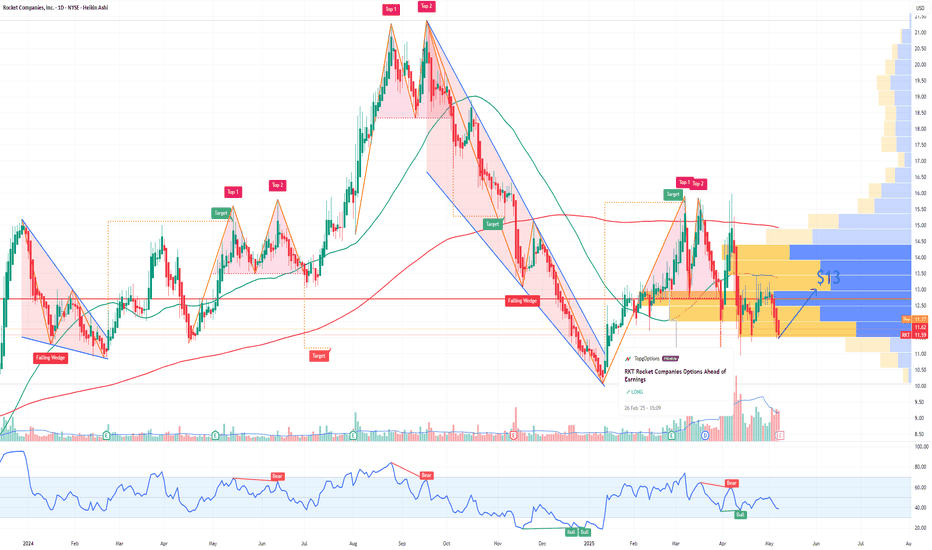

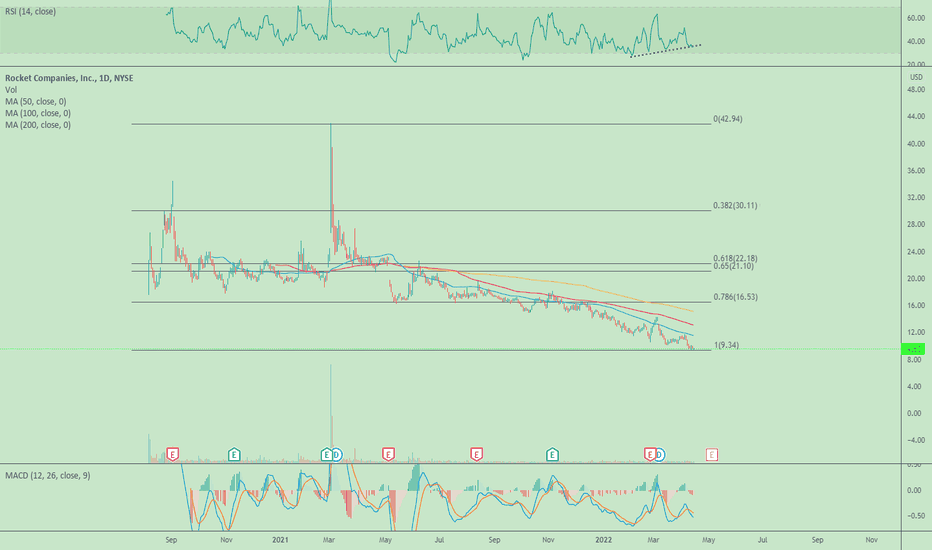

RKT Rocket Companies Options Ahead of EarningsIf you haven`t bought RKT before the previous earnings:

Now analyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.37.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Rocketcompanies

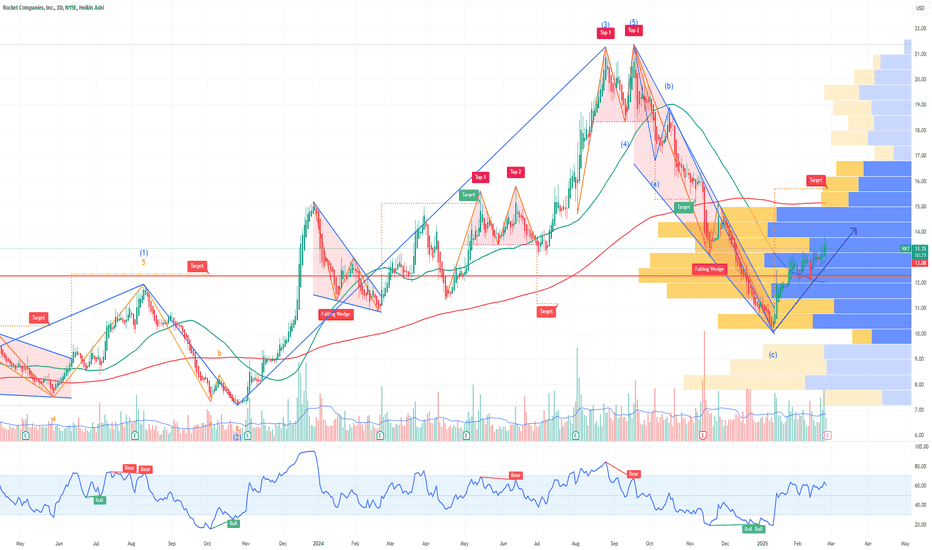

Rocket Companies (RKT) – Fintech-Driven Mortgage GrowthCompany Overview:

Rocket Companies NYSE:RKT is a fintech leader in mortgage and real estate solutions, leveraging AI-driven efficiency to enhance profitability and market share.

Key Catalysts:

Surging Profitability & Efficiency 💰

Adjusted EBITDA margin rose to 18% in Q4 2024, up from 2% a year prior, reflecting strong financial performance.

Rocket Mortgage Growth 📊

Net rate lock volume surged 47% YoY to $23.6 billion, far outpacing industry trends.

Expanding Servicing Portfolio 📈

The $593 billion servicing portfolio (+17%) provides stable revenue and cross-selling opportunities, acting as a hedge against rate volatility.

Resilient Market Share Expansion 🏆

Despite industry headwinds, Rocket continues to grow market share, proving its competitive edge in mortgage lending.

Investment Outlook:

Bullish Case: We are bullish on RKT above $11.80-$12.00, driven by profitability gains, market expansion, and portfolio strength.

Upside Potential: Our price target is $20.00-$21.00, reflecting sustained growth and operational efficiency.

🔥 Rocket Companies – Powering the Future of Mortgage & Fintech. #RKT #MortgageTech #FintechGrowth

RKT Rocket Companies Options Ahead of EarningsAnalyzing the options chain and the chart patterns of RKT Rocket Companies prior to the earnings report this week,

I would consider purchasing the 13usd strike price Calls with

an expiration date of 2025-4-17,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

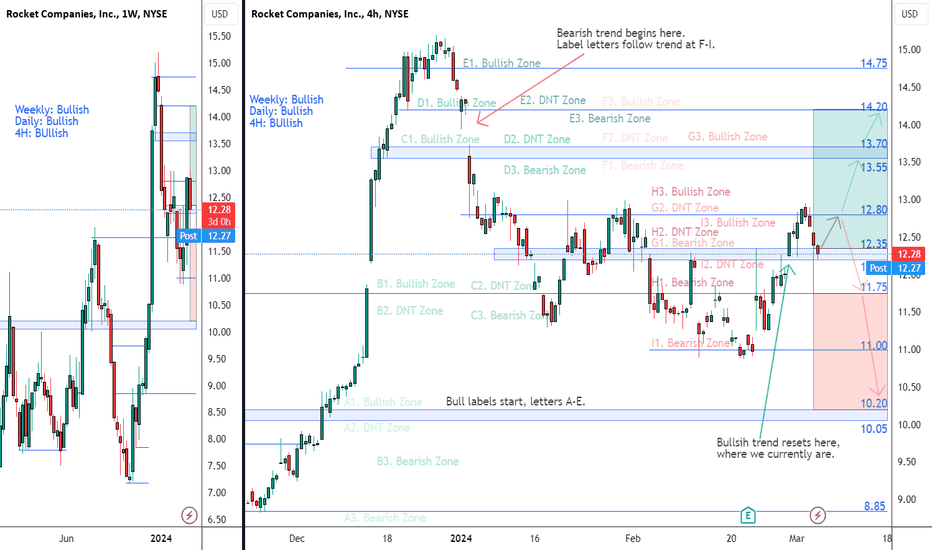

ROCKET COMPANIES $RKT - Apr. 5th, 2024ROCKET COMPANIES NYSE:RKT - Apr. 5th, 2024

BUY/LONG ZONE (GREEN): $13.55 - $14.75

DO NOT TRADE/DNT ZONE (WHITE): $12.80 - $13.55

SELL/SHORT ZONE (RED): $11.50 - $12.80

Weekly: Bullish

Daily: DNT

4H: Bearish

The weekly timeframe has a bullish trend with strong bearish momentum on the most recent candle as the week is wrapping up. The daily timeframe has a breakdown of bullish structure and a retest of the most recent zone that I am using as my trend determiner, I would label this as DNT until we see a new lower low created, even if it were only a wick below 12.80. The 4H timeframe gives a better showing of the strong bearish momentum and the retest of the broken zone. After the retest the bearish momentum continued to reinforce the bearish trend. Any break below 12.80 would confirm the bearish trend and where I'd start to look for short entries. A break above the zone bottom at 13.55, where the bearish momentum continued and where price retested, would signal a reversal into a bullish trend.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

EDUCATIONAL/ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technical indicators, support and resistance, rocketcompanies, rkt, NYSE:RKT , rocketmortgage, rktstock, rkttrend, rocket, rocketcompaniesstock, rktlong, rktshort, rktanalysis, interestrate, mortgagerate, ratecuts,

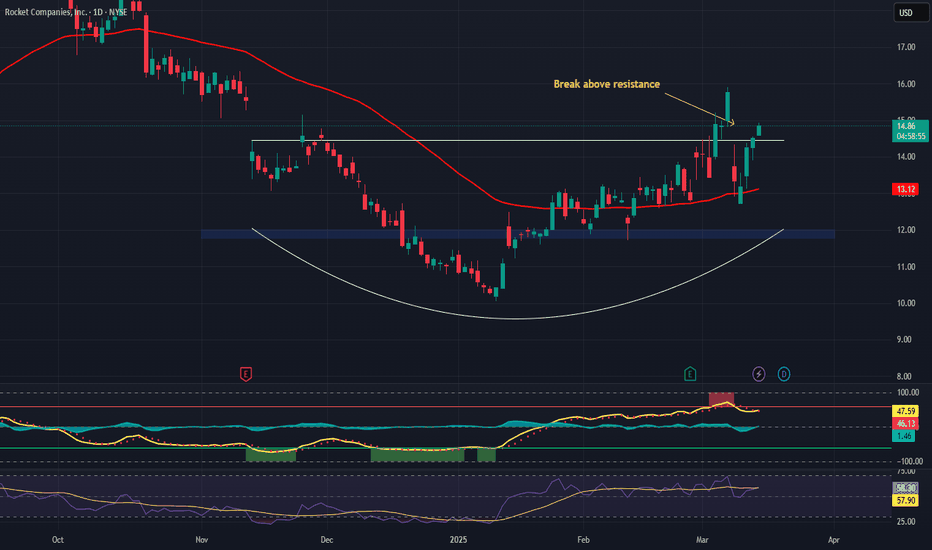

ROCKET COMPANIES $RKT - Mar. 5th, 2024ROCKET COMPANIES NYSE:RKT - Mar. 5th, 2024

BUY/LONG ZONE (GREEN): $12.35 - $14.20

DO NOT TRADE/DNT ZONE (WHITE): $11.75 - $12.35

SELL/SHORT ZONE (RED): $10.20 - $11.75

WEEKLY: Bullish

DAILY: Bullish

4H: Bullish

Bit messy today but hoping this provides more insight and support into how I've been following price movement.

Labeled previous bullish trends letters A-E.

Labeled previous bearish trends letters F-I.

Previous bullish trend and bearish trend beginnings are labeled with arrows.

Last week we saw price go from a DNT zone into a bullish trend on the weekly timeframes after breaking above level $11.75 and zone top level $12.35. Currently seeing rejection of level $12.80 down to the previous zone (top level $12.35; bottom level $12.20). Despite the test and the two red days the bullish trend is still holding, but it should be noted the 4H has wicked into a new low.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

Rocket Companies (NYSE: $RKT) Looks Poised For A Reversal! 🚀Rocket Companies, Inc. engages in the tech-driven real estate, mortgage, and eCommerce businesses in the United States and Canada. It operates in two segments, Direct to Consumer and Partner Network. The company's solutions include Rocket Mortgage, a mortgage lender; Amrock that provides title insurance, property valuation, and settlement services; Rocket Homes, a home search platform and real estate agent referral network, which offers technology-enabled services to support the home buying and selling experience; Rocket Auto, an automotive retail marketplace that provides centralized and virtual car sales support to national car rental and online car purchasing platforms; and Rocket Loans, an online-based personal loans business. Its solutions also include Core Digital Media, a digital social and display advertiser in the mortgage, insurance, and education sectors; Nexsys, a fintech company, which offers a suite of essential tech solutions for mortgage origination and closing processes through digitization and automation; Lendesk, a technology services company that provides a point of sale system for mortgage professionals and a loan origination system for private lenders; and Edison Financial, a digital mortgage startup. In addition, the company originates, closes, sells, and services agency-conforming loans. Rocket Companies, Inc. was founded in in 1985 and is headquartered in Detroit, Michigan. Rocket Companies, Inc. is a subsidiary of Rock Holdings, Inc.