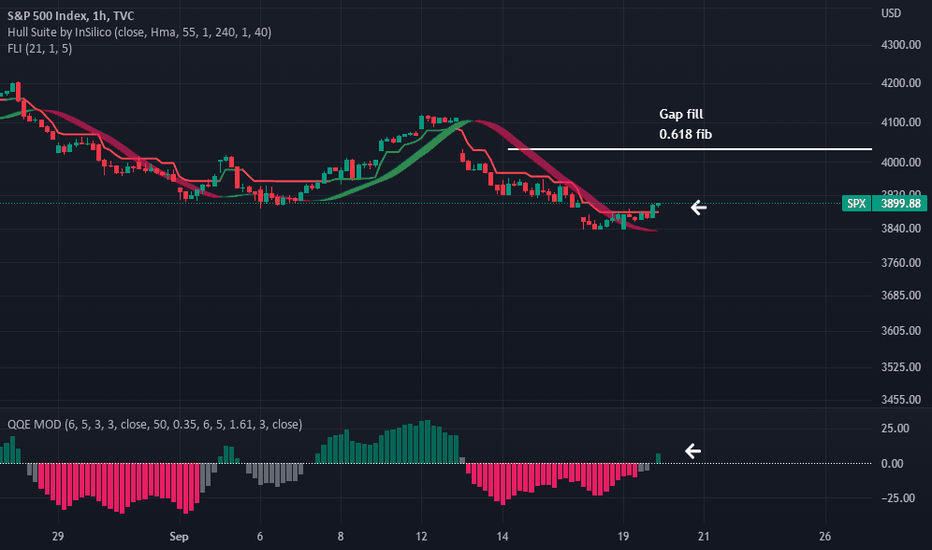

S&P500-Potential for relief run to fill gap at 0.618 ,bot deployTo make this strategy clear , the weakening dollar in "SHORT" term will result in a side ways to upwards markets.

This will lead to volatility in crypto markets which are optimal conditions to deploy trading bots within a price range.

The S&P500 being the leading indicator for this strategy .Considering the Gap @ 0.618fib and a possible short term Dollar cool off ,its probable it gets filled. I can imagine plenty short liquidations above $4000 which will be a nice stop hunt into that price area.

P.S. This is by no means a long signal as fundamentals and economic data is scary AF. Its to deploy bots with risk mitigation when conditions are conducive.

There is no sign of DXY losing momentum in mid to long term and we will see S&P500 much much lower so ensure safety.