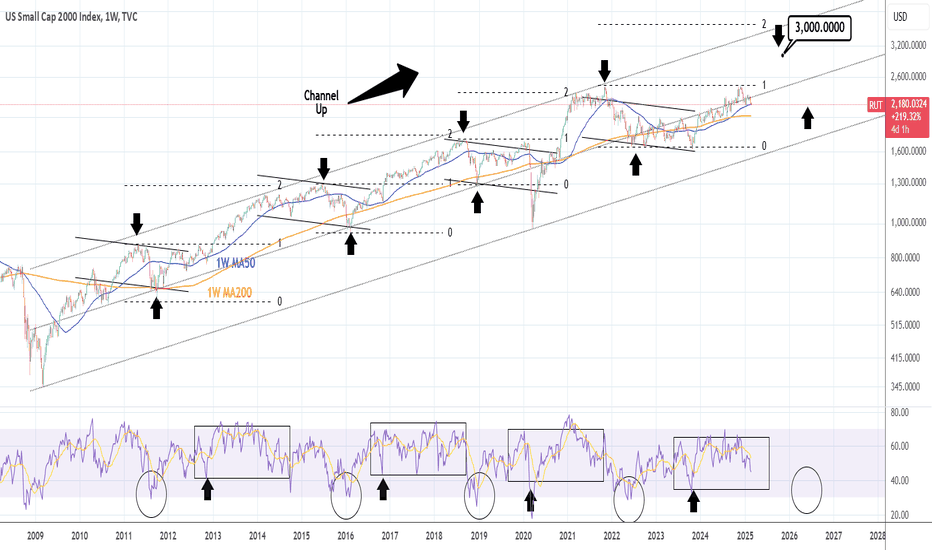

RUSSELL: Targeting at least 3,000 end of yearRussell 200 may be almost neutral on its 1D technical outlook (RSI = 34.476, MACD = -14.090, ADX = 24.893) but still neutral on 1W as the 1W MA50 continues to hold since November 2023. The price action is exactly around the middle of the 16 year Channel Up and since the September 2022 low, we've been on the new Bull Cycle / bullish wave. The Cycles are repetitive and so far in these 16 years we've had another three similar phases of growth. The 1W RSI indicates that the current will top near the end of 2025. All prior have reached at least the 2.0 Fibonacci extension but since the pace of the current Bull Cycle has slowed down, a TP = 3,000 will be much more suited as the target of this Cycle.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Ruttrading

RUSSELL 2000: Short term pullback possible but buy for 1910.Russell 2000 crossed again today overo the 1D MA200 and it remains to be seen if it succeeds at closing above it. After the November 15th crossing but failure to close over it, a repeat may materialize a pullback of at least -4.50%, in similar fashion as the 1D MA200 rejections of May 23rd 2023 and November 1st 2022.

Technically that's possible as on the greater picture, the index is still neutral on the 1W technical outlook (RSI = 50.610, MACD = -19.910, ADX = 34.284) sitting almost halfway of the giant consolidation/ Rectangle pattern of the past year and a half.

Consequently, we will welcome any pullback as a buy opportunity, but we are already bullish, aiming at the R1 level (TP = 1,910).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##