Shorting the wallstreetbets flash-bubble, the trade of a decadeWhat is happening at the moment with stocks mentioned in the wallstreetbets thread on Reddit is totally insane and hard to believe.

But to those who have experience, it offers an amazing trade opportunity.

If you have a few minutes, and take a look at the wallstreetbets thread, you will quickly see that most of the people posting have zero understanding of market's mechanics.

One post I read this afternoon was summarizing it all. The poster was writing about GME: "let's keep buying, don't sell, and we will push the stock to $1,000! Then, when Hedge Funds see the price is not going down, they will have to finally buy it, and we will sell them our positions and f¤¤k them".

So institutional that were short at $15 because this stock was overvalued would be long at a $1,000? How does that make any sens?

I saw some guys opening a trading account just for the occasion to bet their savings, after the stock was up 3,000% for the week, other being surprised that after such a craze, it was pulling back, ...

What is happening is absolutely crazy, and they don't realize that at this point, the buyers are just helping earlier buyers to exit and institutional to start selling again. Because seriously, if you are heavily short at $15, don't you want to be more short at $480, in addition to timing you position thanks to the nice data Robinhood is selling you about what the retail traders are up to?!

This whole thing is without a doubt a crazy flash-bubble.

So now, what is the play?

These stocks will back at pre-bubble levels within a few days. and the to-the-moon Implied Volatility will be back to normal.

So if you have the margin, selling deep ITM Calls with 45 DTE is the trade of a decade!

Robinhood

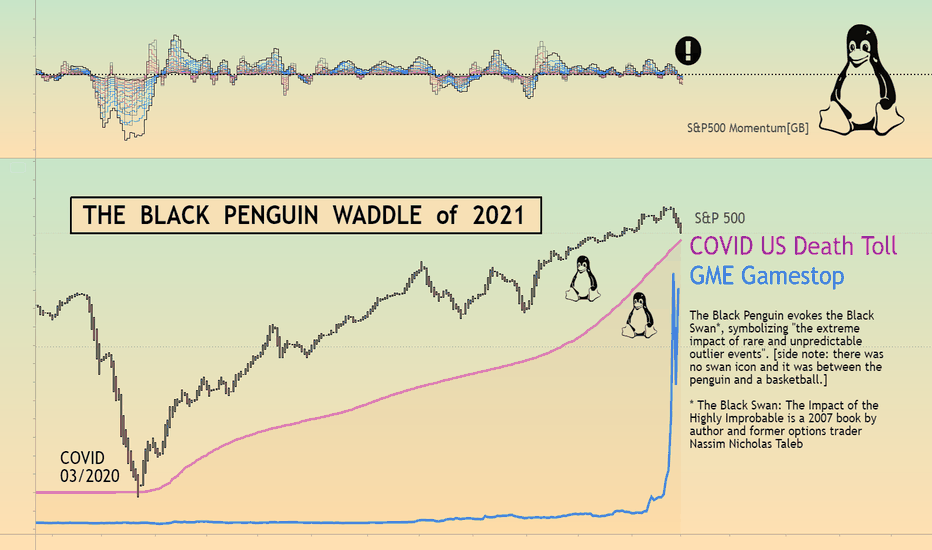

The Black Penguin Waddle of 2021

The chart is one possible visualization of the confluence of unpredictable high-impact events. For example:

February 24th, 2020 World Health Organization declared the COVID-19 outbreak a pandemic and warned that "much of the global community is not yet ready, in mindset and materially,.." Over the following eleven months over 2 million lives were lost globally, more than 430,000 of the US.

Wall Street hedge funds lost billions by betting against a group of amateur day traders who banded together on social media to execute a short squeeze. They sent shares of depressed companies like ( GME ) GameStop and AMC ( AMC ) up into the stratosphere, hurting the billionaire hedge funds that bet against those stocks. Called by some "The Grand Awakening" It was an unprecedented attempt to compete with the pros on Wall Street. The action raised questions of equity and policy reform to ensure a more level playing field.

1) The Black Penguin evokes the Black Swan* symbol from the 2007 book by author and former options trader Nassim Nicholas Taleb. The symbol of the Black Swan represents the extreme impact of rare and unpredictable outlier events.

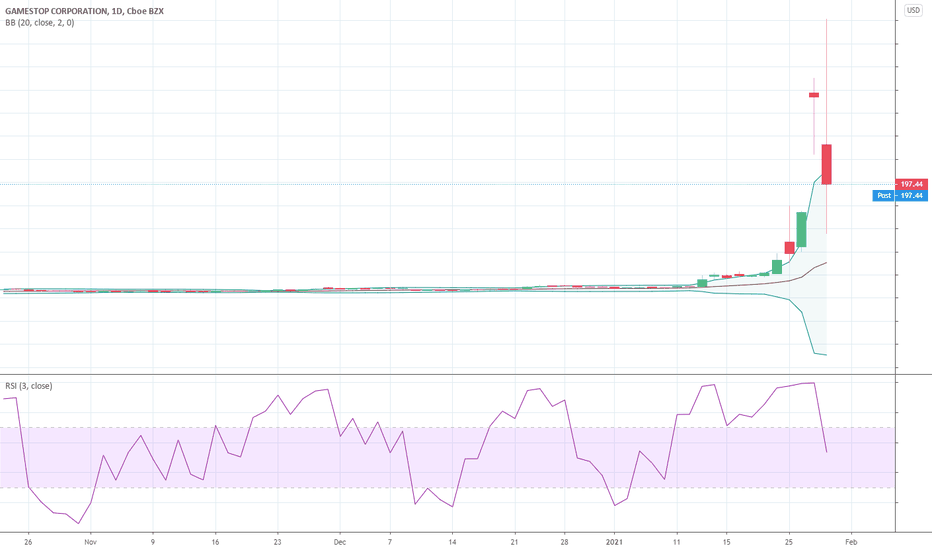

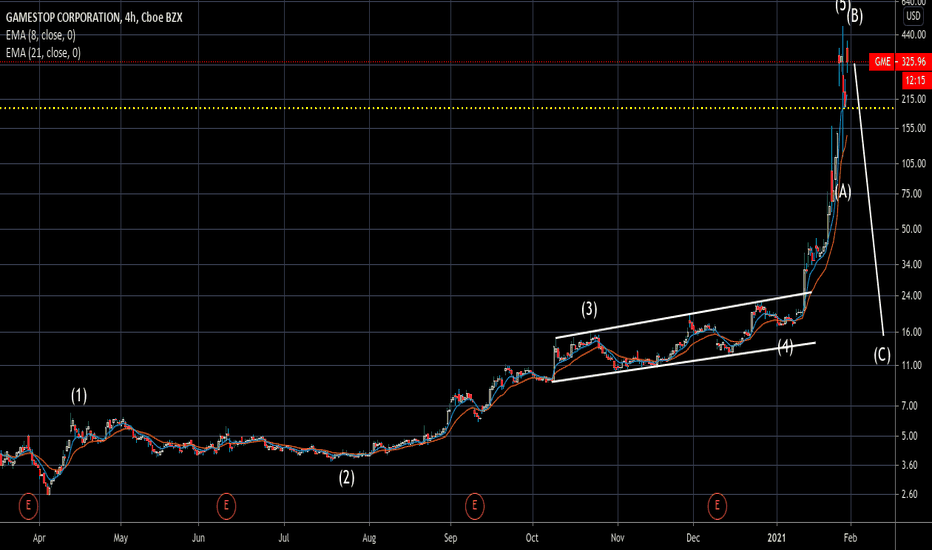

Where is Gamestop Going Next?As I have spoke about before this is a blow off top, wave 5, and evening star formation. The price target is $17. Let me define a few things to put it in perspective.

1. Blow off top definition; Blow-off top patterns are common in securities where there is a lot of speculative interest. Prices rise, usually on positive news or on the prospect of good future news, such as future growth or the release of a positive drug trial, for example. As the price rises, more and more people get excited. More people also start to feel they are missing out, and they don't want to miss out anymore, so they buy. The higher the price goes, the number of people lured in to buy increases, and thus the higher the price and volume go. Blow-off top patterns are common in securities where there is a lot of speculative interest. Prices rise, usually on positive news or on the prospect of good future news, such as future growth or the release of a positive drug trial, for example. As the price rises, more and more people get excited. More people also start to feel they are missing out, and they don't want to miss out anymore, so they buy. The higher the price goes, the number of people lured in to buy increases, and thus the higher the price and volume go.

2. Wave five is the final leg in the direction of the dominant trend. The news is almost universally positive and everyone is bullish. Unfortunately, this is when many average investors finally buy in, right before the top. Volume is often lower in wave five than in wave three, and many momentum indicators start to show divergences (prices reach a new high but the indicators do not reach a new peak). At the end of a major bull market, bears may very well be ridiculed.

3. Evening Star; The Evening Star is a bearish, top trend reversal pattern that warns of a potential reversal of an uptrend. It is the opposite of the Morning Star and, like the morning star, consists of three candlesticks, with the middle candlestick being a star. The first candlestick in the evening star must be light in color and must have a relatively large real body. The second candlestick is the star, which is a candlestick with a short real body that does not touch the real body of the preceding candlestick. The gap between the real bodies of the two candlesticks is what makes a doji or a spinning top a star. The star can also form within the upper shadow of the first candlestick. The star is the first indication of weakness as it indicates that the buyers were unable to push the price up to close much higher than the close of the previous period. This weakness is confirmed by the candlestick that follows the star. This candlestick must be a dark candlestick that closes well into the body of the first candlestick.

The reliability of the evening star is enhanced if the third candlestick opens below the real body of the star leaving a gap between the real bodies of the star and the third candlestick. This, however, occurs very rarely. Reliability is also enhanced by the extent to which the real body of the third candlestick penetrates the real body of the first candlestick, and if the third candlestick has very little or no lower shadow. Finally, volume should also be considered as the pattern is more reliable if the volume on the first candlestick is lower and the volume on the third candlestick is higher.

Sound familiar? If it walks and talks like a duck it's probably a duck. Not shown is multiple similar bubble situations TLRY, SPCE, Bitcoin in 2017, etc. All bubbles burst. My advice is to get out immediately.

GME scandal: Some explanations & why trading got halted.Citadel & Point72 bailed out Melvin Capital which was the GME short selling bagholder, but it does not end here.

There are other short sellers. And these stocks, not just GME, but others too, became extremely volatile and on giant volume.

So first there is the issue of liquidated funds that do not have immediate cash.

They hold positions and would have to unwind them to get cash to cover their margin calls.

Melvin Capital I read was down 30% and got bailed out, so they still have assets, just not liquid, no immediately available cash.

Trust me, if they had a gun to their head they'd have immediately available cash, they'd manage.

Second, even after what happened in 2007-2009, financial institutions with systemic risk are not THAT capitalized.

It's not new and never gets solved: in 1987 NYSE specialists had to bed big banks to provide them with more cash or the whole world would collapse.

And I think bureaucrats do not understand how this all works very well. No one does honestly. But bureaucrats are really clueless and under or overreact. Always.

It gets scary for the clearing firms when you have GME making $35 billion volume and going up 400% in 2 days, AMC making $20 billion and gap 300%, higher volumes than Apple and Amazon that are already higher than usual and on 100 times the volatility.

Interactive Broker CEO was the most honest in my eyes and in an interview with CNBC said they halted trading to protect their clients, the clearing houses, the market, and themselves. He said if they had not done it the short squeeze would have kept "going and going", so regulators & brokers agreed to stop it all to "stop the losses".

Robinhood decided to re-open trading and the CEO pretended he halted trading of the very volatile stocks as routine like "oh didn't notice anything special was going on" 🤡.

Webull CEO said in an interview their clearing house told them they could not take trades anymore. I think they use another entity than Robinhood does.

Not sure why Robinhood halted buying (and not selling). There's really the need for an investigation here. I can't tell you what happened because we do not know.

My 2 cents:

Short sellers are still very strong on this stock, I think they might even have added, I don't know if they are friends with the clearing house but either way they (ch) get stuck in this game, and retail investors are understandably angry at getting blocked like this.

Brokers don't have billions to my knowledge with which they can cover counterparty risk and they have no contractual obligation to do so and I mean they're not santa claus.

My personal opinion is short sellers refusing to liquidate and take the L is the source of all risks and problems (most of it might be options that they can just hold? Not sure how this gets counted in short interest).

Maybe already the counterparty clearing firms got wiped clean, but regardless of this if the price skyrockets further and the bagholding shorts that refuse to close while they can end up being liquidated and margin called, it's truly over for the market. Everyone is going bankrupt, WSB crashed the world.

The counterparty providers risk is real, but I am not their accountant, I do not know how bad things are, and we don't know what actors (if any) are of good faith. It could be (it probably is) shorties refusing to take the L, putting the whole market at risk.

I think they are really worried the price gets to 5000. From the Peterffy (IBKR) interview they really expected this. And it might still happen.

Lehman Brothers, James Cordier, Melvin, same story. They get greedy, they refuse to get out, they get rekt.

And sometimes they get an unfair bailout, and are so deluded they actually think they got unlucky when they really messed up.

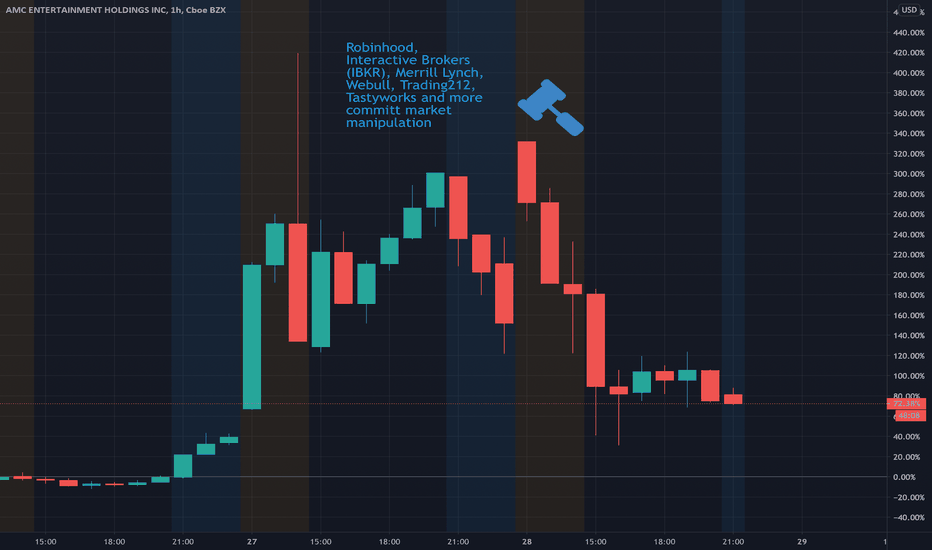

A historic and unprecedented example of market manipulationIn an unprecedented move, today a large number of brokers has committed what many consider to be blatant and transparent market manipulation and defrauding of their own clients. The list includes Robinhood, Interactive Brokers (IBKR), Merrill Lynch, Webull, Tastyworks, Trading 212, and ETrade among others.

They did so by going through with a coordinated effort and simultaneously forbidding their clients from buying a handful of stocks, most notably GME and AMC. Thus, they took millions of buyers away from the market, creating an environment in which only selling is an option. When virually all investors can only sell a security, and buying is removed from the equation, as everyone would assume, the stock drops.

The move came a day after numerous large and powerful hedge funds (some of which it has to be noted, own and control large portions of some of the affected brokers, or have other business relationships with them) were exposed as having already lost billions on shorting the stocks in question. As such, the motivation of such a decidedly lopsided halt is on its face highly suspicious, unprecedented, and has cost the affected brokers' retail clients billions of dollars collectively. It is being reported that lawsuits are already about to be filed due to this event, against both the offendors and as an effort to prevent these practices from occuring in the future, with members of both major US parties and numeroud high-profile investors speaking out about the manipulative act that occured today.

However, there is still no word on most of the brokers' future plans on lifting the "one-way halt" or keeping it in place.

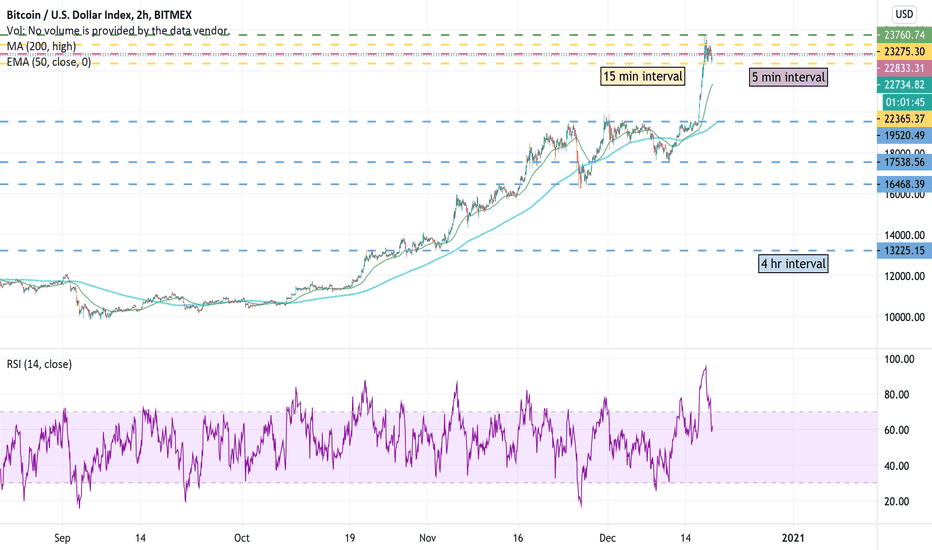

BTC Support & ResistanceThis is support and resistance of bitcoin and potential on where to enter.

Buying below the 200 MA is a great approach and especially is that is supported by the lower resistance levels. Please put more emphasis on the blue 4 hr lines as that is a better support vs the 15 min and 5 min trends.

Wishing this helps in your long term strategy to hold BTC til 2059.

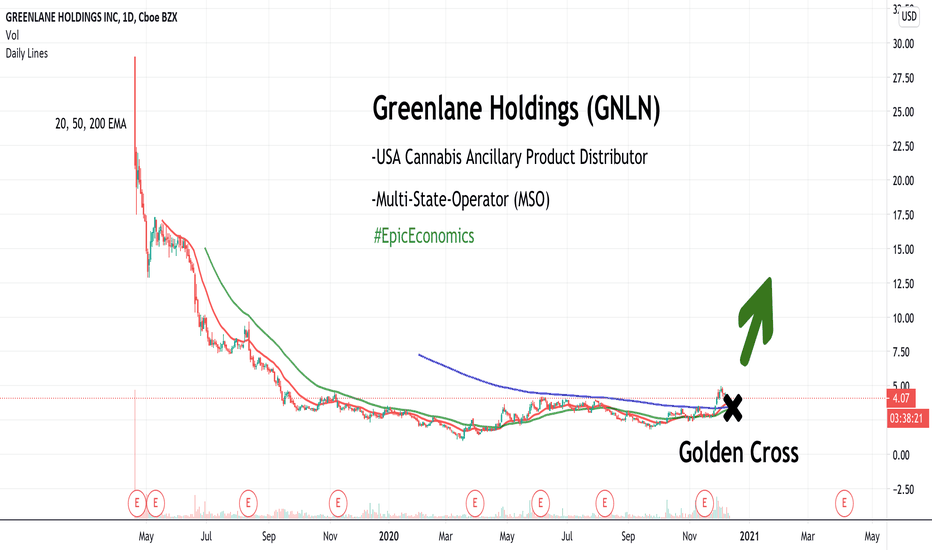

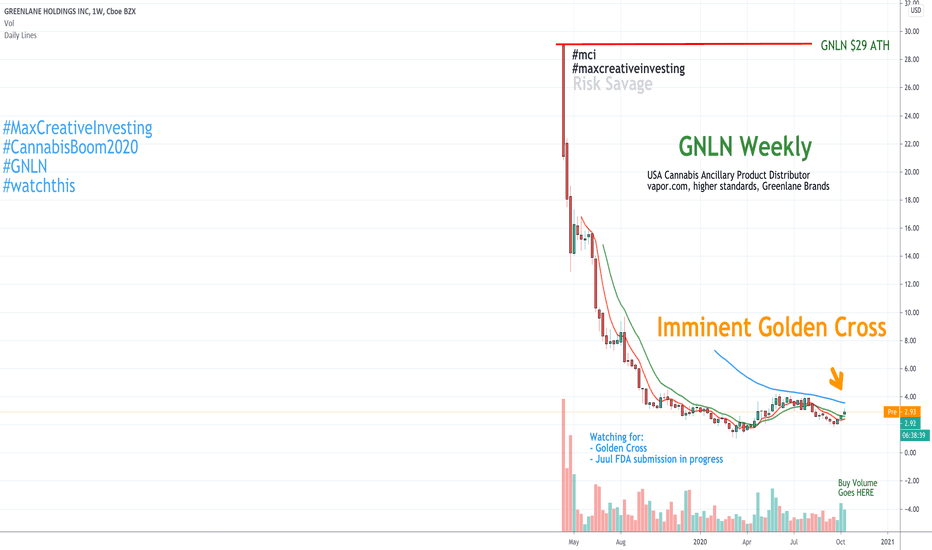

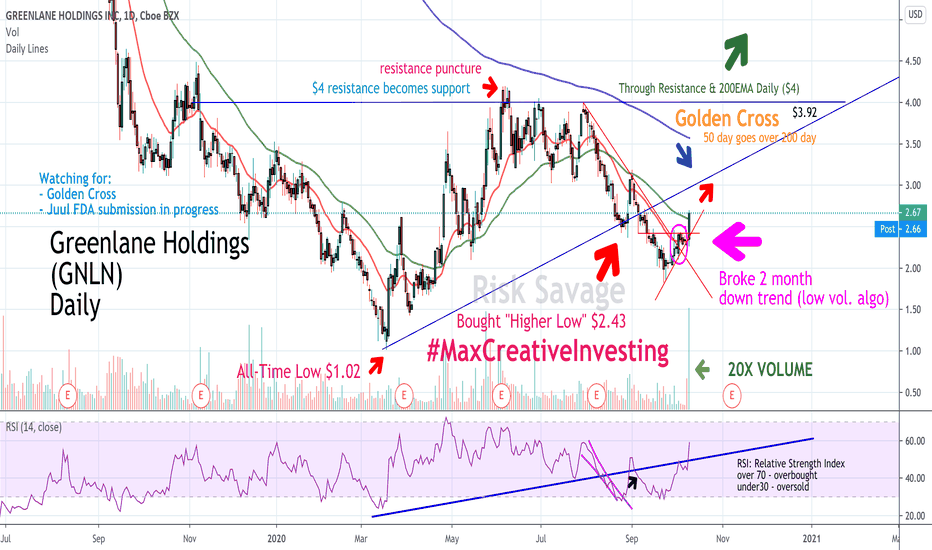

Greenlane Holdings - USA MSO - Golden Cross A seemingly forgotten USA cannabis ancillary product distributor (Multi-State-Operator, "MSO"). They've got a growing list of global partnerships. Federalization in the US is seemingly around the corner as the majority of states and public opinion is LEGALIZE IT, DECRIMINALIZE IT, & FEDERALIZE IT. #cannabiscommunity has won. #EpicEconomics The tax grab is inevitable.

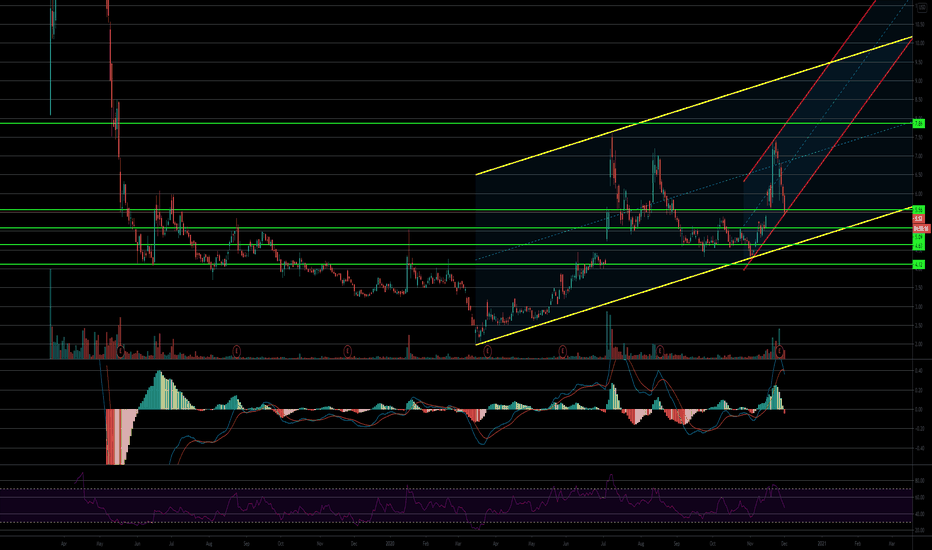

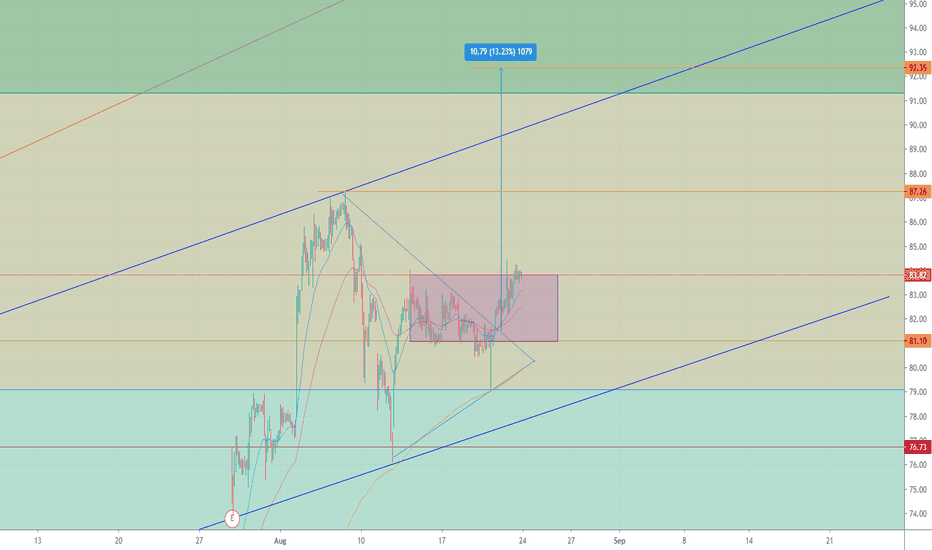

TIGR set to run wild! Long term and near term views...NASDAQ:TIGR is setup to rebound on support and make a play to the upside for a lengthy uptrend that should continue til next earning release around early March 2021. Below I will show you the Big picture and the Near term Picture....

BIG PICTURE

TIGR is in a weekly and daily channel from 6 months ago to now and is headed to the lower band of that channel but has strong support near 5.50, 5.50, 4.75, 4.50, 4.25 and 4. Let's start with the WHY will it rebound?!? This is the robinhood of china and just had an earnings blowout last week. Absolutely amazing earnings of 130+% for users, rev, net profits. China just dumped 30 Billion into their market this week as QE. There is no slowing down for this company any time soon as they are valued at having customer counts in the single digit millions and in an asian market they have virtually unlimited customers to gain locally. The stock took a hit with profit taking and lack of catalyst after the huge earnings but the value still remains. now becoming oversold and undervalued this company is ripe for a large lengthy upside into next quarters earnings. The channel has upside to 9.00 and downside to 4.75 so @ 5.50 this is a STEAL.

NEAR PICTURE

6 month, 3 month, 1 month uptrend embedded readings, 1 week pull back (retracement) signaling profit taking from last quarter.

CATCH the wave and ride long my friends.

Greenlane Holdings Imminent Golden Cross - USA MSO - #federalizeTikTok. Time is up. Recent millions in buy volume shows the higher low confirmed. Cannabis Boom 2020 is here. #watchthis. More Created Content at Risk Savage Linktree. Buy and hold Greenlane for many many years. Adding states continually. THC will be global. As it should be. THC saves lives.

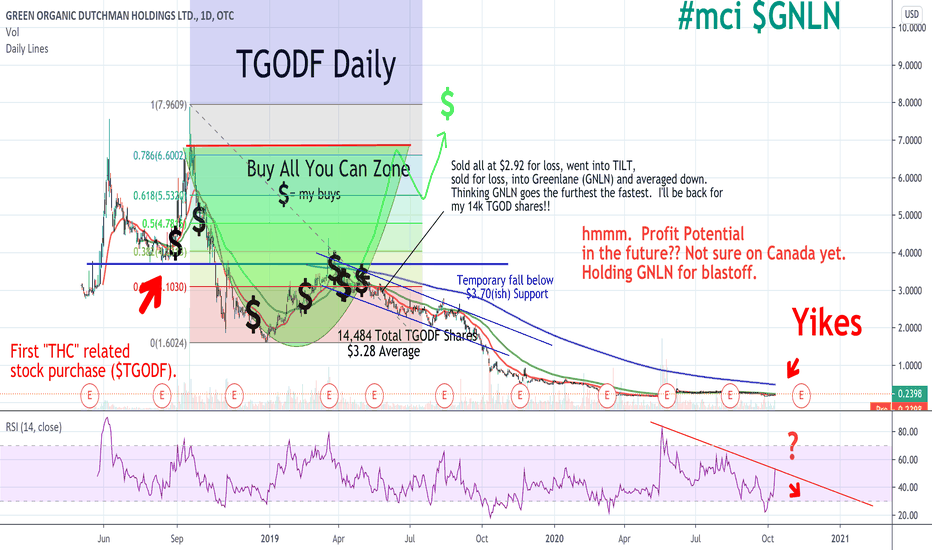

TGODF The Green Organic Dutchman - Not Very Convincing - Show MeAre any Canadian companies gonna produce the profits? Time will tell. Til then, USA mso's. $GNLN. GL weed lovers. USA THC is the future. #federalize #maxcreative #risksavageinthewild #gopromax #iuse #watchthis #gnln

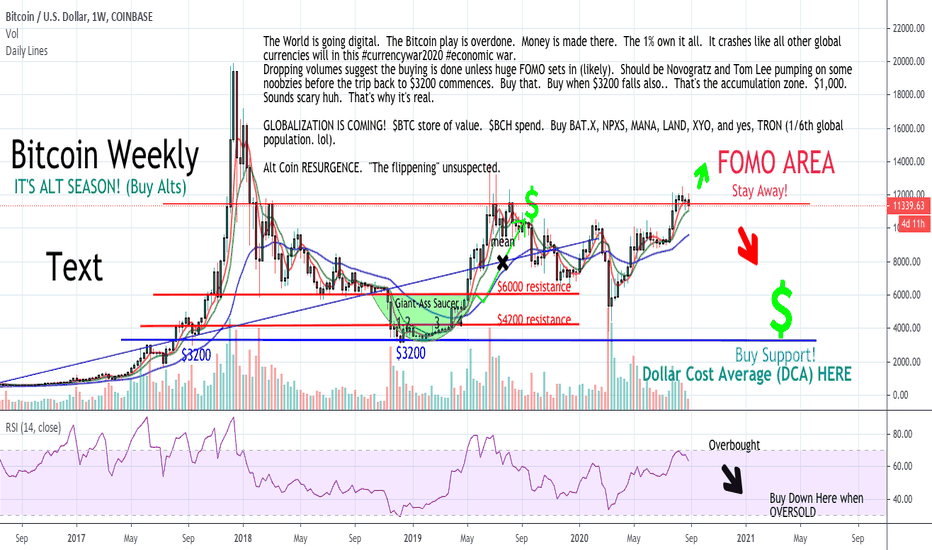

ALT SEASON BEGINS - Bitcoin Becomes Store of Value - BUY ALTSThe all forgotten Alt Coins. Welcome back. The dollar and other currencies will fall. The globe is in currency war. Crypto wins. Just takes years and years. The Bitcoin money making game is done. It'll be store of value and the Crypto economy will boom around it. I'm a fan of decentralization. Go Crypto!! BAT, MANA, LAND, XYO, and even Tron (most people in China. hmmmm. China. lmao)

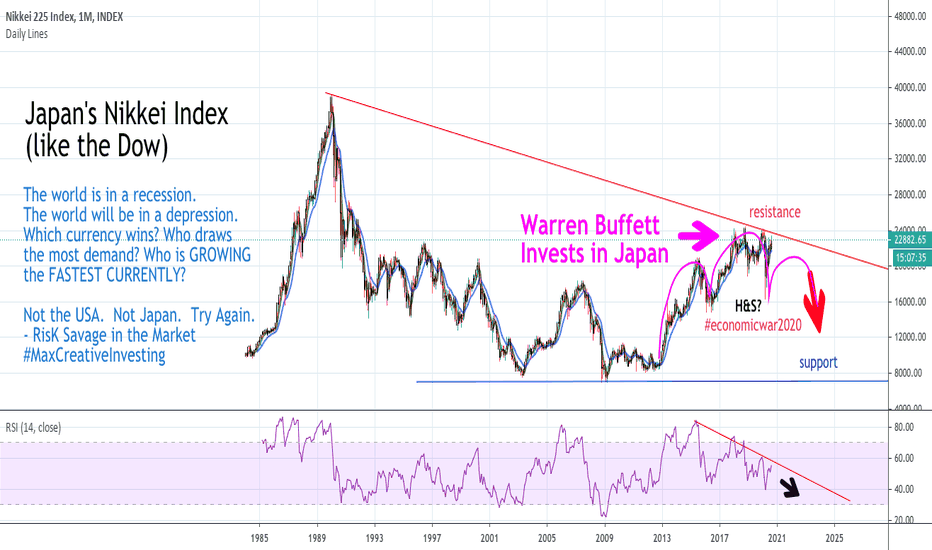

Warren Buffett Invests in Japan - Economic War 2020 - CurrencyAs the world watches the USA capital markets squeeze themselves into just 5 or 6 large cap, over-hyped, mania stocks (Tesla, Apple, Amazon, Google, Facebook, Microsoft, etc.), the richest (1%) are avoiding U.S. stocks altogether. Warren Buffett has just announced his buy-ins into Japan (over past 12 months). *Warren Buffett made gained his massive "unrealized" returns by accumulating stocks just after the great depression. He then held pretty much his entire lifetime. I don't believe Warren has an edge at all anymore. The world has moved lightyears ahead of what the baby boomer generation can generally comprehend. Sorry Warren, stash the cash, go enjoy your family. Your best days are behind you.

Invest in small cap USA or watch the USA struggle for years. Sad stuff. DON'T INVEST IN JAPAN LIKE WARREN. Don't live on leverage like the majority. Invest smart. CONTRARIAN.

INVEST IN $GNLN or other small cap USA companies. Go USA!!! #cannabis

#federalize

#risksavageinthemarket

#maxcreativeinvesting

#watchthis

#stockmarketcrash2020

#cannabisboom2020

#greenlaneholdings

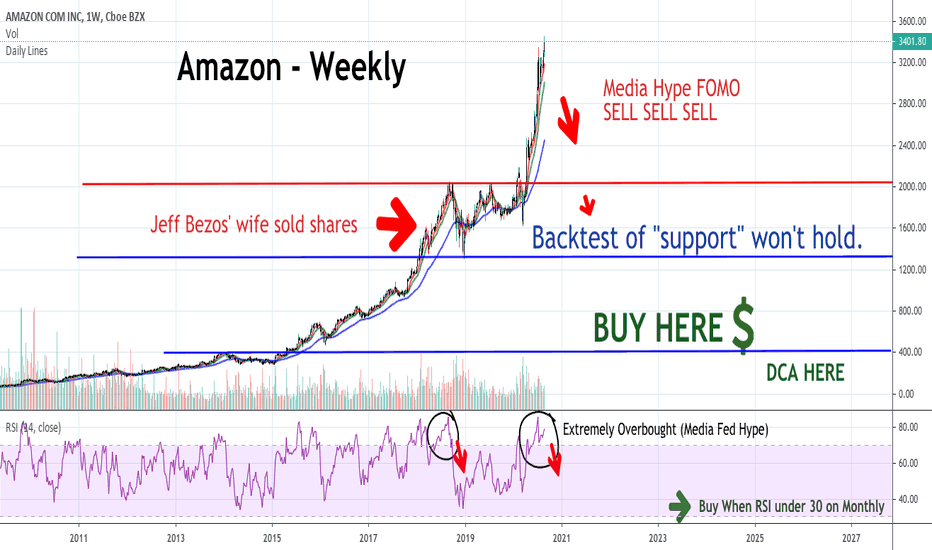

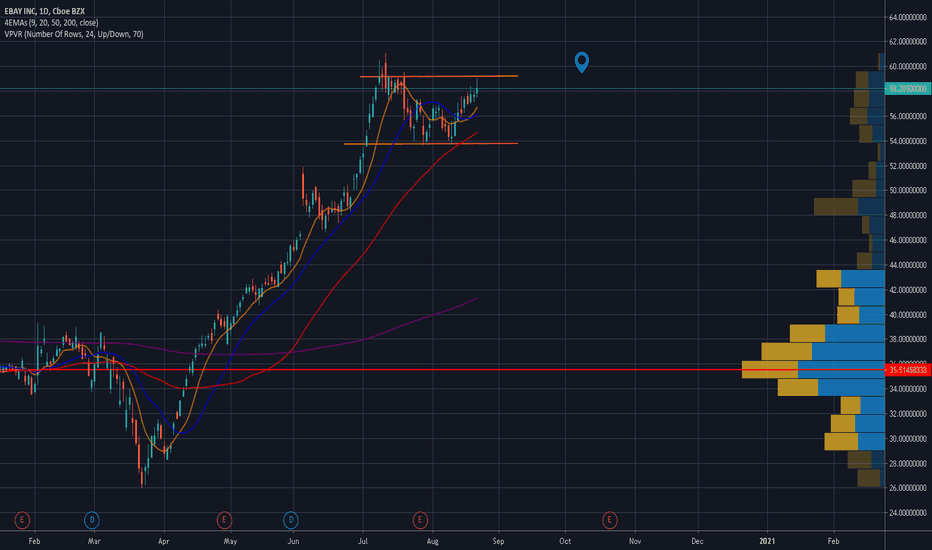

AMD has gone parabolic, good shorting opportunityShort idea is summarized as follows

1. stock has gone parabolic and these typically have aggressive corrections

2. robintrack shows sentiment is extremely optimistic so would like to make a contrarian bet

3. assuming a SZ 84-88 so taking a $4 risk and executing the trade via November PUTS. 80 strike

$AMD PT $91-$93 then to $100AMD is that darling that continues taking share from Intel. We have formed a bull pennant with an inside CH. Appears friday we hit the top of the handle. We need to break that $84-81 range to get continuation to my $93 target. This will then get picked up once again by robinhooders and should propel it beyond $100. My top price (which is insane) is $111 which ends up being exactly the 2.618 Fib extension level. Be ready!! the NVDA drive should start waking people up for AMD. Tread lightly though as i am anticipating a pullback in the market either this week or next.