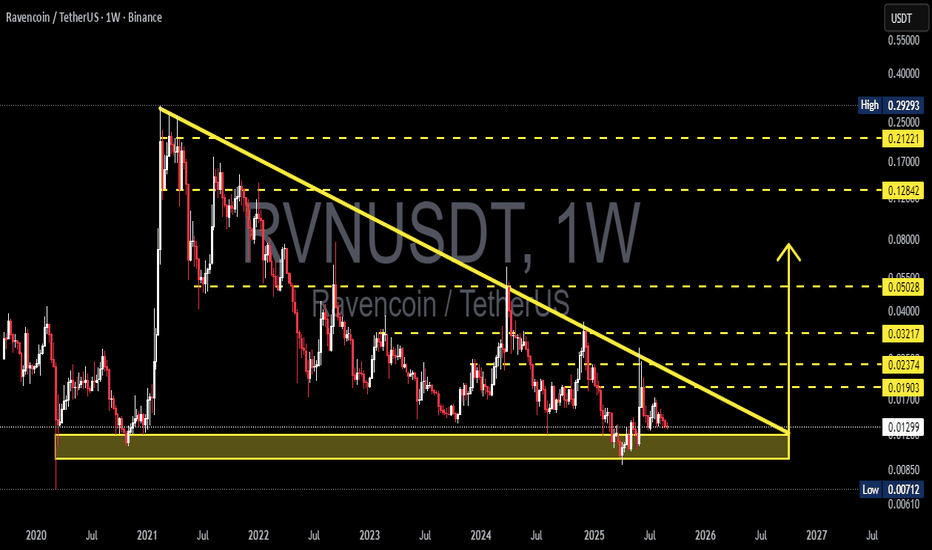

RVN/USDT — Descending Triangle: Breakout or Breakdown?Ravencoin (RVN) is now standing at one of its most critical levels since 2021. On the weekly chart, we clearly see a Descending Triangle pattern:

Lower Highs pressing the price down for years.

Strong demand zone around 0.00712 – 0.0130 USDT still holding as the last defense for buyers.

Price is now sitting right at the triangle’s apex, which means a major move is coming soon — either breakout or breakdown.

---

🔎 Technical Breakdown

Main pattern: Descending Triangle (statistically bearish, but positioned at strong demand).

Historical support: 0.00712 – 0.0130 (tested since 2021, sign of strong accumulation).

Descending trendline: rejected every rally since 2021, still intact.

Key resistances ahead: 0.0190 → 0.0237 → 0.032 → 0.050 → 0.128.

Major high: 0.2929 (far above, but valid long-term target if structure flips bullish).

---

🟢 Bullish Scenario

Trigger: Weekly close above descending trendline + successful retest, or breakout above 0.0190 USDT.

Additional confirmation: Strong volume breakout + weekly RSI reclaiming 50 or showing bullish divergence.

Upside targets:

1. 0.0190 (first resistance)

2. 0.0237 (historical barrier)

3. 0.0322 (trend reversal confirmation)

4. 0.0503 (major breakout level)

If momentum holds → potential extension toward 0.128.

Takeaway: A clean breakout could mark the first long-term bullish trend reversal for RVN in years.

---

🔴 Bearish Scenario

Trigger: Weekly close below 0.00712 USDT with strong volume.

Consequence: Breakdown from multi-year support → “last fortress” of buyers destroyed.

Downside target:

Retest 0.0071 (historical low). If lost, RVN may enter deeper price discovery zones.

Invalidation of bearish case: Price reclaiming above 0.0190.

Takeaway: Losing this demand zone could trigger a strong continuation to the downside.

---

⚖️ Big Picture

RVN is at a make-or-break point:

Breakout above → long-term trend reversal and new bullish cycle.

Breakdown below → bearish continuation with risk of new lows.

This is not just a technical setup; it also reflects overall crypto market sentiment. Bitcoin’s next major move will heavily influence RVN.

---

🎯 Strategy

Conservative traders: Wait for weekly close confirmation (breakout or breakdown).

Aggressive traders: Consider entries inside the demand zone with tight stops below 0.0070.

Risk management: Crucial! Weekly setups often bring big moves.

---

📌 Conclusion

RVN/USDT is “squeezed” at the apex of a descending triangle right on a multi-year demand zone.

Bullish case: breakout → 0.019 → 0.023.

Bearish case: breakdown < 0.0071 → opens the door for new lows.

Whichever direction plays out, a major RVN move seems very close.

---

#RVN #Ravencoin #RVNUSDT #CryptoAnalysis #TechnicalAnalysis #DescendingTriangle #Altcoin #PriceAction #ChartPattern #CryptoTrading

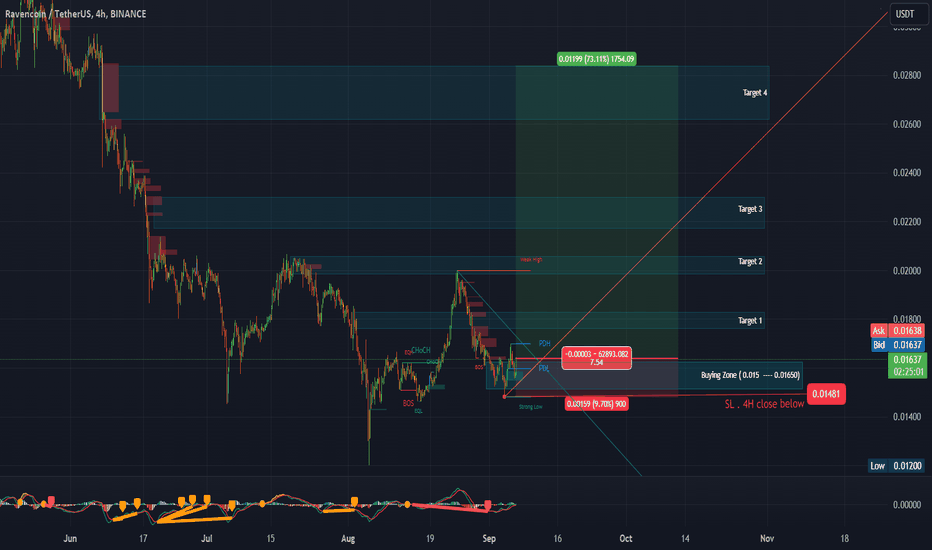

RVNUSDC

#RVN ( SPOT) ..Entry range(,0150 -- ,01650) . SL(,01481)#RVN

Entry range (,0150 -- ,01650)

SL .4H close below (,01481)

Last target (0.02839)

#RVN

#RVNUSDT

#RVNUSD

#swingtrade

#shortterminvestment

#ALTCOIN

#Cryptotading

#cryptoinvesting

#investment

##trading

#cryptocurrencytrading

#bitcoininvestments

#Investing_Coins

#Investingcoins

#Crypto_investing

#Cryptoinvesting

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #RVN ****

#bitcoin

#BTC

#BTCUSDT

BINANCE:RVNUSDT