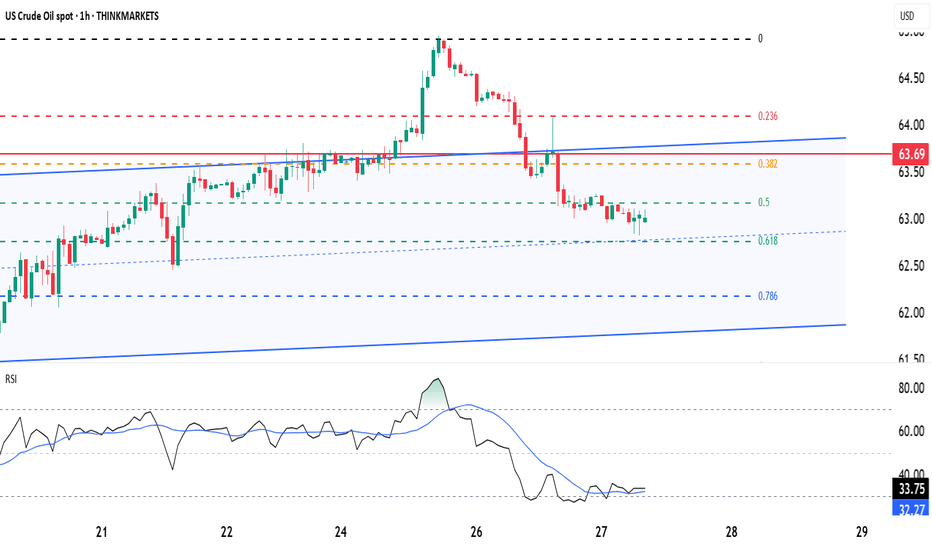

WTI falls after US slaps 50% tariff on India over Russian oilWTI oil prices have dropped from $65 to around $62.80 as markets react to new US tariffs on India, triggered by India’s ongoing oil trade with Russia. These tariffs, along with threats of even higher tariffs on China, are weighing on global demand and pushing oil prices lower. Meanwhile, Iran’s oil production has hit multi-year highs, adding more supply to the market and reinforcing the bearish trend.

Technically, oil has broken below a key Fibonacci support level, signalling a deeper pullback. If prices fall below $62, further downside toward $57 is possible. Upside moves may be short-lived unless there’s a major geopolitical shock, such as an escalation in the Russia-Ukraine conflict. For now, both the macro environment and technical signals indicate continued pressure on oil prices.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Russiaoil

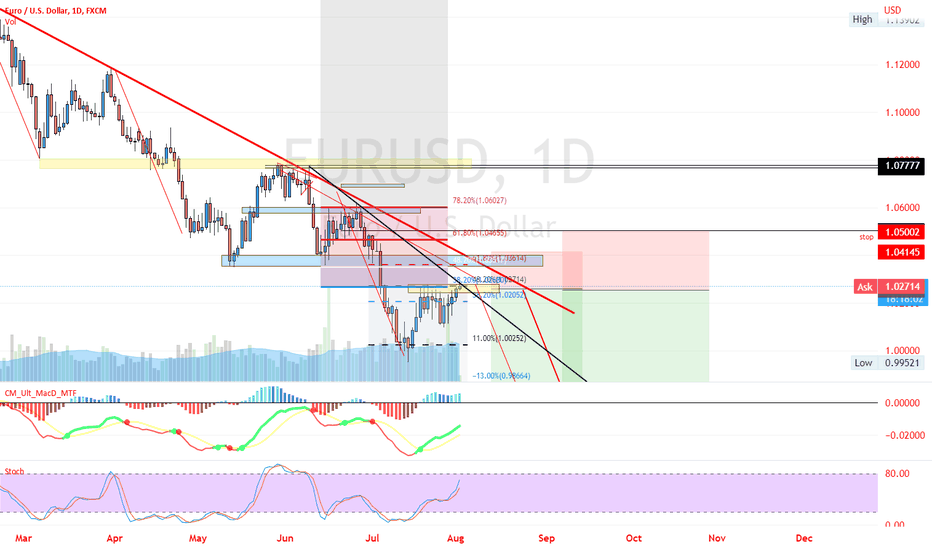

EURUSD Prepping For A Collapse Below ParityFundamentals :

(1) EUR's negative outlook looks bleaker by the day. (2) Geopolitical risks remain high. (3) Market's shrugged off EUR's rate hike. (4) Gas problems will be an elevated fear until EUR can strike a deal or switch to an alternative source of energy. (5) Russia turning off the gas tap so needed by EUR.

Conclusions: (a) EURO recession. (b) Less QT than what the market expects. (c) Bond spreads will widen. (d) I continue to hold a bearish view of EUR, as it is in both a technical and "quarterly" fundamental downtrend.

Technicals :

EUR/USD stalls when it tries to go higher.

Fib confluence

dHd

Stoch overbought range

Price hitting a downward-sloping trendline

Kijun-span acting as resistance

VPA tells a story that bulls are struggling and bears will soon have the upper hand in the medium-term

I am targeting below parity towards around 0.9650 for a 2:1 or 3:1 reward:risk ratio.