ROCKET COMPANIES $RKT - Apr. 5th, 2024ROCKET COMPANIES NYSE:RKT - Apr. 5th, 2024

BUY/LONG ZONE (GREEN): $13.55 - $14.75

DO NOT TRADE/DNT ZONE (WHITE): $12.80 - $13.55

SELL/SHORT ZONE (RED): $11.50 - $12.80

Weekly: Bullish

Daily: DNT

4H: Bearish

The weekly timeframe has a bullish trend with strong bearish momentum on the most recent candle as the week is wrapping up. The daily timeframe has a breakdown of bullish structure and a retest of the most recent zone that I am using as my trend determiner, I would label this as DNT until we see a new lower low created, even if it were only a wick below 12.80. The 4H timeframe gives a better showing of the strong bearish momentum and the retest of the broken zone. After the retest the bearish momentum continued to reinforce the bearish trend. Any break below 12.80 would confirm the bearish trend and where I'd start to look for short entries. A break above the zone bottom at 13.55, where the bearish momentum continued and where price retested, would signal a reversal into a bullish trend.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

EDUCATIONAL/ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!

trendanalysis, trendtrading, priceaction, priceactiontrading, technical indicators, support and resistance, rocketcompanies, rkt, NYSE:RKT , rocketmortgage, rktstock, rkttrend, rocket, rocketcompaniesstock, rktlong, rktshort, rktanalysis, interestrate, mortgagerate, ratecuts,

Rocketcompaniestrend

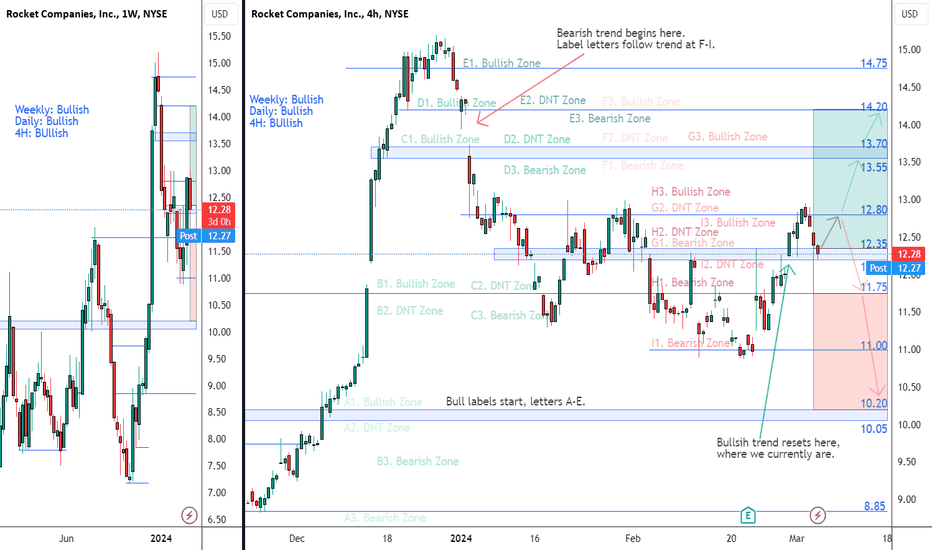

ROCKET COMPANIES $RKT - Mar. 5th, 2024ROCKET COMPANIES NYSE:RKT - Mar. 5th, 2024

BUY/LONG ZONE (GREEN): $12.35 - $14.20

DO NOT TRADE/DNT ZONE (WHITE): $11.75 - $12.35

SELL/SHORT ZONE (RED): $10.20 - $11.75

WEEKLY: Bullish

DAILY: Bullish

4H: Bullish

Bit messy today but hoping this provides more insight and support into how I've been following price movement.

Labeled previous bullish trends letters A-E.

Labeled previous bearish trends letters F-I.

Previous bullish trend and bearish trend beginnings are labeled with arrows.

Last week we saw price go from a DNT zone into a bullish trend on the weekly timeframes after breaking above level $11.75 and zone top level $12.35. Currently seeing rejection of level $12.80 down to the previous zone (top level $12.35; bottom level $12.20). Despite the test and the two red days the bullish trend is still holding, but it should be noted the 4H has wicked into a new low.

This is what I would personally look at before entering trades, everything is subject to change on a daily basis and as I analyze different timeframes and ideas.

ENTERTAINMENT PURPOSES ONLY, NOT FINANCIAL ADVICE!