XAGUSD Analysis for 16/10/2024: Slight Bearish Bias ExpectedIntroduction

On 16th October 2024, XAGUSD (Silver vs. US Dollar) is expected to exhibit a slight bearish bias in today’s trading session. Several fundamental factors and current market conditions are contributing to this outlook, including shifting interest rate expectations, global risk sentiment, and the overall strength of the US Dollar. In this analysis, we will explore the key drivers behind the expected bearish trend for silver and provide insights into the potential short-term outlook.

Key Drivers for XAGUSD Bearish Bias

1. Strength of the US Dollar

The primary driver for the bearish bias in XAGUSD today is the relative strength of the US Dollar. While the US Dollar experienced some weakness in recent weeks, it has regained some footing as traders react to mixed economic data from the United States. The latest CPI (Consumer Price Index) report showed that inflation, while cooling slightly, remains elevated enough for the Federal Reserve to maintain its hawkish tone.

This resurgence in the US Dollar strength is exerting downward pressure on silver, as precious metals tend to move inversely to the US Dollar. The strong USD makes silver more expensive for holders of other currencies, reducing its demand and weighing on XAGUSD.

2. Rising US Treasury Yields

Another key factor contributing to the bearish outlook for XAGUSD is the rise in US Treasury yields. As bond yields climb, the opportunity cost of holding non-yielding assets like silver increases. Investors typically shift capital into assets with higher yields, such as US Treasuries, when interest rates rise, which can hurt the demand for precious metals.

The 10-year US Treasury yield has been on an upward trend, reflecting market expectations of continued tightening from the Federal Reserve. With yields rising, investors are less inclined to seek safety in silver, resulting in a potential decline in XAGUSD.

3. Reduced Safe-Haven Demand

Global risk sentiment has shown signs of stabilizing, with equity markets recovering and fears of an economic slowdown easing. This shift toward a "risk-on" sentiment typically reduces demand for safe-haven assets like silver.

Moreover, geopolitical risks have also subsided to some degree, as major economies navigate through inflationary pressures and geopolitical tensions. As investors regain confidence in riskier assets like equities, the demand for silver as a hedge against uncertainty has weakened, further contributing to the bearish bias in XAGUSD today.

4. Lackluster Industrial Demand

Silver is not only a precious metal but also has significant industrial applications, particularly in sectors like electronics, solar energy, and manufacturing. However, industrial demand for silver has faced challenges recently due to slowing global manufacturing activity, particularly in China and Europe.

China’s efforts to stabilize its economy have shown some positive results, but concerns over a full recovery in its industrial sector remain. Weak industrial demand could limit silver's upside potential, and the reduced demand from industrial sectors is likely to weigh on XAGUSD prices.

5. Technical Analysis

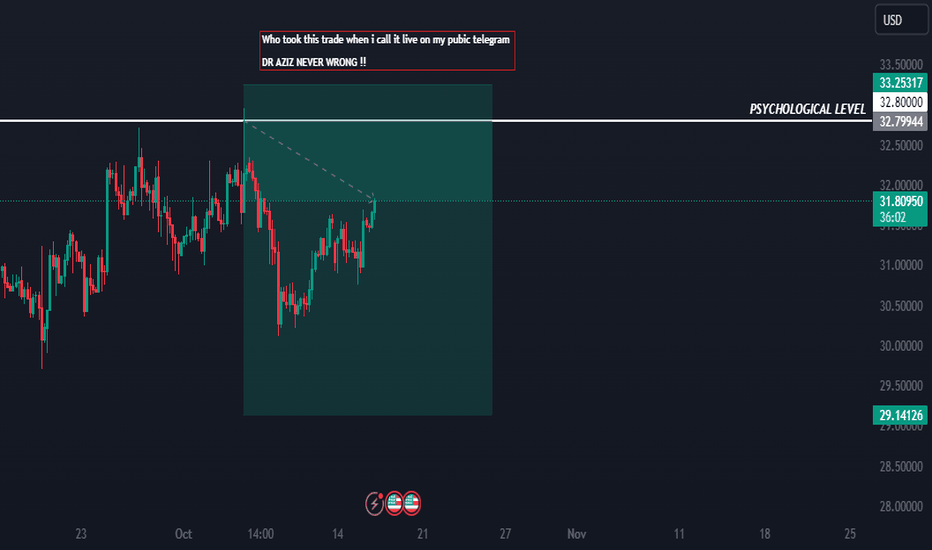

From a technical perspective, XAGUSD is facing downward pressure after failing to break key resistance levels in previous sessions. Silver has been trading below its 50-day moving average, signaling ongoing bearish momentum.

Additionally, the Relative Strength Index (RSI) indicates that silver is not yet in oversold territory, suggesting there may be further room for downside movement. If silver continues to face resistance at the $23.00 psychological level, we may see a continuation of the bearish trend in the short term.

Conclusion

In summary, XAGUSD is expected to trade with a slight bearish bias on 16th October 2024, driven by multiple fundamental factors. The strength of the US Dollar, rising US Treasury yields, reduced safe-haven demand, and lackluster industrial demand are all contributing to the downside pressure on silver. While silver may face near-term weakness, traders should keep an eye on future economic data releases and central bank policies for potential shifts in market sentiment.

For more detailed updates and live analysis of XAGUSD and other financial markets, follow our TradingView channel.

Keywords: XAGUSD analysis, silver price forecast, bearish silver outlook, US Dollar strength, rising US Treasury yields, safe-haven demand, industrial silver demand, silver technical analysis, XAGUSD today, precious metals market.

Risingustreasuryyields

Slightly Bearish Bias Expected on XAGUSD today 09/10/2024.XAGUSD Analysis for 09/10/2024: Slightly Bearish Bias Expected

In today's analysis of XAGUSD (silver to USD), the market appears to be leaning towards a slightly bearish bias based on the latest fundamental factors and current market conditions. As of 09/10/2024, several critical drivers are influencing the precious metal's price, suggesting that downside momentum could dominate the day. This article highlights the key reasons behind the potential bearish outlook for silver.

Fundamental Factors Supporting Bearish Bias

1. Strengthening US Dollar

One of the most significant factors weighing on XAGUSD today is the strengthening of the US Dollar. The US Dollar Index (DXY) has been rising, supported by robust US economic data and expectations that the Federal Reserve may continue its hawkish stance. A stronger USD typically puts pressure on commodities like silver, as it becomes more expensive for investors holding other currencies, leading to reduced demand.

2. Rising US Treasury Yields

Alongside the stronger US Dollar, US Treasury yields have been climbing, reflecting investor expectations for continued high interest rates. Higher yields tend to increase the opportunity cost of holding non-yielding assets like silver, leading to selling pressure in the silver market.

3. Weakening Global Demand for Safe-Haven Assets

Silver, like gold, often benefits from its status as a safe-haven asset in times of uncertainty. However, recent improvements in global risk sentiment have reduced the demand for such assets. The relatively calm geopolitical landscape and better-than-expected economic data from key regions like the US and China have shifted investor attention away from safe havens, contributing to the bearish outlook for silver.

Technical Outlook for XAGUSD on 09/10/2024

- Support and Resistance Levels

XAGUSD is currently facing resistance around the $23.00 level, with key support lying near the $22.50 level. A break below the $22.50 support could trigger further downside momentum, reinforcing the slightly bearish bias for today.

- Moving Averages

The 50-day Moving Average (MA) has turned slightly downward, indicating bearish momentum. Additionally, the Relative Strength Index (RSI) is trending lower but still above the oversold territory, suggesting that there is room for further downside before a potential rebound.

Impact of Market Sentiment and Commodity Outlook

- Commodity Price Pressure

Commodities, in general, have been under pressure as global growth concerns and rising interest rates weigh on demand. Silver, being both an industrial and precious metal, is particularly sensitive to changes in economic outlooks. If growth expectations continue to moderate, it could limit the industrial demand for silver, further pushing prices lower.

- Geopolitical Stability

The relatively stable geopolitical environment has also played a role in reducing demand for silver as a hedge against uncertainty. Unless new tensions emerge, this stability could continue to weigh on safe-haven demand.

Conclusion

In summary, the outlook for XAGUSD today, 09/10/2024, appears to be slightly bearish. A combination of factors, including a stronger US Dollar, rising US Treasury yields, and lower demand for safe-haven assets, are all contributing to downward pressure on silver prices. From a technical perspective, the metal is facing resistance at $23.00, and a break below $22.50 could open the door to further losses.

Traders should monitor key support levels and consider potential short positions if silver continues to trade under pressure. However, it's essential to remain cautious and watch for any sudden shifts in market sentiment or global events that could alter this outlook.

---

Keywords for SEO:

XAGUSD analysis, silver price forecast, XAGUSD bearish bias, US Dollar strength, rising US Treasury yields, safe-haven demand, silver technical analysis, support and resistance levels, XAGUSD 09/10/2024, precious metals market outlook, silver trend, XAGUSD trend, forex trading, commodity market analysis, silver to USD, XAGUSD trading strategy, forex forecast, trading silver today.