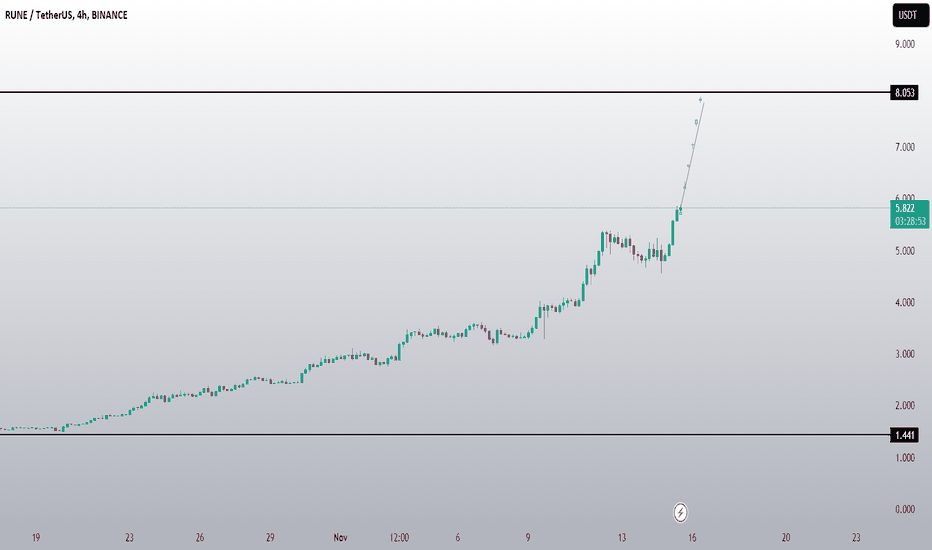

RUNE/USDT The breakout for a long trade in has been confirmed!The chart clearly indicates that RUNE has broken out of its resistance. Now is an opportune moment to initiate a long trade.

#POLYX/USDT LONG SCALP 🍀

Leverage: 3x

Entries: $5.940

Take profit 1: $6.291

Take profit 2: $6.850

Take profit 3: $7.205

Stop Loss: $5.353

Stay tuned for trade confirmation and additional updates. Feel free to express your thoughts by liking and sharing in the comments section:)

Thanks

The sroced. BINANCE:RUNEUSDT.P

RUNEUSDT

Trade signal | THORChain (RUNE) setup for the next pumpHi dear friends, hope you are well and welcome to the new trade setup of THORChain (RUNE) with US Dollar pair.

Previously we caught more than 400% pump of RUNE as below:

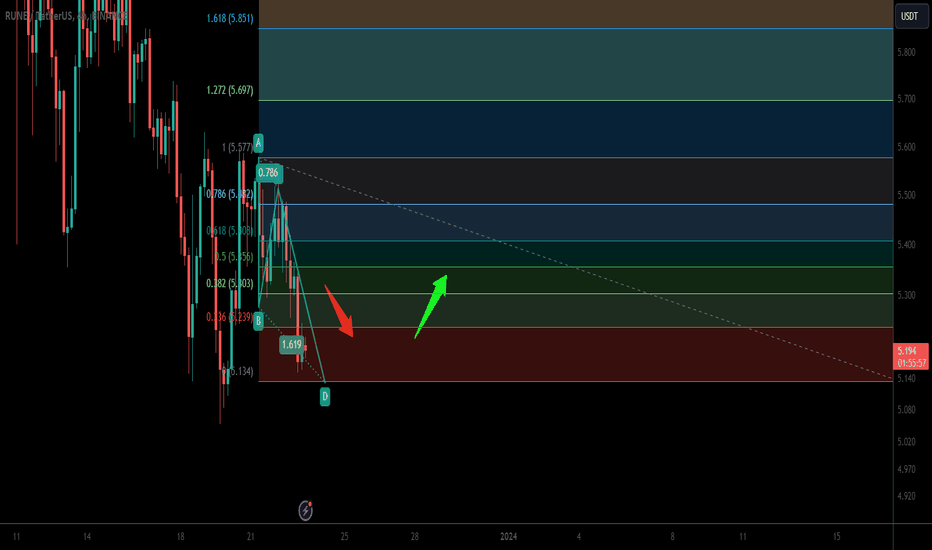

On a 4-hr time frame, RUNE has formed a bullish AB=CD move for the next pump.

Note: Above idea is for educational purpose only. It is advised to diversify and strictly follow the stop loss, and don't get stuck with trade.

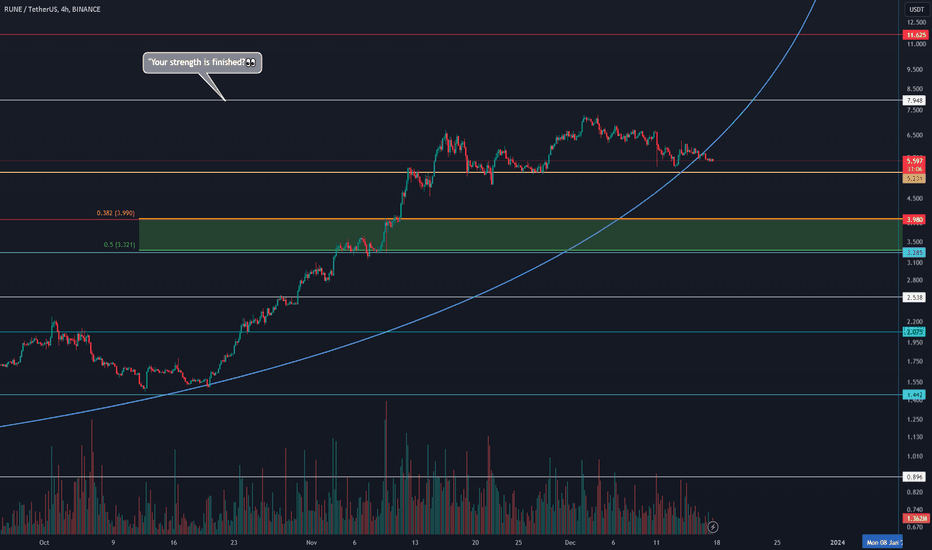

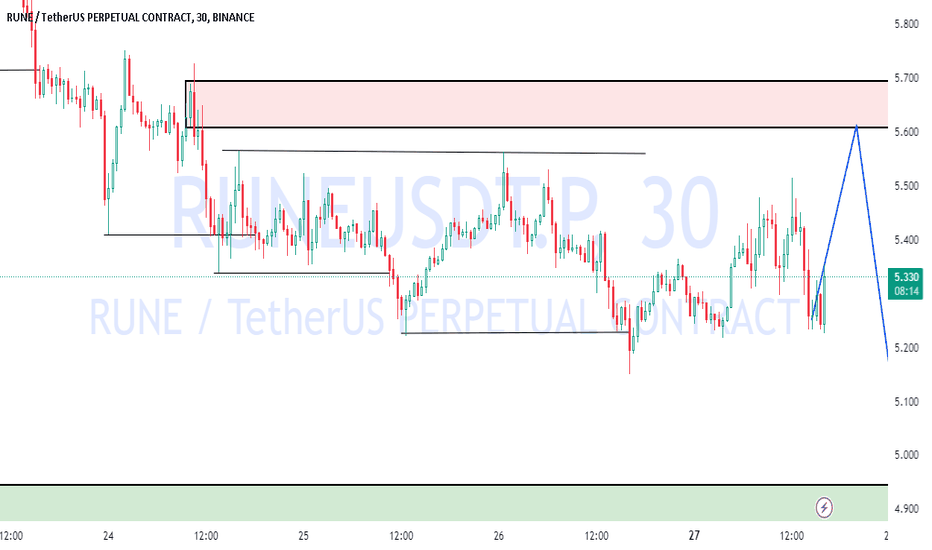

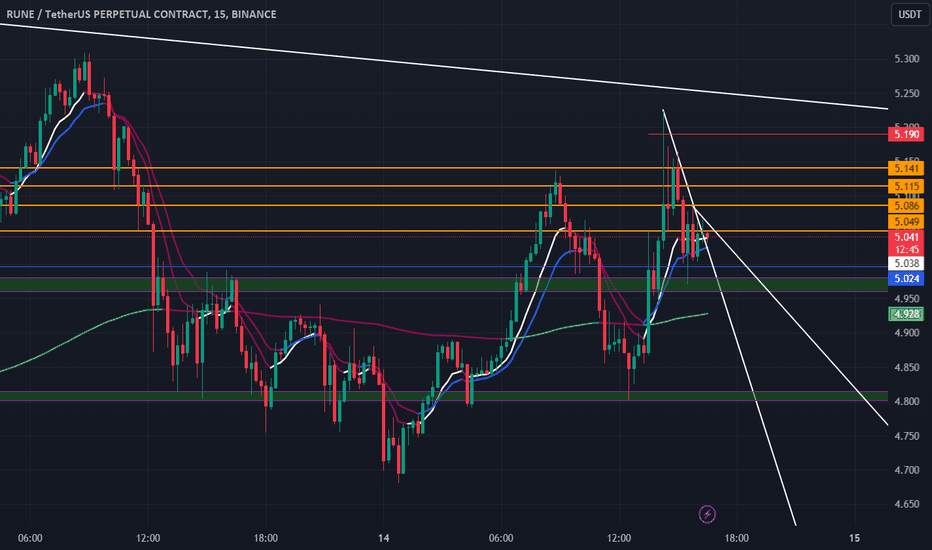

"Your strength is finished?👀

🔴"Buyers have started a tough battle. And so far, they have been able to increase the value of rune by 244 percent."✅

🔴"But have their strength run out❓"

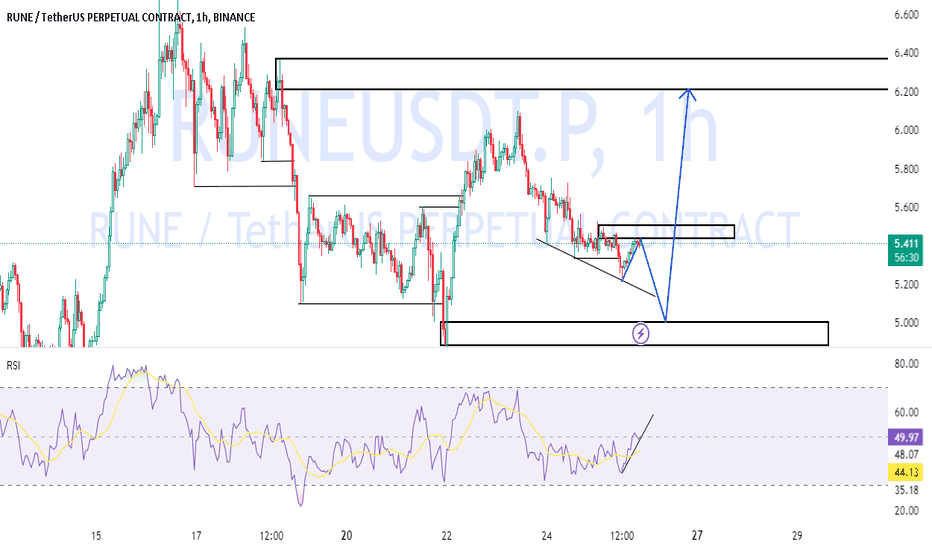

🔴If buyers are unable to sustain the upward price movement, our first trigger is 5.231, with angry sellers and a break of the support line.🔆

🔴I think the buyers have used up their last strength. What is your opinion? Who do you think will win the battle?⚠️

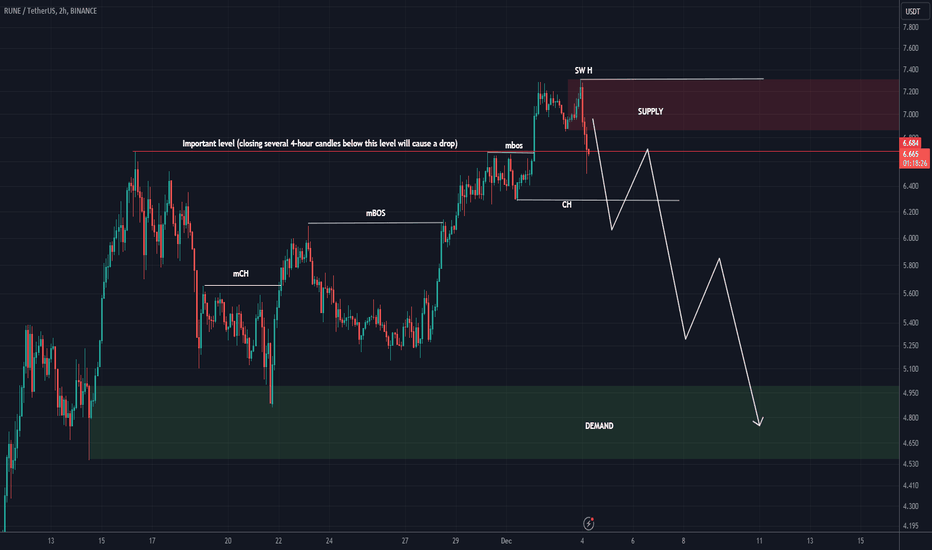

RUNE is turning to bearish trendOn the chart, we have an important level, which we determined that if we have several 4-hour candles under this level, the bearish view on the rune will increase, and the second confirmation is a bearish ch, which, if it occurs, can drop the price to the green area.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

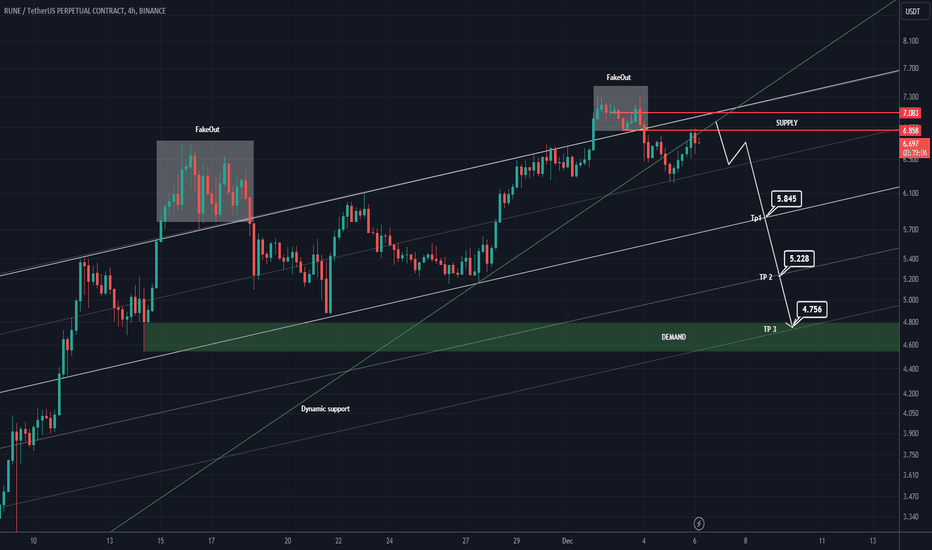

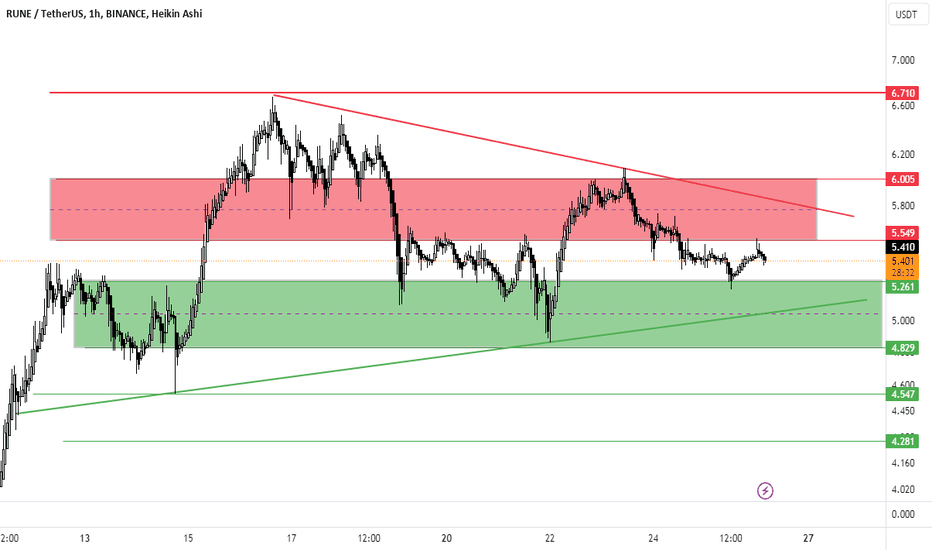

RUNE channelization analysisThis is an analysis based on channelization.

Remember that most of the time everything is reflected in the chart and you should look for signs.

We have had a diagonal channel that the price has faked out twice, which shows selling pressure.

We have also had a dynamic support that has been broken and the price has not been able to recover it.

Now all buyers will become sellers and RUNE will experience a lot of selling pressure.

The bottom channel is the adjacent channel.

I specified the targets.

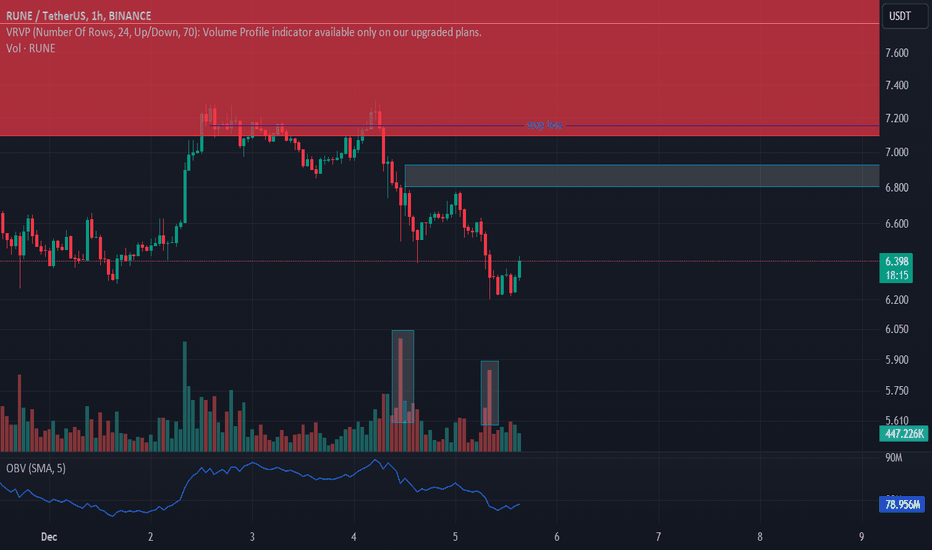

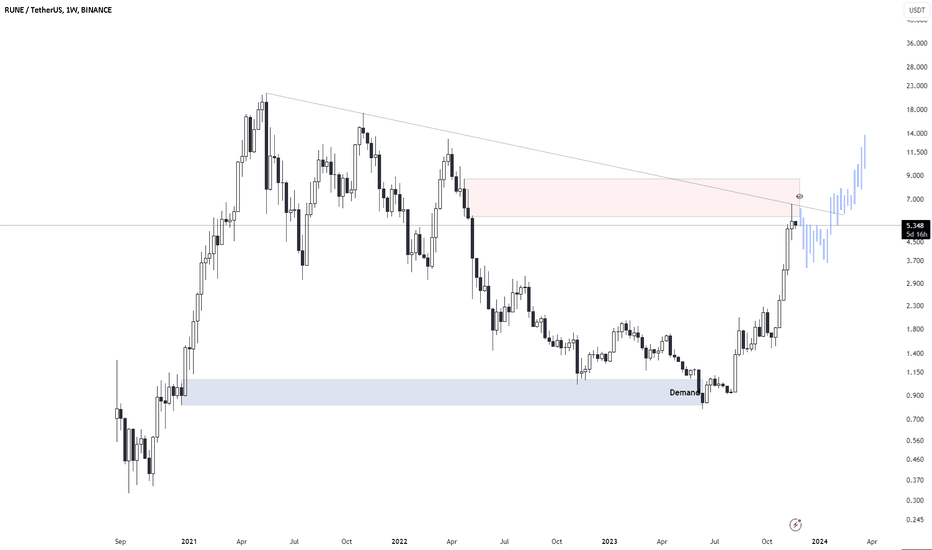

RUNE FIRST ZONE HIT, ABOVE THERE ARE TWO MORE ZONESI will post below where I set the zones earlier, and the first one was hit. The day has not closed yet, so you should be careful. Keeping the price below 6.5$ is a success for this trade

POC from 1. July-13.MAY.

From the other levels we have, it is weekly $7.9, VAH of the same range and full liquidity at 11.6

It is up to you which zone you choose, and how you enter the trade

RUNE USDT: SOLD ALL OF MY RUNE... I sold my first 50% on my previous chart that I failed to gauge the right top.

Now, here I am again thinking that this will be the top. Relatively it is. More on sentiment reasons. I will not explain further, since the explanation are very much the same with the previous chart I did. Here it will be just a bit more detailed and applied with sentiment.

SOLD 6.9 I just find it funny, and related to the fibs. Tried to drag it further while still respecting the levels. Thank you. PS: I added Trend line. I will short accordingly.

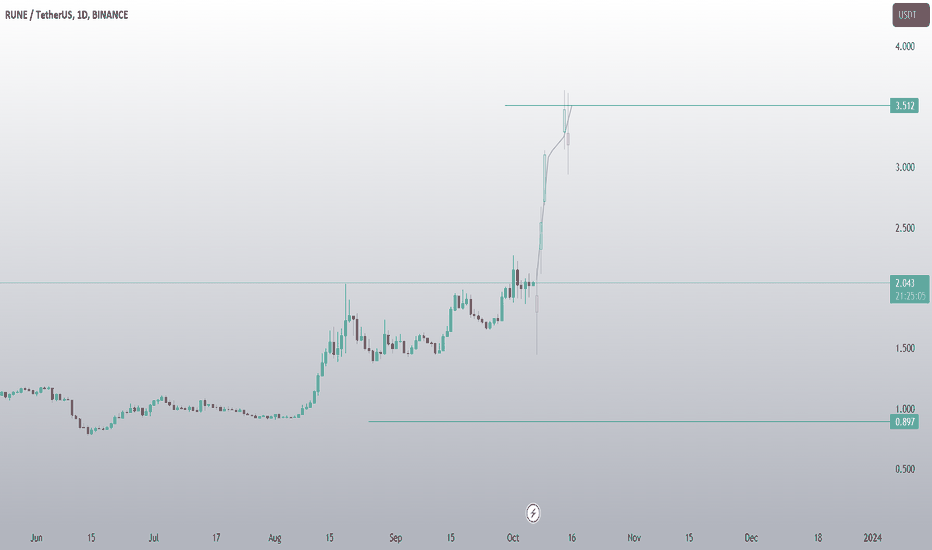

RUNE TAKE PROFIT OR QUICK SHORT An explosion that needs to end. I said that I'm still optimistic about this coin, but profit has to be taken somewhere.

Important levels marked, it's up to you how you will enter/exit.

Divergences are slowly showing, but I am of the opinion that we can go even higher for that liquidity

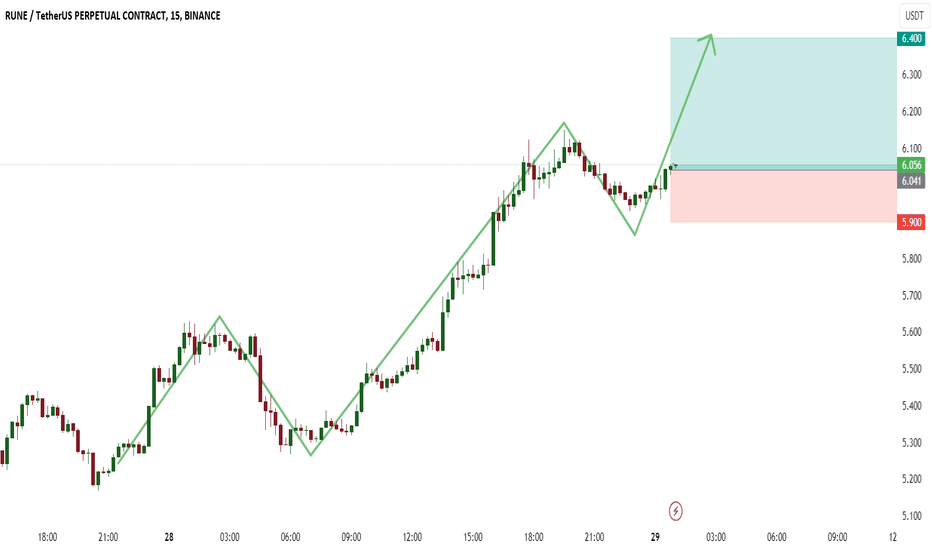

RUNE 3Omins inefficiency RUNE created inefficiency under the 30mins bearish OB and the liquidity need to be grab before our previous long triggered

Good to short from the unmitigated bearish above to 1hr bullish below where our entry point for long is.... Manage your risk and always take profit

Follow for more market update and trade setup

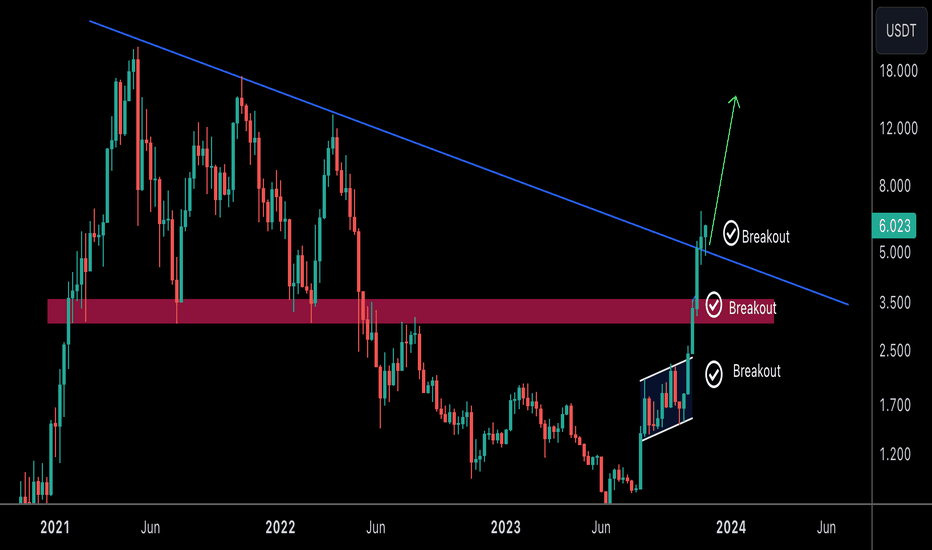

RUNE (the strong bull)RUNE / USDT

One of strongest coin in this bull wave of altcoins

Rune just made 3 consecutive breakouts one after the other

The last breakout (trendline) is the most important one

As long as it hold above major trendline in weekly basis it can push easily to 10$ or higher in short term

Not a financial advice

Retrace? or party RUIN'd Elliott Wave

If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment! Also, check out the links in my signature to get to know me better!

RUNE update.

Rejected from area identified.

Bounced, a bit, off the precise price level identified.

Is it going to hold, though?

Here's the #Elliottwave patterns I am watching and corresponding levels.

here-4.50 ideal.

Below 4.00 🤨

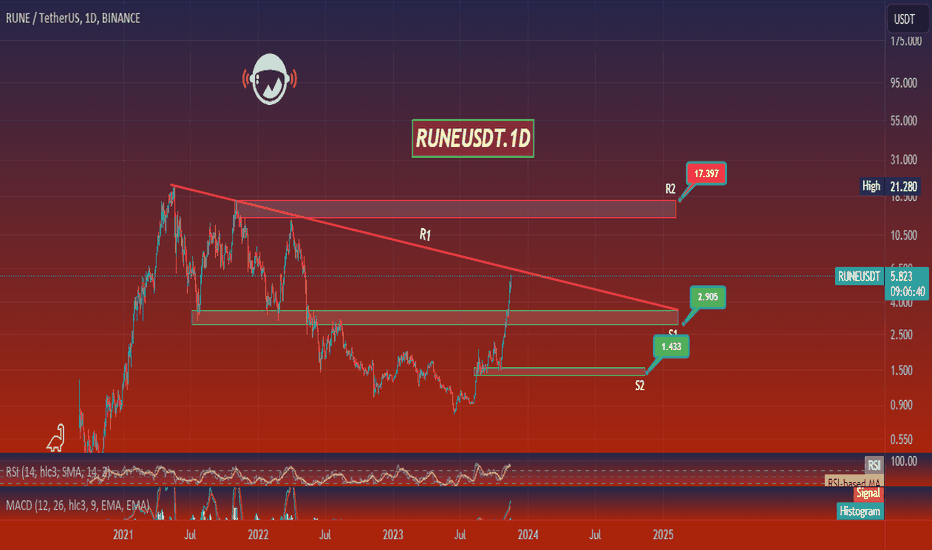

RUNEUSDT.1DBased on the provided market data, the currency RUNE is currently trading at a price of 5.823 USDT.

From a technical standpoint, the 4-hour Relative Strength Index (RSI) is at 77.35, which is typically considered overbought. This could indicate that the market may be due for a correction or pullback. The Moving Average Convergence Divergence (MACD) for the same period is 0.302, suggesting a bullish trend.

On a daily scale, the RSI is at a very high 90.94, which is significantly overbought and could indicate a potential market correction in the near term. The MACD for the daily timeframe is 0.766, which is bullish.

Looking at the Bollinger Bands (Bb), the currency is trading slightly below the upper band in both the 4-hour and daily timeframes, indicating that it is trading near a high range, which could suggest a potential pullback.

In terms of support and resistance levels, the immediate resistance on the 4-hour chart is at 5.849, followed by 6.432 and 6.351. The supports are at 5.153, 4.563, and 4.102. On a daily basis, the resistance levels are at 8.962, 11.900, and 13.700, while the supports are at 3.446, 2.137, and 1.357.

In conclusion, while the currency is in a bullish trend as indicated by the MACD, the high RSI suggests that it is overbought and may be due for a correction. Traders should proceed with caution and consider setting stop losses to protect against potential downturns. This is just an analysis and not a trading advice. Please do your own research before making any investment decisions.