plain Jane high implied volatility underlyings. This week, TSLA, RIG, X round out out the top implied volatility single names; EWZ, the exchange-traded fund top implied volatility play. Here are some possible nondirectional setups, which are naturally preliminary ... .

TSLA: The July 20th 225/330 short strangle is paying 10.15 with a 71% probability of profit metric and break evens at 214.85/340.15. Its defined risk counterpart, the 220/230/330/340 iron condor, is paying 2.66 at the mid with a probability of profit of 62% and break evens at 227.34/332.66. Ideally, I'd like to see a 70% probability of profit plus credit received greater than one-third the width of the wings, however, but would be hesitant to bring in the wings on this underlying, since it has a tendency to move big.

RIG: The July 20th 14 short straddle is paying 1.87 with break evens at 12.13/15.87. Throw on a couple of cheap long wings to convert it into an iron fly -- the 11/14/14/17, and you bring in buying power reduction quite a bit over naked without giving up a huge amount of credit: it's paying 1.61 versus a max loss of 1.39 with break evens at 12.39/15.61. With iron flies, I like to see the setup pay at least 1/4 of the width of the longs (here, 6-wide), so this looks like a good, small buying power effect play.

X: The July 20th 32/42 short strangle is paying 1.69 with a 69% probability of profit, break evens at 31.18/42.82. The corresponding 29/32/42/45 iron condor: .82 with break evens at 31.18/42.82. As with the Tesla play, I would like to see more out of the defined risk setup -- one-third the width of the wings in credit ... .

EWZ: The July 20th 34/42 short strangle is paying 1.13 with a probability of profit of 69% and break evens at 32.87/43.13; the 31/34/42/45 iron condor, .75 with 33.25/42.75 break evens and a 66% probability of profit.

Alternatively, the July 20th 33 short straddle is paying 3.88 with 34.12/41.88, with the corresponding 31/38/38/45 iron fly paying 3.50 with a 3.50 max loss metric and break evens of 34.50/41.50. As with the RIG iron fly, the cheap longs bring in buying power effect quite a bit over naked without giving up a ton in credit received ... .

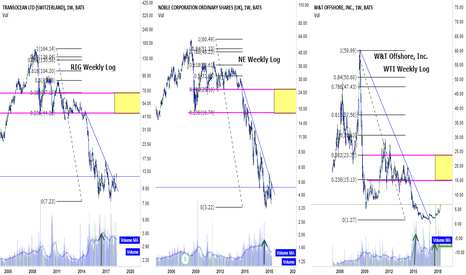

Offshore Long term perpectiveI remain bullish on offshore drilling and services. They have been in long term bear slide. But they have begun to rise on much increased volume. A .236- .382 retraction seems reasonable to me long term. These levels also appear to at expected resistance levels.

Process your way.

RIG: F/U on offshore drilling. Looking good.This is a follow to my posts from Jan 3 and Feb 8 (please see links below). Now have a big up day and a positive reversal in the daily RSI. Very encouraging. WTI another offshore stock also up a lot today. Take a look at these and process your way.

Here is one view of the fundamentals.

seekingalpha.com

GUSH, time to go long? Looking at the chart for GUSH. I am looking for a break above the last high (green dotted line). A move higher should signal a continuation of higher highs and higher lows (red lines). I'll buy with a break above. OIL is looking good and other stocks like RIG and VLO seem to be trending higher. Wait for the break of the green line to confirm, and then set your stop just below it. It must hold.

AXAS set to runAbraksas Pete, AXAS is set to run again. With the weekly chart breaking above the 34sma returns look promising. This stock could run up to the $3 range yielding a nice return. The daily chart and hourly charts also look good. As long as the OIL services sector continues higher AXAS should move higher as well. Others to looks at are GUSH, RIG, DO, VLO. Stay in this one, until you see the stock drop below the 34sma on the daily.

Long ESVStop below the large uptrend channel dating back to the early 90's. Target the 250/300 ema on the monthly.

RIG Weekly: taking a look. Turning around. Also see Daily chart to follow.

RIG is a offshore drilling company which as you see above has been in a long term downtrend esp with adequate oil supplies available already and oil prices down.

It has made a recent bounce right up to the center line of the down channel. I favor there is more up correction to come soon perhaps up to the top of the channel.

Some info on the fundamentals:

seekingalpha.com

seekingalpha.com

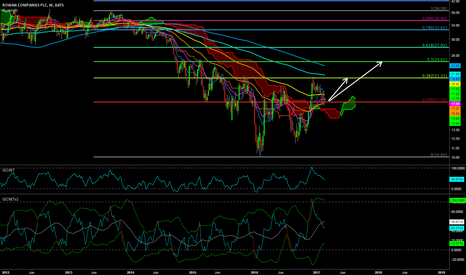

Long RowanBullish price structure. Ideal stop below 17. 4x ev/ebitda.

Healthy cash flow and balance sheet.

Joint venture with Saudi Aramco.

Long RDCRowan has a joint venture with Saudi Aramco. Cash flow is healthy and enough backlog to sustain through 2020 imo. 3.5x ev/ebitda.