Bitcoin Key 116800 Support Tested, US CPI as Decisive Catalyst__________________________________________________________________________________

Technical Overview – Summary Points

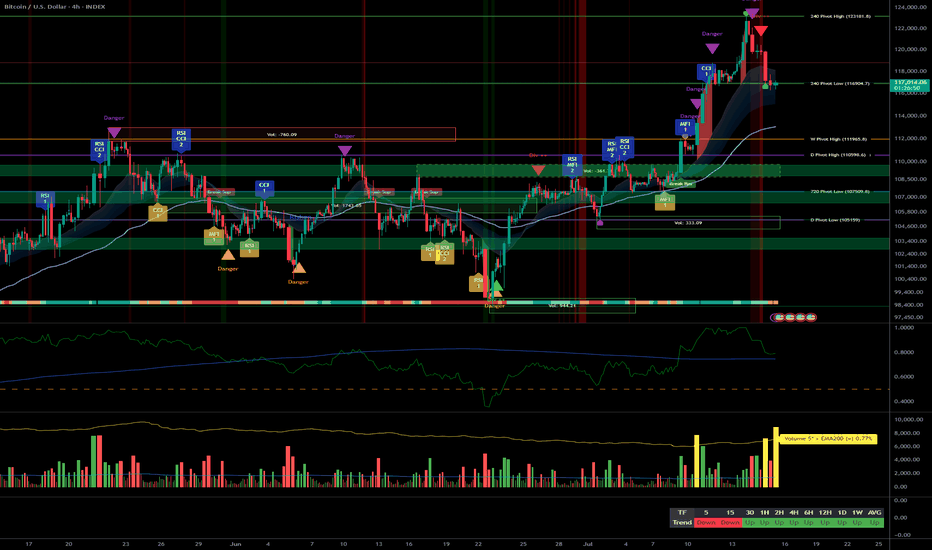

➤ Bullish momentum maintained across all major timeframes (1D to 1H). Key supports held at 116800-117200. Very high volume on low timeframes, indicating distribution/recharging. Risk On / Risk Off Indicator shows Buy across major TFs, micro-buy opportunity signaled on 15min. No extreme behavioral signals, except short-term positive micro-signal.

__________________________________________________________________________________

Strategic Summary

➤ Cautious bullish swing bias as long as 116800-117200 holds. Monitor strong tech sector momentum (Risk On / Risk Off Indicator). Heightened risk zone if support breaks (downward targets: 111000/110500/107200). Main catalyst: US CPI release—active trading management advised before/after. Tactical approach necessary: stop below 116200, TP 119000/120000. Closely watch low timeframe volumes and ISP signals.

__________________________________________________________________________________

Multi-Timeframe Analysis

➤

1D: Bullish, multiple supports at 10510/107200/11050-11190, resistance at 123000/119000-120000. Strong Risk On / Risk Off Indicator acquisition, normal volumes, no behavioral overheating.

12H: Momentum intact, 116800-117200 key area. Volume normal, stable mature market, no emotional excess.

6H: Bullish retest validated on 116800, rising volume but no dramatic spikes, key moment for trend.

4H: Dynamic support at 116800, resistance 119000-120000. Uptrend, healthy as long as support holds.

2H: Very high volume amid consolidation/reloading, increased volatility around 116800.

1H: Still Up, but extreme volume, increased caution. Possible stop hunting.

30min: Slowdown, volume still very high, micro-correction or local exhaustion.

15min: Micro-correction but ISP buy triggered; potential short-term bounce.

Key alignments: All TFs 1D–1H Up, supports held. 30min/15min correction on volume excess.

Major confluence: 116800-117200 = absolute pivot: break = correction, bounce = further up.

Divergences: Extreme volume not confirmed by ISP, except 15min.

Technical zone of action: Bullish scenario confirmed if bounce on 116800; invalidation on breakdown.

__________________________________________________________________________________

Macro & Fundamental Analysis

➤ No major macro event in the very near term

➤ Sole catalyst ahead: US CPI release, watch for possible whipsaws

➤ Institutional flows (ETF AUM record highs); on-chain stability, visible accumulation

➤ Volatility tightly compressed, coiling for next breakout on impulsive move

➤ Geopolitical noise present but limited direct impact in short term

To watch: post-CPI reactions, low timeframe volumes, defense/break of 116800-117200 cluster, micro ISP 15min signal, volatility & ETF institutional flows.

__________________________________________________________________________________

Summary & Action Plan

➤ Preferred scenario: Cautious swing long if 116800-117200 support cluster holds, stop <116200, TP 119000-120000+

➤ Invalidation: Prolonged breakdown of 116800: exit, wait for signal resynchronization.

➤ Catalysts: US CPI, watch for whipsaws (<1h pre/post-release).

➤ Risk management: Avoid adding if extreme volumes persist without ISP buy on short TFs (30m/1H), close monitoring ahead of data.

➤ On-chain context: Record volatility compression—major move likely soon; spot supply clustered—expect amplified reactions.

__________________________________________________________________________________