Trading the bleeding markets with a winning mindset ;)There's a great struggle going from profit to loss.

A burst of a bubble, which in it's essence is hope.

But this is false.

The odds are, that your profits were on paper, so how does a loss on paper differ from a profit on paper?

Truth is - It doesn't.

But what it does do is play with your emotion.

Our mind has a tendency of expecting the worst once things start rolling in that direction.

Take a step back and think about what life threw at you so many times in the past, think about the times you thought things are going to end up the worst but actually didn't.

It could be you planned a nice day outside with your partner in the park but it started to rain.

But instead of crying about the day wasted and how this is just awful, you ended up cooking together a nice lunch and drinking wine while finding a new great TV show to watch, ending up being one of the best days in a while.

Not let's roll back to trading.

And let's cut out negative thinking completely just for 3 minutes and look only at the positive.

Positive points -

1) Cheap instruments all around to invest in

2) Great practice of mental skills while trading, which truly is the most influential aspect of mastering trading

3) It reminds you the very basics of trading that we lose track of once markets start flying up - Buy low, sell high.

4) Opportunity, opportunity, opportunity - Every time you would have bought into the stock market, over a few year period you would make great returns, same thing goes even for people who bought Bitcoin after the decline of 2018 and pretty much any other pop financial instrument.

5) You're a day trader? Great! Volatility is amazing if you have a strategy which is disciplined and consistent as well as based on risk management.

See how bright the light shines at this very moment?

Keep it. Be positive. Be hopeful. Be practical.

The negative quotes such as -

I can lose everything!

It's never going to rally back!

This is taking too long!

I don't have patience for this!

This is turning out to be so not fun!

I didn't expect to hold this trade this long!

How will any of this benefit you in any way? Where's the logic? Where's the gain? Where's the analysis? Where's the market view? Where's the money management?

Only look at what is relevant to your success. Block the negative, ignore it completely as much as you can and eventually always.

------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Thank you so much for reading! I hope you found my idea useful, if you did, please like and follow! It would mean the world to me.

-------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Riskmanagementstrategy

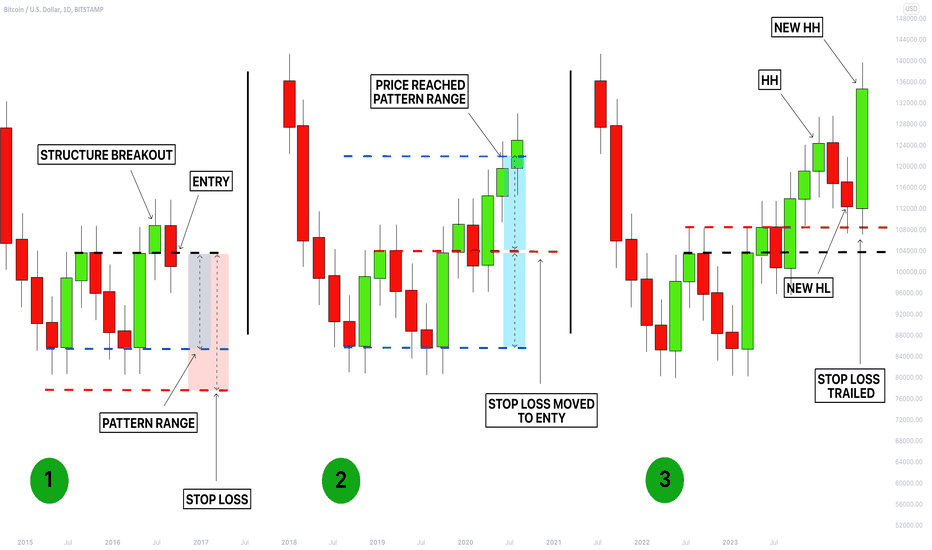

ow to Apply Trailing Stop | PRICE ACTION TRADING 📚

Hey traders,

In this post, I will share with you my strategy to apply a trailing stop.

Please, note that I am applying a trailing stop only in trend-following trades and only when a trade is opened on a key level. I trade price action patterns, so the following technique will be appropriate primarily for price action traders. Moreover, my entries are strictly on a retest.

1️⃣

Spotting a price action pattern I am always waiting for its neckline breakout. (if we talk about different channels, then by a neckline we mean its trend line)

Once I see a candle close below/above the neckline, I set my sell/buy limit order on a retest.

Stop loss will strictly lie below the lows of the pattern if we buy and above the highs of the pattern if we sell.

2️⃣

Once we are in a trade, you should measure the pattern's range (distance from its high to its low based on wicks) and then project that range from the entry to the direction of the trade.

In the picture, the pattern range and its projection are the underlined blue areas.

Once the price reaches the projection of the pattern's range, you should move your stop loss to entry and make your position risk-free.

Move stop to breakeven in traders' slang.

3️⃣

Then you should let the market go.

📈If you are holding a long position you should let the market retrace and set a higher low and then a new higher high or AT LEAST an equal high. Once these conditions are met you can trail your stop and set it below the last higher low.

📉If you are holding a short position you should let the market retrace and set a lower high and then a new lower low or AT LEAST an equal low. Once these conditions are met you can trail your stop and set it above the last lower high.

Catching a trending market you should trail your stop based on new higher lows / lower highs that the price sets. Occasionally you will catch big winners.

How do you apply a trailing stop?

❤️If you have any questions, please, ask me in the comment section.

Please, support my work with like, thank you!❤️

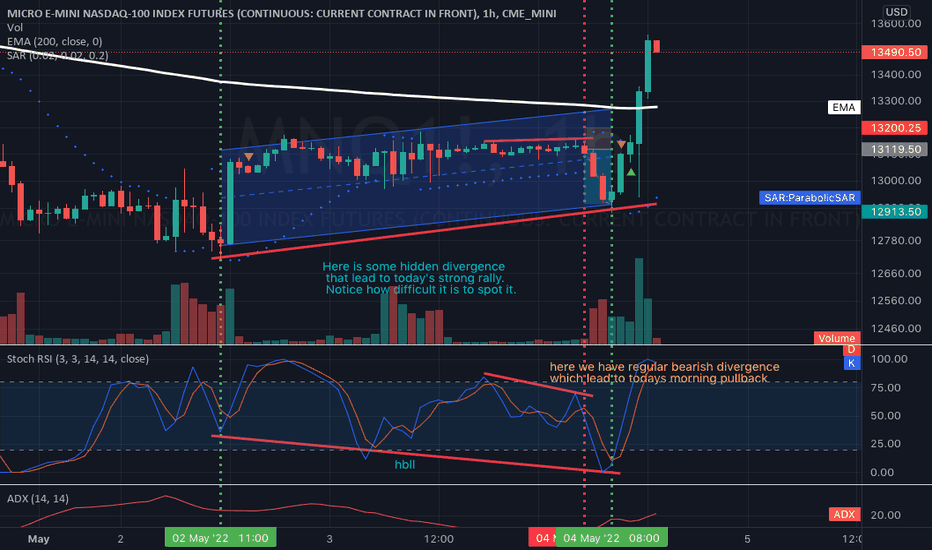

Divergences + Oscillator Confirmation: A Simple System.This will be a tutorial using divergences and oscillator confirmation buy/sell signals.

Hello. Here I present a simple system that is very profitable but along side this system I will present a risk management system that is

easy on emotions and robust on capital.

I predominantly use the 1hr and the 4hr to look for both REGULAR divergences and HIDDEN divergences. The reason I use the 1hr and 4hr is because I

find them easiest to trade. We can spot great and powerful divergences in the weekly or daily time frame but how do you enter into positions on such large time frames? We can't unless we use huge stops and tiny sizes. Therefore we can look for better opportunities in the 1hr and 4hr timeframes where those divergences are reliable and risk is easier to manage. I do not recommend moving any lower than the 1hr time frame because oscillators just generate noise

and bad trades.

REGULAR DIVERGENCE is perhaps easier to identify but more difficult to trade because they most often happen at trend changes when volatility tends to rise. I associate less risk with REGULAR DIVERGENCE specifically smaller positions and wider stops because tops or bottoms are difficult to time.

If you are an inexperienced trader it is best for you to start looking at hidden divergences which trade with the trend.

HIDDEN DIVERGENCE is easiest to trade but possibly more difficult to identify. HIDDEN DIVERGENCE tends to be a continuation of the trend confirmation. This for me tends to be easier to trade because you are buying a dip in the trend which tends to be less volatile (of course this is not always the case and you can see for yourself if you start trading divergences)

REGULAR BULLISH DIVERGENCE:

Regular bullish divergence is when the price action makes a lower low while an oscillator like

The RSI or the Stochastic makes a higher low.

REGULAR BEARISH DIVERGENCE

Regular bearish divergence is when the price action makes a higher high but the

oscillator makes a lower high

HIDDEN BULLISH DIVERGENCE

Hidden bullish divergence is when price action makes a higher low and the oscillator makes a lower low.

HIDDEN BEARISH DIVERGENCE

Hidden bearish divergence is when price action makes a lower high while the oscillator makes a

Higher high.

The method I use is simple.

STEP ONE: IDENTIFY THE TREND: I use the 200EMA in the 1hr or 4hr time frame and take trades corresponding with the trend. The 200EMA simply acts as a method to gauge if the price action is bullish or bearish. If the price action is above the 4hr EMA then I look for a bullish set up. If the price action is below the 4hr 200EMA then I look for a bearish set up. ( I must admit I do not always follow my advice here as today I went short and long but with experience comes flexibility). If you are an unprofitable trader I highly recommend sticking to this part of the system to prevent overtrading and take the most probable trades possible.

STEP TWO: IDENTIFY REGULAR OR HIDDEN DIVERGENCE. This step will get easier with practice. As you see in this chart,

We see both REGULAR DIVERGENCE which IMO is easier to spot and we have also HIDDEN DIVERGENCE which is more difficult to spot as it is across days.

So now that we have identified divergences in the Stochastic RSI we are looking for a confirmation of the divergences we just found.

The Stochastic RSI is simple to use when used with divergences. With out divergences the Stochastic RSI gives too many signals and sometimes wrong signals therefore we should only use the Stochastic RSI (or your oscillator of choice) when combined with divergences. If it is a perfect set up such as the morning trade where I found regular negative divergence I waited for the 1hr Stochastic RSI oscillator to confirm a sell signal by crossing the 70% line DOWNWARDS. I set the correct stop of 1% (more on risk management later) and waited for the oscillator to turn down to oversold where amazingly enough

it fell and created HIDDEN BULLISH DIVERGENCE when we plotted a line from previous days' Stochastic history. Once the Stochastic turned upward on the 20% line this was my signal to exit the trade...AND because the Stochastic had now created HIDDEN BULLISH DIVERGENCE I took the long side which

was an even better trade. Days like today do not happen often if ever but if you read my previous posts I had been anticipating such scenarios based on other factors I will not go into here. Read them posts if you want to know how I suspected this kind of price action was going to happen.

STEP THREE: Is not a step, like I mentioned this is an incredibly simple system but no system is complete without robust RISK MANAGEMENT.

The risk management comes from the great traders at Guerrilla Trading. I am not affiliated in any way but I was with them for two months and

I highly highly recommend them. You will learn price action like no one else. Here I borrow on their money management ideas (I will not share all their ideas

that would be unfair to them). It is simple. We will use only 1% risk by setting our stops accordingly. In the trade short in the morning on the micro Nasdaq I took a stop of 80 points. But I calculated my size according to my total capital meaning that if the Nasdaq moved against me 80 points I would only lose 1% of total capital. That's great! If the trade goes against me I would have only lost 1%. But as I have flexible stops, I also have no fixed targets and I let the oscillator let me know when to get out. In the case of the morning trade I took around 206 points. I did not know where the exit would be I just knew the oscillator would tell me. But as you can see by risking a psychologically manageable amount of risk I was comfortable in leaving the trade on until the oscillator told me when to exit.

Similarly on the lunch trade where I found HIDDEN BULLISH DIVERGENCE and the Stochastic RSI confirmation crossing the 20% line I took the trade

and I am still in the trade because neither the 1hr Stochastic RSI oscillator nor the 4hr oscillator have signalled a sell signal yet. And this is my

own personal strengthening of the system. I try to take the 1hr trade over to the 4hr trade where I find I can remove as much of the noise from the lower timeframes as possible and capture almost an entire move. Shwing Trading baby!

Well that is it. A simple system using divergences and oscillators to create great trading opportunities. This coupled with a 1% risk management and we

have a powerful system that protects capital and maximizes rewards.

Included here are several different examples of divergences I have posted on different time frames to get you started on your journey of using divergences.

How to win over greed?🎃1. Greed is the problem

Many beginners and even experienced traders face greed. It's a feeling that makes you believe in your superiority over the market:

• Opening a lot of trades, breaking risk management

• Continuing to trade after incurring a loss

• Refusing to take profits, hoping to earn more

• Averaging losing trades, because everything is about to change.

• Believing in the reliability of your pattern, although no pattern or indicator always works out 100%.

2. Why does greed take over?

We all have our own desires and goals. Society teaches us that we shouldn't deny ourselves comfort. This leads the vast majority to take out loans for new clothes, iPhones, Cars.. This is how people get used to greed's superiority and put it before discipline, getting accustomed to being able to live beyond their means.

What do you think happens to such people when they come into trading?

God forbid, such a person immediately learns about futures, then he will lose everything in a month at most. This is exactly the 95% who lose money in the market.

They suddenly see an opportunity to make a million out of $10,000 in a month, and, inspired by the stories of dogecoin millionaires from YouTube and Reddit, start to long bitcoin with x125 leverage.

There is another type. They do not rush to make money, they act more cautiously. They set themselves up right away that "trading is a long game and there is no hurry". They develop steadily and study pattern after pattern. However, their game pays off very slowly, and under the influence of their expertise they allow themselves more and more "experiments". They are like King Theoden from Lord of the Rings, who was slowly losing his mind under the watchful eye of Wormtongue.

3. How do you get around greed and start using it to your advantage?

Change your perspective. Instead of being greedy for money, become greedy for your professional growth . Ironically, if you stop focusing on money, they will come.

Create a journal and start analyzing your trades:

• What were your reasons for entering?

• Did you need to open that trade or was it suboptimal?

• Did you act under the influence of emotions, and if so, which one and why?

Develop, grow, and reward yourself when you get better, even if your trading results are unchanged. Your brain needs to get used to the fact that the most important thing now is discipline and small improvements. Step by step, you will become a profitable trader and, when you do, withdraw your honestly earned profits into fiat to reward yourself for your fortitude and persistence. You will succeed, because unlike all casino players, you will have the backbone and endurance!

Good luck on your journey! If you have any questions, feel free to ask them in the comments, I always check and answer them.

Leave a like so you can enjoy the trader psychology posts in the future as well, and thanks for reading to the end. You are the best!

The myth of risk management - Hack it :) I speak to a lot of traders, new and veteran.

It's surprising to see how so many are not sure how risk is calculated and what the exposure really means in terms of P&L.

This obviously is a major block in the road on the way to gaining confidence necessary to avoid losses.

So let's break it down -

*P&L is calculated by lot size * movement.

Example: If you have 100 ounces of Gold (1 lot) - That's $100 in P&L (Profit/loss) for each $1 Gold moves in value, so if the price 1890 and you are buying 1 lot , price moves by $5 higher - That's a $500 profit ($100*$) , same thing in reverse, if it would drop by $5 that's a negative of -$500 in open P&L.

Leverage decides what you are technically able to open in terms of margin used.

So if your leverage on Gold is 1:100 - The value of a 1 lot trade is the price of Gold multiplied by the amount of ounces , so let's say 1890*100 = $189,000 value trade, but your leverage is 1:100, so you would only need $1,890 of used margin (189,000:100) to open the trade.

But if you have 1:20 as leverage, you would need 5 times more used margin to open the trade.

So a common misconception is that your risk is your leverage.

That's not true.

Your risk is your lot size.

But if you have very high leverage , than you can open very high lot size with a small account - Which is extremely dangerous and not advised.

So what does an experienced , smart trader do? No matter what his leverage is, he understands the short-term and the long-term range of movement, and opens a lot size that fits the size of his account considering the range of movement.

If the account size is $100,000 , and you are buying 1 lot of Gold:

The weekly range is 1840-2,000 , the short-term range is 1880-1910 - Price is 1890

So the exposure is ~$1,000 in the short-term (1%) back to the short-term support 1880 , compared to $2,000 on the short-term resistance (2%) of 1910.

The long-term exposure is to 1840, meaning a $5,000 exposure 5% ($100*$50) from 1890 - but 2,000 is the top of the weekly range, meaning - $110 up ($110*100) = $11,000 (11%).

So didn't really matter what the leverage is 1:20 or 1:100, what matters here is the range and the lot size.

Thank you for reading!

-----------------------------------------------------------------------------------------------------------------------------------

If you liked my educational idea please like and follow! It would mean the world to me!

I promise to answer all comments/questions - I encourage you to communicate :)

Thank you so much for reading - Looking forward to reaching as many of you guys as I can :D

-----------------------------------------------------------------------------------------------------------------------------------

Why do traders mostly lose? Point of viewFor 3-5 minutes while going through this forget what you know about trading.

First thing is : Let's remember our goal, every successful action/plan started with a clear goal that led the way:

In our case it's profit

When starting to trade seeing the numbers go up and down plays with your head and emotion quickly tempting you with the unlimited potential at your fingertips.

Even experienced traders that had some lucky streaks forget that the wanted end result is simple - to be in the money, meaning, making profits consistently.

In order to secure our goal of making profit we need to first start with remembering this is not a 'get rich quick' scheme and there is no magic - A big bunch of money won't fall on your head out of nowhere, at least not consistently.

Now - remember this : It's a lot better to be consistently profitable than to have a series of a few winning streaks .

With this in mind, it's great if you would put up a sticky note on your screen reminding this - As at times it gets hard keeping sight when numbers run wild.

I see many traders look at between 5-10 crypto currencies, 3 commodities and 10 currency pairs - Deciding based on a variety of different things what to trade on every time.

This way of action has no structure at all - Which makes it very hard to reach a certain target: profit.

It is necessary to have focus, structure and a plan with a single minded mission: PROFIT.

But not just any profit - smart profit, a profit that was a result of planned action.

So how do you make a plan?

The easiest way to effectively craft a well thought out plan is to focus on between 2 to max 3 instruments

Learning the range, price action and tendencies of 2-3 instruments can be done within a few weeks going through 1h, 4h and weekly time-frames and determining the short-term and long-term projections of each of the 2-3 instruments.

Once you start seeing the patterns and understanding the price action continue by implementing what you learned on the instruments on a demo account testing a possible strategy that relies on clear idea of what to do with every possible scenario.

You may not get it right with the first strategy, so try others until you find one that shows consistent results - while mastering the 2-3 instruments you have chosen and continuing to following up on a daily basis on relevant news, changes in trends on short-term and long-term projections.

For me - Because I've dedicated years trading and following Gold and WTI , learning how and why it moves - I prefer trading a swing trading strategy, keeping trades open between 3 days to 2 weeks usually, this puts my bigger picture understanding of the instruments into true effect

The difficulties you will find while searching for your strategy are -

*Greed

*Fear

*Lack of patience

*Lack of discipline in plan

Don't let them in - Remember your plan and one and only goal : consistent profit!

Thank you for reading,

Let me know what you think and what you would like to hear more about :D

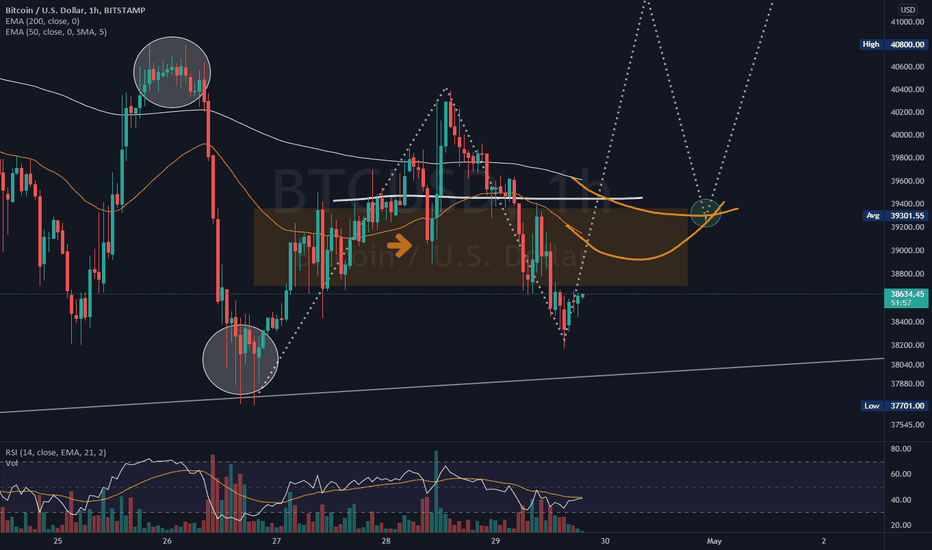

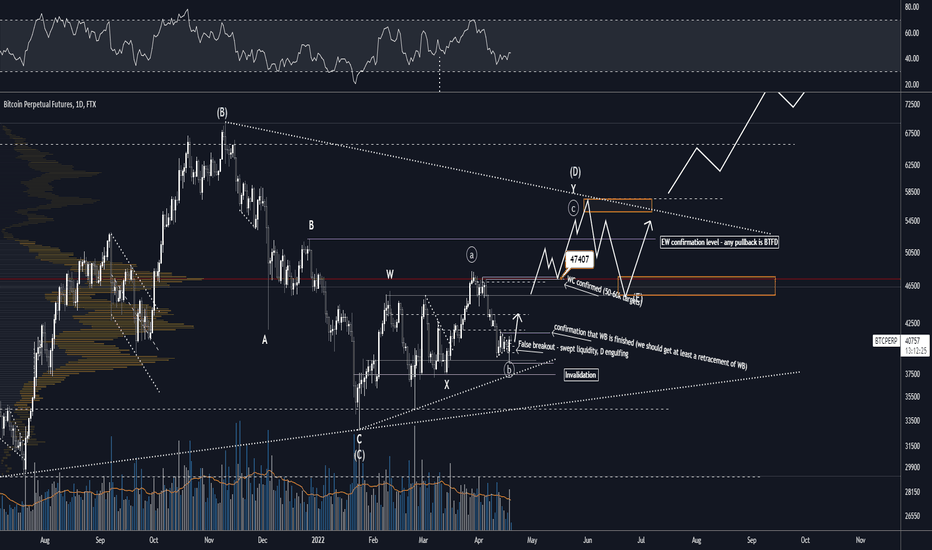

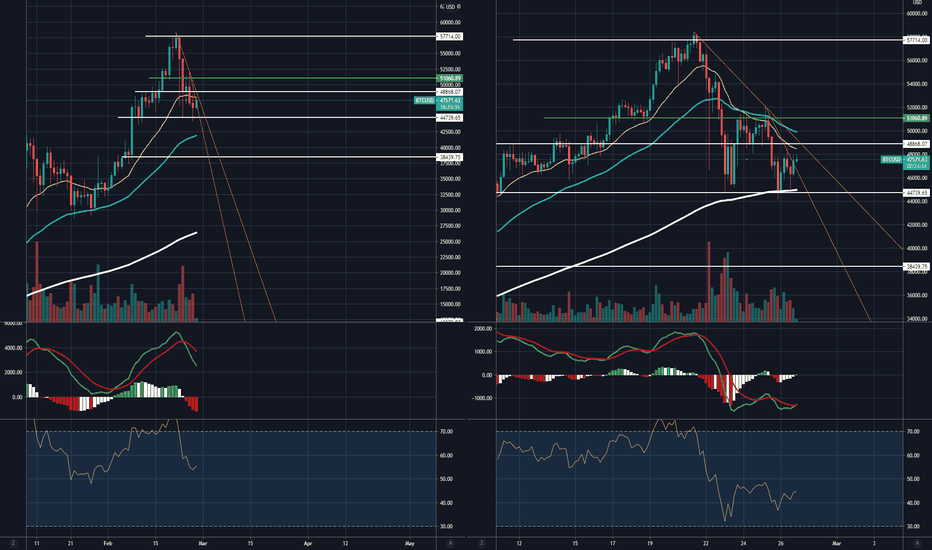

BTC in accumulation from 4/2021. Long-term bullish triangle!Today I want to present my main scenario. As long as 37400 holds I give this scenario the highest probabillity. I have identified an expanded triangle in the WB of the triagnle. Foundation for this scenario is WB which made HH and WC which has corrective nature and was unable to make LL thus it made HL. Now we are moving up in WD which is a complex correction with heavily overlapping structure. It is however still making HHs and HLs. As long this is the case we should be bullish. We have already seen some bullish indications such as D engulfing and swept liquidity below 39k. The probabillity of this scenario increases if we manage to get the confirmations labelled on the chart. If this scenario is correct we should finished the triagnle by summer and ultimately move to ATHs towards the end of the year (and perhaps reached the mythic 100k).

We are forming our gameplan based on the indentified patterns which give us higher probabillity (they have been proven statistically significant) which in the long run should give us an edge (alfa = overperformance) in the markets. However, we should also be prepared for the alternative scenarios with lower probabillity so that we dont suffer large losses or get wiped out, even if it means limiting our profits and cutting losses when we are proven wrong. As TWC says, the only thing you can control in the markets is how much are you going to lose.

Not having a position is also a position - When trading is bad?Every day we start by choosing between long and short.

Sometimes you wake up, look at the btc chart - and clearly see your setup.

And sometimes you don't see it. But you still saw how many of your friends traded shorts successfully and decide to enter a hostile market.

Bottom line: Lost profit, exhausted nerves, stress, a blow to self-esteem.

Most traders forget that there is a third option - to stand aside.

Let's discuss when such position can be useful and why most people use it so rarely.

Pro traders can be split into 2 types:

Bulls and bears. They trade for profit only in one direction, because they have a trained eye to see only their kind of setups.

When a bull finds himself in a bear market, he either trades in the red or breakeven. The same true for the bear.

And yet, even knowing this, the trader continues to trade unfriendly setups. Fueled by success that he carries from his market, he is sure that just a little more, a LITTLE LITTLE more, and he will be able to trade profitably in this market as well. "And if I can trade for profit in both directions, then I will become an absolute terminator and even Warren Buffett himself will personally beg me to share my market forecast with him!" I don’t know if you woke up with such thoughts in the morning, but I definitely had a couple of times.

The answer to this phenomenon is GREED (for money or fame). And the easiest way to get rid of such incidents is to write the following rule in your trading algorithm (I hope you have it):

• Trading during correction is prohibited.

Just one sentence will save you a huge amount of money and help you increase your capital much faster.

Instead of losing money trading corrections, it is better to:

• Relax and spend part of your honestly earned profit on yourself and your loved ones.

• Patiently wait for your market and return to the game.

Do this - and trading will bring you much more pleasure, and you will earn even more and enjoy your life!

If this article was useful to you, please like and leave a comment so that I understand that it has value to you and will continue to write educational material in the future✌️

How to lose your deposit quickly? Easy to follow Step-By-Step🔥Why am I qualified enough to teach you this?

I lost 16 deposits and in 6 years I heard dozens of stories of people who lost their life savings in a couple of months by trading. I have personally tested many of these rules and confirmed that they work.

So what are we waiting for? Lets get it started!

1. Trade with maximum leverage

There is no need to trifle, the bigger leverage is, the greater your profit will be🤑

2. Don't use stop losses

SL’s are for the weak. You probably remember how many times your positions went in the right direction after you closed them by stop loss. Stop losses are evil🤮

3. Average losing positions

Everything is simple here - the more you average, the less you lose. That means you can keep going. Nothing ventured, nothing gained🥂

4. Use your last money and don’t be shy to borrow

The more money you put in, the more money you pull out. Since you are 100% sure that BTC will grow, take loans not only in banks, but also from shady organizations, do not look at interest - you will repay everything back in a month anyway, and your profit will cover any losses💵

5. Trade only when you have been fired from work, haven't slept all night, your girlfriend/wife has left, or you have quarreled with relatives

When everything is bad in your life, it is better to do what you do best - trading. Having earned a lot of money, you will not only be distracted from everyday problems, but also regain confidence and a smile on your face!😉

6. When you closed a losing position, immediately open a new one with double volume to recoup losses

You came into trading to win! So win and never admit defeat! You are Hercules and defeating everyone in the market - this is your 14th feat! No step back, only forward!✊

7. Prioritize Elon Musk's conspiracy theories and tweets over technical analysis

Do you already have the conviction that the Illuminati run the market and every time you open a position and the market goes in the opposite direction, the Illuminati move to harm you? If not, then quickly look at your lost trades. You did everything right, but you still lost money. Why is that? Just don't tell anyone...🤫

8. Believe that trading is luck and the odds are always 50/50

This makes it much easier to make decisions. If black has fallen out on the roulette wheel 2 times in a row, then the chances that red will fall out are much greater. Therefore, do not hesitate to go against the trend, probability theory is on your side 💪

9. Stop exercising your body and mind

You will need neither a healthy body nor a focused mind in trading. You only need your eyes to see “buy“ and “sell“ buttons, you don't need much intelligence for this. Being in the green zone? The green zone is a myth for suckers who engage in self-deception.😏

10. Quit your daily job

Since you already created an account on Binance a week ago, watched a couple of trading videos, sorry, I meant in-depth educational materials, and even have already made a couple of successful trades, then it's time to finally quit that boring job. The road to millions is open, it remains only to take the last step.🤩

11. Manage your friends money

Why getting rich alone? Take your friends and family with you. They will be grateful later.🙌

12. Don't look away from the screen until you've regained every last cent.

Winners don't walk away with losses. Make sure your deposit has at least doubled before ending a session.😎

13. Never fix profits. If it has grown a little, then it will grow more.

Do you remember how you closed the position when the coin grew by 5-10%, and then it rose another 200%? That’s what I’m talking about. Don't close too early, keep trades for the maximum profit.📈

14. Trade at night

If you don't have time, don't give up. There is always an opportunity to earn. Even after a hard day at work.🤜🤛

15. Analyze the market on a 5m timeframe and trade on the 1m.

Opportunities are always there - the main thing is to be open to them.🤞

I hope these tips will help you quickly drain your deposit down and return to a normal life. If you liked them or you are already using them, please click Like and leave a comment so that I understand that it is valuable to you and will continue to write educational materials in the future.✌️

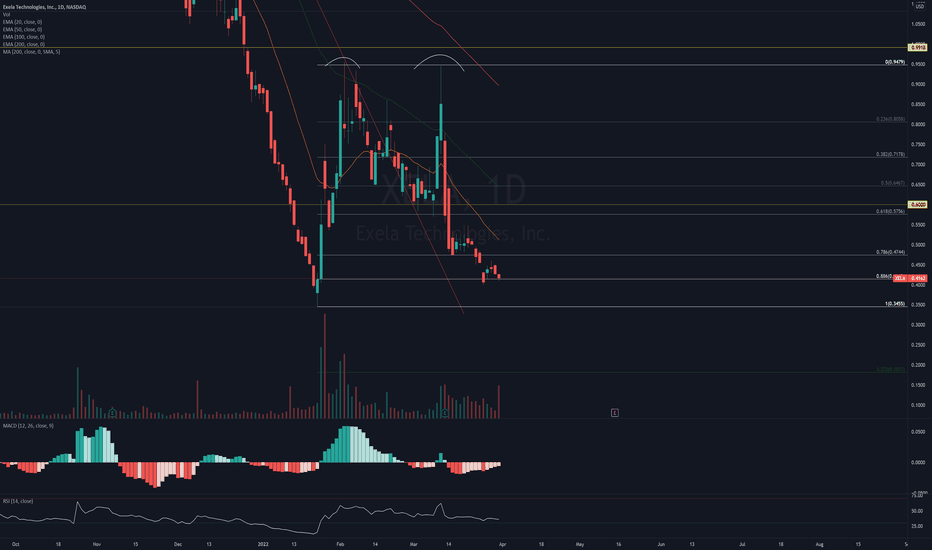

$XELA Exela double bottom at the 886Exela is forming some kind of double bottom at the current .886

One could try a long here. Stop HAS to be the All time low at 0,344.

Take your profits on the way up to 1$

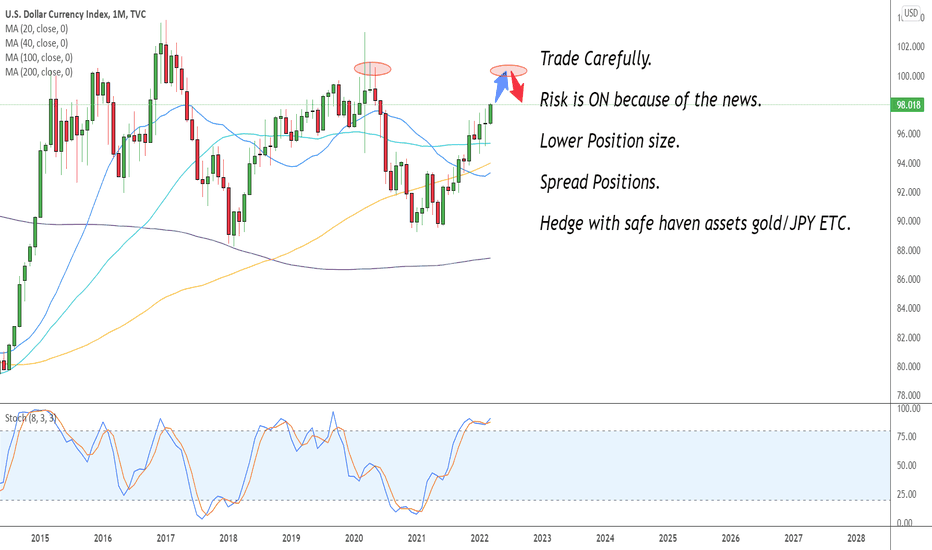

MARKET RISK MANAGEMENT: WHAT YOU NEED TO DOFor More Trading Videos and Analysis, Go ahead and click on the follow button.

Given the current state of the markets at the moment, especially this morning, Correct risk management becomes ever more prominent as a skill. If you do not possess it, you are both putting your capital largely at risk AND missing out on Trades you could actually be taking in the meantime..

This is because when the market moves against you, you can still make money. That in essence is the key to success.

We will use the DXY as a measure on this video due to its market exposure.

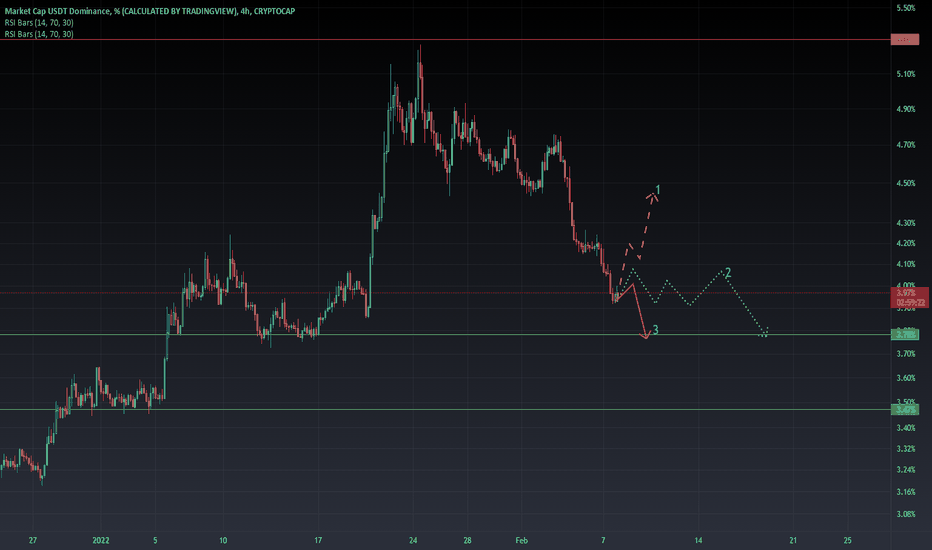

using USDT.D for closing or opening positionseach one of those ideas about the USDT dominance show a great opportunity for you.

if the first one happen and you still have available liquidity of stables coin you might have a chance to build up your portfolio again.

if the 2nd one happen you might wait more to gain more profit from your previous buys.

if the 3rd on happen and BTC still obtain enough demand there would be great chance for those who still wait for 2nd entrance( the 1st on was on BTC around 33).

so based on this logic I guess that would be a reasonable risk management.

the key for a good trader is that you should always have enough liquidity on lower level in order to build a profitable wallet when market go down and give you more opportunity.

meanwhile if market give you a chance to close position with profit don't miss the chance and save money.

having enough liquidity is more important than huge numbers which are only numbers until you change them to Dollars $$$$.

please share your ideas if you are agree or disagree with me and it would be appreciated to press the like button.

hope to have more profits day by day.

thanks for your patience to read my idea .

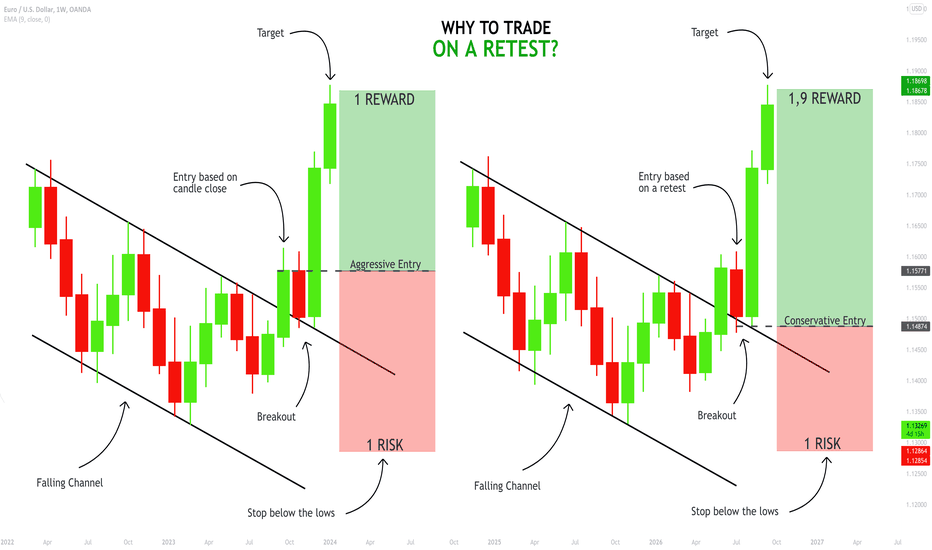

Risk Management Basics | Retest Trading 💡

Hey traders,

Being breakout traders we have two options for trade entries:

when the breakout is confirmed we can either open a trading position aggressively once the candle closes above/below the structure or we can be conservative and wait for a retest of the broken structure first.

What is peculiar about the second option is the fact that the majority of pro traders prefer the retest entries. In this article, we will discuss the pros and cons of retest trading.

✔️First, let's discuss whether the retest is guaranteed. NO. How often do we see that? Around 50-55% of the time. Does it mean that 45-50% of breakout trades will be missed? YES.

The main disadvantage of retest trading is that a lot of trading opportunities will be missed. Occasionally the breakout triggers a strong market rally not letting the price return back to the broken structure.

So what is the point to wait for a retest then? Why let the market go without us in case if there is no retest?

✔️Most of the time the breakout candle closes quite far from a broken level. Opening the trading position once the candle closes and setting a stop loss below/above the broken structure, one can get a very big stop loss. Such a big stop that its pip value exceeds or equals the potential return.

🖼️In the picture, I drew a classic channel breakout trade.

The aggressive trader opened a long position as the candle closed above the channel's resistance.

His stop loss is lying below the lower low of the channel.

Analyzing his risk to reward ratio, we can see that his reward equals his risk.

On the right side is the position of the conservative trader.

His stop loss in lying on the same level.

However, instead of opening a trading position on a breakout candle, he decided to wait for a retest of the broken resistance of the channel. Just a slight adjustment of his entry-level gives him a completely different risk to reward ratio.

❗️Patience pays in trading. Missing some trades a retest trader will outperform the aggressive trader in the long run.

Trading is about weighting your potential gains & losses. Paying commissions and swaps for every trade, it is much better for us to trade less but pick the setups that give us a decent potential reward.

What type of trading do you prefer?

❤️Please, support this idea with like and comment!❤️

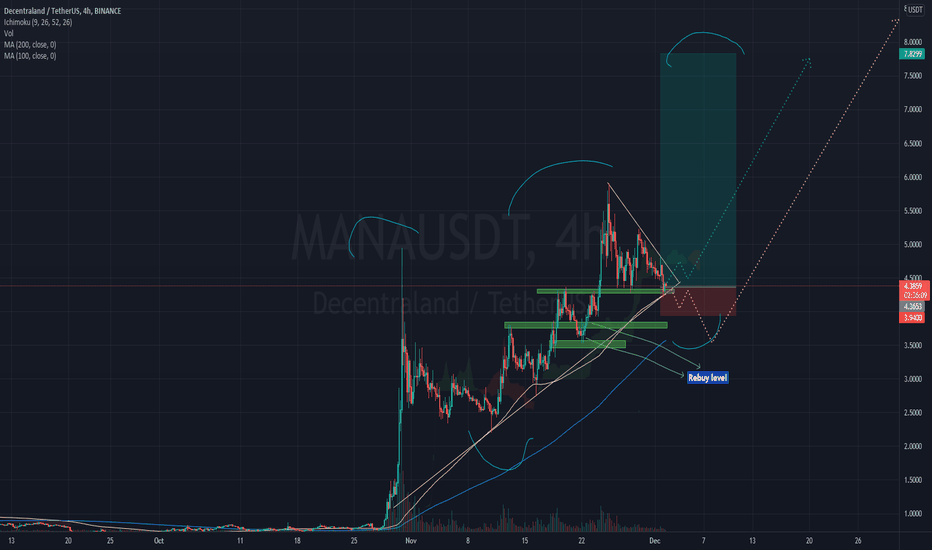

#MANA is ready to pump more than 80%#MANA in it's #USDT pair made a triangle and there is 2 possible scenarios for this chart in 4h time frame

1 : Break out the triangle and reach to 5.3 and 5.8 as next resistance levels

2: break down supporting level in the area of 4.2 and retest next support in 3.93 and 3.5

IN both scenarios #MANA is following targets : 6.5 - 7.8 - 9 - 10 - 15

Best approach is buy step buy step in the supporting levels and rebuy in Rebuy Zone if stoploss (3.93)

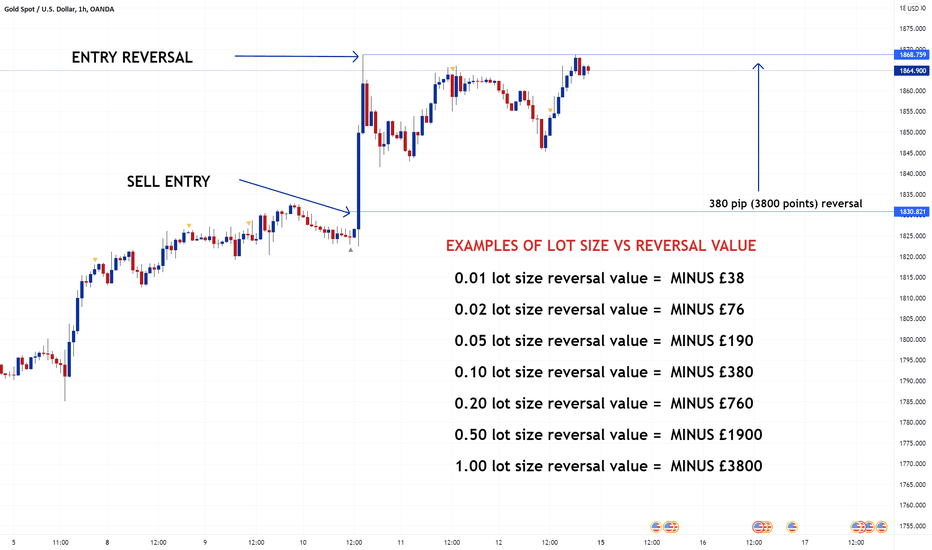

BASIC MONEY MANAGEMENT - LOT SIZE VS REVERSAL AND ACCOUNT SIZEWe see too many new traders trade with random lot sizes with no understanding on the impact it has on account sizes, which result in not only losses but BLOWN accounts. This post is by no means a risk or money management strategy but more so just basics on the movement of reversals and how the lot sizes impact the value of your account during this reversal.

Trading with the right lot sizes allows a trader to manage their account/money when the trade goes against them. The right size allows a trader to move a range without blowing their account and without seeing their account reverse to the point of no equity. This type of trading gives traders anxiety and in return this anxiety impacts trading psychology. This then has a ripple effect and impacts your trading decisions and analysis.

The example we show on the chart is an entry of SELL that reverses by 380 PIPs. This movement happened in literally 2 candles (1hour candles) , so in two hours the price from entry reversed by 380 pips. This example then shows what this equates to in monetary value dependent on lot sizes.

The example shows that anyone with a £500 account trading this movement with a lot size of 0.20 would have blown their account.

Lot size usage should be based on the size of your account for example;

£500 size account - we will only use 0.01 size lot sizes with maximum deployed total no more than 0.05. This will allow an account to survive volatile movements. Also using stop losses ontop of this setup further strengthens the risk management.

£1000 size account - we will use 0.02 lot sizes with maximum deployed total no more then 0.10 any given time.

£2000 size account - we will use 0.03 lot sizes with maximum deployed total no more then 0.30 any given time.

£5000 size account - we will use 0.06 sizes with maximum deployed total no more then 0.50 any given time.

Basically 0.10 for every £!000, as the total deployed usage allows us enough flexibility of movement on the chart and then using stop losses ontop of this, gives us further control of our money management.

We hope this quick basic insight helps some of the newbies better manage their lot size usage.

Please like, comment and follow us to support our work, we really appreciate it!

GoldView

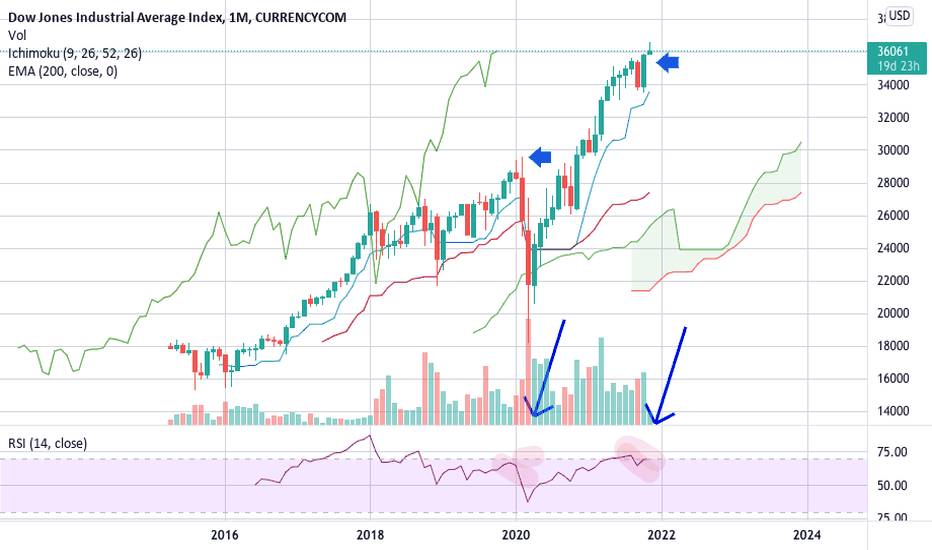

US30 major monthly divergence - bearish for many months!CURRENCYCOM:US30

start scaling in for sure short 1/5 size whole position with risk management cushion to scale in more, optimising overall basket.

look for 4H timeframe to add later, after 4H timeframe reaches 30 on RSI once and hits first RSI resistance or Ichimoku cloud resistance.

XRP/USD NO NEED TO RUSHAnalysis: Right now patience is the key on the market, there is no need for huge spikes to the upside. A constantly growing trend will do the job if a lot of people are interested of buying. A lot of analyst posting about 50/50 chances about the price to go up or down, it's always the case, but we need to be 1 step ahead before the price action. If you wait until you see a huge price rise, you miss the low risk-reward opportunities from buying now safely with a stop loss of 1.10$, and you will start buying at 1.6 or even higher to catch the rise and you will have a nonsense risk reward ratio on the trade. As I shared my chart about my last long position you can see that I entered at the bottom of the correction from 1.2$, so our stop loss is at 1.10 in case of a sudden flash crash. I am not speaking about targets right now until we will go higher than the previous high. If it takes a lot of time to get to that top again, it will offers us higher price targets as well.

Consider to join our community to get more of this kind for Free.

community.protradersnetwork.com

#forextrader #forex #forextrading #forexsignals #forexlifestyle #trading #money #cryptocurrency #trader #bitcoin #forexmarket #forexlife #technicalanalysis #stockmarket #forexanalysis #forexmentor #daytrading #forexgroup

Has Bitcoin found its bottom? How to properly swing trade. Hello Everyone,

This is a chart I made a few days ago as bitcoin was approaching 44k. As always. the first step in my analysis is identifying support and resistances on daily chart and looking for the formation of a bullish/bearish pattern to engage in a buying or selling strategy. Next, I look at price action and see if the selling momentum is waning off to support any buillish divergence I see on the chart.

As we can see, bitcoin is in a double bottom formation. Now, how do you properly trade this without getting burned? You average in.

Averaging in is a way to ensure profit with minimizing your risk.

A first buy would be 25% of portfolio at 44.5k (I always buy a bit above support so my limit order fills) which is right above support. A stop loss would need to be just below 43.3k (the previous lowest low). This is about a 3% loss but a total of .07% to your portfolio. If the trade fails you can walk away taking a very small loss and you get lower prices in return.

A second buy would need to be confirmed by indicators on a 4 hour to daily timeframe with shorter term timeframes showing bullish behavior as well. A good buy would be around 51-52k depending on the close on a 4 hour and daily candle and I would also move my previous stop loss up depending where the daily candle opened. At this point i would do another 25-40% buy depending on how each chart looks.

A third and fourth buy would be constituted by closes above the next resistance levels and how bullish or bearish each timeframe looks.

OVerall, averaging in is a great way to ensure big wins with taking minimum losses. Let your winners win and keep your losers small. Be patient, find confirmation, and utilize risk management strategies to help you become a better trader. Please give me a thumbs up if you found this useful and good luck trading!

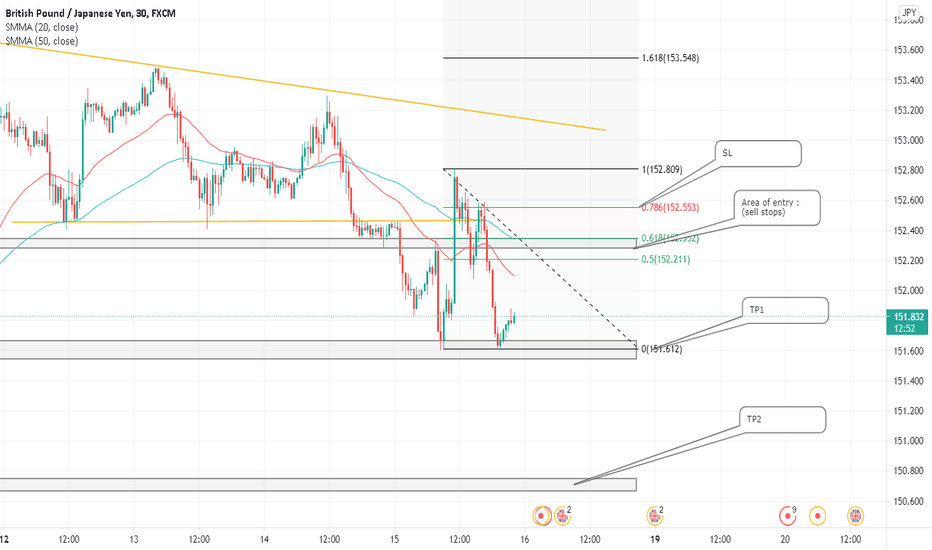

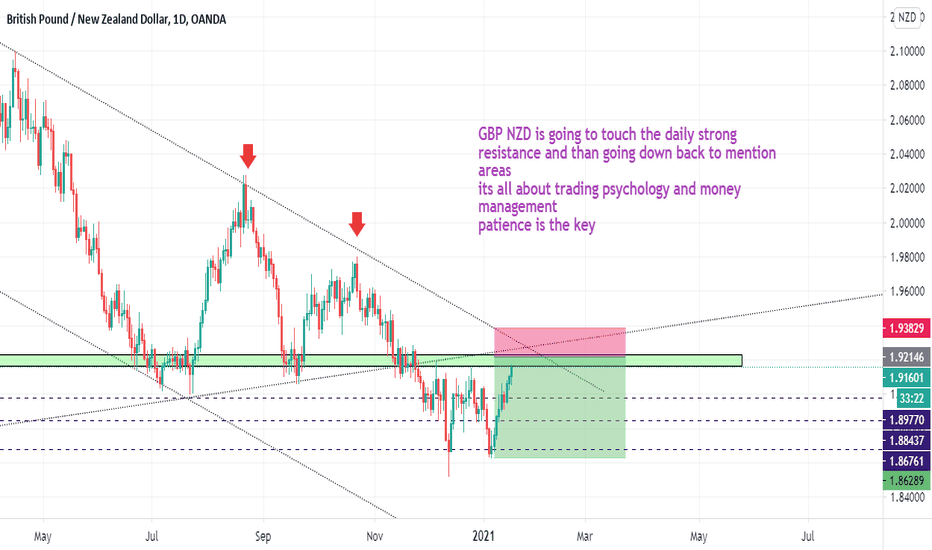

GBP/NZD GOOD SHORT POSITIONGBP NZD is going to touch the daily strong resistance areas and its very very important area look for bearish confirmation and than going down back to mention areas

its all about trading psychology and money management. Trading is all about mindset and discipline if you can hold your nerves will will win definitely but yes not immediately

patience is the key