Rsidivergence

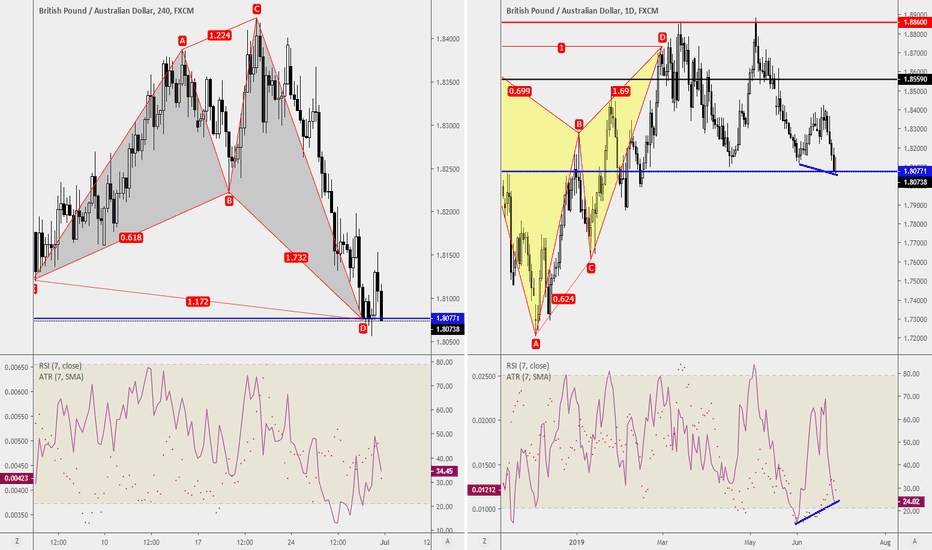

Trade Ideas Educator: GBPAUD RSI DivHaving an RSI Divergence on the daily chart(right) set perspective up for a buying opportunity I'm waiting for. But based on my trading rules, I can't just long because of an RSI-Divergence.

On the 4-hourly chart, a bullish shark forms up on the dot of my prefered entry, adding sprinkles to the dessert on the 1-hourly chart, a bullish crab on the dot.

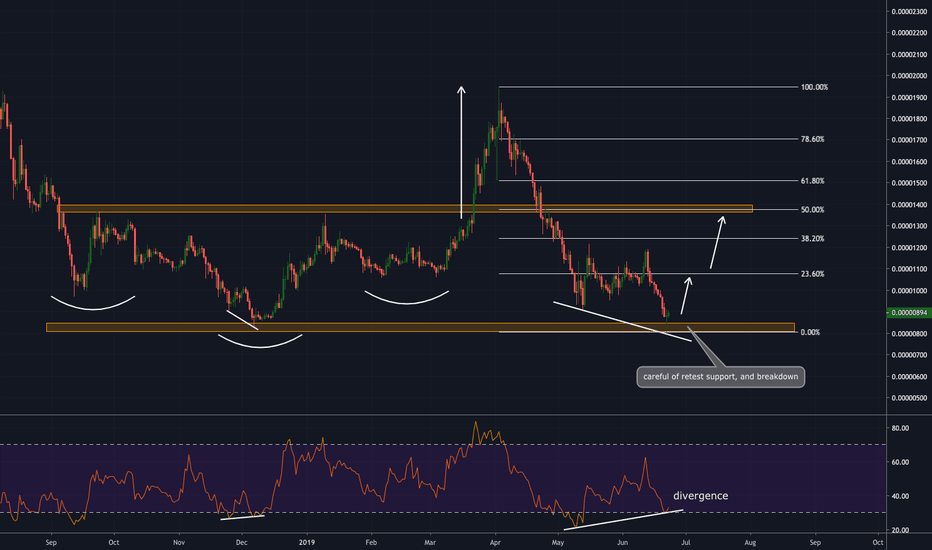

ADABTC looking for that swing opportunityCardano! Shelley! Or just a flop?

Buy the rumour, sell the news? Seems like this is what happened to Cardano, with a nice swing high, breaking out from its inverse HnS, together with much news on the explorer, partnerships, Shelley testnet etc.

Anyway, enough ranting about old news. So what is the chart telling us now?

I'm rather optimistic for the following reasons:

- RSI divergence (lower lows on price, but higher lows on RSI) is signalling some reversal pattern. A similar RSI divergence can be spotted at the peak of the Inverse Head.

- This coincides with ADA's last bottom at approx 800 sats

- 800 sats has proven as a critical level of support

- Yesterday's candle closed a 'bullish doji', indicating weakness in the bears to pushing price below the 800 sats range.

Regardless, if the bears fail to break this critical support level, likely we will proceed with an upward rally, i'd be looking at the 23% fib or 1080 sats range for the first exit point. Notice that this is a the support level, or the peak of the Inverse Shoulders. The next level ideally would fall around the 50% fib or the previous Inverse Neckline, or 1350 sats range.

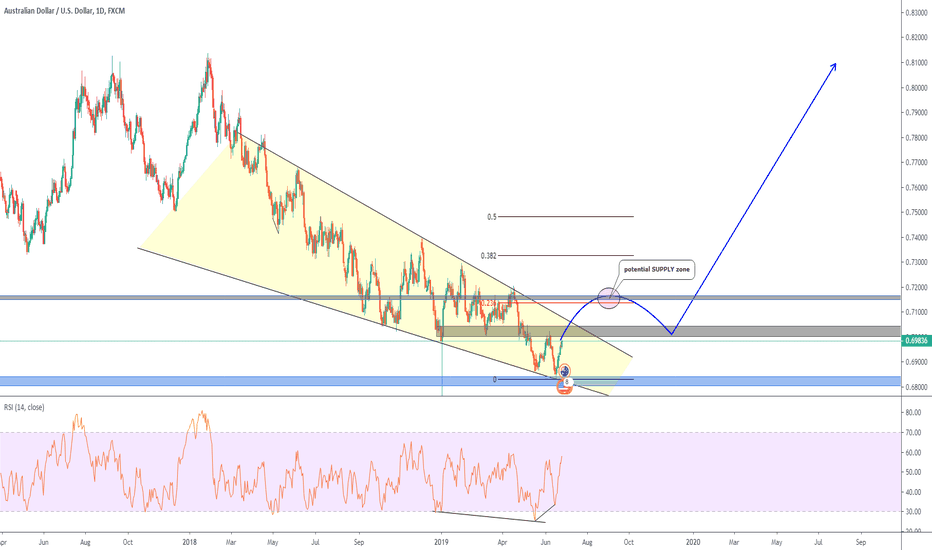

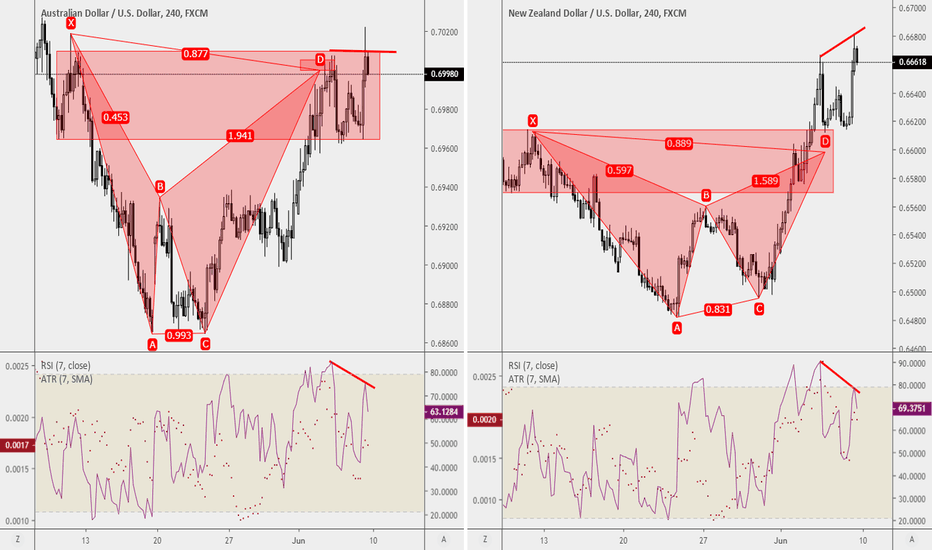

AUDUSD weekday analysis we have WEEKLY RSI DIVERGENCE and also DAILY RSI DIVERGENCE both signaling Bullish Divergence. On daily timeframe price formed a falling wedge pattern on weekly SUPPORT and we would want to wait for the break of the wedge pattern and retest before entering LONG.

Weekly RSI + Daily RSI + Weekly Support + Falling Wedge Pattern = BUY

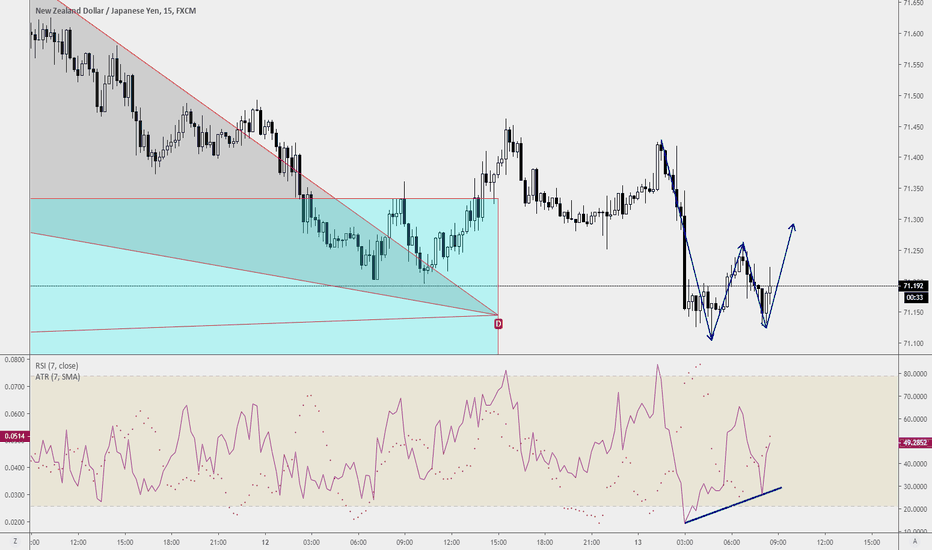

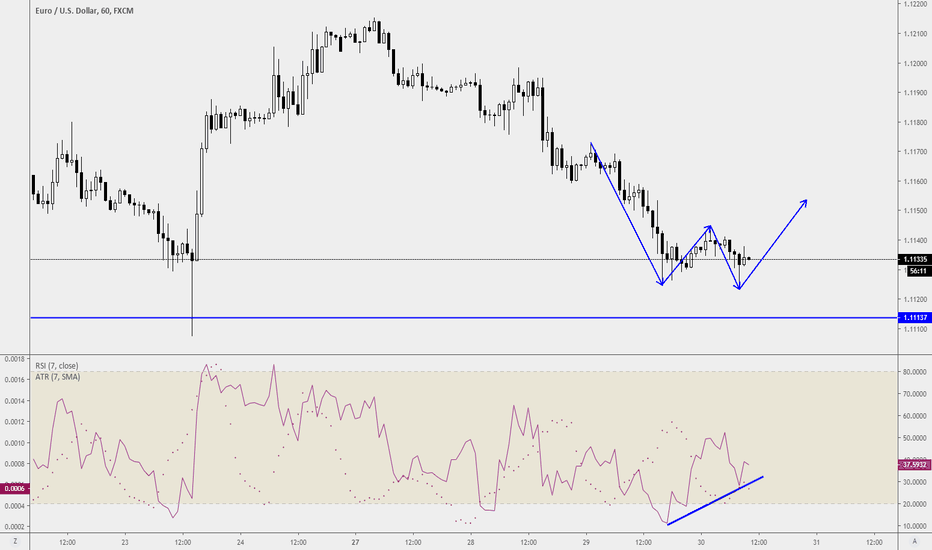

Short IdeaLots of shorts playing the bearish divergence currently getting their heads squeezed off their necks.

be patient and wait.

ONEBTC AnalysisI am very bullish on ONEBTC and here are the reasons why;

1- Falling Wedge

2- We are at strong support level (double bottom)

3- Bullish divergence on RSI

Not a financial advice.

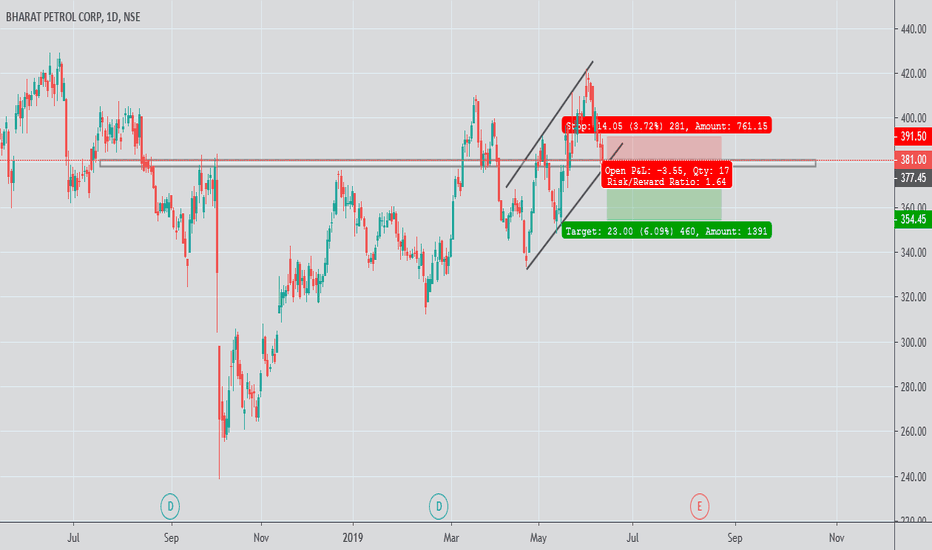

Trade Ideas Educator: Bat DivergenceThis 2 trade got caught by the market. AUDUSD got back to the entry price, but still within the sell zone and with RSI Div. I will still hold onto this trade till it either hit targets or my stop.

NZDUSD, on the other hand is much more tricky. No doubt that is an RSI Divergence as well but the candle break and close above the sell zone forming new high. I will also stick to my plans but what're your thoughts.

Love to hear from you what will you do if you had already engaged a short trade on Point D completion.

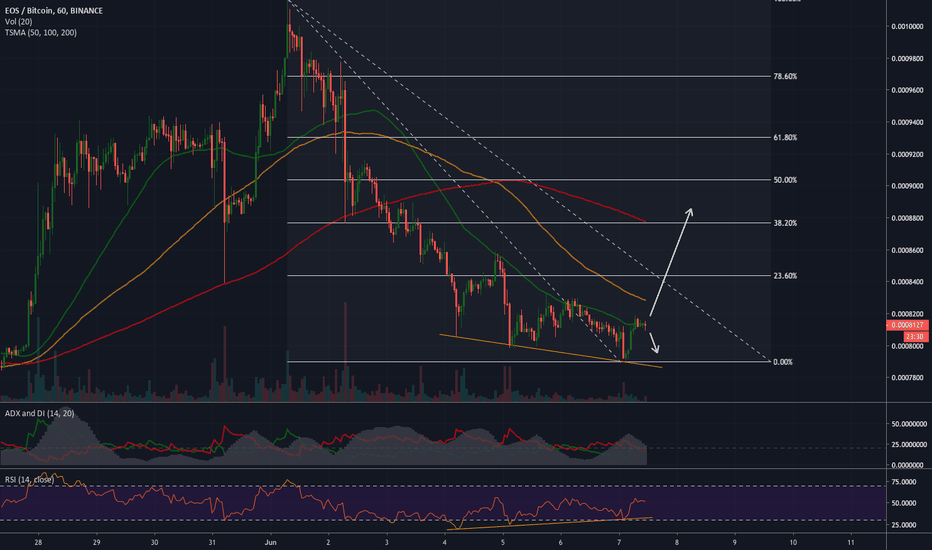

EOSBTC looking for the reversal (Short Term)Following up from previous EOS TA, a possible reversal to the upside may be in play

Opportunity spotted, looking for a breakout to the upside from most immediate overhead resistance on the 50MA (in green).

Clear 3x instance RSI divergence (high highs on RSI, lower lows on Price) indicative of a reversal pattern - compare this against the longer time lines.

Target range from 0.00088000 - 0.00090000 range (38-50% Fib levels)

Will need a to look out for a clear DI crossover with sustained ADX momentum to confirm this move.

This is quite a drastic pullback from the last breakout so risk/reward ratios are quite favourable :)

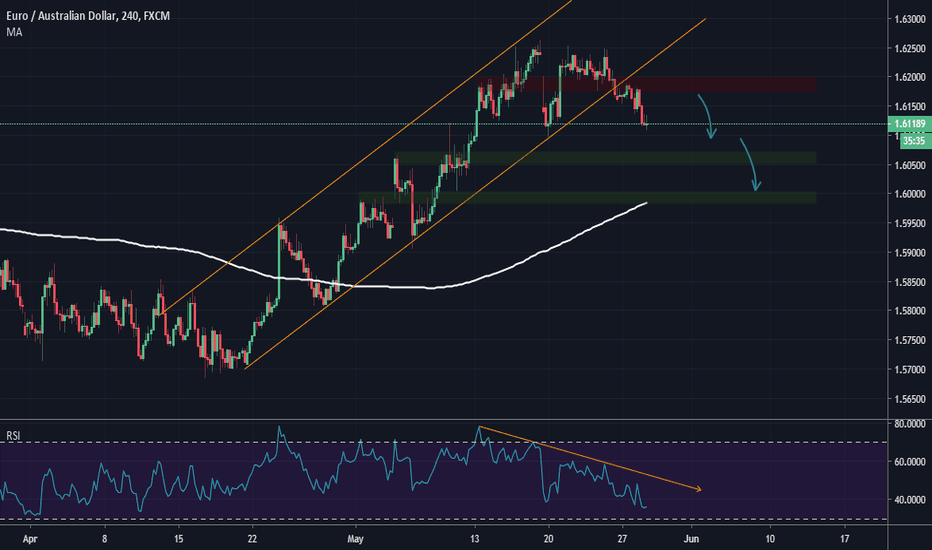

EUR / AUD - Correction after broke bullish trendlineEUR / AUD - Technically, the pair has broken its bullish trendline. The price failed to hold the breakout of a critical resistance on the red line.

We expect the pair to be bearish and move to the green support levels

- Support becomes resistance

- RSI divergence

- Broken bullish trendline

I love such entries because risk-reward is good.

GOOD LUCK and take entry according to your balance.

Please support our setups with your likes, comments and by following me on TradingView, thanks!

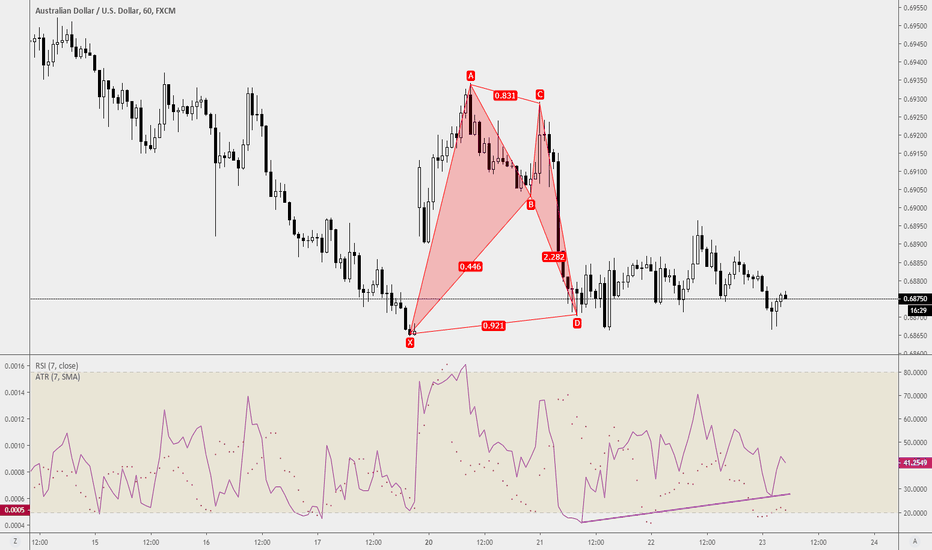

Trade Ideas Position: AUDUSD BatA type 2 Bat has formed up, so what is a type 2 bat, it simply means a retest of the entry level of the bat pattern.

Although if the Bat has hit the 1st target during the setup and it is also a counter-trend move, it is not my favourite bat setup for a retest as some traders might have already exited this trade (losing the force to push it up) . In this particular scenario, there is a RSI Divergence and I do see a good potential setup and further extend upwards for a shorting opportunity. That gives fantastic Reward:Risk(RRR), hence, I'm in.