Rocket Mortgage (RKT) Long SetupGood afternoon everyone,

This is my first post on this account but I have been spending the last four years or so analyzing technical analysis on equities, futures, and crypto currency. Almost all of my published ideas will be based on the following three principles/rules.

1. 1% Risk: This is the most important rule in my trading technique. No one should EVER risk more than 1% of their entire account on any single position.

2. Stop Loss: ALWAYS use a stop loss. This rule is extremely important and should be implemented with rule one.

3. Take Profits: Profit taking should always occur. Your first profit target for your position should cover your possible 1% stop loss, if not more.

As I continue to publish my ideas, I will explain the methods that I use in more detail!

Good luck and happy trading!

Rocket

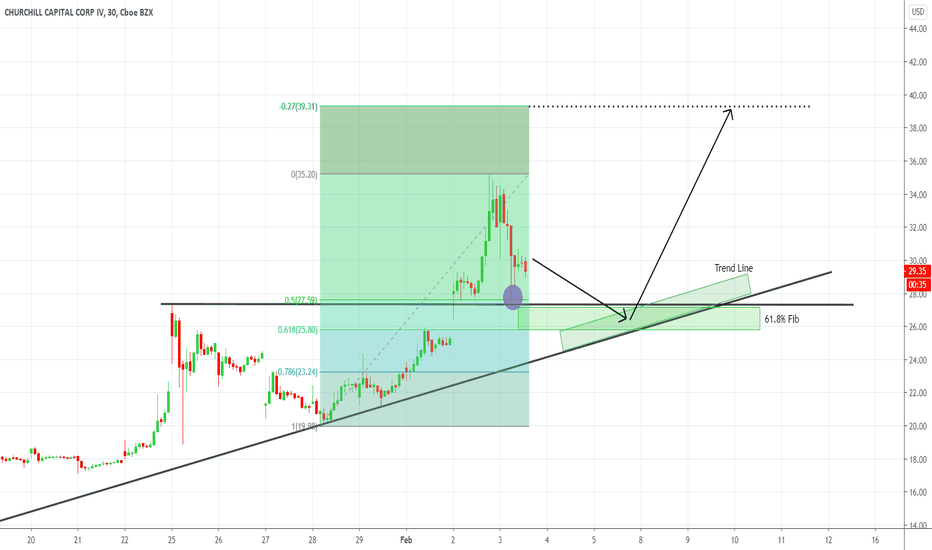

$CCIV Long From RetracementQuite a simple one, yesterday we had a surge to $35.15 from the low of $19.98 last Thursday. There is a strong potential for the price the retrace to the 61.8% fib region at around $25.80 which is also coming up to the region of trend line interception. This offers a textbook opportunity to got long from $25-$26 with a target price of $39 which is just below the -27% fib point. Stop loss at $22.50 which is the weekly low, and roughly 10% below the trend line. If it hits that point, ceteris paribus, I think we we can agree that the trade is void. That is not to say that the price won't hit $39, but if it hits the SL, it may likely also hit $20 or lower which will be an even better opportunity to go long (when the price becomes bullish once again).

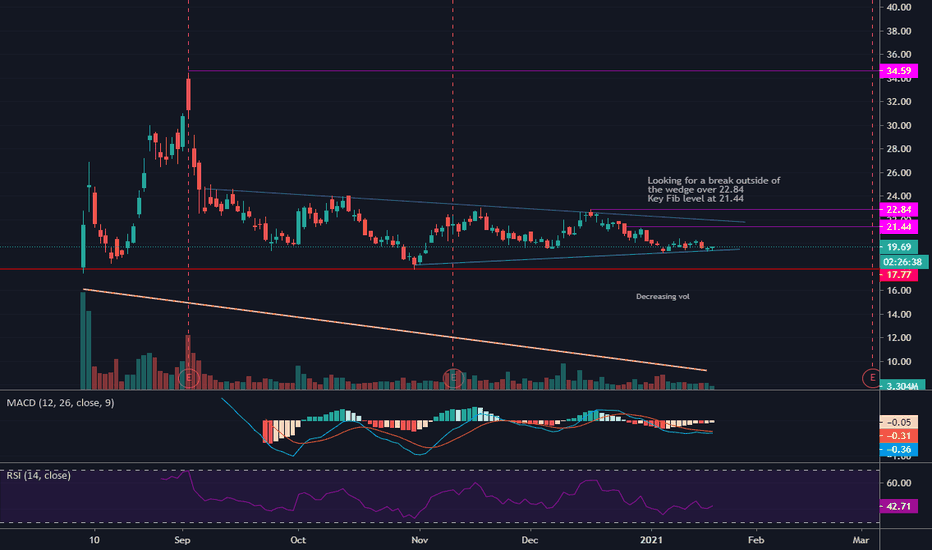

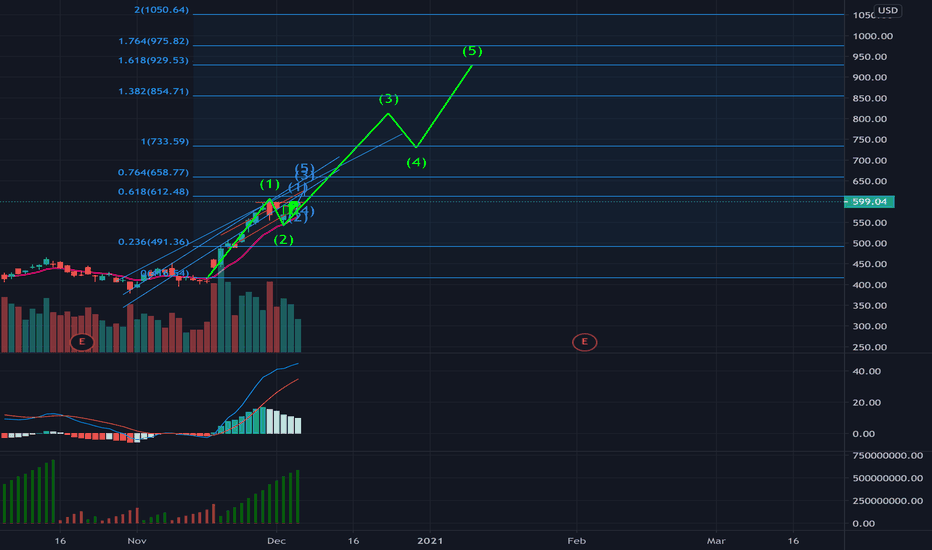

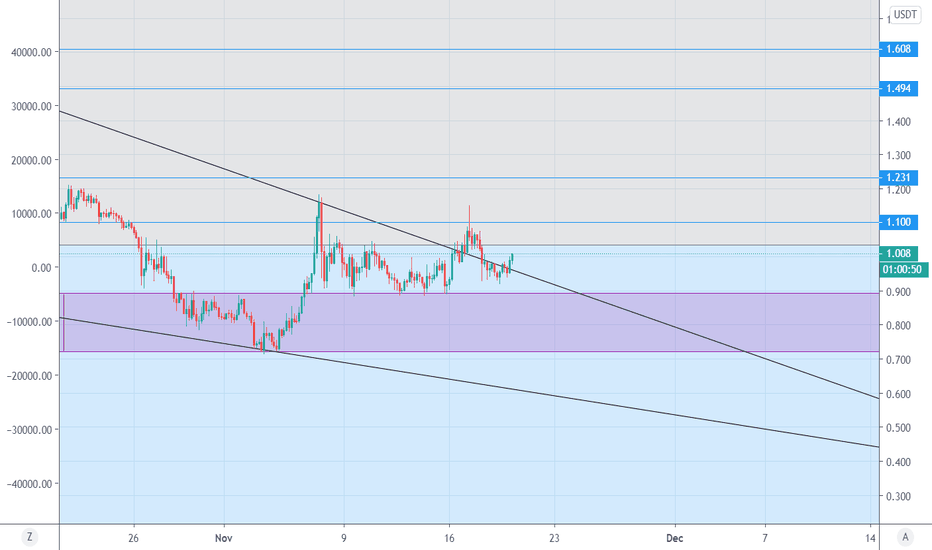

XLM Launchpad All Systems GoWhy XLM?

- Ever since XRP SEC hammer came down. I decided to move into its direct competitor XLM.

- The news/fundamentals around this coin is great.

- The main difference between XRP & XLM is centralization vs decentralized concepts.

- I believe most hodlers will eventually move into xlm has delistings happen. Creating a movement.

Chart Pattern

- Above I drew a bullish pendant flag that I have kept a very close eye on.

- The Stock RSI ( top indicator ) is showing that a move to the upside is very probable.

- The regular RSI is showing a potential bottom sequence playing out. Higher highs.

- It may be a longshot but, if this is indeed a Elliot wave pattern. Wave 3 is traditionally the biggest wave.

Prediction

- Personally, I can see this going to somewhere around a dollar within the next bull run.

- I do like that this the new fomo coin.

P.S - I managed to catch the run up on XLM from 15c-41c but didn't post it. I really got xrp wrong. I needed to get my confidence back to post. Didn't want to mislead.

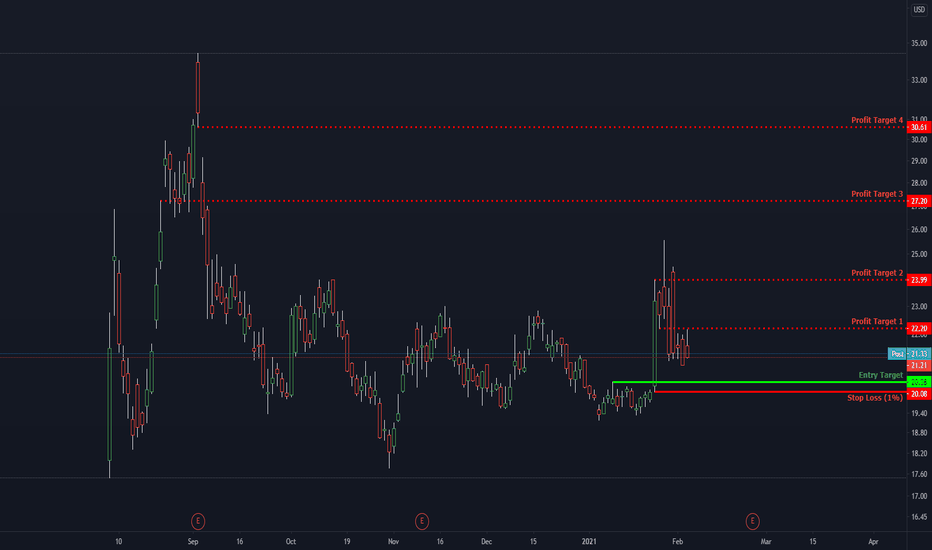

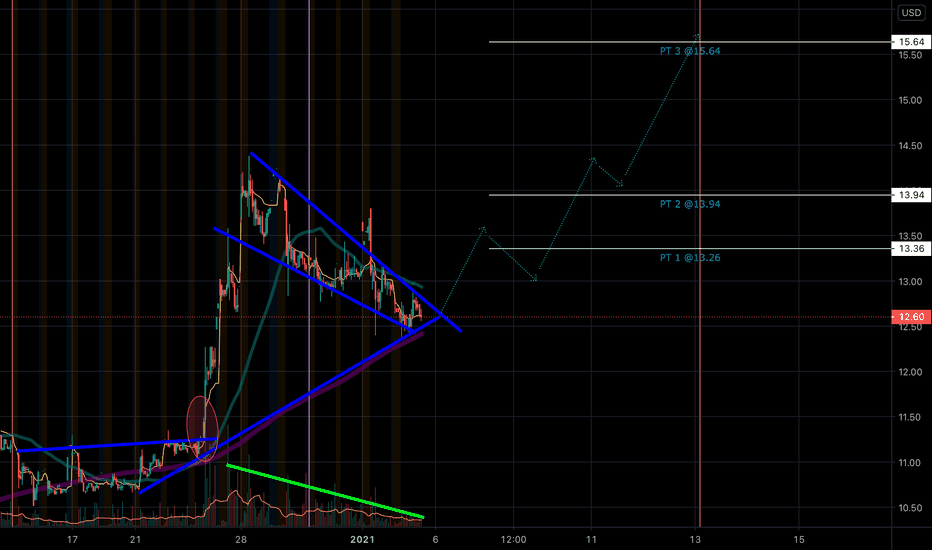

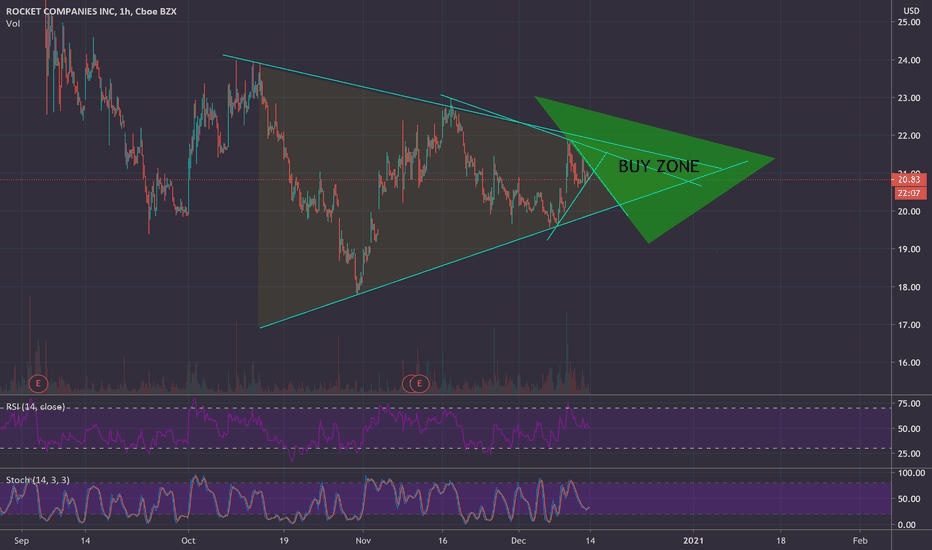

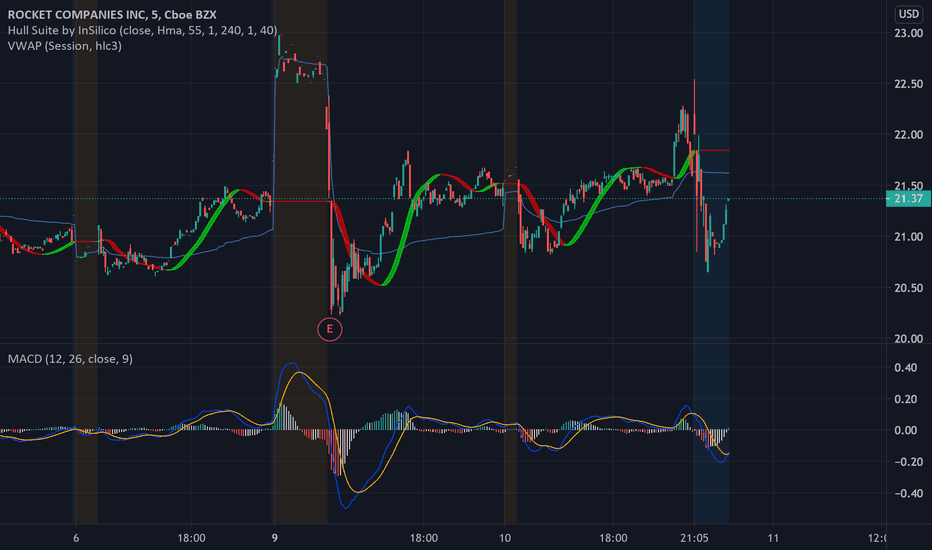

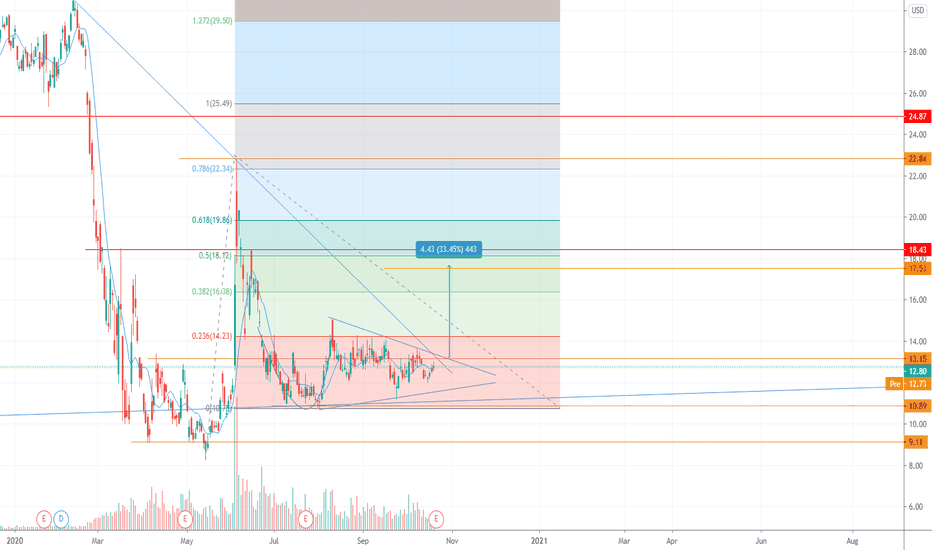

RKT - Buying to OpenBuying to Open 19FEB21 20 @1.35-1.50

Watching the 1hr for oversold entry in the 19.56 area.

Entry Target = 19.56

1st profit Target = 236fib @22.60

2nd Profit target = 382fib @24.14

HODL Target = 618fib @28.06+

______________________________________________________________________________________________________________________

This content is for informational and educational purposes only. This is not in any way, shape or form financial or trading advice.

Good luck, happy trading and stay chill,

2degreez

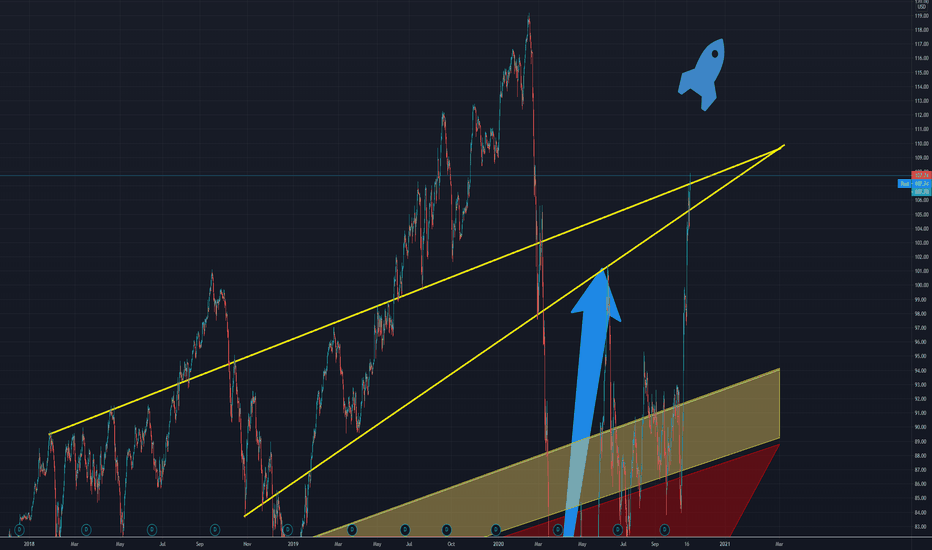

XAR- AEROSPACE AND DEFENSE 🚀one of our favorite ETFs 🚀Apologies for the many 'rockets' lately, we have been using the rocket on our Bitcoin chart but originally the rocket things started from and belongs to XAR AEROSPACE AND DEFENCE ETF.

Fundamentally, with the huge amounts being invested in aerospace (and defense), this sector is expected to fly and to thrive.🚀

Our market segmentation analysis has proved to help us 'Buy the strongest' and 'sell the weakest', for years now.

XAR is an ETF which can deliver excellent returns for us in 2021 to 2025.

FROM STATE STREET:

The SPDR® S&P® Aerospace & Defense ETF seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P® Aerospace & Defense Select Industry® Index

Seeks to provide exposure to the Aerospace & Defense segment of the S&P TMI, which comprises the following sub-industries: Aerospace & Defense

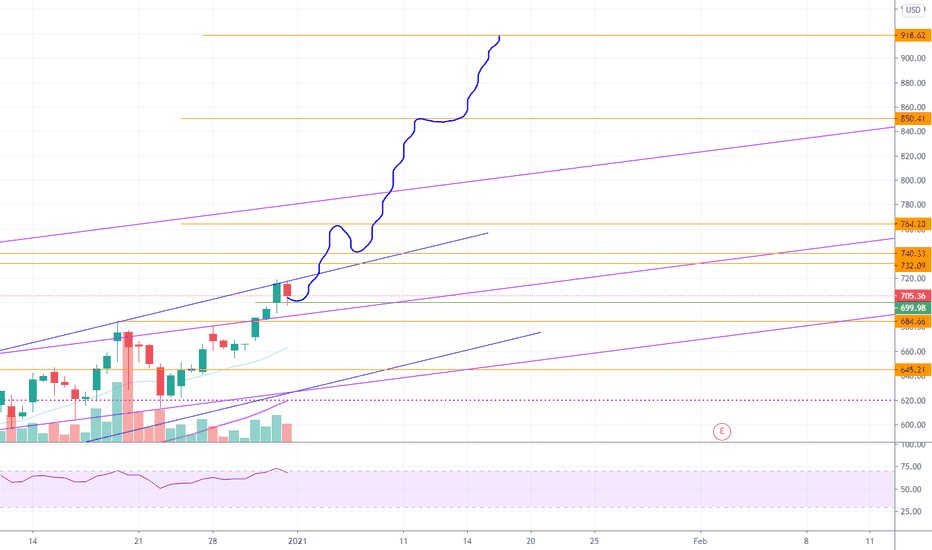

TSLA PT #1 $764.20 PT#2 $850.41 PT#3 $918.62We are already in absolutely overvalued, over extended, beyond parabolic, at the moon. But.... Thats tesla. Fundamentals do not matter at all in this stock and it has been gut wrenching accepting that. Tesla chart is not about Tesla the company, it is only about the candles and numbers on a screen. This making no sense, makes perfect sense. People are trading like they trade bitcoin. It does not actually represent anything tangible. Its simply a number that goes up on a screen and for that reason alone makes it more valuable.

Anyone who disagrees and thinks this represents teslas valuation is delusional.

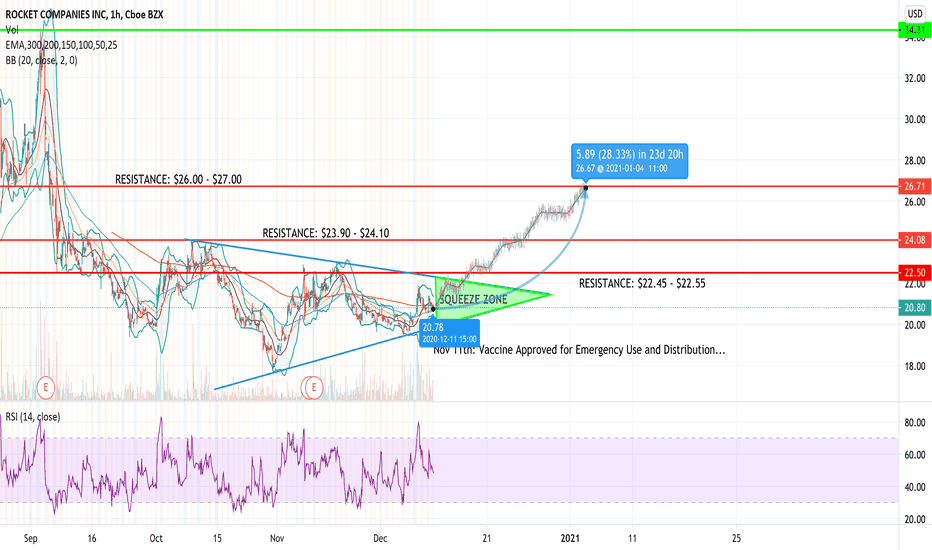

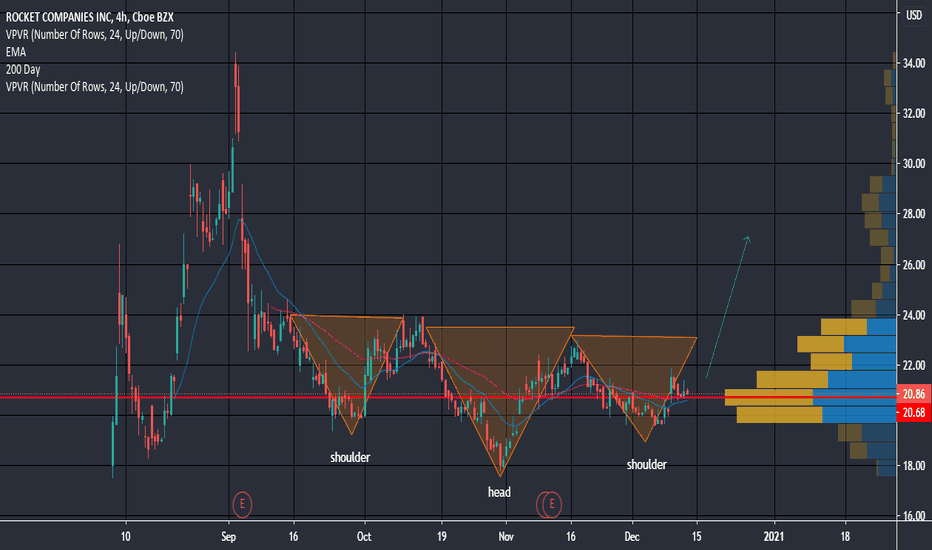

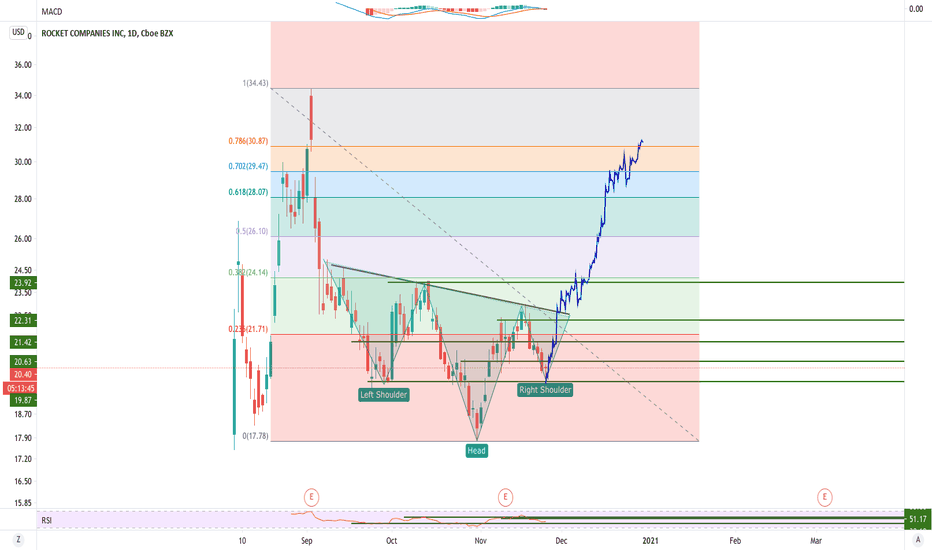

$RKT Breakout Coming Soon after 3 Month Squeeze (25%+ Spike)Rocket Companies remains one of the most undervalued stocks...

The last two Earnings Reports $RKT has continuously to outperformed their expected EPS by a substantial margin. Along with other highly impressive financials.

The CEO Jay Farner was quoted on their IPO Day stating, "The company's profits are so high there is a Good possibility for Dividends..."

That day will soon come... which will cause this Stock to spike higher than what I am currently expecting, 25%-28% after the market reacts to the COVID-19 Vaccine from $PFE & $MRNA.

The whole real estate / mortgage sector should spike substantially...

TSLA on daily looks like entry to Wave 3 on way to 800? TSLA has spent the last few days consolidating between 580-595 and then broke out right at market close. in extended trading we saw it break past $600 for the first time before selling off back to $598. Could this be the big push to 800 that Goldman Sachs predicted? Only time will tell!

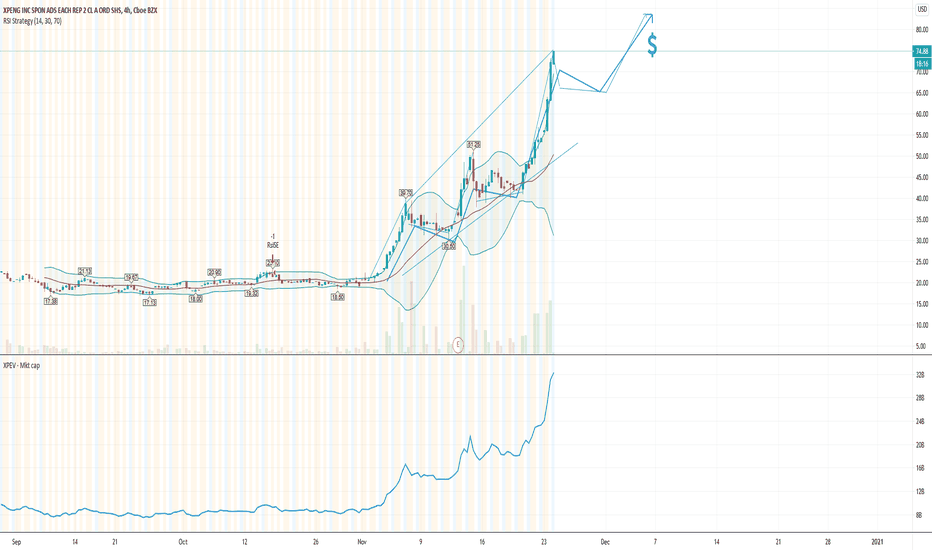

Possible 80 usd before 31 december?This stock has been moving without any logic if the fundamentals are taken into consideration. It is way overpriced, but who cares. As for me, I doesn't make sense to judge such stock from the fundamentals but rather we should consider the future possibilities.

If it continues to follow the trend, it will definitely hit 80 USD.

XAR AEROSPACE AND DEFENCE 🚀our favorite ETF is in Orbit 🚀We have been doing so well on AEROSPACE AND DEFENCE ETF and happy to say it has just broken 2 majpr resistance levels in 1 session!

We are keeping our buy positions until it reached record highs and will be keeping an eye on this for the future.. for a long time

Fundamentally, aerospace and defence are industries that have a bright future and are becoming increasingly important

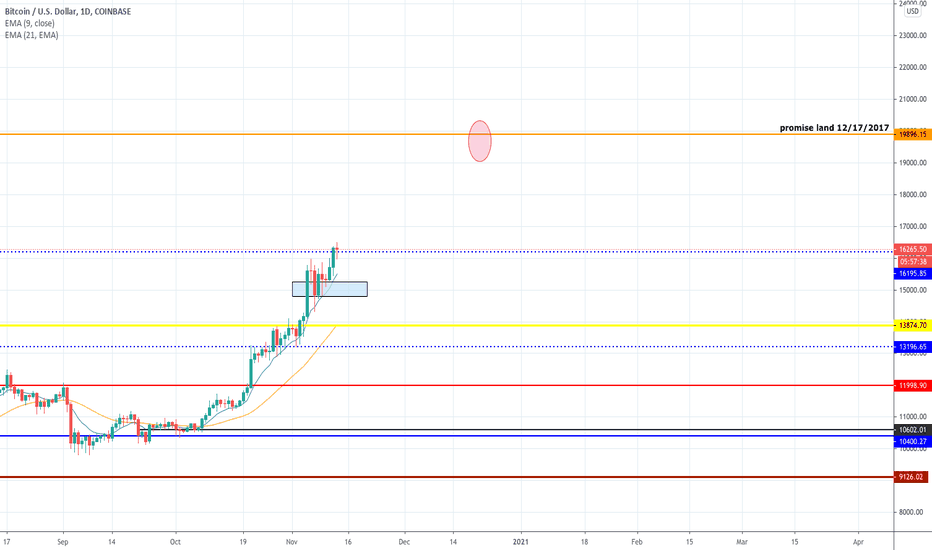

BTC to test 19K highs on 12.21.20we have shaken out the 13k waking zone

Shot past the 15k resistance

next target is 17.5k then we should rocket to 19K!!!

23.5k is my market target but we could see a massive drop after 19k peak to 17-15k levels to retest. '

**Biden winning US election can jump start new "digital age" in the USA**

**a WAR will cause an inverse on both XAU and BTC watch out**

Recount of election can slow down movement of BTC.

11.13- 11.24 prediction test 17k falls to 16.4 holds then either drops again to test 15.8 or begins push to 17.5K